WHAT ARE THE PRACTICAL CHALLENGES IN IMPLEMENTING IPSAS?

28 Slides661.50 KB

WHAT ARE THE PRACTICAL CHALLENGES IN IMPLEMENTING IPSAS? – INDONESIAN EXPERIENCE – Speaker: Binsar H Simanjuntak CHAIRMAN OF INDONESIAN GOVERNMENT ACCOUNTING STANDARDS COMMITTEE DEPUTY FOR MONITORING OF GOVERNMENT INSTITUTIONS, BPKP INDONESIA Presented at General Lecture Universitas Lampung (UNILA) Lampung, 21 Mei 2016

AGENDA 1. Indonesian Government Accounting Standards (IGAS) development 2. Benefits of Accrual Basis versus Cash Basis Accounting 3. Accounting Mandatates 4. Accrual Financial Statements 5. Implication of IGAS implementation to audit opinions in Central and Regional Governments 6. Indonesian Government Accounting Standards Committee 7. Adoption, Convergence, or Adaptation of IPSAS 8. IPSASB study on Indonesian Adoption of Government Accounting Standards 9. Comparison of IPSAS and IGAS 10.Practical Challenges in Implementing IGAS/IPSAS 11.Key Success Factors in Implementing IGAS/IPSAS 12.Conclusions 3

INDONESIAN GOVERNMENT ACCOUNTING STANDARDS (IGAS) DEVELOPMENT IGAS development from time to time . PRE-REFORM ACCOUNTING TRADITION ( until 2003) A MID WAY : THE CASH TOWARDS ACCRUAL BASIS (2004 – 2014) ACCRUAL ACCOUNTING (From 2015) No Government Accounting Standards Cash-based reporting (Cameral system): cash basis information on revenue and expenditure, no accrual information Implementation of Cash Towards Accrual Indonesian Government Accounting Standards (CTA IGAS) CTA accounting: cash basis information on revenue and expenditure, and accrual information on assets, liabilities and equities CTA IGAS applies to central and regional governments Implementation of Accrual Indonesian Government Accounting Standards (Accrual IGAS) Accrual accounting: cash basis information on revenue and expenditure, and accrual information on revenue, expense, assets, liabilities and equities Accrual IGAS applies to central and regional governments 4

BENEFITS OF ACCRUAL BASIS VERSUS CASH BASIS ACCOUNTING 1. Provide a comprehensive picture of government financial performance and position (asets and liabilities) for the purpose of transparency and accountability, and stakeholders decision making 2. Provide information for government performance evaluation related to programs/activities efficiency (cost calculation) and effectiveness (achievement of government goals) 3. Provide information for assets and liabilities management, allocation of resource and government finance statistics 4. Align with international best practices to allow cross-countries comparison 5

ACCOUNTING MANDATES Law Number 17 Year 2003 on State Finance Law Number 1 Year 2004 on State Treasury Law Number 15 Year 2004 on Audit of State Finance Management and Accountability Law Number 23 Year 2014 on Regional Governments Goverment Regulation Number 71 Year 2010 on Government Accounting Standards Government Regulation Number 58 Year 2005 on Regional Financial Management 6

ACCOUNTING ENTITY AND REPORTING ENTITY ACCOUNTING ENTITY REPORTING ENTITY Accounting Entity is a government unit that manages budget, asset and liabilities and therefore is obliged to perform accounting and prepare financial statements to be compiled into those of the reporting entity. Reporting Entity is a government unit consisting of one or more accounting entities which according to the statutory regulations is obliged to prepare and submit accountability reports in the form of general purpose financial statements Reporting Entity consist of (a) Central Government; (b) Regional Governments; (c) line ministries/agencies in Central Government (d) Spending units in central government/regional governments/other organization that according to the regulation is obliged to prepare financial statements (accountability report) 7

ACCRUAL FINANCIAL STATEMENTS 1. Statement of Budget Realizations 2. Statement of Changes in Accumulated Budget Surplus Balance 3. Statement of Operations 4. Statement of Changes in Equity 5. Balance Sheet 6. Statement of Cash Flows 7. Notes to the Financial Statements 8

