ENDORSING, DEPOSITING & RECONCILING Understanding Checking Accounts

29 Slides233.22 KB

ENDORSING, DEPOSITING & RECONCILING Understanding Checking Accounts and Debit Card Transactions

2.7.3.G 1 MAKING A DEPOSIT Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 ENDORSING A CHECK Endorsement Signature on the back of a check to approve it to be deposited or cashed A check must be endorsed to be deposited Three types of endorsements: Blank Restrictive Special Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

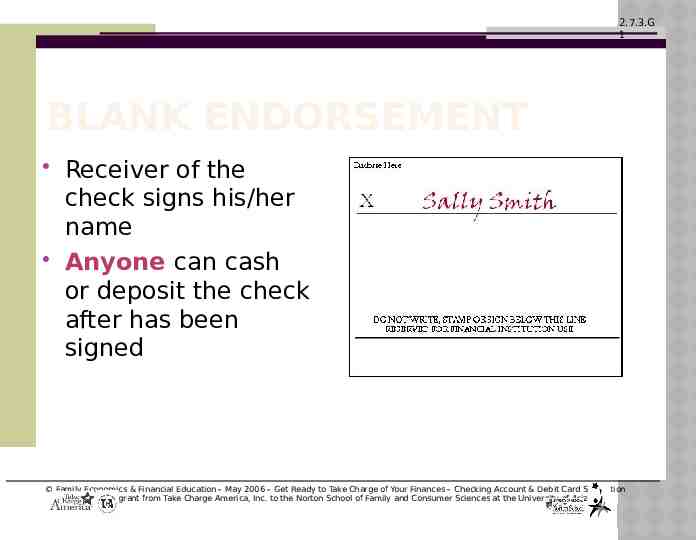

2.7.3.G 1 BLANK ENDORSEMENT Receiver of the check signs his/her name Anyone can cash or deposit the check after has been signed Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

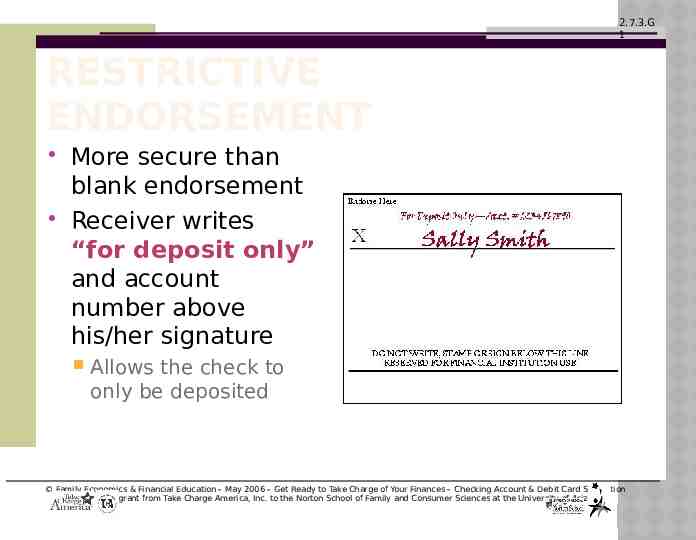

2.7.3.G 1 RESTRICTIVE ENDORSEMENT More secure than blank endorsement Receiver writes “for deposit only” and account number above his/her signature Allows the check to only be deposited Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

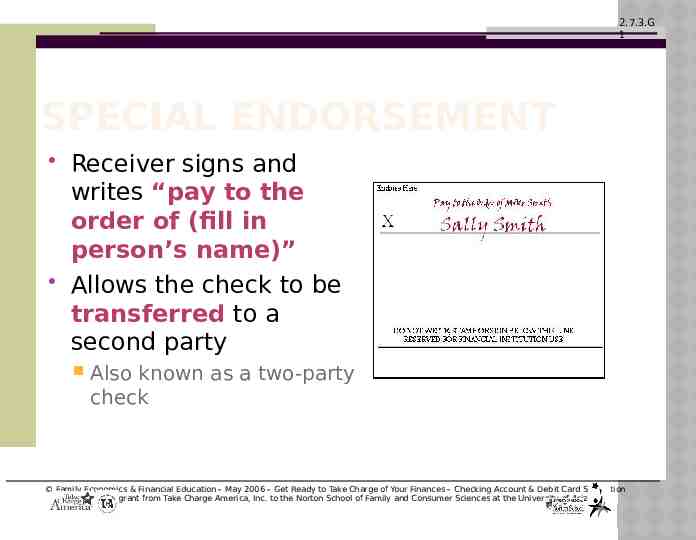

2.7.3.G 1 SPECIAL ENDORSEMENT Receiver signs and writes “pay to the order of (fill in person’s name)” Allows the check to be transferred to a second party Also known as a two-party check Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 Now it’s your turn to practice ENDORSEMENT PRACTICE Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

