Illinois Health & Hospital Association Update Reporting on Use of

44 Slides4.56 MB

Illinois Health & Hospital Association Update Reporting on Use of PRFs February 2, 2021

Agenda 1 Introductions & Objectives 2 State of the Union – What’s Changed? 3 Update on Strategies & Resources for Tracking Funds 4 What Should We Be Doing Now? 5 Single Audit Update

Introductions & Objectives

Introductions & Objectives Frederick FrederickK. K.Helfrich, Helfrich,CPA CPA Partner Partner St. Louis 314.231.5544 [email protected] St. Louis 314.231.5544 [email protected] Brian BrianJ. J.Pavona, Pavona,CPA, CPA,FHFMA FHFMA Partner Partner Chicago 312.288.4653 [email protected] Chicago 312.288.4653 [email protected] 4

Disclaimer Information in this presentation is as of February 1, 2021 Additional FAQs are expected; Other changes possible AHA, IHA, the AICPA Health Care Expert Panel, HFMA and others are reviewing and looking to provide additional guidance and insight Stay tuned for further developments through IHA and BKD ThoughtwareTM 5

State of the Union – What’s Changed?

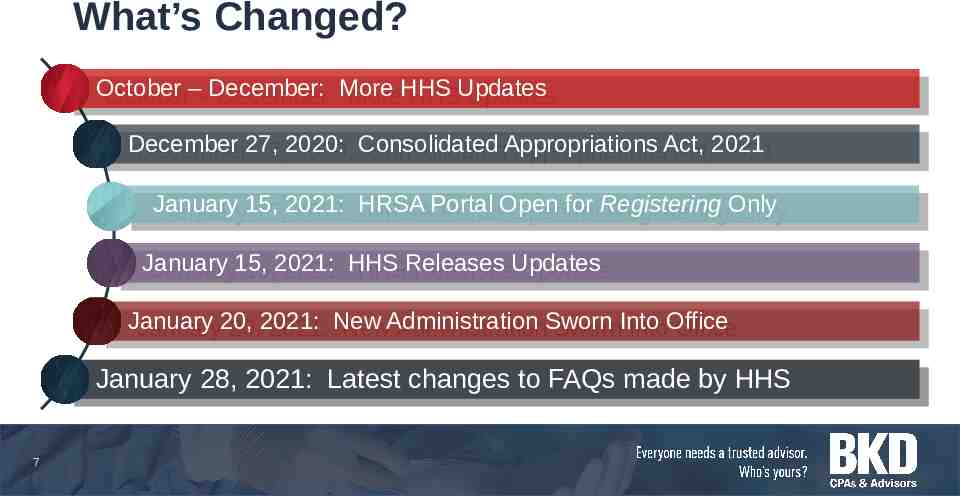

What’s Changed? October October––December: December: More MoreHHS HHSUpdates Updates December December27, 27,2020: 2020: Consolidated ConsolidatedAppropriations AppropriationsAct, Act,2021 2021 January January15, 15,2021: 2021: HRSA HRSAPortal PortalOpen Openfor forRegistering RegisteringOnly Only January January15, 15,2021: 2021: HHS HHSReleases ReleasesUpdates Updates January January20, 20,2021: 2021: New NewAdministration AdministrationSworn SwornInto IntoOffice Office January January28, 28,2021: 2021: Latest Latestchanges changestotoFAQs FAQsmade madeby byHHS HHS 7

Provider Relief Fund Guidance Timeline HHS initially posted some Frequently Asked Questions (FAQs) on May 6 & continued to update through January 28, 2021 Multiple updates of the FAQs with major changes, with 19 FAQs added or modified on January 28, 2021 (and at least one FAQ omitted) Issued Post-Payment Notices on September 19, October 22, November 2, & January 15, 2021 January 15, 2021 included some Consolidated Appropriations Act changes 8

Regulatory Freeze In a memo dated January 20, 2021, President Joe Biden has frozen all federal agency rules and guidances issued under the Trump administration that have not yet taken effect and that have yet to be published in the Federal Register The memo states that for any rules that have been published in the Federal Register or issued in any manner but have not yet taken effect, agency heads should consider postponing the rules’ effective data for 60 days from the date of the memo. The memo also states that during the 60-day effective date delay, agencies should consider opening a 30-day comment period to let interested parties provide input on “issues of fact, law, and policy raised by those rules.” Agencies also should consider any pending petitions that ask for those rules to be reconsidered. After the 60-day delay, agencies should notify the director of the White House Office of Management and Budget of any rule that raises substantial questions of fact, law or policy and take further appropriate action in consultation with the OMB director, the memo says. The “open question” is, what, if anything, will change during the 60-day period? While there are a number of health-related actions by HHS and other agencies affected by this memo, it is unclear whether the HHS PRFs reporting will be impacted in any way. 9

Omitted FAQ – Other Assistance Received HHS FAQs How does “other assistance received” factor into my reported expenses? (Added 10/28/2020) Other assistance received is reported as operating revenue and used in the calculation of year-over-year change in patient care related revenue. 10

