Quarterly Dashboard Assessment Presentation to the Year Up Board

19 Slides945.50 KB

Quarterly Dashboard Assessment Presentation to the Year Up Board of Directors June 18th, 2007 1

Introduction This document looks at seven critical areas of Year Up’s work. For each area, we set performance benchmarks and rate our progress with a color coded system: Green means that the area is performing on target Yellow means caution and further attention and analysis is warranted Red means there are significant concerns and follow-up is a priority For areas that focus on class-specific data, classes are identified by their graduation month and year (i.e. Jan ’06, Jul ’06, etc.). The goal is to provide the Year Up staff and Board with a tool to clearly assess organizational health and to zero in on problem areas. 2

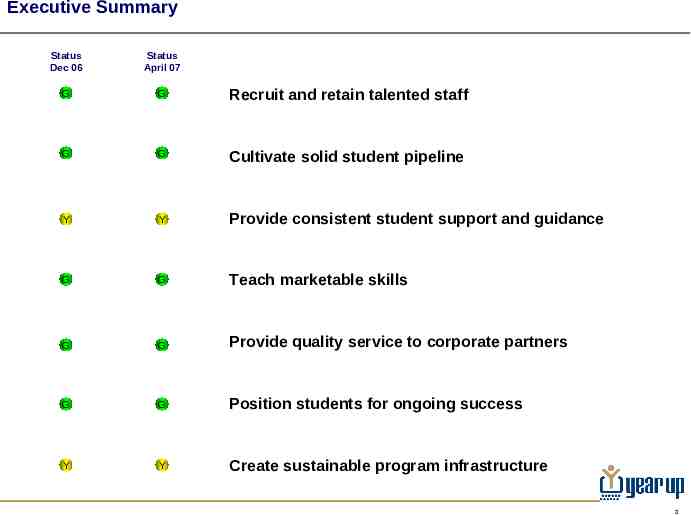

Executive Summary Status Dec 06 Status April 07 G G Recruit and retain talented staff G G Cultivate solid student pipeline Y Y Provide consistent student support and guidance G G Teach marketable skills G G Provide quality service to corporate partners G G Position students for ongoing success Y Y Create sustainable program infrastructure 3

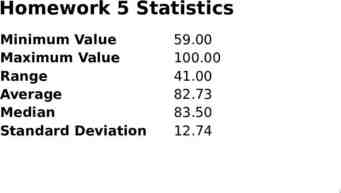

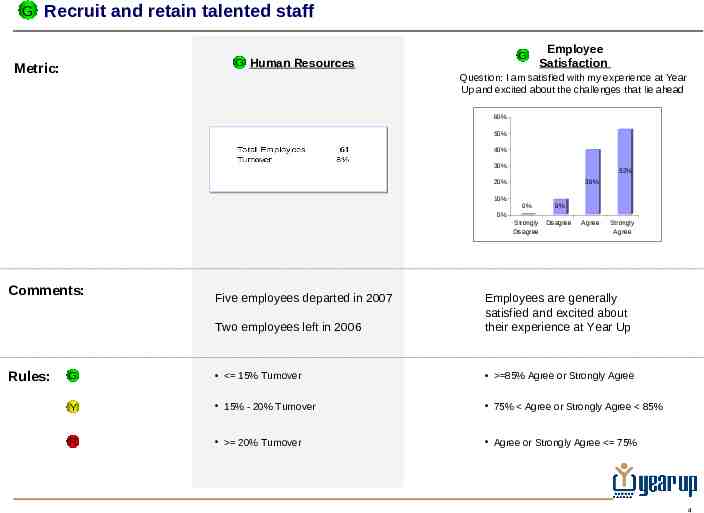

G Recruit and retain talented staff G G Human Resources Metric: Employee Satisfaction Question: I am satisfied with my experience at Year Up and excited about the challenges that lie ahead 60% 50% 40% 30% 52% 39% 20% 10% 0% 9% 0% Strongly Disagree Disagree Comments: Rules: Five employees departed in 2007 Agree Strongly Agree Two employees left in 2006 Employees are generally satisfied and excited about their experience at Year Up G 15% Turnover 85% Agree or Strongly Agree Y 15% - 20% Turnover 75% Agree or Strongly Agree 85% R 20% Turnover Agree or Strongly Agree 75% 4

