Recovery Audit Contractors (RACs) & Other CMS Initiatives June

42 Slides886.50 KB

Recovery Audit Contractors (RACs) & Other CMS Initiatives June 19, 2008

Examples of Current Government Audit Requests Medicare CERT Medicare Focused Medical Review (pre and post payment) Medicaid Fraud & Inspector General Units Payment Error Rate Measurement Program (PERM) Integrated Healthcare Auditing and Services Inc. (IHAS) QIO Reviews OIG and USDOJ Government Investigations

New Government Initiatives Medicare Recovery Audit Contractors (“RACs”) Medicaid Integrity Programs (“MIP”) State Inspector General Investigations (“FCA”) CMS “Data Mining” projects for identifying trends and patterns in coding and billing CMS Implementation of Medically Unlikely Edits (“MUEs”)

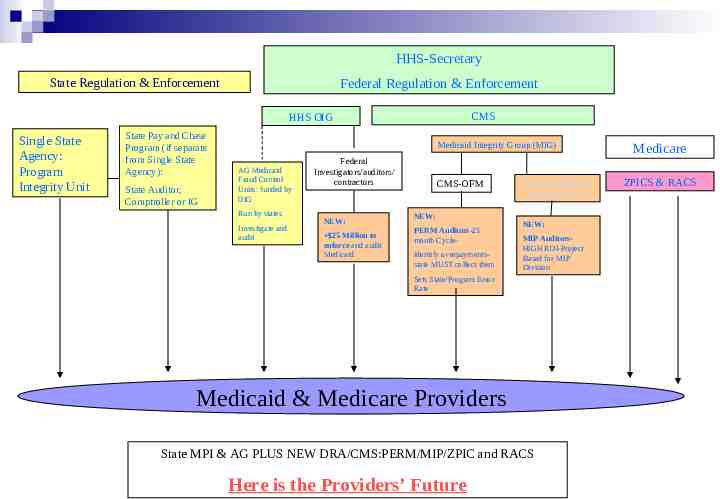

HHS-Secretary State Regulation & Enforcement Federal Regulation & Enforcement CMS HHS OIG Single State Agency: Program Integrity Unit State Pay and Chase Program (if separate from Single State Agency): State Auditor, Comptroller or IG Medicaid Integrity Group (MIG) AG Medicaid Fraud Control Units: funded by OIG Run by states Investigate and audit Federal Investigators/auditors/ contractors NEW: 25 Million to enforce and audit Medicaid CMS-OFM NEW: PERM Auditors-23 month CycleIdentify overpaymentsstate MUST collect them Medicaid Integrity Program (MIP) NEW: MIP AuditorsHIGH ROI-Project Based for MIP Division Sets State/Program Error Rate Medicaid & Medicare Providers State MPI & AG PLUS NEW DRA/CMS:PERM/MIP/ZPIC and RACS Here is the Providers’ Future Medicare ZPICS & RACS

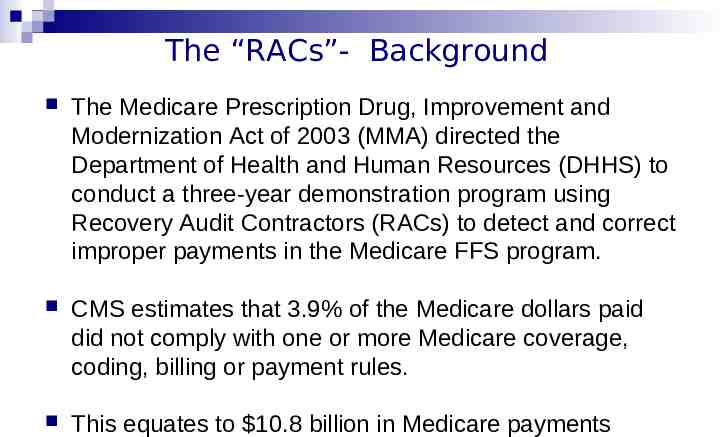

The “RACs”- Background The Medicare Prescription Drug, Improvement and Modernization Act of 2003 (MMA) directed the Department of Health and Human Resources (DHHS) to conduct a three-year demonstration program using Recovery Audit Contractors (RACs) to detect and correct improper payments in the Medicare FFS program. CMS estimates that 3.9% of the Medicare dollars paid did not comply with one or more Medicare coverage, coding, billing or payment rules. This equates to 10.8 billion in Medicare payments

