Overview of Government Finance Statistics Stephen McDonagh

15 Slides1.40 MB

Overview of Government Finance Statistics Stephen McDonagh

Overview Role of Central Statistics Office What is Government Finance Statistics How is data compiled Relationship with public accounts (Exchequer)

Role of CSO National Statistical Institute (NSI) Part of the European Statistical System Primacy of role of the NSI and of the DG in relation to statistical matters established in national and EU law. Statistics Act, 1993 Regulation (EC) No 223/2009 (as amended 2015)

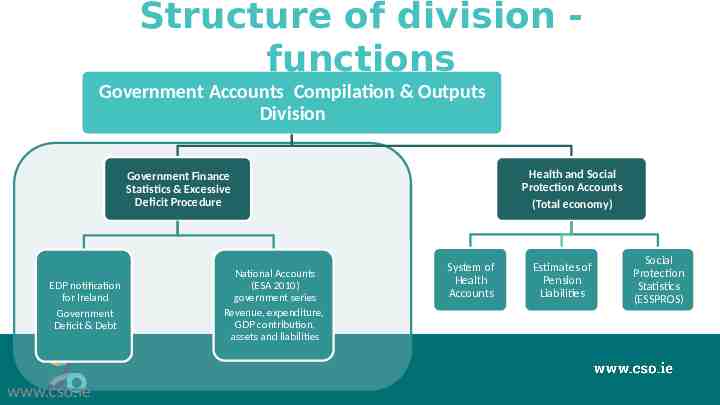

Structure of division functions Government Accounts Compilation & Outputs Division Health and Social Protection Accounts (Total economy) Government Finance Statistics & Excessive Deficit Procedure EDP notification for Ireland Government Deficit & Debt www.cso.ie National Accounts (ESA 2010) government series Revenue, expenditure, GDP contribution, assets and liabilities System of Health Accounts Estimates of Pension Liabilities Social Protection Statistics (ESSPROS)

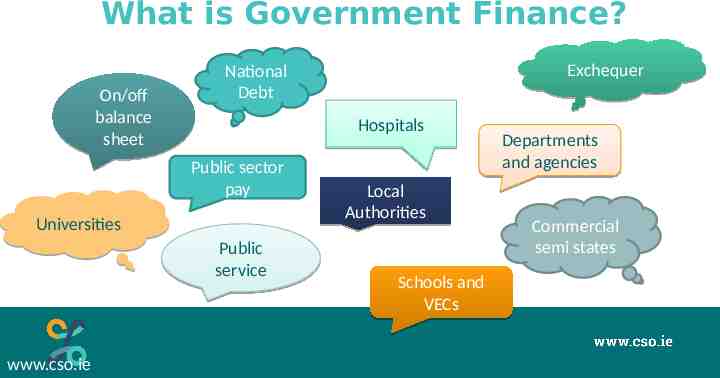

What is Government Finance? On/off balance sheet Hospitals Public sector pay Universities Public service www.cso.ie Exchequer National Debt Local Authorities Schools and VECs Departments and agencies Commercial semi states

What is Government Finance Statistics Compiled as part of National Accounts Legally binding EU standards – European System of Accounts 2010 (ESA2010) Describe the economic functions and activity of government Based on the concept of “general government” (from ESA2010)

Outputs Non-financial accounts of government Revenue/Income Expenditure Financial accounts of government Assets Liabilities

Outputs Government Finance Statistics are part of the National Accounts Framework But GFS presentation of revenue/expenditure is more like standard business accounting than national accounts presentation However all of the measures/concepts map into national accounts framework and sequence of accounts

Excessive Deficit Procedure Excessive Deficit Procedure notification Biannual, end March/September Reporting of government deficit and debt levels for Ireland to Eurostat as required under Stability and Growth Pact and subsequent EU legislation. Reporting forms part of “preventive arm” of EDP – monitoring of EU MSs deficit and debt levels SGP limited these to 3% of GDP (deficit) and 60% of GDP (debt) Fiscal Compact requires ‘balanced budget’ or surplus i.e. structural deficit of not more than 0.5% of GDP

EDP – Key measures In theory In practice there is usually a statistical discrepancy )

Where does the data come from Exchequer statement – overall balance and specific transactions Finance Accounts – final audited accounts of Exchequer Estimates system – expenditure by programme, subhead Appropriation accounts Tax data from Revenue Commissioners NTMA/ISIF returns Joint surveys with Dept of Finance Annual reports of other bodies Local authority accounts

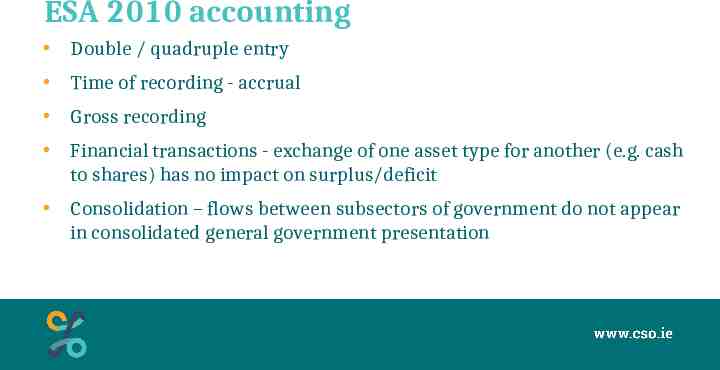

ESA 2010 accounting Double / quadruple entry Time of recording - accrual Gross recording Financial transactions - exchange of one asset type for another (e.g. cash to shares) has no impact on surplus/deficit Consolidation – flows between subsectors of government do not appear in consolidated general government presentation

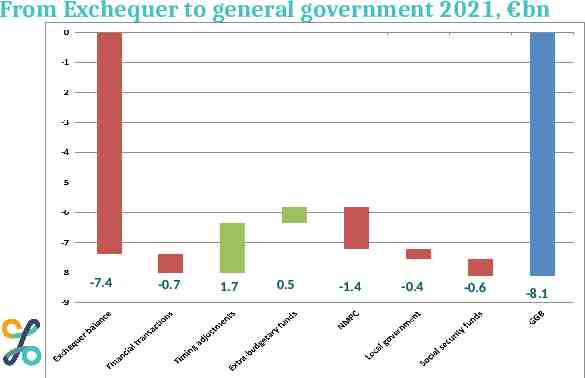

From Exchequer to general government 2021, bn -7.4 -0.7 1.7 0.5 -1.4 -0.4 -0.6 -8.1

CSO GFS publications https://www.cso.ie/en/statistics/governmentaccounts/ Information note https://www.cso.ie/en/releasesandpublications/in/webggb/inf ormationnotewalkfromexchequerbalancetogeneralgovernmentbalance/ CSO Government Accounts Compilation and Outputs Division [email protected]