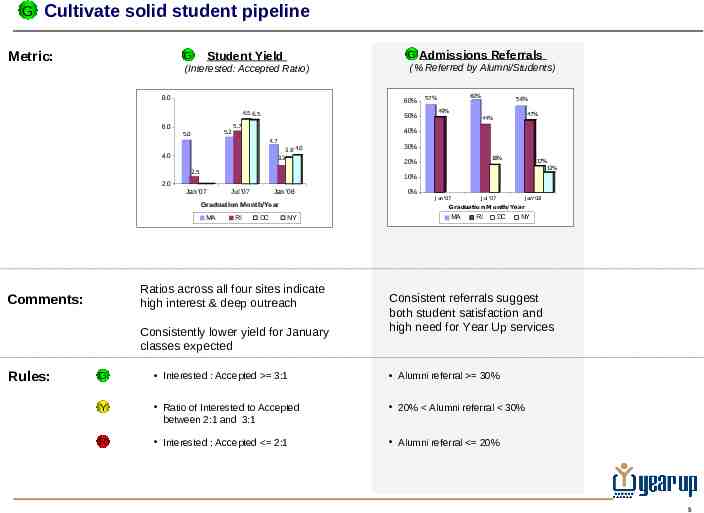

G Cultivate solid student pipeline Metric: G Student Yield (Interested: Accepted Ratio) 8.0 60% 6.5 6.5 50% 5.7 6.0 4.7 3.9 4.0 3.3 4.0 2.5 56% 49% 47% 44% 30% 18% 20% 17% 13% 10% 2.0 Jan '07 Jul '07 Jan '08 Graduation Month/Year MA RI DC 0% J an '07 J ul '07 J an '08 Graduation M onth/Year NY Ratios across all four sites indicate high interest & deep outreach Consistently lower yield for January classes expected Rules: 60% 57% 40% 5.2 5.0 Comments: G Admissions Referrals (% Referred by Alumni/Students) MA RI DC NY Consistent referrals suggest both student satisfaction and high need for Year Up services G Interested : Accepted 3:1 Alumni referral 30% Y Ratio of Interested to Accepted between 2:1 and 3:1 20% Alumni referral 30% R Interested : Accepted 2:1 Alumni referral 20% 5

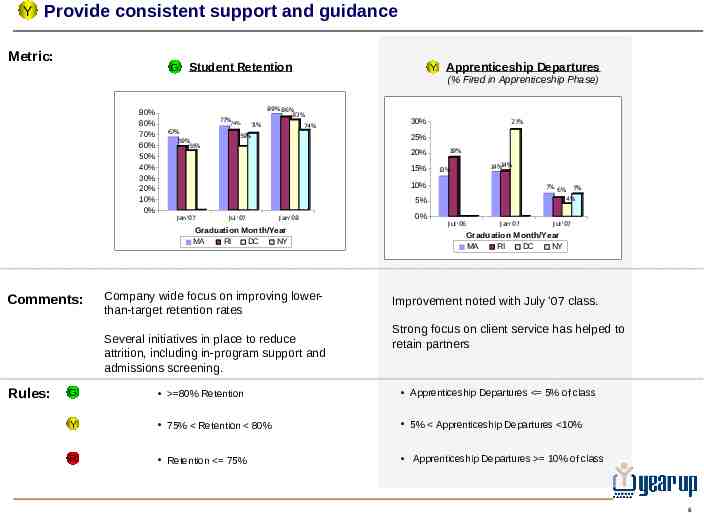

Y Provide consistent support and guidance Metric: G 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Student Retention 89% 86% 83% 77% 74% 67% 59% 55% Y Apprenticeship Departures (% Fired in Apprenticeship Phase) 71% 74% 59% 20% 15% 19% 14%14% 13% 10% 7% 5% J an '07 J ul '07 J an '08 Company wide focus on improving lowerthan-target retention rates Several initiatives in place to reduce attrition, including in-program support and admissions screening. Rules: 27% 25% Graduation Month/Year MA RI DC NY Comments: 30% 0% J ul '06 J an '07 6% 7% 4% J ul '07 Graduation Month/Year MA RI DC NY Improvement noted with July ’07 class. Strong focus on client service has helped to retain partners G 80% Retention Apprenticeship Departures 5% of class Y 75% Retention 80% 5% Apprenticeship Departures 10% R Retention 75% Apprenticeship Departures 10% of class 6