ACCRUAL FINANCIAL STATEMENTS STATEMENT OF BUDGET REALIZATIONS Revenue and Grant Tax Revenue Non-tax Revenue Grants Expenditure Employee Goods/Services Capital Interest Subsidy Grant Social Assistance Other Expenditure Transfers to Regional Governments Budget Surplus (Deficit) STATEMENT OF CHANGES IN ACCUMULATED BUDGET SURPLUS BALANCE Beginning Balance of Accumulated Budget Surplus Utilization of Accumulated Budget Surplus Balance in current year Budget Surplus (Deficit) after Financing Corrections from previous year Others Ending Balance of Accumulated Budget Surplus Financing Domestic Financing Foreign Financing (Net) Foreign Loans (Gross) Subsidiary Loans Payment of Foreign Loans Budget Surplus (Deficit) after financing 9

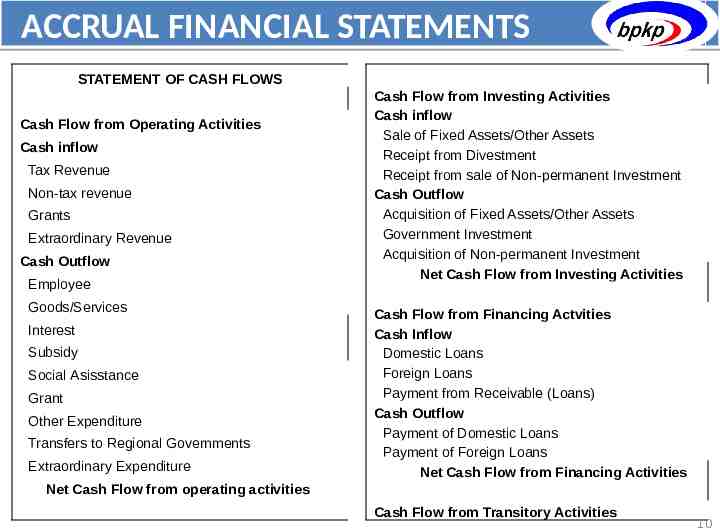

ACCRUAL FINANCIAL STATEMENTS STATEMENT OF CASH FLOWS Cash Flow from Operating Activities Cash inflow Tax Revenue Non-tax revenue Grants Extraordinary Revenue Cash Outflow Employee Goods/Services Interest Subsidy Social Asisstance Grant Other Expenditure Transfers to Regional Governments Extraordinary Expenditure Cash Flow from Investing Activities Cash inflow Sale of Fixed Assets/Other Assets Receipt from Divestment Receipt from sale of Non-permanent Investment Cash Outflow Acquisition of Fixed Assets/Other Assets Government Investment Acquisition of Non-permanent Investment Net Cash Flow from Investing Activities Cash Flow from Financing Actvities Cash Inflow Domestic Loans Foreign Loans Payment from Receivable (Loans) Cash Outflow Payment of Domestic Loans Payment of Foreign Loans Net Cash Flow from Financing Activities Net Cash Flow from operating activities Cash Flow from Transitory Activities 10

ACCRUAL FINANCIAL STATEMENTS STATEMENT OF CHANGES IN EQUITY STATEMENT OF OPERATIONS OPERATIONAL ACTIVITIES REVENUE Tax Revenue Non-Tax Revenue Grants EXPENSE Employee Goods and Services Interest Subsidy Grant Social Assistance Depreciation/Amortization Transfers to Regional Governments Other Expense Beginning Balance of Equity Surplus/Deficit Operational Cumulative Effect of changes in policies/errors Correction of inventories Revaluation of Assets Others Ending Balance of Equity SURPLUS/DEFICIT FROM OPERATIONAL ACTIVITIES NON OPERATIONAL ACTIVITIES Surplus on sale of non-current assets Surplus on settlement of non-current liabilities Deficit on sale of non-current assets Deficit on settlement of non-current liabilities SURPLUS/DEFICIT BEFORE EXTRAORDINARY ITEMS 11

