EASTMAN BUSINESS PARK ROCHESTER, NY BUSINESS CASE The Eastman

52 Slides9.32 MB

EASTMAN BUSINESS PARK ROCHESTER, NY BUSINESS CASE The Eastman Business Park in Rochester, New York: An optimal location for food processing and manufacturing May 2017

Table of Contents page page page 03 05 12 Executive Summary Industry Overview page page page 18 41 46 EBP/Region’s Assets & Opportunities EBP/Region’s Challenges Company Identification Critical Industry Siting Criteria and EBP/Region’s Position 2

Food Processing & Manufacturing Executive Summary Specialty food and ingredients; packaged food and vegetables; and dairy products, and baked goods are the industry subclusters for which the EBP is best positioned for. The food processing and manufacturing industry cluster is a growing industry. This cluster has had solid growth in recent years in employment, total value of shipments and receipts, value added, and CAPEX. The industry is also expected to continue growing its revenue at a rate of 3% - 4% within the next five years. The Eastman Business Park (EBP) and the Rochester, NY Economic Area, where the Park is located, are very well positioned to attract companies from this industry cluster. The Region particularly exhibits strong employment specialization in the specialty food and ingredients; packaged food and vegetables; and dairy products. Even though the region is not positioned as a strong one in terms of employment specialization in the baked goods segment, the growth exhibited in this subcluster in recent years in employment, total value of shipments and receipts, value added, and CAPEX, make it one worth exploring. It is easy to assume that given the Region’s strong specialization in the food industry overall, that there are sufficient strong capabilities that can be transferred into this industry subcluster. The EBP and the Region offer numerous assets and opportunities around critical site selection criteria such as transportation infrastructure, utilities, real estate product offer, workforce, and operation cost location drivers, that make the Park and Rochester an optimal location for food processing and manufacturing. 3

Food Processing & Manufacturing Executive Summary The EBP and the Region offer numerous assets and opportunities around critical site selection criteria such as transportation infrastructure, utilities, real estate product offer, workforce, and operation cost location drivers, that make the Park and Rochester an optimal location for food processing and manufacturing. These are the main reasons why the EBP and the Rochester, NY Economic Area are optimal locations for food processing and manufacturing: Transportation infrastructure: o 17 miles of rail track within the Park, plus two accumulation yards with capacity for delivery and storage of 100 railcars daily o 2-5 minutes from interstate highway system o Within the Northern Crescent Farm Resource Region* with 15% of farms and 15% of value of production in the U.S. for access to raw materials Market opportunity: o Within 400 miles of an 86.6-million-people market, 25% of U.S. and Canadian populations Utility infrastructure: o Electricity: 117 MW power plant plus 41 MW interconnection with RG&E o Water: Permitted to up to 54 MGD from Lake Ontario, and with own industrial water treatment plant o Natural gas: 2,400 Dekatherms/hour, with 1,100 – 1,200 Dekatherms/hour peak capacity o Steam: 1.5M lbs./hour installed capacity, plus 200K lbs./ hour backup capacity. Different nominal pressure levels, from 260 psig. to down to 5 psig. o Wastewater: 36 MGD wastewater treatment facility on-site with Title V / RCRA permitted multiple hearth incinerator Real estate product: o Several site and building options, ranging from 1 to up to 75 acres, and 46K sq. ft. to up to 1M sq. ft. Workforce: 550K labor pool in a 60-minute commute 9,815 workers in the food processing & manufacturing industry alone, with high specialization Operation cost location drivers: o RED-Rochester LLC is owner and exclusive utility provider at the EBP, focused on optimizing costs and services o Regional average wage for industry cluster of 28,902, versus 47,788 national industry average wage 4

Industry Overview

Food Processing & Manufacturing Industry Overview Food Manufacturin g Wineries Food Processing & Manufacturi ng Nonalcoholi c Beverages Products Meat, seafood, dairy products, fruits and vegetables, milled grains and oilseeds, baked goods, and candy; distilled, blended, or mixed liquors; beer, ale, malt liquor, and nonalcoholic beer; carbonated and noncarbonated soft drinks, bottled water, and ice; wine and brandies. Customers Grocery wholesalers, warehouse club stores, food service distributors, vending machine distributors, and convenience stores; distributors that resells to retailers; restaurants, hotels, clubs, supermarkets, liquor stores, mass merchandisers, and institutions Cash Flow Cash flow for many food products is seasonal, often higher in the second half of the year. U.S. Market 35,360 establishments (singlelocation companies and branches of multi-location companies). Combined annual revenue of about 901 billion. Distilleries Breweries *Euromonitor international 6

Food Processing & Manufacturing Industry Overview World Market Food Manufacturing 2.5 trillion in retail sales. China, the US, and Brazil are the largest packaged food markets*. Global industry revenue is increasing, but economic slowdowns in key emerging markets have curbed growth in recent years. Distilleries Increased globalization. International merger and acquisitions deals by many of the largest conglomerates. International deals allow for broader global distribution. Breweries 2 billion hectoliters production of beer annually**. Largest producers are China, the US, Brazil, Germany, and Russia. Developing markets in Asia, Latin America, and Africa are being targeted for industry growth. Nonalcoholic Beverages Wineries 800 billion per year sales. Growing despite weak sales of carbonated soft drinks*. The leading regional markets for soft drinks are Latin America, North America, and Western Europe. 260 million hectoliters produced per year****. Major producers are Italy, France, and Spain, followed by the US, Australia, China, and Argentina. The US is the world's largest wine consuming country by volume, but emerging economies in Asia, Africa, and South America may offer opportunities for future industry growth. Consumption is flat or declining in most mature European markets. *Euromonitor international **The Barth Report *** Single-location companies and units of multi-location companies ****International Organization of Vine and Wine. 7

Food Processing & Manufacturing Market Outlook The industry is forecast to grow at an annual compound rate of 3%- 4% between 2017 and 2021. Growth rating for distilleries and wineries is high, whereas for breweries and nonalcoholic beverages is medium, and for food manufacturing, low. Revenue Growth Forecast 2017 – 2021* Food Manufacturi ng Distilleries 3% 4% Growth Growth rating: Low Demand depends on food consumption Needs efficient operations Risk: Volatile ingredient prices Growth rating: High Demand if tied to consumption and income Needs efficient operations and strong distribution channels Risk: Greater regulation and litigation Breweries 4% Nonalcoholic Beverages 3% Growth rating: Medium Demand if tied to consumer leisure activity Needs good marketing, distribution, and operational efficiency Risk: Rising import competition Growth rating: Medium Demand is limited by demographics and consumer tastes Needs effective marketing Risk: Health concerns that limit consumption Trends Shifting Consumer Tastes Private-Label Products Gluten-Free Products and Marketing Snacks Replacing Meals Streamlining Distribution American Whiskey Makes a Comeback Flavored Malt Beverage Market Evolving Fluctuating Grain Prices Oversupply of Distillers Grains Industry Consolidation Craft Breweries Gaining Market Share Seasonal, Holiday Brews Consolidation Environmentally Friendly Packaging All-Natural Sweeteners Sparkling Water Sales Increase Growth rating: High Reliance on Restaurant Sales Demand depends on consumer income and Baby Boomers core demographic leisure for wine consumers Profits are tied to production volume and Agritourism help promote the sales price business Risk: Greater import competition and Winery Proliferation *Annual compounded rate, between 2017 and 2021, basedpests, on changes in physical volume and unit prices. vulnerability to weather, and disease Wineries 4% 8

