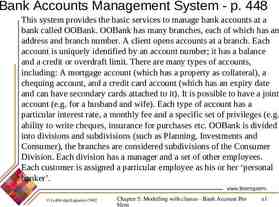

Service Contract Act (SCA) Service Contract Act Price Adjustment and

76 Slides960.60 KB

Service Contract Act (SCA) Service Contract Act Price Adjustment and Kyle Roberts Air Force East Region Labor Advisors Office SAF/AQCA SCA COMPLIANCE PRINCIPLES (DOL briefing follows) Dept of Labor Prevailing Wage Conference Washington, DC 5 October 2011 Be America’s Best War-Winning Capabilities, on Time, on Cost 1

Overview Agency Labor Advisors Contract Price Adjustment Resources (Air Force) Contract Price Adjustment due to the Service Contract Act (SCA) SCA Price Adjustment Elements SCA Price Adjustment Sample Questions Be America’s Best War-Winning Capabilities, on Time, on Cost

Agency Labor Advisors Be America’s Best War-Winning Capabilities, on Time, on Cost

Overview Agency Labor Advisors Price Adjustment Resources (Air Force) SCA Price Adjustment SCA Price Adjustment Elements SCA Price Adjustment Sample Questions Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Resources http://ww3.safaq.hq.af.mil/ AF Labor Advisor Public Website contracting/ Note: Other agencies have similar Guides. Check with your Agency Labor Advisor Be America’s Best War-Winning Capabilities, on Time, on Cost 5

Overview Agency Labor Advisors Price Adjustment Resources (Air Force) SCA Price Adjustment SCA Price Adjustment Elements SCA Price Adjustment Sample Questions Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment What is the Federal Acquisition Regulation (FAR) contractual authority for allowing a Service Contract Act (SCA) labor price adjustment? FAR 52.222-43, Fair Labor Standards Act and Service Contract Act -- Price Adjustment (Multiple Year and Option Contracts) (Nov 2006) (a) This clause applies to both contracts subject to area prevailing wage determinations and contracts subject to collective bargaining agreements. FAR FAR 52.222-43 52.222-43 provides provides the the authority authority to adjust the to adjust the contract contract price for SCA-covered price for SCA-covered labor; labor; this this clause clause can can only be included in only be included in firm-fixed firm-fixed price price contracts or contracts or laborlaborhour contracts hour contracts (b) The Contractor warrants that the prices in this contract do not include any allowance for any contingency to cover increased costs for which adjustment is provided under this clause . Note: highlighting used throughout this briefing is provided for emphasis and does not appear in the actual FAR text Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment (cont’d) FAR 52.222-43 (cont’d) (d) The contract price or contract unit price labor rates will be adjusted to reflect the Contractor’s actual increase or decrease in applicable wages and fringe benefits to the extent that the increase is made to comply with or the decrease is voluntarily made by the Contractor as a result of: (1) The Department of Labor wage determination applicable on the anniversary date of the multiple year contract, or at the beginning of the renewal option period. Contractor Contractor must must provide actual provide actual payroll payroll data data Contracting Contracting Officer Officer calculates the calculates the difference difference between between the the amount paid amount paid by by the the Contractor Contractor and and the the new new Wage Determination Wage Determination (WD) (WD) The The period period covered covered by by the adjustment begins the adjustment begins with with the the date date the the new new WD is required WD is required by by the the terms of the contract terms of the contract –– not not the the date date of of the the WD WD Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment (cont’d) Triggered by incorporation of a new wage determination IAW FAR 22.1007 (c) Annual anniversary date/option exercise (for contracts using annual appropriations) Biennial anniversary date if term exceeds 2 years (and not funded or subject to annual appropriations) A new wage determination is generally only incorporated into a contract at these times Just because a new wage determination is available on WDOL.gov does NOT automatically mean it should be incorporated Be America’s Best War-Winning Capabilities, on Time, on Cost 9

