Presented by: Mountain West Financial Manufactured Homes

33 Slides1.31 MB

Presented by: Mountain West Financial Manufactured Homes

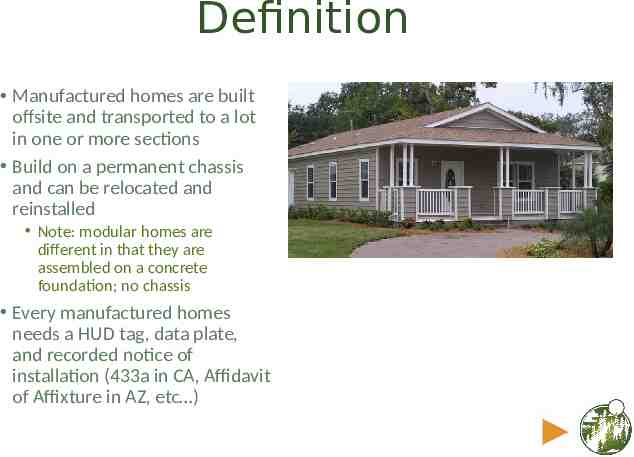

Definition Manufactured homes are built offsite and transported to a lot in one or more sections Build on a permanent chassis and can be relocated and reinstalled Note: modular homes are different in that they are assembled on a concrete foundation; no chassis Every manufactured homes needs a HUD tag, data plate, and recorded notice of installation (433a in CA, Affidavit of Affixture in AZ, etc )

History Originally only about 6 – 8 feet wide and marketed as truly mobile homes Typical mobile home increased in size to 10 feet wide and began being installed on permanent foundations in the 1950s Industry expansion led to many companies building homes to varying standards in the 1970s

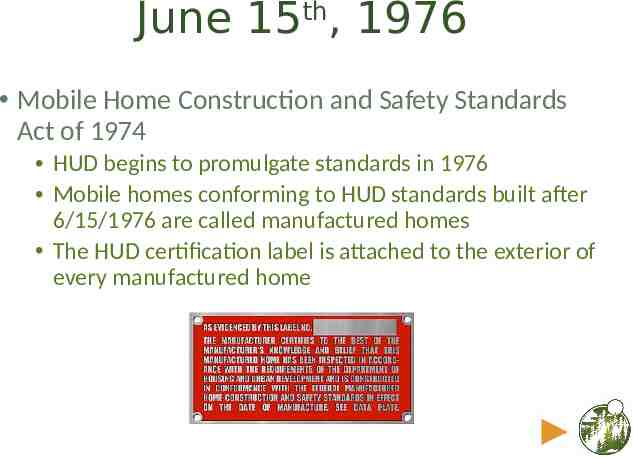

June 15th, 1976 Mobile Home Construction and Safety Standards Act of 1974 HUD begins to promulgate standards in 1976 Mobile homes conforming to HUD standards built after 6/15/1976 are called manufactured homes The HUD certification label is attached to the exterior of every manufactured home

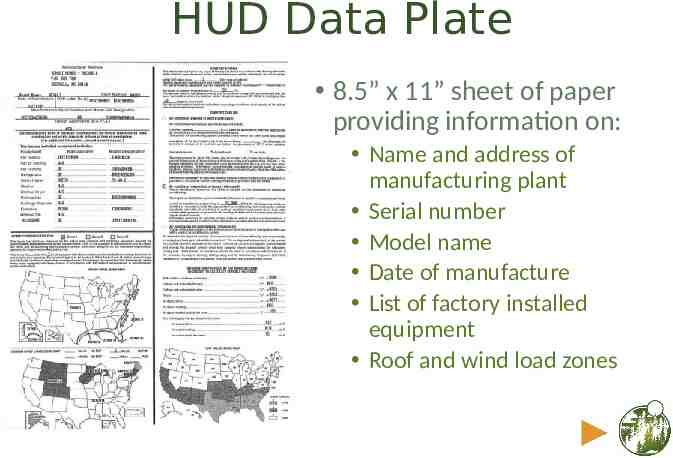

HUD Data Plate 8.5” x 11” sheet of paper providing information on: Name and address of manufacturing plant Serial number Model name Date of manufacture List of factory installed equipment Roof and wind load zones

