Fleet Management AGENCY FLEET COORDINATOR TRAINING fleet.wv.gov Photo

85 Slides4.86 MB

Fleet Management AGENCY FLEET COORDINATOR TRAINING https://fleet.wv.gov Photo by Roger Fenton (1819–1869) / Public domain

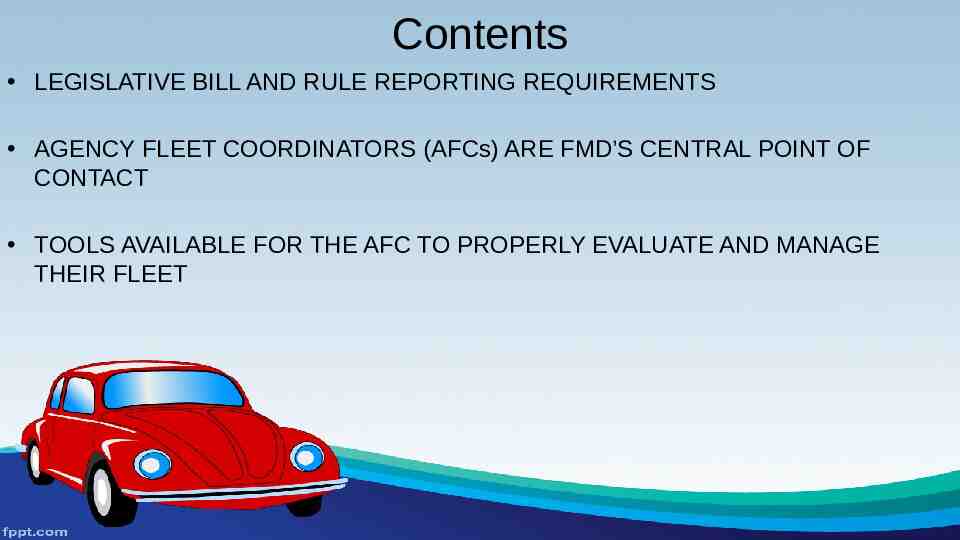

Contents LEGISLATIVE BILL AND RULE REPORTING REQUIREMENTS AGENCY FLEET COORDINATORS (AFCs) ARE FMD’S CENTRAL POINT OF CONTACT TOOLS AVAILABLE FOR THE AFC TO PROPERLY EVALUATE AND MANAGE THEIR FLEET

LEGISLATIVE POLICIES CONCERNING STATE OWNED AND OPERATED VEHICLES HB4015 HB103 ADMINISTRATIVE RULE TITLE 148 SERIES 3 STATE-OWNED VEHICLES ADMINISTRATIVE POLICY, EMPLOYEE USE OF EMPLOYER PROVIDED MOTOR VEHICLES COMPLETE VERSIONS CAN BE FOUND ON THE FLEET MANAGEMENT DIVISION’S WEBSITE http://www.fleet.wv.gov/

HB4015 – Passed during the 2018 Legislative Session, effective June 5, 2018 Establishes the requirements of governing the use of state vehicles Reporting requirements and responsibilities for fleet coordinators Information to be collected and maintained on state vehicle log sheets Manner for each spending unit to report to the division and the information that shall be collected and maintained Requirements and polices governing commuting and take home state vehicles The DMV relicensing project Annual report Auditor’s Office 20% compliance

HB103 – Passed during the 2018 Legislative Session, effective June 5, 2018 Added a requirement to HB4015 that require spending units to send FMD a list of bona fide noncompensatory business reasons for which a state vehicle is being provided to each employee on or before July 1st each year Reporting form DOA-FM-HB-103 found on FMD webpage https://fleet.wv.gov/AFC Resources/Pages/default.aspx

LEGISLATIVE RULE 148CSR03 – Passed during the 2018 Legislative Session, effective date 3/1/2019 Administration Rule Title 148 Series 3 State-Owned Vehicles Authority §5A-3-48, 5A-12-5 Expands on HB4015 Provides dates and identifies the data and information that needs to be maintained and reported https://fleet.wv.gov/AFC Resources/Pages/default.aspx

Administrative Policy: Employee Use of Employer Provided Motor Vehicles https://fleet.wv.gov/new-driver-orientation/Documents/Governor%27s%20Policy%20effective%2010-31-18.pdf This policy is to be reviewed by each driver of a state owned vehicle annually. Compliance must be documented with DOA-FM-011 by January 15 of each calendar year. A copy of this policy must be kept in each employer provided vehicle.

BONA FIDE NONCOMPENSATORY EMPLOYEES WHO ARE PROVIDED A STATE VEHICLE SOURCE HB103 DOA-FM-HB-103 FORM TO BE PROVIDED TO FMD ON OR BEFORE JULY 1ST OF EACH YEAR 2.3. “Commuting” means the use of a state vehicle by an employee who has been assigned a state vehicle, whether permanent or temporary, to drive to and from the employee’s home and regular place of employment, in accordance with the Internal Revenue Service Publication 15-B, Employer’s Tax Guide to Fringe Benefits. 2.4. “De Minimis personal use” means the use of a state-owned vehicle for personal purposes, of which the value of that personal use is so small that accounting for it would be unreasonable and administratively impractical, including while commuting when permitted, in accordance with the Internal Revenue Service Publication 15-B, Employer’s Tax Guide to Fringe Benefits.

AGENCY FLEET COORDINATORS 148CSR03

SPENDING UNITS SHALL NAME A FLEET COORDINATOR AND SUBMIT TO FMD Beginning each fiscal year form DOA-FM-006 will need to be submitted to FMD

AFCs ARE THE CENTRAL POINT OF CONTACT BETWEEN FMD AND ENTITIES WITHIN YOUR AGENCY: Responsible for making sure invoices from ARI maintenance, fuel, and lease payments are forwarded to appropriate accounts payable representative in your agency Responsible for communication with fixed asset person regarding entry of agency-owned vehicle into OASIS – remember this must be done prior to receiving state plates Updating vehicle information with BRIM Responsible for forwarding all communication from FMD to the appropriate person within your spending unit Responsible for ordering vehicles for replacement Responsible for reporting requirements Driver training Accident procedures

Agency Fleet Coordinator Schedule of Reporting Checklist DATE REPORTING REQUIRMENTS INFORMATION FOUND Governor's Policy for State Review driver understanding of the Governor's Administrative employee use of Employer Provided Policy of Employee Use of Employer Provided Motor Vehicles/ Motor Vehicles Driver Completes December 31 of each Driver Completes the Employee Acknowledgement form DOA-FM- the Employee Acknowledgement year 011 form. A copy to the policy must be in each state vehicle. form DOA-FM-011 form. July 1 of each year All vehicles must be in wvOASIS Fixed Assets Spending Units shall affirm that all vehicles are in Fixed Assets with Surplus Property July 1 each year All previous fiscal year Utilization Exemption Request forms are void and new forms must be submitted July 1 each year July 1 each year Spending unit names a Fleet Coordinator and submits to FMD New Insurance cards must be in every vehicle Surplus Property or wvOASIS HelpDesk DOA-FM-013 form in the forms data base on FMD webpage and ARI General Info tab DOA-FM-006 form in the forms Data base on FMD webpage FMD webpage On or before July 1 each year Spending unit shall prepare and maintain a list of all employees who are provided a state vehicle and specify the bona fide noncompensatory business reasons for which the state vehicle is being provided to the employee DOA-FM-HB- 103 Found on FMD webpage July 31 each year Spending unit shall report to Fleet Management Division the number of occasions off-hours/after-hours that a vehicle was used that has an approved Utilization Exemption Request for categories SEV or ERV. This report can be run in ARI

