Cost Transfer Policy Office of the Vice President for Research

11 Slides373.00 KB

Cost Transfer Policy Office of the Vice President for Research Office of Grants Management 631-632-4886 https://www.stonybrook.edu/commcms/osp-ogm/ about.php The Research Foundation for SUNY Stony Brook University 2021

Cost Transfers As outlined in Office of Management and Budget OMB 2 CFR Part 200, all research expenditures must be allowable, reasonable, necessary and allocable to support the award(s) that will directly benefit from the cost, at the time of expense. If it becomes necessary to transfer costs to a different award, these cost principals must also be applied. This means when determining if the award to where cost would be transferred, can accept these previously expensed items, OGM approval is to ensure that the same cost principals were applied. The new Award(s)/Project(s)/Task(s) must directly benefit from the transferred or reallocated cost.

§200.403 Factors affecting allow ability of costs. Costs must be necessary and reasonable for the performance of the Federal award and be allocable thereto under these principles. Be consistent with policies and procedures that apply uniformly to both federally-financed and other activities of the non-Federal entity. Be accorded consistent treatment. Be determined in accordance with generally accepted accounting principles (GAAP), except, for state and local governments and Indian tribes only, as otherwise provided for in this part. Not be included as a cost or used to meet cost sharing or matching requirements of any other federally-financed program in either the current or a prior period. See also §200.306(b). Be adequately documented. See also §§200.300 through 200.309 of this part. Cost must be incurred during the approved budget period. §200.404 Reasonable costs. A cost is reasonable if, in its nature and amount, it does not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the cost. The question of reasonableness is particularly important when the non-Federal entity is predominantly federally-funded. §200.405 Allocable costs. A cost is allocable to a particular Federal award or other cost objective if the goods or services involved are chargeable or assignable to that Federal award or cost objective in accordance with relative benefits received.

Examples of circumstances where Cost Transfer may be allowable To correct a clerical error To redirect an expenditure to the correct Award Project and/or Task following administrative review and discovery Reallocation of costs where multiple Award, Project and/or Task will benefit Process a category refund due to vendor credit to a previously paid invoice or cost Expenditures requiring a Cost Transfer may be identified by the Principal Investigator, Department Administrator or by the Office of Grants Management during the monitoring and analysis of cost during the life of award.

Cost Transfer Procedure Identify the specific expenditure to be transferred Verify that the transfer request is made timely; within 90 days of discovery of error Verify that sufficient funds are available in the new Award/Project/Task Confirm that the Award/Project/Task to be charged will benefit from the item or service. Confirm costs were incurred within the period of performance that would allow for benefit. A detailed justification must include: why the transfer is being requested why the costs were not initially allocated correctly how the costs benefit the research on the updated Award/Project/Task The costs are consistent with sponsor guidelines of the new Award/Project to be charged Cost Transfers will never be approved to spend down available funds.

Cost Transfer of Payroll Expenditures To correct cost allocations for salary expense, an updated RF Employee Change form must be generated to reflect the updated Labor Schedule to distribute the employee effort. This should include the justification for the reallocation of labor costs when it is for retroactive salary costs representing effort changes. All Employee Change Forms must first be submitted and executed by the campus Human Resource/Payroll Office. Once received in Office of Grants Management for the execution of Labor Schedule, the process will include the completion of a Payroll Distribution Adjustment form to document the costs that are being transferred as a result of the approved reallocation of labor cost.

Cost Transfer Payroll Expenditures continued Complete the Distribution Adjustment Form Attach and file with the corresponding Payroll Form If greater than two pay periods, attach programmatic justification from the Principal Investigator or Departmental Administrator who has delegated authority. Signatures Required: Principal Investigator or DA with delegated authority Sponsored Award Analyst or Senior Award Analyst *A programmatic justification is not required for changes occurring within two Research Foundation pay periods. Two pay periods is defined as the period of time between the PI’s signature date and the new labor schedule start date. This represents a reasonable time frame for the Employee Change form to be approved by PI and received by the HRS/Payroll Office.

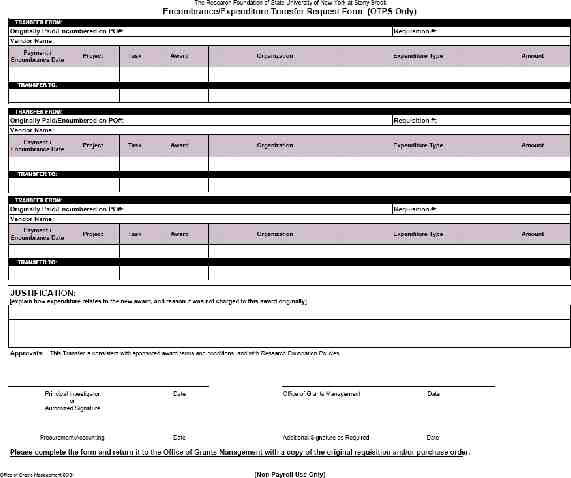

Encumbrance/Expenditure Transfer Request Form (Direct Cost that are other than personnel ) To be used to transfer encumbered Purchase Order and/or non-personnel expenditures. Complete the Encumbrance/Expenditure Transfer Request Form Must include: Justification that includes direct benefit to award where cost should have been charged reason for request copy of expenditure transaction: Requisition, Purchase Order, Invoice(s), Receipts export from Award/Project/Task to document where the transaction was originally charged or encumbered. Signatures Required: Principal Investigator or Authorized Delegate Sponsored Award Analyst Assistant Director of OGM, Sr. Sponsored Award Analyst, Director of Grants Management

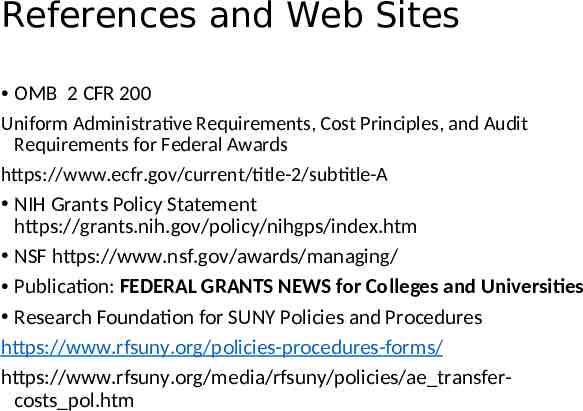

References and Web Sites OMB 2 CFR 200 Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards https://www.ecfr.gov/current/title-2/subtitle-A NIH Grants Policy Statement https://grants.nih.gov/policy/nihgps/index.htm NSF https://www.nsf.gov/awards/managing/ Publication: FEDERAL GRANTS NEWS for Colleges and Universities Research Foundation for SUNY Policies and Procedures https://www.rfsuny.org/policies-procedures-forms/ https://www.rfsuny.org/media/rfsuny/policies/ae transfercosts pol.htm