Estate Planning: 101 February 11, 2020 R. Dyan Zimmerman

29 Slides402.24 KB

Estate Planning: 101 February 11, 2020 R. Dyan Zimmerman

Who needs an estate plan? Everyone! There are two things for sure in this world .death and taxes. We are all going to die sometime and if we die owning anything with our name on it, we need an estate plan. Additionally, with many members of our community living longer, several individuals also are impacted with cognitive impairment, which also can be addressed with estate planning and is an extremely important element of estate planning.

Critical team member What is a Paralegal’s Role? Second set of eyes and ears Draftsman/Draftswoman Client communicator

Importance of Paralegal Why are the duties of the estate planning paralegal so important to the process?

Capacity Paralegals are important assistant in determining level of capacity. There are many standards and levels of capacity. Levels – can have the capacity to sign certain documents but not others Legal Incapacity/Legal Disability

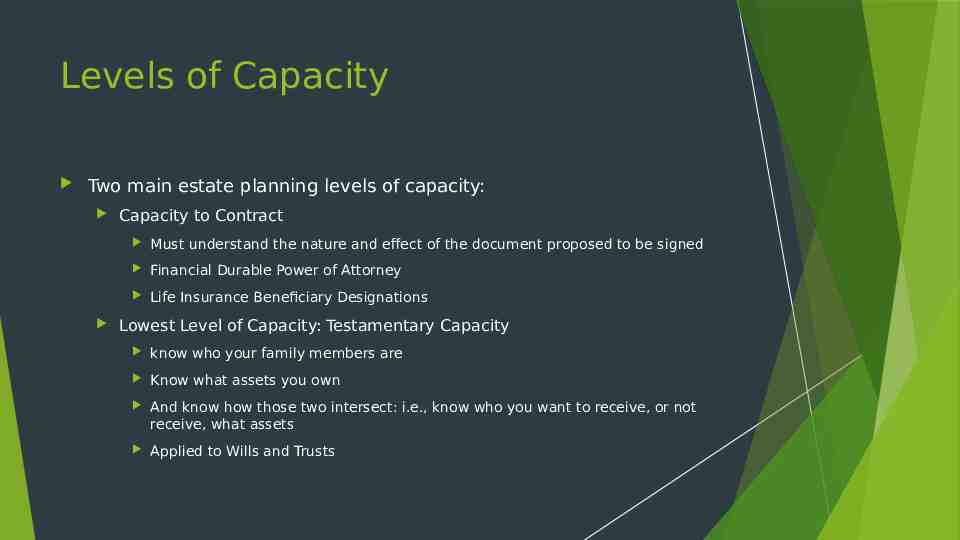

Levels of Capacity Two main estate planning levels of capacity: Capacity to Contract Must understand the nature and effect of the document proposed to be signed Financial Durable Power of Attorney Life Insurance Beneficiary Designations Lowest Level of Capacity: Testamentary Capacity know who your family members are Know what assets you own And know how those two intersect: i.e., know who you want to receive, or not receive, what assets Applied to Wills and Trusts