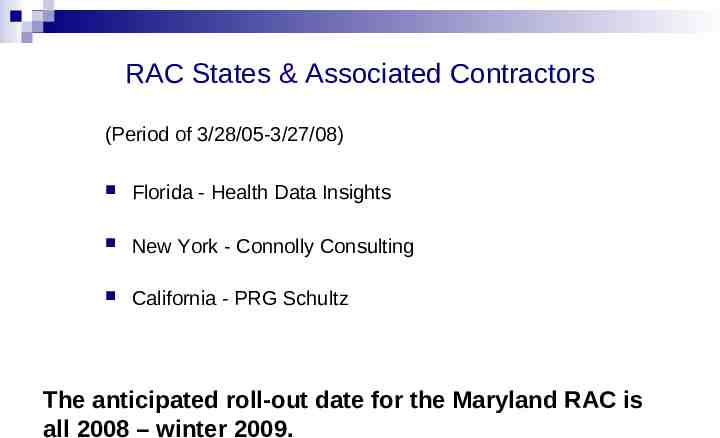

RAC States & Associated Contractors (Period of 3/28/05-3/27/08) Florida - Health Data Insights New York - Connolly Consulting California - PRG Schultz The anticipated roll-out date for the Maryland RAC is all 2008 – winter 2009.

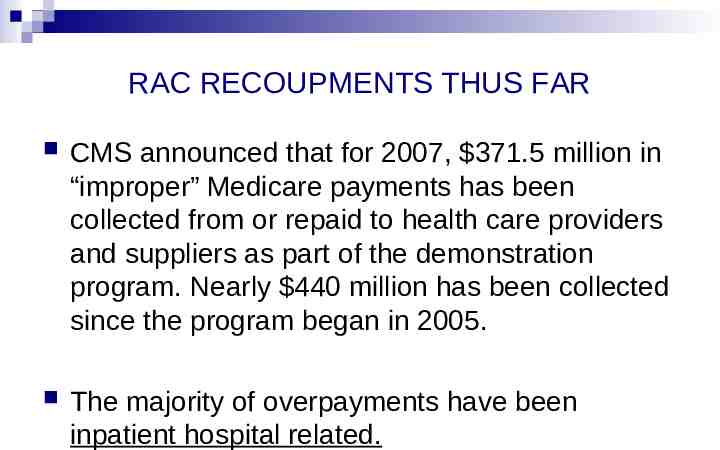

RAC RECOUPMENTS THUS FAR CMS announced that for 2007, 371.5 million in “improper” Medicare payments has been collected from or repaid to health care providers and suppliers as part of the demonstration program. Nearly 440 million has been collected since the program began in 2005. The majority of overpayments have been inpatient hospital related.

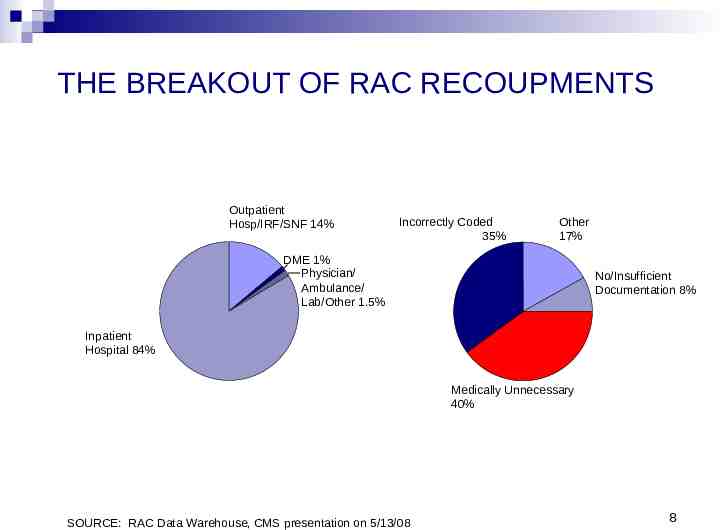

THE BREAKOUT OF RAC RECOUPMENTS Outpatient Hosp/IRF/SNF 14% Incorrectly Coded 35% Other 17% DME 1% Physician/ Ambulance/ Lab/Other 1.5% No/Insufficient Documentation 8% Inpatient Hospital 84% Medically Unnecessary 40% SOURCE: RAC Data Warehouse, CMS presentation on 5/13/08 8

