Session 18 NSLDS UPDATE Valerie Sherrer and Eric Hardy | Nov.

56 Slides1.49 MB

Session 18 NSLDS UPDATE Valerie Sherrer and Eric Hardy Nov. 2012 U.S. Department of Education 2012 Fall Conference

Agenda MyStudentData Download Pell Grant LEU Changes Enrollment Reporting Updates NSLDS Data Integrity New Federal Loan Servicers Aggregate Calculation Updates Recent Changes Upcoming Changes 2

MyStudentData Download 3

Blue Button Allows students to download their loan, grant, and aid overpayment history Available on the NSLDS Student Access (SA) website Download available in text version only 4

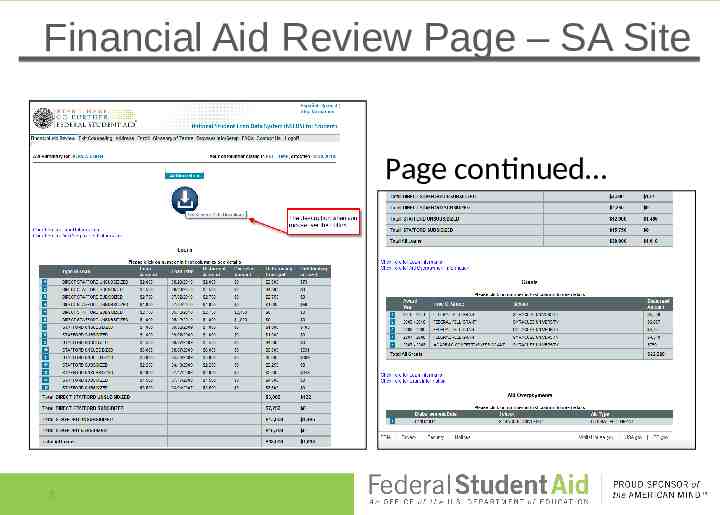

Financial Aid Review Page – SA Site Click to add text 5 Click to add text Page continued

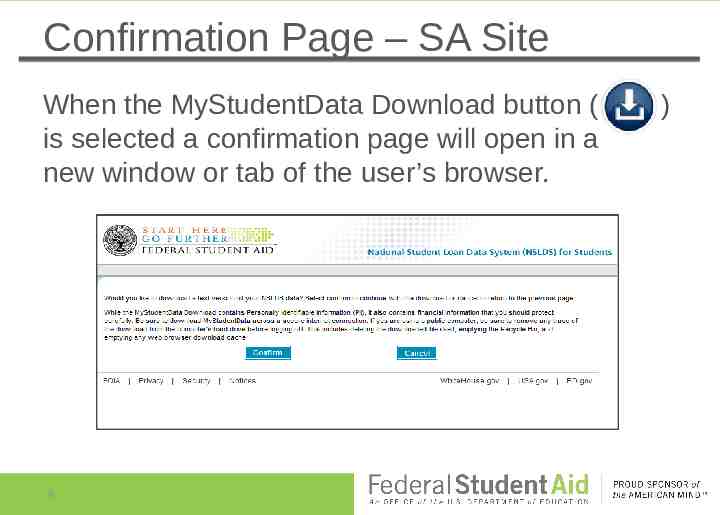

Confirmation Page – SA Site When the MyStudentData Download button ( is selected a confirmation page will open in a new window or tab of the user’s browser. 6 )

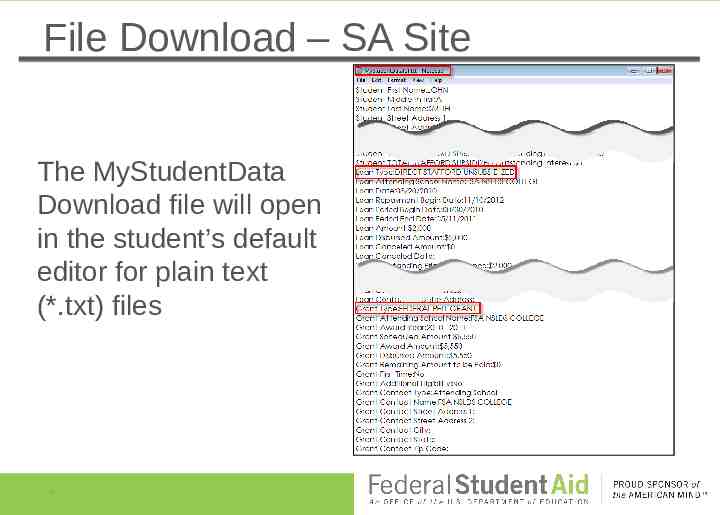

File Download – SA Site The MyStudentData Download file will open in the student’s default editor for plain text (*.txt) files 7

Pell Grant LEU Changes 8

Lifetime Eligibility Used (LEU) Pell Grant LEU percentages were reported to NSLDS to correspond with the 2012-2013 reduction of the Pell Grant Program’s Duration of Eligibility COD is the authority for Pell Grant LEU percentages 9 Student eligibility was reduced to the equivalent of 12 full-time semesters (LEU 600%) from the previous eligibility equivalent of 18 full-time semesters (LEU 900%) NSLDS reports and displays Pell Grant information as received from COD