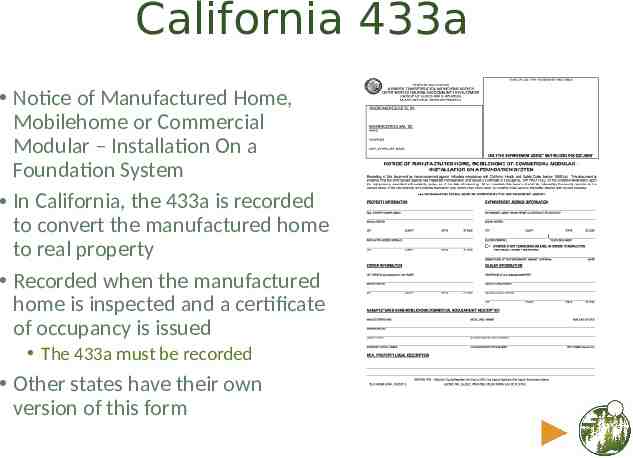

State Specific Documentation California 433a Notice of Manufactured Home Installation on a Foundation System Colorado Affidavit of Real Property for Manufactured Homes Certificate of Permanent Location for a Manufactured Home Oregon Application & Certification Exempting Manufactured Structure from Ownership Nevada Affidavit of Conversion Washington Manufactured Home Application

California 433a Notice of Manufactured Home, Mobilehome or Commercial Modular – Installation On a Foundation System In California, the 433a is recorded to convert the manufactured home to real property Recorded when the manufactured home is inspected and a certificate of occupancy is issued The 433a must be recorded Other states have their own version of this form

Conventional

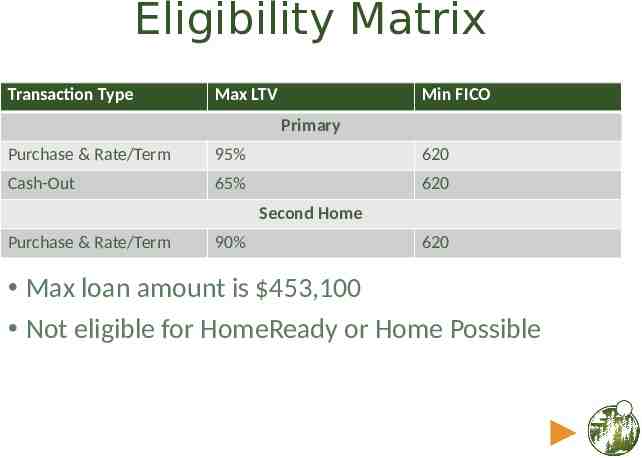

Eligibility Matrix Transaction Type Max LTV Min FICO Primary Purchase & Rate/Term 95% 620 Cash-Out 65% 620 Second Home Purchase & Rate/Term 90% 620 Max loan amount is 453,100 Not eligible for HomeReady or Home Possible