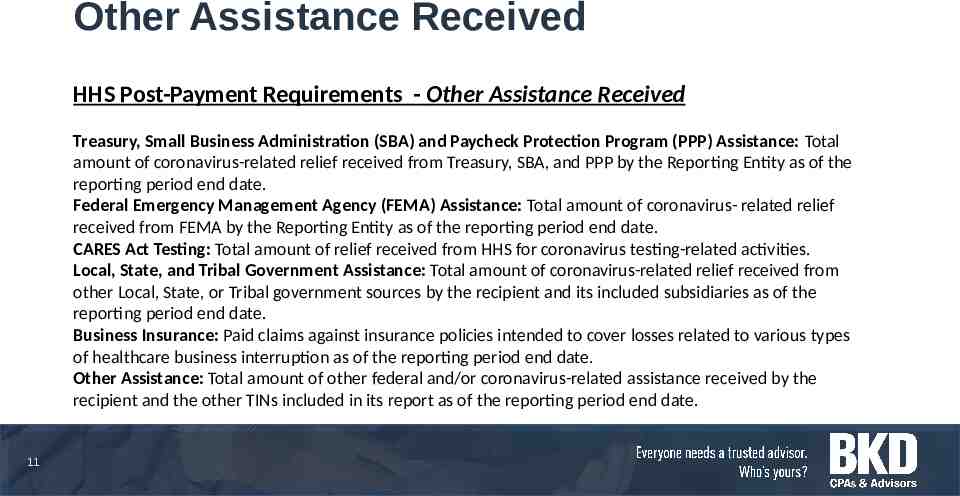

Other Assistance Received HHS Post-Payment Requirements - Other Assistance Received Treasury, Small Business Administration (SBA) and Paycheck Protection Program (PPP) Assistance: Total amount of coronavirus-related relief received from Treasury, SBA, and PPP by the Reporting Entity as of the reporting period end date. Federal Emergency Management Agency (FEMA) Assistance: Total amount of coronavirus- related relief received from FEMA by the Reporting Entity as of the reporting period end date. CARES Act Testing: Total amount of relief received from HHS for coronavirus testing-related activities. Local, State, and Tribal Government Assistance: Total amount of coronavirus-related relief received from other Local, State, or Tribal government sources by the recipient and its included subsidiaries as of the reporting period end date. Business Insurance: Paid claims against insurance policies intended to cover losses related to various types of healthcare business interruption as of the reporting period end date. Other Assistance: Total amount of other federal and/or coronavirus-related assistance received by the recipient and the other TINs included in its report as of the reporting period end date. 11

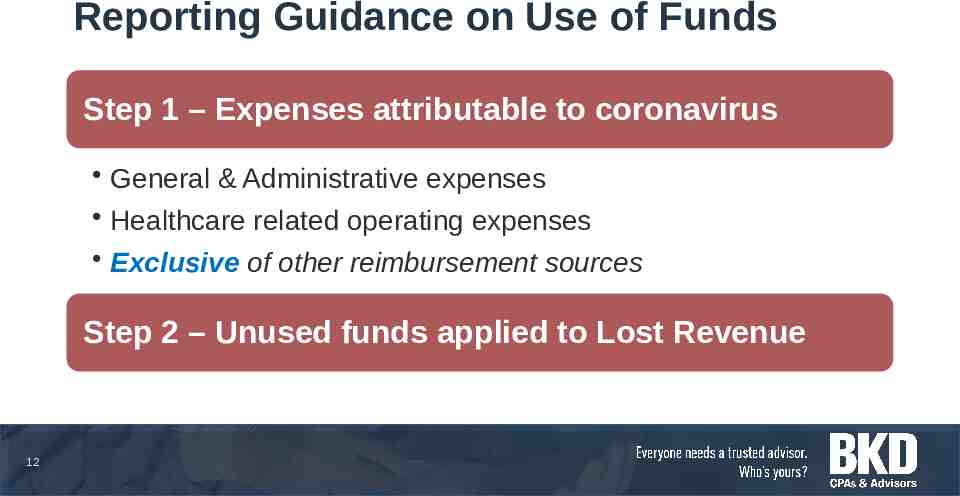

Reporting Guidance on Use of Funds Step 1 – Expenses attributable to coronavirus General & Administrative expenses Healthcare related operating expenses Exclusive of other reimbursement sources Step 2 – Unused funds applied to Lost Revenue 12

Reporting Guidance on Use of Funds D E G N Step 1 – Expenses attributable to coronavirus A H C N U Y General & Administrative expenses L L A R Healthcare related operating E expenses N E G Exclusive of other reimbursement sources S P E T S Step 2 – Unused funds applied to Lost Revenue 13

But. 14

December 27, 2020: Consolidated Appropriations Act, 2021 signed Reintroduced lost revenue concepts from June 2020 Opened the potential to reallocate targeted funds Act did not include all the necessary details to analyze January 15, 2021 HHS Post-Payment Reporting Requirements and updated FAQs have many answers; not all January 15, 2021 HHS Post-Payment Reporting Requirements supersede all previously issued requirements 15

Post-Payment Notice of Reporting Requirements Issued January 15 Does not apply to SNF Infection Control or Rural Health Clinic Testing Funds Significant items/changes of note: Lost Lostrevenues revenues––reverts revertstotooriginal originalguidance guidancewith withoptions options Expenses Expenses––few fewchanges changesfrom fromNovember Novemberguidance guidance Expenses Expenses––adds addsinin“attributable “attributabletotocoronavirus” coronavirus”language languagetotoG&A G&Aexpenses expenses Interest-bearing Interest-bearingaccounts accountsfor forfunds fundsheld held 16

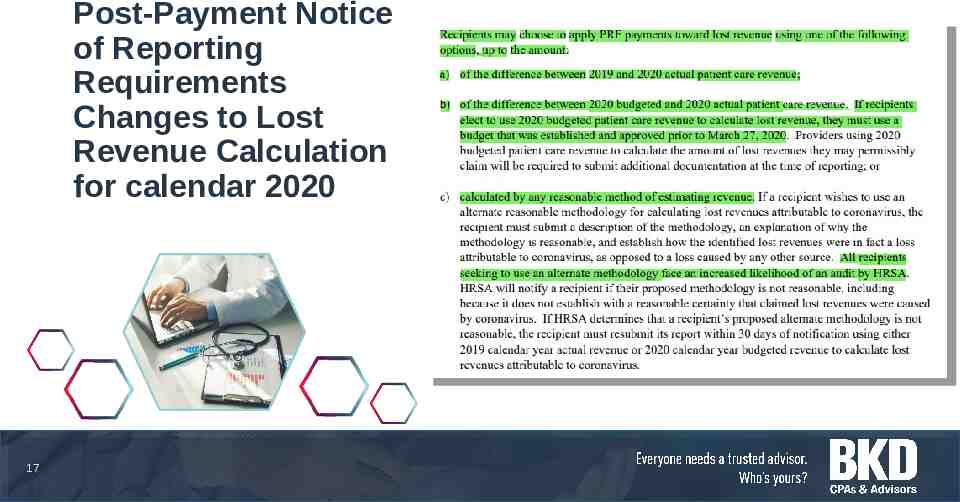

Post-Payment Notice of Reporting Requirements Changes to Lost Revenue Calculation for calendar 2020 17