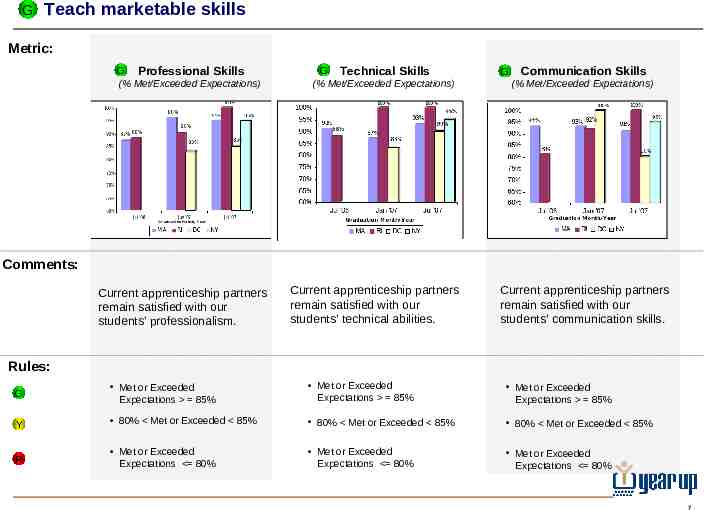

G Teach marketable skills Metric: G Professional Skills (% Met/Exceeded Expectations) G Technical Skills (% Met/Exceeded Expectations) G Communication Skills (% Met/Exceeded Expectations) Comments: Current apprenticeship partners remain satisfied with our students’ professionalism. Current apprenticeship partners remain satisfied with our students’ technical abilities. Current apprenticeship partners remain satisfied with our students’ communication skills. Rules: G Met or Exceeded Expectations 85% Met or Exceeded Expectations 85% Met or Exceeded Expectations 85% Y 80% Met or Exceeded 85% 80% Met or Exceeded 85% 80% Met or Exceeded 85% R Met or Exceeded Expectations 80% Met or Exceeded Expectations 80% Met or Exceeded Expectations 80% 7

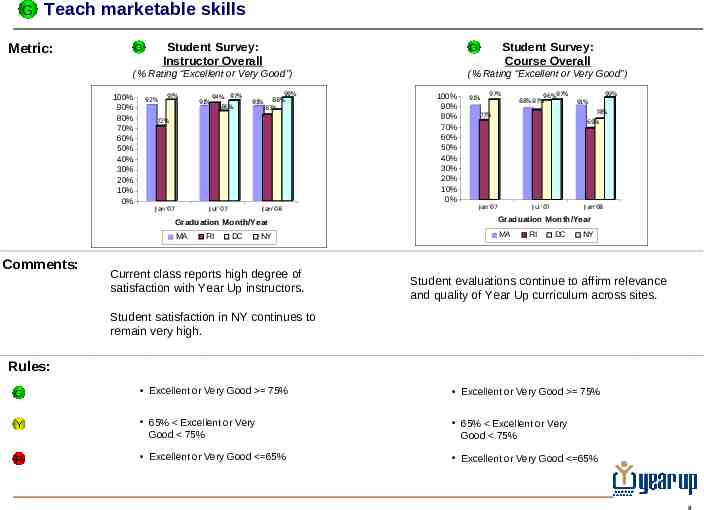

G Teach marketable skills Metric: Student Survey: Instructor Overall G (% Rating “Excellent or Very Good”) 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Comments: 92% 97% 91% 94% 97% 86% 91% 99% 88% 83% 72% J an '07 J ul '07 Student Survey: Course Overall G J an '08 (% Rating “Excellent or Very Good”) 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 91% 97% 96%97% 88% 87% 99% 91% 78% 77% 69% J an '07 J ul '07 J an '08 Graduation Month/Year Graduation Month/Year MA MA RI DC NY Current class reports high degree of satisfaction with Year Up instructors. RI DC NY Student evaluations continue to affirm relevance and quality of Year Up curriculum across sites. Student satisfaction in NY continues to remain very high. Rules: G Excellent or Very Good 75% Excellent or Very Good 75% Y 65% Excellent or Very Good 75% 65% Excellent or Very Good 75% R Excellent or Very Good 65% Excellent or Very Good 65% 8