SCA Price Adjustment (cont’d) FAR 52.222-43(d)(1) (cont’d) For example, the prior year wage determination required a minimum wage rate of 4.00 per hour. The Contractor chose to pay 4.10. The new wage determination increases the minimum rate to 4.50 per hour. Even if the Contractor voluntarily increases the rate to 4.75 per hour, the allowable price adjustment is .40 per hour If If the the Contractor Contractor chooses chooses to to pay pay more more than the WD than the WD rates, rates, the the adjustment is based adjustment is based on on what the Contractor what the Contractor ACTUALLY ACTUALLY paid--NOT paid--NOT on on the previous WD rates the previous WD rates Previous WD hourly rate: 4.00/hr Contractor actual: 4.10/hr New WD hourly rate: 4.50/hr Adjustment: .40/hr (4.50/hr - 4.10/hr) Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment (cont’d) What is allowed in the SCA labor price adjustment under FAR 52.222-43? (e) Any adjustment will be limited to increases or decreases in wages and fringe benefits , and the accompanying increases or decreases in social security and unemployment taxes and workers’ compensation insurance, but shall not otherwise include any amount for general and administrative costs, overhead, or profit. Certain Certain tax tax increases increases must must "accompany" "accompany" (be (be caused by) the caused by) the WD WD increase. The increase. The clause clause provides provides no no relief relief from from tax tax increases from increases from other other causes causes or or tax tax increases on a increases on a Contractor's Contractor's total total payroll payroll Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment (cont’d) General calculation of price adjustment New minimum wage and/or Health and Welfare (H&W) Minus (-) actual wage/H&W paid in previous contract period Plus ( ) change in payroll taxes and workers comp (on amount of increase, only) 15.00 15.00 -- 14.50 14.50 paid) paid) .50 .50 .08 .08 .12 .12 .70/hr .70/hr (new (new wage) wage) (previous (previous wage wage (wage (wage increase) increase) (H&W increase) (H&W increase) (change (change in in taxes) taxes) (price (price adjustment) adjustment) Equals ( ) the price adjustment Remember: no overhead (OH), general and administrative (G&A) or profit allowed under the authority of FAR 52.222-43(e) Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment (cont’d) Two Price Adjustment Methods Forward Pricing Method Contractor claims an adjustment based on the projected impact of a new or revised WD The projection uses the employee hours in the prior contract period factoring in any known or expected changes to contract scope or work force Most Most SCA SCA labor labor price price adjustments are adjustments are done done using using the the Forward Pricing Forward Pricing Method Method Actual Cost Method If the claim has been delayed until after the adjustment period is over, by either an approved extension to the 30-day requirement for filing or by delay in contract modification, the Contractor should use actual employee hours worked as the basis for the claim Be America’s Best War-Winning Capabilities, on Time, on Cost

Overview Agency Labor Advisors Price Adjustment Resources (Air Force) SCA Price Adjustment SCA Price Adjustment Elements SCA Price Adjustment Sample Questions Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Elements Adjustment of wages FAR FAR 52.222-43(d) 52.222-43(d) (1) (1) specifically specifically states states that that the the Government’s Government’s adjustment adjustment will will be be based on what the based on what the Contractor Contractor actually actually paid paid (provided (provided it it was was at at least least the the previous previous WD’s WD’s minimum) minimum) Contractor provides actual wage rate information paid in the previous contract performance period Contracting Officer calculates the difference to the new WD rate from the actual rate previously paid by the Contractor (not necessarily the same as the minimum rate required by the previous WD) Category Actual Wage Paid by Contractor Wage on Current WD Increase 23023 – Env Tech III 22.89 23.59 .70/hr Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Elements (cont’d) Adjustment of Health & Welfare (H&W) Contractor may be required to provide data supporting the actual premiums paid in previous period If the H&W increase is paid directly to employees, it is considered taxable wages. The Contractor will incur an accompanying expense in FICA, WCI and possibly FUTA and SUTA If H&W is paid to a third-party provider, Contractor incurs no increase in payroll taxes so no FICA or WCI adjustment is due on the H&W increase FICA FICA and and WCI WCI adjustment adjustment are are due due on the H&W amount on the H&W amount when when H&W H&W is is paid paid directly to the directly to the employees. employees. No No FICA FICA or or WCI WCI adjustment is adjustment is due due on on H&W amount if it is H&W amount if it is paid paid into into an an insurance insurance plan. plan. Actual H&W Paid by Contractor H&W on Current WD Increase 3.50/hr 3.59/hr .09/hr Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Elements (cont’d) Adjustment of Vacation A vacation adjustment is only appropriate if the revised WD changed the vacation benefit or entitlement criteria (if, for instance, the old WD stated “one week paid vacation after 1 year of service” and the new WD states “two weeks paid vacation after 1 year of service”) Typical Typical hours/year: hours/year: No adjustment is permitted merely because an individual employee's seniority has increased his/her entitlement Vacation Vacation required required by by the the WD is found in the notes WD is found in the notes following following the the WD WD classifications classifications (or (or in in the the CBA) CBA) Vacation hours required by the WD may be included in the claim (applying the hourly wage and H&W increase to the vacation hours) Productive Productive Hrs: Hrs: 1,920 1,920 Vacation: Vacation: Holidays: 80 Holidays: 80 Be America’s Best War-Winning Capabilities, on Time, on Cost 80 80