Lost Revenue Options - Summary 18

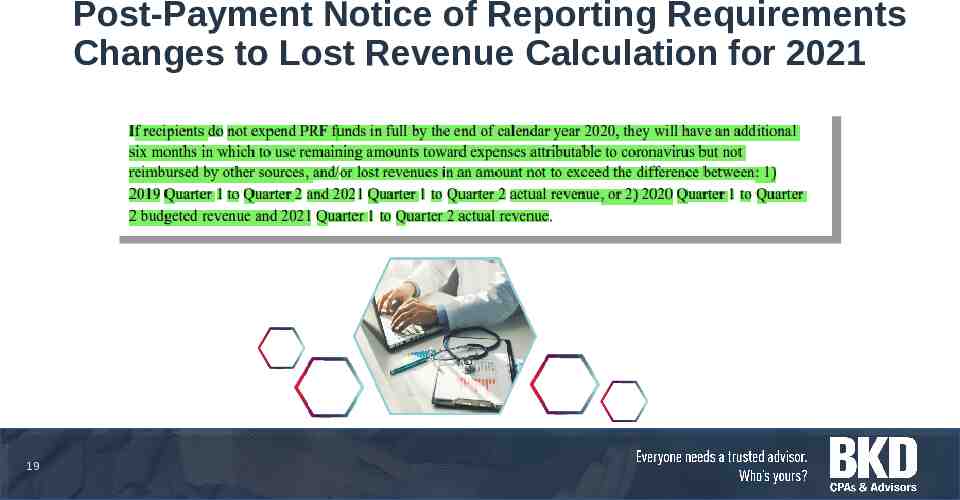

Post-Payment Notice of Reporting Requirements Changes to Lost Revenue Calculation for 2021 19

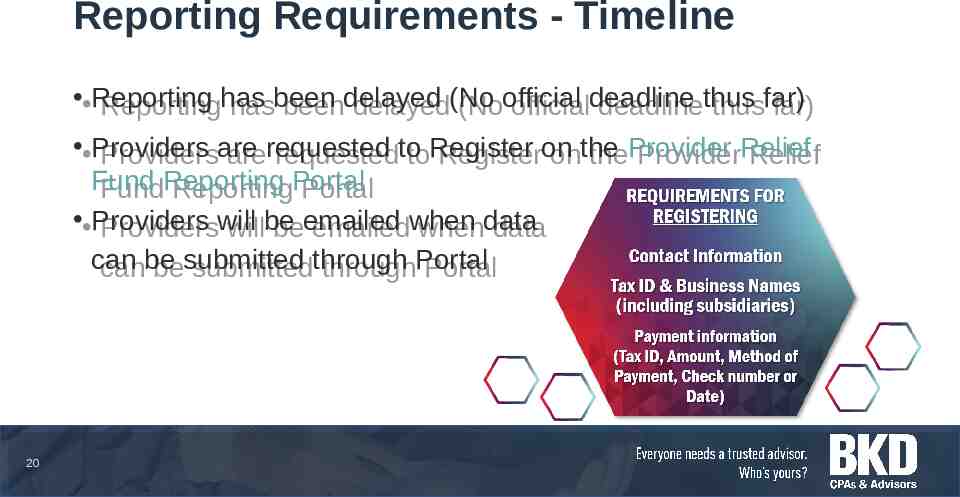

Reporting Requirements - Timeline Reporting Reportinghas hasbeen beendelayed delayed(No (Noofficial officialdeadline deadlinethus thusfar) far) Providers Providersare arerequested requestedto toRegister Registeron onthe theProvider ProviderRelief Relief Fund FundReporting ReportingPortal Portal Providers Providerswill willbe beemailed emailedwhen whendata data can canbe besubmitted submittedthrough throughPortal Portal 20

Strategies & Resources

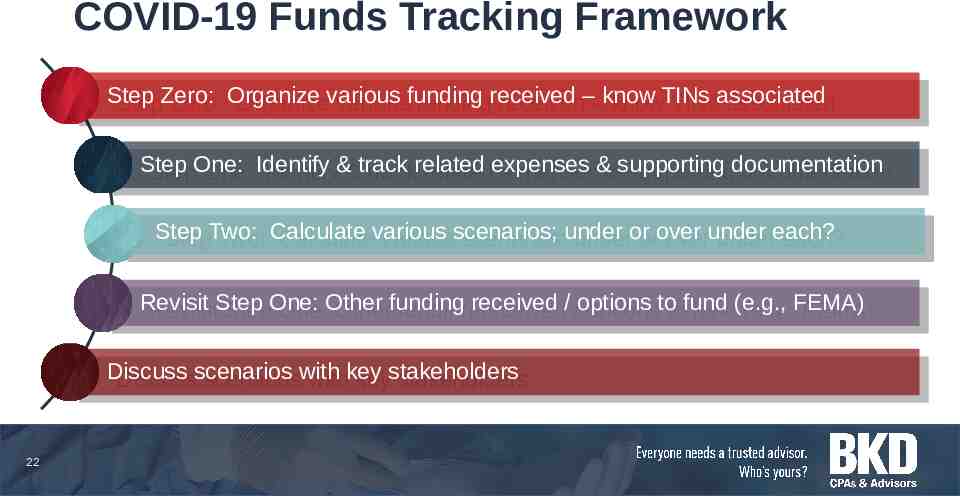

COVID-19 Funds Tracking Framework Step StepZero: Zero: Organize Organizevarious variousfunding fundingreceived received––know knowTINs TINsassociated associated Step StepOne: One: Identify Identify&&track trackrelated relatedexpenses expenses&&supporting supportingdocumentation documentation Step StepTwo: Two: Calculate Calculatevarious variousscenarios; scenarios;under underororover overunder undereach? each? Revisit RevisitStep StepOne: One:Other Otherfunding fundingreceived received/ /options optionstotofund fund(e.g., (e.g.,FEMA) FEMA) Discuss Discussscenarios scenarioswith withkey keystakeholders stakeholders 22

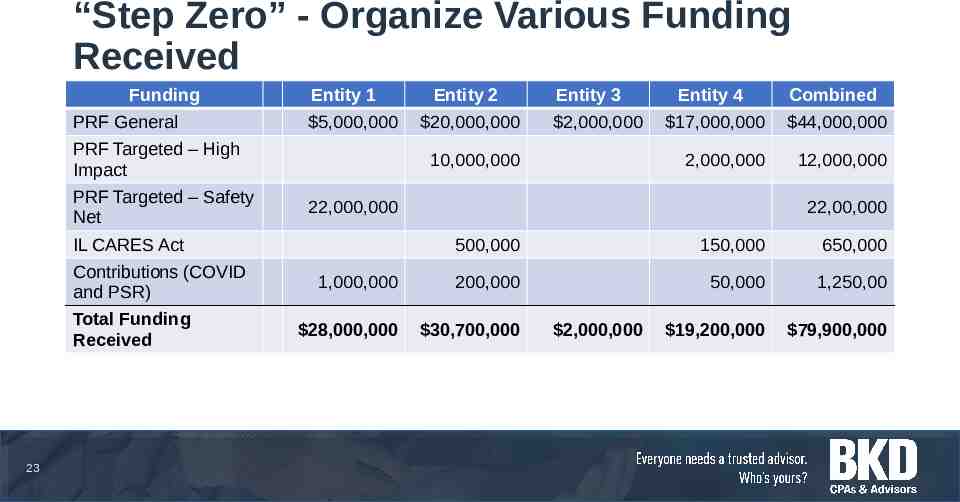

“Step Zero” - Organize Various Funding Received Funding PRF General Entity 1 5,000,000 PRF Targeted – High Impact PRF Targeted – Safety Net Total Funding Received 23 20,000,000 Entity 3 2,000,000 10,000,000 Entity 4 Combined 17,000,000 44,000,000 2,000,000 12,000,000 22,000,000 IL CARES Act Contributions (COVID and PSR) Entity 2 22,00,000 500,000 150,000 650,000 1,000,000 200,000 50,000 1,250,00 28,000,000 30,700,000 19,200,000 79,900,000 2,000,000

