The Eaton Active Special Opportunity Property Fund Market Update

14 Slides1.15 MB

The Eaton Active Special Opportunity Property Fund Market Update May 2009 “Market Turning”

Contents The Current Market Opportunity The Eaton Fund - Adding Value

The Current Market Opportunity

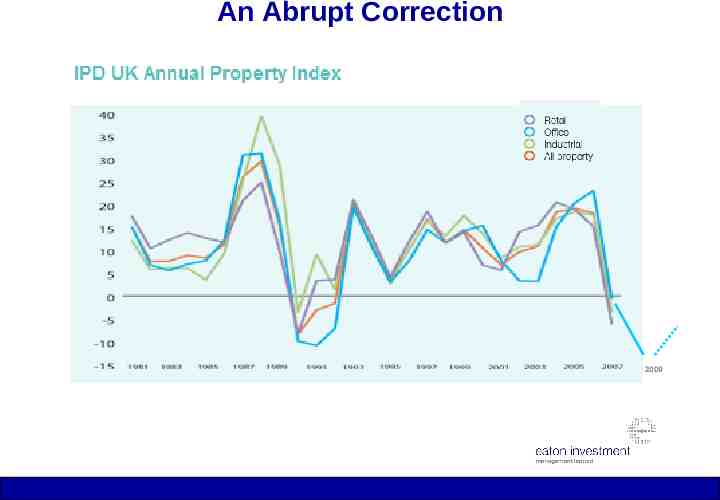

An Abrupt Correction 2009

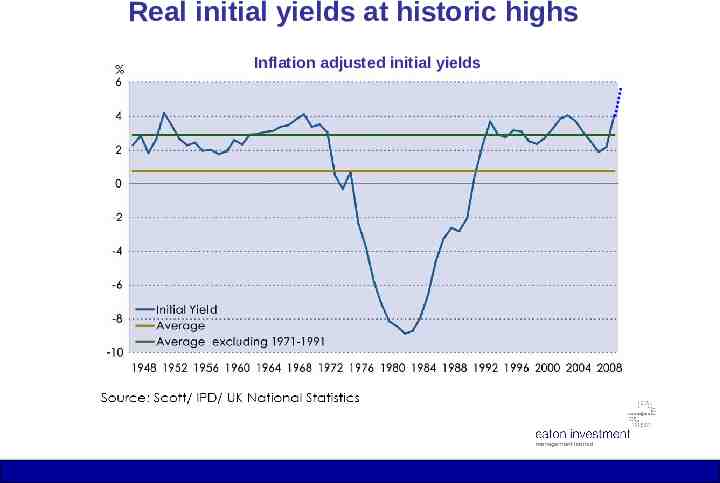

Real initial yields at historic highs Inflation adjusted initial yields

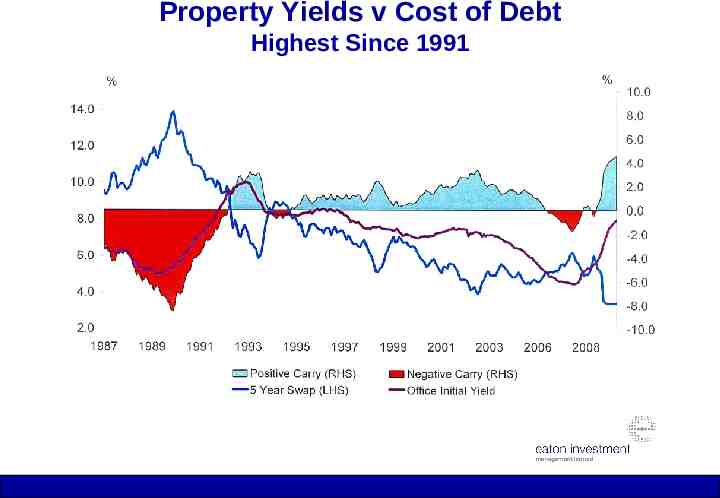

Property Yields v Cost of Debt Highest Since 1991

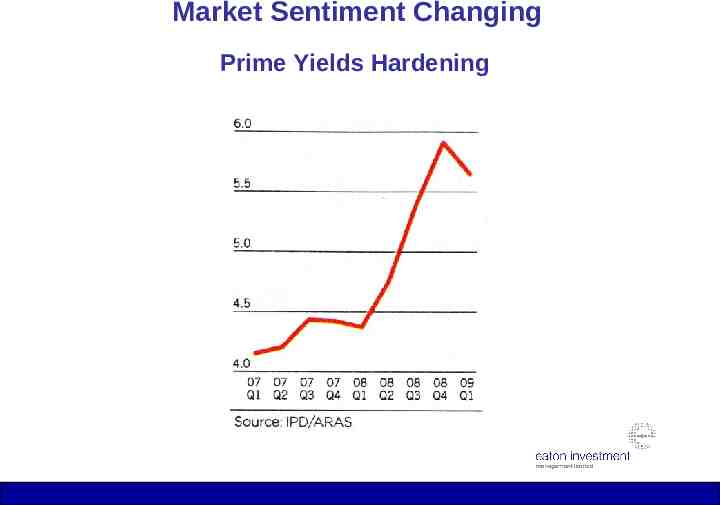

Market Sentiment Changing Prime Yields Hardening

The Buying Opportunity 2009

The Current Market – Deals Examples of current high yield investment grade propositions

Significant Players Back In The Market Mould & Vaughan (London and Stamford) Nick Leslau (Prestbury) John Caudwell (Phones4U) David Whelan (JJB, Wigan Athletic) WW Advisors (Middle East Investors) Stenham UK Property Fund BP Pension Fund Moorfield Mars Pension Fund AFIAA (Swiss Pension Fund) IAK (German Pension Fund) J P Morgan

