Predictive Modeling and Analysis 8-1

38 Slides2.50 MB

Predictive Modeling and Analysis 8-1

Logic-Driven Modeling Data-Driven Modeling Analyzing Uncertainty and Model Assumptions Model Analysis Using Risk Solver Platform 8-2

Logic-Driven Modeling Predictive modeling is the heart and soul of business decisions. Building decision models is more of an art than a science. Creating good decision models requires: - solid understanding of business functional areas - knowledge of business practice and research - logical skills It is best to start simple and enrich models as necessary. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-3

Logic-Driven Modeling Example 8.1 The Economic Value of a Customer A restaurant customer dines 6 times a year and spends an average of 50 per visit. The restaurant realizes a 40% margin on the average bill for food and drinks. Annual gross profit on a customer 50(6)(0.40) 120 30% of customers do not return each year. Average lifetime of a customer 1/.3 3.33 years Average gross profit for a customer 120(3.33) 400 OR Average gross profit for a customer 120/.3 400 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-4

Logic-Driven Modeling Example 8.1 (continued) The Economic Value of a Customer V value of a loyal customer R revenue per purchase F purchase frequency (number visits per year) M gross profit margin D defection rate (proportion customers not returning each year) Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-5

Logic-Driven Modeling Example 8.2 A Profit Model Develop a decision model for predicting profit in face of uncertain demand. P profit R revenue C cost p unit price c unit cost F fixed cost S quantity sold D demand Q quantity produced Figure 8.1 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-6

Logic-Driven Modeling Example 8.2 (continued) A Profit Model Cost fixed cost variable cost C F cQ Revenue price times quantity sold R pS Quantity sold Minimum{demand, quantity sold} S min{D, Q} Profit Revenue Cost P p*min{D, Q} (F cQ) Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-7

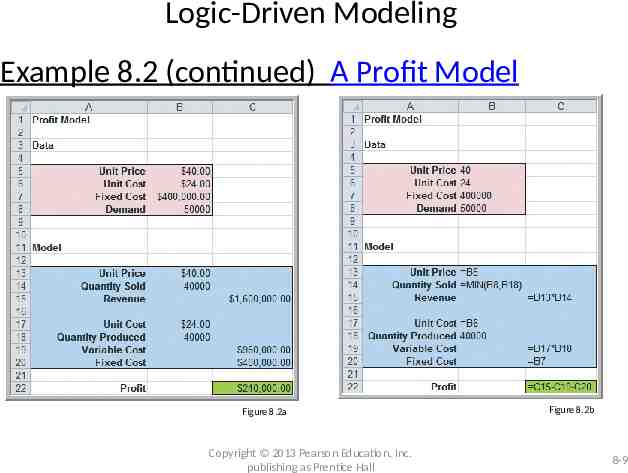

Logic-Driven Modeling Example 8.2 (continued) A Profit Model p 40 c 24 F 400,000 D 50,000 Q 40,000 Compute: R p*min{D,Q} 40(40,000) 1,600,000 C F cQ 1,360,000 400,000 24(40,000) P R C 1,600,000 – 1,360,000 240,000 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall Figure 8.2a 8-8

Logic-Driven Modeling Example 8.2 (continued) A Profit Model Figure 8.2a Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall Figure 8.2b 8-9

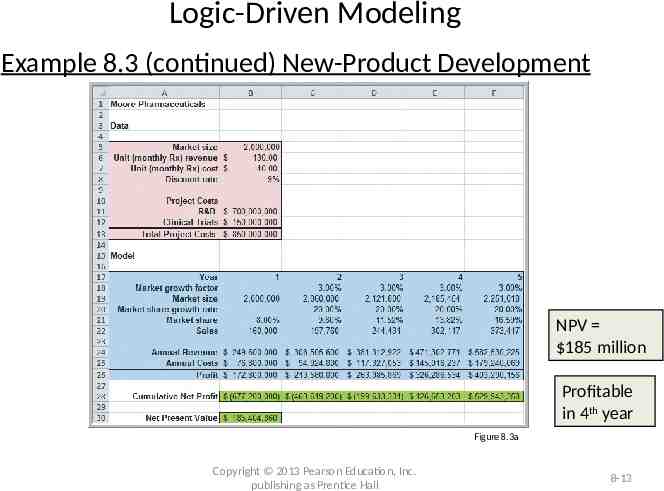

Logic-Driven Modeling Example 8.3 New-Product Development Moore Pharmaceuticals needs to decide whether to conduct clinical trials and seek FDA approval for a newly developed drug. Estimated figures: R&D cost 700 million Clinical trials cost 150 million Market size 2 million people Market size growth 3% per year Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-10

Logic-Driven Modeling Example 8.3 (continued) New-Product Development Additional estimated figures Market share 8% Market share growth 20% per year (for 5 years) Revenue from a monthly prescription 130 Variable cost for a monthly prescription 40 Discount rate for net present value 9% Moore Pharmaceuticals wants to determine net present value for the next 5 years and to determine how long it will take to recover fixed costs. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-11

Logic-Driven Modeling Example 8.3 (continued) New-Product Development Figure 8.3b Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-12

Logic-Driven Modeling Example 8.3 (continued) New-Product Development NPV 185 million Profitable in 4th year Figure 8.3a Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-13

Logic-Driven Modeling Single-Period Purchase Decisions One-time purchase decisions often must be made in the face of uncertain demand. Newsvendor Problem: How many newspapers to purchase each day? C cost to purchase a newspaper Q number of newspapers the vendor purchases D number of newspapers demanded R revenue from selling a newspaper S salvage value of unsold newspapers Net profit R(min{Q,D}) S(max{0,Q D}) CQ Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-14

Logic-Driven Modeling Example 8.4 A Single-Period Purchase Decision Model Net profit 18(min{Q,D}) 9(max{0,Q D}) 12Q Figure 8.4 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-15

Logic-Driven Modeling Example 8.5 A Hotel Overbooking Model A popular resort hotel has 300 rooms. The room rate is 120 per night. Reservations can be cancelled by 6:00 p.m. Cost of overbooking is 100 per occurrence. Determine net revenue on the rooms. Q 300, P 120, C 100 D Reservations Cancellations Net revenue P(min{300,D}) C(max{0,D Q}) 120(min{300,D}) 100(max{0,D 300}) Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-16

Logic-Driven Modeling Example 8.5 (continued) A Hotel Overbooking Model Net revenue 120(min{300,D}) 100(max{0,D 300}) Figure 8.5 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-17

Logic-Driven Modeling Example 8.6 A Retirement-Planning Model Start work at age 22, earning 50,000 per year. Expect a salary increase of 3% per year. Required to contribute 8% to retirement. Employer contributes 35% of that amount. Expect an annual return of 8% on the portfolio. Determine the value of the retirement account when the employee is 50 years old. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-18

Logic-Driven Modeling Example 8.6 (continued) Retirement-Planning Model Salary 1.03(previous year’s salary) Employee contribution 0.08(salary) Employer contribution 0.35(employee contrib.) Value of account 1.08(previous value) employee contribution employer contribution Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall Figure 8.6a 8-19

Logic-Driven Modeling Example 8.6 (continued) Retirement Planning Model Value at 22 years old 5,400 Value at 50 years old 751,757 Figure 8.6b Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-20

Data-Driven Modeling Example 8.7 Modeling Retail Markdown Pricing Decisions In the spring, a department store introduces a new line of bathing suits that sells for 70. The store purchases 1000 of these bathing suits. During the prime selling season, the store sells an average of 7 units per day at full price (40 days). On 10 sale days, the price is discounted 30% and sales increase to 32.2 units per day. Around July 4th, the price is marked down 70% to sell off remaining inventory. Determine total revenue from the bathing suits. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-21

Data-Driven Modeling Example 8.7 (continued) Modeling Retail Markdown Pricing Decisions Assume a linear trend model between sales and price: daily sales a – b(price) 7 a – b(70) 32.2 a – b(49) Daily sales 91 – 1.2(price) Figure 8.7 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-22

Data-Driven Modeling Example 8.7 (continued) Revenue from full retail sales units sold * days * price (7)*(40)*(70) 19,600 Revenue from sale weekends (32.2)*(10)*(49) 15,778 Revenue from clearance sales leftovers * price (1000 7(40) 32.2(10))*(21) (398)(21) 8,358 Figure 8.7 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-23

Data-Driven Modeling Example 8.7 (continued) Modeling Retail Markdown Pricing Decisions Total revenue 43,736 Figure 8.7 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-24

Data-Driven Modeling Modeling Relationships and Trends in Data Create charts to better understand data sets. For cross-sectional data, use a scatter chart. For time series data, use a line chart. Consider using mathematical functions to model relationships. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-25

Data-Driven Modeling Excel Trendline tool Click on a chart Chart tools Layout Trendline Choose a Trendline. Choose whether to display equation and R-squared. R-squared values closer to 1 indicate better fit of the Trendline to the data. Figure 8.8 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-26

Data-Driven Modeling Example 8.8 Modeling a Price-Demand Function Linear demand function: Sales -9.5116(price) 20512 Figure 8.9 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-27

Analyzing Uncertainty and Model Assumptions What-If Analysis Spreadsheet models allow you to easily evaluate what-if questions. How do changes in model inputs (that reflect key assumptions) affect model outputs? Systematic approaches to what-if analysis make the process easier and more useful. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-28

Analyzing Uncertainty and Model Assumptions Data Tables Data Tables summarize the impact of one or two inputs on a specified output. Excel data table types: One-way data tables – for one input variable Two-way data table – for two input variables To construct a data table: Data What-If Analysis Data Table Figure 8.14 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-29

Analyzing Uncertainty and Model Assumptions Example 8.11 A One-Way Data Table for Uncertain Demand Create a column of demand values (column E). Enter C22 in cell F3 (to reference the output cell). Highlight the range E3:F11. Choose Data Table. Enter B8 for Column input cell. (tells Excel that column E is demand values) Data Table tool computes these values Figure 8.15a Figure 8.14 Education, Inc. Copyright 2013 Pearson publishing as Prentice Hall 8-30

Analyzing Uncertainty and Model Assumptions Example 8.11 (continued) A One-Way Data Table for Uncertain Demand The Data Table tool computes the profit values in column F (below 240,000). Figure 8.15b Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-31

Analyzing Uncertainty and Model Assumptions Example 8.12 One-Way Data Tables with Multiple Outputs Create a second output, revenue. Enter C15 in cell G3. Highlight E3:G11. Choose Data Table Proceed as in the previous example. Excel computes the revenues values. Figure 8.15 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-32

Analyzing Uncertainty and Model Assumptions Example 8.13 A Two-Way Data Table for the Profit Model Evaluate the impact of both unit price and unit cost Create a column of unit prices (F5:F15). Create a row of unit costs (G4:J4). Enter C22 in cell F4. Select F4:J15. Choose Data Table. Data Table tool computes these cell values. Figure 8.17a Enter B6 for Row input cell. Enter B5 for Column input cell. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-33

Analyzing Uncertainty and Model Assumptions Example 8.13 (continued) A Two-Way Data Table for the Profit Model Figure 8.17b Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-34

Analyzing Uncertainty and Model Assumptions Goal Seek Goal Seek allows you to alter the data used in a formula in order to find out what the results will be. Set cell contains the formula that will return the result you're seeking. To value is the target value you want the formula to return. By changing cell is the location of the input value that Excel can change to reach the target. Figure 8.21 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-35

Analyzing Uncertainty and Model Assumptions Example 8.15 Finding the Breakeven Point in the Outsourcing Model (using Goal Seek) Find the value of demand at which manufacturing cost equals purchased cost Set cell: B19 To value: 0 By changing cell: B12. Figure 8.21 The breakeven volume is 1000 units. Figure 8.22 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall

Model Analysis Using Risk Solver Platform Tornado Chart Shows the impact that variation in a model input has on some output while holding all other inputs constant. Shows which inputs are the least and most influential on the output. Helps you select the inputs that you would want to further analyze. Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-37

Model Analysis Using Risk Solver Platform Example 8.17 Creating a Tornado Chart in Risk Solver Platform Profit Model Select cell C22. Parameters Identify A 10% change in unit price (B5) affects profit the most. Next is unit cost (B6). Figure 8.28 Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall 8-38