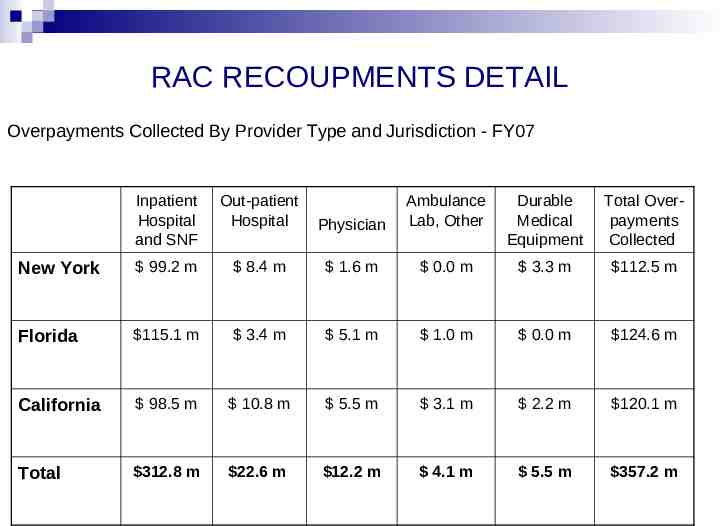

RAC RECOUPMENTS DETAIL Overpayments Collected By Provider Type and Jurisdiction - FY07 Inpatient Hospital and SNF Out-patient Hospital Physician Ambulance Lab, Other Durable Medical Equipment Total Overpayments Collected New York 99.2 m 8.4 m 1.6 m 0.0 m 3.3 m 112.5 m Florida 115.1 m 3.4 m 5.1 m 1.0 m 0.0 m 124.6 m California 98.5 m 10.8 m 5.5 m 3.1 m 2.2 m 120.1 m Total 312.8 m 22.6 m 12.2 m 4.1 m 5.5 m 357.2 m

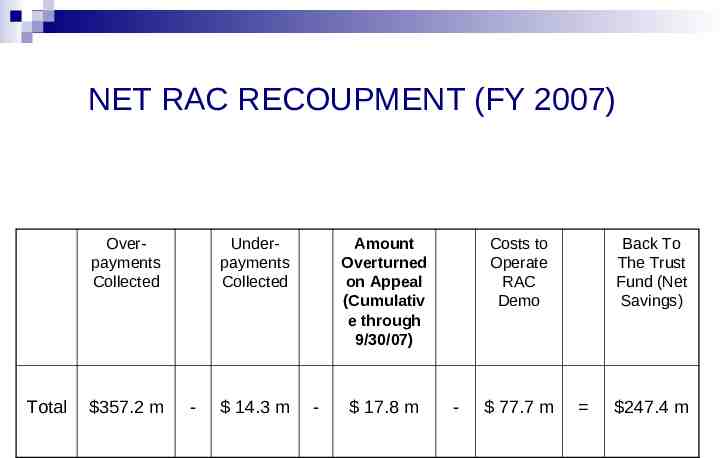

NET RAC RECOUPMENT (FY 2007) Overpayments Collected Total 357.2 m Underpayments Collected - 14.3 m Amount Overturned on Appeal (Cumulativ e through 9/30/07) - 17.8 m Costs to Operate RAC Demo - 77.7 m Back To The Trust Fund (Net Savings) 247.4 m

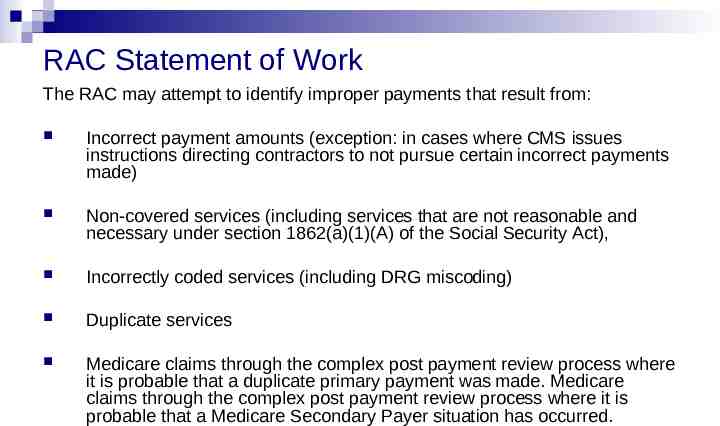

RAC Statement of Work The RAC may attempt to identify improper payments that result from: Incorrect payment amounts (exception: in cases where CMS issues instructions directing contractors to not pursue certain incorrect payments made) Non-covered services (including services that are not reasonable and necessary under section 1862(a)(1)(A) of the Social Security Act), Incorrectly coded services (including DRG miscoding) Duplicate services Medicare claims through the complex post payment review process where it is probable that a duplicate primary payment was made. Medicare claims through the complex post payment review process where it is probable that a Medicare Secondary Payer situation has occurred.

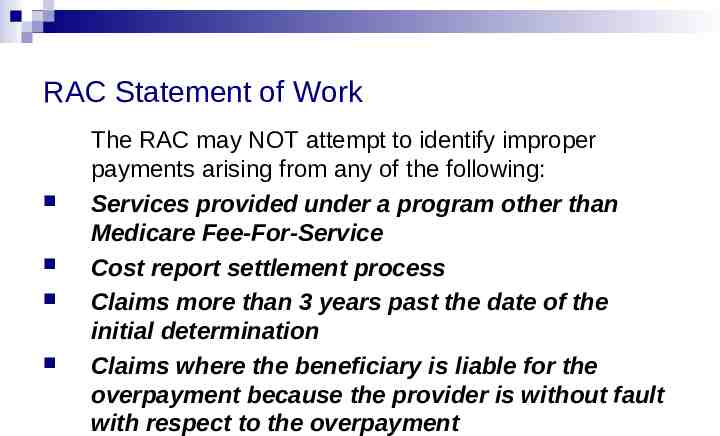

RAC Statement of Work The RAC may NOT attempt to identify improper payments arising from any of the following: Services provided under a program other than Medicare Fee-For-Service Cost report settlement process Claims more than 3 years past the date of the initial determination Claims where the beneficiary is liable for the overpayment because the provider is without fault with respect to the overpayment