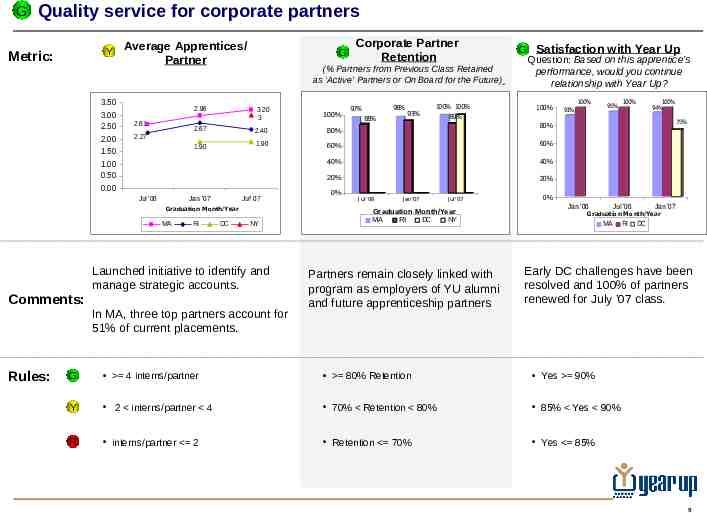

G Quality service for corporate partners Y Metric: 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 Average Apprentices/ Partner 2.61 (% Partners from Previous Class Retained as ‘Active’ Partners or On Board for the Future) Rules: 100% 100% 89% 100% 100% 2.67 2.40 80% 1.90 1.90 60% 60% 40% 40% 20% 20% Jan '07 Jul' 07 RI DC NY Launched initiative to identify and manage strategic accounts. Comments: 98% G Satisfaction with Year Up Question: Based on this apprentice’s performance, would you continue relationship with Year Up? 3.20 3 Graduation Month/Year MA Corporate Partner Retention 2.96 2.27 Jul '06 G In MA, three top partners account for 51% of current placements. 0% 97% 88% J ul '06 93% 100% 91% 95% 100% 100% 94% 75% 80% J an '07 J ul '07 Graduation Month/Year MA RI DC NY Partners remain closely linked with program as employers of YU alumni and future apprenticeship partners 0% Jan '06 Jul '06 Jan '07 Graduatio n Month/Year MA RI DC Early DC challenges have been resolved and 100% of partners renewed for July ’07 class. G 4 interns/partner 80% Retention Yes 90% Y 2 interns/partner 4 70% Retention 80% 85% Yes 90% R interns/partner 2 Retention 70% Yes 85% 9

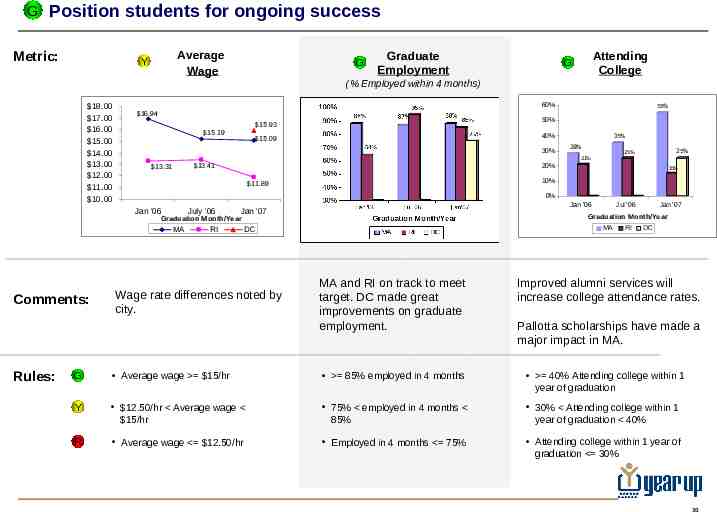

G Position students for ongoing success Metric: Average Wage Y G Graduate Employment Attending College G (% Employed within 4 months) 18.00 17.00 16.00 15.00 14.00 13.00 12.00 11.00 10.00 60% 16.94 50% 15.93 15.19 40% 15.09 30% 25% 25% 21% 15% 10% 11.89 0% July '06 Jan '06 Jan '07 MA RI MA DC Wage rate differences noted by city. Jul '06 Jan '07 Graduation Month/Year Graduation Month/Year Rules: 35% 28% 20% 13.41 13.31 Jan '06 Comments: 55% MA and RI on track to meet target. DC made great improvements on graduate employment. RI DC Improved alumni services will increase college attendance rates. Pallotta scholarships have made a major impact in MA. G Average wage 15/hr 85% employed in 4 months 40% Attending college within 1 year of graduation Y 12.50/hr Average wage 15/hr 75% employed in 4 months 85% 30% Attending college within 1 year of graduation 40% R Average wage 12.50/hr Employed in 4 months 75% Attending college within 1 year of graduation 30% 10

