July 20, 2018 Public Service Loan Forgiveness Program To

74 Slides3.10 MB

July 20, 2018 Public Service Loan Forgiveness Program To encourage individuals to enter and continue in full-time public service employment. OFM OFFICE OF FINANCIAL MANAGEMENT

Public Service Loan Forgiveness Program Although the information contained in this training is accurate at the time of publication, the Office of Financial Management cannot guarantee its future accuracy or completeness. You should independently verify accuracy as there may have been changes to the Public Service Loan Forgiveness Program by Congress. OFM 01/29/2023 2

Overview and Course Objectives Brief training overview This training offers a resource for public service employees to use while navigating the application process for the Public Service Loan Forgiveness program. Course objectives Gain an understanding of the application process for PSLF. Learn what loan types are eligible for the PSLF program. Learn how to determine if your employment and employer qualify for the PSLF program. Determine how your monthly student loan payments need to be repaid before you are considered eligible for the PSLF program. Develop an understanding of the Temporary Expanded Public Service Loan Forgiveness opportunity and how you may benefit from it if you are denied from the PSLF program. OFM 01/29/2023 Myfedloan.org 3

Public Service Loan Forgiveness Program OFM 01/29/2023 Myfedloan.org 4

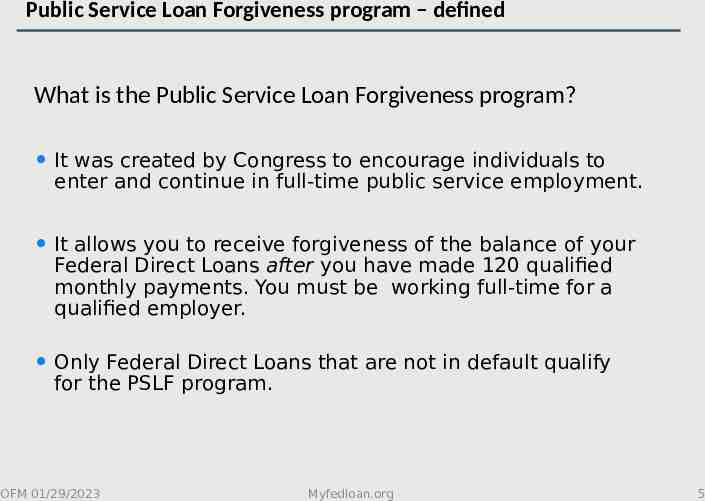

Public Service Loan Forgiveness program – defined What is the Public Service Loan Forgiveness program? It was created by Congress to encourage individuals to enter and continue in full-time public service employment. It allows you to receive forgiveness of the balance of your Federal Direct Loans after you have made 120 qualified monthly payments. You must be working full-time for a qualified employer. Only Federal Direct Loans that are not in default qualify for the PSLF program. OFM 01/29/2023 Myfedloan.org 5

How to qualify for the PSLF program OFM 01/29/2023 Myfedloan.org 6

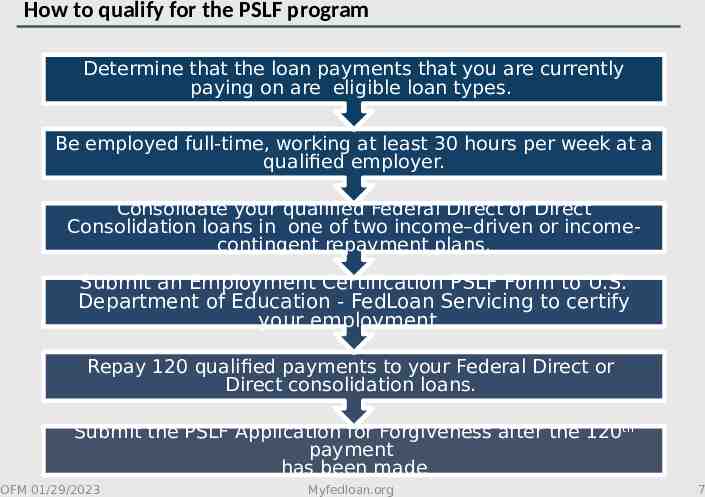

How to qualify for the PSLF program Determine that the loan payments that you are currently paying on are eligible loan types. Be employed full-time, working at least 30 hours per week at a qualified employer. Consolidate your qualified Federal Direct or Direct Consolidation loans in one of two income–driven or incomecontingent repayment plans. Submit an Employment Certification PSLF Form to U.S. Department of Education - FedLoan Servicing to certify your employment. Repay 120 qualified payments to your Federal Direct or Direct consolidation loans. Submit the PSLF Application for Forgiveness after the 120th payment has been made OFM 01/29/2023 Myfedloan.org 7