Agency Fleet Coordinator Schedule of Reporting Checklist Cont. DATE October 1 each year October 1 each year October 1 each year October 1 each year 5th of each Month REPORTING REQUIRMENTS AFC are to report Mileage Reimbursement data to FMD for previous fiscal year AFC are to report Rental Vehicle data to FMD for previous fiscal year AFC are to report all vehicle / driver complaint data to FMD for previous fiscal year AFC are to report all vehicle operating costs to FMD for previous fiscal year INFORMATION FOUND wvOASIS reports on Object and SubObject Codes. Call wvOASIS HelpDesk wvOASIS reports on Object and SubObject Codes. Call wvOASIS HelpDesk AFC to track ARI Database and other information tracked by AFC Email request from FMD Monthly Report requested Odometer Readings to FMD Ensures drivers report commuting miles on Vehicle Log Sheet and sends copy to FMD Reviews vehicle usage and submits Utilization Exemption Request forms as needed Daily / As Needed Ensures new drivers have valid license and completes the DOAFM-023 form as well as the Administration Policy AFC to track and have Driver complete DOA-FM-11 Monthly Daily / As Needed Daily / As Needed Daily / As Needed AFC to collect from Drivers DOA-FM-013 form and ARI General Info tab Complete DOA-FM-021 Vehicle Change Request form as needed DOA-FM-021 form on FMD webpage Review ARI Dashboard for Alerts and Widgets ARI insights Dashboard License/Registration changes must be submitted to FMD within 30 days of the change DMV

148-3-11. State-owned vehicle data required to be reported to the Fleet Management Division. 11.1. Each spending unit with state-owned vehicles shall conduct an annual survey of its fleet and reconcile its vehicle records with those of the Fleet Management Division and with the centralized inventory database maintained by the Enterprise Resource Planning Board. 11.2. Agency fleet coordinators shall provide by October 31st each year, or upon request, to the Fleet Management Division data on each state-owned vehicle, including: 11.2.a. vehicle identification number; 11.2.b. manufacturer, make, model and year of the vehicle; 11.2.c. class or type of each vehicle; 11.2.d. license plate number of each vehicle; 11.2.e. date of acquisition of each vehicle; 11.2.f. vehicle inspection records of each vehicle; 11.2.g. annual costs associated with vehicle rental expenses;

11.2.h. annual reimbursement by the agency for employees’ personal vehicle use, which shall include total miles and reimbursement rate; 11.2.i. funding source for each vehicle (department number, unit number and fund number); 11.2.j. odometer readings for each vehicle; 11.2.k. fuel usage of each vehicle; 11.2.l. all maintenance events associated with each vehicle; and 11.2.m. annual total indirect costs of operating state-owned vehicles for the agency. 11.3. The Fleet Management Division will provide to the Governor and Joint Committee on Government and Finance an annual report of state vehicle usage, including operating costs and the number of vehicles.

VEHICLE LOG

§148-3-10. Commuting in state-owned vehicles 10.1. State-owned vehicles that are assigned primarily to one employee may be used for commuting to and from the employee’s regular workplace so long as the commuting value is calculated and reported as a fringe benefit. 10.2. Commuting value shall be calculated in accordance with Internal Revenue Service Publication 15-B, Employer’s Tax Guide to Fringe Benefits. 10.3. If an employee has been assigned a vehicle and the vehicle is used to commute to and from the employee’s regular workplace during that temporary assignment, commuting value must be calculated and reported for the days the employee used the state-owned vehicle to commute. 10.3.a. The employee assigned to the vehicle is responsible for accurately collecting information needed to calculate the commuting value and reporting to the appropriate person within the spending unit that manages payroll. 10.4. The spending unit shall report the commuting value as wages and salary to the Internal Revenue Service and the State of West Virginia and shall report the commuting value at least annually to the Fleet Management Division on the prescribed form. 10.5. Failure to submit the prescribed form may result in the termination of the assignment of a vehicle to the employee, will result in a determination by the spending unit business office that miles driven during the unreported period are personal use miles, and may result in applicable penalties levied by the Internal Revenue Service.

MINIMUM UTILIZATION §148-3-9. Minimum Utilization. 9.1. To ensure proper utilization and to justify the size of the state’s fleet, state-owned vehicles must meet an annual average minimum monthly mileage of 1,100, less any commuting miles. 9.2. For vehicles with an annual average of less than 1,100 miles per month, if the spending unit wishes to retain the vehicle, the spending unit must request a waiver from the minimum mileage required in Subsection 9.1 of this section. The request shall be submitted to the Fleet Management Division on the prescribed form. A waiver granted by the Fleet Management Division is valid until the end of the fiscal year and must be resubmitted by the spending unit annually. JULY 1 BEGINNING OF FISCAL YEAR UTILIZATION FORMS ARE VOID AND NEW FORMS MUST BE SUBMITTED REVIEW THIS SECTION OF THE LEGISLATIVE RULE FOR CATEGORIES OF EXEMPTIONS TO BE USED WITH FORM DOA-FM-013

9.3.b. SEV - Vehicles assigned to employees whose job duties require the constant use or continuous availability of specialized equipment which cannot feasibly or economically be transferred between a pool vehicle or carried in personal vehicles. Such equipment may include medical supplies, monitoring or testing equipment, or equipment necessary to carry out the mission of the spending unit. 9.3.c. ERV - Vehicles assigned to employees who are on call 24-hours a day, or who must respond to emergencies on a regular or continuing basis where the location requiring the emergency response is not the employee’s regular workplace. This report is due July 31 of each year. Each spending unit must report the number of occasions off-hours/after-hours that a vehicle was actually utilized for categories SEV or ERV.

Fleet replacement and lifecycle management §148-3-4. Purchase of New or Replacement Vehicles. 4.1. Regardless of means of acquisition, a spending unit may not add or replace vehicles in its fleet without prior notification and approval by the Fleet Management Division. The request shall be made on the form prescribed by the Fleet Management Division. The Fleet Management Division shall respond to the request by the spending unit within five business days of receiving the request. 4.2. The Fleet Management Division will approve the purchase of a new vehicle to replace an existing vehicle: 4.2.a. if the existing vehicle is more than five years old and has more than 120,000 miles, 4.2.b. if the existing vehicle is destroyed and is considered a total loss, or 4.2.c. if the existing vehicle requires repairs or maintenance with costs that cannot be justified based upon the remaining life of the vehicle.