The Current Market Prime Yields may have ‘topped out’ Investment Grade Yields available 7.5 – 9% Market Bottoming Out Asset Management and Planning Angles still overly discounted Bank finance - terms easing – low fixed rates Competition for best deals increasing Smart Money and Institutions back in the Market

The Eaton Fund Adding Capital Value

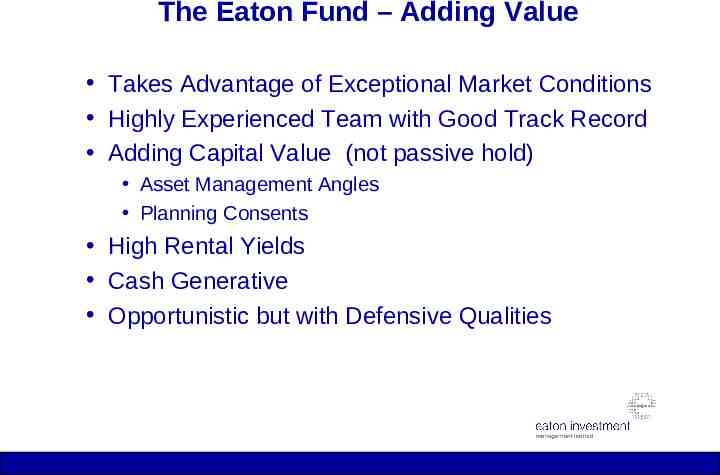

The Eaton Fund – Adding Value Takes Advantage of Exceptional Market Conditions Highly Experienced Team with Good Track Record Adding Capital Value (not passive hold) Asset Management Angles Planning Consents High Rental Yields Cash Generative Opportunistic but with Defensive Qualities

Summary Abrupt market correction (25-30%) Inflation adjusted yields now at a post war high Prime Rental Yields hardening Bank finance easing Smart Investors (and Institutions) back in the market Market turning (very best deals possibly gone?) Eaton – benefit of high rental yields and actively adding capital value