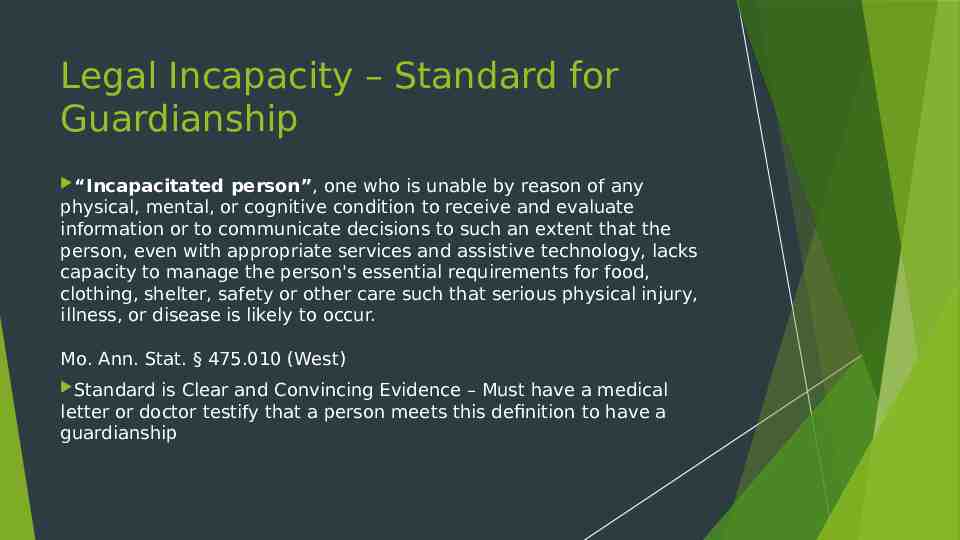

Legal Incapacity – Standard for Guardianship “Incapacitated person”, one who is unable by reason of any physical, mental, or cognitive condition to receive and evaluate information or to communicate decisions to such an extent that the person, even with appropriate services and assistive technology, lacks capacity to manage the person's essential requirements for food, clothing, shelter, safety or other care such that serious physical injury, illness, or disease is likely to occur. Mo. Ann. Stat. § 475.010 (West) Standard is Clear and Convincing Evidence – Must have a medical letter or doctor testify that a person meets this definition to have a guardianship

Legal Disability – Standard for Conservatorship “Disabled” or “disabled person”, one who is: Unable by reason of any physical, mental, or cognitive condition to receive and evaluate information or to communicate decisions to such an extent that the person lacks ability to manage the person's financial resources Mo. Ann. Stat. § 475.010 (West) Definition used to determine if a Conservatorship is necessary for someone.

Incapacity vs Death A good estate plan addresses a plan for both: What is the difference?

Incapacity Default Plan for Incapacity Guardianship – personal care decisions (placement, medical care, etc) Conservatorship – financial care decisions (how should funds be expended)

Guardianship/Conservatorship Pros Court oversight Good forum for disputes Sometimes despite estate planning, we end up in Court anyway Cons Expensive Public If assets, an ongoing expense

Durable Powers of Attorney How to avoid a Guardianship/Conservatorshi p Trust Agreements

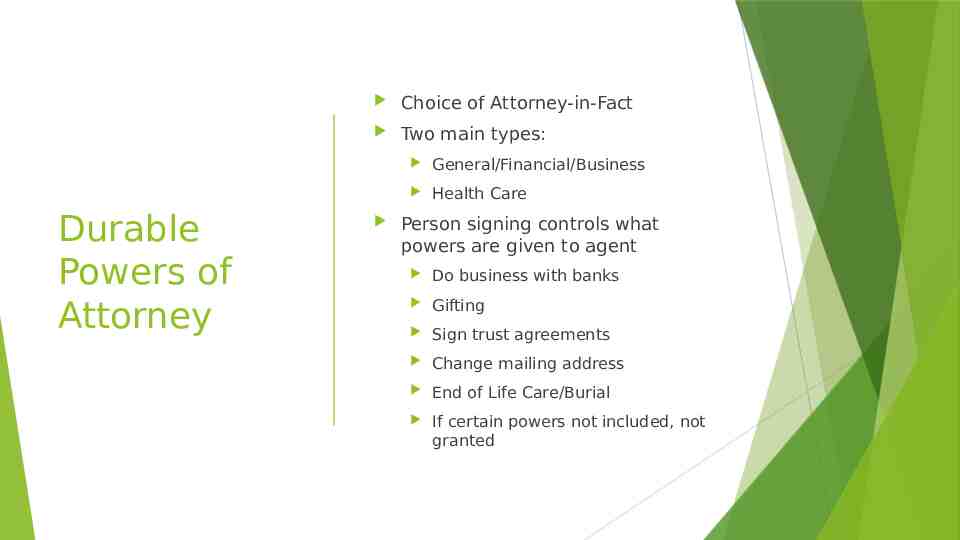

Durable Powers of Attorney Choice of Attorney-in-Fact Two main types: General/Financial/Business Health Care Person signing controls what powers are given to agent Do business with banks Gifting Sign trust agreements Change mailing address End of Life Care/Burial If certain powers not included, not granted

Durable Powers of Attorney Durable Powers of Attorney are considered “must have” estate planning documents, and are arguably one of the most important documents a person can have. DPOAs are good during life (not after) in times that you cannot make decisions for yourself. Financial DPOA can be effective the day you sign, or at a later date, if a doctor declares a person to be incapacited.

