How will the credit union industry evolve to manage digital assets?

35 Slides2.78 MB

How will the credit union industry evolve to manage digital assets?

Background for eDOC’s Network Focus Group Glossary for today’s workgroup: Digital asset an image that has a monetary value eNote an image of a loan guarantee that has never been in paper format. ESIGN Legislation known as Electronic Signatures in Global National Commerce Act UETA Legislation known as Uniform Electronic Transaction Act A distributed ledger is a database that is consensually shared and synchronized across a network that is spread across multiple sites, institutions or geographies. Blockchain technology documents online transactions while ensuring that those transactions are secure, by encrypting each piece of information, or “block”, contained in its record with a string of numbers and letters.

Background for eDOC’s Network Focus Group The concept of digital assets has been around for a long time in credit unions. CHECK21 ACT A check is an image that has monetary value.

Background for eDOC’s Network Focus Group On June 30, 2000, Congress enacted the Electronic Signatures in Global and National Commerce Act (ESIGN) to facilitate the use of electronic records and signatures in interstate and foreign commerce by ensuring the validity and legal effect of electronic contracts. Mortgage and consumer lenders began a move towards an electronic lending process, known today as eClosings: the act of closing a mortgage or consumer loan guarantee electronically; and the creation of a new class of assets known today as “eNotes”. Business impacts of the law: Technology providers rushed to create new solutions to automate electronic contracting. Financial institutions recognized the operational value of electronic processing and began to adopt new technologies.

Case Study – 265 Credit Unions In 2016, eDOC undertook a research effort, utilizing a market segment of 265 credit unions, for the purpose to ascertain the market conditions related to the following three questions: 1. 2. 3. How many credit unions use eClosings in-branch solutions today? How many credit unions have adopted eClosings for mobile signing? How much of the credit union’s loan portfolio is digital today through the use of eClosing processing?

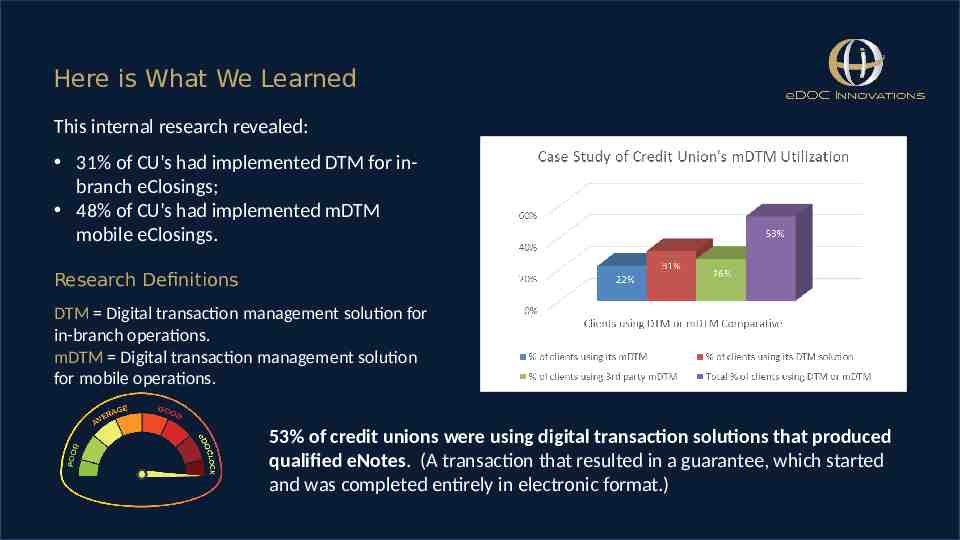

Here is What We Learned This internal research revealed: 31% of CU’s had implemented DTM for inbranch eClosings; 48% of CU’s had implemented mDTM mobile eClosings. Research Definitions DTM Digital transaction management solution for in-branch operations. mDTM Digital transaction management solution for mobile operations. 53% of credit unions were using digital transaction solutions that produced qualified eNotes. (A transaction that resulted in a guarantee, which started and was completed entirely in electronic format.)