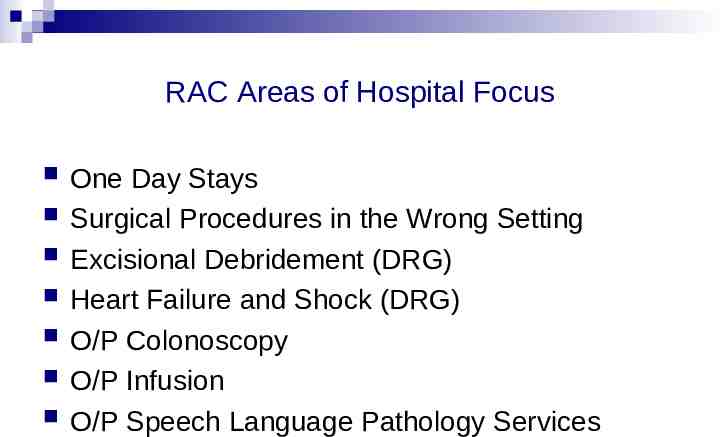

RAC Areas of Hospital Focus One Day Stays Surgical Procedures in the Wrong Setting Excisional Debridement (DRG) Heart Failure and Shock (DRG) O/P Colonoscopy O/P Infusion O/P Speech Language Pathology Services

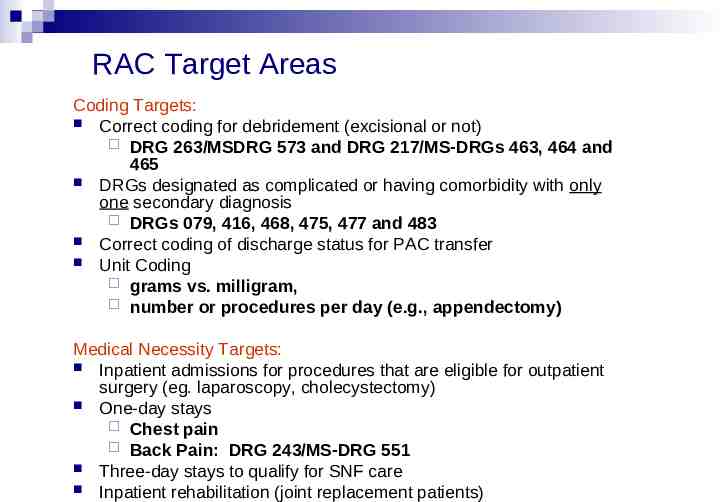

RAC Target Areas Coding Targets: Correct coding for debridement (excisional or not) DRG 263/MSDRG 573 and DRG 217/MS-DRGs 463, 464 and 465 DRGs designated as complicated or having comorbidity with only one secondary diagnosis DRGs 079, 416, 468, 475, 477 and 483 Correct coding of discharge status for PAC transfer Unit Coding grams vs. milligram, number or procedures per day (e.g., appendectomy) Medical Necessity Targets: Inpatient admissions for procedures that are eligible for outpatient surgery (eg. laparoscopy, cholecystectomy) One-day stays Chest pain Back Pain: DRG 243/MS-DRG 551 Three-day stays to qualify for SNF care Inpatient rehabilitation (joint replacement patients)

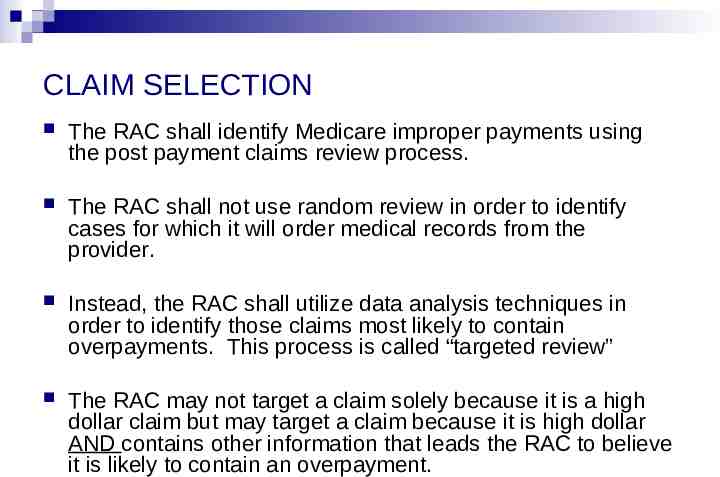

CLAIM SELECTION The RAC shall identify Medicare improper payments using the post payment claims review process. The RAC shall not use random review in order to identify cases for which it will order medical records from the provider. Instead, the RAC shall utilize data analysis techniques in order to identify those claims most likely to contain overpayments. This process is called “targeted review” The RAC may not target a claim solely because it is a high dollar claim but may target a claim because it is high dollar AND contains other information that leads the RAC to believe it is likely to contain an overpayment.