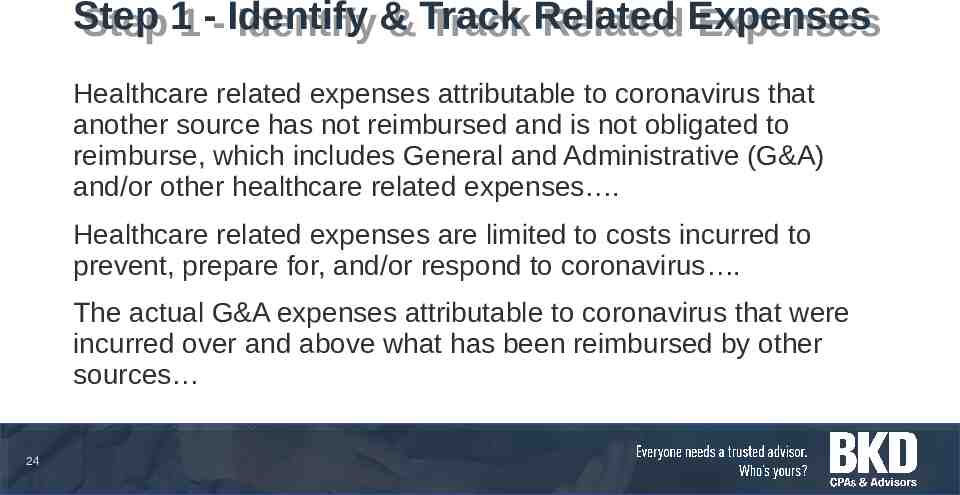

Step Step 11 -- Identify Identify && Track Track Related Related Expenses Expenses Healthcare related expenses attributable to coronavirus that another source has not reimbursed and is not obligated to reimburse, which includes General and Administrative (G&A) and/or other healthcare related expenses . Healthcare related expenses are limited to costs incurred to prevent, prepare for, and/or respond to coronavirus . The actual G&A expenses attributable to coronavirus that were incurred over and above what has been reimbursed by other sources 24

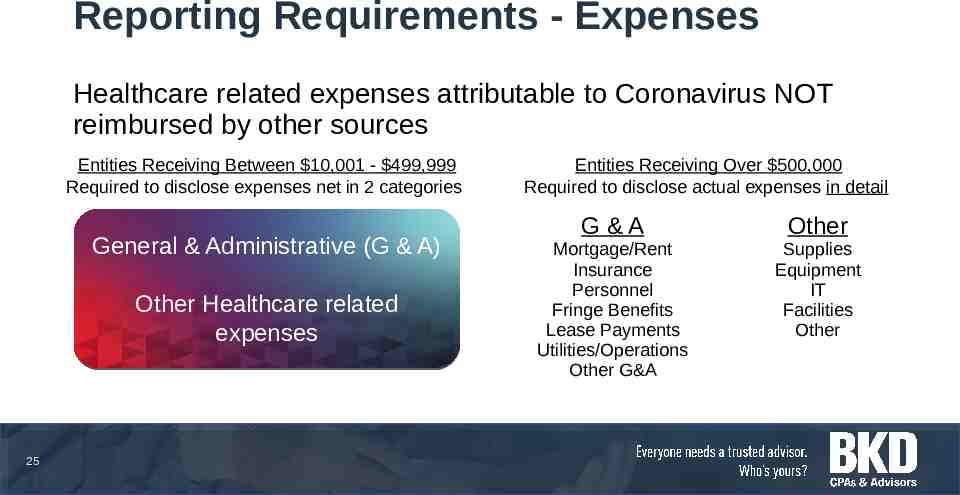

Reporting Requirements - Expenses Healthcare related expenses attributable to Coronavirus NOT reimbursed by other sources Entities Receiving Between 10,001 - 499,999 Required to disclose expenses net in 2 categories General & Administrative (G & A) Other Healthcare related expenses 25 Entities Receiving Over 500,000 Required to disclose actual expenses in detail G&A Other Mortgage/Rent Insurance Personnel Fringe Benefits Lease Payments Utilities/Operations Other G&A Supplies Equipment IT Facilities Other

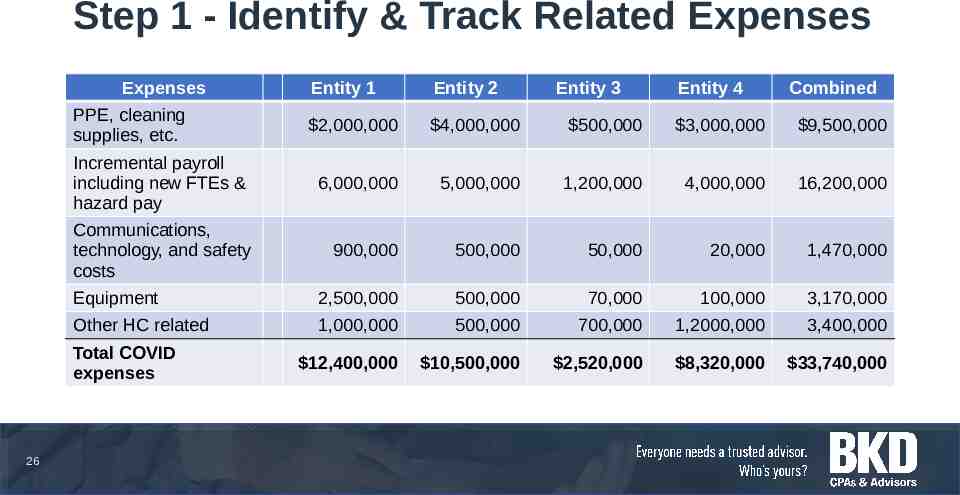

Step 1 - Identify & Track Related Expenses Expenses Entity 1 Entity 2 2,000,000 4,000,000 500,000 3,000,000 9,500,000 Incremental payroll including new FTEs & hazard pay 6,000,000 5,000,000 1,200,000 4,000,000 16,200,000 Communications, technology, and safety costs 900,000 500,000 50,000 20,000 1,470,000 Equipment 2,500,000 500,000 70,000 100,000 3,170,000 Other HC related 1,000,000 500,000 700,000 1,2000,000 3,400,000 12,400,000 10,500,000 2,520,000 8,320,000 33,740,000 PPE, cleaning supplies, etc. Total COVID expenses 26 Entity 3 Entity 4 Combined