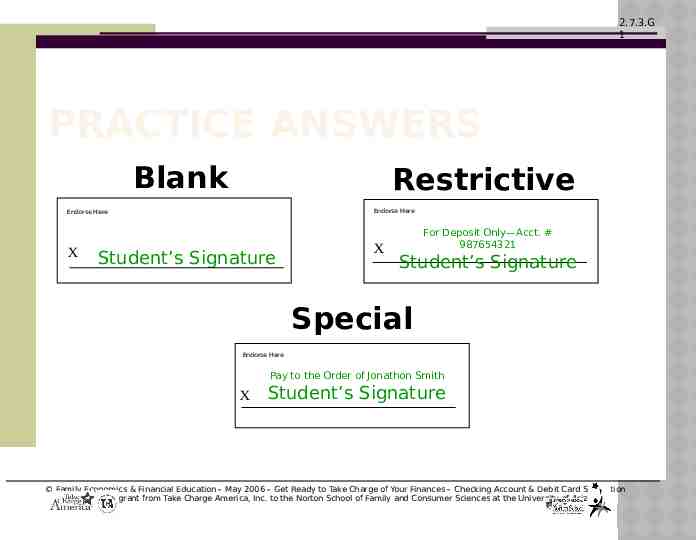

2.7.3.G 1 PRACTICE ANSWERS Blank Restrictive Endorse Here Endorse Here X Student’s Signature X For Deposit Only—Acct. # 987654321 Student’s Signature Special Endorse Here Pay to the Order of Jonathon Smith X Student’s Signature Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 MAKING A DEPOSIT Deposit slip Contains the account holder’s account number Allows money (cash or check) to be deposited Located in the back of the checkbook Deposits can be made with a mobile app at an ATM or with a bank teller Don’t forget to record your deposit in your spreadsheet!! Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

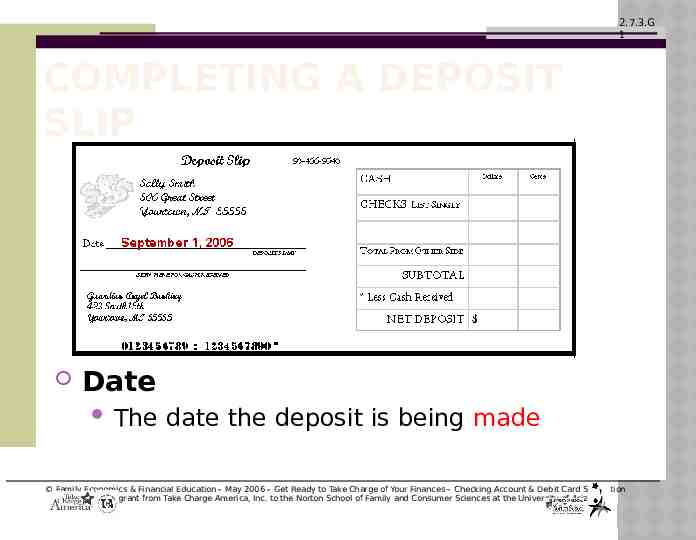

2.7.3.G 1 COMPLETING A DEPOSIT SLIP Date The date the deposit is being made Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

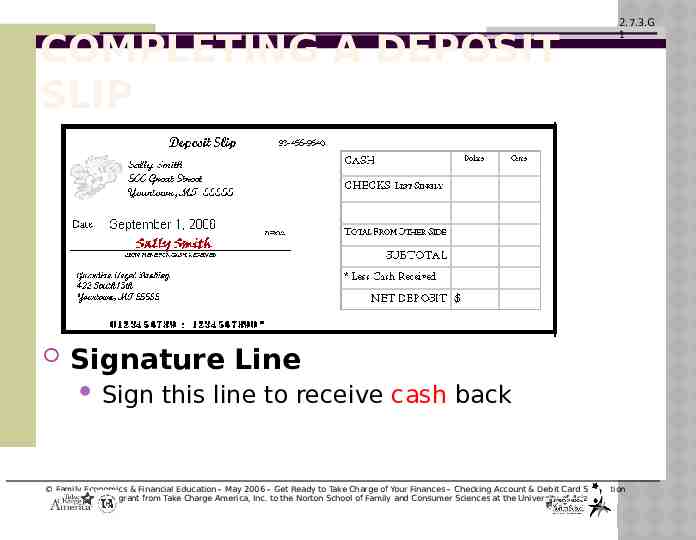

COMPLETING A DEPOSIT SLIP 2.7.3.G 1 Signature Line Sign this line to receive cash back Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

