It’s RRSP Time! February 19, 2020

53 Slides9.08 MB

It’s RRSP Time! February 19, 2020

Rob Tétrault, B.A., J.D., MBA, CIM

Rob Tétrault, B.A., J.D., MBA, CIM Adam W. Buss Wealth & Estate Planning Specialist CFP RRC FCSI CLU

The Team The Advisory Group providing World Class Investment Solutions Claude Tétrault Derrek Funk Jean Moquin Investment Associate Investment Advisor Business Development Associate Over 40 years of experience in the Investment Industry Over 10 years of experience in the Financial Services Industry FCSI Over 5 years of experience in the Digital Marketing Industry Karen Kazina CIM , MTI Investment Advisor Assistant Over 15 years of experience in the Financial Services Industry

The Team The Advisory Group solving the financial problems you identified Jean-Luc Laflèche Associate Over 10 years experience in Business Operations Adam Buss CFP RRC FCSI CLU Wealth and Estate Planning Specialist Ester Kamenz Branch Administrator Over 5 years of experience in the Financial Services Over 16 years of experience Industry in Wealth and Estate Planning Keri Wersh Investment Associate Over 20 years of experience in the Financial Services Industry

Awards & Accolades Voted #2 in Wealth Professional’s 2018 List of Top 50 Wealth Advisors in Canada.

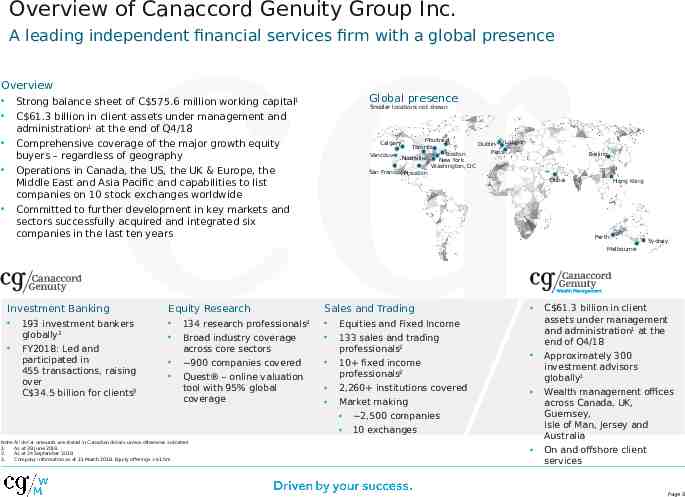

BNN Bloomberg

Overview of Canaccord Genuity Group Inc. A leading independent financial services firm with a global presence Overview Global presence Strong balance sheet of C 575.6 million working capital1 Smaller locations not shown C 61.3 billion in client assets under management and administration1 at the end of Q4/18 Comprehensive coverage of the major growth equity buyers – regardless of geography Montreal London Dublin Toronto Paris Boston Vancouver Nashville New York Washington, DC San FranciscoHouston Calgary Operations in Canada, the US, the UK & Europe, the Middle East and Asia Pacific and capabilities to list companies on 10 stock exchanges worldwide Committed to further development in key markets and sectors successfully acquired and integrated six companies in the last ten years Beijing Dubai Hong Kong Perth Sydney Melbourne Investment Banking Equity Research Sales and Trading 193 investment bankers globally2 134 research professionals Equities and Fixed Income FY2018: Led and participated in 455 transactions, raising over C 34.5 billion for clients3 Broad industry coverage across core sectors 133 sales and trading professionals2 900 companies covered Quest – online valuation tool with 95% global coverage 10 fixed income professionals2 2,260 institutions covered Market making 2,500 companies 2 Note: All dollar amounts are stated in Canadian dollars unless otherwise indicated 1. As at 28 June 2018. 2. As at 24 September 2018. 3. Company information as at 31 March 2018. Equity offerings 1.5m C 61.3 billion in client assets under management and administration1 at the end of Q4/18 Approximately 300 investment advisors globally1 Wealth management offices across Canada, UK, Guernsey, Isle of Man, Jersey and Australia On and offshore client services 10 exchanges Page 8

RRSPs 9

What is a RRSP? Registered Retirement Savings Account Great savings vehicle to save towards your retirement! - Contribute with pre-tax dollars - Tax savings on contributions - Tax deferred growth 10