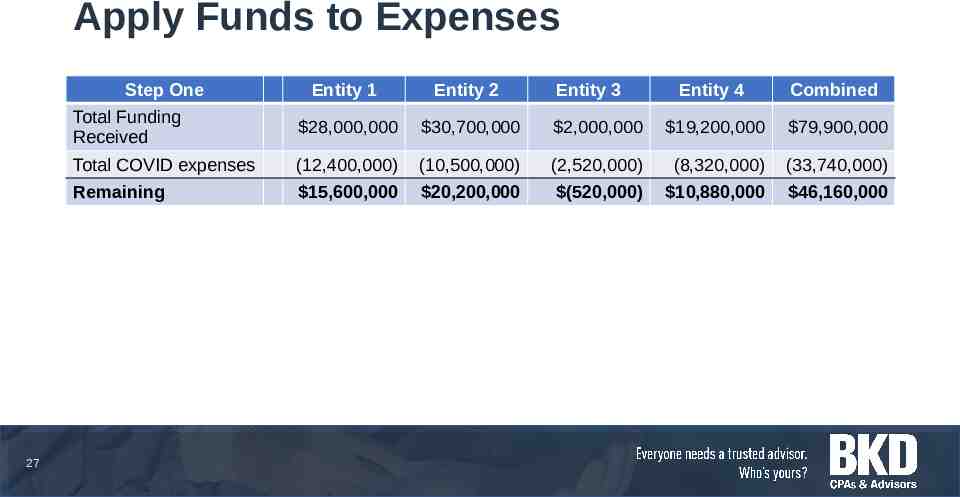

Apply Funds to Expenses Step One 27 Entity 1 Entity 2 Total Funding Received 28,000,000 30,700,000 Total COVID expenses (12,400,000) Remaining 15,600,000 Entity 3 Entity 4 Combined 2,000,000 19,200,000 79,900,000 (10,500,000) (2,520,000) (8,320,000) (33,740,000) 20,200,000 (520,000) 10,880,000 46,160,000

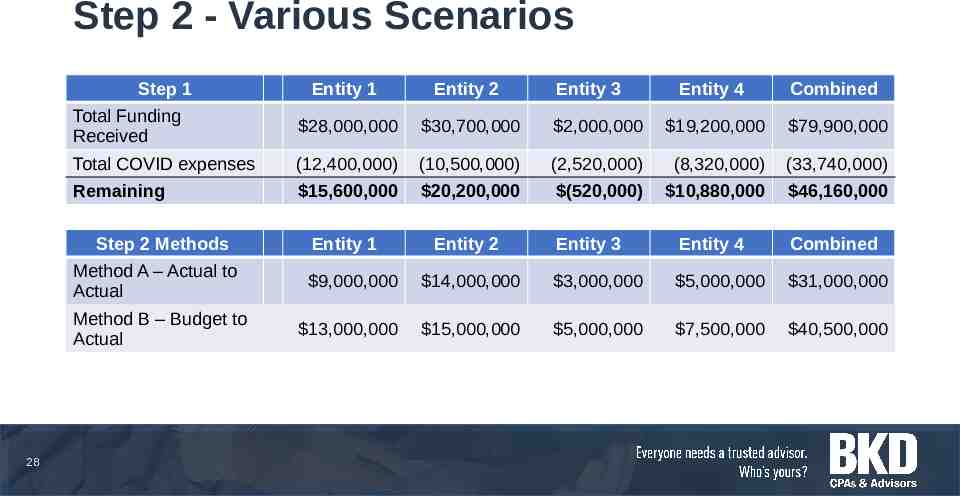

Step 2 - Various Scenarios Step 1 Entity 1 Entity 2 Total Funding Received 28,000,000 30,700,000 Total COVID expenses (12,400,000) Remaining Step 2 Methods 28 Entity 3 Entity 4 Combined 2,000,000 19,200,000 79,900,000 (10,500,000) (2,520,000) (8,320,000) (33,740,000) 15,600,000 20,200,000 (520,000) 10,880,000 46,160,000 Entity 1 Entity 2 Entity 3 Entity 4 Combined Method A – Actual to Actual 9,000,000 14,000,000 3,000,000 5,000,000 31,000,000 Method B – Budget to Actual 13,000,000 15,000,000 5,000,000 7,500,000 40,500,000

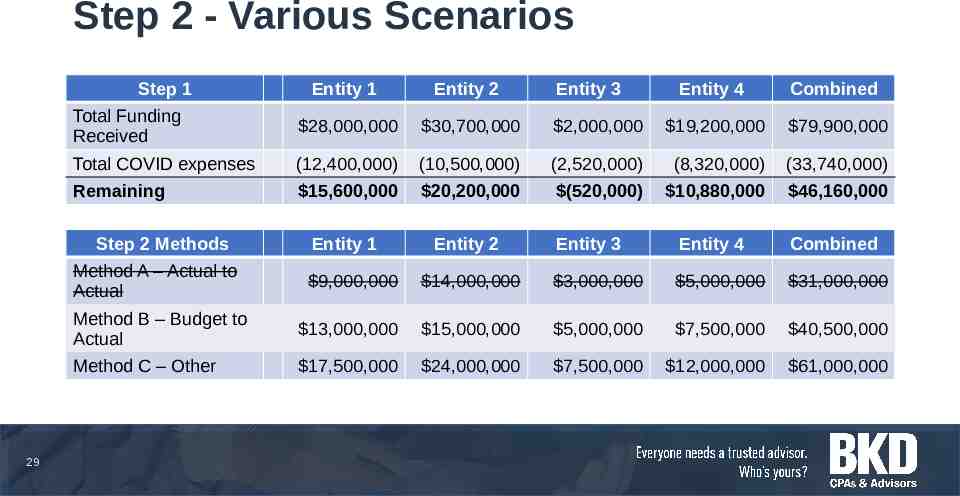

Step 2 - Various Scenarios Step 1 Entity 1 Entity 2 Total Funding Received 28,000,000 30,700,000 Total COVID expenses (12,400,000) Remaining Step 2 Methods 29 Entity 3 Entity 4 Combined 2,000,000 19,200,000 79,900,000 (10,500,000) (2,520,000) (8,320,000) (33,740,000) 15,600,000 20,200,000 (520,000) 10,880,000 46,160,000 Entity 1 Entity 2 Entity 3 Entity 4 Combined Method A – Actual to Actual 9,000,000 14,000,000 3,000,000 5,000,000 31,000,000 Method B – Budget to Actual 13,000,000 15,000,000 5,000,000 7,500,000 40,500,000 Method C – Other 17,500,000 24,000,000 7,500,000 12,000,000 61,000,000