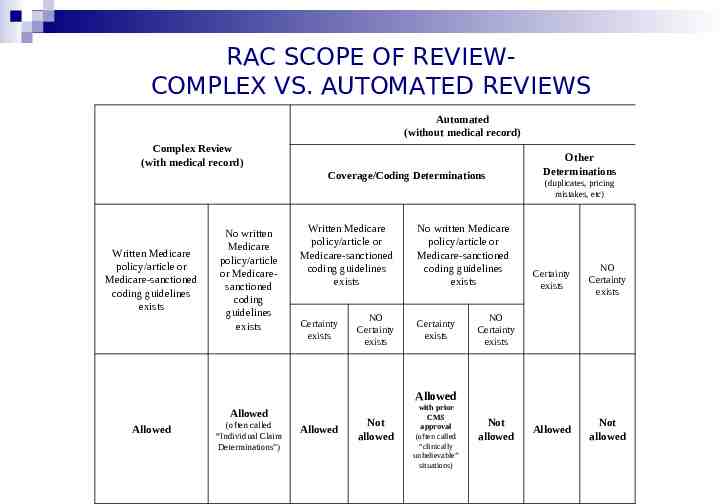

RAC SCOPE OF REVIEWCOMPLEX VS. AUTOMATED REVIEWS Automated (without medical record) Complex Review (with medical record) Coverage/Coding Determinations Written Medicare policy/article or Medicare-sanctioned coding guidelines exists No written Medicare policy/article or Medicaresanctioned coding guidelines exists Written Medicare policy/article or Medicare-sanctioned coding guidelines exists Certainty exists NO Certainty exists No written Medicare policy/article or Medicare-sanctioned coding guidelines exists Certainty exists Other Determinations (duplicates, pricing mistakes, etc) Certainty exists NO Certainty exists Allowed Not allowed NO Certainty exists Allowed Allowed Allowed (often called “Individual Claim Determinations”) Allowed Not allowed with prior CMS approval (often called “clinically unbelievable” situations) Not allowed

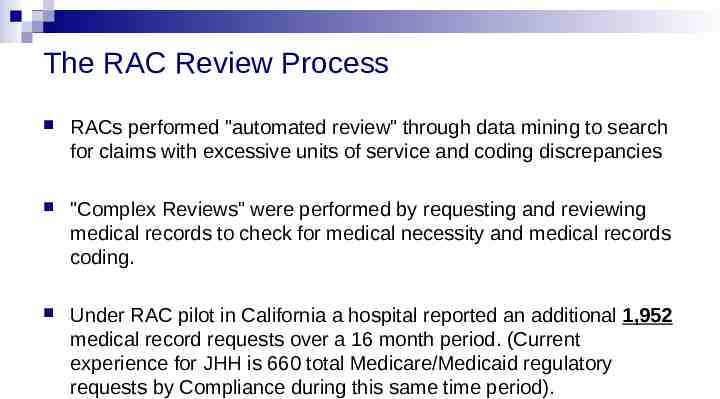

The RAC Review Process RACs performed "automated review" through data mining to search for claims with excessive units of service and coding discrepancies "Complex Reviews" were performed by requesting and reviewing medical records to check for medical necessity and medical records coding. Under RAC pilot in California a hospital reported an additional 1,952 medical record requests over a 16 month period. (Current experience for JHH is 660 total Medicare/Medicaid regulatory requests by Compliance during this same time period).