Eligible loan types for PSLF OFM 01/29/2023 Myfedloan.org 8

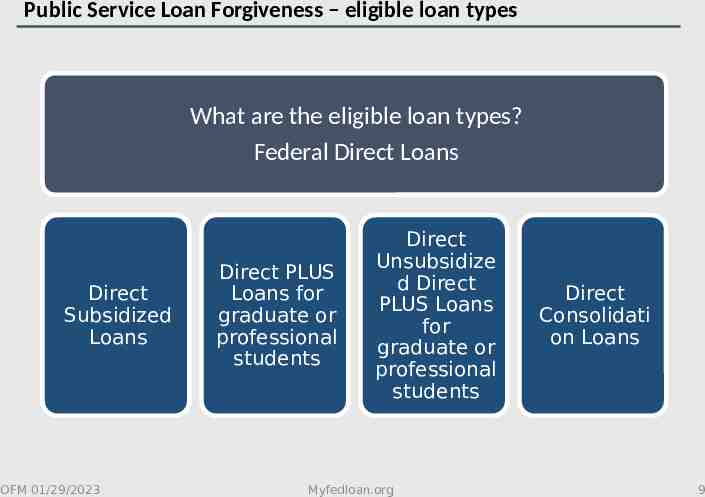

Public Service Loan Forgiveness – eligible loan types What are the eligible loan types? Federal Direct Loans Direct Subsidized Loans OFM 01/29/2023 Direct PLUS Loans for graduate or professional students Direct Unsubsidize d Direct PLUS Loans for graduate or professional students Myfedloan.org Direct Consolidati on Loans 9

Ineligible loan types for PSLF OFM 01/29/2023 Myfedloan.org 10

Public Service Loan Forgiveness – ineligible loan types What are the ineligible loan types? Private loans. Private education loans are not eligible for PSLF and cannot be consolidated in a new Direct Consolidation Loan. OFM 01/29/2023 Myfedloan.org 11

Qualified employment status OFM 01/29/2023 Myfedloan.org 12

Public Service Loan Forgiveness – qualified employment status What is the definition of full-time employment? You must be working full-time at least an annual average of 30 hours per week for a qualifying employer at the time you submit the PSLF Application for Forgiveness and working full-time at least 30 hours per week at the moment the balance on your loan is forgiven. Vacation, leave time or leave taken under the Family and Medical Leave Act provided by an employer is equivalent to hours worked in qualifying employment. OFM 01/29/2023 Myfedloan.org 13

Public Service Loan Forgiveness – qualified employer What is the definition of a qualified employer? Government (federal, state, local or tribal) Tax-exempt not-for-profit (501[c][3]) Nonprofit providing certain public service activities AmeriCorps Peace Corps position that is a full-time assignment under the Peace Corps Act (22 U.S.C 2504) OFM 01/29/2023 Myfedloan.org 14

Public Service Loan Forgiveness – qualified employment status Your employment can be a combination of any of the qualified employers listed. OFM 01/29/2023 Myfedloan.org 15

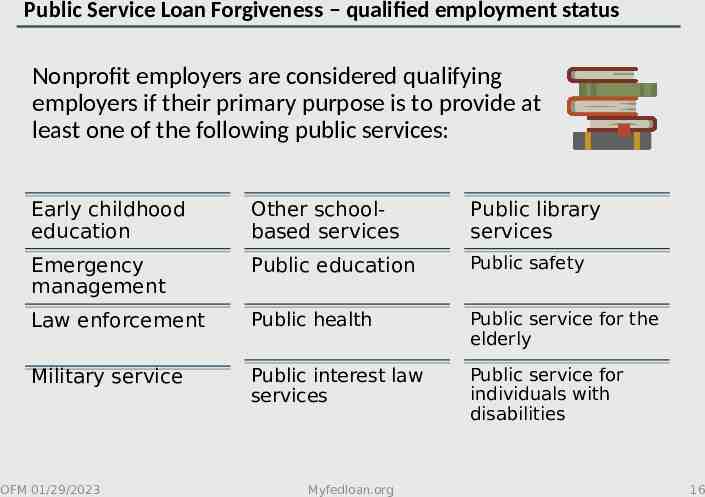

Public Service Loan Forgiveness – qualified employment status Nonprofit employers are considered qualifying employers if their primary purpose is to provide at least one of the following public services: Early childhood education Other schoolbased services Public library services Emergency management Public education Public safety Law enforcement Public health Public service for the elderly Military service Public interest law services Public service for individuals with disabilities OFM 01/29/2023 Myfedloan.org 16

Public Service Loan Forgiveness – qualified employment status What are some definitions of public service? Public health includes public (not private) organizations’ professionals engaged in health care practitioner occupations and health support occupations. Public interest law refers to legal services provided by an organization that is funded in whole or in part by a local, state, federal or tribal government. Early childhood education includes licensed or regulated child care, Head Start and state funded pre-kindergarten. Law enforcement includes organizations that are publicly funded and whose principal purposes include crime prevention, control or reduction of crime, or the enforcement of criminal law. Public education includes services that provide educational enrichment or support directly to students or their families in a school or a schoollike setting. OFM 01/29/2023 Studentaid.ed.gov 17

