HEALTH INSURANCE 1

18 Slides523.06 KB

HEALTH INSURANCE 1

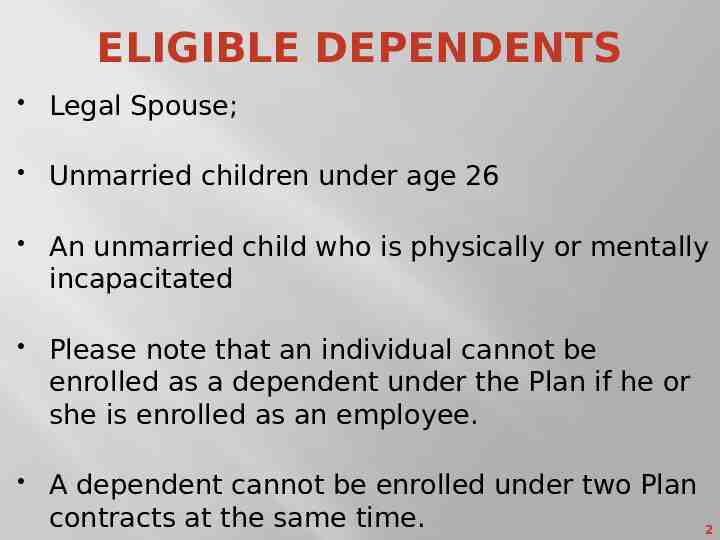

ELIGIBLE DEPENDENTS Legal Spouse; Unmarried children under age 26 An unmarried child who is physically or mentally incapacitated Please note that an individual cannot be enrolled as a dependent under the Plan if he or she is enrolled as an employee. A dependent cannot be enrolled under two Plan contracts at the same time. 2

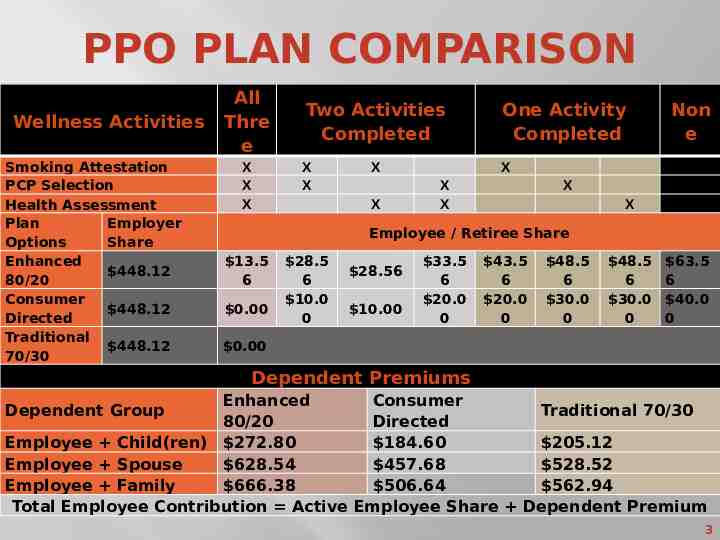

PPO PLAN COMPARISON Wellness Activities Smoking Attestation PCP Selection Health Assessment Plan Employer Options Share Enhanced 448.12 80/20 Consumer 448.12 Directed Traditional 448.12 70/30 All Thre e X X X Two Activities Completed One Activity Completed X X X X X X X Non e X X Employee / Retiree Share 13.5 6 0.00 28.5 6 10.0 0 28.56 10.00 33.5 6 20.0 0 43.5 6 20.0 0 48.5 6 30.0 0 48.5 6 30.0 0 63.5 6 40.0 0 0.00 Dependent Premiums Enhanced Consumer Traditional 70/30 80/20 Directed Employee Child(ren) 272.80 184.60 205.12 Employee Spouse 628.54 457.68 528.52 Employee Family 666.38 506.64 562.94 Total Employee Contribution Active Employee Share Dependent Premium Dependent Group 3