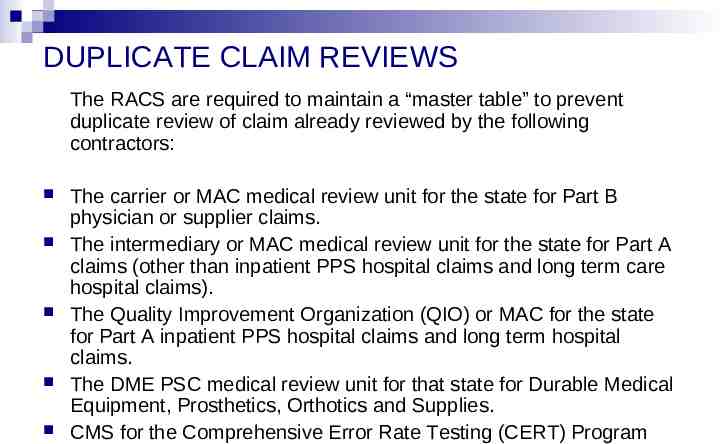

DUPLICATE CLAIM REVIEWS The RACS are required to maintain a “master table” to prevent duplicate review of claim already reviewed by the following contractors: The carrier or MAC medical review unit for the state for Part B physician or supplier claims. The intermediary or MAC medical review unit for the state for Part A claims (other than inpatient PPS hospital claims and long term care hospital claims). The Quality Improvement Organization (QIO) or MAC for the state for Part A inpatient PPS hospital claims and long term hospital claims. The DME PSC medical review unit for that state for Durable Medical Equipment, Prosthetics, Orthotics and Supplies. CMS for the Comprehensive Error Rate Testing (CERT) Program

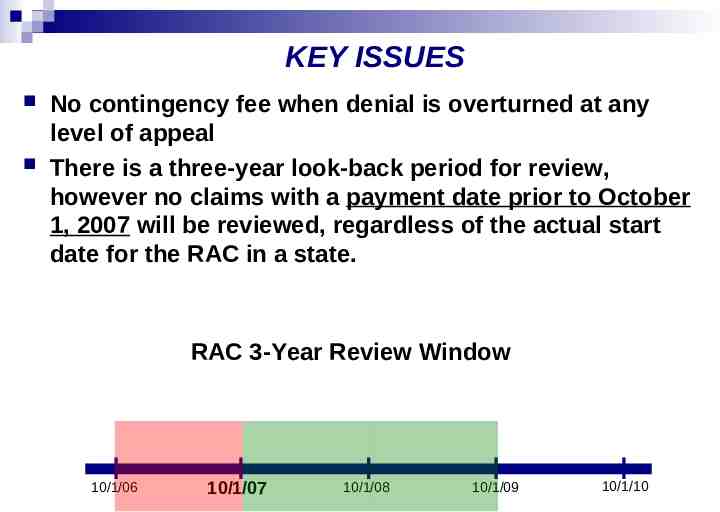

KEY ISSUES No contingency fee when denial is overturned at any level of appeal There is a three-year look-back period for review, however no claims with a payment date prior to October 1, 2007 will be reviewed, regardless of the actual start date for the RAC in a state. RAC 3-Year Review Window 10/1/06 10/1/07 10/1/08 10/1/09 10/1/10

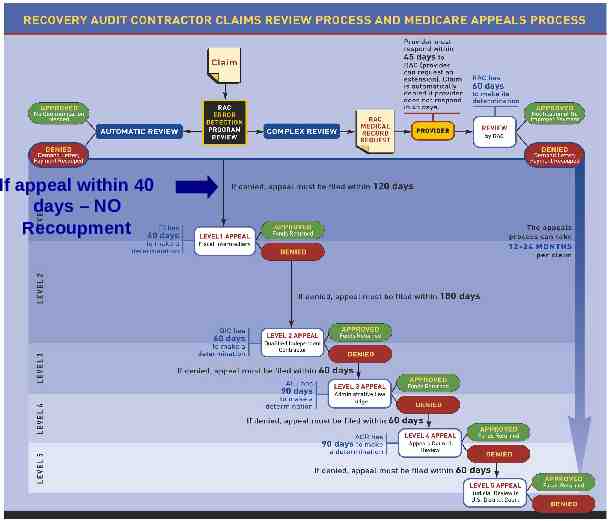

APPEALS Hospitals can appeal using the standard Medicare appeals process- this can take as long as 1 year. Timing is critical for both filing the appeal and its ultimate success. The goal is an interdisciplinary team approach to managing denials including individual department level involvement. Department assistance will be critical with outpatient coding related denials.

If appeal within 40 days – NO Recoupment

JHH/JHM Preparation PFS, UM, HIM & Compliance have been following the actions of the RACs and preparing for months. Creation of individual entity committee & RAC Czar to review and respond to issues/requests, track and gather denial data. Creation of JHM RAC Committee to be able to report system-wide impact and share entity strategies. Creation of master database to track RAC requests, submissions and appeals.

JHH/JHM Preparation Cont. Where possible, we have created an internal focus on key issues in preparation (i.e., one-day stays vs. observation and Compliance Work Plan items). JHHS representatives will request an entrance conference prior to the commencement of RAC activities. Review/address past repayments Identify contacts and resources JHHS is active with MHA and its efforts to provide RAC education on Maryland payment system (HSCRC) and establish parameters, where possible, on scope of activities.

AHA RACTrac Web-based survey that will collect RAC experience data from hospitals Collect both quarterly snapshot and cumulative information on RAC experience to date Unit of analysis is the hospital Financial impact (underpayments and overpayments) Appeals information Trends in types of services being reviewed and broad reasons for denial Administrative burden General Medical/Surgical Hospitals LTCH Psych Rehab Quarterly data collection to begin after the permanent program rolls out

More CMS Medicare Reform Initiatives Reshaping THE the MACS and the PSCs BIG SHIFT– Starting May 2008ZPICS!

