Chapter 9 AUDITING COMPUTER-BASED INFORMATION SYSTEMS FOSTER School of

41 Slides459.25 KB

Chapter 9 AUDITING COMPUTER-BASED INFORMATION SYSTEMS FOSTER School of Business 320 Acctg 1

Questions to be addressed What are the scope and objectives of audit work, and what major steps take place in the audit process? What are the objectives of an information systems audit, and what is the four-step approach for meeting those objectives? How can a plan be designed to study and evaluate internal controls in an AIS? How can computer audit software be useful in the audit of an AIS? What is the nature and scope of an operational audit? FOSTER School of Business 320 Acctg 2

Introduction We focus on the concepts and techniques used in auditing an AIS. Auditors are employed for a wide range of tasks and responsibilities: Organizations employ internal auditors to evaluate company operations. The GAO and state governments employ auditors to evaluate management performance and compliance with legislative intent. The Defense Department employs auditors to review financial records of defense contractors. Publicly-held corporations hire external auditors to provide an independent review of their financial statements. FOSTER School of Business Acctg 320 3

Introduction This chapter is written primarily from the perspective of an internal auditor. They are directly responsible for helping management improve organizational efficiency and effectiveness. They assist in designing and implementing an AIS that contributes to the entity’s goals. External auditors are primarily responsible to shareholders and investors. Only indirectly concerned with AIS effectiveness. But most internal audit concepts apply to external audits. FOSTER School of Business Acctg 320 4

Nature of Auditing The American Accounting Association (AAA) defines auditing as: A systematic process of objectively obtaining and evaluating evidence. Regarding assertions about economic actions and events. To ascertain the degree of correspondence between those assertions and established criteria. And communicating the results to interested users. Committee on Basic Auditing Concepts, A Statement of Basic Auditing Concepts (Sarasota, FL.: American Accounting Association, 1973), 2. FOSTER School of Business Acctg 320 5

Nature of Auditing Auditing requires a step-by-step approach. Should be carefully planned and techniques should be judiciously selected and executed. Auditing involves collecting, reviewing, and documenting audit evidence. The auditor uses criteria such as the principles of management control discussed in previous chapters to develop recommendations. FOSTER School of Business Acctg 320 6

Nature of Auditing Auditors used to audit around the computer and ignore the computer and programs. Assumption: If output was correctly obtained from system input, then processing must be reliable. (Blackbox) Current approach: Audit through the computer. Uses the computer to check adequacy of system controls, data, and output. SAS-94 requires that external auditors evaluate how audit strategy is affected by an organization’s use of IT. Also states that auditors may need specialized skills to: Determine how the audit will be affected by IT. Assess and evaluate IT controls. Design and perform both tests of IT controls and substantive tests. FOSTER School of Business Acctg 320 7

Internal Audit Standards According to the IIA, the purpose of an internal audit is to: Evaluate the adequacy and effectiveness of a company’s internal control system; and Determine the extent to which assigned responsibilities are carried out. Today’s organizations use a computerized AIS to process, store, and control company information. To achieve the five objectives, an internal auditor must be qualified to examine all elements of the computerized AIS and use the computer as a tool to accomplish these auditing objectives. Computer expertise is essential to these tasks. FOSTER School of Business Acctg 320 8