Lifetime Eligibility Used (LEU) NSLDS received a one-time update of Pell Grant LEU percentages from COD in July 2012 Since the one-time update, COD sends LEU percentages to NSLDS when Pell Grants are made or changed 10 Included Pell Grant recipients from 1973-1974 award year to present LEU percentages for students with no NSLDS record(s) were not loaded Pell Grants might not load to NSLDS due to identifier conflicts If NSLDS and COD display different percentages, COD is the authority

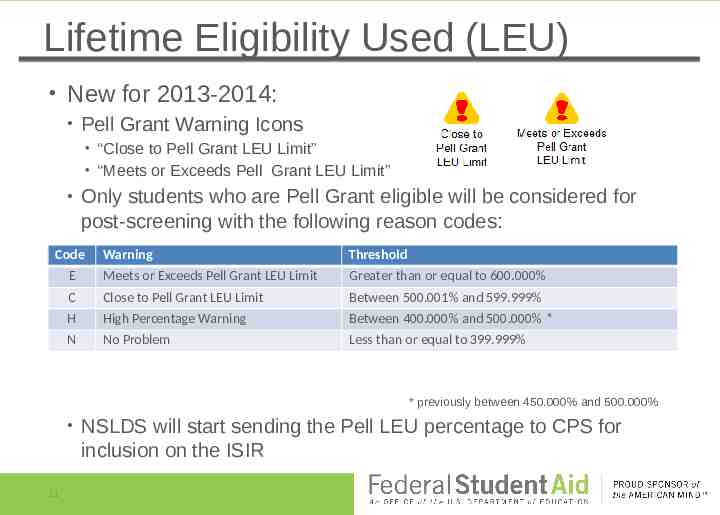

Lifetime Eligibility Used (LEU) New for 2013-2014: Pell Grant Warning Icons “Close to Pell Grant LEU Limit” “Meets or Exceeds Pell Grant LEU Limit” Only students who are Pell Grant eligible will be considered for post-screening with the following reason codes: Code Warning Threshold E Meets or Exceeds Pell Grant LEU Limit Greater than or equal to 600.000% C Close to Pell Grant LEU Limit Between 500.001% and 599.999% H High Percentage Warning Between 400.000% and 500.000% * N No Problem Less than or equal to 399.999% * previously between 450.000% and 500.000% 11 NSLDS will start sending the Pell LEU percentage to CPS for inclusion on the ISIR

Enrollment Reporting Updates 12

Enhancements for Enrollment Reporting New Enrollment Reporting Options Batch Processing Options Online Update Options Managing your School’s Reporting Options New Enrollment Reporting Data Fields 13

New Enrollment Reporting Options Enrollment Reporting has been enhanced to include additional fields and provide new batch reporting formats Enhanced Fixed Width flat file Comma Separated Values (CSV) file eXtensible Markup Language (XML) file Batch File Layouts posted to NSLDS Record Layouts section on the IFAP Web site on 04/06/2012. 14

New Enrollment Reporting Options Enrollment Reporting has also added online reporting formats 15 Spreadsheet Upload Online Updates

Creating the Spreadsheet 16 Enrollment Submittal Spreadsheet Instructions developed to assist in the creation of the spreadsheet User file can be created in any spreadsheet tool which uses columnar data presentation User file can also be created using the CSV batch file File Layout tailored to spreadsheet usage is included with instructions on how to handle dates, numbers, and text values

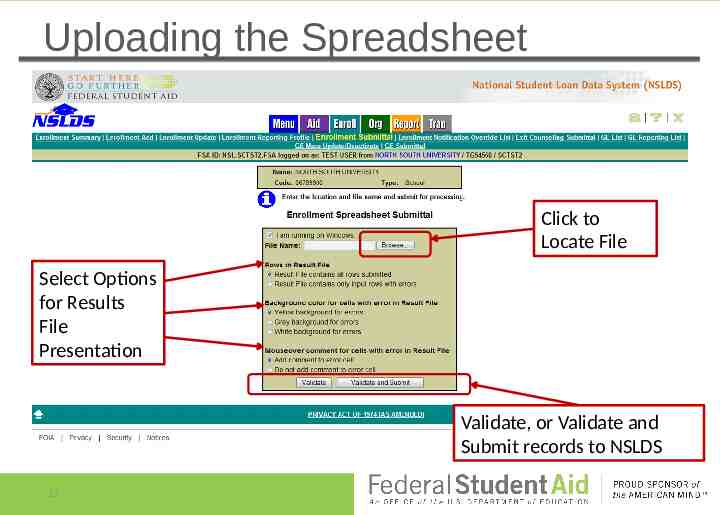

Uploading the Spreadsheet Click to Locate File Select Options for Results File Presentation Validate, or Validate and Submit records to NSLDS 17

Spreadsheet Results File If Validate is selected: 18 NSLDS will evaluate all records against the edits and return results of this evaluation in a spreadsheet The results spreadsheet will open on the desktop Error numbers and messages will display in the spreadsheet as selected by the user Any errors can be corrected and saved in the results file and resubmitted to NSLDS