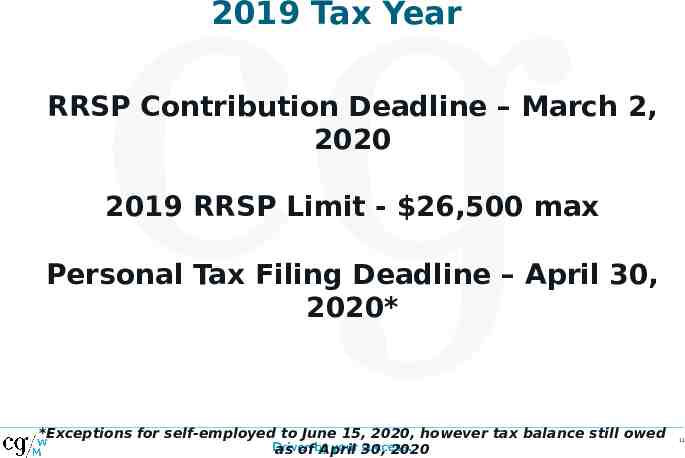

2019 Tax Year RRSP Contribution Deadline – March 2, 2020 2019 RRSP Limit - 26,500 max Personal Tax Filing Deadline – April 30, 2020* *Exceptions for self-employed to June 15, 2020, however tax balance still owed as of April 30, 2020 11

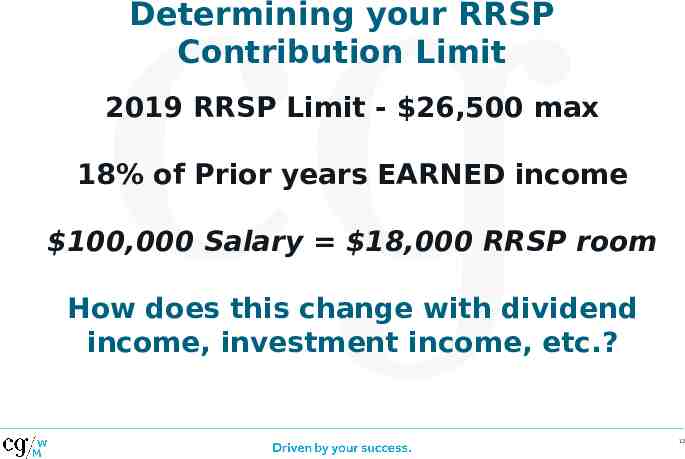

Determining your RRSP Contribution Limit 2019 RRSP Limit - 26,500 max 18% of Prior years EARNED income 100,000 Salary 18,000 RRSP room How does this change with dividend income, investment income, etc.? 12

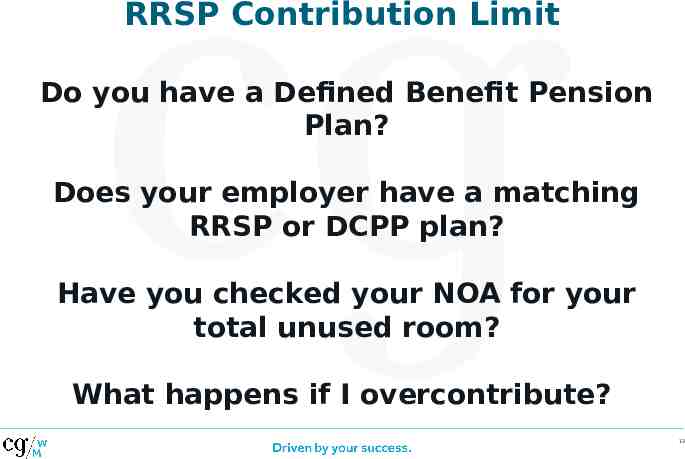

RRSP Contribution Limit Do you have a Defined Benefit Pension Plan? Does your employer have a matching RRSP or DCPP plan? Have you checked your NOA for your total unused room? What happens if I overcontribute? 13