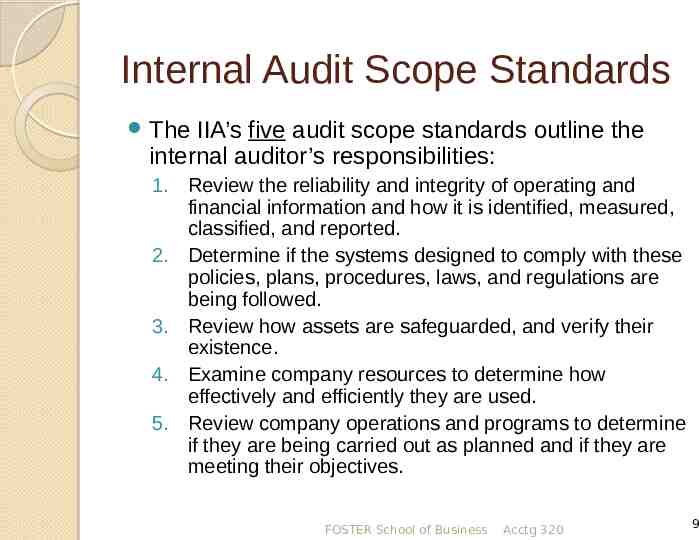

Internal Audit Scope Standards The IIA’s five audit scope standards outline the internal auditor’s responsibilities: 1. Review the reliability and integrity of operating and financial information and how it is identified, measured, classified, and reported. 2. Determine if the systems designed to comply with these policies, plans, procedures, laws, and regulations are being followed. 3. Review how assets are safeguarded, and verify their existence. 4. Examine company resources to determine how effectively and efficiently they are used. 5. Review company operations and programs to determine if they are being carried out as planned and if they are meeting their objectives. FOSTER School of Business Acctg 320 9

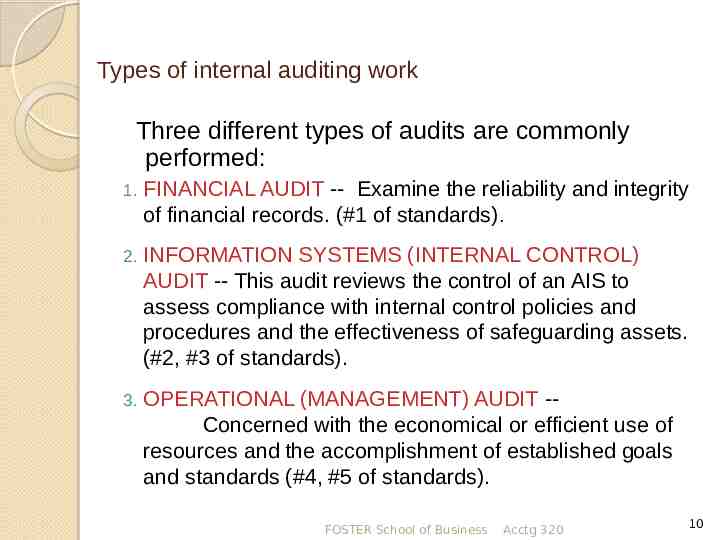

Types of internal auditing work Three different types of audits are commonly performed: 1. FINANCIAL AUDIT -- Examine the reliability and integrity of financial records. (#1 of standards) . 2. INFORMATION SYSTEMS (INTERNAL CONTROL) AUDIT -- This audit reviews the control of an AIS to assess compliance with internal control policies and procedures and the effectiveness of safeguarding assets. (#2, #3 of standards). 3. OPERATIONAL (MANAGEMENT) AUDIT -Concerned with the economical or efficient use of resources and the accomplishment of established goals and standards (#4, #5 of standards). FOSTER School of Business Acctg 320 10

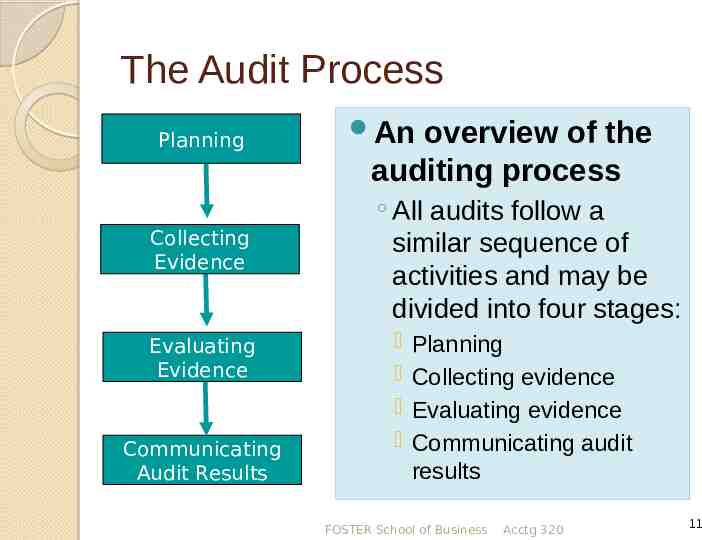

The Audit Process Planning Collecting Evidence Evaluating Evidence Communicating Audit Results An overview of the auditing process All audits follow a similar sequence of activities and may be divided into four stages: Planning Collecting evidence Evaluating evidence Communicating audit results FOSTER School of Business Acctg 320 11