ACCRUAL FINANCIAL STATEMENTS BALANCE SHEET ASSETS CURRENT ASSETS Cash Short-term Investment Tax/Non-tax Receivable Prepaid Expense Current Portion of Long-term Receivable Inventories LONG TERM INVESTMENTS Non-permanent Investment Permanent Investment FIXED ASSETS Land Equipment and Machinery Building and Structure Road, Irrigation and Network Other Fixed Assets Construction in Progress Accumulated Depreciation OTHER ASSETS Installment Sales/Indemnification Receivable Partnership with Third Parties Intangible Assets LIABILITIES CURRENT LIABILITIES Payable to Third Parties Interest payables Current portion of Non-current Liabilities Unearned revenue NON-CURRENT LIABILITIES Domestic Liabilities Foreign Liabilities EQUITY 12

IMPLICATIONS OF IGAS IMPLEMENTATION (1/2) 1. CHANGES IN FINANCIAL STATEMENTS 1. 2. 3. 4. 1. Statement of Budget Realizations 2. Statement of Changes in Accumulated Budget Surplus Balance 3. Statement of Operations 4. Balance Sheet 5. Statement of Cash Flows 6. Statement of Changes in Equity 7. Notes to the Financial Statements Statement of Budget Realizations Balance Sheet Statement of Cash Flows Notes to the Financial Statements 2. IMPACT ON SUPREME AUDIT BOARD AUDIT OPINION OF CENTRAL GOVERNMENT FINANCIAL STATEMENTS Year Audit Opinion of Reporting Entities (Line ministries/agencies & State General Treasurer) 2009 2010 2011 2012 2013 2014 Unqualified 42 50 61 62 65 62 Qualified 24 25 17 22 19 18 Disclaimer 7 2 2 3 3 7 Adverse 0 0 0 0 0 0 Total 73 77 80 87 87 87 Central Government Financial Statements gain Disclaimer opinion in 2004 – 2008, and Qualified Opinion in 2009 - 2014 YEAR 2015*? * Ongoing audit process 13

IMPLICATIONS OF IGAS IMPLEMENTATION (2/2) 3. IMPACT ON SUPREME AUDIT BOARD AUDIT OPINION OF REGIONAL GOVERNMENT FINANCIAL STATEMENTS 70% 67% 66% 65% 61% 60% 59% 50% 47% 46% 40% 30% 30% 23% 22% 20% 10% 10% 3% 23% 19% 15% 13% 7% 9% 5% 2% 6% 2% 1% 1% 0% 2009 2010 2011 Unqualified Audit Opinion of Reporting Entities (Regional Governments) Unqualified Qualified Disclaimer Adverse Total 2012 Qualified Disclaimer 2013 2014 Adverse Year 2009 2010 2011 2012 2013 2014 15 330 111 48 504 34 343 119 26 522 67 349 100 8 524 120 156 252 319 311 247 79 46 35 6 11 5 524 524 539 YEAR 2015*? * Ongoing audit process 14

INDONESIAN GOVERNMENT ACCOUNTING STANDARDS COMMITTEE Indonesian Government Accounting Standards Committee (KSAP) Organization Independent Committee, mandated by Law, established by Presidential Decree Member Representatives from Ministry of Finance, Ministry of Home Affairs, government internal auditors, other line ministries, local governments, accounting profession institutions (IAI) and academicians Main strategies and references in standard development Main Strategies Follow best international accounting practices Consider existing conditions and needs in Indonesia, Transition periods/stages Main References International Public Sector Accounting Standards Indonesian Financial Accounting Standards Financial Accounting Standards Board Due Process Topic Identification Research Discussion of preliminary draft Decision making by the Committee Exposure Draft Limited hearings & public hearings Discussion of comments from hearings Request for Supreme Audit Institution (BPK) comments Discussion of Supreme Audit comments Finalization of the standards Standards promulgation & socialization. 15