Case Study Feedback One credit union reported, “[We] are digitally signing nearly 100% of all consumer loans, with very few exceptions. We see monthly averages of 30-40% remote closings, the rest digitally – in branch. Home Equity loans are still printed and signed today, but we will be looking to digitalize what we are able to later this year.” Another credit union reported, “I [estimate] well over 50%, [as high as] 75% now [digital], as we have been using the sig pads in-house for years now.” The research data suggests that credit unions utilizing DTM and/or mDTM solutions for eClosings today have nearly 70% of their consumer loan portfolios as eNotes (digital assets), and that percentage is growing. **(Mortgage lending was not studied in depth.)

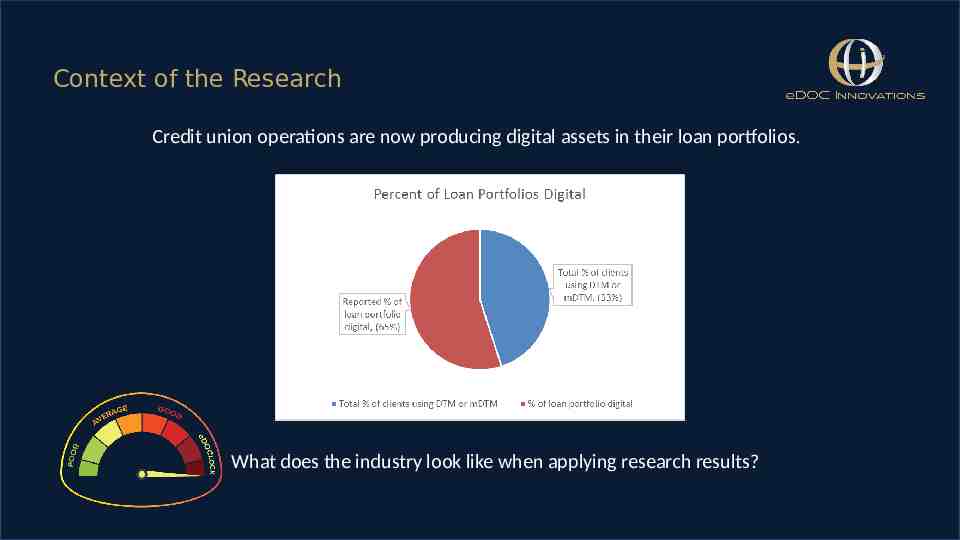

Context of the Research Credit union operations are now producing digital assets in their loan portfolios. What does the industry look like when applying research results?

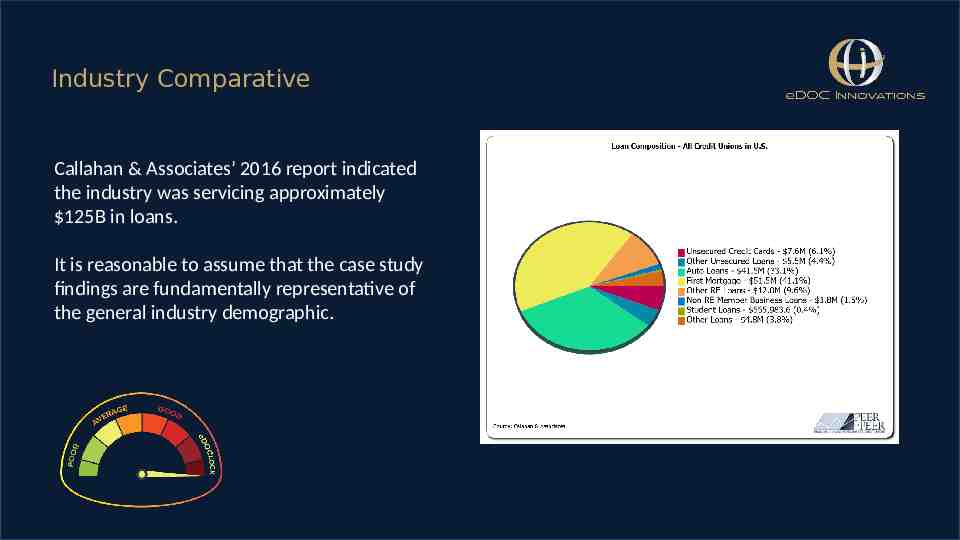

Industry Comparative Callahan & Associates’ 2016 report indicated the industry was servicing approximately 125B in loans. It is reasonable to assume that the case study findings are fundamentally representative of the general industry demographic.

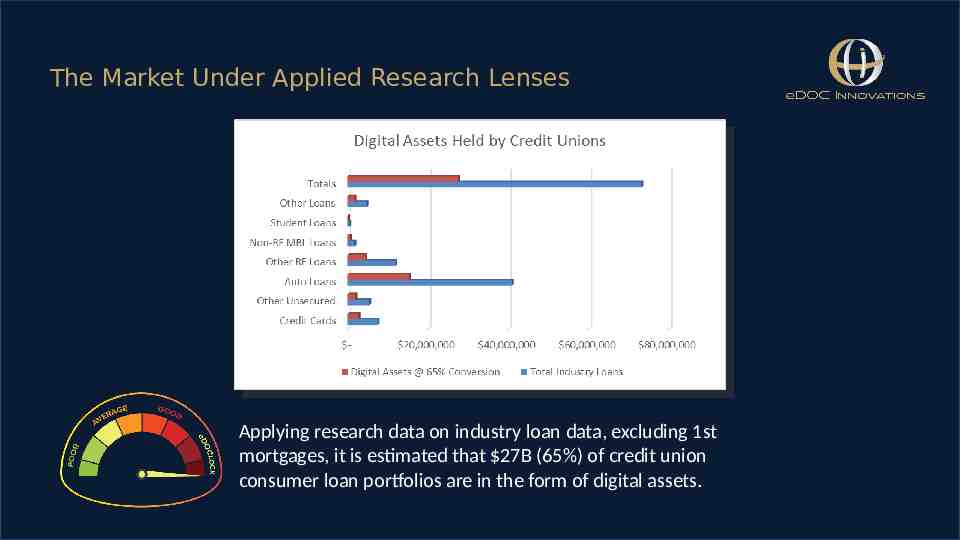

The Market Under Applied Research Lenses Applying research data on industry loan data, excluding 1st mortgages, it is estimated that 27B (65%) of credit union consumer loan portfolios are in the form of digital assets.

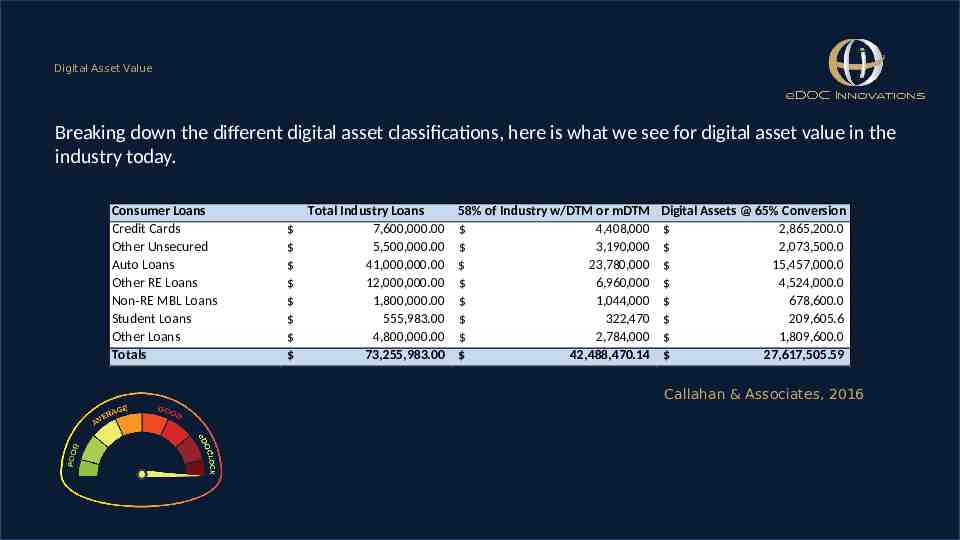

Digital Asset Value Breaking down the different digital asset classifications, here is what we see for digital asset value in the industry today. Consumer Loans Credit Cards Other Unsecured Auto Loans Other RE Loans Non-RE MBL Loans Student Loans Other Loans Totals Total Industry Loans 58% of Industry w/DTM or mDTM 7,600,000.00 4,408,000 5,500,000.00 3,190,000 41,000,000.00 23,780,000 12,000,000.00 6,960,000 1,800,000.00 1,044,000 555,983.00 322,470 4,800,000.00 2,784,000 73,255,983.00 42,488,470.14 Digital Assets @ 65% Conversion 2,865,200.0 2,073,500.0 15,457,000.0 4,524,000.0 678,600.0 209,605.6 1,809,600.0 27,617,505.59 Callahan & Associates, 2016

Observations from Research Data Our research on consumer behavior supports the conclusion that eClosings will continue to increase in volume and frequency. The appetite for remote eSignature convenience will not retreat; consumer and business economics will only increase utilization of eClosings. Credit union adoptions has passed key diffusion theory milestones.

Present Day Outlook Traditional outlooks on digital transaction processing are evolving, both in financial and government agencies that openly acknowledge the value and business requirement for engaging in digital transactions. Here’s an example of this evolution:

Present Day Outlook In April of 2014 Nicholas Ballasy reported: WASHINGTON – The CFPB is launching a pilot program to evaluate “eClosing” solutions and how they can improve the mortgage loan closing process. “Our goal will be to determine how the eClosing process can be made to reflect the spirit of our Know Before You Owe rule by generating increased consumer understanding, fewer surprises at the closing table, and a more empowered consumer,” said CFPB Director Cordray on Wednesday during a forum held at the CFPB headquarters in Washington. “This is not a rulemaking process. Instead it is a potential ‘win-win’ effort to work with all stakeholders to ensure that consumers understand the commitment they are making and experience a more transparent, efficient, and effective process,” he added. “The bureau hypothesizes that technologyenabled electronic closing (eClosing) solutions may have the potential to improve consumer understanding and empowerment and efficiency for all involved,” said the CFPB’s eClosing pilot guidelines. CU Times, April 24, 2014

Present Day Outlook Since the 2008 mortgage market crash, the outlook and attention to digital assets has increased. In major mortgage markets, lenders and originators have made moves to provide greater security of digital assets. That evolution has included: 1. 2. 3. 4. Creation of MERS Registry for digital assets MISMO data standards for creating and exchanging mortgage loan digital assets Vaulting services for providing warranty of the digital asset ANSI standards for exchange of digital assets

Present Day Outlook Once thought to be only a consideration for big lending markets, today we have other types of guarantees and associated digital assets being represented and managed. Other types, and classes of digital assets, are being created today in areas of: 1. 2. 3. 4. 5. P2P loans Group funding Insurance policies Title issuance Tech innovations

Present Day Outlook For credit unions, the topic of digital assets has moved closer to home. Although many credit unions do not have the requirements of 1st mortgage lending, the issue of digital assets has emerged in consumer lending. In April of 2014, the matter became an issue at a credit union who utilized FHLB for its liquidity credit line. FHLB issued an inquiry for digital asset registry, and responded to that request by reducing credit limit against the credit union’s then digital loan portfolio of 15M. Here’s what the FHLB said: “In order for the FHLB to continue to accept e-notes as eligible collateral for borrowings [we must have] assurance of their marketability [and accessibility] should we have to take possession of the eNotes and sell them to satisfy outstanding advances.” For more information on FHLB’s definition of eNotes, visit: https://vimeo.com/207695646/d66dae48e2

Building Trust in Digital Transactions FHLB has started a chain reaction for credit union consumer lending practices. FHLB has by their actions said, “If you want trust, register your digital assets.” We believe a new business competency will be required in the future – a competency to earn trust – Digital Asset Registry and Management.

What is Digital Asset Registry and Management? The accelerating pace of eClosings and increasing volumes of digital assets, a new business competency to earn trust includes multiple considerations. 1. 2. 3. 4. Digital asset authenticity Digital asset security Digital asset collateralization Digital asset transferability #1 - Digital asset authenticity is the ability to warrant that a digital asset is: a) “Authentic”, executed with all due formalities; and, b) “The Original”, the authoritative copy of the digital asset that is unique, identifiable, and unalterable.

What is Digital Asset Registry and Management? Effective authentication of digital assets address these consequences, which exist when a lender fails to effectively authenticate its digital assets: a) b) c) d) e) f) g) Risk of regulatory reprisal in audit Risk of insurance or bond coverage cancellation Risk of liquidity cancellation or reduction Exposure to UETA and ESIGN regulatory penalties Failure to uphold litigious dispute of transaction, including: intent, fees, disclosure, etc. Failure to substantiate repossession of asset Inability to market or transfer the asset

What is Digital Asset Registry and Management? The accelerating pace of eClosings, and the creation of digital assets, pose multiple considerations for this focus group to evaluate. 1. 2. 3. 4. Digital asset authenticity Digital asset security Digital asset collateralization Digital asset transferability #2 - Digital asset security is the storage of the digital asset in a qualified eVault: a) Management of the digital asset, through its lifecycle, with due formalities respecting owners and lien holders; and, b) Protections for authenticated originals, with associated owner and stakeholder representations and history.

What is Digital Asset Registry and Management? Effective vaulting for digital assets address these areas of consideration for lenders, lien-holders and owners of the digital assets: a) b) c) d) e) f) g) Warranty of authenticated original 3rd party repository for lien-holder interests Lifecycle management of the digital asset Audit history of digital asset Ownership designation Lien-holder interests Transfer services for digital assets

What is Digital Asset Registry and Management? The accelerating pace of eClosings, and the creation of digital assets, pose multiple considerations for this focus group to evaluate. 1. 2. 3. 4. Digital asset authenticity Digital asset security Digital asset collateralization Digital asset transferability #3 - Digital asset collateralization is the act of offering digital assets as loan security: a) Pledging of a loan, or group of loans, as security for a line of credit, with due formalities respecting issuer of the credit; and, b) Packing of a loan, or group of loans, for investment or resale purposes.

What is Digital Asset Registry and Management? Requirements for a digital asset to be secured and pledged, as collateral requires the pledger to warrant that a digital asset is: a) Compliant: evidence that the borrower has “affirmatively consented to use electronic records for the transaction (UETA); and, b) UCC Controlled: verifiable, secured for lender control. c) Insured: insurance protection for violations in privacy or unauthorized access.

What is Digital Asset Registry and Management? The accelerating pace of eClosings, and the creation of digital assets, pose multiple considerations for this focus group to evaluate. 1. 2. 3. 4. Digital asset authenticity Digital asset security Digital asset collateralization Digital asset transferability #4 - Digital asset transfer is the act of transferring ownership of, and/or custodial possession for, the digital asset: a) The ability to transfer the digital asset’s ownership, with due formalities respecting lien-holder interests; and, b) Transferability of the digital asset from one eVault to another, while preserving all audit, security and authenticity requirements and history.

Observations from Research Data There is nothing in the foreseeable future that suggests legal, regulatory or business requirements for parties entering into guarantees will have a material change. The requirement for eNotes will continue and grow in both utilization and standards enforcement. The competitive landscape for winning business is dramatically changing.

Building Trust in Digital Transactions How would we respond if the corporate credit union network were required to have digital asset assurances, comparable to what FHLB now does? What outlooks would change? What perspectives would that alter? I don’t believe this topic rests in the argument of lending liquidity and risk mitigation. I do believe it will be a matter of business competency and expectation of trust for an accelerating mobile business economy. Like an SSL for a website, a registry for digital assets will be expected business practice. Builder of Technology? Builder of Solution?

Building Trust in Digital Transactions eDOC has been actively working on this topic for several years. eDOC has been evolving its technology base in several key areas: 1. 2. 3. 4. Secure repository: industrializing security and storage of digital assets. Automation: deeply integrating digital workflows that remove friction and overhead in eClosings. Authenticity: closing the remote eSignature signing process, moving toward authenticated originals. Design study: developed the conceptual design for digital asset registry. eDOC has two options in front of it: Be a builder of technology for registry services. Be a builder of a registry service.

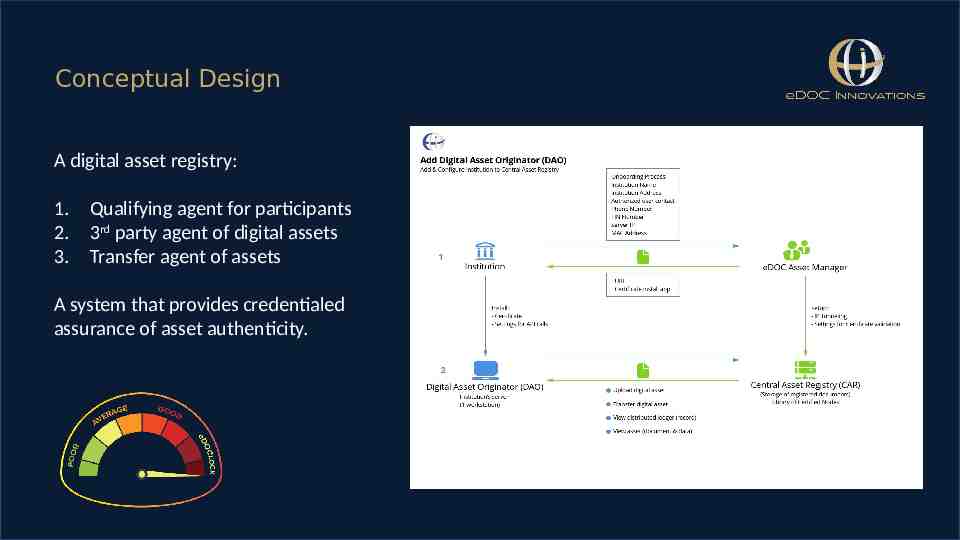

Conceptual Design A digital asset registry: 1. 2. 3. Qualifying agent for participants 3rd party agent of digital assets Transfer agent of assets A system that provides credentialed assurance of asset authenticity.

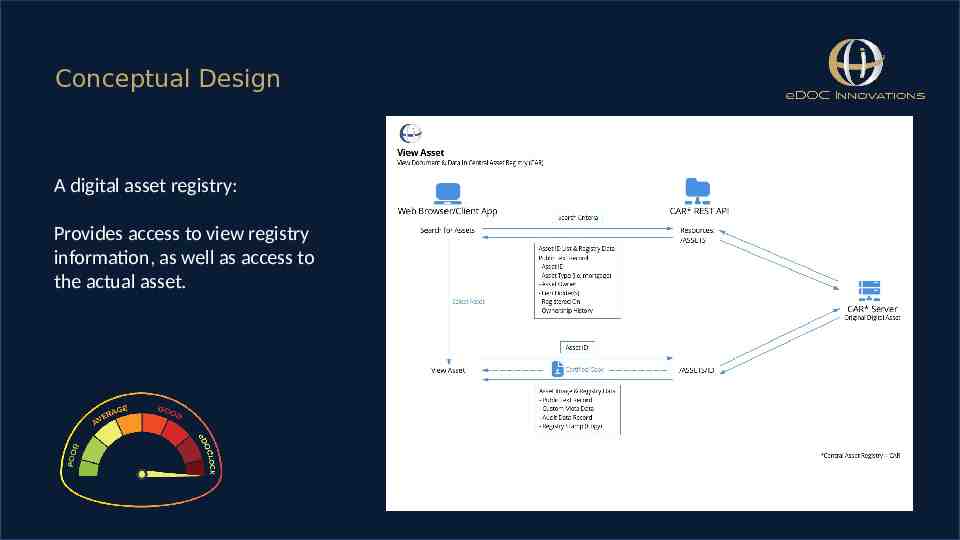

Conceptual Design A digital asset registry: Provides access to view registry information, as well as access to the actual asset.

Objectives in Building a Network Business Building business as a network is not easy – in fact, it is hard work. Our network has a history of building things together, for the benefit of all the participants and the member owners of those credit unions. The value of industry ownership includes: a) Own the technology to service those who are in the registry business. b) Own the registry for business process and adaptability. c) Cost management through aggregation and patronage. d) Business process considerations, adaptability to industry requirements. e) Standardization for industry and compliance with external markets. f) Own the service, control of systems and registry rails.

Purpose of eDOC’s Focus Group Winning business in the future, and earning trust on that business, is changing. In the future every credit union will need a registry service, we believe, a solution that warrants authenticity, originality, marketability and transferability for electronic contracts. We have been evaluating and designing for several years now, watching it emerge as technology utilization has grown. What we have learned is valuable. How do we make this project a truly impactful one for our network?

Next Steps: 1. We need this group to think about what we have learned, and come back to our next meeting having studied the material on the website and prepared to discuss a solution design. 2. We need to firm up our next meeting date, end of May or early June ? 3. What plans do your peers have on their radar? Your corporate? Etc a) What are they thinking? b) Do they have a plan in place for digital assets? c) Would they wish to participate in this project? 4. Complete the business outline. (eDOC) Watch for more information coming soon.

Getting Ahead of the Curve We are looking for partners that have the capacity to serve as an incubator for digital asset leadership in the industry. Recently I read this question, “How do you anticipate the future, be nimble and push yourself to excel in changing environments?” (Randy Karnes) Simple: Innovate before you have to.

Thank you for your time and participation