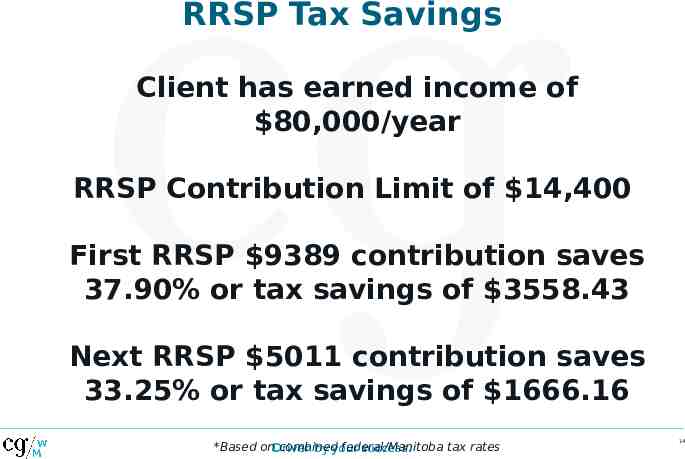

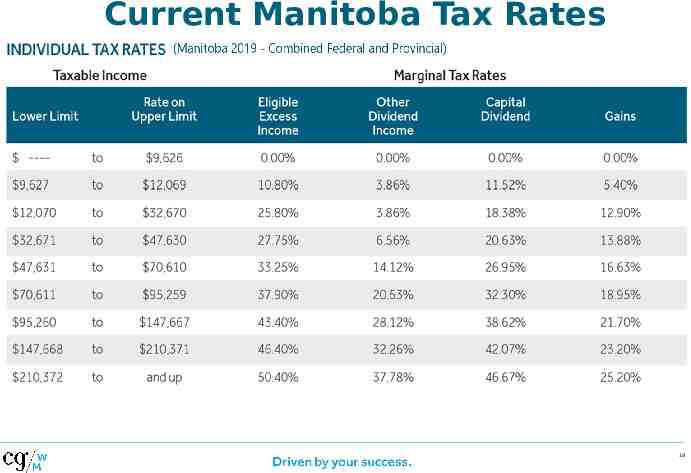

RRSP Tax Savings Client has earned income of 80,000/year RRSP Contribution Limit of 14,400 First RRSP 9389 contribution saves 37.90% or tax savings of 3558.43 Next RRSP 5011 contribution saves 33.25% or tax savings of 1666.16 *Based on combined federal/Manitoba tax rates 14

Spousal RRSPs What is a spousal RRSP? Proactive Income Splitting Contributing spouse gets tax deduction Receiving spouse claims income when withdrawn Beware of the 3 year attribution rule Ideal for situations with large income differences between spouses 15

Other Contribution information - Contribute to your own RRSP until the age of 71 - Contribute to a spousal RRSP of younger spouse as long as they are under 71 - Will you save a tax bracket? - Do you have a high income year to top off your unused room? 16

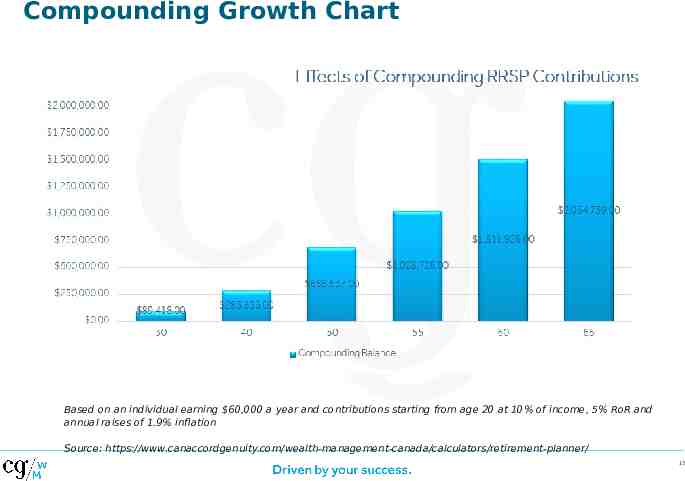

Compounding Growth Chart Based on an individual earning 60,000 a year and contributions starting from age 20 at 10% of income, 5% RoR and annual raises of 1.9% inflation Source: https://www.canaccordgenuity.com/wealth-management-canada/calculators/retirement-planner/ 17

Current Manitoba Tax Rates 18

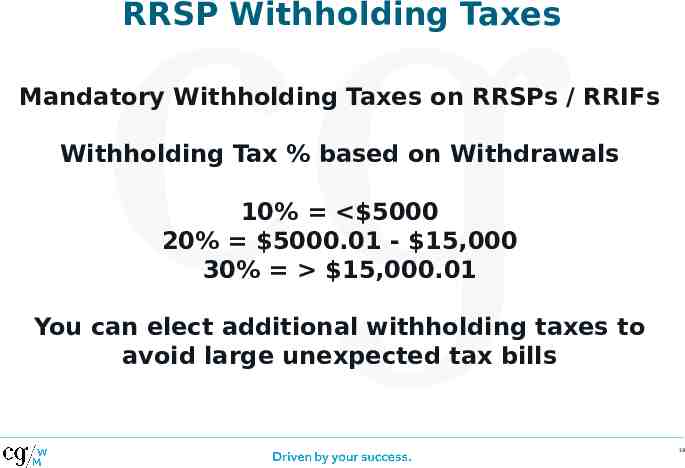

RRSP Withholding Taxes Mandatory Withholding Taxes on RRSPs / RRIFs Withholding Tax % based on Withdrawals 10% 5000 20% 5000.01 - 15,000 30% 15,000.01 You can elect additional withholding taxes to avoid large unexpected tax bills 19