Audit Planning When? By whom will the audit be performed? Purpose? Scope and objectives of the audit. Internal audits may be broader in scope, more detailed and extensive than an external audit. They may also focus on company objectives, not just whether the financials are stated properly. FOSTER School of Business Acctg 320 12

Audit Planning: Risk Three types of risk when conducting an audit. Focus on areas with the most risk. Inherent Risk. This is the susceptibility to material risk in the absence of controls. Control Risk. This is the risk that a material misstatement will get through the internal control structure and into the financial statements. Detection Risk. This is the risk that auditors and their audit procedures will not detect a material error or misstatement. FOSTER School of Business Acctg 320 13

Collection of Audit Evidence Much audit effort spent here. Most common methods: Observation of the activities being audited. Review of documentation to understand how a particular accounting information system or internal control system is supposed to function . Discussions with employees about their jobs and how they carry out certain procedures . Questionnaires that gather data about the system. Physical examination of the quantity and/or condition of tangible assets such as equipment, inventory or cash . Confirmation of the accuracy of certain information, such as customer account balances, through communication with independent third parties (banks, attorneys.). Reperformance of selected calculations to verify quantitative information on records and reports. Vouching for the validity of a transaction by examining all supporting documents. Analytical review of relationships and trends among information to detect items that should be further investigated. FOSTER School of Business Acctg 320 14

Evaluation of Audit Evidence Materiality and reasonable assurance are important when deciding how much audit work is necessary and when to evaluate the evidence. Determining materiality, what is and is not important in a given set of circumstances, is primarily a matter of judgment. The auditor seeks reasonable assurance that no material error exists in the information or process audited. Reasonable assurance is not a guarantee FOSTER School of Business Acctg 320 15

Communication of Audit Results (the audit report) The auditor prepares a written (and sometimes oral) report summarizing the audit findings and recommendations. Then, Follow-up study to see if implemented. FOSTER School of Business Acctg 320 16

The Risk-Based Audit Approach Determine the threats (fraud and errors) facing the accounting information system. Identify the control procedures implemented to minimize each threat by preventing or detecting the fraud and errors . Evaluate internal control procedures. Reviewing system documentation and interviewing appropriate personnel to determine if the necessary procedures are in place is called a systems review. Then tests of controls are conducted to determine if these procedures are satisfactorily followed. Evaluate weaknesses to determine their effect on the nature, timing, or extent of auditing procedures and client suggestions. If control weaknesses, then check for Compensating controls that compensate for the internal control weakness deficiency. FOSTER School of Business Acctg 320 17

Information Systems Audit Auditors have to make sure that the following 6 objectives are meet: Security provisions protect computer equipment, programs, communications, and data from unauthorized access, modification or destruction. Program development and acquisition are performed in accordance with management’s general and specific authorization. Program modifications have management’s authorization and approval. Processing of transactions, files, reports and other computer records is accurate and complete. Source data that are inaccurate or improperly authorized are identified and handled according to prescribed managerial policies. Computer data files are accurate, complete and confidential. FOSTER School of Business Acctg 320 18

Objective 1: Overall Security Table 9-1 on Page 336 contains a framework for auditing computer security; showing the following: Types of security errors and fraud found by the companies: hardware or software damage, theft, loss or unauthorized information disclosure, interruption of crucial business activities. Control procedures to minimize security errors and fraud: security protection plan, restrictions on physical and logical access, password protection, antivirus software, disaster recovery plan, backup and recovery, fault tolerant design. FOSTER School of Business Acctg 320 19

Objective 1: Overall Security (continued) Systems Review audit procedures: these include inspecting sites, interviewing people, reviewing policies and procedures, examining access logs, disaster recovery plans. Test of Controls—audit procedures, testing the controls: observe site access procedures, process for backing up files, password process, firewalls, uninterruptible power supplies, preventative maintenance, data transmission controls Compensating controls—do these exist if the controls are weak? Do you have sound personnel policies? Effective user controls? Segregation of incompatible duties? FOSTER School of Business Acctg 320 20