ADOPTION, CONVERGENCE OR ADAPTATION OF IPSAS 1. One crucial issue in development of IGAS is decision on adoption, convergence or adaptation of IPSAS a. Adoption implies that national rules are set aside and replaced by the international accounting standards requirement. Adoption means IPSAS are implemented in the same manner as issued by the IPSASB (full compliant ). b. Convergence means a gradual process of the country’s Accounting Standard Board to develop IPSAS-compatible accounting standards by working together with IPSASB. Compliance is partial and a country may deviate to a certain extent from the IPSAS. c. Adaptation implies that IPSAS are adapted to national context when appropriate. 2. Indonesia choose adaptation strategy. 16

IPSASB STUDY ON INDONESIAN ADOPTION OF GOVERNMENT ACCOUNTING STANDARDS 1. Dr. Andreas Bergmann, former Chairman of IPSASB, has conducted comparison study and gap analysis between Cash Toward Accrual Indonesian Government Accounting Standards (CTA IGAS) and IPSAS as benchmark in 2010. Each standard was analyzed considering Indonesia condition and situation at that time. 2. The study concluded that: (i) Indonesian CTA IGAS are going beyond the requirements of the Cash Basis IPSAS in all significant aspects, (ii) Substantial convergence between CTA IGAS and IPSAS in many areas (small gaps only), and (iii) Action steps which have been taken the last few years in Indonesia have shown a huge progress in the accounting system 3. The recommendations are a. Further development of IGAS on the basis of accrual IPSAS updating on a current basis b. Support the intended timetable to implement full accrual by 2015 c. The reliance on local knowledge should be maintained 4. Due to substantial convergence between IGAS and IPSAS in many areas, it is likely that practical challenges in implementing IGAS is similar to those of IPSAS. 17

COMPARISON OF IPSAS & IGAS IPSAS The Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities IPSAS 1—Presentation of Financial Statements IPSAS 2—Cash Flow Statements IPSAS 3—Accounting Policies, Changes in Accounting Estimates and Errors IPSAS 4—The Effects of Changes in Foreign Exchange Rates IPSAS 5—Borrowing Costs IPSAS 6—Consolidated and Separate Financial Statements IPSAS 7—Investments in Associates IPSAS 8—Interests in Joint Ventures IPSAS 9—Revenue from Exchange Transactions IPSAS 10—Financial Reporting in Hyperinflationary Economies IPSAS 11—Construction Contracts IPSAS 12—Inventories IPSAS 13—Leases IPSAS 14—Events after the Reporting Date IPSAS 15—Financial Instruments: Disclosure and Presentation IPSAS 16—Investment Property IPSAS 17—Property, Plant, and Equipment IPSAS 18—Segment Reporting IPSAS 19—Provisions, Contingent Liabilities and Contingent Assets IPSAS 20—Related Party Disclosures IPSAS 21—Impairment of Non-Cash-Generating Assets IPSAS 22—Disclosure of Financial Information about the General Government Sector IPSAS 23—Revenue from Non-Exchange Transactions (Taxes and Transfers) IPSAS 24—Presentation of Budget Information in Financial Statements IPSAS 25—Employee Benefits IPSAS 26—Impairment of Cash-Generating Assets IPSAS 27—Agriculture IPSAS 28—Financial Instruments: Presentation IPSAS 29—Financial Instruments: Recognition and Measurement IPSAS 30—Financial Instruments: Disclosures IPSAS 31—Intangible Assets IPSAS 32—Service Concession Arrangements: Grantor IPSAS 33 – First-time adoption of Accrual Basis IPSASs IPSAS 34 – Separate Financial Statements IPSAS 35 – Consolidated Financial Statements IPSAS 36 – Investment in Associates and Joint Ventures IPSAS 37 – Joint Arrangements IPSAS 38 – Disclosure of Interest in Other Entities Accrual IGAS The Conceptual Framework of the Government Accounting Statement 1: Presentation of Financial Statements Statement 2: Statement of Budget Realizations Statement 3: Statement of Cash Flows Statement 4: Notes to the Financial Statements Statement 5: Accounting for Inventories Statement 6: Accounting for Investments Statement 7: Accounting for Fixed Assets Statement 8: Accounting for Construction in Progress Statement 9: Accounting for Liabilities Statement 10: Correction of Errors, Changes in Accounting Policies, and Extraordinary Events Statement 11: Consolidation of Financial Statements Statement 12: Statement of Operations Statement 13: Accounting for Public Service Agencies Interpretation 1: Transaction in foreign currencies Interpretation 2: Recognition of revenue received in State/Regional General Cash Accounts Interpretation 3: Recognition of financing transactions received in/disbursed by State/Regional General Cash Accounts Interpretation 4: Changes in Accounting Policies and Correction of errors without restatement Technical Bulletin 13: Accounting for Grants Technical Bulletin 15: Accounting for Fixed Assets Technical Bulletin 16: Accounting for Receivable Technical Bulletin 17: Accounting for Intangible Assets Technical Bulletin 18: Accounting for Accrual Depreciation Technical Bulletin 19: Accounting for Social Assistance Technical Bulletin 20: Accounting for Loss and Indemnification Technical Bulletin 21: Accounting for Liabilities Technical Bulletin 22: Accounting for Transfers to Regional Governments 18

