Who is hurt and who is helped by Inflation? H = hurt G = gains

15 Slides62.50 KB

Who is hurt and who is helped by Inflation? H hurt G gains U uncertain

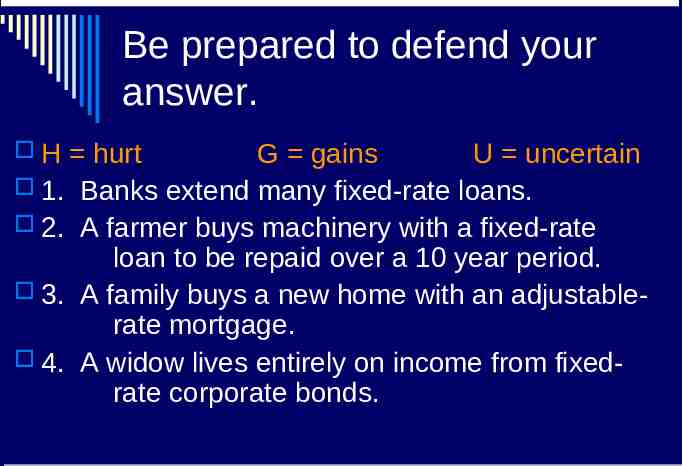

Be prepared to defend your answer. H hurt G gains U uncertain 1. Banks extend many fixed-rate loans. 2. A farmer buys machinery with a fixed-rate loan to be repaid over a 10 year period. 3. A family buys a new home with an adjustablerate mortgage. 4. A widow lives entirely on income from fixedrate corporate bonds.

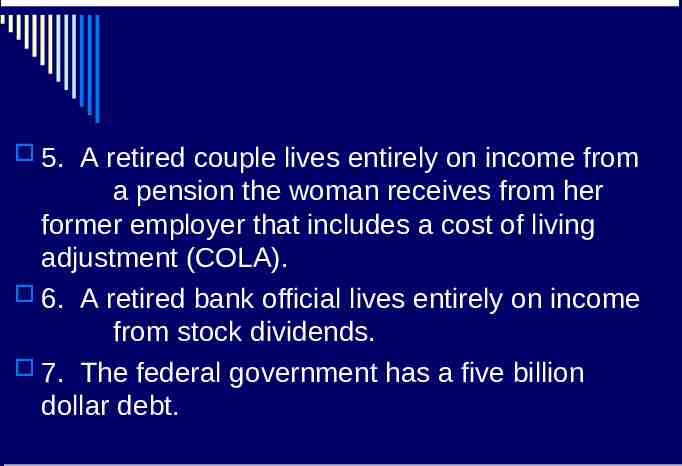

5. A retired couple lives entirely on income from a pension the woman receives from her former employer that includes a cost of living adjustment (COLA). 6. A retired bank official lives entirely on income from stock dividends. 7. The federal government has a five billion dollar debt.

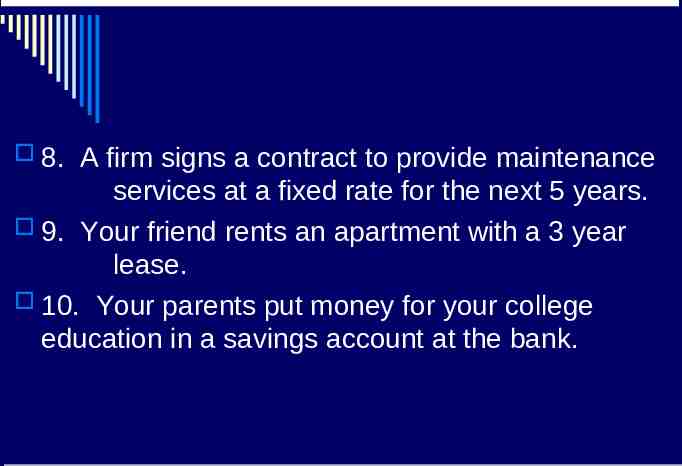

8. A firm signs a contract to provide maintenance services at a fixed rate for the next 5 years. 9. Your friend rents an apartment with a 3 year lease. 10. Your parents put money for your college education in a savings account at the bank.

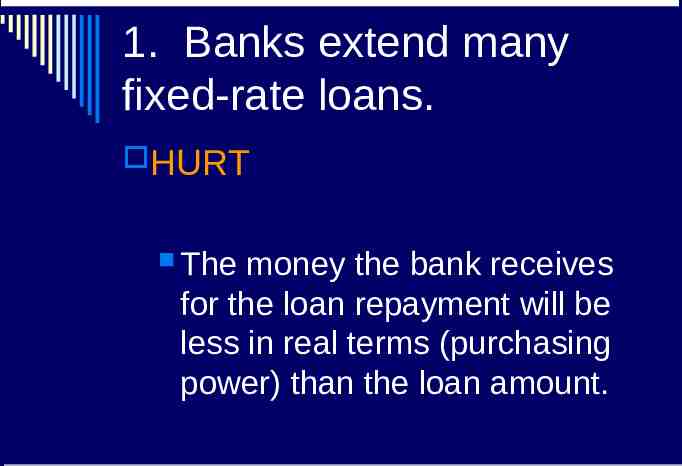

1. Banks extend many fixed-rate loans. HURT The money the bank receives for the loan repayment will be less in real terms (purchasing power) than the loan amount.

2. A farmer buys machinery with a fixed-rate loan to be repaid over a 10 year period. GAINS Farmer makes payments that are less in real terms than the loan amount.

3. A family buys a new home with an adjustable-rate mortgage. UNCERTAIN It depends on what happens to the future interest rate relative to the inflation rate. If the interest rate raises above the loan rate, the family will be hurt. If the interest rate is below the loan rate, the family will not have to pay more.

4. A widow lives entirely on income from fixed-rate corporate bonds. HURT The purchasing power of the income will be less as inflation continues to deflate the value of the dollar.

5. A retired couple lives entirely on income from a pension the woman receives from her former employer that includes a cost of living adjustment (COLA). GAINS The purchasing power of the pension payment will be higher then the inflation rate because of the COLA.

6. A retired bank official lives entirely on income from stock dividends. UNCERTAIN It depends on the growth in stock dividends relative to the inflation rate. In general, stock dividends increase with inflation while bond interest rates are fixed; however, the increase does not have to match the inflation rate.

7. The federal government has a five billion dollar debt. GAINS The government will repay the debt with money that has less purchasing power.

8. A firm signs a contract to provide maintenance services at a fixed rate for the next 5 years. HURT Revenue from contract will be worth less.

9. Your friend rents an apartment with a 3 year lease. GAINS Rent payments will be lower in real terms.

10. Your parents put money for your college education in a savings account at the bank. UNCERTAIN It depends on the return on the savings relative to the inflation rate.

In Conclusion Individuals who receive fixed incomes are HURT by inflation Lenders and savers People who make fixed payments GAIN borrowers