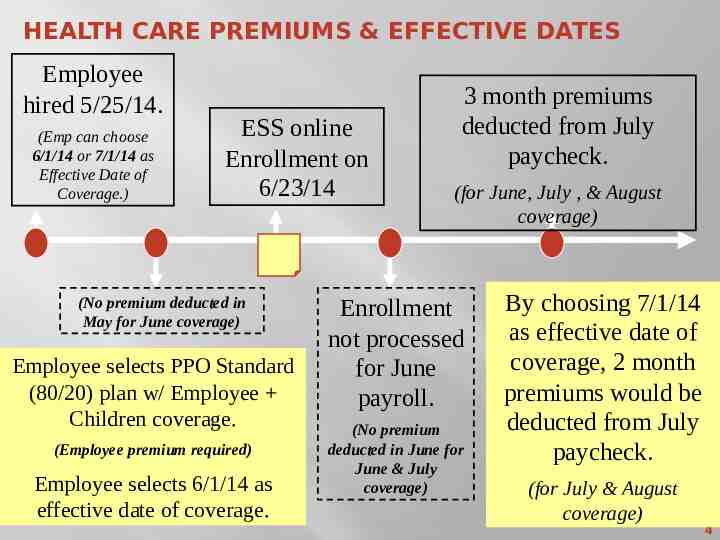

HEALTH CARE PREMIUMS & EFFECTIVE DATES Employee hired 5/25/14. (Emp can choose 6/1/14 or 7/1/14 as Effective Date of Coverage.) ESS online Enrollment on 6/23/14 (No premium deducted in May for June coverage) Employee selects PPO Standard (80/20) plan w/ Employee Children coverage. (Employee premium required) Employee selects 6/1/14 as effective date of coverage. 3 month premiums deducted from July paycheck. (for June, July , & August coverage) Enrollment not processed for June payroll. (No premium deducted in June for June & July coverage) By choosing 7/1/14 as effective date of coverage, 2 month premiums would be deducted from July paycheck. (for July & August coverage) 4

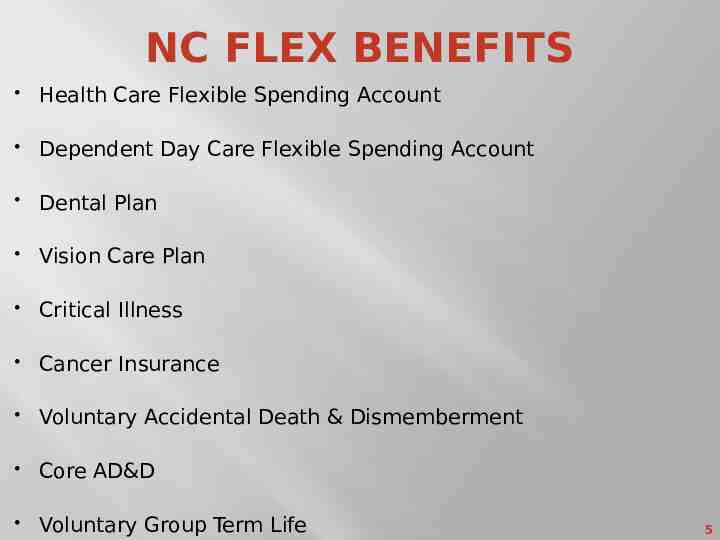

NC FLEX BENEFITS Health Care Flexible Spending Account Dependent Day Care Flexible Spending Account Dental Plan Vision Care Plan Critical Illness Cancer Insurance Voluntary Accidental Death & Dismemberment Core AD&D Voluntary Group Term Life 5

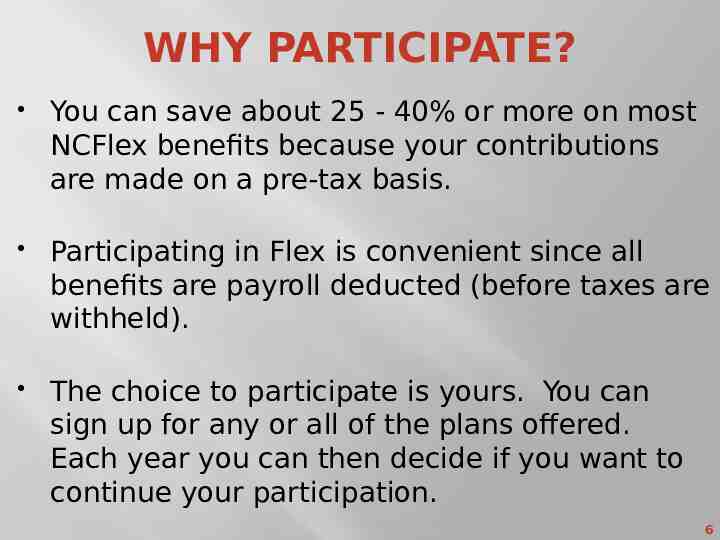

WHY PARTICIPATE? You can save about 25 - 40% or more on most NCFlex benefits because your contributions are made on a pre-tax basis. Participating in Flex is convenient since all benefits are payroll deducted (before taxes are withheld). The choice to participate is yours. You can sign up for any or all of the plans offered. Each year you can then decide if you want to continue your participation. 6