New Enrollment Reporting Options Schools must transition to one of the new formats by March 31, 2013 Schools must indicate file type choice on the new Enrollment Reporting Profile page Current file format will be used until a new format is selected Any school that has not selected a file type by March 31, 2013, will be set up to receive the enhanced fixed-width format 19

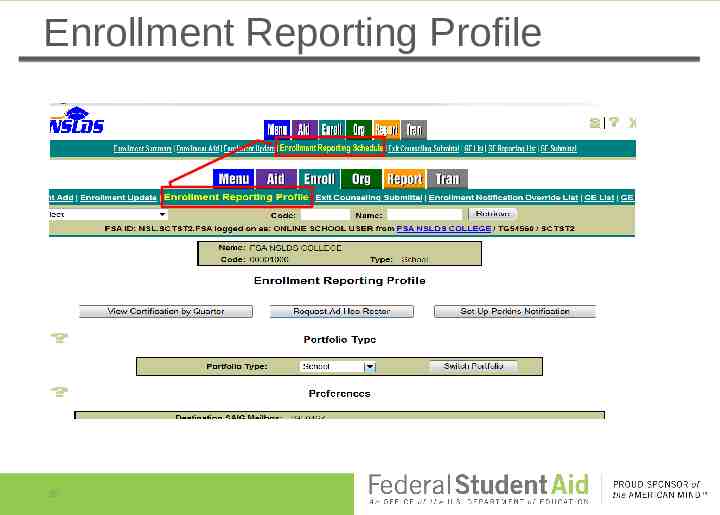

Enrollment Reporting Profile 20

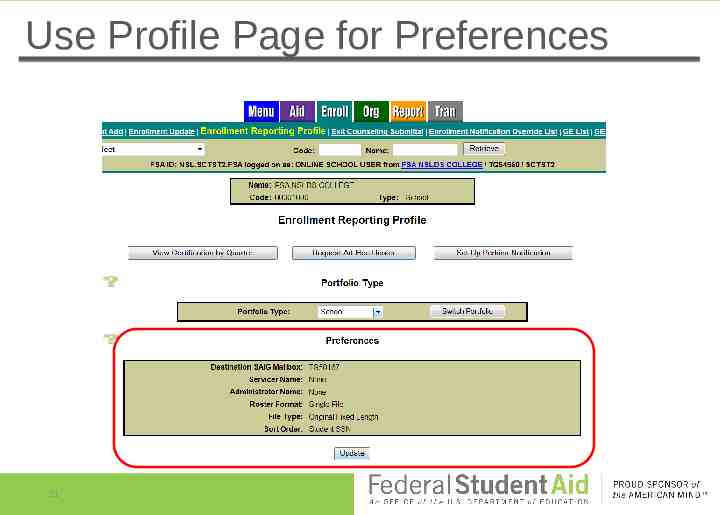

Use Profile Page for Preferences 21

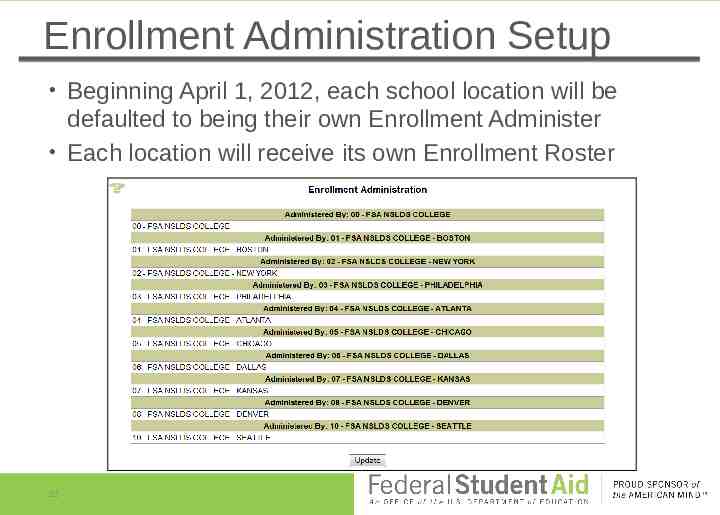

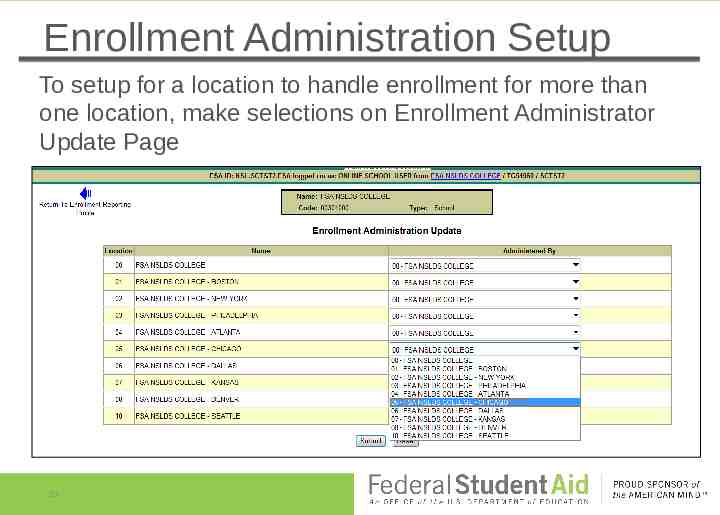

Enrollment Administration Setup 22 Beginning April 1, 2012, each school location will be defaulted to being their own Enrollment Administer Each location will receive its own Enrollment Roster