Food Processing & Manufacturing Market Outlook U.S. Market Growth 2012 – 2015 Food Processing & Manufacturing Employment Total Value of Shipments & Receipts Value Added CAPEX 2.5% 4.4% 8.3% 10.7% -2.6% 5.6% 6.4% Vs. All Manufacturing -0.4% 9

Food Processing & Manufacturing Regional Overview U.S. Market Growth*** 2012 - 2015 Subcluster Dairy Products Specialty Foods and Ingredients Baked Goods Milling and Refining of Cereals and Oilseeds Animal Foods Packaged Fruit and Vegetables Soft Drinks and Ice Malt Beverages Candy and Chocolate Wineries Coffee and Tea Distilleries Milling and Refining of Sugar Total Value Value Employees of Shipments added CAPEX and Receipts 0.4% 4.8% 4.0% 28.4% 2.8% 9.7% 3.3% 2.6% 1.9% 13.1% 1.3% 3.8% 15.6% -14.6% -13.0% -15.2% -1.5% 2.9% 12.2% 29.8% 1.3% 11.3% 11.6% -2.9% -4.8% 28.3% 2.8% 7.5% 0.3% 25.9% 3.1% 9.8% 12.9% 28.2% 8.8% 35.5% 7.2% -16.6% 5.6% 55.9% 18.1% 12.5% 30.8% 6.7% 6.8% -17.9% 42.9% 83.5% 7.8% -10.7% -18.0% -6.0% Dairy products; specialty foods and ingredients; packaged fruit and vegetables; and baked goods are the top employment sub-clusters in the Rochester, NY economic area within the food processing and manufacturing industry cluster. The first three are also sub-clusters where the region has high employment specialization*. Although the region does not exhibit high employment specialization in the baked goods sub-cluster, the overall strong specialization of the region in food processing and manufacturing provides expertise that is transferrable across different segments of this industry cluster. These four sectors have experienced growth nationally between 2012 and 2015 in employment, value of shipments and receipts, and value added. Additionally, dairy products, specialty foods and ingredients, and baked goods have shown growth in CAPEX within the same period. Although malt beverages, wineries, and distilleries are sub-clusters where the Rochester economic area exhibits high employment specialization, and they have grown between 2012 and 2015 in terms of employment, total value of shipments and receipts, value added, and CAPEX, the dairy products, specialty foods and ingredients, packaged fruit and vegetables, and baked goods subclusters are the ones the present a stronger affinity with EBP’s predominantly heavy-industrial uses, and are the ones with the most synergies with existing operations. Rochester, NY Economic Area Food Processing & Manufacturing Cluster Rank in U.S. Employment by Sub-Cluster 2014** (Out of 179 Economic Areas) Packaged Fruit and Vegetables Dairy Products Specialty Foods and Ingredients Baked Goods Wineries Malt Beverages Animal Foods Candy and Chocolate Distilleries Soft Drinks and Ice Coffee and Tea Milling and Refining of Cereals and Oilseeds Milling and Refining of Sugar - 18 28 41 44 7 21 47 41 26 94 46 Highlighting indicates a Strong Subcluster in the region. A strong cluster is a cluster that has high employment specialization in a region. 500 1,000 1,500 69 37 2,000 *Economic Areas with High Employment Specialization in a cluster meet these criteria: a) Location Quotient of Cluster Employment must be greater than the 75th percentile when measured across all Economic areas; b) To differentiate marginal cases, Location Quotient of Cluster Employment must be greater than 1.0, Share of National Cluster Employment greater than the 25th percentile, and Share of National Cluster Establishments greater than the 25th percentile. **U.S. Cluster Mapping (http://clustermapping.us), Institute for Strategy and Competitiveness, Harvard Business School. Copyright 2014 President and Fellows of Harvard College. All rights reserved. Research funded in part by the U.S. Department of Commerce, Economic Development Administration. ***U.S. Census Bureau’s Annual Survey of Manufactures (ASM) 2,500 10

Food Processing & Manufacturing Regional Overview Cluster 1.94 Location Quotient High Employment Specialization Top Strong Sub-Clusters With High Employment Specialization in the Region Packaged Fruits & Vegetables 18 U.S. Rank* 3.39 LQ** Dairy Products 28 U.S. Rank* 2.58 LQ** 65% Industry employment in the Rochester, NY Economic Area Specialty Foods & Ingredients 41 U.S. Rank* 1.55 LQ** Baked Goods*** 44 U.S. Rank* 1.55 LQ** Average Wage for Industry Cluster 28,902 Rochester, NY Vs. 47,788 National *Out of 179 economic areas in the U.S. **LQ Location Quotient ***Although the region does not exhibit high employment specialization in the baked goods sub-cluster, the overall strong specialization of the region in food processing and manufacturing provides expertise that is transferrable across different segments of this industry cluster. 11

Critical Industry Siting Criteria and EBP/Region’s Position

Food Processing & Manufacturing Industry Needs Main site selection criteria for industrial capital investment projects is mainly based on six factors: transportation infrastructure, utilities, real estate product, workforce, operation cost location drivers, and environmental and permitting Transportation infrastructure Utilities Site/building size Workforce Operation cost location drivers Environmental & permitting requirements. 13

Food Processing & Manufacturing Industry Needs & EBP/Region’s Position Transportation EBP Meets Criteria? May require rail 17 miles of rail track within the Park, plus two accumulation yards with capacity for delivery and storage of 100 railcars daily Requires proximity to interstate for logistics and distribution 2-5 minutes from interstate highway system May requires close proximity to raw material Within the Northern Crescent Farm Resource Region Requires close proximity to customers Within 400 miles of an 86.6-millionpeople market, 25% of U.S. and Canadian populations Utilities EBP Meets Criteria? Moderate electricity demand 117 MW power plant plus 41 MW interconnection with RG&E Significant water demand Permitted to up to 54 MGD from Lake Ontario. Own industrial water treatment plant Moderate natural gas demand 2,400 Dekatherms/hour, with 1,100 – 1,200 Dekatherms/hour peak capacity Significant steam demand 1.5M lbs./hour installed capacity, plus 200K lbs./ hour backup capacity. Different nominal pressure levels, from 260 psig. to down to 5 psig. Significant wastewater output 36 MGD wastewater treatment facility on-site with Title V / RCRA permitted multiple hearth incinerator 14

Food Processing & Manufacturing Industry Needs & EBP/Region’s Position Site Size Moderate facility and equipment requirements Workforce EBP Meets Criteria? Several site and building options, ranging from 1 to up to 75 acres, and 46K sq. ft. to up to 1M sq. ft. EBP Meets Criteria? Moderate total employment 550K labor pool in a 60-minute commute Low demand for specific skills. Workforce with a relatively high proportion of lesser-skilled employees 9,815 workers in the food processing & manufacturing industry alone, with high specialization 15