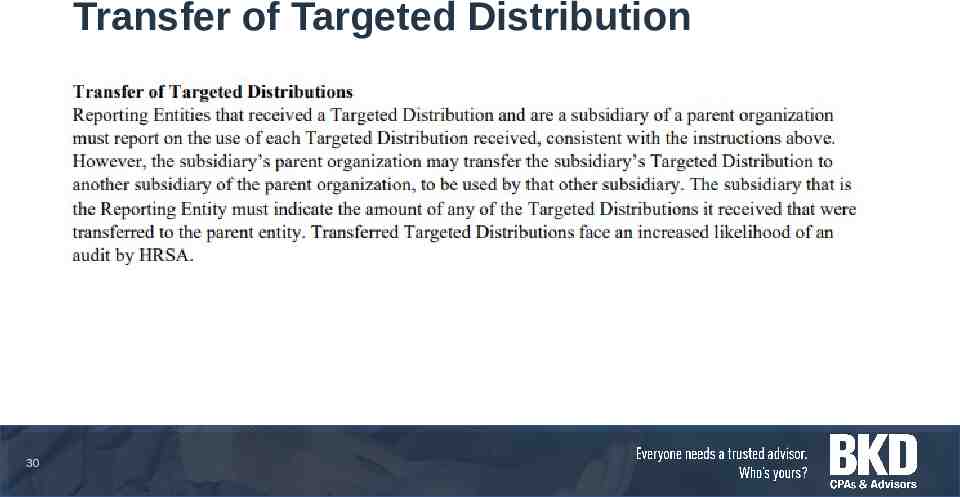

Transfer of Targeted Distribution 30

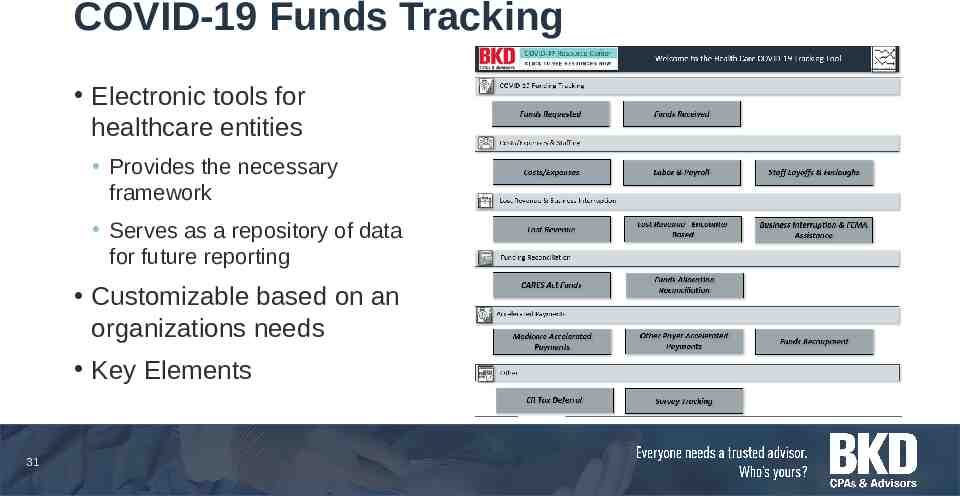

COVID-19 Funds Tracking Electronic tools for healthcare entities Provides the necessary framework Serves as a repository of data for future reporting Customizable based on an organizations needs Key Elements 31

What Now?

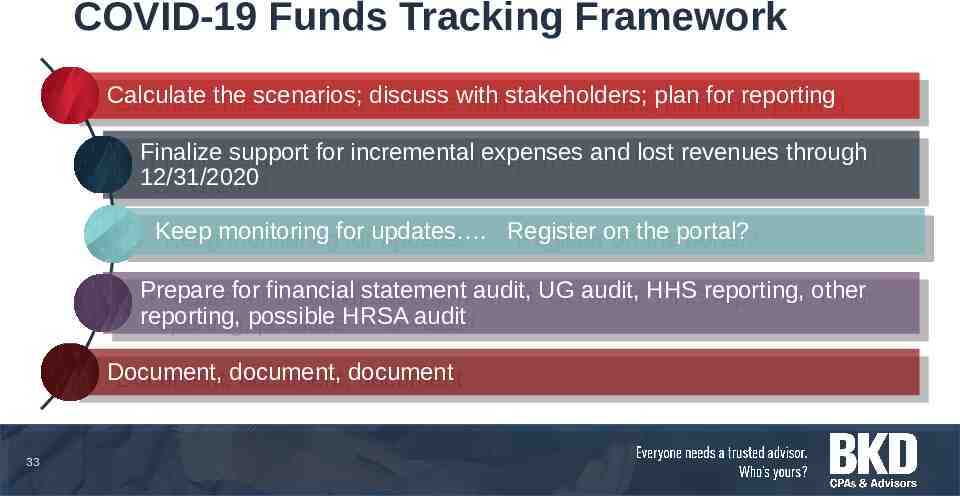

COVID-19 Funds Tracking Framework Calculate Calculatethe thescenarios; scenarios;discuss discusswith withstakeholders; stakeholders;plan planfor forreporting reporting Finalize Finalizesupport supportfor forincremental incrementalexpenses expensesand andlost lostrevenues revenuesthrough through 12/31/2020 12/31/2020 Keep Keepmonitoring monitoringfor forupdates . updates . Register Registeron onthe theportal? portal? Prepare Preparefor forfinancial financialstatement statementaudit, audit,UG UGaudit, audit,HHS HHSreporting, reporting,other other reporting, reporting,possible possibleHRSA HRSAaudit audit Document, Document,document, document,document document 33

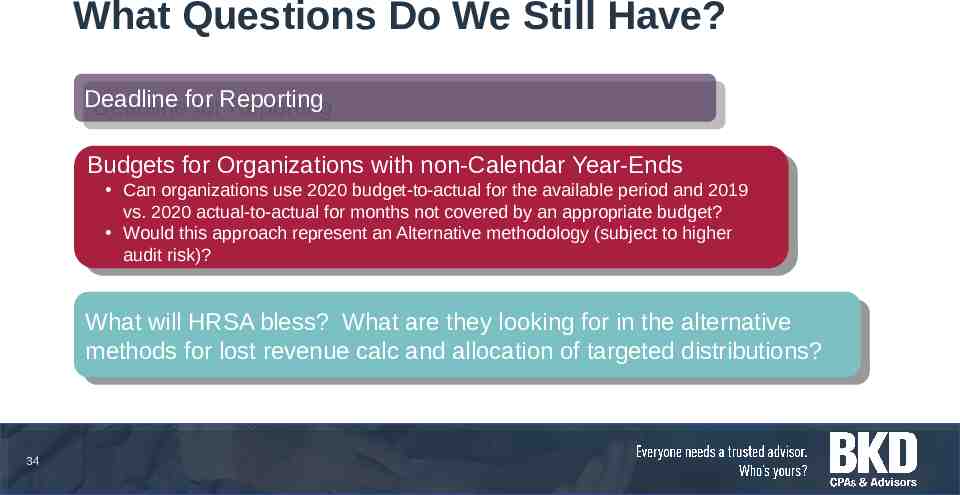

What Questions Do We Still Have? Deadline Deadlinefor forReporting Reporting Budgets Budgetsfor forOrganizations Organizationswith withnon-Calendar non-CalendarYear-Ends Year-Ends Can Canorganizations organizationsuse use2020 2020budget-to-actual budget-to-actualfor forthe theavailable availableperiod periodand and2019 2019 vs. 2020 actual-to-actual for months not covered by an appropriate budget? vs. 2020 actual-to-actual for months not covered by an appropriate budget? Would Wouldthis thisapproach approachrepresent representan anAlternative Alternativemethodology methodology(subject (subjecttotohigher higher audit auditrisk)? risk)? What Whatwill willHRSA HRSAbless? bless? What Whatare arethey theylooking lookingfor forininthe thealternative alternative methods methodsfor forlost lostrevenue revenuecalc calcand andallocation allocationofoftargeted targeteddistributions? distributions? 34

Single Audit

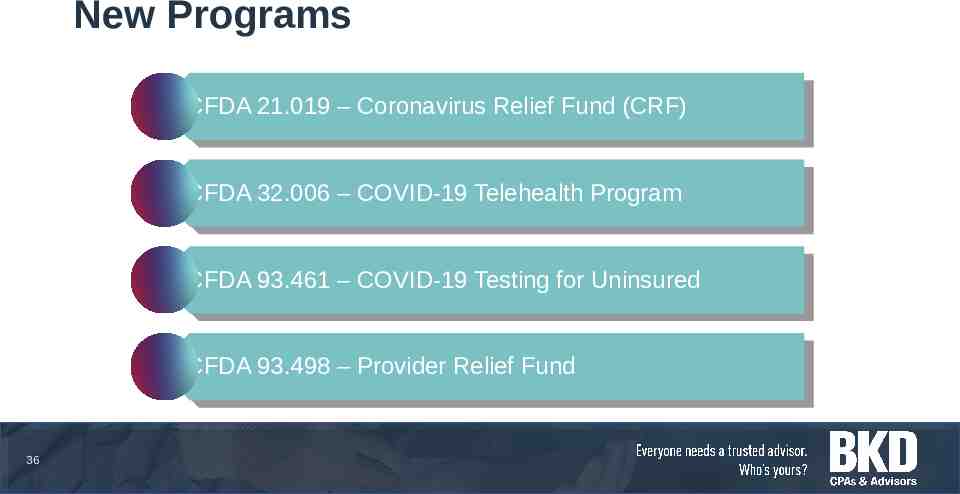

New Programs CFDA CFDA21.019 21.019––Coronavirus CoronavirusRelief ReliefFund Fund(CRF) (CRF) CFDA CFDA32.006 32.006––COVID-19 COVID-19Telehealth TelehealthProgram Program CFDA CFDA93.461 93.461––COVID-19 COVID-19Testing Testingfor forUninsured Uninsured CFDA CFDA93.498 93.498––Provider ProviderRelief ReliefFund Fund 36

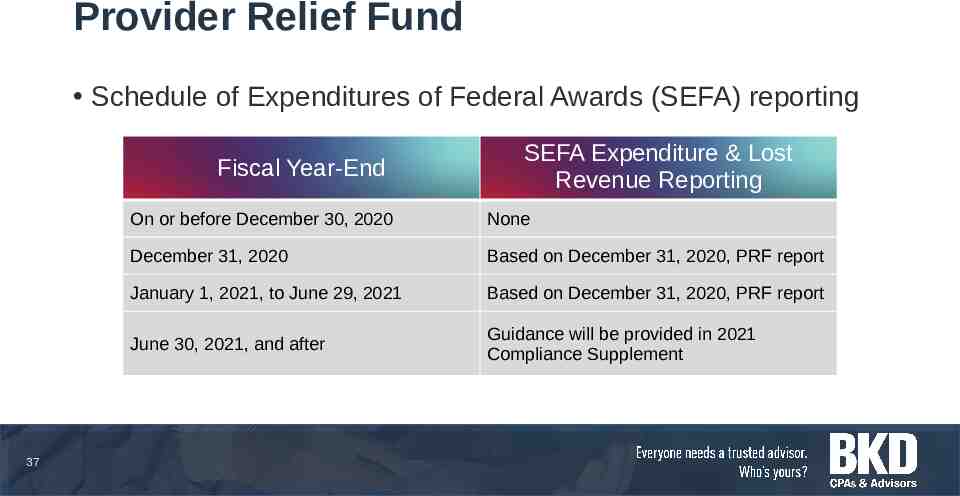

Provider Relief Fund Schedule of Expenditures of Federal Awards (SEFA) reporting Fiscal Year-End 37 SEFA Expenditure & Lost Revenue Reporting On or before December 30, 2020 None December 31, 2020 Based on December 31, 2020, PRF report January 1, 2021, to June 29, 2021 Based on December 31, 2020, PRF report June 30, 2021, and after Guidance will be provided in 2021 Compliance Supplement