CMS Medicare Reform Initiative Medicare has integrated the Part A/B contractors. seven zones have been created based on the newly established Medicare Administrative Contractor (MAC) jurisdictions. Home health and hospice workloads have been consolidated into four of the A/B MAC contracts The home health and hospice workload has been split into four jurisdictions that match those for the MACs that will be serving the Durable Medical Equipment suppliers.

CMS Medicare Reform Initiative As a result of the seven zones, new entities entitled Zone Program Integrity Contractors (ZPICs) have been created to perform program integrity for Medicare Parts A, B, C, D, Durable Medical Equipment (DME) and Regional Home Health Intermediaries (RHHI).

CMS Medicare Reform Initiative - ZPICs Report on Medicare Compliance (10/1/07) “In a major shift in its war on fraud, CMS is replacing program safeguard contractors (PSCs) with seven “zone program integrity contractors” (ZPICs). They will tackle all benefit-integrity activities across the country and form “rapid response teams” with a more aggressive fraud fighting mandate, said Kim Brandt, director of the CMS Program Integrity Group Fundamental activities of the Zone Program Integrity Contractor (ZPIC) that will help ensure payments are appropriate and consistent with Medicare coverage, coding, and audit policy, and will also identify, prevent, or correct potential fraud, waste and/or abuse.

CMS Statement of Work for ZPICs General The ZPIC shall review and analyze a variety of data in order to focus its program integrity efforts by identifying vulnerabilities and/or specific providers for review and investigation within its zone, referral of potential fraud and abuse cases to law enforcement, and pursuance of administrative actions, which include but are not limited to payment suspension, provider revocation and the implementation of claims processing edits that limit or stop payment to suspect providers. Further, the ZPIC shall be proactive and aggressive in pursuing many different sources and techniques for analyzing data in order to reduce any of its risks within this SOW.

CMS Statement of Work for ZPICs Perform Benefit Integrity (“BI”) investigations Refer cases to law enforcement Make coverage and coding determinations Review audit, settlement, and reimbursement of cost reports Review bids for participation in the prescription drug program Assist CMS in developing a list of entities that may require future monitoring based upon past history

CMS Statement of Work for ZPICs Conduct preliminary investigations into entities conducting fraudulent enrollment, eligibility determination and benefit distribution Match and analyze claims data Coordinating potential fraud, waste and abuse activities with the appropriate MMEs Complaint screening (Medicare Parts C and D only) Conduct specified audits Conduct specified complaint investigations (part C and part D only)

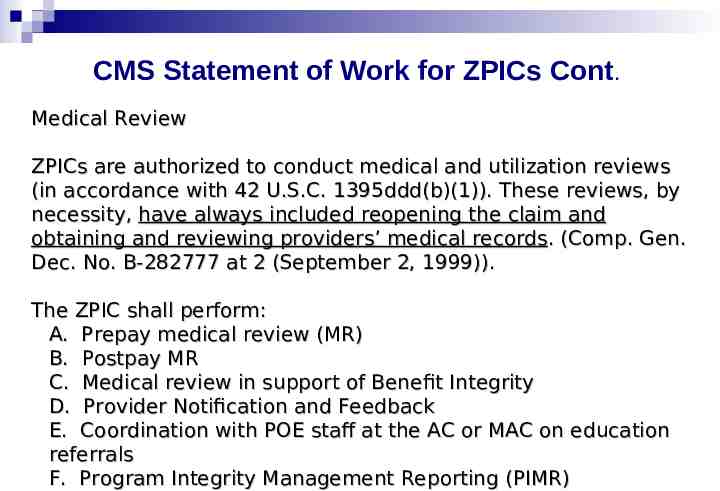

CMS Statement of Work for ZPICs Cont. Medical Review ZPICs are authorized to conduct medical and utilization reviews (in accordance with 42 U.S.C. 1395ddd(b)(1)). These reviews, by necessity, have always included reopening the claim and obtaining and reviewing providers’ medical records. (Comp. Gen. Dec. No. B-282777 at 2 (September 2, 1999)). The ZPIC shall perform: A. Prepay medical review (MR) B. Postpay MR C. Medical review in support of Benefit Integrity D. Provider Notification and Feedback E. Coordination with POE staff at the AC or MAC on education referrals F. Program Integrity Management Reporting (PIMR)

The Medicaid Integrity Program (“MIP”)