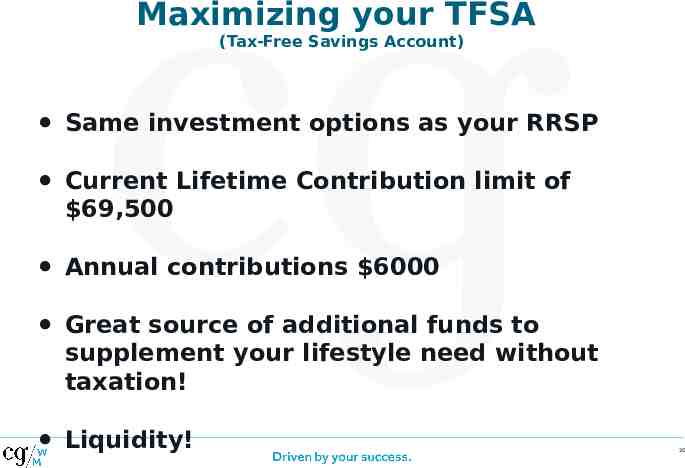

Maximizing your TFSA (Tax-Free Savings Account) Same investment options as your RRSP Current Lifetime Contribution limit of 69,500 Annual contributions 6000 Great source of additional funds to supplement your lifestyle need without taxation! Liquidity! 20

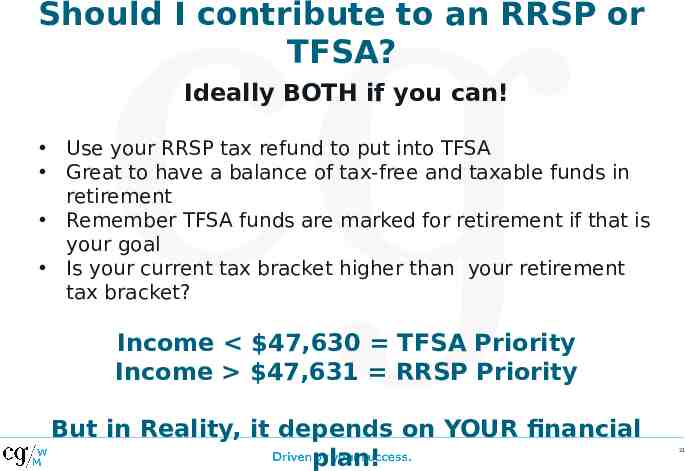

Should I contribute to an RRSP or TFSA? Ideally BOTH if you can! Use your RRSP tax refund to put into TFSA Great to have a balance of tax-free and taxable funds in retirement Remember TFSA funds are marked for retirement if that is your goal Is your current tax bracket higher than your retirement tax bracket? Income 47,630 TFSA Priority Income 47,631 RRSP Priority But in Reality, it depends on YOUR financial plan! 21

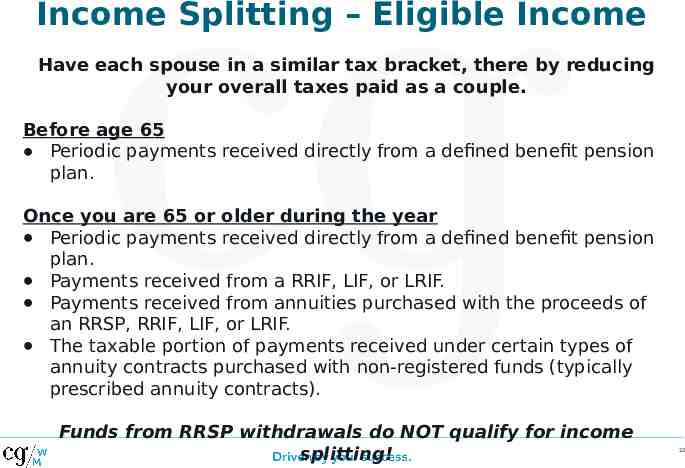

Income Splitting – Eligible Income Have each spouse in a similar tax bracket, there by reducing your overall taxes paid as a couple. Before age 65 Periodic payments received directly from a defined benefit pension plan. Once you are 65 or older during the year Periodic payments received directly from a defined benefit pension plan. Payments received from a RRIF, LIF, or LRIF. Payments received from annuities purchased with the proceeds of an RRSP, RRIF, LIF, or LRIF. The taxable portion of payments received under certain types of annuity contracts purchased with non-registered funds (typically prescribed annuity contracts). Funds from RRSP withdrawals do NOT qualify for income splitting! 22