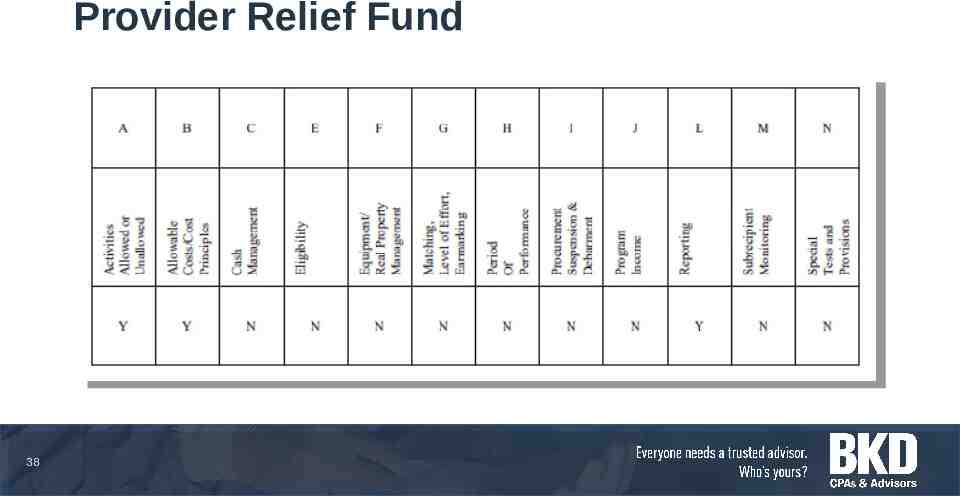

Provider Relief Fund 38

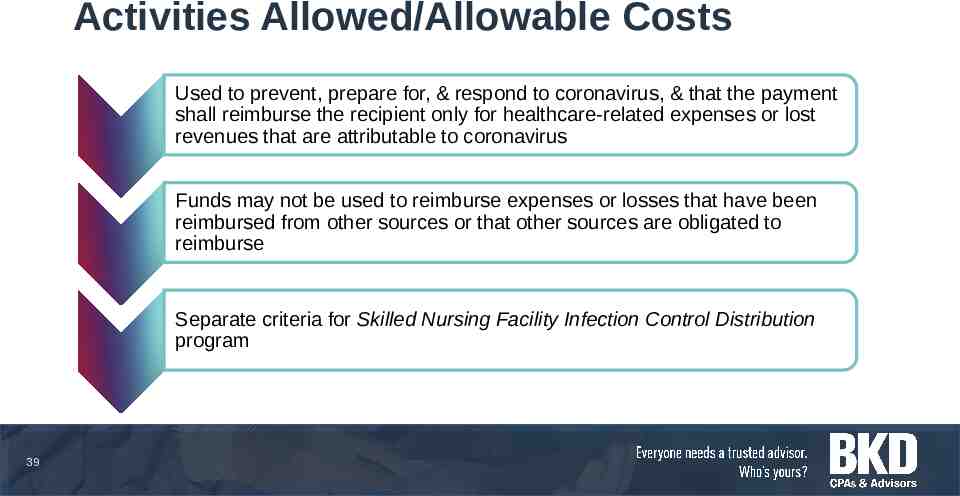

Activities Allowed/Allowable Costs Used to prevent, prepare for, & respond to coronavirus, & that the payment shall reimburse the recipient only for healthcare-related expenses or lost revenues that are attributable to coronavirus Funds may not be used to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse Separate criteria for Skilled Nursing Facility Infection Control Distribution program 39

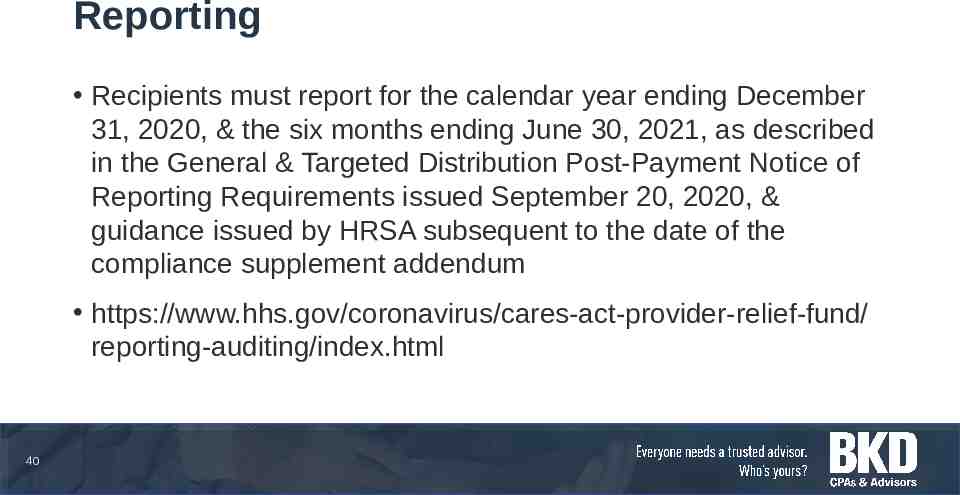

Reporting Recipients must report for the calendar year ending December 31, 2020, & the six months ending June 30, 2021, as described in the General & Targeted Distribution Post-Payment Notice of Reporting Requirements issued September 20, 2020, & guidance issued by HRSA subsequent to the date of the compliance supplement addendum https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/ reporting-auditing/index.html 40

Personal Protective Equipment (PPE) Nonfederal entities that received donated PPE should provide the fair market value of the PPE at the time of receipt as a standalone footnote accompanying their SEFA The amount of donated PPE SHOULD NOT be counted for purposes of determining the threshold for a Single Audit or determining Type A/B threshold Donated PPE is not required to be audited as a major program The donated PPE footnote may be marked “unaudited” Similar treatment for COVID-19 Vaccine? 41

For-Profit HC Entities Applicability Not subject to Single Audit HHS has indicated that for-profit entities will have two options Financial related audit of the award or awards conducted in accordance with Government Auditing Standards Audit in conformance with the requirements of 45 CFR 75 Subpart F (Single Audit) AICPA is working to provide guidance on option for financial related audit – needs HHS approval 42

Contact Information Brian BrianJ. J.Pavona, Pavona,CPA, CPA,FHFMA FHFMA Partner Partner Chicago 312.288.4653 [email protected] Chicago 312.288.4653 [email protected] Frederick FrederickK. K.Helfrich, Helfrich,CPA CPA Partner Partner St. Louis 314.231.5544 [email protected] St. Louis 314.231.5544 [email protected] 43

Thank Thank you! you!