Food Processing & Manufacturing Operating Costs Location Drivers EBP Meets Criteria? Raw materials, primary Within the Northern Crescent Farm Resource Region* with 15% of farms and 15% of value of production in the U.S. Utility costs, low RED-Rochester LLC is owner and exclusive utility provider at the EBP, focused on optimizing costs and services Logistics, primary Excellent highway, rail, and airport interconnectivity for transport Labor, moderate Regional average wage for industry cluster of 28,902, versus 47,788 national industry average wage Industry Needs & EBP/Region’s Position *United States Department of Agriculture, USDA 16

Food Processing & Manufacturing Industry Needs & EBP/Region’s Position Environmental/Permitting EBP Meets Criteria? Air permitting demands depend on size and type of operation. TBD, based on specific project needs Other requirements: Food processors are subject to a variety of state and federal government regulations that focus on worker safety, food safety, and the proper disposal of processing wastes. Agencies such as OSHA, FDA, USDA, FTC, and EPA impose rules governing the industry. Fruit and vegetable processing often involves extensive washing operations; wastewater usually requires special treatment facilities, especially if crops have residual pesticides. The Food Allergen Labeling and Consumer Protection Act requires that manufacturers disclose if specific allergens are in the product. The FDA requires that manufacturers disclose hydrogenated oils (trans fats). TBD, based on specific project needs 17

EBP/Region’s Assets & Opportunities

EBP & Regional Assets & Opportunities Workforce & Workforce Development Resources Business Environment & Quality of Life Utility Infrastructure Industrial Real Estate Product Environmental, Permitting & Zoning Shared Services & Business Support Ownership & Site Control Highway, Rail, Intermodal & Airport Connectivity Market Potential Emergency Protective Services Synergies Business Incentives 19

EBP & Regional Assets & Opportunities Ownership Some parcel options are available for sale or lease and some are only available for lease. Buildings may be sold anywhere in the Park. 700 acres, 58% of the total acreage at the Park is owned by Kodak. The remaining 500 acres, 42% of the total, are owned by LiDestri Food and Drink, and Acquest Development. LiDestri is a premier private label and contract manufacturer of food, beverages and spirits. Acquest Development specializes in the acquisition, development, construction and management of a variety of industrial and commercial properties. Ownership is committed and invested in the Park’s and Region’s growth and development. Furthermore, REDRochester, LLC that owns and operates the utilities at the Park, is fully committed to the Park’s and the area’s success, as well as to optimizing utilities infrastructure and the tenants’ operations. The Eastman Business Park and RED are motivated to the development of the Park pursuing new investors that are significant utility users and economic development engines. New tenants to the park will not have to deal with multiple landowners and can expect a streamlined acquisition process, saving both time and money. Real Estate Product & Ownership Real Estate Product The Eastman Business Park offers a 1,200-acre campus with 16 million sq. ft. in manufacturing, lab, warehouse & office space, and 400 acres ready for new build. These 400 acres are comprised of 18 parcels, ranging from 1 to 28 acres that available for lease and/or sale. Some parcels can be amalgamated to form 55 – 65-acre sites in the northeast section, and 40 – 50-acre sites in the northwest. The largest contiguous property is 75 acres. These 75 acres seat on the southwest section of the Park where food processing and manufacturing operations take place. These existing food processing and manufacturing operations are: LiDestri Food and Drink, Danisco-Dupont, G’s Fresh, Ltd., and in the near future, the recently announced Clearwater Organic Farms 20

EBP & Regional Assets & Opportunities Wetlands No wetlands present at the Park. The Genesee River runs on the eastern boundary of the site, and Paddy Hill Creek on the western site boundary, but there are no wetlands within the Park’s boundaries. Floodplain The Park is not in the 100-year flood plain. Wastewater RED’s wastewater treatment facility on-site with Title V / RCRA permitted multiple hearth incinerator and NPDES wastewater permit can be leveraged to allow for third party discharges to the industrial wastewater treatment plant without a separate permit. Industrial Water RED is permitted to up to 54 MGD from Lake Ontario. Tenants can leverage this permit for their industrial water needs. Environmenta l, Permitting & Zoning Environmental In comparison with other brownfield industrial parks, the EBP is in a very good position. The site is not a federal superfund site. All environmental issues have been very well characterized and remedial plans have been completed. Kodak and the State of New York have established a 99 Million dollar environmental trust to address the need to clean up legacy environmental liabilities to the extent they are encountered and to encourage companies to move into the park as both property lessees or owners. There aren’t any unknowns at the Park in terms of recognized environmental conditions. Additionally, PCB’s are not present. Kodak converted transformers to eliminate PCB’s from the buildings. 21

EBP & Regional Assets & Opportunities Environmenta l, Permitting & Zoning EBP Zoning Map Zoning/Use Requirements The EBP is split into five sections: East end (EBPE), central (EBPW), west central (EBPX), northwest (EBPM), and south (EBPS). EBPW and EBPX are zoned M-1. Manufacturing, high-tech or light industrial uses are permitted under zoning M-1. EBPE, EBPW, and EBPX fall under the jurisdiction of the City of Rochester. EBPM and EBPS fall under the jurisdiction of the Town of Greece. EBPM and EBPS are zoned Industrial General (IG). The GI zoning allows for general manufacture, assembly or processing activities. Current Park’s zoning allows for a broad spectrum of industrial operations. Manufacturing, high-tech or light industrial uses are permitted at the Park. EBPE is zoned PD#12. Permitted uses under PD#12 includes manufacturing activity. Special permit is needed of uses which may be noxious or injurious due to production or emission of dust, smoke, odor, gases, fumes, solid or liquid waste, noise, light, vibration or nuclear or electromagnetic radiation or due to the likelihood of injury to persons or damage to property if an accident occurs. 22

EBP & Regional Assets & Opportunities Transport Connectivity Road Access Rail Service 2-5 minutes from interstate highway system: I390 borders the Park to the West. I490, 5 minutes to the East on NY 104. Easy access and little traffic or congestion to access both highways. There are a number of roads with access to the Park. Currently entrance to the fenced portion of the Park is available during daytime hours in the East, along Eastman Avenue. On the West, access is available 365/24/7 on Latona Road. Roads are permitted to handle heavy industrial traffic. Public transportation is available through Rochester Transit System (RTS), that provides service to Lake Avenue (Route 1) and West Ridge Road (Routes 14 and 106). 17 miles of rail track within the Park. Multiple buildings with direct rail service. Line easy to extend to other parts of the Park. Daily service. Connection to both CSX Transportation and G&W's Rochester & Southern Railroad (RSR), which connects to Norfolk Southern, Canadian National and Canadian Pacific. Air Transport Greater Rochester International Airport (ROC) is 9 miles away from the Park. There are 7 airline carriers serving ROC: AirCanada, Allegiant, American, Delta, JetBlue, Southwest, and United. Ample rail car storage at the Park. Intermodal EBP has two accumulation yards with capacity for delivery and storage of 100 railcars daily. Rochester Switching Services, Inc. (RSS), formerly the Eastman Business Park Railroad, delivers an assortment of products – ranging from food and building products to plastics or metals – to a variety of manufacturing buildings and processes via sixteen miles of continuous track and two large inbound and outbound accumulation yards, operating 6 days per week, 52 weeks per year. Routing choices amongst all eastern “Class 1” railroads. 23