Enrollment Administration Setup To setup for a location to handle enrollment for more than one location, make selections on Enrollment Administrator Update Page 23

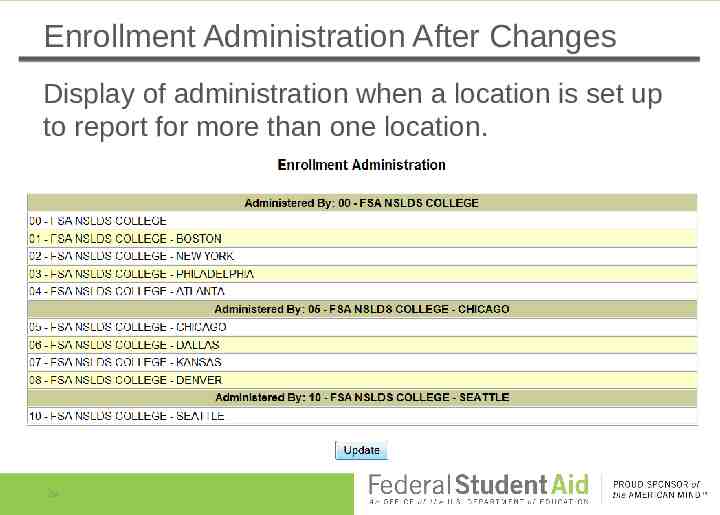

Enrollment Administration After Changes Display of administration when a location is set up to report for more than one location. 24

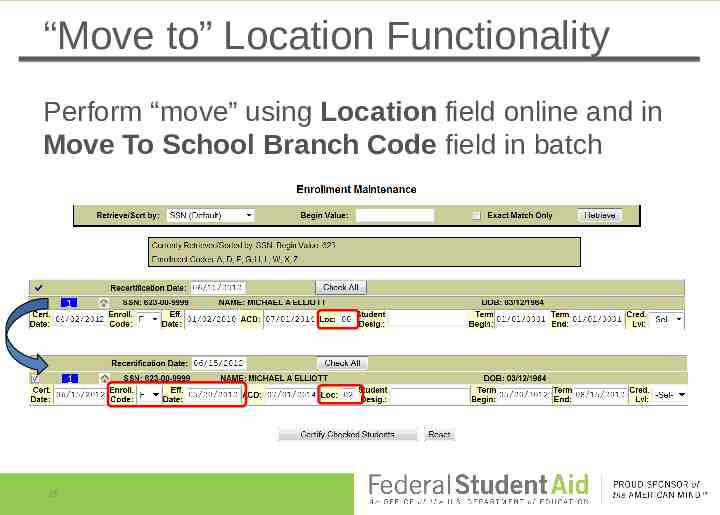

“Move to” Location Functionality Perform “move” using Location field online and in Move To School Branch Code field in batch 25

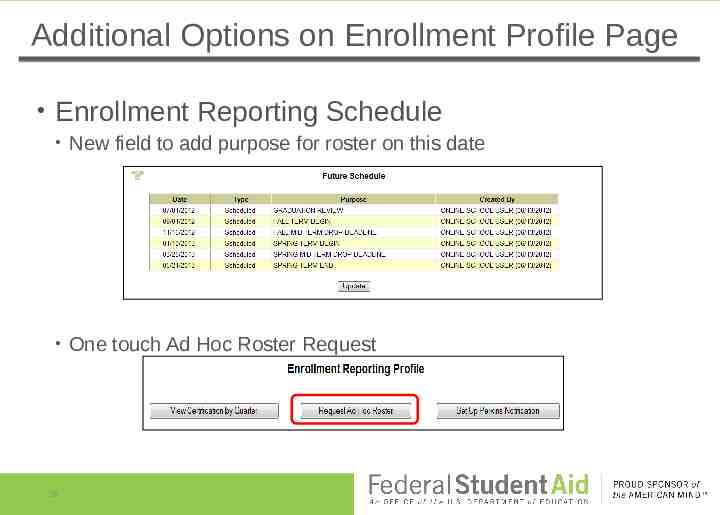

Additional Options on Enrollment Profile Page Enrollment Reporting Schedule New field to add purpose for roster on this date One touch Ad Hoc Roster Request 26

COD Enrollment School Code Allows NSLDS to place the student on the correct school location’s roster Reported with disbursement records 27 Location reporting is critical Administrators can move a student to any location they administer without updating the COD Enrollment School Code Reported to NSLDS by COD on Pell Grant disbursements Provided by Federal Loan Servicers on Direct Loan disbursements Please be diligent to ensure the correct school code is reported to COD. The COD Enrollment School Code is not edited to be reasonable to the attending or original school codes.