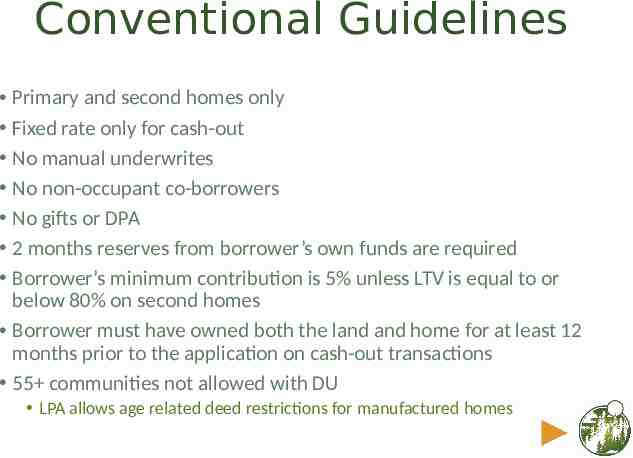

Conventional Guidelines Primary and second homes only Fixed rate only for cash-out No manual underwrites No non-occupant co-borrowers No gifts or DPA 2 months reserves from borrower’s own funds are required Borrower’s minimum contribution is 5% unless LTV is equal to or below 80% on second homes Borrower must have owned both the land and home for at least 12 months prior to the application on cash-out transactions 55 communities not allowed with DU LPA allows age related deed restrictions for manufactured homes

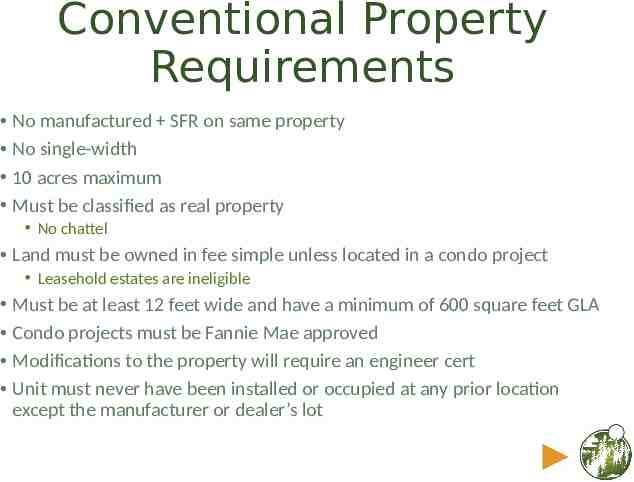

Conventional Property Requirements No manufactured SFR on same property No single-width 10 acres maximum Must be classified as real property No chattel Land must be owned in fee simple unless located in a condo project Leasehold estates are ineligible Must be at least 12 feet wide and have a minimum of 600 square feet GLA Condo projects must be Fannie Mae approved Modifications to the property will require an engineer cert Unit must never have been installed or occupied at any prior location except the manufacturer or dealer’s lot

Standard Property Requirements Must be built after June 15th, 1976 Must have HUD data plate or IBTS verification Must be one unit classified as real property 433A or applicable state specific documentation

FHA

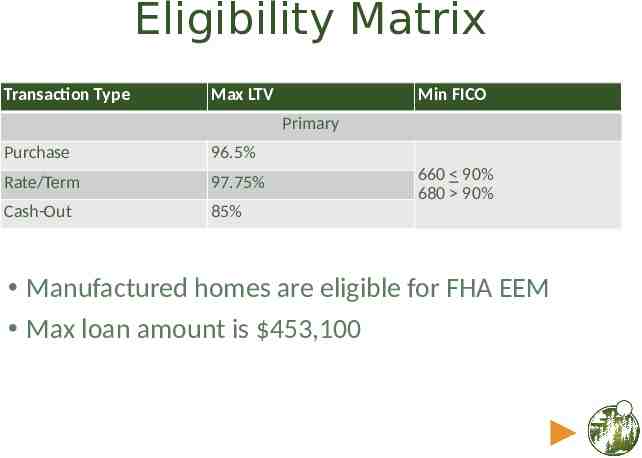

Eligibility Matrix Transaction Type Max LTV Min FICO Primary Purchase 96.5% Rate/Term 97.75% Cash-Out 85% 660 90% 680 90% Manufactured homes are eligible for FHA EEM Max loan amount is 453,100

Refinances On a refinance transaction, the manufactured home must have been installed on a site for at least 12 months prior to the case assignment