Price Adjustment Elements (cont’d) Adjustment of Holidays When the revised WD increases the number of required holidays, the Contractor may generally claim an adjustment for the increased cost The adjustment is the SCA minimum wage rate times the number of increased holiday hours (generally, eight hours per each new holiday for a full-time employee) The The total total number number of of holidays holidays required required by by the the WD WD is is found found in in the the notes notes following following the the WD WD classifications classifications (or (or in in the the CBA) CBA) Holiday hours required by the WD may be included in the claim (applying the per hour wage and H&W increase to the holiday hours) Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Elements (cont’d) Adjustment of Unemployment Taxes The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) payments are normally not affected by a WD revision Unemployment taxes are paid by Contractors on wages up to a specific annual ceiling or cap The current FUTA rate is only paid on wages up to a cap of 7,000; Contractors should have included this in their initial offers SUTA caps vary by state, but most states use caps under 20,000. Rates vary by state and by employer. SUTA websites can be reached through http://www.americanpayroll.org/members/stateui Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Elements (cont’d) Adjustment of Unemployment Taxes (cont’d) Since annual employee wages usually exceed the caps in most states without regard to the revised WD, typically no additional FUTA or SUTA is required-- the Contractor is already paying the maximum tax The contract price is not adjusted for changes in the FUTA or SUTA rate; if an adjustment is warranted, the current rates apply Contracting Officer verifies the applicable SUTA rate by requesting suitable documentation from the Contractor or contacting the relevant state employment tax office If an adjustment is due, it is only for the FUTA/SUTA percent rate times the wage rate differential Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Elements (cont’d) No adjustment is allowed on General and Administrative (G&A) costs, overhead and profit These elements are specifically excluded by FAR 52.222-43(e) and are not allowable as part of an SCA price adjustment Increases in general liability insurance, state gross receipts taxes and bonding costs are also not allowable as part of an SCA adjustment (despite such costs being calculated based on total wages or total revenue) Be America’s Best War-Winning Capabilities, on Time, on Cost

Price Adjustment Elements (cont’d) No adjustment is allowed for employee reimbursements Employee expenses reimbursed by the Contractor, such as payment for fuel, mileage, meals, lodging, tool and uniform allowances and safety shoes, boots or gear, are not considered when calculating the hourly wage rate paid Such payments are considered as reimbursement of a Contractor’s business expenses and not wages or fringe benefits These items must be excluded from any calculation for price adjustment under FAR 52.222-43 Be America’s Best War-Winning Capabilities, on Time, on Cost