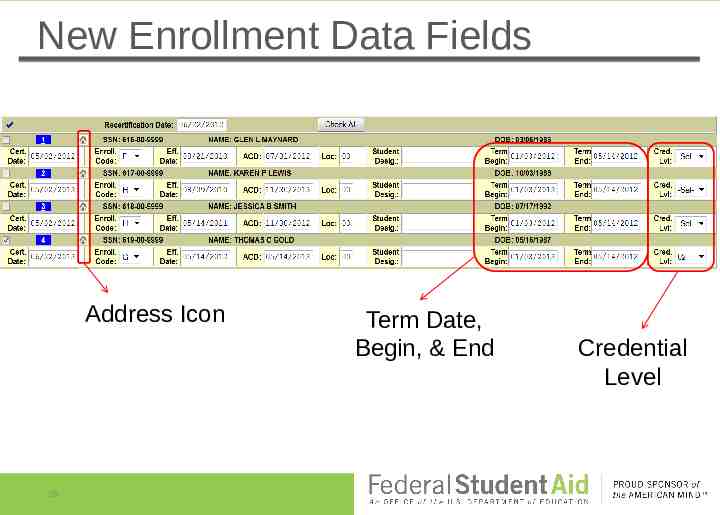

New Enrollment Data Fields Address Icon 28 Term Date, Begin, & End Credential Level

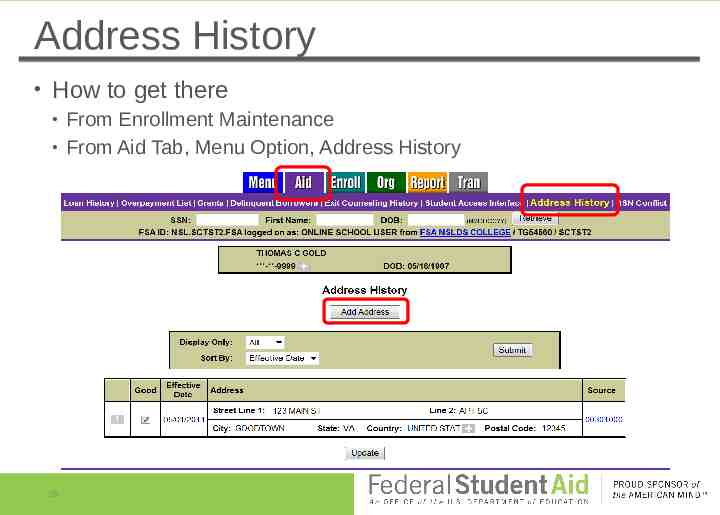

Address History How to get there 29 From Enrollment Maintenance From Aid Tab, Menu Option, Address History

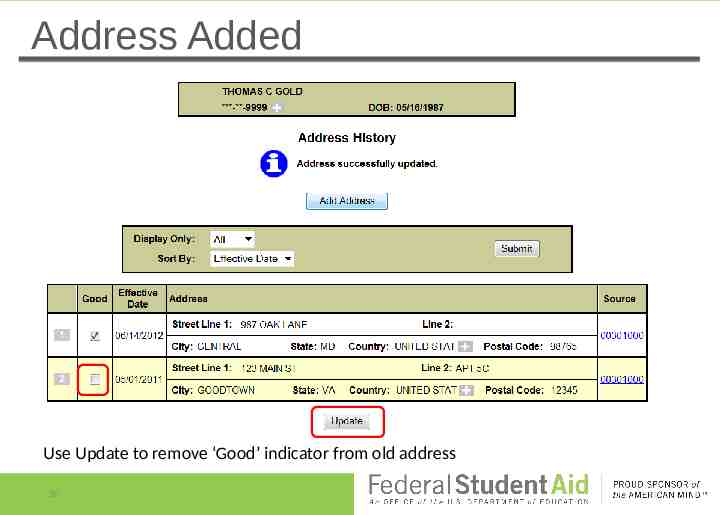

Address Added explain “good” flag and how to change Use Update to remove ‘Good’ indicator from old address 30

Enrollment Reporting Resources Updated NSLDS Enrollment Reporting Guide posted to IFAP, November 20, 2012 NSLDS Newsletters # 39 and # 40 An Enrollment Reporting Webinar will be scheduled in January 31

NSLDS Data Integrity 32

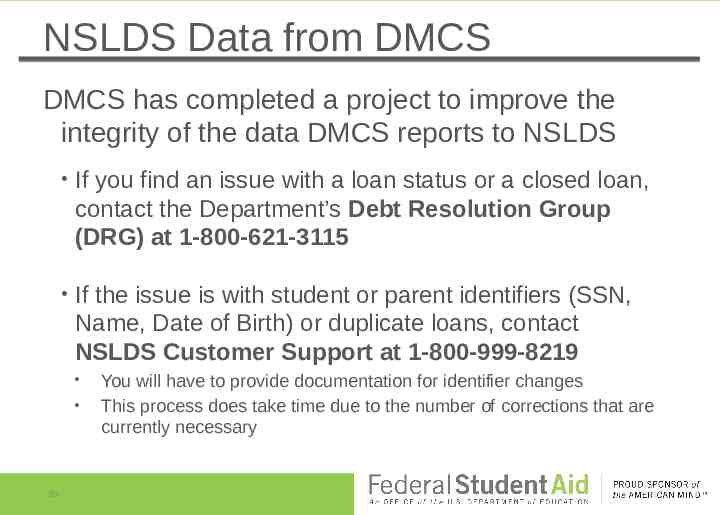

NSLDS Data from DMCS DMCS has completed a project to improve the integrity of the data DMCS reports to NSLDS If you find an issue with a loan status or a closed loan, contact the Department’s Debt Resolution Group (DRG) at 1-800-621-3115 If the issue is with student or parent identifiers (SSN, Name, Date of Birth) or duplicate loans, contact NSLDS Customer Support at 1-800-999-8219 33 You will have to provide documentation for identifier changes This process does take time due to the number of corrections that are currently necessary

New Federal Loan Servicers 34

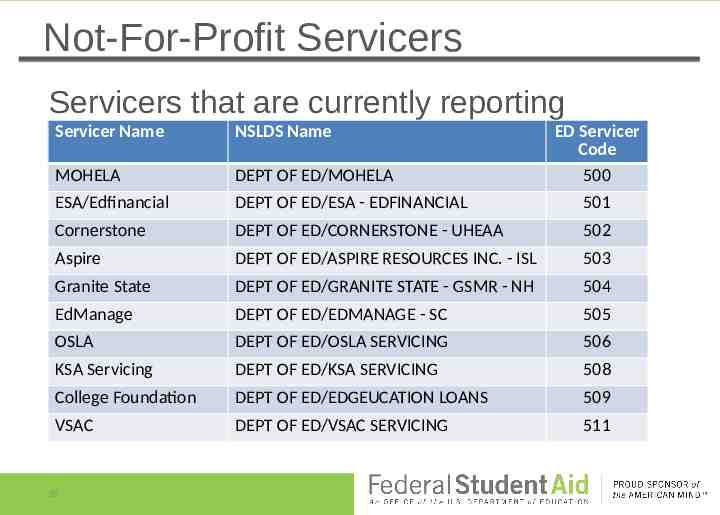

Not-For-Profit Servicers Servicers that are currently reporting Servicer Name NSLDS Name MOHELA DEPT OF ED/MOHELA ESA/Edfinancial DEPT OF ED/ESA - EDFINANCIAL 501 Cornerstone DEPT OF ED/CORNERSTONE - UHEAA 502 Aspire DEPT OF ED/ASPIRE RESOURCES INC. - ISL 503 Granite State DEPT OF ED/GRANITE STATE - GSMR - NH 504 EdManage DEPT OF ED/EDMANAGE - SC 505 OSLA DEPT OF ED/OSLA SERVICING 506 KSA Servicing DEPT OF ED/KSA SERVICING 508 College Foundation DEPT OF ED/EDGEUCATION LOANS 509 VSAC DEPT OF ED/VSAC SERVICING 511 35 ED Servicer Code 500

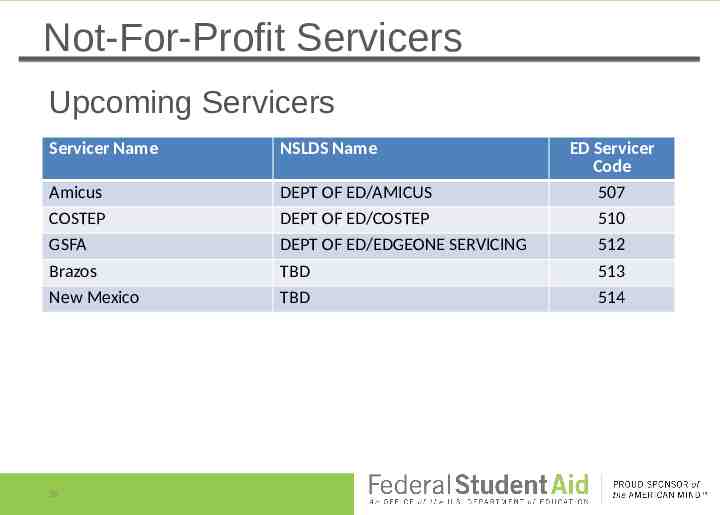

Not-For-Profit Servicers Upcoming Servicers Servicer Name NSLDS Name Amicus COSTEP GSFA Brazos New Mexico DEPT OF ED/AMICUS DEPT OF ED/COSTEP DEPT OF ED/EDGEONE SERVICING TBD TBD 36 ED Servicer Code 507 510 512 513 514

Aggregate Calculation Updates 37

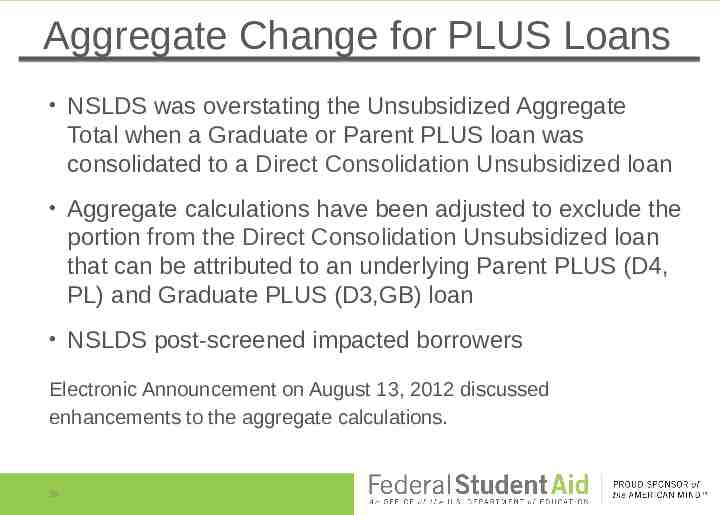

Aggregate Change for PLUS Loans NSLDS was overstating the Unsubsidized Aggregate Total when a Graduate or Parent PLUS loan was consolidated to a Direct Consolidation Unsubsidized loan Aggregate calculations have been adjusted to exclude the portion from the Direct Consolidation Unsubsidized loan that can be attributed to an underlying Parent PLUS (D4, PL) and Graduate PLUS (D3,GB) loan NSLDS post-screened impacted borrowers Electronic Announcement on August 13, 2012 discussed enhancements to the aggregate calculations. 38

Recent Changes 39

Loan Record Detail Report (LRDR) Updates 40 GA/Federal Loan Servicer Code at Calculation NSLDS is adding a new field to the LRDR to identify the Guaranty Agency (GA) or Federal Loan Servicer which held the loan at the time the Cohort was calculated This field is being added to better direct a potential challenge or appeal to the proper data manager

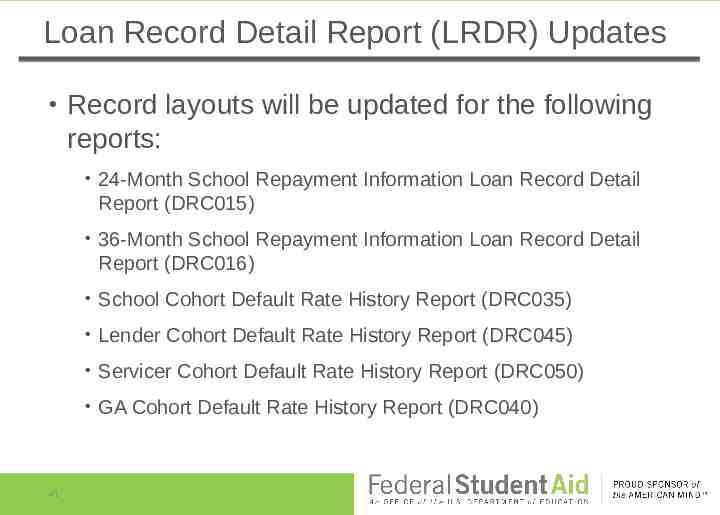

Loan Record Detail Report (LRDR) Updates 41 Record layouts will be updated for the following reports: 24-Month School Repayment Information Loan Record Detail Report (DRC015) 36-Month School Repayment Information Loan Record Detail Report (DRC016) School Cohort Default Rate History Report (DRC035) Lender Cohort Default Rate History Report (DRC045) Servicer Cohort Default Rate History Report (DRC050) GA Cohort Default Rate History Report (DRC040)

School Portfolio Report (SCHPR1) This “all purpose” report provides details on borrowers in your current loan portfolio 42 Based on loan repayment begin date If your school has merged, previous school codes are included Available in extract only

School Portfolio Report (SCHPR1) November 2012 - New Data Fields Addition of monthly due date with repayment plan information Addition of most recent deferment loan information Addition of most recent forbearance loan information 43 Current Deferment Start Current Deferment Stop Current Deferment Reason Code Current Forbearance Start Current Forbearance Stop Current Forbearance Reason Code

School Portfolio Report (SCHPR1) November 2012 – Output Formats Fixed Width New Comma Delimited Format 44 Using new Message Class: SCHRPFOP - School Portfolio Report - Fixed Width Using new Message Class: SCHRPCOP - School Portfolio Report - Comma Delimited Both formats currently available for on request report or new scheduled report option

School Portfolio Report (SCHPR1) November 2012 - Scheduled Report Set up to automatically receive the report at designated times sent via the SAIG Establish preferences on the school profile page Set frequency – Bi-Weekly – Monthly – Quarterly Specify output format – Fixed Width – Comma Delimited Specify TG mailbox

School Portfolio Report (SCHPR1) The School Portfolio Report, when on request, provides up to three years of data based on dates entered for “date entered repayment begin” and “date entered repayment end” The scheduled School Portfolio Report will provide data three years prior, the current cohort and two years after the current cohort year

Upcoming Changes

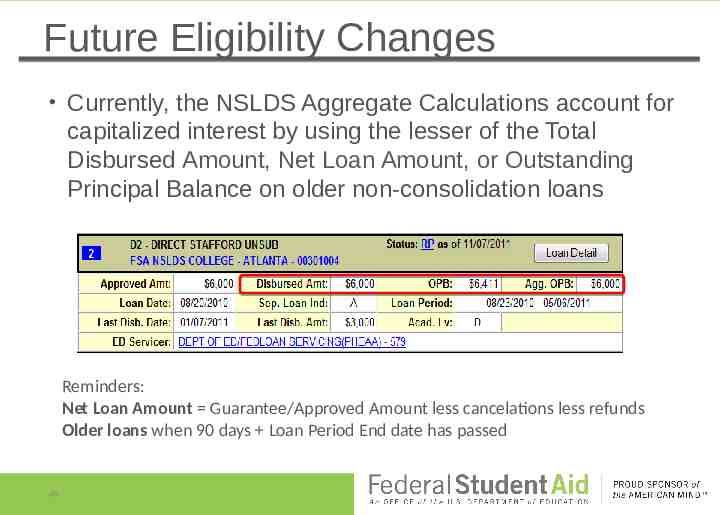

Future Eligibility Changes Currently, the NSLDS Aggregate Calculations account for capitalized interest by using the lesser of the Total Disbursed Amount, Net Loan Amount, or Outstanding Principal Balance on older non-consolidation loans Reminders: Net Loan Amount Guarantee/Approved Amount less cancelations less refunds Older loans when 90 days Loan Period End date has passed 48