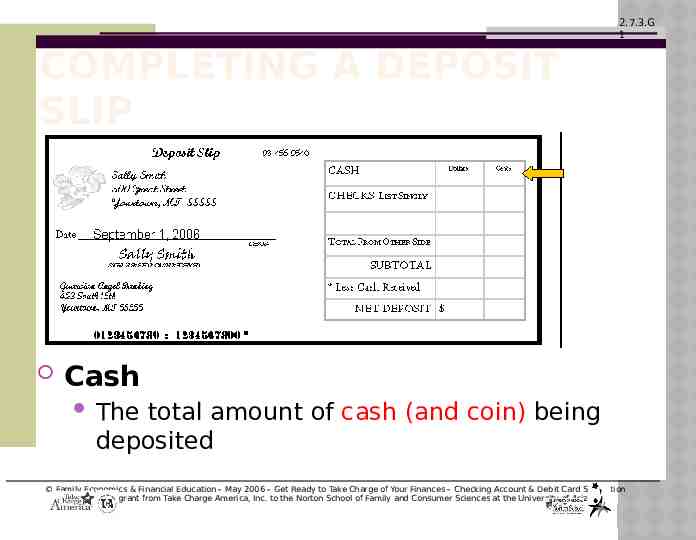

2.7.3.G 1 COMPLETING A DEPOSIT SLIP Cash The total amount of cash (and coin) being deposited Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

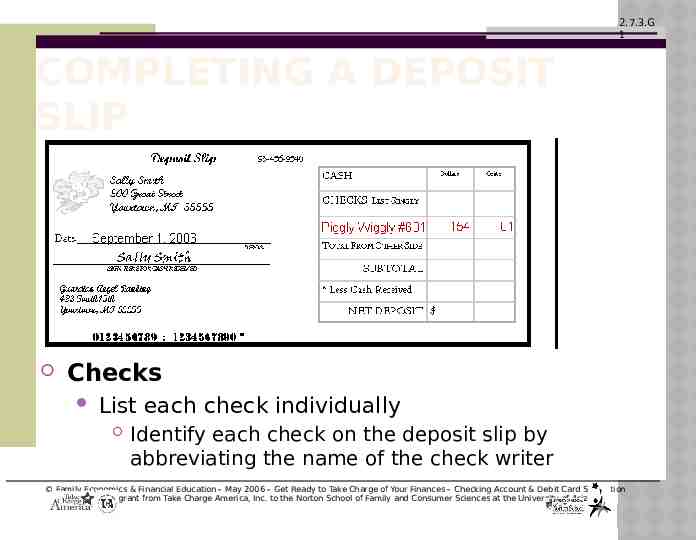

2.7.3.G 1 COMPLETING A DEPOSIT SLIP Checks List each check individually Identify each check on the deposit slip by abbreviating the name of the check writer Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

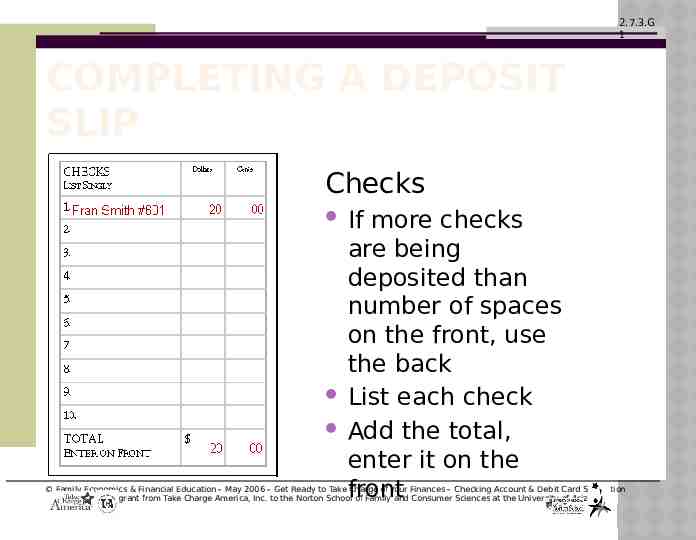

2.7.3.G 1 COMPLETING A DEPOSIT SLIP Checks If more checks are being deposited than number of spaces on the front, use the back List each check Add the total, enter it on the front Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