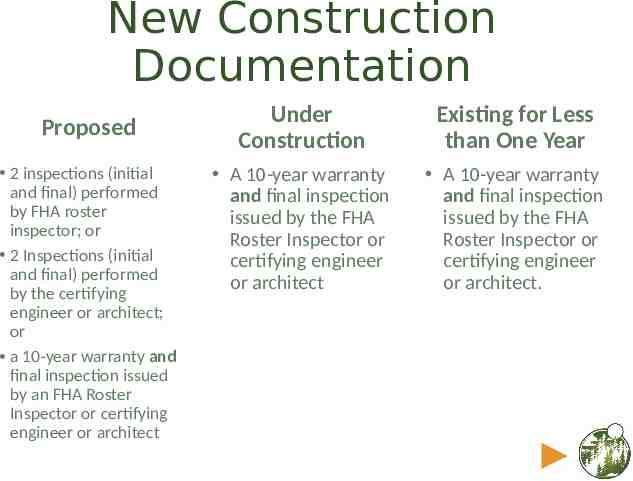

New Construction There are 3 categories of new construction Proposed No concrete or permanent material placed Under Construction Permanent material placed No cert of occupancy Existing for Less than One Year 100% complete for 1 year from date of Certificate of Occupancy Never occupied FHA treats the sale of an occupied property that has been completed for less than 1 year as existing construction

New Construction Documentation Proposed 2 inspections (initial and final) performed by FHA roster inspector; or 2 Inspections (initial and final) performed by the certifying engineer or architect; or a 10-year warranty and final inspection issued by an FHA Roster Inspector or certifying engineer or architect Under Construction Existing for Less than One Year A 10-year warranty and final inspection issued by the FHA Roster Inspector or certifying engineer or architect A 10-year warranty and final inspection issued by the FHA Roster Inspector or certifying engineer or architect.

FHA Guidelines Maximum DTI is 45% No gift funds 2 months reserves No manual underwrites Down payment, closing costs, and reserves must come from borrowers’ own funds

Property Requirements No manufactured SFR on same property Must be above 100-year flood plane May not be processed as site condos Must be HUD approved projects Minimum GLA is 400 square feet Minimum of 2 manufactured comps on appraisal Must be built on or after June 15th, 1976 Must be classified as real estate Must have been transported directly to the site from manufacturer or dealership Must have HUD label or IBTS cert 433A or applicable state specific documentation

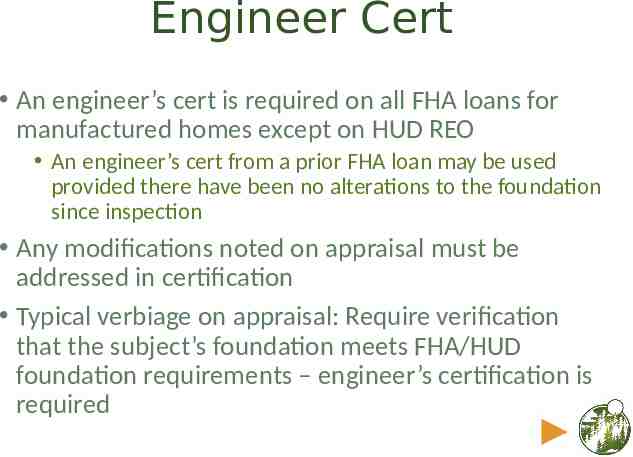

Engineer Cert An engineer’s cert is required on all FHA loans for manufactured homes except on HUD REO An engineer’s cert from a prior FHA loan may be used provided there have been no alterations to the foundation since inspection Any modifications noted on appraisal must be addressed in certification Typical verbiage on appraisal: Require verification that the subject’s foundation meets FHA/HUD foundation requirements – engineer’s certification is required