EBP & Regional Assets & Opportunities Utilities Steam 1,500,000 pounds per hours installed capacity from utility-grade boilers, with an additional 200,000 pounds per hour capacity from emergency backup boilers. Utility grade boiler firm capacity is 950,000 - 1,100,000 pounds per hour. Approximately 300,000 pounds per hour of available capacity. Generated at 1,400 psig/900 F and supplied at different nominal pressure levels of 260 Robust utility infrastructure throughout. RED-Rochester LLC is owner and exclusive utility provider at the Eastman Business Park psig, 140 psig, 70 psig and 5 psig. Electricity 117 MW power plant producing electricity, steam & chilled water. In addition, RED has a 41 MW interconnection with RG&E. Firm capacity without the largest turbine generator in service is 133 MW. Generated at 13,800 volts and distributed on a small grid with underground redundant feeds to doubleended load centers/substations for highest reliability and quality. Standard delivery is nominal 480 volts, 3 phase alternating current. Current Peak Loads are approximately 60 MW, leaving approximately 73 MW available capacity. Wastewater Industrial sewage treatment; hazardous waste permitted multiple hearth incinerator; and precious metals recovery capabilities. NPDES wastewater permit can be leveraged to allow for third party discharges to the industrial wastewater treatment plant without a separate permit. 36 MGD wastewater treatment facility on-site with Title V / RCRA permitted multiple hearth incinerator. The average flow is 8.7 MGD, with a peak of 18.1 MGD. Average available flow is approximately 18 MGD. 24

EBP & Regional Assets & Opportunities Utilities Robust utility infrastructure throughout. RED-Rochester LLC is owner and exclusive utility provider at the Eastman Business Park Refrigeration & Water Refrigeration & Water Chilled water: 60,000 tons installed capacity of tri-generation – nominal supply temperature 40 F. 9 F, -95 F Brine Industrial water: RED is permitted to up to 54 MGD from Lake Ontario. There are three pipelines (24”, 30”, and 48”) that transport the lake water from RED’s pump house on Lake Ontario four miles south to Eastman Business Park. Current peak demand is approximately 17 MGD, the average is approximately 11 MGD. Approximately 37 MGD of available capacity. Average delivery pressure is approximately 80 psig. 3.5 MM water reservoir under baseman of building 56. The other 12.5 MM water reservoir is under a parking lot to the property on the west Northeast corner. Used for risk mitigation in case there are issues at Lake Station that impede them from supplying water to customers. Fire protection is supplied from the reservoir. High-purity water: 300 gal/min firm capacity of reverse osmosis deionized water - minimum resistivity 2 megohms. Kodak uses it. Film sensitizing, R&D. RED trucks it to few places. Using only ¼ or less. Demineralized water: Treated process water using anion and cation exchangers with maximum conductivity of 4 micromhos. Demineralized water for boiler use, but also provide to Kodak. 25

EBP & Regional Assets & Opportunities EBP’s Existing Utility Assets Utilities Robust utility infrastructure throughout. RED-Rochester LLC is owner and exclusive utility provider at the Eastman Business Park Compressed Air Natural Gas 47,000 standard cubic feet per minute installed capacity. Nominal gauge pressure of 75 psig and a maximum dew point of 55 F. Distributed to various customers within EBP by RED. Current line sizing depends on specific location within EBP. RED’s contract with supplier is noninterruptible. There are 2 – 8” – distribution lines coming into the site from the RF&E meter station. Currently there is a 625 Dekatherms/hour capacity and another 1800 is being added. Peak is currently 200 Dekatherms per hour. This will be approx.1,100 – 1,200 Dekatherms per hour, post MACT upgrade. The total natural gas capacity will be approx. 2,400 Dekatherms per hour, post MACT upgrade. Natural gas also used for internal operations. Nitrogen 148,000 standard cubic feet per hour installed on-site plant capacity with equivalent capacity of backup liquid vaporizers. Minimum purity is 99.999% with a nominal gauge pressure of 70 psig and a maximum dew point of -100 F. 26

EBP & Regional Assets & Opportunities Food Processing & Manufacturing 1.94 Location Quotient High Employment Specialization Workforce & Workforce Developmen t Labor Pool The business park boasts a sizable labor force in the surrounding areas, with 544,276 workers within a 60-minute drive time of the park. Within a 30minute drive time, there are approximately 43,848 people working in the manufacturing industry alone. At the 45-minute and 60-minute drive times, the manufacturing workforce increases to 56,559 and 68,579, respectively. Workforce in the food processing and manufacturing industry cluster amounts to 9,815, exhibiting high specialization, with a 1.94 location quotient, ranking # 30 in the U.S. out of 179 economic areas*. The top employment industry sub-clusters with high employment specialization in the region are packaged foods and vegetables, dairy products, specialty foods and ingredients, and baked goods. *U.S. Cluster Mapping (http://clustermapping.us), Institute for Strategy and Competitiveness, Harvard Business School. Copyright 2014 President and Fellows of Harvard College. All rights reserved. Research funded in part by the U.S. Department of Commerce, Economic Development Administration. 2014 data. 27

EBP & Regional Assets & Opportunities Educational Attainment* Population 25 by Educational Attainment and Drive Time Total Less than 9th Grade 9th - 12th Grade, No Diploma High School Graduate GED/Alternative Credential Some College, No Degree Associate Degree Bachelor's Degree Graduate/Professional Degree 30 Minutes 514,006 3.2% 6.3% 20.1% 4.0% 17.0% 12.0% 20.8% 16.5% 45 Minutes 631,981 3.1% 6.2% 21.3% 4.3% 17.3% 12.2% 20.1% 15.5% 60 Minutes 748,988 3.2% 6.5% 22.5% 4.7% 17.5% 12.2% 18.8% 14.5% Workforce Quality The region has highly-skilled and quality workforce with 68% of the population within a 60-minute commute with some college education. Based on 2014 data from the US Department of Education, the Greater Rochester Area ranks at the top in terms of degrees per capita in STEM areas when compared against the 53 largest metros: 1st in physical science, 1st in mathematics, 3rd in engineering and engineering technologies, 3rd in biological and biomedical sciences, and 5th in computer and information sciences and support services. This constitutes an opportunity for attracting high-tech and advanced manufacturing operations to the area. Workforce & Workforce Developmen t Based on the Rochester Business Alliance - RBA – Employer Survey from April 2016, from 1 to 5, with 1 being poor and 5 excellent, the Greater Rochester Area has an average score of 4.1 in work ethics; 4.2 in willingness to work overtime; 4 in productivity compared to that of company’s other sites; 4 in productivity; and 3.8 in punctuality. The Rochester Chamber Annual Turnover/Absenteeism Survey from March 2016 reports a rate of 3.3% or 8.3 days in the manufacturing sector; 2.5% or 6.3 days in the service sector; and 2.8% or 7.1 days in all sectors. Additionally, due to legacy industries such as Kodak, Bausch & Lomb, and Xerox, there is a good labor pool in the chemicals, photonics, and food & agricultural sectors. *Source: U.S. Census Bureau, Census 2010 Summary File 1. Esri forecasts for 2016 and 2021 Esri converted Census 2000 data into 2010 geography. 28