Mandatory forms that need submitted to Fleet Management Division DOA-FM-006 Agency Fleet Coordinator Contact Profile – This form is to be used to designate the Agency Fleet Coordinator for your agency. It is also used when you want to modify the existing Agency Fleet Coordinator. Should be submitted on an as needed basis and is due by July 1 st of each year DOA-FM-007 Vehicle Lease & Administrative Agreement – This form is pre-filled by the FMD Fleet Coordinator for any vehicle that has been leased through Fleet Management Division or has requested ARI services. The form is then sent to the AFC who is responsible for ensuring completion of the Driver Information and signature sections. DOA-FM-013 Agency Fleet Utilization Exemption – This form is to be submitted annually (on or before July 1 st of each year) and should denote the specified reason for the vehicle’s underutilization. DOA-FM-021 Vehicle Change Request – This form should be used to record any alterations in the vehicle’s storage address, operator information, etc. Must be submitted prior to any planned revisions.

Mandatory forms that need submitted to Fleet Management Division DOA-FM-059 Vehicle Request – This form is to be submitted to FMD anytime a vehicle is being acquired or decommissioned, prior to occurrence. All vehicle acquisitions must first receive approval from both the Cabinet Secretary of the agency, as well as the Governor’s office prior to submission (unless the agency in question is exempt from the Governor’s office approval). DOA-FM-003 Daily Use Vehicle Reservation Request – This is the form FMD provides for reservations of our daily use rental fleet. DOA-FM-HB-103 Driver List for noncompensatory business reasons – This form should be completed to specify the bona fide noncompensatory business reasons for which a state vehicle is provided to an employee. Should be submitted to FMD on or before July 1 st of each year. DOA-FM-067 State of WV Vehicle Log Sheet (Submission is mandatory ONLY if commuting mileage is recorded) – All commuting miles should be reported to FMD on a monthly basis. This form provides a template for the information your vehicle log sheet should include. If no commuting miles are driven, this form should not be submitted to FMD and should be retained internally only.

Mandatory forms that should be utilized internally DOA-FM-011 Fleet Policies and Procedures Driver Acknowledgement – This acknowledgement form refers to the review of the Governor’s administrative policy on Employee use of Employer Provided Motor Vehicles. It should be completed by your drivers annually by January 15 th of each year. It also should be completed by any new drivers your agency assigns. The form should be retained internally and should not be submitted to FMD. DOA-FM-023 Defensive Driving Training and DMV Driver's License Record – This form should be completed both annually and as needed and submitted to BRIM as well as retained internally.

Supplementary forms for your use DOA-FM-031 Fuel Card User Agreement – This acknowledgement form should be used prior to your drivers utilizing an ARI fuel card. This should be retained internally and should not be submitted to FMD. DOA-FM-018 Fleet Vehicle Inspection Checklist – This form provides a helpful template for your driver’s vehicle inspection. This form can be modified to better suit your agency’s mission for the vehicle. Should be retained internally and should not be submitted to FMD. DOA-FM-067 State of WV Vehicle Log Sheet – This form provides a template for the information your vehicle log sheet should include. This form can be modified to better suit your agency’s mission for the vehicle. Should be retained internally with the exception if commuting miles are driven. All commuting miles should be reported to FMD on a monthly basis.

FUEL AND MAINTENANCE PER 148CSR03 §148-3-12. Vehicle management programs provided by the Fleet Management Office. 12.1. The Fleet Management Division will offer to spending unit’s vehicle management programs including, but not limited to fuel purchasing, repairs and maintenance management, towing, and short-term vehicle rentals. If the Fleet Management Division provides a fuel or maintenance management program, agencies with state-owned vehicles must utilize the program provided. Agencies may request in writing an exemption from the management program with justification for the exemption. The Fleet Management Division will evaluate the request for exemption and recommend approval or denial of the request to the Secretary of the Department of Administration, who will make the final decision on approval or denial of the request for exemption.

ARI Insights https://ariinsights.arifleet.com

ARI Insights ARI Insights Agenda 1. 2. 3. 4. Dashboard and Widgets Quick Search Search Tab Reporting Tab

ARI Insights Dashboard/Widgets Dashboard/General Fleet Info Three biggest are Inventory, Fuel and Maintenance

ARI Insights Dashboard/Widgets Dashboard Store Where you can customize your dashboard

ARI Insights Dashboard/Widgets Inventory Dashboard

ARI Insights Dashboard/Widgets Maintenance

ARI Insights Dashboard/Widgets Fuel

ARI Insights Dashboard/Widgets Other facts about the dashboard 1. 2. 3. 4. 5. 6. The data displayed should only be for the vehicles you are over In ARI the Division is equivalent to the OASIS Cabinet and the Prefix is equivalent to the Bill Codes Widgets can be moved around Other widgets can be added to a dashboard Filters can be created to only look at specific items Clicking on certain data within widgets will give you a detailed vehicle listing

ARI Insights Dashboard/Widgets Adding widgets to a dashboard Scroll to the bottom of the page and in a blank space click the plus sign that shows up

ARI Insights Dashboard/Widgets Adding widgets to a dashboard Once you click the plus sign another page will pop up and you can drag and drop whichever widgets you would like into whichever space you would like

ARI Insights Dashboard/Widgets Adding filters to dashboard Click on blue car filter at the top right of the screen then click on “Create a new vehicle filter”

ARI Insights Dashboard/Widgets Adding filters to dashboard You can select from the filters that come up or you can add new filters from the “Add Fields” drop down box

ARI Insights Dashboard/Widgets Getting specific vehicle data from a widget Click on a number or a piece of a graph to get an excel style list of the vehicles that make up that widget The example below is of 5 vehicles that went over their tank capacity in the last week