Overview Agency Labor Advisors Price Adjustment Resources (Air Force) SCA Price Adjustment SCA Price Adjustment Elements SCA Price Adjustment Sample Questions Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample Our SCA Labor Price Adjustment situation : 1. Custodial and grounds maintenance services, fixed price, ABC Clean is the Contractor; location: Grissom ARB, IN 2. The wdol.gov wage determination* for the next option has been incorporated into the contract; it requires wage increases for the classifications used by the Contractor *If *If contract contract has has a a CBA CBA WD, WD, use rates found in the use rates found in the current current CBA; CBA; methodology methodology for doing the price for doing the price adjustment adjustment is is the the same— same— just have to verify just have to verify cost cost data data with CBA rates and with CBA rates and benefits benefits (e.g., (e.g., sick sick leave, leave, vacation accrual, etc.) vacation accrual, etc.) 3. The H&W rate also increases from 3.50 to 3.59/ hour. The wage determination specifies the ‘employee-by-employee” method of compliance ** therefore, the 3.59 is due on all hours compensated up to a maximum of 40 hours per week ** ** Currently Currently there there are are two two H&W H&W methods methods for for each each location. location. The The alternate alternate WD WD requires requires an an average average cost cost of of 3.59/hr 3.59/hr based based on on all all hours hours worked worked by by SCA-covered SCA-covered employees. employees. Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) 4. Per FAR clause 52.222-43, the Contractor makes a claim for the increased cost. 5. ABC Clean provides information which includes (1) each employee’s work hours, paid vacation and holiday hours, (2) a “Defense Contract Audit Agency (DCAA) approved” overhead tax rate of 11.65%, (3) the cost of new T-shirts for the employees (the contract required Contractor-identifiable clothing) and (4) employee vehicle mileage reimbursement. The Contractor provided no payroll records. 6. The Contractor claims the increase for the (1) janitors, (2) lead janitor, (3) grounds maintenance laborers, (4) tractor operator, (5) pest controller, (6) payroll clerk, and (7) the project manager. The lead janitor wage rate is not listed on the wage determination and the procedure (“conformance”) to establish the minimum SCA wage rate was not completed Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) Step-by-step, what does the Government do to evaluate this claim? What increased costs are required of (forced on) the Contractor to comply with the revised SCA wage determination? Step Step 1: 1: Eliminate Eliminate unallowable unallowable costs: costs: Non-SCA Non-SCA employees: employees: Payroll Payroll Clerk Clerk and and Project Project Manager Manager Non-wage/benefit Non-wage/benefit costs: costs: T-shirts, T-shirts, mileage mileage 11.65% 11.65% “DCAA-approved” “DCAA-approved” tax tax rate rate ? ? What accompanying costs are permitted by 52.222-43? Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) Payroll information needed to calculate the SCA labor price adjustment from the previous year to the current year should be provided by the Contractor The authority to require this information is provided under FAR 52.222-43(g): “(g) The Contracting Officer or an authorized representative shall have access to and the right to examine any directly pertinent books, documents, papers and records of the Contractor until the expiration of 3 years after final payment under the contract.” Step Step 2: 2: What What additional additional information information is is needed to evaluate? needed to evaluate? Payroll Payroll records records showing showing actual actual wages wages and and H&W H&W Actual Actual hours hours worked/paid worked/paid How How was was H&W H&W paid? paid? What What is is the the current current workers workers comp rate? comp rate? Were Were any any employee employee wages wages previously previously less less than than the the FUTA and/or SUTA caps? FUTA and/or SUTA caps? Any Any other other documents documents needed by needed by the the CO CO to to verify verify the the claim claim Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) Step 3: Calculate: Hours (2080/yr) Title Labor, Grounds Maintenance Hourly Wages WD 05Actual Rate 2195 Rev 7 Pd (FY10) (FY11) Delta/Hr Total Wage Increase 20,800 9.50 10.00 0.50 10,400.00 Tractor Operator 2,080 10.50 11.75 1.25 2,600.00 Pest Controller 2,080 17.00 18.15 1.15 2,392.00 9.50 10.00 .50 5,200.00 2,080 10.50 11.50** 1.00** Janitors 10,400 Lead Janitor (1)** Total 37,440 20,592.00 ** The Lead Janitor classification was not legally established through a “conformance” (see FAR 52.222-41(c)), therefore, no adjustment is due. The Lead Janitor is being paid above the minimum requirement for Janitor so there will be no adjustment to the wages (see FAR 52.222.43(d)). Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) As a reminder, it is the Contractor’s responsibility to conform a position to the WD (FAR 52.222-41(c) Compensation) (2)(i) If a wage determination is attached to Referred Referred to to as as a a “conformance” “conformance” Accomplished Accomplished via via SF SF 1444 1444 Requires Requires Contractor Contractor to to conform conform wage wage determination within 30 days after determination within 30 days after the the unlisted unlisted class class of of employee employee performs performs any any contract work contract work Contractor Contractor submits submits completed completed SF1444 SF1444 (including employee (including employee agreement agreement or or disagreement) to the Contracting disagreement) to the Contracting Officer Officer Contracting Contracting Officer Officer submits submits SF1444 SF1444 to to the DOL the DOL DOL DOL approves/disapproves approves/disapproves and and returns returns to to the Contracting Officer who forwards to the Contracting Officer who forwards to the the Contractor Contractor this contract, the Contractor shall classify any class of service employee which is not listed therein and which is to be employed under the contract (i.e., the work to be performed is not performed by any classification listed in the wage determination) so as to provide a reasonable relationship (i.e., appropriate level of skill comparison) between such unlisted classifications and the classifications listed in the wage determination Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) FOR THIS EXERCISE: The contractor documents that H&W was paid to a third-party provider So, no accompanying costs are due on the H&W increase Step Step 4: 4: Was Was health health and and welfare welfare paid paid in in cash cash to to the the employees or paid employees or paid to to a a third-party provider? third-party provider? If If cash: cash: calculate calculate accompanying accompanying costs on H&W costs on H&W total total If If third-party third-party provider: provider: do not do not calculate calculate accompanying accompanying costs costs of of the the H&W total H&W total Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) Hourly Wages Hours (2080/yr) Title Labor, Grnds Maint Actual WD 05Rate Paid 2195 Rev (FY10) 7 (FY11) Delta/Hr 20,800 9.50 10.00 0.50 Tractor Operator 2,080 10.50 11.75 1.25 Pest Controller 2,080 17.00 18.15 1.15 Janitors Lead Janitor** 10,400 2,080 37,440 Total 9.50 10.00 .50 10.50 11.50** 1.00** Total Wage Increase H&W ( .09/hr) 10,400.00 1,872.00 2,600.00 187.20 2,392.00 187.20 5,200.00 936.00 - 187.20** 20,592.00 3,369.60 ** Although the lead janitor wage rate was not conformed, it is an SCA-covered position, due the minimum H&W. Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Price Adjustment Sample (cont’d) Step 5: Calculate accompanying costs: FICA (6.20% for Social Security 1.45% for Medicare, 7.65% Total) Workers Compensation Insurance (Contractor rate 4 per 100 (4%)) Federal Unemployment Tax Allowance (FUTA) (if applicable) Hourly Wages State Unemployment Tax Allowance (SUTA) (if applicable) Hours (2080/yr) Title Labor, Grnds Maint WD 05Actual Rate 2195 Rev Paid (FY10) 7 (FY11) Delta/Hr Total Wage Increase H&W ( .09/hr) FICA (7.65%)* WCI (4%)* 20,800 9.50 10.00 0.50 10,400.00 1,872.00 795.60 416.00 Tractor Operator 2,080 10.50 11.75 1.25 2,600.00 187.20 198.90 104.00 Pest Controller 2,080 17.00 18.15 1.15 2,392.00 187.20 182.99 95.68 397.80 208.00 Janitors Lead Janitor Total 10,400 9.50 10.00 .50 5,200.00 936.00 2,080 10.50 11.50 1.00 - 187.20 37,440 20,592.00 - 3,369.60 1,575.29 *FICA and WCI are not applied to H&W since H&W is paid to an insurance plan and not in cash Be America’s Best War-Winning Capabilities, on Time, on Cost - 823.68

SCA Price Adjustment Sample (cont’d) Total SCA labor price adjustment due for the upcoming contract performance period: 26,360.57 Hourly Wages WD 05Actual 2195 Total Wage Hours Rate Paid Rev 7 (2080/yr) (FY10) (FY11) Delta/Hr Increase Title H&W ( .09/hr) FICA (7.65%) WCI (4%) Amt Due Labor, Grnds Maint 20,800 9.50 10.00 0.50 10,400.00 1,872.00 795.60 416.00 Tractor Operator 2,080 10.50 11.75 1.25 2,600.00 187.20 198.90 104.00 3,090.10 Pest Controller 2,080 17.00 18.15 1.15 2,392.00 187.20 182.99 10,400 9.50 10.00 5,200.00 936.00 397.80 208.00 6,741.80 2,080 10.50 11.50 1.00 Janitors Lead Janitor Total 37,440 .50 - 187.20 20,592.00 3,369.60 1,575.29 - 13,483.60 95.68 2,857.87 823.68 - 187.20 26,360.57 Be America’s Best War-Winning Capabilities, on Time, on Cost

Questions Be America’s Best War-Winning Capabilities, on Time, on Cost

SCA Compliance Principles U.S. Department of Labor Wage and Hour Division

SCA Compliance Principles Payment of wages and fringe benefits Bona fide Fringe Benefit Plans Health & Welfare Fringe Benefits Paid Vacation Fringe Benefits Paid Holiday Fringe Benefits Equivalent Fringe Benefits Temporary & Part-time employment U.S. Department of Labor Wage and Hour Division

Payment of Wages (29 C.F.R. § 4.165) Wages established by wage determination, otherwise FLSA minimum wage Calculated on fixed and regularly recurring workweek of 7 consecutive 24-hour workday periods Payroll records kept on this basis Bi-weekly or semi-monthly pay periods if advance notice U.S. Department of Labor Wage and Hour Division

Payment of Fringe Benefits Cash payments in lieu of fringe benefits (FBs) must be paid on regular pay date (29 C.F.R. § 4.165(a)) Payments into bona fide FB plans must be made no less often than quarterly (29 C.F.R. § 4.175(d)) FB costs may not be credited toward wage requirements (29 C.F.R. § 4.167) U.S. Department of Labor Wage and Hour Division

Discharging Minimum Wage & Fringe Benefit Obligations Under SCA, the contractor may not credit excess wage payment against the FB obligation: Wage Determination: Employee Paid: Wage 10.25 Wage 12.00 FB 3.59 FB 1.84 Total 13.84 Total 13.84 U.S. Department of Labor Wage and Hour Division

Computation of Hours Worked (29 C.F.R. §§ 4.178-4.179 & Part 785) Determined under the FLSA pursuant to 29 C.F.R. Part 785 Includes all periods in which employee is “suffered or permitted” to work Hours work subject to SCA are those performed on covered contracts Must keep affirmative proof of time spent on covered and non-covered work in a workweek U.S. Department of Labor Wage and Hour Division

Wage Payments for Work Subject to Different Rates Employee must be paid Highest rate for all hours worked, unless Employer’s payroll records or other affirmative proof show periods spent in each class of work Applies when employee works part of workweek on SCA-covered and non-SCA-covered work U.S. Department of Labor Wage and Hour Division

Bona Fide Fringe Benefits (29 C.F.R. § 4.171(a)) Constitute a legally enforceable obligation that Is communicated in writing to employees Provides payment of benefits to employees Contains a definite formula for determining amount of contribution and benefits provided Is paid irrevocably to an independent trustee or third person pursuant to a fund, trust, or plan Meets criteria set forth by IRS and ERISA U.S. Department of Labor Wage and Hour Division

Fringe Benefits Plans (29 C.F.R. § 4.171(a)(2)) Provide benefits to employees on account of: Death Disability Advanced age Retirement Illness Medical expenses Hospitalization Supplemental unemployment benefits U.S. Department of Labor Wage and Hour Division

Health and Welfare (H&W) Fringe Benefits Three types of FB requirements: “Fixed cost” per employee benefits “Average cost” benefits Collectively bargained (CBA) benefits Types and amounts of benefits and eligibility requirements are contractor’s prerogative U.S. Department of Labor Wage and Hour Division

“Fixed Cost” Benefits (29 C.F.R. § 4.175(a)) Increased to 3.59 per hour June 17, 2011 Included in all “invitations for bids” opened, or Other service contracts awarded on or after June 17, 2011 Required to be paid “per employee” basis For ALL HOURS PAID FOR up to 40 hours in a workweek, and 2,080 hours a year U.S. Department of Labor and Includes paid leave and holidays Wage Hour Division

“Fixed cost” H&W Contributions Bi-Weekly Payroll Employee Libby Jean Ann Tim Tom Total Hrs. paid FB’s Cash Total 80 180.00 107.20 287.20 *100 180.00 107.20 287.20 20 0.00 71.80 71.80 80 287.20 0.00 287.20 60 151.00 64.40 215.40 *340 1,148.00 * FBs and cash payments may vary so long as total equals 3.59 per hour. 20 hours of overtime excluded. U.S. Department of Labor Wage and Hour Division

“Average Cost” Benefits (29 C.F.R. § 4.175(b)) Contributions may vary depending upon employee’s marital or employment status Total contributions must average at least 3.59 per hour per employee: Excludes paid leave time and holidays For all “HOURS WORKED” Compliance determined on a group basis, not an individual basis U.S. Department of Labor Wage and Hour Division

“Average Cost” Benefit Contributions Employee Libby Jean Ann Tim Tom Total Hours Worked 250 150 250 50 100 800 Contributions 650 450 650 0 250 2000 2000/800 2.50 average FB contributions U.S. Department of Labor Wage and Hour Division

“Average Cost” Benefits Contributions Employee Libby Jean Ann Tim Tom Total Hours 250 150 250 50 100 800 Shortfall Total 1.09 272.50 1.09 163.50 1.09 272.50 1.09 54.50 1.09 109.00 872.00 2000 872 2872/800 hours 3.59 U.S. Department of Labor Wage and Hour Division

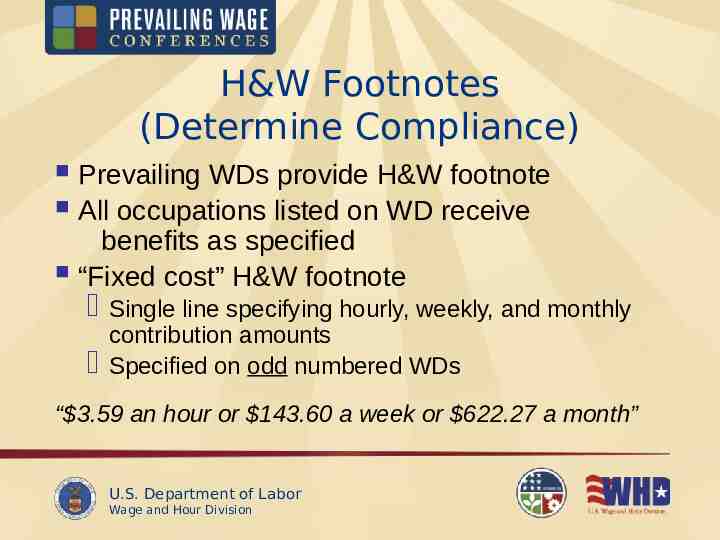

H&W Footnotes (Determine Compliance) Prevailing WDs provide H&W footnote All occupations listed on WD receive benefits as specified “Fixed cost” H&W footnote Single line specifying hourly, weekly, and monthly contribution amounts Specified on odd numbered WDs “ 3.59 an hour or 143.60 a week or 622.27 a month” U.S. Department of Labor Wage and Hour Division

H&W Footnotes (Cont’d) “Average Cost” H&W footnote - brief paragraph listing types of benefits and hourly contribution and specified on even numbered WDs “HEALTH & WELFARE: Life, accident, and health insurance plans, sick leave, pension plans, civic and personal leave, severance pay, and savings and thrift plans. Minimum employer contributions must cost an average of 3.59 per hour computed on the basis of all hours worked by service employees employed on the contract.” U.S. Department of Labor Wage and Hour Division

Collectively Bargained Benefits Fringe Based on CBA Required to be paid by successor contractor under section 4(c) of SCA Need not provide specifically the FBs stipulated in CBA. Equivalent benefits may be provided Cash equivalent payments can be used to offset the FBs due U.S. Department of Labor Wage and Hour Division

Vacation Fringe Benefits (29 C.F.R. § 4.173(c)(1)) Are vested and become due after the employee’s anniversary date Need not be paid immediately after the anniversary date, but must be discharged before, whichever occurs first: The next anniversary date; The completion of the contract; or The employee terminates employment U.S. Department of Labor Wage and Hour Division

Anniversary Date (12-months of Service) Employee eligible for vacation benefits Contractor who employs employee on anniversary date owes vacation Paid at hourly rate in effect in workweek vacation is taken H&W benefits due under “fixed cost” requirements U.S. Department of Labor Wage and Hour Division

“Continuous Service” (29 C.F.R. § 4.173(a)-(b)) Determines employee’s eligibility for vacation benefits Is determined by total length of time: Present contractor in any capacity, and/or Predecessor contractors in performance of similar contract functions at same facility Contractor’s liability determined by WD U.S. Department of Labor Wage and Hour Division

Continuous Service Examples (WD – 1-week vacation after 1-year) Present contractor –employee “in any capacity” 6-months on SCA-contract 6-months on “commercial” work Present and predecessor contractors 16-months for predecessor at same facility 8-months for present contractor Employee eligible for vacation benefits U.S. Department of Labor Wage and Hour Division

Incumbent Contractor’s List (29 C.F.R. §§ 4.6(l)(2) & 4.173(d)(2)) Must be furnished to contracting officer 10 days prior to contract completion Identifies service employees on last month’s payroll Provides anniversary date of employment Difficulty in obtaining list does not relieve contractor to provide vacation benefits U.S. Department of Labor Wage and Hour Division

Holiday Fringe Benefits (29 C.F.R. § 4.174) Employee entitled to holiday pay if works in the holiday workweek Employee not entitled to holiday pay if holiday not named in WD (i.e., government closed by proclamation) Paid holidays can be traded for another day off if communicated to employees U.S. Department of Labor Wage and Hour Division

Equivalent Fringe Benefits (29 C.F.R. § 4.177) Contractor may dispose of FBs: By furnishing the benefits listed in WD, or Furnish equivalent combinations of bona fide FBs, or Make equivalent cash payments Equal in cost Separately stated in employer’s record Not used to offset wage requirements U.S. Department of Labor Wage and Hour Division

Furnishing Cash Equivalents (29 C.F.R. § 4.177(c)) For FBs listed in weekly amounts ( 60), divide amount by hours worked (40): 60/40 hours 1.50 per hour For FBs listed in non-cash amounts (one week paid vacation), multiply wage ( 10) by vacation (40 hours) and divide by annual non-overtime hours (2080 hours): 10 X 40 hours 400/2080 hours 0.19 per hour U.S. Department of Labor Wage and Hour Division

Part-time Employees (29C.F.R. § 4.176) Entitled to proportionate amount Maximum: Vacation/Holidays 40/8 hours Part-time employee works 20 hours per week: Entitled to ½ week of vacation, or 20 hours Entitled to ½ holiday pay, or 4 hours Must receive full amount of H&W FBs U.S. Department of Labor Wage and Hour Division

SCA Overtime Compliance U.S. Department of Labor Wage and Hour Division

Overtime Pay SCA does not provide premium rates for overtime hours of work, but recognizes other Federal laws that do Fair Labor Standards Act (FLSA) (29 U.S.C. § 201, et seq.) has broadest application Contract Work Hours and Safety Standards Act (CWHSSA) (40 U.S.C. §§ 327-332) applies to contracts in excess of 100,000 that employ “laborers” and “mechanics” U.S. Department of Labor Wage and Hour Division

Overtime Pay Determined in same manner under both laws: Calculated at 1-1/2 times employee’s basic hourly rate of pay for all hours worked over 40 in a workweek Liquidated damages can be assessed under CWHSSA at 10 per day when overtime not properly paid U.S. Department of Labor Wage and Hour Division

Overtime Compliance with “Fixed cost” H&W Benefits An employee worked 44 hours on a covered contract as a janitor at a WD rate of 15 plus 3.59 in “fixed cost” H&W FBs per hour. 40 hours X 3.59 143.60 H&W FBs 44 hours X 15.00 660.00 S/T Wages 4 hours X 15.00 x 1/2 30.00 O/T Pay Total 833.60 U.S. Department of Labor Wage and Hour Division

Overtime Compliance with the “Average Cost” H&W Benefits An employee worked 44 hours on a covered contract as a janitor at a WD rate of 15 plus 3.59 in “average cost” H&W FBs per hour. 44 hours X 3.59 157.96 H&W FBs 44 hours X 15.00 660.00 Wages 4 hours X 15.00 x ½ 30.00 Overtime Pay Total 847.96 U.S. Department of Labor Wage and Hour Division