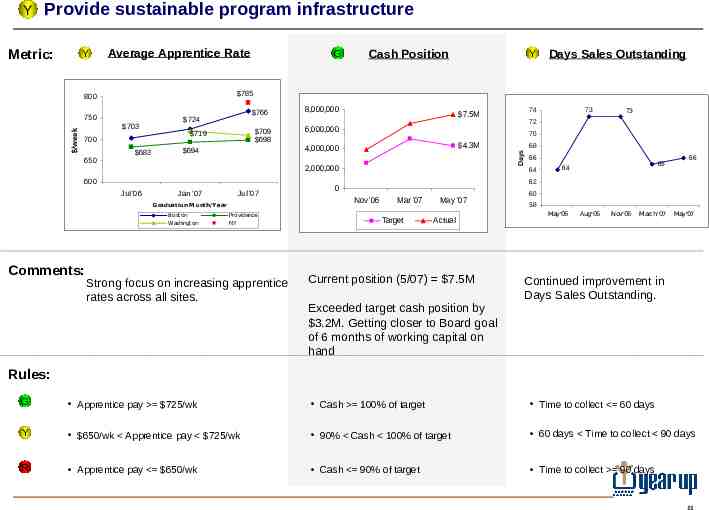

Provide sustainable program infrastructure Metric: Y Average Apprentice Rate /week 750 703 700 683 766 724 709 698 719 8,000,000 Y Days Sales Outstanding Jan '07 Jul '07 Graduation M onth/ Y ear Boston Washington Providence NY Strong focus on increasing apprentice rates across all sites. 73 72 6,000,000 70 4.3M 2,000,000 Jul '06 73 74 7.5M 4,000,000 694 600 Comments: Cash Position 785 800 650 G 68 Days Y 66 64 65 64 66 62 0 Nov '06 Mar '07 Target May '07 Actual Current position (5/07) 7.5M Exceeded target cash position by 3.2M. Getting closer to Board goal of 6 months of working capital on hand 60 58 May'06 Aug '06 Nov'06 March ' 07 May'07 Continued improvement in Days Sales Outstanding. Rules: G Apprentice pay 725/wk Cash 100% of target Time to collect 60 days Y 650/wk Apprentice pay 725/wk 90% Cash 100% of target 60 days Time to collect 90 days R Apprentice pay 650/wk Cash 90% of target Time to collect 90 days 11

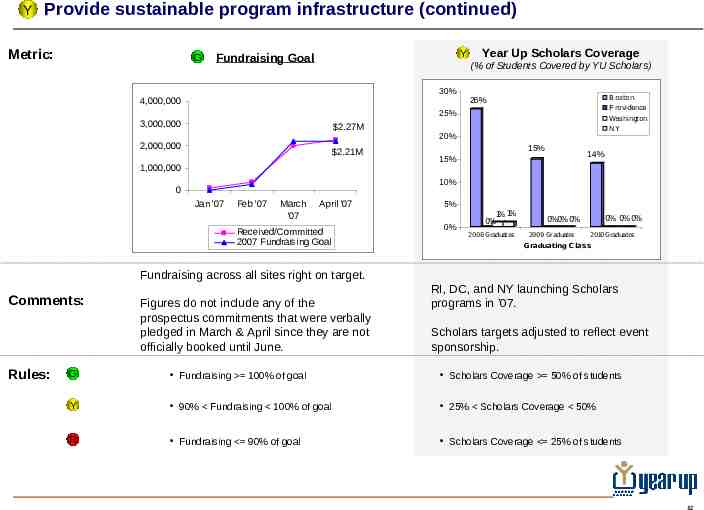

Y Provide sustainable program infrastructure (continued) Metric: G Y Fundraising Goal Year Up Scholars Coverage (% of Students Covered by YU Scholars) 30% 4,000,000 Boston P rovidence 26% 25% 3,000,000 2.27M 2,000,000 2.21M 1,000,000 Washington NY 20% 15% 14% 15% 10% 0 Jan '07 Feb '07 March '07 April '07 Received/Committed 2007 Fundraising Goal 5% 0% 1% 1% 0% 2008 Graduates 0% 0%0% 0%0%0% 2009 Graduates 2010 Graduates Graduating C lass Fundraising across all sites right on target. Comments: Rules: Figures do not include any of the prospectus commitments that were verbally pledged in March & April since they are not officially booked until June. RI, DC, and NY launching Scholars programs in ’07. Scholars targets adjusted to reflect event sponsorship. G Fundraising 100% of goal Scholars Coverage 50% of students Y 90% Fundraising 100% of goal 25% Scholars Coverage 50% R Fundraising 90% of goal Scholars Coverage 25% of students 12