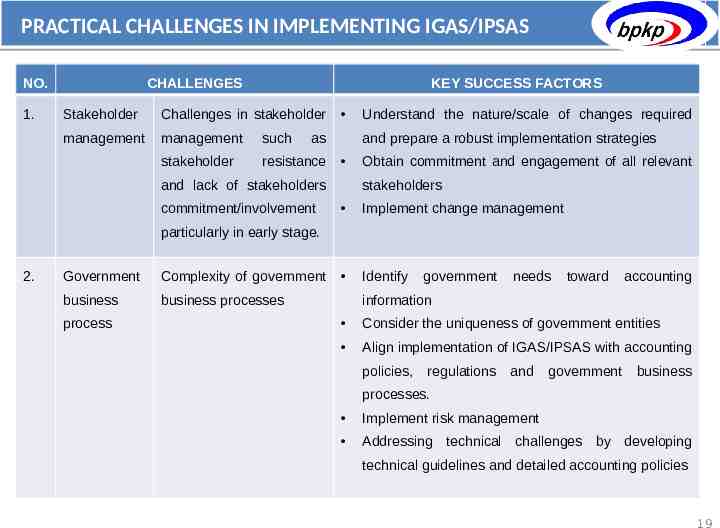

PRACTICAL CHALLENGES IN IMPLEMENTING IGAS/IPSAS NO. 1. CHALLENGES KEY SUCCESS FACTORS Stakeholder Challenges in stakeholder management management such stakeholder resistance as and prepare a robust implementation strategies and lack of stakeholders commitment/involvement Understand the nature/scale of changes required Obtain commitment and engagement of all relevant stakeholders Implement change management Identify particularly in early stage. 2. Government Complexity of government business business processes process government needs toward accounting information Consider the uniqueness of government entities Align implementation of IGAS/IPSAS with accounting policies, regulations and government business processes. Implement risk management Addressing technical challenges by developing technical guidelines and detailed accounting policies 19

PRACTICAL CHALLENGES IN IMPLEMENTING IGAS/IPSAS NO. 3. CHALLENGES Human Resources a. Lack KEY SUCCESS FACTORS of government accountants government needs or human resource b. Human resource policies that overlook needs or either government human resource capacity map c. Lack of budget allocation for capacity building d. Duplication of trainings 4. Alignment of human resources policies with capacity map Adequate budget allocation for capacity building Development of an integrated program training Building up an infrastructure of knowledgeable IGAS/IPSAS practitioners Information Difficulties in customization of Customize accounting information system System information system according to from cash toward accrual basis to accrual requirements of IGAS/IPSAS basis Develop integrated financial management information system Provide an adequate implementation support and guidance 20