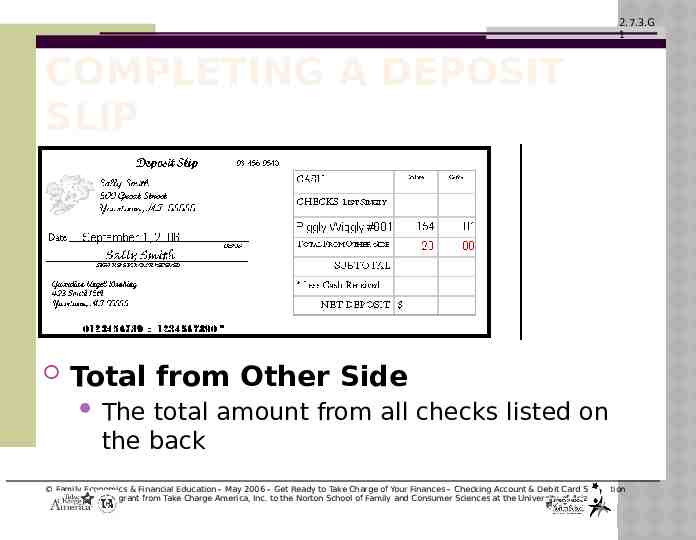

2.7.3.G 1 COMPLETING A DEPOSIT SLIP Total from Other Side The total amount from all checks listed on the back Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

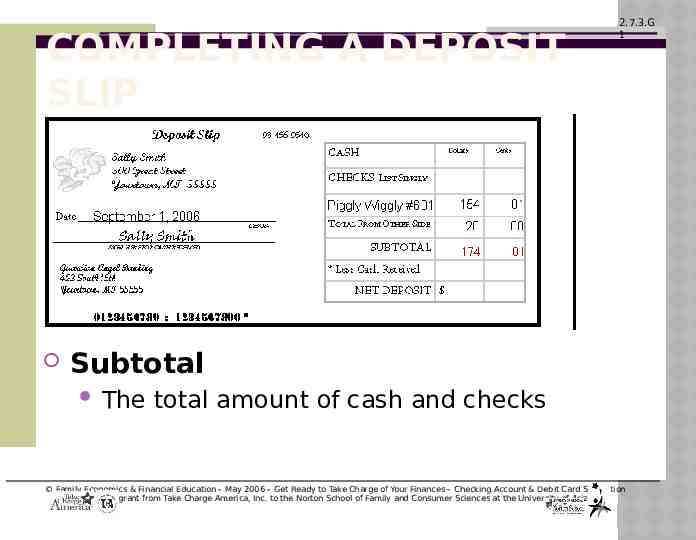

COMPLETING A DEPOSIT SLIP 2.7.3.G 1 Subtotal The total amount of cash and checks Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

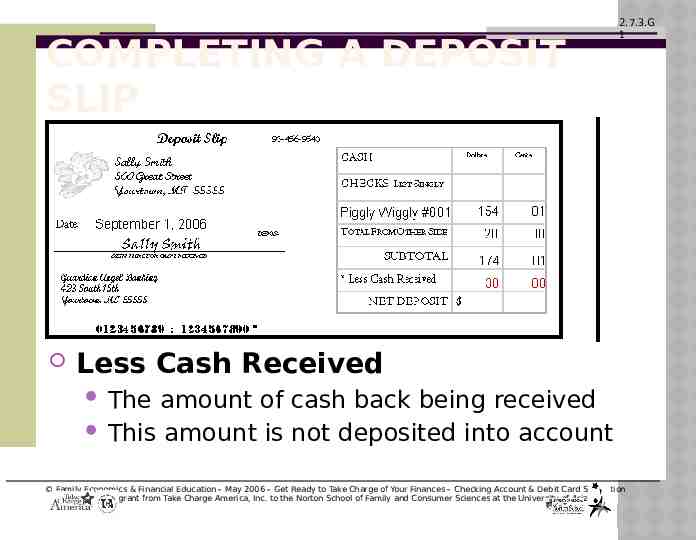

COMPLETING A DEPOSIT SLIP 2.7.3.G 1 Less Cash Received The amount of cash back being received This amount is not deposited into account Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