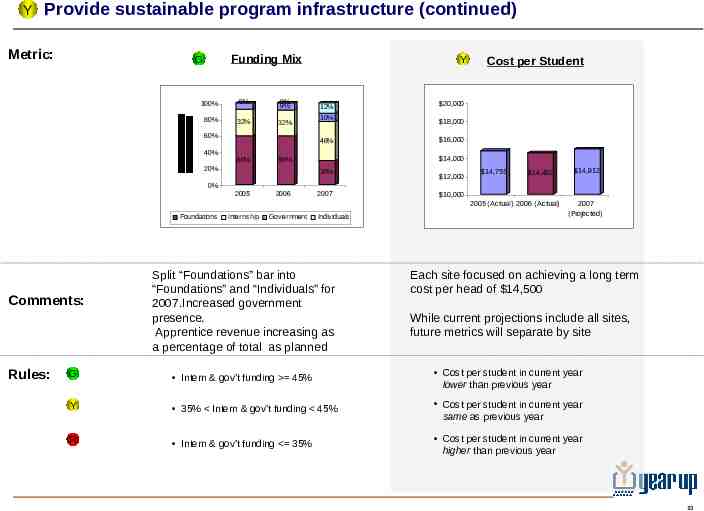

Y Provide sustainable program infrastructure (continued) Metric: Funding Mix G 100% 0% 0% 9% 80% 32% 32% 60% 40% Y 12% 10% 48% 60% 20,000 18,000 16,000 14,000 59% 20% Cost per Student 30% 12,000 14,755 14,482 14,912 0% 2005 2006 2007 10,000 2005 (Actual) 2006 (Actual) Foundations Comments: Rules: Internship Government Individuals Split “Foundations” bar into “Foundations” and “Individuals” for 2007.Increased government presence. Apprentice revenue increasing as a percentage of total as planned 2007 (Projected) Each site focused on achieving a long term cost per head of 14,500 While current projections include all sites, future metrics will separate by site G Intern & gov’t funding 45% Cost per student in current year lower than previous year Y 35% Intern & gov’t funding 45% Cost per student in current year same as previous year R Intern & gov’t funding 35% Cost per student in current year higher than previous year 13

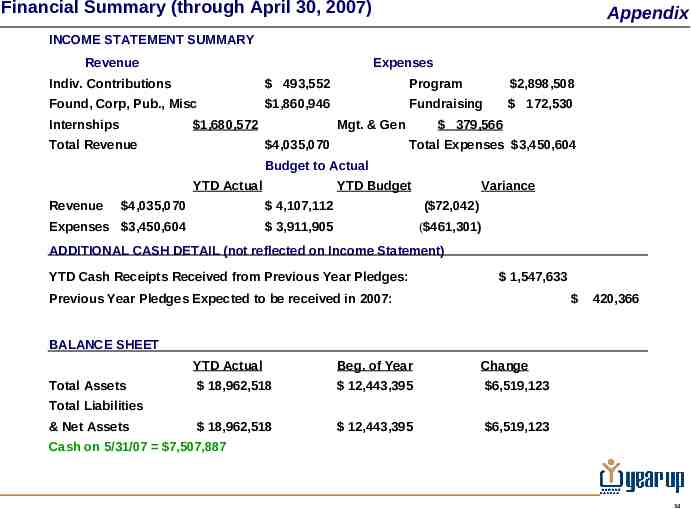

Financial Summary (through April 30, 2007) Appendix INCOME STATEMENT SUMMARY Revenue Expenses Indiv. Contributions 493,552 Program 2,898,508 Found, Corp, Pub., Misc 1,860,946 Fundraising 172,530 Internships 1,680,572 Total Revenue Mgt. & Gen 4,035,070 379,566 Total Expenses 3,450,604 Budget to Actual YTD Actual Revenue YTD Budget Variance 4,035,070 4,107,112 ( 72,042) Expenses 3,450,604 3,911,905 ( 461,301) ADDITIONAL CASH DETAIL (not reflected on Income Statement) YTD Cash Receipts Received from Previous Year Pledges: 1,547,633 Previous Year Pledges Expected to be received in 2007: 420,366 BALANCE SHEET Total Assets YTD Actual Beg. of Year Change 18,962,518 12,443,395 6,519,123 18,962,518 12,443,395 6,519,123 Total Liabilities & Net Assets Cash on 5/31/07 7,507,887 14

Year Up National – Update Appendix Launching due diligence research for site expansion. Operations HBS intern leading summer project to update the Dash Board Conducting national training for cross site operations staff. Staffing Searches in progress: Future Executive Directors. Hired: National Director for Academics & Program, Finance Coordinator & Director of Data Systems and Operations Hired: National Director for Strategic Partnerships & Development. Program Pilots with national implications include alternative credentialing model, alumni services infrastructure, TABE learning assessment, and empowerment curriculum. Launched cross site Leadership & Management training program for growing staff of middle managers. Human Asset Management Infrastructure & Systems Partnership Building Strengthening professional development procedures and introducing job categories and career tracking. In final stages prototype design for national database to improve data collection & analysis for student tracking, fundraising and contact management Launching cross site purchase order system integrated with company intranet. National corporate partnerships evolving– Monster, Bank of America, Perot Systems, State Street and Ipswitch. Public Launch of Microsoft Partnership Involvement of Governor’s office: Governor participation – Prayer Breakfast and NECN Panel Fundraising: Growth Capital Campaign National Fundraising Wins – New Profit ( 1M), Josh Bekenstein ( 2.5M) Largest Donation in Year Up history – Jensen Family Foundation 5M with 1M incentive for reaching 18M goal by September 2007. 15

Year Up Greater Boston – Update Operations Program & Academics Appendix Buildout at 93 Summer will take place June-September – creating capacity for an additional learning community (70 students/year) and national headquarters functions. New “Admission Forum” approach launched to consolidate applicant information and facilitate improved decisionmaking Alumni Association re-launched on May 15 with new officers, board members, and committee structure. Alumni reunion scheduled for June 9. Staffing Two FT instructors departed mid-semester. Current focus on recruiting for September class and developing new pipeline model for faculty. Full-time Events and Communications Manager will consolidate expertise for local events Students 15/19 of the Kellogg-funded pilot for students with no HS diploma or GED remain. 4 of these students have received GED/diploma since starting Year Up. Initial indications that non-GED attrition follows similar pattern to traditional Year Up students. Apprenticeships 100% of July placements secured as of May 31. Continued selling will create contractor opportunities for graduates. State Street pilot with Investment Operations has resulted in FT job offers to all current apprentices and increased interest in apprenticeship program. Consultant leading the documentation of sales and client service strategy for “site in a box”. Microsoft relationship officially launched in early May – next steps include rolling out certification training/testing services for YU staff, students, and alumni Increased visibility in Q2 with Governor’s Prayer Breakfast & WBZ, NECN, and Cuencavision, Fundraising and Marketing Wins – MA State Budget ( 400K), Workforce Competitiveness Trust Fund ( 500K/3 years), United Way ( 140K/3 years), Marathon ( 40K), Ludcke ( 50K), Bilezikian ( 20K), Babson ( 10K) June Prospects – Drive Fore Success Golf Tournament ( 200K) & Bank of America ( 200K) Upcoming “Know Your Donor” survey will assist in targeting cultivation and cultivation efforts 16

Year Up Providence – Update Appendix Graduation planned for August 1st. Likely speaker Dean Esserman, Providence Police Chief. Program CCRI 12-credit articulation agreement secured. Johnson & Wales draft dual-enrollment agreement still in our hands for review. New junior tech instructor, James Angell, recently hired. He’s a YU RI Class 2 grad. Team New site leader, Joe Gerena, helping to ensure focus on high support and retention Class of July 2007 – 25 of 34 students retained with two months to go (74%). Students Apprenticeships Class of January 2008 – 31 of 36 students retained after three months (86%). Working to secure 31 apprenticeships for July. Current gap appears to be 3 – 4 apprentices. New partners signed on include Gilbane (new CIO renewed), Collette Vacations and Hasbro. Still have not re-upped with the State of RI. They were one of our largest partners, with 3 – 4 apprentices per class, but the current state budget crisis is affecting their ability to work with us. Also lost the RIEDC because they’re outsourcing IT. Still pursuing other prospects: APC, BCBS RI, Brown University, EDS, Edwards & Angell, FM Global, HinckleyAllen, and Unicom. Wins – 60K from State WIBs, 20K individuals, 5K Horton fund, 5K APC, 5K in-kind clothes Fundraising & Board Dev Pending – Federal appropriations ( 700K), RI Dept. of Adult Education ( 176K), RI Foundation ( 50K), RI General Assembly ( 44K), Bank of America Foundation ( 25K), Kimball Foundation ( 20K), TriMix Foundation ( 20K), Grimshaw-Gudewicz Foundation ( 15K), and Robert Stoico/FIRSTFED Charitable Trust ( 10K). Individuals – Currently working on developing relationships with Liz Chace, Brad Faxon, Rick Bready, Shivan Subramaniam, Bob Savoie, Bill Daugherty Advisory Board – Recently added Pete Hayes of Hayes & Sherry Real Estate. Working to add more new members. 17