VA

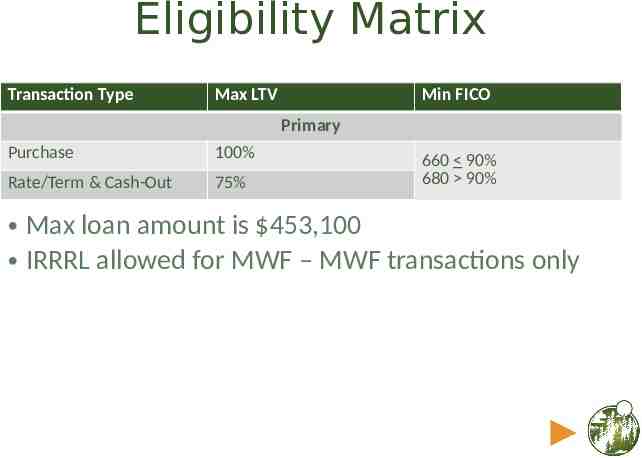

Eligibility Matrix Transaction Type Max LTV Min FICO Primary Purchase 100% Rate/Term & Cash-Out 75% 660 90% 680 90% Max loan amount is 453,100 IRRRL allowed for MWF – MWF transactions only

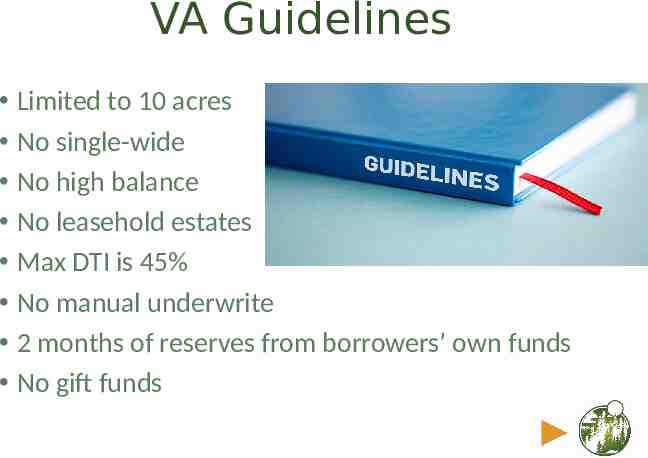

VA Guidelines Limited to 10 acres No single-wide No high balance No leasehold estates Max DTI is 45% No manual underwrite 2 months of reserves from borrowers’ own funds No gift funds

New vs Existing Construction New Existing Home has not been installed on a permanent foundation When the foundation is complete and the home is installed, the home is considered existing construction

New Construction Warranty Proposed or under construction The contractor responsible for the construction of the foundation must provide the one-year warranty New manufactured home The manufacturer must provide a one-year warranty on VA Form 26-8599 Manufactured Home Warranty Used manufactured home sold by dealer The dealer must provide a 6 month warranty on Form 26-8730 Used Manufactured Home Limited Warranty

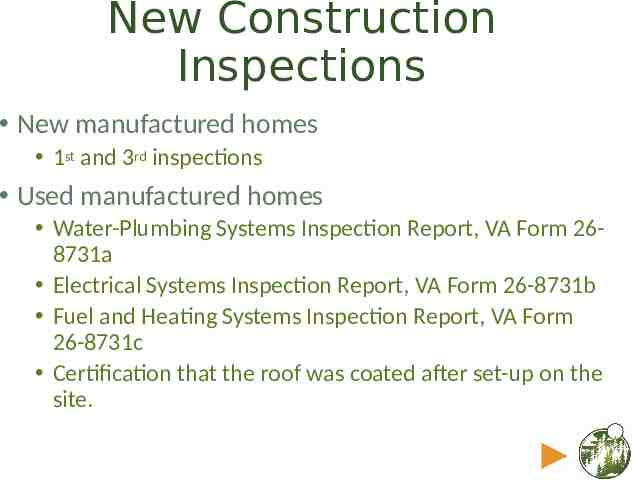

New Construction Inspections New manufactured homes 1st and 3rd inspections Used manufactured homes Water-Plumbing Systems Inspection Report, VA Form 268731a Electrical Systems Inspection Report, VA Form 26-8731b Fuel and Heating Systems Inspection Report, VA Form 26-8731c Certification that the roof was coated after set-up on the site.