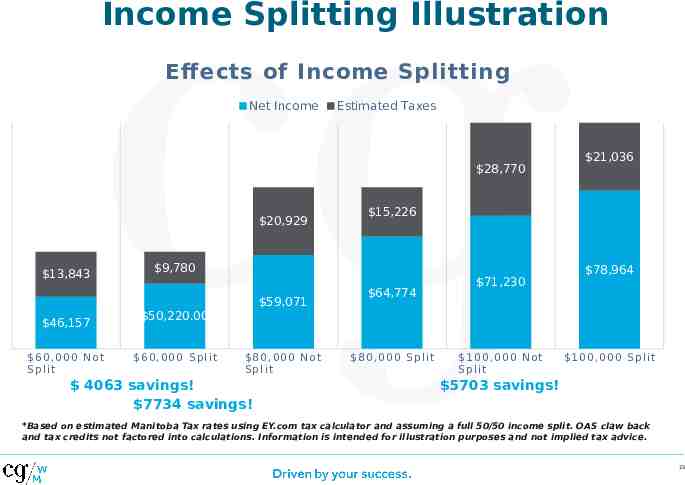

Income Splitting Illustration Eff ects of Income Splitting Net Income Estimated Taxes 28,770 20,929 13,843 46,157 6 0 ,0 0 0 No t Split 15,226 9,780 59,071 21,036 64,774 71,230 78,964 50,220.00 6 0 ,0 0 0 S p l i t 8 0 ,0 0 0 No t Split 4063 savings! 7734 savings! 8 0 ,0 0 0 S p l i t 1 0 0 ,0 0 0 No t Split 1 0 0 ,0 0 0 S p l i t 5703 savings! *Based on estimated Manitoba Tax rates using EY.com tax calculator and assuming a full 50/50 income split. OAS claw back and tax credits not factored into calculations. Information is intended for illustration purposes and not implied tax advice. 23

Retirement Planning How much does your current lifestyle cost you? How will this change in Retirement? Any other income sources? Will you have debt? How will you spend your free time? Upcoming major expenses? Any financial dependents? 24

Importance of Retirement Planning Optimize your income splitting What order should you draw down your retirement assets? Effective RRSP Meltdown Tax efficiency Improved Investment Management Identify your goals Peace of Mind! 25

Drawdown Strategy What order should you draw down or access your retirement nest egg? Should you convert your RRSP to a RRIF prior to age 71? Should you take your RRSP first before funds from a corporation? What tax bracket are you in and how might that change over retirement? As part of our comprehensive analysis, we want to determine the most tax efficient way to access your funds both in the current year and over your lifetime. Drawing these assets in the right order can result in a substantial long term tax 26

Investment Planning in Retirement If you are fortunate enough to have several buckets of retirement proceeds, such as RRSPs/RRIFs, TFSAs, NonRegistered accounts and Corporate Investments, we want to ensure the incomes generated are tax efficient. Most often an important factor is having your investments generate a steady income stream of tax efficient income.but we can’t forget about growth in retirement, after all the cost of living increases annually! What rate of return do you need to achieve your lifestyle goals over the next 20, 30 or even 40 years of retirement? 27

Should all your investments hold the same assets? Think of the tax consequences of the potential returns on your investments: Interest Income (highest tax rate on the income) Dividends (dividend tax credit) Capital Gains (only half is taxed) Return of Capital (not taxed in year received – tax deferred) This is something we do automatically for clients ! Most portfolios we see don’t! 28

Market Update Page 29

What’s Going on in the Market Covid-19 (Coronavirus) Pipeline Protests US-China Trade War Oil price volatility Corporate Earnings Household Debt at all time highs Unemployment Recession? 30

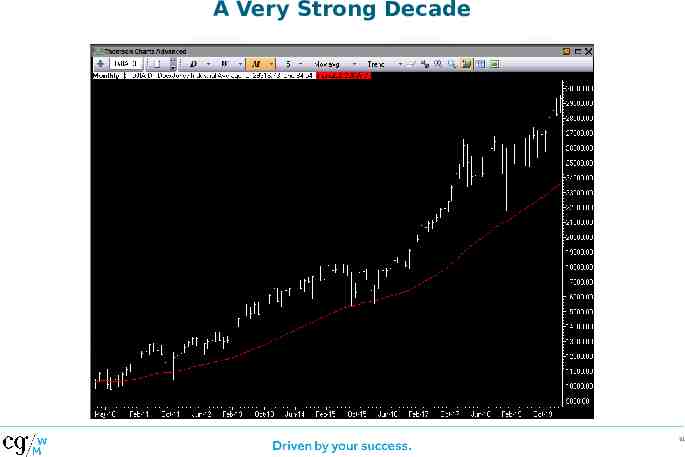

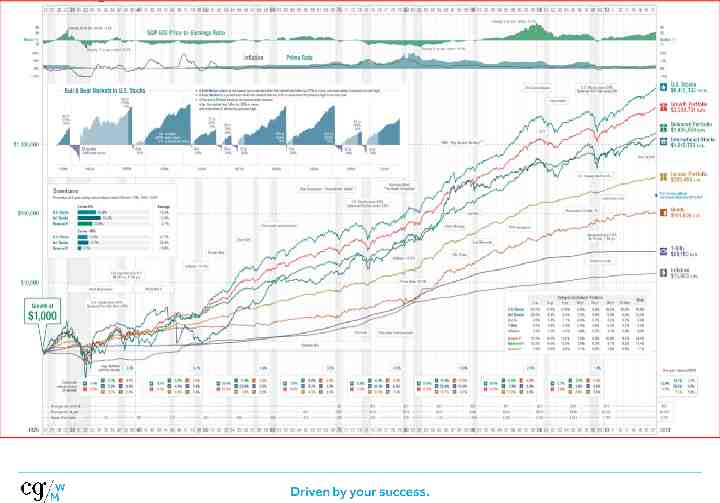

A Very Strong Decade 31

Portfolio Management Page 32

What’s a fiduciary obligation? “A Fiduciary obligation is the highest standard of care that exists at law in a client/professional relationship. It requires the fiduciary to act at all times for the sole benefit and interest of the client. It’s an enhanced level of protection for the client.” MFDA IIROC Financial Advisor Investmen t Advisor Fiduciary Obligation Portfolio Manager