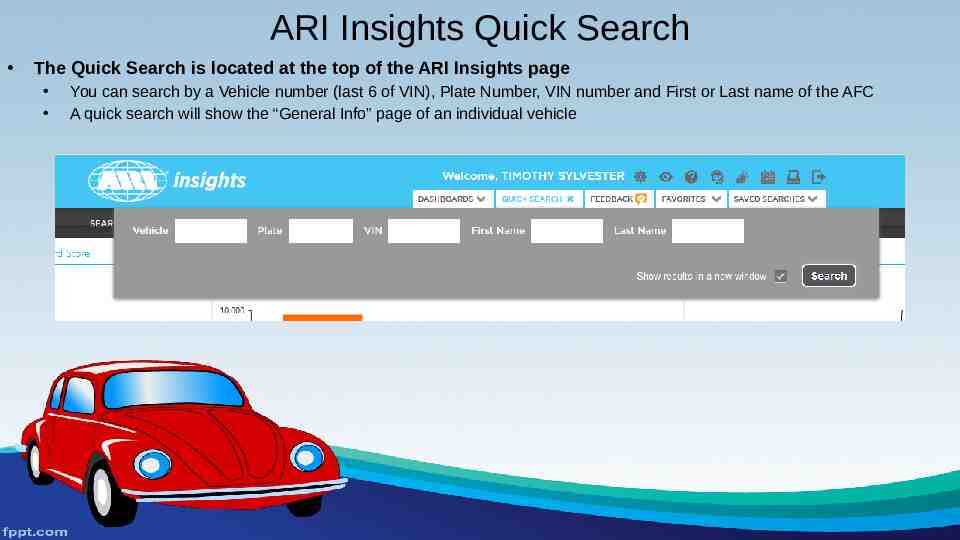

ARI Insights Quick Search The Quick Search is located at the top of the ARI Insights page You can search by a Vehicle number (last 6 of VIN), Plate Number, VIN number and First or Last name of the AFC A quick search will show the “General Info” page of an individual vehicle

ARI Insights Quick Search

ARI Insights Search Tab The search tab consist of many vehicle related reports The two most used reports are “General Vehicle” and “Inventory Management” These reports can be filtered and customized in multiple ways You can save the customized reports to the “Saved Searches” tab

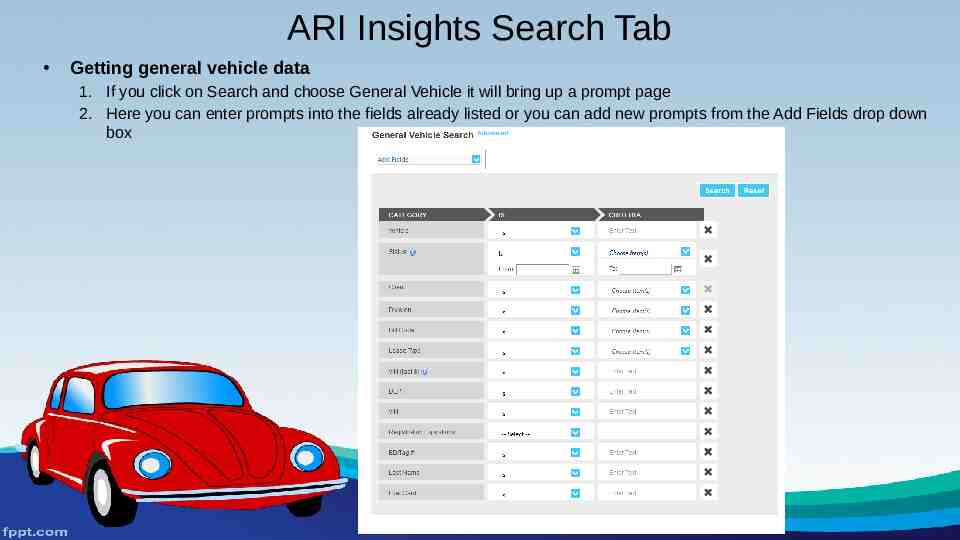

ARI Insights Search Tab Getting general vehicle data 1. If you click on Search and choose General Vehicle it will bring up a prompt page 2. Here you can enter prompts into the fields already listed or you can add new prompts from the Add Fields drop down box

ARI Insights Search Tab Getting general vehicle data Once you have all of your prompts entered click search and your data will come up in a listed format

ARI Insights Search Tab Customizing a Search 1. In the top left under “Options” select “customize” 2. From here you can select different fields to add to the report 3. Once you have all the fields you want added checked, click “apply” and the new fields will be added at the end of the report

ARI Insights Search Tab Saving a Search 1. In the top left under “Options” select “Save Search” 2. In the center of the screen a “Save Search Name” box will appear and you will type in what you want to call this search 3. The saved search will save under the “Saved Searches” tab

ARI Insights Search Tab Exporting a search as an excel file 1. Under the “Actions” tab select “Export List” to excel 2. Or click the excel symbol on the right side of the screen

ARI Insights Reporting Tab Reporting tab is where detailed reports can be found “Reporting Template Search” is where all of the reports can be found

ARI Insights Reporting Tab The most important reports that we will discuss should be listed under “My Published Reports” Those reports are the Fixed And Operating Expenses and the LOV (Life of Vehicle) Operating Costs reports You can also search under the different Report Data Areas to find several canned reports

ARI Insights Reporting Tab Fixed and Operating Report 1. 2. 3. 4. Start and end dates are mandatory prompts Date prompts need to be entered as a four digit year followed by a two digit month EX: 201904 Optional prompts are Division and Prefix (Division is cabinet and Prefix is Bill Code) Multiple Divisions and Prefixes can be entered into this report

ARI Insights Reporting Tab Fixed and Operating Report Tabs 1. 2. 3. 4. 5. Summary – Shows a summary of expenses in a graph format Expense Summary – Shows a summarized breakout of expenses by expense type and expense category Fleet Breakouts – Shows expenses by an expense group and group detail Vehicle Detail – Shows expenses per vehicle Op Expense by Qtr, Op Expense by Month, Cost PVPM, Fuel Expense by Month and CPM per Month – All are bar graphs 6. Operating exp – Shows operating expense totals 7. Definition – Gives an explanation of the report

ARI Insights Reporting Tab LOV Operating Cost Report 1. Shows a snapshot of active vehicles and their maintenance and fuel expenses broken out in different ways 2. Automatically runs when you open it 3. Contains a description tab that describes every field on the report

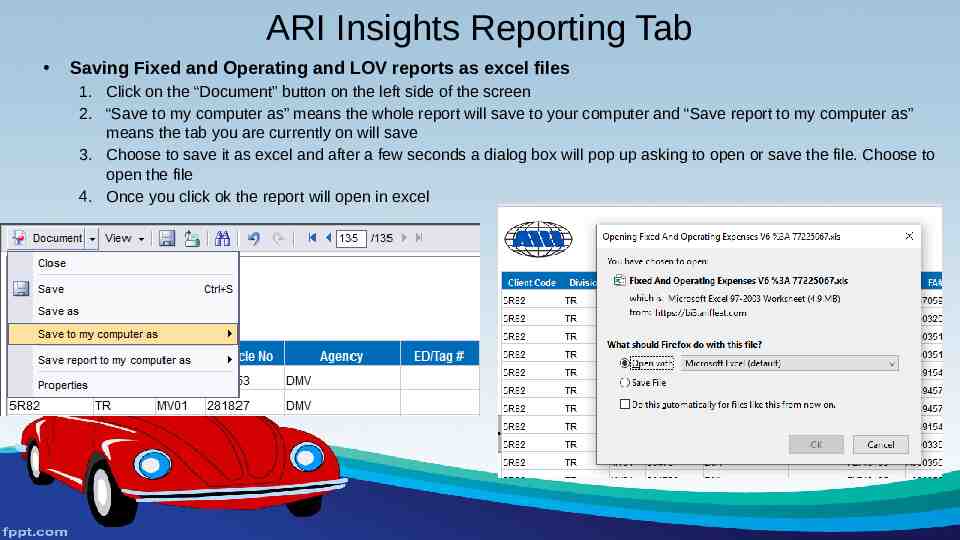

ARI Insights Reporting Tab Saving Fixed and Operating and LOV reports as excel files 1. Click on the “Document” button on the left side of the screen 2. “Save to my computer as” means the whole report will save to your computer and “Save report to my computer as” means the tab you are currently on will save 3. Choose to save it as excel and after a few seconds a dialog box will pop up asking to open or save the file. Choose to open the file 4. Once you click ok the report will open in excel