Objective 2: Program Development and Acquisition The auditor’s role in systems development should be limited to an independent review of systems development activities. Auditors should also review the policies, procedures, standards and documentation (listed in Table 9-2 on Page 338) Audited on the process by which software is selected. Did management approve of it? Do they have a strategic IT plan? FOSTER School of Business Acctg 320 21

Objective 3: Program Modification Auditing application program and system software changes: When a program change is submitted for approval, a list of all required updates should be compiled and approved by management and program users. During systems review, auditors should gain an understanding of the change process by discussing it with management and user personnel. An important part of an auditor’s tests of controls is to verify that program changes were identified, listed, approved, tested and documented. To test for unauthorized program changes, auditors can use a source code comparison program. FOSTER School of Business Acctg 320 22

Objective 3: Program Modification (cont.) Two additional techniques to detect unauthorized program changes: 1. The reprocessing technique also uses a verified copy of the source code. On a surprise basis, the auditor uses the program to reprocess data and compare that output with the company’s data. 2. Parallel simulation is similar to reprocessing except that the auditor writes a program instead of saving a verified copy of the source code. The auditor’s results are compared with the company’s results and any differences are investigated. FOSTER School of Business Acctg 320 23

Objective 4: Computer Processing The focus is the processing of transactions, files and related computer records to update files and databases and to generate reports. Does the system detect erroneous input? Does it properly correct input errors? Are there examples of improper distribution or disclosure of output? Options to test processing controls: a) Processing test data b) Concurrent audit techniques c) Analyzing program logic FOSTER School of Business Acctg 320 24

Process Test Data One way to test a program is to process a hypothetical series of valid and invalid transactions The following resources are helpful when preparing test data: A listing of actual transactions. The test transactions the programmer used to test the program. A test data generator program, which automatically prepares test data based on program specifications. FOSTER School of Business Acctg 320 25

Process Test Data (contin.) Disadvantages of processing test transactions: The auditor must spend considerable time developing an understanding of the system and preparing an adequate set of test transactions. Care must be taken to ensure that test data do not corrupt (affect) the company’s files and databases. FOSTER School of Business Acctg 320 26

Concurrent Audit Techniques The auditor uses concurrent audit techniques to continually monitor the system and collect audit evidence while live data are processed during regular operating hours. Concurrent audit techniques use embedded audit modules, which are segments of program code that perform audit functions. These report results to the auditors. FOSTER School of Business Acctg 320 27

Concurrent Audit Techniques (contin.) Auditors normally use five concurrent audit techniques: (1) Integrated test facility [ITF], (2) Snapshot technique, (3) System control audit review file [SCARF], (4) Audit Hooks, (5) Continuous and Intermittent Simulation (CIS) FOSTER School of Business Acctg 320 28

Integrated Test Facility (ITF) An integrated test facility (ITF) technique places a small set of fictitious records in the master files. The auditor compares processing with expected results to verify that the system and its controls are operating correctly. FOSTER School of Business Acctg 320 29

Snapshot Technique The snapshot technique examines the way transactions are processed. Selected transactions are marked with a special code that triggers the snapshot process. Focus is on correct processing. FOSTER School of Business Acctg 320 30

SCARF System control audit review file (SCARF) uses embedded audit modules to continuously monitor transaction activity and collect data on transactions with special audit significance (e.g., high transactions). FOSTER School of Business Acctg 320 31

Audit Hooks Audit hooks are audit routines that flag suspicious transactions. This approach is known as real-time notification, which displays a message on the auditor’s terminal as these questionable transactions occur. Good example in text re: State Farm Life. FOSTER School of Business Acctg 320 32

CIS Continuous and intermittent simulation (CIS) embeds an audit module in a database management system (DBMS). The CIS module examines all transactions that update the database using criteria similar to those of SCARF. FOSTER School of Business Acctg 320 33

Analysis of Program Logic If an auditor suspects that a particular application program contains unauthorized code or serious errors, then a detailed analysis of the program logic may be necessary. There are software that: create automatic flowcharts, create automated decision tables, scan for occurrences of variables or characters, map for unexecuted code. trace program steps Key: there is a lot of software to help auditors. FOSTER School of Business Acctg 320 34