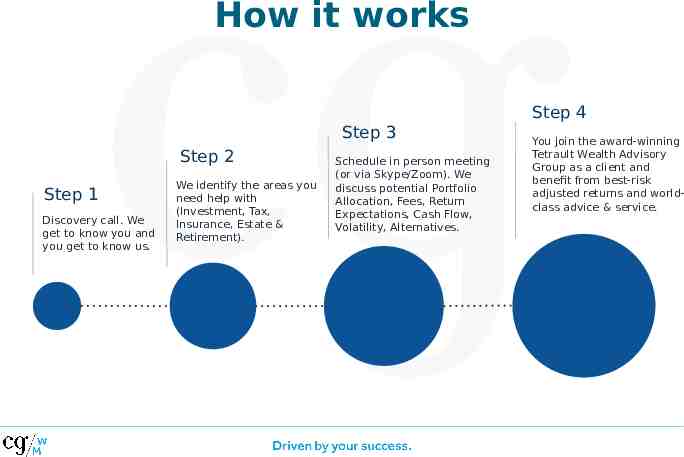

How it works Step 4 Step 3 Step 2 Step 1 Discovery call. We get to know you and you get to know us. We identify the areas you need help with (Investment, Tax, Insurance, Estate & Retirement). Schedule in person meeting (or via Skype/Zoom). We discuss potential Portfolio Allocation, Fees, Return Expectations, Cash Flow, Volatility, Alternatives. You join the award-winning Tetrault Wealth Advisory Group as a client and benefit from best-risk adjusted returns and worldclass advice & service.

Why Asset Allocation Matters For Retirement? Bonds vs. Stocks performance over time. Why do people actually own Bonds? Volatility vs. Risk. We evaluate the current and future upside and downside of asset classes. Why Alternatives? Bottom Line: Proven track record and asset classes that perform in all markets. 36

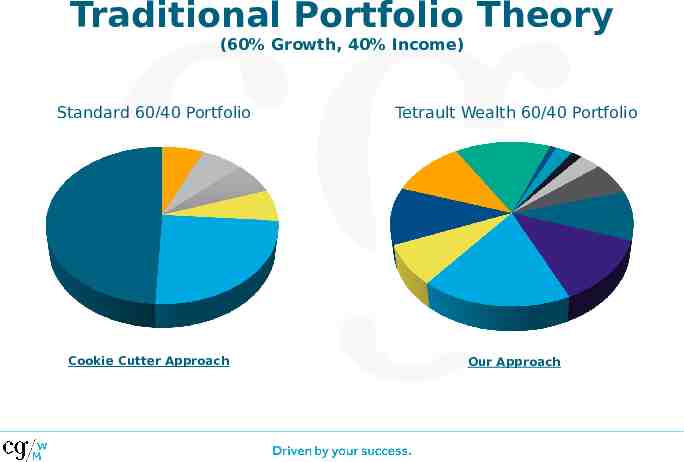

Traditional Portfolio Theory (60% Growth, 40% Income) Standard 60/40 Portfolio Cookie Cutter Approach Tetrault Wealth 60/40 Portfolio Our Approach

Why Alternatives 38

Alternatives – A Proven Asset Class Alternatives can be both privately sourced Real Estate, and publicly offered institutional deals. They can also be Private Equity, Farmland, and a whole other potential offerings that are not traditional stocks or bonds. Most of the alternatives we use have liquidity build into them, which gives us flexibility in liquidating and moving to other asset classes. 39

Alternatives – Advantages Alternatives have several key advantages: Extremely tax efficient Payment Classified as Return of Capital – not taxable in year it is received. Becomes a deferred Capital Gain, eventually be taxed at 25% Significantly enhanced diversification Very low correlation to traditional stock markets Very strong historical returns for the asset class 40