wvOASIS wvOASIS Agenda 1. 2. 3. 4. 5. 6. 7. 8. https://myapps.wvsao.gov/apps/Portal/Default.aspx FA, FD, FM and FC documents in the Financial Application Vehicle catalog codes (02,03,32,50) FARCOMP page in the Financial Application AM-17V vehicle inventory report AM-006 assets retired report AM-043 asset documents report Vehicle related expenses through BI reporting o Object and sub-object codes

wvOASIS FA Documents 1. 2. 3. 4. 5. 6. Fixed Asset Acquisition document Document used to put an asset into OASIS FMD creates the FA documents for the vehicles that are financed through them The agencies create FA documents for the vehicles that they own When entering vehicles it is important to be as descriptive as possible Component-Specification tab important items: o o o o Manufacturer The make of the vehicle Model Number The vehicle model Drawing The vehicle’s model year Serial Number The VIN of the vehicle

wvOASIS FA Documents Cont. 1. Component-Component Classification Fixed Asset Catalog o 02 1 Ton and Under vehicles 1 Ton and Under is not based on weight, rather it is based on a classification of vehicles EX: F-350, Ram 3500, Silverado 3500 and under would be considered 1 Ton and Under o 03 Over 1 Ton Also not based on weight, but based on a classification of vehicles EX: F-450, Ram 4500, Silverado 4500 and up would be considered over 1 Ton o 32 Agency third party leased vehicles Vehicles that an agency leases for a year or more from a private company o 50 Licensed trailers New catalog code created to keep track of licensed non-motorized units All licensed trailers will be converted to the new catalog code by FMD and OASIS

wvOASIS FD Documents 1. Used to retire a vehicle 2. When an agency is exempt from surplus, FMD will approve the FD once the required documentation is attached to the header Bill of sale Executed title 3. Methods of disposition for a vehicle Deliver to surplus Surplus pick-up Sell on-site Trade-in Sell for scrap Recycle/dispose as waste Lost asset Stolen asset Destroyed asset

wvOASIS FM Documents 1. Used to modify existing vehicles in OASIS 2. Things that usually get modified Year, Make or Model VIN numbers o Requires approval from surplus with documentation attached to the header Catalog codes Custodian codes

wvOASIS FC Documents 1. Used to cancel a vehicle in OASIS 2. Usually only used to cancel duplicate VIN numbers

wvOASIS FARCOMP 1. This is the OASIS Financial Application page that you can search for active assets 2. Can search on multiple fields, the two most used being Fixed Asset Number and Serial Number 3. * can be used as a wild card in any search field EX: Serial Number can be searched using the last six of the VIN *012345

wvOASIS FARCOMP Cont. 1. DMV Requires a print out of the FARCOMP page with the General Information, Specification, and Acquisition/Disposition tab expanded in order to get a license plate for a vehicle

wvOASIS Fixed Asset BI Reports 1. WV-FIN-AM-017V Vehicles by Department 2. WV-FIN-AM-006 Assets Retired 3. WV-FIN-AM-043 Fixed Asset Documents

wvOASIS Fixed Asset BI Reports 1. WV-FIN-AM-017V Vehicles by Department Shows an OASIS inventory of the vehicles you own Run for catalog codes 02,03,32 and 50

wvOASIS Fixed Asset BI Reports 1. WV-FIN-AM-006 Assets Retired Will show the vehicles that have been decommissioned in OASIS Run for catalog codes 02,03,32 and 50

wvOASIS Fixed Asset BI Reports 1. WV-FIN-AM-043 Fixed Asset Documents Will show all fixed asset documents in any state or phase Run for catalog codes 02,03,32 and 50 to see vehicle related documents