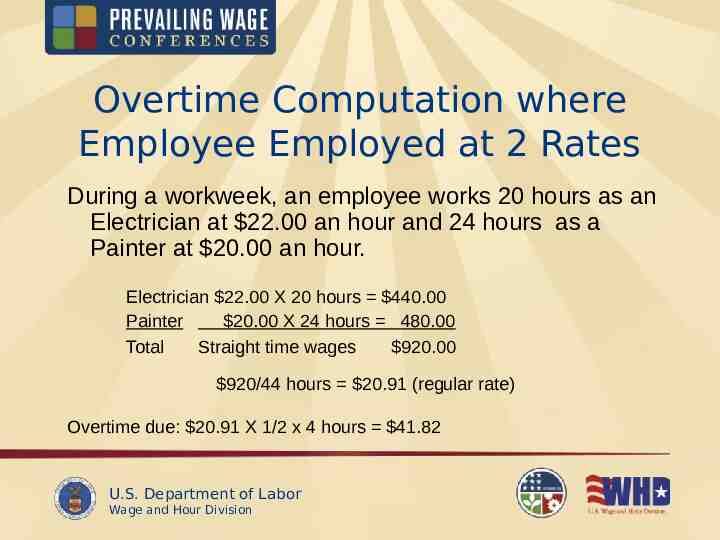

Overtime Computation where Employee Employed at 2 Rates During a workweek, an employee works 20 hours as an Electrician at 22.00 an hour and 24 hours as a Painter at 20.00 an hour. Electrician 22.00 X 20 hours 440.00 Painter 20.00 X 24 hours 480.00 Total Straight time wages 920.00 920/44 hours 20.91 (regular rate) Overtime due: 20.91 X 1/2 x 4 hours 41.82 U.S. Department of Labor Wage and Hour Division

Computing Liquidated Damages under CWHSSA Are computed at 10 per day per violation: S M T Regular Time W T F S Total 0 10 12 13 9 8 3 55 15 weekly hours of overtime were worked on 3 calendar days (Thursday, Friday, Saturday) without payment of overtime. Liquidated damages computed at 30. U.S. Department of Labor Wage and Hour Division

Recordkeeping Requirements (29 C.F.R. §§ 4.6(g), 4.185) Contractor and each subcontractor must maintain for each employee for 3 years: Name, address and social security number Work classification, wages and benefits Daily/weekly compensation and hours worked, and any payroll deductions Length of service list of the predecessor contractor U.S. Department of Labor Wage and Hour Division

SCA Labor Standards Contract Stipulations: Prevailing wages to be paid to various classes of service employees Fringe benefits to be furnished Safety and health provisions Notice of required compensation to be furnished to employees U.S. Department of Labor Wage and Hour Division

Authority and Reasons for SCA Investigations DOL has sole enforcement authority under SCA WHD may conduct investigations for a number of reasons Reason is not disclosable Many are initiated by complaints Complaints are confidential U.S. Department of Labor Wage and Hour Division

Compliance Issues An investigation will generally identify and examine the following issues: Are SCA stipulations included in contract? Does contract have correct WD? Are the SCA poster and WD, including any conformance actions, posted at the site or made available to employees? Does WD contain necessary classifications? U.S. Department of Labor Wage and Hour Division

Compliance Issues (cont’d) More investigation issues: Is a conformance necessary? Are employees properly classified? Are fringe benefits being properly paid? Is “overtime” correctly paid under the FLSA or CWHSSA, if appropriate? Has employer kept accurate payroll records? U.S. Department of Labor Wage and Hour Division

Executive Order 13495 Nondisplacement of Qualified Workers Under Service Contracts The Department of Labor, Wage and Hour Division has issued a final rule to implement Executive Order 13495, Nondisplacement of Qualified Workers Under Service Contracts. The Order and the final rule require contractors and subcontractors who are awarded a federal service contract to provide the same or similar services at the same location to, in most circumstances, offer employment to the predecessor contractor’s employees in positions for which they are qualified. Successor contractors are allowed to reduce the size of the workforce and to give first preference to certain of their current employees. U.S. Department of Labor Wage and Hour Division

Executive Order 13495 cont’d The Executive Order and the final rule mandate the inclusion of a contract clause requiring (subject to the terms and conditions of the Executive Order and the final rule) the successor contractor and its subcontractors to offer those employees employed under the predecessor contract, whose employment will be otherwise terminated as a result of the award of the successor contract, a right of first refusal of employment under the successor contract in positions for which they are qualified. The final rule will be effective once the Federal Acquisition Regulatory Council (FARC) issues regulations for the inclusion of the nondisplcement contract clause in covered Federal solicitations and contracts, as required by the Executive Order. U.S. Department of Labor Wage and Hour Division

Disclaimer This presentation is intended as general information only and does not carry the force of legal opinion. The Department of Labor is providing this information as a public service. This information and related materials are presented to give the public access to information on Department of Labor programs. You should be aware that, while we try to keep the information timely and accurate, there will often be a delay between official publications of the materials and the modification of these pages. Therefore, we make no express or implied guarantees. The Federal Register and the Code of Federal Regulations remain the official source for regulatory information published by the Department of Labor. We will make every effort to keep this information current and to correct errors brought to our attention. U.S. Department of Labor Wage and Hour Division