EBP & Regional Assets & Opportunities Workforce Training Very strong University and college presence in the immediate area. Home to top-tier technical/engineering programs at Rochester Institute of Technology, University of Rochester and SUNY Brockport. Just hours away from renowned programs at Cornell University, SUNY Buffalo, Rensselaer Polytechnic Institute, Syracuse University and Alfred University. A total of 19 colleges and universities. 87,500 enrolled students. 19,000 diplomas annually. The area is 1st for degrees in the physical sciences and mathematics fields; 2nd for degrees in biological and life sciences fields; 3rd for degrees in engineering and engineering-related fields; and 6th in computing and information sciences. There are also over 75 Vocational School, Trade School and Technical School programs and institutions in Rochester including - for manufacturing and technology training and certification - the Rochester Education Opportunity Center, Monroe Community College, Rochester Institute of Technology Adult & Continuing Education, the Rochester City School District Family Learning Center, Monroe #1 BOCES, and Edison Career and Technology High School. Certificate programs range from entry-level administrative career training to Lean Six Sigma to mechatronics engineering. Monroe Community College works with Workforce & Workforce Developmen t manufacturers to provide tailored training to students. One such program example is the Optical Technology program at MCC, which trains students from high school through Associate's Degrees in the optics and photonics fields. Rochester Institute of Technology's Adult & Continuing Education programs also partner with companies to offer custom training and education in STEM processes, manufacturing, and offer talent acquisition services to companies. Additionally, RochesterWorks! serving Monroe County, offers free recruitment, training, and connectivity to job fairs and other programming for area companies. The organization also provides job candidates with connections to employers and new job openings, skills assessment and development programs, and referrals. Employers and employees at the Eastman Business Park have their own workforce training resources on-site via the Finger Lakes Workforce Development Center created in 2016 by the Monroe Community College (MCC) to offer manufacturing-oriented programs and skilled trades training within classroom and lab space. MCC offers professional development and training solutions for people, businesses and organizations throughout Monroe County and works with area manufacturers to develop custom training programs and degree tracks. 29

EBP & Regional Assets & Opportunities Emergency Protective Services Emergency protective services These services are available onsite, with 24/7 site security and fire department with back-up by Town of Greece Police/Fire Departments and City of Rochester Police/Fire Departments. Onsite fire department services include emergency medical services for basic and advance life support; special chemical emergency response, morgan lens (eye care), and tox-medic; fire suppression with foam for firefighting and vapor control, fire alarm/maintenance, production support, and blood spill clean up; HAZMAT support for spill containment/cleanup, emergency mitigation, and monitoring; technical Rescue for confined space rescue and machine & vehicle extrication; HSES support for permits, consultation for inspection & permit services; afterhours roving monitoring; notification to federal, state, and local agencies as required of chemical releases to the environment, insurance inspections, and systems coordination. Onsite site security services include electronic access control at all staffed and un-staffed locations; badging, and auto pass management; Kodak Rochester Control Center (KRCC) which is a full service 911 facility for alarm/CCTV monitoring, emergency dispatching, emergency notification, and trouble call handling (transportation emergencies, maintenance, poison control); mobile and foot patrols for inspections, emergency response, personnel escorts, and traffic violation enforcement; consultation services for security assessments/audits and crime prevention training; emergency preparedness planning to include management of site emergency & crisis management plans, coordinate site & Kodak Rochester Control Center table top drills, and interface with community emergency response organizations 30

EBP & Regional Assets & Opportunities Synergies Synergies In-house and regional capabilities across an array of industry sectors and technologies present ample opportunities for synergies for new incoming businesses. Whereas sharing best practices, forming strategic alliances, cooperating on specific projects, or directly becoming a customer or supplier, these synergies can provide opportunities to future potential tenants for cost-savings, technology development, risk mitigation, expanded production capacity, etc. Legacy industries like Kodak, Bausch and Lomb, and Xerox have helped built the expertise and technical infrastructure for making Rochester a powerhouse in photonics, roll-to-roll manufacturing, specialty chemicals, solvent recovery, pharma, biotech & life sciences, to name a few. These capabilities can be leveraged by a myriad of industries. Kodak’s Specialty Chemicals operation offers processes and services for pharmaceuticals, agribusiness, personal care, electronics, graphics, and security. The Company’s Solvents Recovery operation on the other hand, offers processes and services for pharmaceuticals; chemicals; steel, copper construction; recovery operations; acetone recovery, hexane, commodity based solvents; industries needing to recycle materials to virgin quality; industries that need purification (e.g. alcohol market); etc. Furthermore, Kodak’s Roll-to-Roll manufacturing capabilities can be used in photovoltaics, as well as in the manufacturing of battery electrodes, fuel cells, window films, membrane technology, medical devices, a variety of films (LED lighting, optical, packaging, and electronic). 31

EBP & Regional Assets & Opportunities Synergies Synergies Additional EBP and regional assets in photonics, energy storage, and food processing and manufacturing open doors for expanded opportunities. Photonics technologies are used in information technology and telecommunications; biophotonics in healthcare and life sciences; optical sensing, lighting, energy and displays; manufacturing machinery optical components; lasers and security devices for national security and defense; among others. The EBP is the new home of the Test, Assembly and Packaging (TAP) manufacturing facility of the American Institute for Manufacturing Integrated Photonics (AIM Photonics). Moreover, the State government recently announced the establishment of a 10 million, multiyear Photonics Venture Challenge in Rochester, which will help position the City as a critical hub for this technology and the industries that benefit from it. Likewise, the EBP is becoming a hub for the development of critical next generation battery and energy storage technologies designed to improve the reliability and resilience of the Country’s electric grid, as well as support hundreds of new product applications from Li Ion Batteries, to PEM Fuel Cells to Ultracapacitors. Through the BEST Test & Commercialization Center housed at the EBP, companies and universities from around the world are working together to create prototypes for new energy storage and generation systems, test them, do pilot manufacturing and get products to market. Finally, the Park has over 90 tenants belonging to varied industries, including food processing and manufacturing, imaging sensors, medical components, metallurgical and refining, among many others. These companies provide an excellent basis of know-how and support network for similar industries, or industries that can leverage their expertise. Particularly, the EBP is becoming a cluster of food processing and manufacturing operations, led by LiDestri, a premier private label and contract manufacturer of food, beverages and spirits, and DaniscoDupont, . Recent additions and announcements confirm the EBP’s strong position in the food processing and manufacturing industry cluster. From G’s Fresh, Ltd. from the UK - which manufactures ready-to-eat packaged beet products and bottled beet juice under the brand Love Beets – to Clearwater Organic Farms which recently announced its decision to locate a hydroponic commercial greenhouse at the Park, which will be the largest of its kind in the U.S. 32