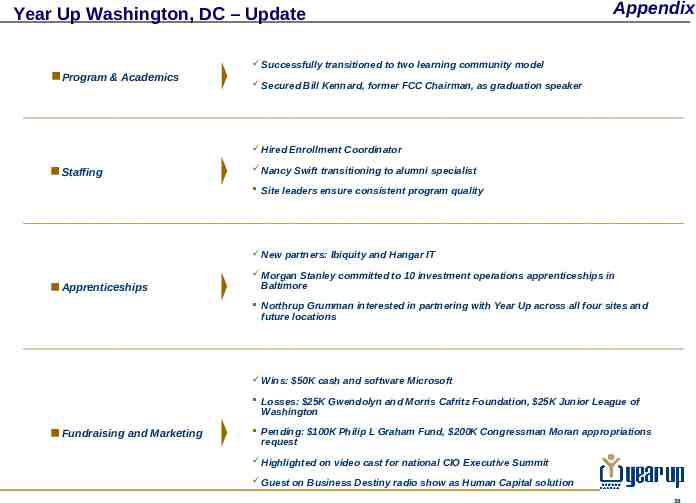

Year Up Washington, DC – Update Appendix Successfully transitioned to two learning community model Program & Academics Secured Bill Kennard, former FCC Chairman, as graduation speaker Hired Enrollment Coordinator Staffing Nancy Swift transitioning to alumni specialist Site leaders ensure consistent program quality New partners: Ibiquity and Hangar IT Apprenticeships Morgan Stanley committed to 10 investment operations apprenticeships in Baltimore Northrup Grumman interested in partnering with Year Up across all four sites and future locations Wins: 50K cash and software Microsoft Losses: 25K Gwendolyn and Morris Cafritz Foundation, 25K Junior League of Washington Fundraising and Marketing Pending: 100K Philip L Graham Fund, 200K Congressman Moran appropriations request Highlighted on video cast for national CIO Executive Summit Guest on Business Destiny radio show as Human Capital solution 18

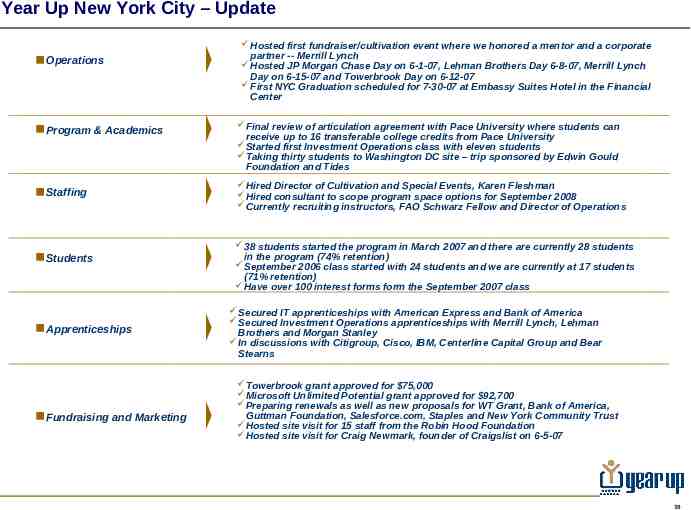

Year Up New York City – Update Operations Program & Academics Staffing Students Apprenticeships Fundraising and Marketing Hosted first fundraiser/cultivation event where we honored a mentor and a corporate partner -- Merrill Lynch Hosted JP Morgan Chase Day on 6-1-07, Lehman Brothers Day 6-8-07, Merrill Lynch Day on 6-15-07 and Towerbrook Day on 6-12-07 First NYC Graduation scheduled for 7-30-07 at Embassy Suites Hotel in the Financial Center Final review of articulation agreement with Pace University where students can receive up to 16 transferable college credits from Pace University Started first Investment Operations class with eleven students Taking thirty students to Washington DC site – trip sponsored by Edwin Gould Foundation and Tides Hired Director of Cultivation and Special Events, Karen Fleshman Hired consultant to scope program space options for September 2008 Currently recruiting instructors, FAO Schwarz Fellow and Director of Operations 38 students started the program in March 2007 and there are currently 28 students in the program (74% retention) September 2006 class started with 24 students and we are currently at 17 students (71% retention) Have over 100 interest forms form the September 2007 class Secured IT apprenticeships with American Express and Bank of America Secured Investment Operations apprenticeships with Merrill Lynch, Lehman Brothers and Morgan Stanley In discussions with Citigroup, Cisco, IBM, Centerline Capital Group and Bear Stearns Towerbrook grant approved for 75,000 Microsoft Unlimited Potential grant approved for 92,700 Preparing renewals as well as new proposals for WT Grant, Bank of America, Guttman Foundation, Salesforce.com, Staples and New York Community Trust Hosted site visit for 15 staff from the Robin Hood Foundation Hosted site visit for Craig Newmark, founder of Craigslist on 6-5-07 19