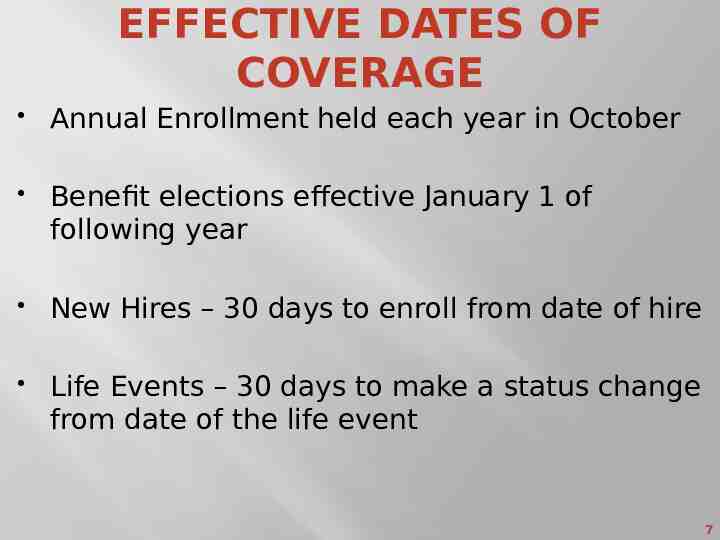

EFFECTIVE DATES OF COVERAGE Annual Enrollment held each year in October Benefit elections effective January 1 of following year New Hires – 30 days to enroll from date of hire Life Events – 30 days to make a status change from date of the life event 7

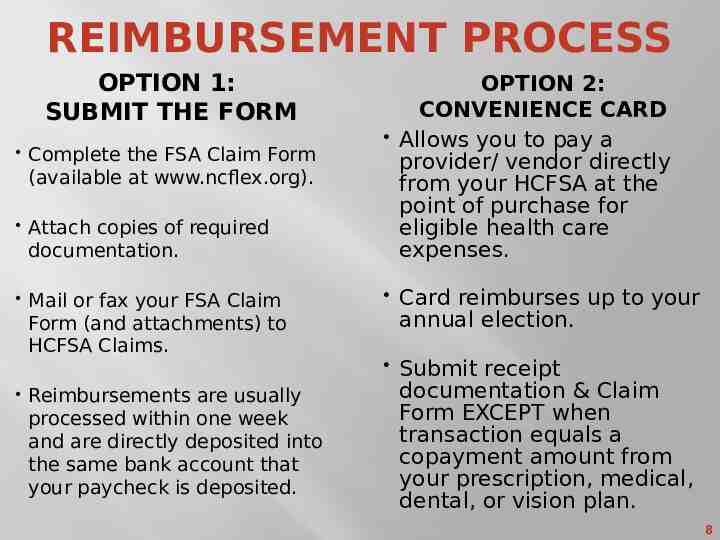

REIMBURSEMENT PROCESS OPTION 1: SUBMIT THE FORM Complete the FSA Claim Form (available at www.ncflex.org). Attach copies of required documentation. Mail or fax your FSA Claim Form (and attachments) to HCFSA Claims. Reimbursements are usually processed within one week and are directly deposited into the same bank account that your paycheck is deposited. OPTION 2: CONVENIENCE CARD Allows you to pay a provider/ vendor directly from your HCFSA at the point of purchase for eligible health care expenses. Card reimburses up to your annual election. Submit receipt documentation & Claim Form EXCEPT when transaction equals a copayment amount from your prescription, medical, dental, or vision plan. 8

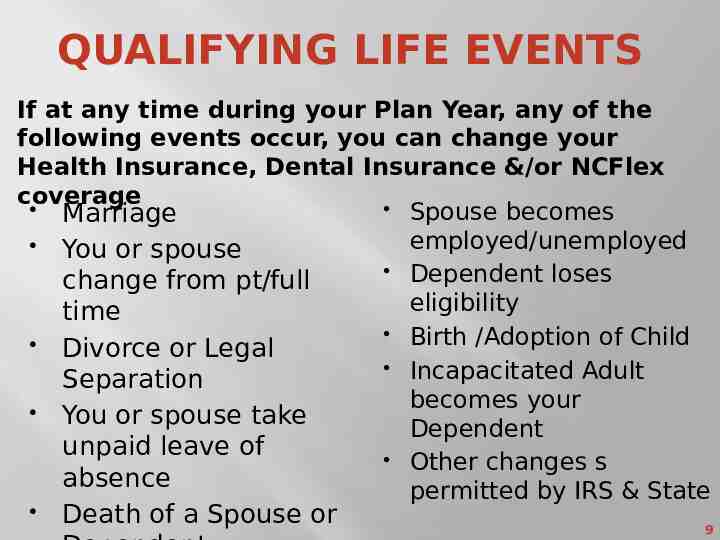

QUALIFYING LIFE EVENTS If at any time during your Plan Year, any of the following events occur, you can change your Health Insurance, Dental Insurance &/or NCFlex coverage Spouse becomes Marriage employed/unemployed You or spouse Dependent loses change from pt/full eligibility time Birth /Adoption of Child Divorce or Legal Incapacitated Adult Separation becomes your You or spouse take Dependent unpaid leave of Other changes s absence permitted by IRS & State Death of a Spouse or 9