Property Requirements Must be built on or after June 15th, 1976 Must be classified as real estate 433A must be recorded

USDA

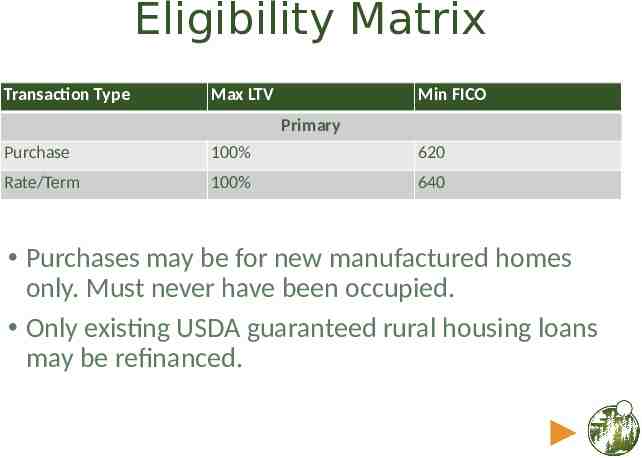

Eligibility Matrix Transaction Type Max LTV Min FICO Primary Purchase 100% 620 Rate/Term 100% 640 Purchases may be for new manufactured homes only. Must never have been occupied. Only existing USDA guaranteed rural housing loans may be refinanced.

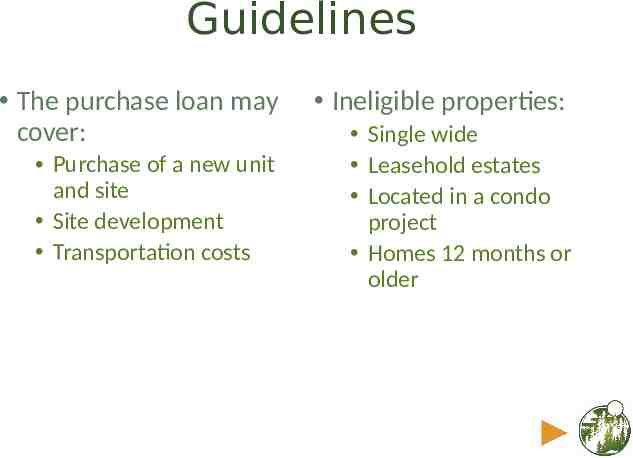

Guidelines The purchase loan may cover: Purchase of a new unit and site Site development Transportation costs Ineligible properties: Single wide Leasehold estates Located in a condo project Homes 12 months or older

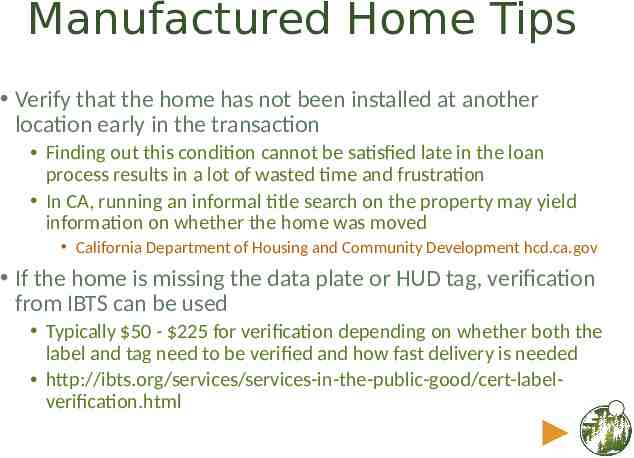

Manufactured Home Tips Verify that the home has not been installed at another location early in the transaction Finding out this condition cannot be satisfied late in the loan process results in a lot of wasted time and frustration In CA, running an informal title search on the property may yield information on whether the home was moved California Department of Housing and Community Development hcd.ca.gov If the home is missing the data plate or HUD tag, verification from IBTS can be used Typically 50 - 225 for verification depending on whether both the label and tag need to be verified and how fast delivery is needed http://ibts.org/services/services-in-the-public-good/cert-labelverification.html

Questions?

Thank you!