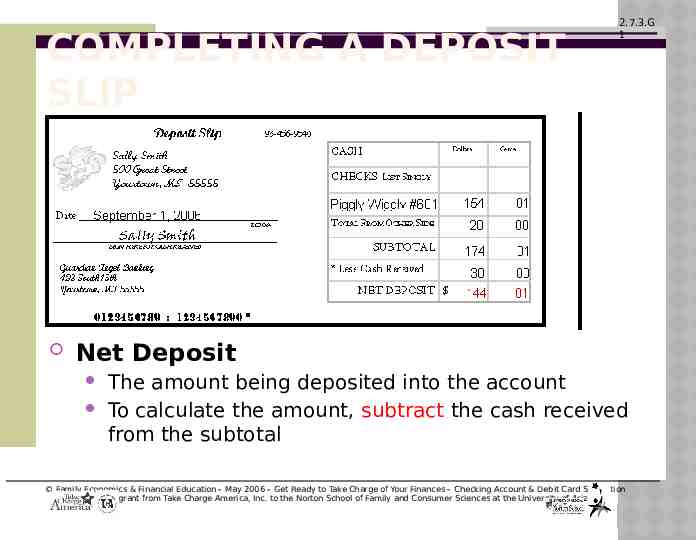

COMPLETING A DEPOSIT SLIP 2.7.3.G 1 Net Deposit The amount being deposited into the account To calculate the amount, subtract the cash received from the subtotal Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 Now it’s your turn to practice DEPOSIT SLIP PRACTICE Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

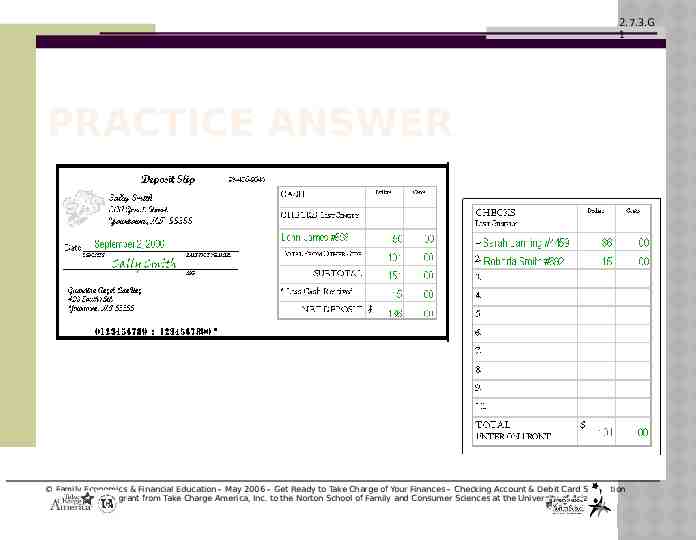

2.7.3.G 1 PRACTICE ANSWER Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 CHECKING ACCOUNT REGISTER Place to record all account transactions for a checking account Deposits, checks, ATM use, debit card purchases, additional bank fees Provides a running balance Using your debit card and mobile banking app before you buy will help your account remain balanced Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 RECONCILING YOUR CHECKING ACCOUNT Reconcile Balancing your spreadsheet each month to match the balance shown online in your bank account. Knowing the correct balance can help to avoid bouncing checks Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 WHAT IS A CANCELLED CHECK? A check that has cleared the depositor’s account and has been marked “canceled” by the bank Can be used as proof of payment Used to be returned in a mailed monthly statement Current day – images of scanned copies are added to a monthly statements Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 REPORTING LOST/STOLEN CARDS If a checkbook, ATM, and/or debit card becomes lost or stolen Immediately report it to the financial institution File a report with the police Reported lost/stolen checkbook: Financial institutions generally do not hold the account holder liable for any fraudulent charges Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 LOST/STOLEN CARDS CONT Reported lost/stolen ATM/debit card: Within 2 business days Cardholder is only liable for 50.00 Longer than 2 business days Could be liable for up to 500.00 Varies depending upon the financial institution Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 TRAVELER’S CHECKS Used in place of currency when traveling to foreign countries Insured against loss and theft by the issuing party NOT the FDIC Customers pay a small fee to purchase (1-2%) Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 SAFETY DEPOSIT BOX Located inside a bank - used to store valuables (documents, jewelry) Customers pay an annual rent and accessed with keys or PIN number Valuables are not insured by the FDIC Safety Deposit Boxes Obsolete The Truth About Safety Deposit Boxes Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 MONEY ORDER A certificate that allows the payee to receive cash – similar to a check Issued by a bank, post office or retail store for a fee Often used by those who don’t have access to a checking account. Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G 1 RECONCILING Family Economics & Financial Education – May 2006 – Get Ready to Take Charge of Your Finances – Checking Account & Debit Card Simulation Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona