Risk

21 Slides762.54 KB

Risk

What is risk? What’s the worst thing that can happen?

What is risk? Risk Exposure Probability of Loss or Damage

Ways to Manage Risk Accept it: Performance Obligations Avoid it: Unacceptable or Catastrophic Risks Abate it: Learn/Improve/Plan; QC/QM Allocate it: Contract responsibilities Finance it: Buy (or require) Insurance

Assess Risks What can happen, when, how, and why? Identify existing controls Determine level of risk Purchased Insurance Retained Risk/Deductible Contractual Transfer Identify Risks Control Risks Risk Finance Administration Accept Risk Avoid Risk Transfer Risk Reduce Risk Communicate Implement Monitor QC/QM

Insurance Types Property General Liability Professional Liability Workers Compensation and Employers Liability Automobile

Property Insurance Owner’s Property (Fire) Builders Risk Inland Marine Installation Floaters

Builders Risk – The Good Builder’s Risk Construction contracts are indivisible Progress payments don’t excuse performance Obligation is to deliver completed building Covers all parties’ interest in project: Owner, GC, subs GC must purchase IRF can’t insure non-government interests Beware: only policy owner may be entitled to cancellation notice Subrogation and claim waivers

Builders Risk – the Not-So-Good Replacement cost only No consequential damages See Owner’s Loss of Use Insurance GC administers policy and claims Accidental damage to boilers and equipment excluded See Boiler and Machinery Insurance Coverage Terminates at Substantial Completion Must be replaced with Owner’s property insurance Value of completed building and FF&E exceeds contract price

Builders Risk – Do You Even Need It? Site work Renovation/Upfit work Damage to existing structure covered under Owner’s property insurance Your policy doesn’t protect GC/subcontractor interest In appropriate circumstances, Installation Floater may be enough

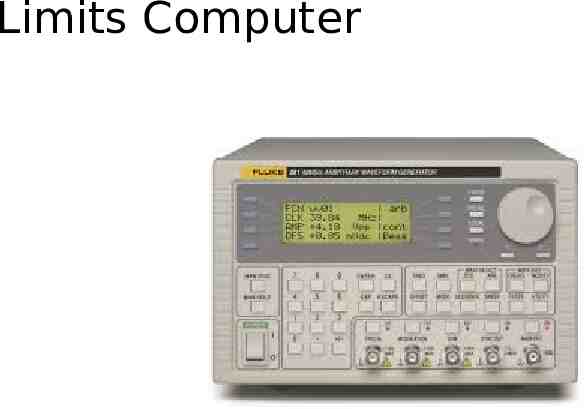

Builders Risk Limits

Liability Insurance – Policy Basis Claims Made and Reported Occurrence Latent claims covered in later policy years A/E may be gone-dead, retired, moved to Alaska Can’t monitor if coverage maintained Tail or extended reporting period Different “triggers” Multiple policies (and limits) may be triggered Certificate “plus” will verify coverage Rick, we’ll always have Paris

Commercial General Liability Insurance Architects and contractors GC should require subcontractor policies Architects GL coverage not as broad Almost always written on an occurrence basis Contractual Liability: coverage for indemnity obligations Exclusions-watch out! Completed Operations: the gift that keeps on giving

CGL: What’s covered? Bodily injury, sickness or death Property Damage: Physical damage To Tangible Property Including loss of use AND loss of use of property not physically damaged Exclusion: “your own work” Except for completed operations

CGL: What triggers? Accident Property Damage: “continuous exposure to same generally harmful conditions” Property Damage: “Manifestation?” Completed operations

CGL: How much? Sovereign Immunity 300,000 per claimant 600,000 per occurrence, regardless how many governmental units involved Immunity doesn’t apply to GC, subs or A/E Effectively caps their indemnity exposure

CGL: How much more? What’s the worst that can happen? Sitework, isolated location Demolition/implosion downtown Agency activities Research facility with limited access Active campus with curious students Construction is almost always a “high risk” activity You may be immune; doesn’t mean you won’t be sued

CGL: How much more (more)? Defective construction Repair cost Diminished value Bodily injury, sickness or death Damage to other property Difficult to value

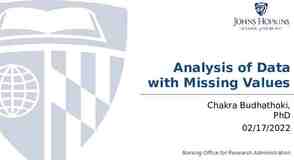

General Liability Limits

Limits Computer