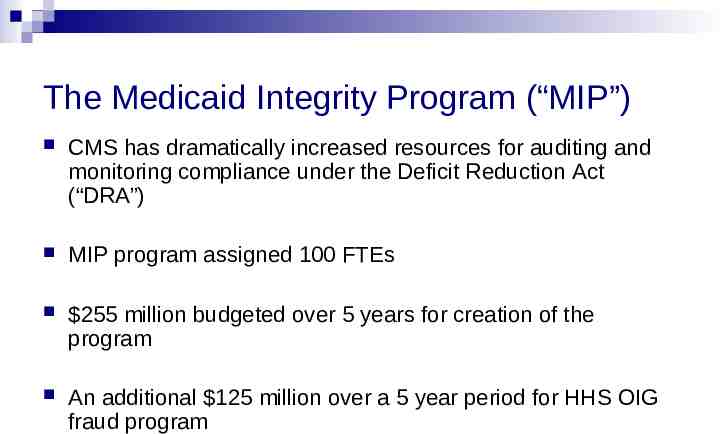

The Medicaid Integrity Program (“MIP”) CMS has dramatically increased resources for auditing and monitoring compliance under the Deficit Reduction Act (“DRA”) MIP program assigned 100 FTEs 255 million budgeted over 5 years for creation of the program An additional 125 million over a 5 year period for HHS OIG fraud program

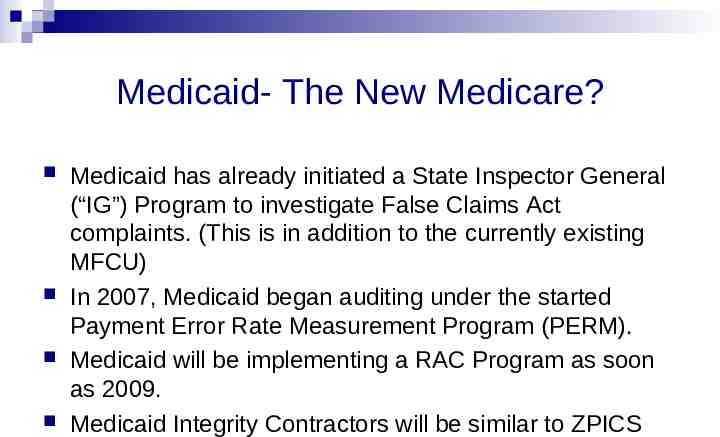

Medicaid- The New Medicare? Medicaid has already initiated a State Inspector General (“IG”) Program to investigate False Claims Act complaints. (This is in addition to the currently existing MFCU) In 2007, Medicaid began auditing under the started Payment Error Rate Measurement Program (PERM). Medicaid will be implementing a RAC Program as soon as 2009. Medicaid Integrity Contractors will be similar to ZPICS

CMS Medicare and Medicaid Reform Initiative 2008 MIP Program Requirements MEDICAID INTEGRITY CONTRACTORS (MICS) Review actions of individuals or entities furnishing items or services under Medicaid in order to determine whether fraud, waste, and abuse has occurred, is likely to occur, or whether such actions have the potential for fraud, Audit claims, Identify overpayments and, Educate Medicaid providers, MCOs, beneficiaries and others concerning payment integrity and quality-of-care.

Types of MICS Review MICs Contracts awarded to 5 contractors. Using Medicaid claims data and working with Division of Fraud Research & Detection, Review MICs will identify potentially fraudulent claims and supply leads to audit MICs of providers to be audited.

TYPES OF MICs Cont . Review MICs shall use data-mining and analysis techniques to develop models that combines healthcare quality indicators, billing practices and Medicaid specific business rules to predict aberrant provider patterns to identify and rank by risk providers to be audited. Review MICs will develop reporting tools that show ranked providers according to risk of fraud/overpayment problems with sufficient detail for auditors to begin their audits.

TYPES OF MICs Cont . Audit MICs Audit MICs will conduct post-payment audits of individual providers and institutional providers of Medicaid services within the region Will include fee-for service, cost reports and eventually MCOs. Audits will identify overpayments but Audit MICs will not be involved in collection. State process will be used to accomplish overpayment recoupment.

TYPES OF MICs Cont . Audit MICs Audit MICs will concentrate on Region IV and Region III: Alabama, N&S Carolina, Florida, Georgia, Kentucky, Mississippi, Tennessee, Delaware, DC, Maryland, Pennsylvania, West Virginia, and Virginia. “It is my expectation that by this time next year, our audit contractors will be doing approximately a couple hundred provider audits a month The reason MIG is doing this two regions at a time is we didn’t want to unleash the MIPs all at once ”said MIG Director David Frank. (MIG Director David Frank, HCCA, AIS Medicaid Compliance News, Vol. 2, Number 5, May 2008)

What You Can Do Appreciate the scope and magnitude of the upcoming audits and associated appeals. Respond timely to requests for information. The exact roles and responsibilities for receiving and responding to these various requests are still being discussed. Please contact Compliance should you receive any CERT, PERM, RAC or ZPIC requests.

QUESTIONS?