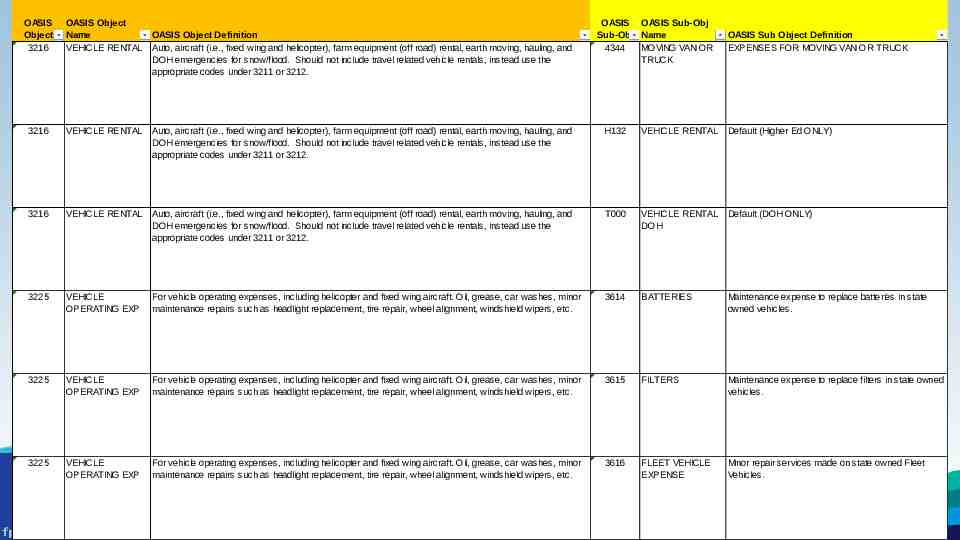

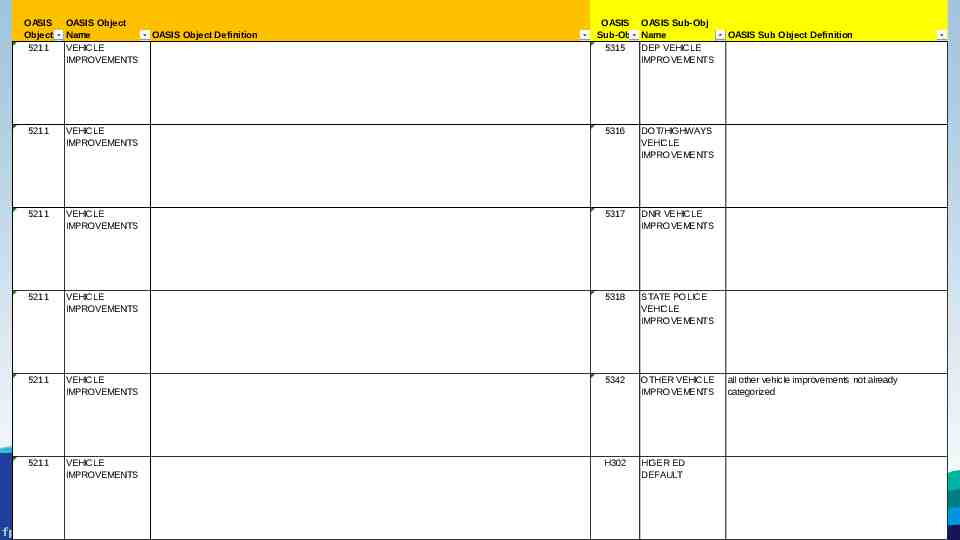

wvOASIS Vehicle Expense Reporting in Business Intelligence 1. WV-FIN-GL-146 Document Listing 2. Certain Objects and Sub-objects will list out all vehicle related expenses

wvOASIS WV-FIN-GL-146

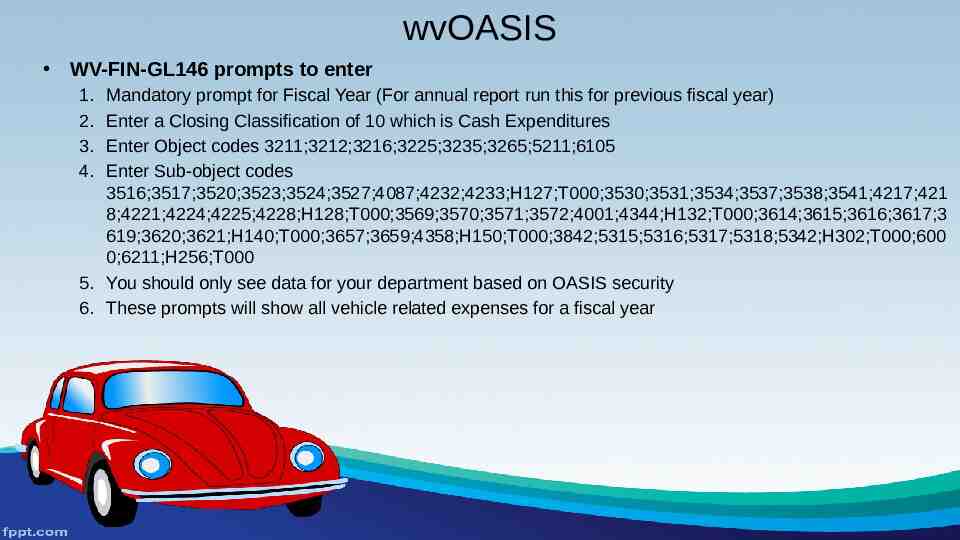

wvOASIS WV-FIN-GL146 prompts to enter 1. 2. 3. 4. Mandatory prompt for Fiscal Year (For annual report run this for previous fiscal year) Enter a Closing Classification of 10 which is Cash Expenditures Enter Object codes 3211;3212;3216;3225;3235;3265;5211;6105 Enter Sub-object codes 3516;3517;3520;3523;3524;3527;4087;4232;4233;H127;T000;3530;3531;3534;3537;3538;3541;4217;421 8;4221;4224;4225;4228;H128;T000;3569;3570;3571;3572;4001;4344;H132;T000;3614;3615;3616;3617;3 619;3620;3621;H140;T000;3657;3659;4358;H150;T000;3842;5315;5316;5317;5318;5342;H302;T000;600 0;6211;H256;T000 5. You should only see data for your department based on OASIS security 6. These prompts will show all vehicle related expenses for a fiscal year

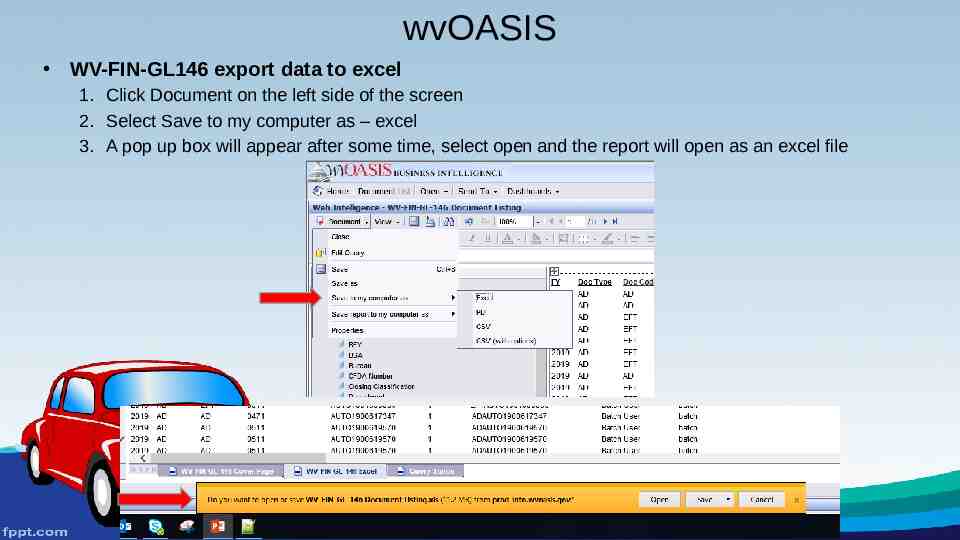

wvOASIS WV-FIN-GL146 export data to excel 1. Click Document on the left side of the screen 2. Select Save to my computer as – excel 3. A pop up box will appear after some time, select open and the report will open as an excel file

OASIS Object 3211 OASIS Object Name TRAVEL EMPLOYEE OASIS OASIS Sub-Obj OASIS Object Definition Sub-Obj Name Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of 3516 IN STATE CAR their job function/or position in accordance with the State Travel Regulations as issued by the Travel RENTAL Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3517 IN STATE GASOLINE RENTAL 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3520 IN STATE MILEAGE Costs associated with in state travel for mileage reimbursements for a state employee or offical conducting offical state business. 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3523 OUT OF STATE CAR RENTAL Costs associated with out of state travel for car rental fees by a state employee or offical conducting offical state business. 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3524 OUT OF STATE GASOLINE RENTAL Costs associated with out of state travel for car rental gasoline fees by a state employee or offical conducting offical state business. 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3527 OUT OF STATE MILEAGE Costs associated with out of state travel for mileage reimbursements for a state employee or offical conducting offical state business. OASIS Sub Object Definition Costs associated with in state travel for car rental fees by a state employee or offical conducting offical state business . Costs associated with in state travel for car rental gasoline fees by a state employee or offical conducting offical state business .