EBP & Regional Assets & Opportunities Shared Services & Business Support Shared Services The Eastman Business Park offers additional amenities that can be used and enjoyed by its tenants, such a 1,968-seat theater, a conference center, a 13,070 square foot gymnasium, a 14,000 square foot fitness center, dinning room with kitchen that can seat 350 people, and four full service cafeterias. Business Support The EBP has a strong partnership with the economic development organizations in the area including Empire Development Finger Lakes Region, the Finger Lakes Economic Development Council, and the Greater Rochester Enterprise,. These economic development organizations work hand-in-hand to market the available sites and buildings within the business park to new and expanding businesses. These organizations lend their resources to facilitate companies start up and operations. From acting as a liaison through all the network of regulatory and permitting agencies and processes, to serving as a facilitator to solve issues, share best practices, connect with varied local and regional resources, and many more, these organizations are a company’s best resource for establishing a solid operation from the get go. Additionally, the Region offers a strong network of business services (staffing, IT, accounting, etc.) and industrial services (machine shop, tool & die, maintenance & repair, etc.). Finally, Rochester has a robust network of professional organizations in the area that can help facilitate business recruiting, sharing of best practices, lobbying, etc. Examples of these organizations are: FAME: Finger Lakes Manufacturing Enterprise; Rochester Tooling and Machining Association, RTMA; Rochester Regional Photonics Cluster, RRPC; and the Manufacturing Association of Central NY. 33

EBP & Regional Assets & Opportunities Business Environment & Quality of Life Business Environment & Quality of life When compared to neighboring communities and other mid-sized cities, Rochester has an edge due to a very vibrant high-tech presence in the area. Aspects like the easy commute and exceptional quality of schools are strong attributes. The Brighton Central, Penfield Central, and West Irondequoit school districts are highly rated by Neighborhood Scout, with a 10 out of 10 for district quality compared to New York State, and district quality compared to the U.S. Efforts like the construction of the Innovation Zone, led by the Rochester Downtown Development Corporation, are creating the environment to attract not only young newcomers, but also Rochester’s diaspora that is feeling compelled to come back to the City. These efforts, are helping develop a very vibrant Downtown, that is calling the attention of high-tech talent, while enhancing the quality of life, and spurring entrepreneurship via startups in industries such as food, software development, gaming, etc. Additionally, Rochester’s affordability makes it easier for people to move to the area. The City’s cost of living index is 89, compared to 122 of New York State, and 100 of the U.S.* Home sales prices are 42% more affordable than the national average**. The area is also very competitive in terms of wages, when compared with other mid-sized, high-tech areas, making it an attractive proposition for employers. *City of Rochester, Area Vibes-Council for Community and Economic Research. **Based on National Association of Home Builders – NAHB – Housing Opportunity Index from the third quarter of 2016. 34

EBP & Regional Assets & Opportunities Market Potential Market Potential Major Metropolitan Area Toronto, ON Ottawa, ON Cleveland, OH Montreal, QC Detroit, MI New York City, NY Philadelphia, PA Washington, D.C. Columbus, OH Boston, MA Miles from Rochester, NY Population (In Million) 171 252 260 309 328 337 344 385 396 397 *Esri Business Analyst 6.4 1.3 2.0 4.0 4.3 8.5 6.0 6.0 2.0 4.6 The Rochester, NY economic area is within 400 miles of an 86.6-million-people market, one-quarter of the U.S. and Canadian populations. This market is characterized by a median age of 39.7 years, a 59,294 median household income, a 2.52-person average household size, and annual household spending in groceries of 5,497, and 3,403 in eating out.* 35

EBP & Regional Assets & Opportunities Market Potential Market Potential. From a supply-chain standpoint for food processing & manufacturing operations, Rochester is part of the Northern Crescent Farm Region, which has approximately 15% of farms in the U.S., with 15% of value of production, and 9% of cropland. The Region’s farming activity is concentrated in dairy, general crop, and cash grain farms.* *United States Department of Agriculture, USDA 36

EBP & Regional Assets & Opportunities Business Incentives Business Incentives* Business incentives are provided by economic development agencies at the State, regional, and local levels to encourage business investments that that generate new jobs and contribute to economic growth. Incentives are based on total capital investment and job creation and/or retention by a company over a three to five-year period. Programs are available individually or bundled as part of a comprehensive package for larger capital investments that retain or create jobs as well as projects that create may high paying jobs. Incentives may apply to companies: Acquiring land, buildings or machinery and equipment Constructing or renovating buildings for business operations, including lease-hold improvements Constructing or improving infrastructure required for new location or expansion. Training new or existing employees Incentives generally fall into one of four categories: Grants Loans Tax exemptions, tax credits and incentives Special incentives, included power related *Sources: Greater Rochester Enterprise and Empire State Development 37

EBP & Regional Assets & Opportunities Business Incentives Tax exemptions, Tax credits & Incentives Level of Funding Incentive State State State Excelsior Jobs Tax Credit Excelsior Investment Tax Credit Excelsior Research and Development Tax Credit State Excelsior Real Property Tax Credit State Employee Training Incentive Program State START-UP NY State Empire State Jobs Retention Program State Economic Development Fund (EDF) Regional Council Capital Fund Program (ESD Grants – REDC) County County Real Property Tax Abatement Sales and Mortgage Tax Abatements Overview Credit of 6.85% of wages per net new job. Valued at 2% of qualified investments Credit of 50% of the Federal Research and Development credit up to six percent of research expenditures in NYS Available to firms locating in certain distressed areas and to firms in targeted industries that meet higher employment and investment thresholds Employee Training Incentive Program: a credit of 50% of eligible training costs, up to 10,000 per employee receiving eligible training from an approved, 3rd party training provider. Internship Program: a credit of 50% of the stipend paid to an intern, up to 3,000 per intern. Offers new and expanding businesses the opportunity to operate tax-free for 10 years on or near eligible university or college campuses in New York State. No business, corporate, sales, state or local taxes and no franchise fees. And no income tax for the company or its employees. Jobs tax credit of 6.85 percent of wages per impacted job that is retained in NYS for business operations impacted by natural disaster Financial assistance for projects that promote New York State’s economic health by facilitating job creation and/or retention, or increased business activity in the state. Funds may be used for: Acquisition or leasing of land, buildings, machinery and/or equipment; acquisition of existing business and/or assets; demolition and environmental remediation; new construction, renovation or leasehold improvements; acquisition of furniture and fixtures; soft costs up to twenty-five (25%) of total project costs; planning and feasibility studies related to a capital project Tax abatements on improvements to property over ten or more years Sales and mortgage tax exemption on construction materials and equipment, and/or mortgage *Sources: Greater Rochester Enterprise, Empire State Development, Monroe County Economic Development, County of Monroe Industrial Development Agency (COMIDA), Finger Lakes Hired, City of Rochester 38