Trust Agreement In addition to being a tool to distribute one’s assets at death, a Trust can house assets during life, with a Trustee to manage the assets, similar to a DPOA

Death Default Estate Plan Right of Sepulcher Personal Representative/Executor Beneficiaries/Recipients of the Estate

Right of What?! Right of Sepulcher Who has the power to make burial and/or cremation decisions? R.S.Mo. 194.119 An AIF appointed in a DPOA Surviving Spouse Adult children

Personal Representativ e Who is your default Executor/Personal Representative? R.S.Mo. 473.110 Person nominated in a (validly executed) Last Will and Testament Surviving Spouse Persons entitled to receive property from the Estate whom the court believes will best manage and preserve the Estate

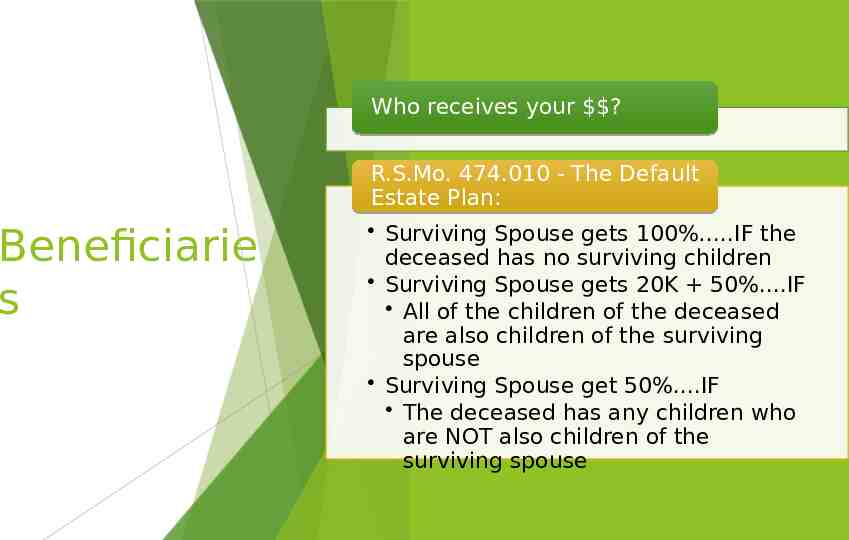

Who receives your ? Beneficiarie s R.S.Mo. 474.010 - The Default Estate Plan: Surviving Spouse gets 100% .IF the deceased has no surviving children Surviving Spouse gets 20K 50%.IF All of the children of the deceased are also children of the surviving spouse Surviving Spouse get 50%.IF The deceased has any children who are NOT also children of the surviving spouse

If the “Default Estate Plan” is not on point . Then you need an estate plan! An individual has the power to change the default estate plan at any point that he or she has capacity.

Planning for Death Trust Agreement Last Will and Testament Deeds Gift Affidavit Transfer of Corporate assets, Notes, etc. Beneficiary Designations

Not just for the “rich” A probate avoidance tool Trust Agreement A mechanism to “control” assets after you pass Allows for someone else to manage assets during life Can create a more detailed plan for contingent beneficiaries – minors – individuals with creditor problems, or special needs Many types of trusts, for many different purposes!

Instructs Probate Court who receives your assets Goes through probate Last Will and Testament Names executors Names beneficiaries Can name guardians of minor children Can funnel any missed assets into a Trust Agreement Can make certain elections to minimize cost of a probate administration Bond waiver Independent administration

Deeds Plan addressing real estate Beneficiary Deeds Quit Claim Deeds (trust or joint tenancy)

Good planning tool for the “stuff” Gift Affidavit Believe it or not, sometimes the biggest fights are over the personal items Simple document to declare assets pass outside of probate, either to a Trust or directly to beneficiaries

Additional Transfer Documents Own a business? Need to transfer! Hold a promissory note? Need to transfer! What about a business succession plan? How should it be structured?

Beneficiary Designations Let’s avoid probate! Essentially every asset can have a beneficiary named. POD – Pay on Death TOD – Transfer on Death Trusts or individuals

Having a good intake process is critical Intake Forms/Questionnaires 80 Will Helps with thorough, and successful, plan creation

Questions? How can I help? Please feel free to contact me for assistance. Dyan Zimmerman, Oswald Roam & Rew LLC 816-229-8121