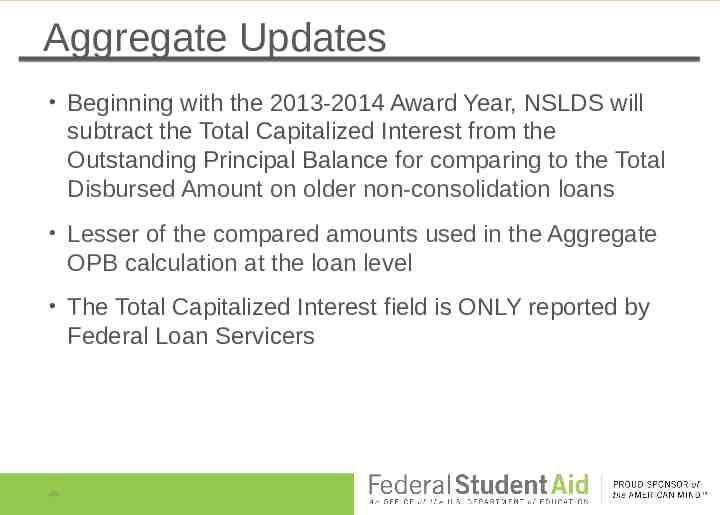

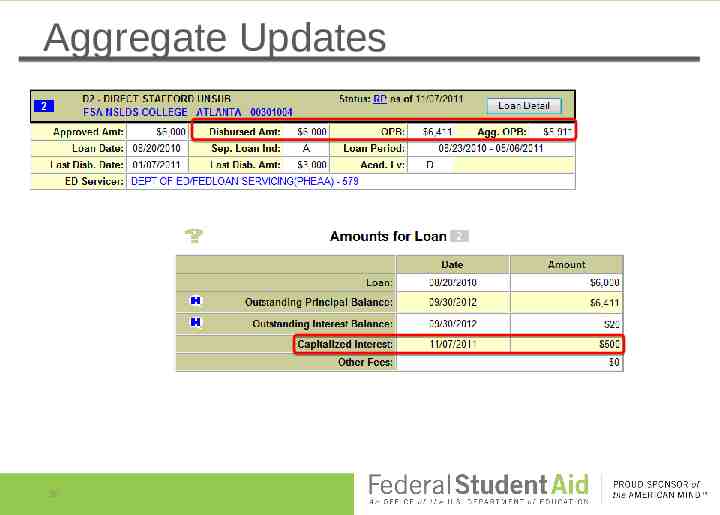

Aggregate Updates Beginning with the 2013-2014 Award Year, NSLDS will subtract the Total Capitalized Interest from the Outstanding Principal Balance for comparing to the Total Disbursed Amount on older non-consolidation loans Lesser of the compared amounts used in the Aggregate OPB calculation at the loan level The Total Capitalized Interest field is ONLY reported by Federal Loan Servicers 49

Aggregate Updates 50

Unusual Enrollment History NSLDS will begin monitoring Pell Grant Award History of students starting with the 2013-2014 Award Year Unusual patterns of Pell award history, as defined by the Department, will be identified on NSLDS New pre-screening indicators and post-screening reason codes will be transmitted to CPS for inclusion on the ISIR alerting schools to unusual or questionable award history It will be identified by a new indicator and comment codes outlining the necessary action for resolution 51

Exit Counseling Online loan exit counseling is moving from NSLDS to www.studentloans.gov in the spring of 2013 NSLDS will continue to store exit counseling completion data and send out exit counseling reports to schools, loan holders, and loan servicers TEACH exit counseling will remain on NSLDS For more information about online counseling on www.studentloans.gov, please visit the COD session on Counseling Products 52

Borrower Demographic Report This report will provide demographic information on borrowers in your school’s portfolio Report will include: 53 Borrower contact information (address, phone and e-mail) reported by Federal Loan Servicers and by the school through the Enrollment Reporting process Contact information, reference, next of kin and employment information provided by the borrower in Exit Counseling This report will be available for request in extract format only

Using 3rd Party Servicers Schools using a 3rd Party Servicer for any functionality requiring NSLDS usage is required to report that relationship to FSA 54 All 3rd Party Servicers must be noted on your ECAR, including enrollment reporting servicers To add a servicer, use the E-App Web site at http://eligcert.ed.gov Each school is responsible for ensuring that any data received from NSLDS by either the school or its 3rd Party Servicer is adequately protected and secured

QUESTIONS?

NSLDS Contact Information NSLDS Customer Support Center Phone: 800-999-8219 Toll: 785-838-2141 Fax: 785-838-2154 Web: www.nsldsfap.ed.gov E-mail: [email protected] 56