Examples of uncommon qualified employment status OFM 01/29/2023 Myfedloan.org 18

Qualified employment status – uncommon employment status If you are a teacher who does not teach during the summer months, the following must apply for your payments to qualify for PSLF: You must have a contract for an employment period of at least 8 months out of a 12-month period. You must work an average of 30 hours per week during that period. Your employer must still consider you to be employed full-time during the summer break. Your employer should include the dates of the summer break when reporting your dates of employment on the PSLF Employment Certification Form, even though you are not actually teaching during that period. OFM 01/29/2023 Myfedloan.org 19

Qualified employment status – uncommon employment status Are you working for more than one employer? If you are working part-time for more than one qualifying employer at the same time, you will be considered full-time for PSLF purposes as long as your combined hours worked equal to at least 30 hours per week. OFM 01/29/2023 Myfedloan.org 20

Nonqualified employers or employment OFM 01/29/2023 Myfedloan.org 21

Nonqualified employers or employment – employers What types of employers never qualify for PSLF? For-profit organizations or businesses Labor unions Partisan political organizations For-profit organizations (this includes for-profit government contractors) Not-for-profit organizations that are not tax-exempt under Section 501(c) (3) of the Internal Revenue Code and do not provide a qualifying public service as their primary function Member of Congress OFM 01/29/2023 Myfedloan.org 22

Nonqualified employers or employment Examples of nonqualifying activities and employers that do not meet the full-time employment requirement for PSLF If you are employed by a not-for-profit organization, any time you spend on religious instruction, worship services or any form of proselytizing may not be counted toward meeting the full-time employment requirement. For-profit government contractors are not qualifying employers. You must be directly employed by a qualifying employer for your employment to count toward PSLF. OFM 01/29/2023 Myfedloan.org 23

Loan types that must be consolidated to qualify for PSLF OFM 01/29/2023 Myfedloan.org 24

Loan types that must be consolidated for PSLF The following loan types must first be consolidated into a Direct Consolidation Loan. Then they must be repaid through an income-driven repayment plan to make them eligible for PSLF. OFM 01/29/2023 Myfedloan.org 25

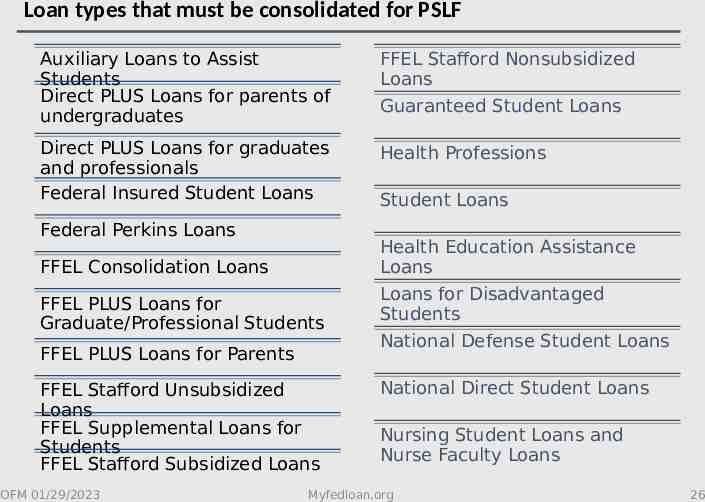

Loan types that must be consolidated for PSLF Auxiliary Loans to Assist Students Direct PLUS Loans for parents of undergraduates FFEL Stafford Nonsubsidized Loans Direct PLUS Loans for graduates and professionals Federal Insured Student Loans Health Professions Federal Perkins Loans Student Loans Health Education Assistance Loans FFEL Consolidation Loans FFEL PLUS Loans for Graduate/Professional Students FFEL PLUS Loans for Parents FFEL Stafford Unsubsidized Loans FFEL Supplemental Loans for Students FFEL Stafford Subsidized Loans OFM 01/29/2023 Guaranteed Student Loans Loans for Disadvantaged Students National Defense Student Loans National Direct Student Loans Nursing Student Loans and Nurse Faculty Loans Myfedloan.org 26

Loan types that must be consolidated for PSLF Direct PLUS loan types must first be consolidated into a Direct Consolidation Loan. Then they must be repaid through an income-contingent repayment plan to make them eligible for PSLF. OFM 01/29/2023 Myfedloan.org 27

Loan types that must be consolidated for PSLF Direct PLUS Loans for parents of dependent undergraduates vs. graduates or professional students Direct PLUS Loans for parents of dependent undergraduates must be consolidated in a new Direct Consolidation Loan, then repaid under an income-contingent repayment plan to benefit from PSLF. The employment of the student’s parent will be reviewed for PSLF eligibility – not the student’s employment. Direct PLUS Loans for graduates or professional students must be consolidated in a new Direct Consolidation Loan, then repaid under any income-driven repayment plan. OFM 01/29/2023 Myfedloan.org 28

Employment Certification Form OFM 01/29/2023 Myfedloan.org 29

Public Service Loan Forgiveness – Employment Certification Form When should you complete and submit an Employment Certification Form? FedLoan Servicing recommends that you submit your first ECF after you are confident that you have qualifying loans and have made some qualifying payments. If you do so, you get early confirmation that you are on the right track. Once your first ECF is approved, it is recommended that you submit a new ECF annually. This will help you track your progress in the PSLF Program. Each time FedLoan Servicing approves an ECF, it will update the number of qualifying payments you have made. OFM 01/29/2023 Myfedloan.org 30

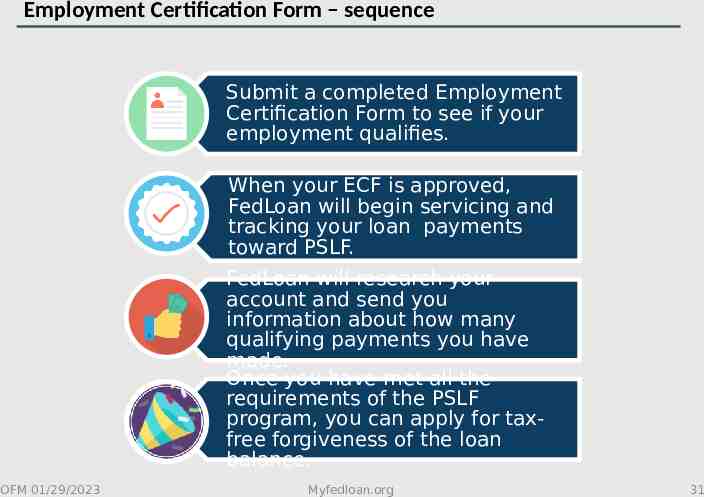

Employment Certification Form – sequence Submit a completed Employment Certification Form to see if your employment qualifies. When your ECF is approved, FedLoan will begin servicing and tracking your loan payments toward PSLF. FedLoan will research your account and send you information about how many qualifying payments you have made. Once you have met all the requirements of the PSLF program, you can apply for taxfree forgiveness of the loan balance. OFM 01/29/2023 Myfedloan.org 31

Employment Certification Form – preparation assistance Do you currently have student loans serviced by FedLoan? You can get help preparing your ECF in your online account through Account Access with Forms Assistance. Forms Assistance can prepopulate most of the ECF, making it easier and more convenient to complete the form. Sign in or create an online account at: myfedloan.org/borrower/specialprograms OFM 01/29/2023 Myfedloan.org 32

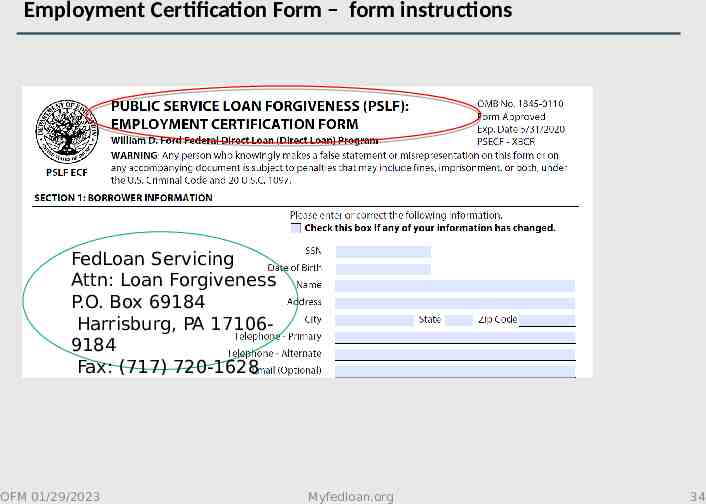

Employment Certification Form – form instructions If you do not have a student loan serviced by FedLoan: You will need to mail or fax your Employment Certification form. Complete Section 2 and Section 3 of the Employment Certification form on your own. An authorized official may complete Section 3, if you need help doing so. Section 4 can be completed only by an authorized official. This official may include a person authorized by your employer to certify your current or past employment status. Many employers designate the human resource office staff as authorized officials. Once the form has been completed and signed, mail or fax the form to the address circled in green on the next slide. OFM 01/29/2023 Myfedloan.org 33

Employment Certification Form – form instructions FedLoan Servicing Attn: Loan Forgiveness P.O. Box 69184 Harrisburg, PA 171069184 Fax: (717) 720-1628 OFM 01/29/2023 Myfedloan.org 34

Employment Certification Form – print form The link to print your Employment Certification Form: https://myfedloan.org/documents/repayment/ fd/pslf-ecf.pdf OFM 01/29/2023 Myfedloan.org 35

Qualified loan payment OFM 01/29/2023 Myfedloan.org 36

Qualified loan payment PSLF – qualified loan payment Your payment is considered qualified if your payments meet each of the following 6 criteria: 1. Loan payments made after Oct. 1, 2007. 2. Loan payments made while employed full-time at a qualifying employer, working at least 30 hours per week. 3. Loan payments made under a qualifying repayment plan. 4. Loan payments paid on time (no later than 15 days after the scheduled due date). 5. Installment amount due for each month is paid in full. 6. Loan is actively billed and not in a default status. OFM 01/29/2023 Myfedloan.org 37

Qualified loan payment – make payments when required You can only make monthly payments to your loan when you are required to. Therefore, you cannot make a qualifying monthly payment while your loans are in: In-school status Grace period Deferment Forbearance OFM 01/29/2023 Myfedloan.org 38

Qualified loan payment – inquire on your loan type If you do not know what type of loan you have, review your previous loan servicing paperwork and visit the website below: Studentaid.ed.gov/login OFM 01/29/2023 Myfedloan.org 39

Qualifying repayment plans OFM 01/29/2023 Myfedloan.org 40

Qualifying repayment plans – definition What is a qualifying repayment plan? These are income-driven repayment plans that base your monthly student loan payment on your income. Revised Pay As You Earn (REPAYE) Pay As You Earn (PAYE) Income-based repayment Income-contingent repayment OFM 01/29/2023 Myfedloan.org 41

Qualifying repayment plans – 10-year standard repayment plan Does the 10-year standard repayment plan for Direct Consolidation Loans qualify for PSLF? Yes, only if your 10-year standard repayment plan is structured for 10 years. It is unlikely that you will benefit from PSLF because the 10-year standard repayment plan will result in paying off your entire balance in 10 years, leaving nothing left to forgive. Please contact FedLoan Servicing directly for a loan calculation that will be tailored to your circumstances. OFM 01/29/2023 Myfedloan.org 42

Public Service Loan Forgiveness Application OFM 01/29/2023 Myfedloan.org 43

Public Service Loan Forgiveness Application When do you complete and submit your PSLF Application for Forgiveness? After you have completed your Employment Certification Form and made your final payment toward the 120 qualifying payments required for PSLF. You must be working full-time at least 30 hours per week for a qualifying employer at the time you submit the PSLF Application for Forgiveness and working full-time at least 30 hours per week at the moment the balance on your loan is forgiven. OFM 01/29/2023 Myfedloan.org 44

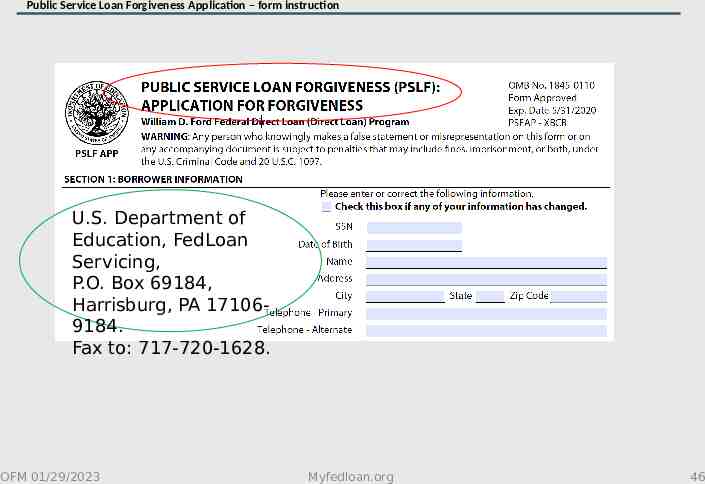

Public Service Loan Forgiveness Application – instructions If you do not have a student loan serviced by FedLoan: You will need to mail or fax in your PSLF application. Complete Section 2 and Section 3 of the application on your own. An authorized official may complete Section 3, if you need help doing so. Section 4 can be completed only by an authorized official. This official may include a person authorized by your employer to certify your current or past employment status. Many employers designate the human resource office staff as authorized officials. Once form has been completed and signed, you may mail or fax form to the address circled in green on the next slide. OFM 01/29/2023 Myfedloan.org 45

Public Service Loan Forgiveness Application – form instruction U.S. Department of Education, FedLoan Servicing, P.O. Box 69184, Harrisburg, PA 171069184. Fax to: 717-720-1628. OFM 01/29/2023 Myfedloan.org 46

Public Service Loan Forgiveness application – link to print application The link to print out your Public Service Loan Forgiveness application: https://myfedloan.org/documents/repayment/fd/p slf-app.pdf OFM 01/29/2023 Myfedloan.org 47

Public Service Loan Forgiveness Application – questions Whom do I contact with questions about PSLF? If you have questions or cannot email FedLoan Servicing, call it at: 855-265-4038 OFM 01/29/2023 Myfedloan.org 48

Temporary Expanded Public Service Loan Forgiveness The Consolidated Appropriations Act 2018 provided limited, additional conditions under which you may become eligible for loan forgiveness if some or all the payments you made on your Federal Direct Loans were under a nonqualifying repayment plan for PSLF. OFM OFFICE OF FINANCIAL MANAGEMENT

Temporary Expanded Public Service Loan Forgiveness opportunity What is TEPSLF opportunity and how can it help me? If your PSLF application was previously denied because some or all your payments were not made on a qualifying repayment plan for PSLF, you may be able to receive loan forgiveness under a temporary opportunity. OFM 01/29/2023 Myfedloan.org 50

Temporary Expanded Public Service Loan Forgiveness opportunity – eligibility If my PSLF application was denied, why would I be eligible under TEPSLF? The U.S. Department of Education will reconsider your eligibility for PSLF using an expanded list of qualifying repayment plans. Some payments that do not count toward loan forgiveness under PSLF may count toward forgiveness under TEPSLF. OFM 01/29/2023 Myfedloan.org 51

How to qualify for the TEPSLF program OFM 01/29/2023 Myfedloan.org 52

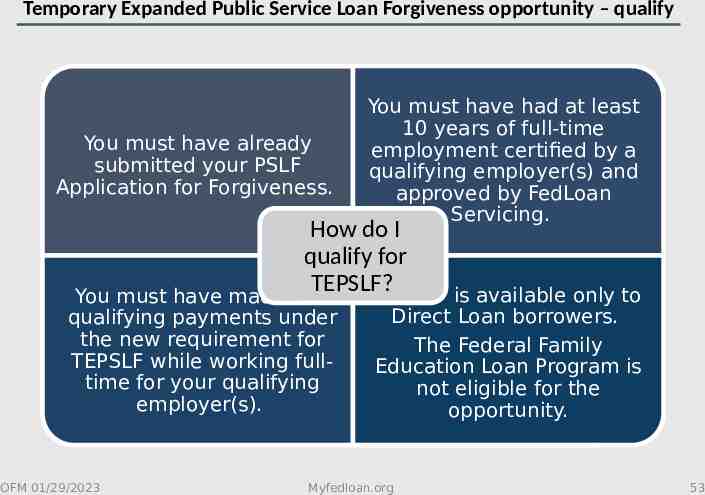

Temporary Expanded Public Service Loan Forgiveness opportunity – qualify You must have already submitted your PSLF Application for Forgiveness. You must have had at least 10 years of full-time employment certified by a qualifying employer(s) and approved by FedLoan Servicing. How do I qualify for TEPSLF? TEPSLF is available only to You must have made 120 qualifying payments under the new requirement for TEPSLF while working fulltime for your qualifying employer(s). OFM 01/29/2023 Direct Loan borrowers. The Federal Family Education Loan Program is not eligible for the opportunity. Myfedloan.org 53

Temporary Expanded Public Service Loan Forgiveness opportunity – qualify You will be eligible for the TEPSLF opportunity only if, among other requirements, the amount you paid 12 months prior to applying for TEPSLF and the last payment you made before applying for TEPSLF are at least as much as you would have paid under an income-driven repayment plan. FedLoan Servicing will assess this and contact you if it needs documentation of your income to determine whether you are eligible. OFM 01/29/2023 Myfedloan.org 54

Temporary Expanded Public Service Loan Forgiveness opportunity – qualify The Department of Education will reconsider your eligibility for PSLF using this expanded list of qualifying repayment plans: Graduated Repayment Plan Extended Repayment Plan Consolidation Standard Repayment Plan Consolidation Graduated Repayment Plan These plans do not usually qualify for PSLF, only TEPSLF. OFM 01/29/2023 Myfedloan.org 55

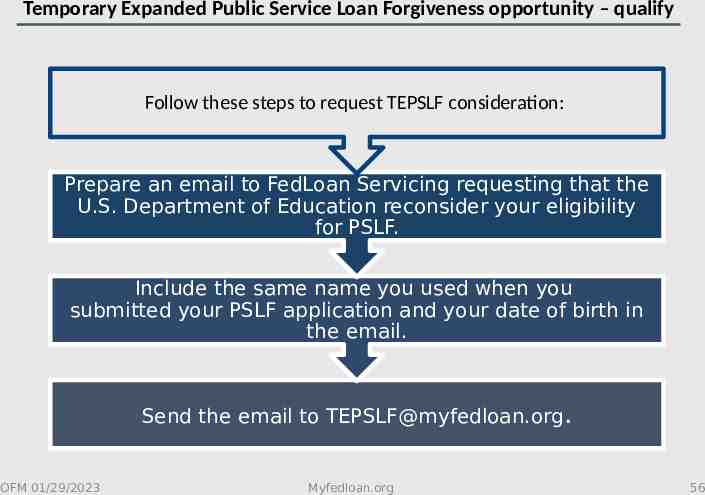

Temporary Expanded Public Service Loan Forgiveness opportunity – qualify Follow these steps to request TEPSLF consideration: Prepare an email to FedLoan Servicing requesting that the U.S. Department of Education reconsider your eligibility for PSLF. Include the same name you used when you submitted your PSLF application and your date of birth in the email. Send the email to [email protected]. OFM 01/29/2023 Myfedloan.org 56

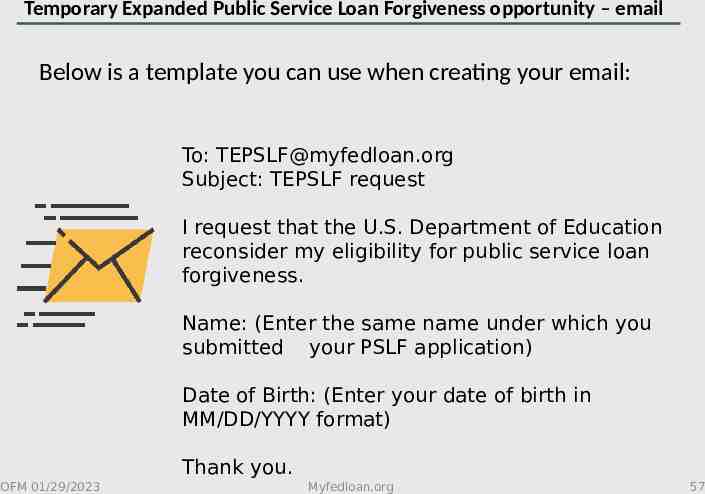

Temporary Expanded Public Service Loan Forgiveness opportunity – email Below is a template you can use when creating your email: To: [email protected] Subject: TEPSLF request I request that the U.S. Department of Education reconsider my eligibility for public service loan forgiveness. Name: (Enter the same name under which you submitted your PSLF application) Date of Birth: (Enter your date of birth in MM/DD/YYYY format) Thank you. OFM 01/29/2023 Myfedloan.org 57

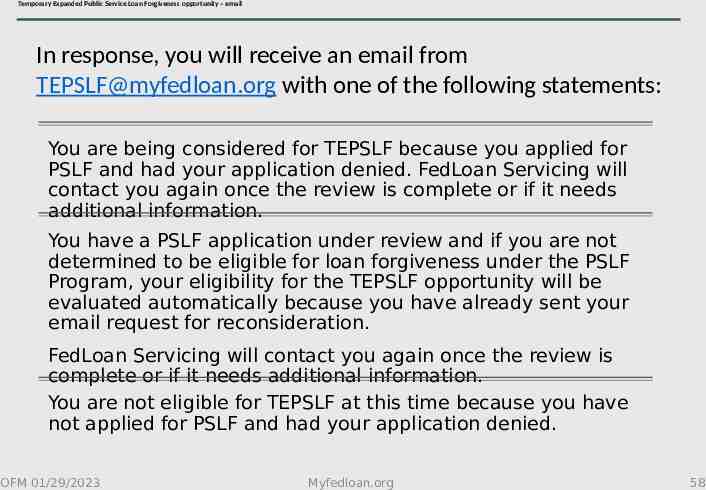

Temporary Expanded Public Service Loan Forgiveness opportunity – email In response, you will receive an email from [email protected] with one of the following statements: You are being considered for TEPSLF because you applied for PSLF and had your application denied. FedLoan Servicing will contact you again once the review is complete or if it needs additional information. You have a PSLF application under review and if you are not determined to be eligible for loan forgiveness under the PSLF Program, your eligibility for the TEPSLF opportunity will be evaluated automatically because you have already sent your email request for reconsideration. FedLoan Servicing will contact you again once the review is complete or if it needs additional information. You are not eligible for TEPSLF at this time because you have not applied for PSLF and had your application denied. OFM 01/29/2023 Myfedloan.org 58

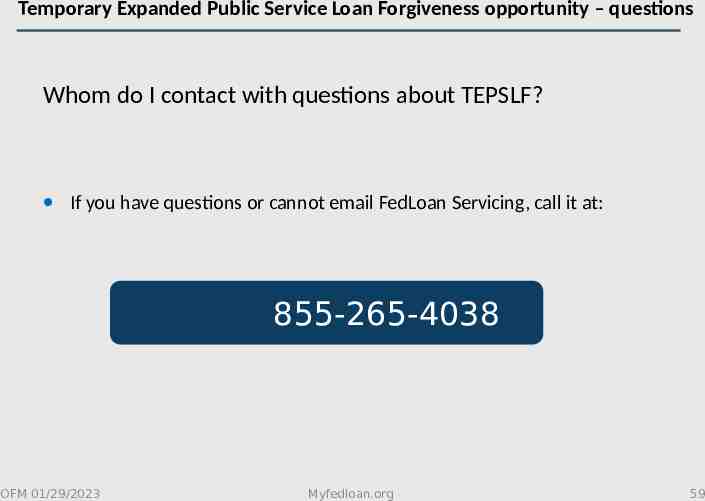

Temporary Expanded Public Service Loan Forgiveness opportunity – questions Whom do I contact with questions about TEPSLF? If you have questions or cannot email FedLoan Servicing, call it at: 855-265-4038 OFM 01/29/2023 Myfedloan.org 59

Loan Servicers and Consumer Financial Protection Bureau OFM 01/29/2023 Myfedloan.org 60

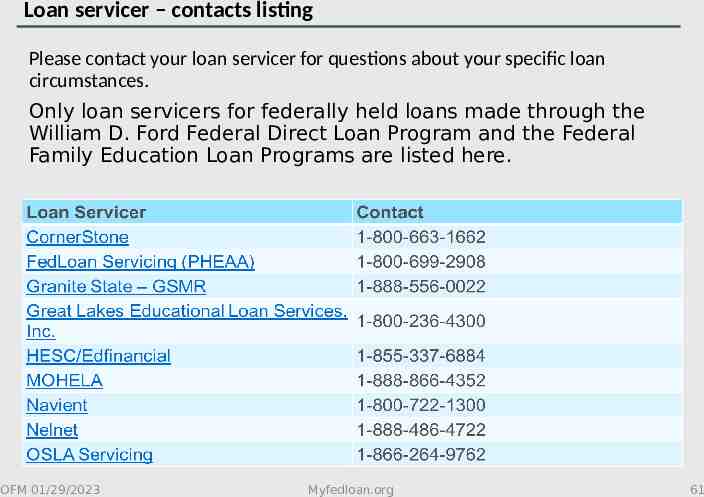

Loan servicer – contacts listing Please contact your loan servicer for questions about your specific loan circumstances. Only loan servicers for federally held loans made through the William D. Ford Federal Direct Loan Program and the Federal Family Education Loan Programs are listed here. OFM 01/29/2023 Myfedloan.org 61

Loan Servicer – Consumer Financial Protection Bureau Do you have a problem with a financial product or service from your loan servicer? Consumer Financial Protection Bureau can help! Consumer Financial Protection Bureau will connect with financial companies to understand issues, fix errors and get direct responses about problems. When you submit a complaint, CFPB will work to get you a response. Most companies respond to complaints within 15 days. 855-265-4038 OFM 01/29/2023 Myfedloan.org 62

Questions and answers OFM 01/29/2023 Myfedloan.org 63

Questions and answers – qualifying loan payments If I made qualifying payments on a Direct Loan and then consolidated it into a Direct Consolidation Loan, do I have to start over making qualifying payments on the new Direct Consolidation Loan? Yes. The payments that you made to the Direct Loan will not count toward the new Direct Consolidation Loan. You will need to start making new qualified payments. OFM 01/29/2023 Myfedloan.org 64

Questions and answers – not a qualified employer If I am making payments via a qualified Income-DrivenRepayment Plan on a qualified Federal Direct Loan, but I am working for Boeing, do I qualify for the PSLF program? No. Boeing is not a qualified employer because it is a forprofit business. OFM 01/29/2023 Myfedloan.org 65

Questions and answers – qualifying loan payments Once approved for PSLF, what happens if I make a late payment or leave public service for a brief period? You will remain eligible for the PSLF program itself, although your payments may not count toward the 120 qualified payments. Contact MyFedloan for details at 855-265-4038. OFM 01/29/2023 Myfedloan.org 66

Questions and answers – not a qualified employer Do I have to pay all 120 qualified payments in a row? No. The payments do not have to be consecutive. If you have a period of employment that you are working for a nonqualified employer, you will not lose credit for prior qualifying payments. OFM 01/29/2023 Myfedloan.org 67

Questions and answers – defaulted loan If my Federal Direct Loans are in default, do I still qualify for the PSLF program? No. However, a defaulted loan may become eligible for PSLF if you resolve the default. OFM 01/29/2023 Myfedloan.org 68

Questions and answers – no income requirement for PSLF Can I be certain that the PSLF Program will exist by the time I have made my 120 qualifying payments? No. There are no guarantees about the future availability of PSLF. The PSLF Program was created by Congress and Congress could change or end it. OFM 01/29/2023 Myfedloan.org 69

Questions and answers – no income requirement for PSLF Does my income level determine my eligibility for PSLF? No. There is no income requirement to qualify for PSLF. OFM 01/29/2023 Myfedloan.org 70

Questions and answers – no income requirement for PSLF Are loan amounts forgiven under PSLF considered taxable by the IRS? No. According to the IRS, student loan amounts forgiven under PSLF are not considered income for tax purposes. For more information, check with the IRS or a tax adviser. OFM 01/29/2023 Myfedloan.org 71

Questions and answers – no income requirement for PSLF If I pay more than my scheduled monthly student loan payment amount, can I get PSLF sooner than 10 years? No. You must make 120 separate monthly payments. Paying extra won’t make you eligible to receive PSLF sooner. If you do pay ahead, the excess payment will be applied to future loan payments, unless you request otherwise. OFM 01/29/2023 Myfedloan.org 72

Now is the time to take control of your student loan debt! OFM 01/29/2023 73

For more information : Contact FedLoan Servicing at 855-265-4038 Assistance with Employment Verification forms or PSLF Application at 855-265-4038 Consumer Financial Protection Bureau at 855-411-2372 Resources Myfedloan.org Studentaid.ed.gov Consumerfinance.gov OFM OFFICE OF FINANCIAL MANAGEMENT