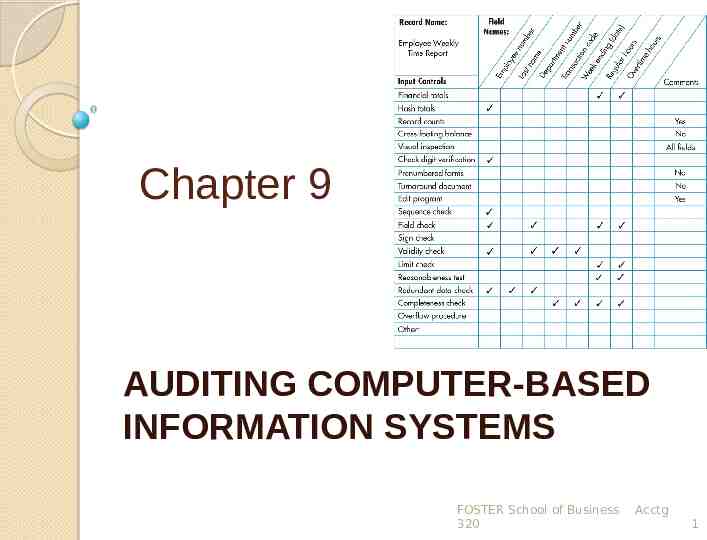

Objective 5: Source Data Auditors use an input controls matrix, such as the one shown in Figure 9-3 on Page 344. The matrix shows the control procedures applied to each field of an input record. Table 9-5 on Page 345 shows the internal controls that prevent, detect and correct inaccurate or unauthorized source data. Need to understand control on entry of source data. Authorization: Are there tests to prevent, detect and correct flawed information? Are the transactions complete? Do other controls compensate? FOSTER School of Business Acctg 320 35

Objective 6: Data Files The sixth objective concerns the accuracy, integrity and security of data stored in machine-readable files. Table 9-6 on page 347 summarizes the errors, controls and audit procedures for this objective. Accuracy, integrity and security of data. Are they protected against unauthorized modification, destruction or disclosure of data? FOSTER School of Business Acctg 320 36

Computer Software: Audit A number of computer programs, called computer audit software (CAS) or generalized audit software (GAS), have been written especially for auditors. General Audit Software is software designed to read, process and write data with the help of functions performing specific audit routines and with self-made macros. It is a tool in applying Computer Assisted Auditing Techniques Functions of generalized audit software include importing computerized data; thereafter other functions can be applied. FOSTER School of Business Acctg 320 37

Computer Software: Audit Two of the most popular software are Audit Control Language (ACL) and IDEA. Audit Control Language is a data interrogation tool used by auditors to view, explore and analyze data efficiently and cost effectively. ACL enables auditors to access data in diverse formats and on various types of storage devices. IDEA (Interactive Data Extraction and Analysis) is a Generalized Audit Software. It is able to import a wide range of different types of data files. During the import an IDEA file and its field statistics are created. FOSTER School of Business Acctg 320 38

Computer Software: Audit The primary purpose of CAS is to assist the auditor in reviewing and retrieving information in computer files. CAS cannot replace the auditor’s judgment or free the auditor from other phases of the audit. FOSTER School of Business Acctg 320 39

Operational Audits of an Accounting Information System The techniques and procedures used in operational audits are similar to audits of information systems and financial statements. The basic difference is that the scope of the information systems audit is confined to internal controls, whereas the scope of the financial audit is limited to systems output. In contrast, the scope of the operational audit is much broader, encompassing all aspects of information systems management. Operational audit objectives include evaluating such factors as: effectiveness, efficiency and goal achievement. FOSTER School of Business Acctg 320 40

Operational Audits of an Accounting Information System Evidence collection includes: Reviewing operating policies and documentation Confirming procedures with management and operating personnel Observing operating functions and activities Examining financial and operating plans and reports Testing the accuracy of operating activities Testing controls Ideal operational auditor has audit experience and several years’ experience as a manager. FOSTER School of Business Acctg 320 41