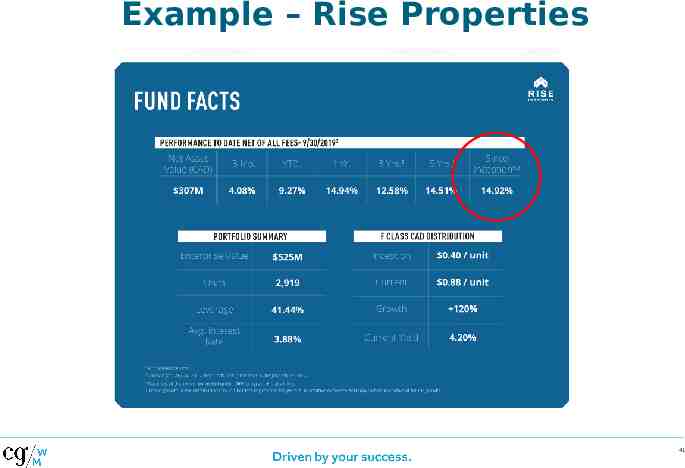

Example – Rise Properties 41

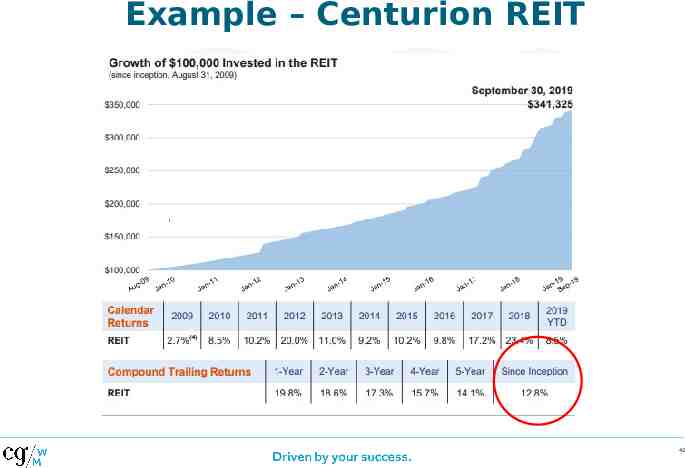

Example – Centurion REIT 42

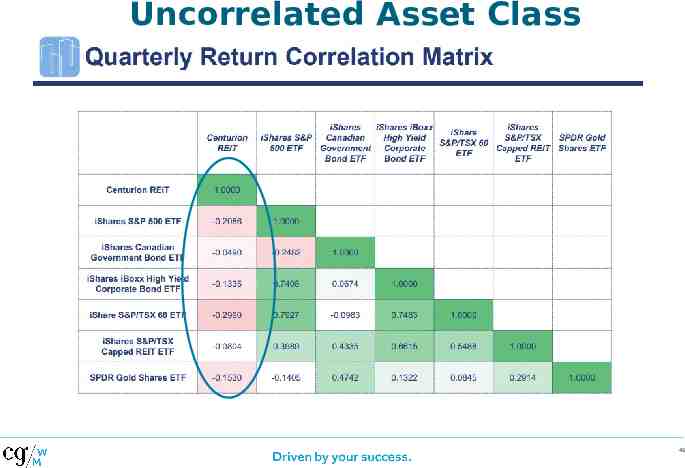

Uncorrelated Asset Class 43

Financial Planning & Services 44

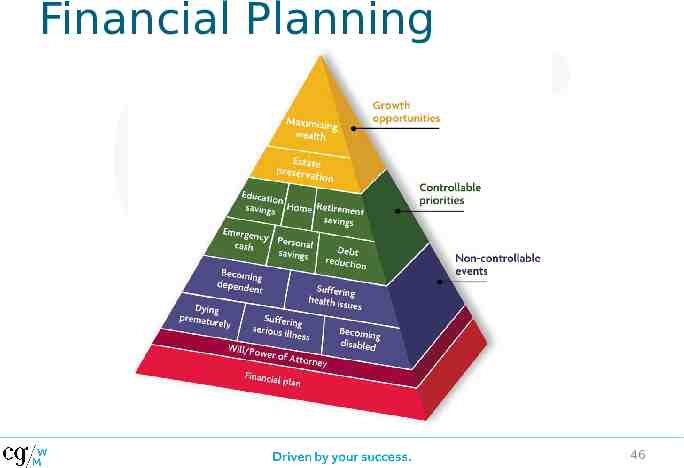

Wealth & Estate Planning Planning Areas to Address Estate Planning (Wills, POA, Health Care Core Services Offered Financial & Estate Directive) Estate Tax planning Planning Insurance (Life, Cottage Succession or Rental Properties Disability, Critical Illness Insurance Needs Analysis and Benefits) Emergency Funds Review Education Savings Debt Management Retirement Planning Referrals to Lawyers & Accountants Additional CharitableServices Foundations Offered Mortgage Brokerage Tax Optimization Financial Education Business Succession & Corporate Tax Strategies 45

Financial Planning 46

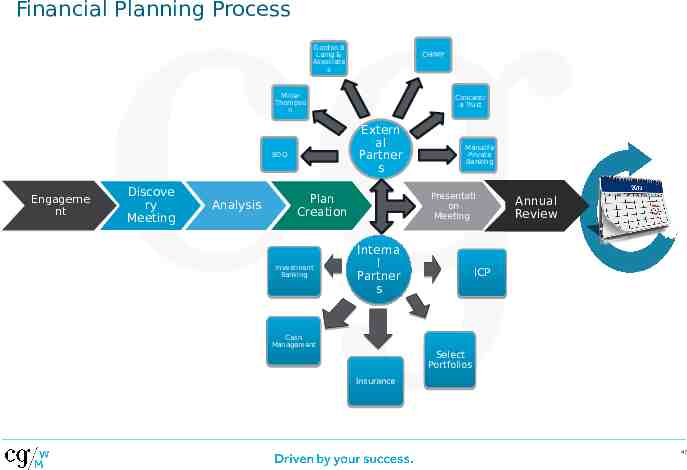

Financial Planning Process Gordon B Laing & Associate s CHIMP Miller Thompso n Extern al Partner s BDO Engageme Referral nt Discove ry Meeting Analysis Concentr a Trust Presentati on Meeting Plan Creation Investment Investment Banking Banking Manulife Private Banking Interna l Partner s Cash Cash Management Management Follow Annual UP Review ICP Select Portfolios Insurance Insurance 47

Summary 48

Benefits of Partnering with our Team! Learn & apply proven real-world advice from a national award-winning firm. Peace of mind & less stress. More time to enjoy the things you want to do. Protect your capital, generate income & get great risk-adjusted returns. Secure your family’s future. Difference between retiring comfortably or continuously doubting your financial situation. Dealing with a Portfolio Manager IIROC licensed, who owes you a fiduciary duty along with a in-house Certified Financial Planner Canaccord Genuity Wealth Management is a member of the CIPF. 49

Questions! 50

Thank you! Page 5

CONTACT INFO www.RobTetrault.com [email protected] (204) 259-2859 https://www.linkedin.com/in/robtetrault/ https://www.facebook.com/RobTetrault.TetraultWealth/ Rob Tetrault – Tetrault Wealth robtetrault tetraultwealth

Disclaimer This material is provided for information purposes only and is intended for distribution in those jurisdictions where subsidiaries of Canaccord Genuity Group Inc. (together, “Canaccord Genuity”) are registered as advisors or dealers in securities. Any distribution or dissemination of this material in any other jurisdiction is strictly prohibited. The information does not constitute an offer or solicitation in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. This is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. This material is prepared for general circulation to clients and does not have regard to the investment objectives, financial situation or particular needs to any person. Clients should obtain advice based on their own individual circumstances before making an investment decision. Any client wishing to effect any transactions should do so through a Canaccord Genuity qualified salesperson in their jurisdiction of residence. The information contained herein has been compiled by Canaccord Genuity from sources believed to be reliable, but no representation or warranty, express or implied, is made by Canaccord Genuity or any other person to its fairness, accuracy, completeness or correctness. To the fullest extent permitted by law, neither Canaccord Genuity nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of the information contained herein. All material presented in this document, unless specifically indicated otherwise, is under trademark and copyright to Canaccord Genuity. None of the material, or its content, or any copy of it, may be altered in any way, or transmitted to or distributed to any other party, without the prior express written permission of Canaccord Genuity. Copyright Canaccord Genuity Corp. 2018. – Member IIROC/Canadian Investor Protection Fund Copyright Canaccord Genuity Limited 2018. – Member of the London Stock Exchange, authorized and regulated by the Financial Conduct Authority. Copyright Canaccord Genuity LLC 2018. – Member FINRA/SIPC Copyright Canaccord Genuity (Australia) Limited 2017. – Authorized and regulated by ASIC. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION This document may contain certain “forward-looking information” (as defined under applicable securities laws). These statements relate to future events or future performance and include management’s expectations, beliefs, plans, estimates, intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts, business and economic conditions and Canaccord Genuity Group LLC’s (the “Company”) growth, results of operations, market position, ability to compete and future financial or operating performance of the Company, performance and business prospects and opportunities. Such forward-looking information reflects management’s current beliefs and is based on information currently available to management. In some cases, forward-looking information can be identified by terminology such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue”, “target”, “intend”, “could” or the negative of these terms or other comparable terminology. By its very nature, forward-looking information involves inherent risks and uncertainties, both general and specific, and a number of factors could cause actual events or results to differ materially from the results discussed in the forward-looking information. In evaluating these statements, readers should specifically consider various factors, which may cause actual results to differ materially from any forward-looking statement. These factors include, but are not limited to, market and general economic conditions, the nature of the financial services industry, the risks and uncertainties discussed from time to time in the Company’s interim and annual consolidated financial statements and its Annual Information Form filed on www.sedar.com. Readers are cautioned that the preceding list of material factors or assumptions is not exhaustive. Except as may be required by applicable law, the Company does not undertake, and specifically disclaims, any obligation to update or revise any forward-looking information, whether as a result of new information, future developments or otherwise. Page 5