EBP & Regional Assets & Opportunities Business Incentives Workforce Training & Development Level of Funding Local Local Local County Incentive Overview Recruitment - RochesterWorks! Post Job Openings Recruitment - RochesterWorks! Recruitment Services Recruitment - RochesterWorks! Candidate Assessment Tools - Career Readiness Credential (CRC) Free jobs posting at RochesterWorks! Hot Jobs section and Jobs Central Recruiting ‘Round Rochester, Recruiting on the Road, Annual Career Conference & Job Fair, and Summer Job Fair Career credential that certifies that job seekers have the core employability skills required across multiple industries and occupations around: Applied Mathematics, Reading for Information, and Locating Information. Connects graduates of the Monroe Community College Applied Technology Center with local manufacturing companies by providing both the employer and employee a 1,500 bonus. Provide training for current, full-time employees earning 10.00 – 25.00 per hour to help them achieve transferable skill upgrades. The grant reimburses up to 5,000 in training costs for training that must be completed within six (6) months. A minimum 50% match is required for this program. The OJT program reimburses businesses between 50-75% of total wages paid to a new hire who is being trained by another member of the company’s team and gaining the skills needed or their job. The maximum award amount per OJT contract is 5,000. Businesses are limited to three OJTs per year. Available to companies participating in qualified certification programs which lead to an industry recognized certification or transferable credential. Program expenses are eligible for reimbursement, up to 4,000 per employee or 16,000 per company. Employers must match at least 50% of the total program cost. Supports local employers willing to consider an applicant who may have barriers to employment; to observe their skills and work habits and determine that they are the right fit for the job. Fully subsidized program. Can reimburse companies for 50% to 90% of their new hire’s wages during their training period. Financial assistance for major business expansion and attraction efforts that will create or attract significant numbers of permanent, full-time private sector jobs in New York State. There are three categories of funding: Economic Development Loans and Grants; Job Creation Grants; and Workforce Training Grants. Recruitment - Monroe Manufactures Jobs Local Training - RochesterWorks! Customized Grants Local Training - RochesterWorks! On-the-Job Training Grants County Training - Monroe on the Job Regional Training - Work Experience 'Tryout' Program Regional Training - Finger Lakes Hired Grant State Training - JOBS Now *Sources: Greater Rochester Enterprise, Empire State Development, Monroe County Economic Development, County of Monroe Industrial Development Agency (COMIDA), Finger Lakes Hired, City of Rochester 39

EBP & Regional Assets & Opportunities Innovation Development Support New York State offers resources designed to enable new and existing businesses to become more competitive through the use of innovative technologies. Empire State Development's Division of Science, Technology and Innovation (NYSTAR) programs and centers emphasize the importance of working with industry as a way to leverage New York State’s technology strengths to produce new products. * A number of centers for advanced technology and centers of excellence are located throughout the state at universities and research institutions to help spur innovation and collaboration between the industry and the academy. Life sciences; biotechnology; biomedical and bioengineering; additive manufacturing and multifunctional printing; advanced technology in nanomaterials and nanoelectronics; advanced systems and engineering; automation technologies; energy systems; and advanced materials processing, are examples of the centers available. Specifically in Rochester, the Rochester Institute of Technology has the Additive Manufacturing and Multifunctional Printing (AMPrint) Center and the Center of Excellence in Advanced & Sustainable Manufacturing (COEASM). Likewise, the University of Rochester has the Center for Emerging and Innovative Sciences (CEIS) and the Center of Excellence in Data Science Business Incentives Other Incentives Utility Infrastructure and Energy Efficiency support Low Cost Power Allocations Low Interest Loans and Interest Subsidies Foreign Trade Zone Grants *Empire State Development **Sources: Greater Rochester Enterprise, Empire State Development, Monroe County Economic Development, County of Monroe Industrial Development Agency (COMIDA), Finger Lakes Hired, City of Rochester. Bond Financing 40

EBP/Region’s Challenges

EBP & Regional Challenges Challenges Zoning & Future Planned Zoning Kodak’s consideration of making the east end of the site a mixed-use-type of development may be a deterrent to future potential industrial tenants. Additionally, the fact that a portion of the Park falls under the City of Rochester and another one under the Town of Greece, may add perception of complexity for permitting, operative, and fiscal processes, among others. This needs to be investigated further. Air Quality & Environmental The Park in a non-attainment area for 8h-ozone. Credits are available on the open market, Kodak does not have available credits that can be used. Quality of life The perception of Rochester as an old industrial town, may be a deterrent for attracting professional employees to the area. Taxes High taxation in New York State may be a deterrent to attract talent from more affordable and less-tax burdened areas. New York State is the state with the highest taxation in the country, with a state and local tax burden of 12.7% and an effective state tax rate ( 50,000 taxable income) of 5.8%.* Additionally, stringent environmental regulations and permitting processes in the State of New York may be a deterrent for potential heavy industry users. *Forbes, March 2016 42

EBP & Regional Challenges Challenges Right to Work States Right-To-Work The fact the New York State is a non right-to-work state, may offer comparative disadvantages specially when competing against right-to-work states. In our experience, clients usually take the right-to-work status for granted, and do not usually discuss this topic exhaustively; however, rightto-work often comes up as a must-to have or desired attribute among the list of criteria to benchmark site options against. 43

EBP & Regional Challenges Challenges Workforce Availability & Quality While the suburbs exhibit strength in terms of workforce quality, the City’s quality of schools and crime represent a weakness; therefore, workforce coming from the area may present challenges for employers. Additionally, there is an aging population problem in the area. Population 60 grew 14% between 2010 and 2016, from 19.7% to 22.5%, respectively, and it is expected to reach 25.2% by 2021. Also, a large workforce that were part of the “big three” (Kodak, Bausch & Lomb, Xerox) at the back end of their careers Neighborhood Scout reports that the area has a crime index of 7, meaning that its is safer than only 7% of the cities in the U.S. Rochester has 8.78 crimes per 1,000 residents on average, compared to 3.8 of New York State, and 3.8 of the whole country. Likewise, property crime rate in Rochester is reported at 39.48 per 1,000 residents, compared to 16.06 of the State, and 24.9 of the U.S. Crimes per square mile in the area are reported at 275 on average, in comparison to 41 in New York, and 32 of the country. On the other hand, in terms of education, the Rochester City School District’s quality has a score of 1, with 10 being best, meaning that the District is better than only 1.4% of NY school districts, and 4.5% than U.S. school districts. Reading and math proficiency is reported at 7%, versus 35% of the State. Employers interviewed, also reported that there is a challenge to retain high level technical and engineering talent in the area, as there is a 44

EBP & Regional Challenges EBP’s Lot Options Challenges Lot options Sites/building size & configuration Sites available are small in size which may limit the options for bringing in sizable heavy-utility industrial operations, and/or for expansion in the future. Options for amalgamating parcels to make larger sites may be constrained by development limitations such as existing structures with high demolition costs, intersecting roads, utility easements, active rail line, etc. Existing buildings product inventory is dated and may require retrofitting. Neighboring operations Location of the Park within City limits and in close proximity to residential areas, may be disadvantageous for some industrial operations, and in comparison with more opened and unencumbered industrial parks. Environmental The heavy industrial/brownfield look and feel of the Park may be a deterrent to some looking for greener and more open-type of environment. Additionally, the stigma of perceived environmental contamination may be a deterrent for some. 45