AGENCY SPECIFIC INSURANCE In addition to the state-sponsored insurance programs, DPS can approve and make available other insurance options for DPS employees. These insurance programs are approved through the DPS Insurance Committee and are administered through private insurance agencies/brokers. The supplemental agency-specific plans are NOT part of N.C. State Government and, therefore, are NOT transferable if you leave DPS and transfer to another State Agency. Current Options: MetLife Dental The MetLife dental insurance is comparable to the NC Flex high option dental plan. 10

NC HEALTHSMART NC HealthSmart is an initiative by the State Health Plan to provide employees with resources and information to be as healthy as you can be. Please visit the NC HealthSmart Wellness Programs link on the www.shpnc.org website to view a wealth of resources that can help you reach your health and wellness goals. 11

AFFORDABLE CARE ACT Offers individuals to buy private health insurance through a 'Health Insurance Marketplace‘. This allows you to find private health insurance options to compare with the State's health coverage In purchasing private insurance thru the Exchange, you may be eligible for a tax credit, which may result in a lower premium. Please be aware that if you purchase a private health plan through the Exchange, you may lose your employer contribution to the health benefit plan offered by the State. 12

WORKERS COMPENSATION Provides medical benefits, compensation for lost time from work and compensation for any permanent or permanent partial disability that results from a compensable job related injury. All claims are handled by CorVel, a third party administrator. CorVel decides whether a claim is compensable 13

WORKERS COMPENSATION Employee Responsibilities: Immediately report any injury/illness by notifying the supervisor or work location designee when an on the job injury/illness occurs. Provide written notice to the work location that an injury/illness occurred by completing the DPS WC-EE Form. Accept medical treatment by a medical provider approved by the employer/CorVel to treat the injury. Obtain and provide a Medical Authorization Form for the treating physician to complete. Follow the prescribed treatment to affect a cure for the injury (NOTE: Refusal may bar the employee from further compensation until such refusal is resolved). Provide supervisor with any medical restrictions (NOTE: Refusal to comply with work restrictions may bar the employee from further compensation.) Employees without restrictions shall return to the regular work schedule). Provide supervisor with an out of work medical note. The supervisor will forward a copy of the medical note to the Workers’ Compensation office. Maintain contact with supervisor weekly while out of work. 14

EMPLOYEE ASSISTANCE PROGRAM The EAP Program is a contracted service with McLaughlin Young The provide referrals and assistance on many issues: Personal Counseling Personal Health/Wellness Work/Life Services Elder Care Issues There is no fee for the services provided by the EAP. 15

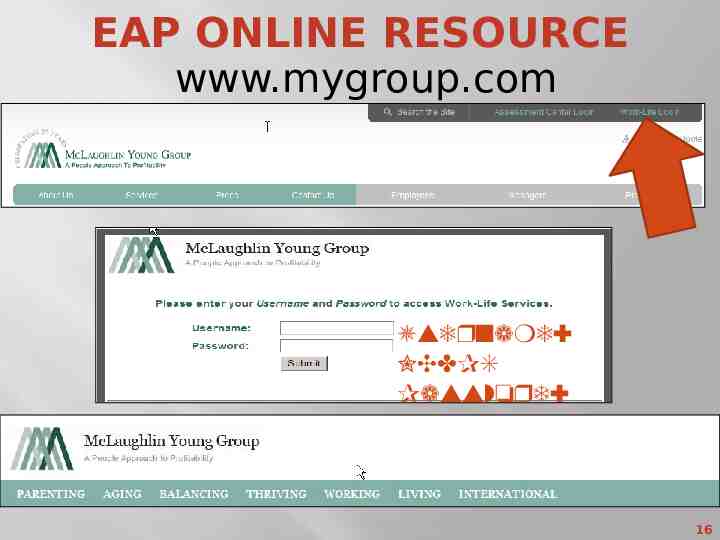

EAP ONLINE RESOURCE www.mygroup.com Username: NCDPS Password: Guest 16

WE CARE WE CARE is a new initiative created by DPS to address employees’ overall wellness. WE CARE stands for Wellness Education Committed to Assisting and Reaching our Employees and is supported by the NCDPS Employee Wellness and Resilience Committee. The purpose of the WE CARE initiative is to provide all DPS Employees with positive reinforcements through multiple avenues and to support them when they are faced with adverse situations. We Care Programs include: QPR Gatekeeper Suicide Prevention Training Program Corrections Fatigue to Fulfillment Training Program 17

VETERANS EARN AND LEARN Veterans have the opportunity to “EARN and LEARN” in a Registered Apprenticeship while receiving GI Bill education benefits? DPS is working together with the Department of Commerce and NC Works/apprenticeship to make GI Bill approval for registered apprenticeship programs a seamless process. Registered Apprenticeship programs are qualified to be “Approved for GI Bill ” Visit the website for more information. 18