KEY SUCCESS FACTORS: 1. DEVELOPMENT OF ROBUST IMPLEMENTATION & TRANSITION STRATEGIES GOVERNMENT STRATEGIES TO IMPLEMENT IGAS DEVELOPMENT OF LEGAL FRAMEWORK, ACCOUNTING SYSTEM & POLICIES DEVELOPMENT OF INTEGRATED FINANCIAL MANAGEMENT INFORMATION SYSTEM/ IT SUPPORT SYSTEM INFORMATION AND COMMUNICATION Formulate regulations, guidelines, business process, system and policies for accrual accounting Indonesian experience: Indonesian government developed has IGAS implementation and transition strategies. Implement change of IT systems (hardware & software) for accrual accounting One of the transition strategies is to maintain a paralel system (accounting policies, chart of Secure high-level commitment from stakeholders accounts system) and in information 2015 for the preparation of 2014 financial statement CAPACITY BUILDING/TRAINING Training on regulations, IGAS, accounting policies and information system in cash toward accrual basis and the recording of 2015 transactions in accrual basis. 21

Indonesian Government Indonesian Government Accounting Standards Accounting Standards Committee Committee KEY SUCCESS FACTORS: 1. DEVELOPMENT OF ROBUST IMPLEMENTATION & TRANSITION STRATEGIES Prepare regulations, business process, and accounting system/IFMIS Develop accounting system/IFMIS, guidelines, capacity building, and IT Develop regulations and guidances on implementation of IGAS in regional governments and capacity building 2015 Full Implementation Accrual based Financial Statements Isuance of IGAS and Implementation plan/strategy Capacity building, support the preparation regional Piloting the accounting system/IFMIS, system improvement and capacity building of goverment accounting policies and Parallel implementation of accounting system/IFMIS, system evaluation and finalization system, and coordination with relevant institutions Action plans by Ministry of Finance/central government Action plans by Ministry of Home Affairs/regional governments Central Government and regional governments have developed implementation and transition strategies so that all stakeholders will understand, actively involved and adapt well to the change in order to support successful migration to accrual IGAS. 22

KEY SUCCESS FACTORS: 2. CHANGE MANAGEMENT AND STAKEHOLDER COMMITMENT Change management will bring the stakeholders towards “commitment” to the new processes Focused Change Initiatives and Activities 100 80 60 Level of Commitment Embedded and Sustained Feedback & Continuous Improvement Change Readiness Structures and Roles Communications Training and Skill Building Adoption Positive Perception Stakeholder assessment Contact Understanding 1. Obtain commitment and engagement of all relevant stakeholders: implementation b. Gain understanding and maintain Awareness Time Indonesian experience a. Assign specific roles for 40 20 Vision Contact : Individuals have heard about change Awareness : Individuals are aware of the context, scope, concept and initiatives of change being pursued. Understanding : Individuals understand the change impact to the organization and their functional areas. Positive Perception : Individuals understand change impacts and benefits to them Adoption : Individuals are willing to work and implement the change Embed and Sustain : The change is the way the work is done good communication c. Establish accountabilities. 2. Change management 23

KEY SUCCESS FACTORS: 3. ALLIGNMENT OF IGAS WITH OTHER REGULATIONS/BUSINESS PROCESSES LEGAL FRAMEWORK (REGULATIONS) State Finance Law mandates the implementation of accrual accounting. Cash based recognition and measurement for revenue and expenditure will be used until the implementation of accrual accounting takes place. Government Regulation 71/2010 on Government Accounting Standards (IGAS) mandates implementation of accrual accounting no later than 2015. Further provisions on accrual IGAS implementation at Central Government shall be regulated by the Minister of Finance (MOF) Regulation, while accrual IGAS implementation at regional governments are regulated by the Minister of Home Affairs (MOHA) Regulation Indonesian government harmonizes accrual IGAS and accounting policies with regulations in budget, budget execution, treasury management (national and regional financial management). ACCOUNTING POLICIES AND SYSTEMS Central Government Regional Governments MOF Regulation 213/2013: Central Government Accounting System MOF Regulation 214/ 2013:Chart of Accounts MOF Regulation 215/ 2013:Standard Journal MOF Regulation 219/ 2013: Accrual Accounting Policies MOHA Regulation 64/2013 on Implementation of Accrual IGAS at Regional Governments Head of regional government regulation on accounting policies 24

KEY SUCCESS FACTORS: 4. RECRUITMENT, PLACEMENT, ROTATION AND CAPACITY BUILDING INTEGRATED PROGRAM FOR ACCRUAL ACCOUNTING TRAINING Indonesian experience Ministry of Finance/Ministry of Home Affairs Accelerated Training Program Alignment of resources policies with government needs or human Trainers of accelerated Training Program Spending unit of line ministries/ agencies and local governments Vertical Offices of Ministry of Finance Training agencies/home office of line ministries/local governments/ academicians Other stakeholders e.g. Indonesian Government Accounting Standards Committee, Accounting Profession Institution, Universities Goal : Improve the competencies of human resources in implementing Accrual Accounting human resource capacity map Adequate budget allocation for capacity building Development of integrated an training program Building up an infrastructure knowledgeable of IGAS/ IPSAS practitioners. 25 25

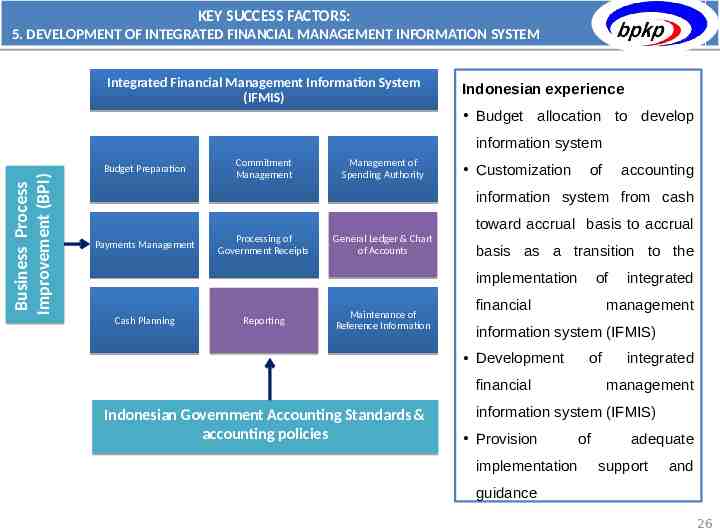

KEY SUCCESS FACTORS: 5. DEVELOPMENT OF INTEGRATED FINANCIAL MANAGEMENT INFORMATION SYSTEM Integrated Financial Management Information System (IFMIS) Indonesian experience Budget allocation to develop Business Business Process Process Improvement Improvement (BPI) information system Budget Preparation Commitment Management Management of Spending Authority Customization of accounting information system from cash toward accrual basis to accrual Payments Management Processing of Government Receipts General Ledger & Chart of Accounts basis as a transition to the implementation Cash Planning Reporting Maintenance of Reference Information of financial management information system (IFMIS) Development of financial Indonesian Government Accounting Standards & accounting policies integrated integrated management information system (IFMIS) Provision implementation of adequate support and guidance 26

CONCLUSIONS 1. Implementation of IGAS/IPSAS will support the implementation of accrual accounting to ensure that accounting decisions are made in a unified and reasonable way. 2. Indonesia experiences in identifying practical challenges in implementing accrual IGAS and finding solution to overcome them can become lessons learned for other countries in implementing IPSAS/their national government accounting standards. 3. While there are similarities in both the challenges and the benefits that adopting national government accounting standards/IPSAS brings, every country is different and will therefore follow its own path towards achieving the objective. 27

Thank You Terima Kasih