Company Identification

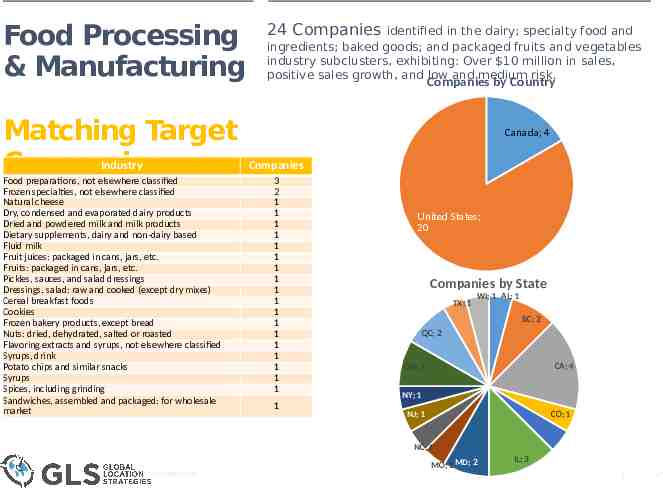

Food Processing & Manufacturing Matching Target Industry Companies Food preparations, not elsewhere classified Frozen specialties, not elsewhere classified Natural cheese Dry, condensed and evaporated dairy products Dried and powdered milk and milk products Dietary supplements, dairy and non-dairy based Fluid milk Fruit juices: packaged in cans, jars, etc. Fruits: packaged in cans, jars, etc. Pickles, sauces, and salad dressings Dressings, salad: raw and cooked (except dry mixes) Cereal breakfast foods Cookies Frozen bakery products, except bread Nuts: dried, dehydrated, salted or roasted Flavoring extracts and syrups, not elsewhere classified Syrups, drink Potato chips and similar snacks Syrups Spices, including grinding Sandwiches, assembled and packaged: for wholesale market 24 Companies identified in the dairy; specialty food and ingredients; baked goods; and packaged fruits and vegetables industry subclusters, exhibiting: Over 10 million in sales, positive sales growth, and low and medium risk. Companies by Country Canada; 4 Companies 3 2 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 United States; 20 Companies by State TX; 1 WI; 1 AL; 1 BC; 2 QC; 2 CA; 4 OH; 2 NY; 1 CO; 1 NJ; 1 NC; 1 Hoovers.com MO; 1 MD; 2 FL; 1 IL; 3 47

Food Processing & Manufacturing Matching Target Companies 92% of companies have over 50M in Sales Hoovers.com 48

Food Processing & Manufacturing Matching Target Companies58% of companies have over 1,000 employees Hoovers.com 49

Food Processing & Manufacturing Matching Target Companies Company Name Location Location Type Saint-Leonard QC Saputo Inc. Headquarters Canada The J M Smucker Orrville OH United Headquarters Company States TREEHOUSE FOODS, Oak Brook IL Headquarters INC. United States POST HOLDINGS, Saint Louis MO Headquarters INC. United States McCormick & Sparks MD United Company Headquarters States Incorporated THE WHITEWAVE Denver CO United Headquarters FOODS COMPANY States The Hain Celestial New Hyde Park NY Headquarters Group Inc. United States SNYDER'S-LANCE, Charlotte NC Headquarters INC. United States Sensient Milwaukee WI Technologies Headquarters United States Corporation Lancaster Colony Westerville OH Headquarters Corporation United States Premium Brands Richmond BC Holdings Headquarters Canada Corporation BLUE DIAMOND Sacramento CA Headquarters GROWERS United States Hoovers.com The next couple of slides contain the list of 24 companies identified within the dairy; specialty food and ingredients; baked goods; and packaged fruits and vegetables industry subclusters, exhibiting positive sales growth, over 10 million in sales, and low or medium risk. Sales ( Mil) Employees SIC 8,478.84M 12,500 20229902 Natural cheese 7,811.20M 6,910 20990100 Syrups 6,175.09M 16,027 20350000 Pickles, sauces, and salad dressings 5,026.80M 8,700 20430000 Cereal breakfast foods 4,411.50M 10,500 20990404 Spices, including grinding 4,198.10M 5,800 20260000 Fluid milk 2,688.52M 6,307 20230300 Dried and powdered milk and milk products 1,656.40M 6,100 20529905 Cookies 1,383.21M 4,083 20870000 Flavoring extracts and syrups, not elsewhere classified 1,191.11M 2,700 20350101 Dressings, salad: raw and cooked (except dry mixes) 1,070.68M 4,507 20990706 Sandwiches, assembled and packaged: for wholesale market 1,006.36M 1,500 20990000 Food preparations, not elsewhere classified 50

Food Processing & Manufacturing Matching Target Companies – Cont. Company Name Location J & J SNACK FOODS CORP. JOHN B. SANFILIPPO & SON, INC. Pennsauken NJ United States Elgin IL United States Menlo Park CA Landec Corporation United States Atrium Innovations Westmount QC Inc. Canada Owings Mills MD MEDIFAST, INC. United States OVERHILL FARMS, Vernon CA United INC. States Sun-Rype Products Kelowna BC Ltd Canada Golden Enterprises, Birmingham AL Inc. United States Amplify Snack Austin TX United Brands, Inc. States LIFEWAY FOODS, INC. Morton Grove IL NASDAQ OMX : United States LWAY Armanino Foods of Hayward CA Distinction, Inc. United States Celsius Holdings, Boca Raton FL Inc. United States Location Type Sales ( Mil) Employees Headquarters 992.78M 3,600 Headquarters 952.06M 1,350 Headquarters 541.10M 552 Headquarters 437.49M 600 Headquarters 274.53M 422 Headquarters 194.39M 400 Headquarters 153.27M 400 Headquarters 135.87M 749 20960000 Potato chips and similar snacks Headquarters 132.36M 45 20990000 Food preparations, not elsewhere classified Headquarters 123.88M 320 20230000 Dry, condensed and evaporated dairy products Single Location 35.69M 46 20380000 Frozen specialties, not elsewhere classified Headquarters 22.76M 39 20870208 Syrups, drink Hoovers.com SIC 20530000 Frozen bakery products, except bread 20689901 Nuts: dried, dehydrated, salted or roasted 20330310 Fruits: packaged in cans, jars, etc. 20239905 Dietary supplements, dairy and non-dairy based 20990000 Food preparations, not elsewhere classified 20380000 Frozen specialties, not elsewhere classified 20330305 Fruit juices: packaged in cans, jars, etc. 51

Woody Hydrick Managing Principal Global Location Strategies Tel. 1.678.988.0078 [email protected] Catalina Valencia Senior Consultant Global Location Strategies Tel. 1.314.809.1741 [email protected] Gideon Gradman Managing Director Integrated Energy Advisors Tel. 1.773.230.1979 [email protected]