OASIS Object 3211 OASIS Object Name TRAVEL EMPLOYEE OASIS OASIS Sub-Obj OASIS Object Definition Sub-Obj Name OASIS Sub Object Definition Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of 4087 TURNPIKE Turnpike tolls/transponder fees their job function/or position in accordance with the State Travel Regulations as issued by the Travel TOLLS/TRANSPON Management Office, Division of Purchasing, Department of Administration and other approved travel plans. DER FEES This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 4232 IN STATE POV IN LIEU OF OTHER TRANSP MODE Costs associated with in state travel associated with an employee driving a personal vehicle in lieu of other transportation modes that are more cost effective, such as vehicle rental or airfare, and the reimbursement will only be paid up to the cost of the least expensive other transportation mode. 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 4233 OUT OF STATE POV IN LIEU OF OTHER TRANSP MODE Costs associated with out of state travel associated with an employee driving a personal vehicle in lieu of other transportation modes that are more cost effective, such as vehicle rental or airfare, and the reimbursement will only be paid up to the cost of the least expensive other transportation mode. 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. H127 TRAVEL EMPLOYEE Default (Higher Ed ONLY) 3211 TRAVEL EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. T000 TRAVEL EMPLOYEE DOH Default (DOH ONLY) 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3530 IN STATE CAR RENTAL Costs associated with a vehicle rental by a board member, commission member,consultant, contractor for authorized in state travel.

OASIS Object 3212 OASIS Object Name TRAVEL NON EMPLOYEE OASIS OASIS Sub-Obj OASIS Object Definition Sub-Obj Name Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of 3531 IN STATE their job function/or position in accordance with the State Travel Regulations as issued by the Travel GASOLINE Management Office, Division of Purchasing, Department of Administration and other approved travel plans. RENTAL This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3534 IN STATE MILEAGE Costs associated with mileage reimbursements by a board member, commission member,consultant, contractor for authorized in state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3537 OUT OF STATE CAR RENTAL Costs associated with a vehicle rental by a board member, commission member,consultant, contractor for authorized out of state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3538 OUT OF STATE GASOLINE RENTAL Costs associated with vehicle rental gasoline expense by a board member, commission for authorized out of state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3541 OUT OF STATE MILEAGE Costs associated with mileage reimbursements by a board member, commission member,consultant, contractor for authorized out of state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 4217 CLIENT PATIENT IN Costs associated with airfare by a client or patients of STATE CAR state hospitals or institutions for authorized in state RENTAL travel. OASIS Sub Object Definition Costs associated with vehicle rental gasoline expense by a board member, commission member,consultant, contractor for authorized in state travel.

OASIS Object 3212 OASIS Object Name TRAVEL NON EMPLOYEE OASIS OASIS Sub-Obj OASIS Object Definition Sub-Obj Name Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of 4218 CLIENT PATIENT IN their job function/or position in accordance with the State Travel Regulations as issued by the Travel STATE GASOLINE Management Office, Division of Purchasing, Department of Administration and other approved travel plans. RENTAL This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 4221 CLIENT PATIENT IN Costs associated with mileage by a client or patients STATE MILEAGE of state hospitals or institutions for authorized in state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 4224 CLIENT PATIENT OUT OF STATE CAR RENTAL Costs associated with car rental by a client or patients of state hospitals or institutions for authorized in state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 4225 CLIENT PATIENT OUT OF STATE GASOLINE RENTAL Costs associated with gasoline rental by a client or patients of state hospitals or institutions for authorized in state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 4228 CLIENT PATIENT OUT OF STATE MILEAGE Costs associated with mileage by a client or patients of state hospitals or institutions for authorized in state travel. 3212 TRAVEL NON EMPLOYEE Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of their job function/or position in accordance with the State Travel Regulations as issued by the Travel Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. H128 TRAVEL NON EMPLOYEE Default (Higher Ed ONLY) OASIS Sub Object Definition Costs associated with gasoline rental by a client or patients of state hospitals or institutions for authorized in state travel.

OASIS Object 3212 OASIS Object Name TRAVEL NON EMPLOYEE OASIS OASIS Sub-Obj OASIS Object Definition Sub-Obj Name Payments for authorized in-state and out-of-state travel expenses for persons who must travel as part of T000 TRAVEL NON their job function/or position in accordance with the State Travel Regulations as issued by the Travel EMPLOYEE DOH Management Office, Division of Purchasing, Department of Administration and other approved travel plans. This object code is applicable to state employees, board members, commission members, consultants, contractors, and students, patients, and inmates of state schools, hospitals and institutions. Includes athletic travel, team and associated individual travel, student recruiting expenses, and passports. 3216 VEHICLE RENTAL Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. 3569 EARTH MOVING, HAULING 3216 VEHICLE RENTAL Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. 3570 LEASED VEHICLES Vehicle lease payments made to an outside agency such as Enterprise. 3216 VEHICLE RENTAL Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. 3571 OTHER VEHICLE RENTAL 3216 VEHICLE RENTAL Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. 3572 RENTAL VEHICLES Fees paid for vehicle rentals. 3216 VEHICLE RENTAL Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. 4001 Employee Non Taxable Default OASIS Sub Object Definition Default (DOH ONLY) Rental of heavy equipment for the moving and hauling of rock, dirt, etc.

OASIS Object 3216 OASIS Object Name VEHICLE RENTAL 3216 VEHICLE RENTAL Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. H132 VEHICLE RENTAL Default (Higher Ed ONLY) 3216 VEHICLE RENTAL Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. T000 VEHICLE RENTAL DOH Default (DOH ONLY) 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. 3614 BATTERIES Maintenance expense to replace batteries in state owned vehicles. 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. 3615 FILTERS Maintenance expense to replace filters in state owned vehicles. 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. 3616 FLEET VEHICLE EXPENSE Minor repair services made on state owned Fleet Vehicles. OASIS Object Definition Auto, aircraft (i.e., fixed wing and helicopter), farm equipment (off road) rental, earth moving, hauling, and DOH emergencies for snow/flood. Should not include travel related vehicle rentals, instead use the appropriate codes under 3211 or 3212. OASIS OASIS Sub-Obj Sub-Obj Name 4344 MOVING VAN OR TRUCK OASIS Sub Object Definition EXPENSES FOR MOVING VAN OR TRUCK

OASIS Object 3225 OASIS Object Name VEHICLE OPERATING EXP OASIS Object Definition For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. OASIS OASIS Sub-Obj Sub-Obj Name 3617 LUBRICANTS 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. 3619 TIRES Maintenance expense to replace tires on state owned vehicles. 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. 3620 TOWING Towing cost for a state owned vehicle. 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. 3621 MISCELLANEOUS VEHICLE EXPENSES 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. H140 VEHICLE OPERATING EXP Default (Higher Ed ONLY) 3225 VEHICLE OPERATING EXP For vehicle operating expenses, including helicopter and fixed wing aircraft. Oil, grease, car washes, minor maintenance repairs such as headlight replacement, tire repair, wheel alignment, windshield wipers, etc. T000 VEHICLE OPERATING EXP DOH Default (DOH ONLY) OASIS Sub Object Definition Maintenance expense for fuels an lubricants for state owned vehicles.

OASIS Object 3235 OASIS Object Name OASIS Object Definition ENERGY EXP MTR Expenditures for petroleum supplies purchased to operate motor vehicles, equipment, and aircraft for State VEH/AIR. use. Includes gasoline, natural gas, diesel fuel, aircraft fuel, etc. OASIS OASIS Sub-Obj Sub-Obj Name 3657 DIESEL 3235 ENERGY EXP MTR Expenditures for petroleum supplies purchased to operate motor vehicles, equipment, and aircraft for State VEH/AIR. use. Includes gasoline, natural gas, diesel fuel, aircraft fuel, etc. 3659 GASOLINE Expenditures for gasoline purchased to operate motor vehicles or equipment for state use. 3235 ENERGY EXP MTR Expenditures for petroleum supplies purchased to operate motor vehicles, equipment, and aircraft for State VEH/AIR. use. Includes gasoline, natural gas, diesel fuel, aircraft fuel, etc. 4358 FUEL TAXES Expenditures for fuel taxes associated with the purchase of fuel 3235 ENERGY EXP MTR Expenditures for petroleum supplies purchased to operate motor vehicles, equipment, and aircraft for State VEH/AIR. use. Includes gasoline, natural gas, diesel fuel, aircraft fuel, etc. H150 ENERGY EXP MTR Default (Higher Ed ONLY) VEH/AIR. 3235 ENERGY EXP MTR Expenditures for petroleum supplies purchased to operate motor vehicles, equipment, and aircraft for State VEH/AIR. use. Includes gasoline, natural gas, diesel fuel, aircraft fuel, etc. T000 ENERGY EXP MTR Default (DOH ONLY) VEH/AIR. DOH 3265 REIMBURSEMENT Expense to Expense transfers for services provided in accordance with applicable state law and not identified by a specific object code(s). May also include authorized reimbursements to county and/or Local Governments which are not processed as expense to expense transactions. 3842 VEHICLE USE OASIS Sub Object Definition Expenditures for diesel purchased to operate motor vehicles or equipment for state use. Reimbursable expense for personal vehicle use.

OASIS Object 5211 OASIS Object Name VEHICLE IMPROVEMENTS 5211 VEHICLE IMPROVEMENTS 5316 DOT/HIGHWAYS VEHICLE IMPROVEMENTS 5211 VEHICLE IMPROVEMENTS 5317 DNR VEHICLE IMPROVEMENTS 5211 VEHICLE IMPROVEMENTS 5318 STATE POLICE VEHICLE IMPROVEMENTS 5211 VEHICLE IMPROVEMENTS 5342 OTHER VEHICLE IMPROVEMENTS 5211 VEHICLE IMPROVEMENTS H302 HIGER ED DEFAULT OASIS Object Definition OASIS OASIS Sub-Obj Sub-Obj Name 5315 DEP VEHICLE IMPROVEMENTS OASIS Sub Object Definition all other vehicle improvements not already categorized

OASIS Object 5211 OASIS Object Name VEHICLE IMPROVEMENTS OASIS Object Definition OASIS OASIS Sub-Obj Sub-Obj Name T000 VEHICLE IMPROVEMENTS DOH OASIS Sub Object Definition DOH USE ONLY 6105 VEHICLE REPAIRS Repair of vehicles used primarily for individual(s) transportation; autos, vans, buses, station wagons, aircraft (i.e., fixed wing and helicopters). This object code is to be used for repairs considered major repairs as opposed to regular maintenance. (Use Object Code 036 for regular maintenance.) 6000 VEHICLE REPAIR- Expense for mechanical repair to vehicle not MECHANICAL considered routine. 6105 VEHICLE REPAIRS Repair of vehicles used primarily for individual(s) transportation; autos, vans, buses, station wagons, aircraft (i.e., fixed wing and helicopters). This object code is to be used for repairs considered major repairs as opposed to regular maintenance. (Use Object Code 036 for regular maintenance.) 6211 DAMAGES TO STATE VEHICLES 6105 VEHICLE REPAIRS Repair of vehicles used primarily for individual(s) transportation; autos, vans, buses, station wagons, aircraft (i.e., fixed wing and helicopters). This object code is to be used for repairs considered major repairs as opposed to regular maintenance. (Use Object Code 036 for regular maintenance.) H256 VEHICLE REPAIRS Default (Higher Ed ONLY) 6105 VEHICLE REPAIRS Repair of vehicles used primarily for individual(s) transportation; autos, vans, buses, station wagons, aircraft (i.e., fixed wing and helicopters). This object code is to be used for repairs considered major repairs as opposed to regular maintenance. (Use Object Code 036 for regular maintenance.) T000 VEHICLE REPAIRS DOH USE ONLY DOH Expense to repair damages to state vehicles.

Questions Contact [email protected] Director: Kenny Yoakum - [email protected] Fleet Manager: Becky Farmer - [email protected] Fleet Administrator: Tim Sylvester - [email protected] Maintenance Analyst: James Parsons - [email protected] Fleet Assistant: Chena Hill - [email protected] Fleet Coordinator: Stephanie Lane - [email protected] Fuel Analyst: Kristi Abdalla - [email protected] Fleet Assistant: Michelle Spencer - [email protected] Call Toll Free: 1-855-817-1910

THANK YOU FOR ATTENDING The Fleet Management Division appreciates the teamwork each of you provide to the State of West Virginia’s management of the State’s vehicle assets. Please know each of the employees at FMD are always happy to assist you to do your job better.

FMD’S ACCOMPLISHMENTS

FMD’S ACCOMPLISHMENTS

FMD’S ACCOMPLISHMENTS

FMD’S ACCOMPLISHMENTS MV18 Contract: Assisted in acquiring/processing 527 vehicle requests – 92 Agency Owned – 356 Financed by FMD – 5 Reassigned – 74 Decommissioned July 2017 – March 2018: Collected and uploaded 26,235 odometer readings July 2017 – March 2018: Processed and tracked 96 state vehicle/driver complaints and toll violations July 2017 – March 2018: Processed 360 rental vehicle reservation requests July 2017 – March 2018: Completed 20 Agency Fleet Reviews covering 80% of the State’s licensed inventory with focus on inventory, maintenance and fueling cost along with highlighting the LOV report and the ARI Dashboard to assist with lowering operation cost.

FMD’S FUTURE PLANS Telematics Pilot Program through ARI – 50 GeoTab units with DEP Kiosk with online reservation, monitoring and reporting – An online reservation and scheduling system for pool or shared vehicles Vehicle keys are dispensed through an ATM-like box by an authorization code – Provides reports to agencies the data to maximize the utilization of vehicles – Provides data to agencies to manage and utilize their fleet more efficiently and effectively