Chapter 13 Annuities and Sinking Funds McGraw-Hill/Irwin 2011

20 Slides610.50 KB

Chapter 13 Annuities and Sinking Funds McGraw-Hill/Irwin 2011 The McGraw-Hill Companies, All Rights Reserved

#13 Annuities and Sinking Funds Learning Unit Objectives LU13.1 Annuities: Ordinary Annuity and Annuity Due (Find Future Value) 1. Differentiate between contingent annuities and annuities certain 2. Calculate the future value of an ordinary annuity and an annuity due manually and by table lookup 13-2

#13 Annuities and Sinking Funds Learning Unit Objectives LU13.2 Present Value of an Ordinary Annuity (Find Present Value) 1. Calculate the present value of an ordinary annuity by table lookup and manually check the calculation 2. Compare the calculation of the present value of one lump sum versus the present value of an ordinary annuity 13-3

#13 Annuities and Sinking Funds Learning Unit Objectives LU13.3 Sinking Funds (Find Periodic Payments 1. Calculate the payment made at the end of each period by table lookup 2. Check table lookup by using ordinary annuity table 13-4

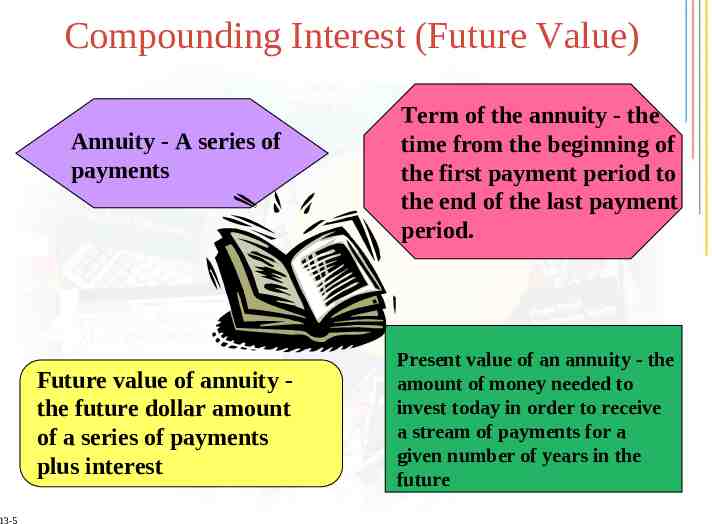

Compounding Interest (Future Value) Annuity - A series of payments Future value of annuity the future dollar amount of a series of payments plus interest 13-5 Term of the annuity - the time from the beginning of the first payment period to the end of the last payment period. Present value of an annuity - the amount of money needed to invest today in order to receive a stream of payments for a given number of years in the future

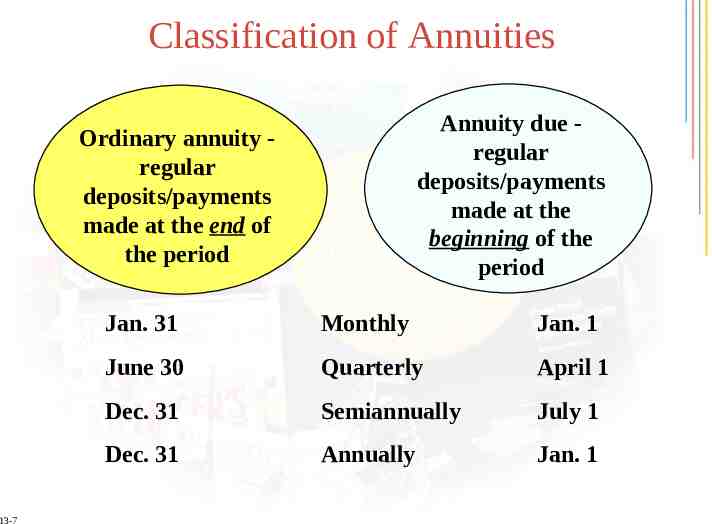

Classification of Annuities 13-6 Contingent Annuities have no fixed number of payments but depend on an uncertain event Annuities certain - have a specific stated number of payments Life Insurance payments Mortgage payments

Classification of Annuities Annuity due regular deposits/payments made at the beginning of the period Ordinary annuity regular deposits/payments made at the end of the period 13-7 Jan. 31 Monthly Jan. 1 June 30 Quarterly April 1 Dec. 31 Semiannually July 1 Dec. 31 Annually Jan. 1

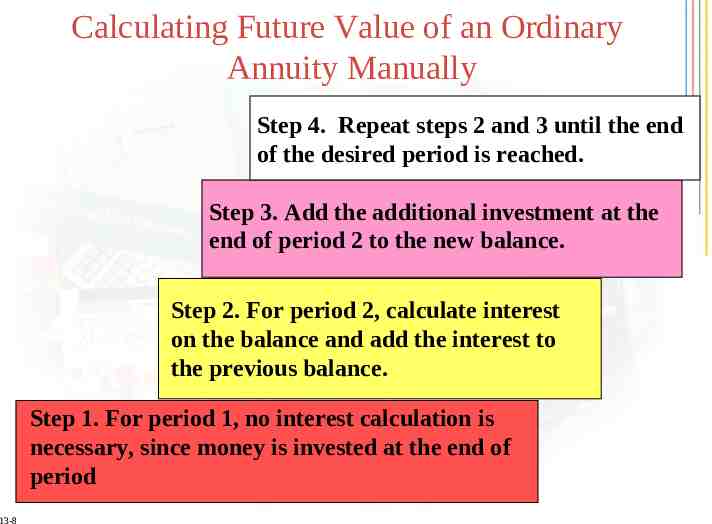

Calculating Future Value of an Ordinary Annuity Manually Step 4. Repeat steps 2 and 3 until the end of the desired period is reached. Step 3. Add the additional investment at the end of period 2 to the new balance. Step 2. For period 2, calculate interest on the balance and add the interest to the previous balance. Step 1. For period 1, no interest calculation is necessary, since money is invested at the end of period 13-8

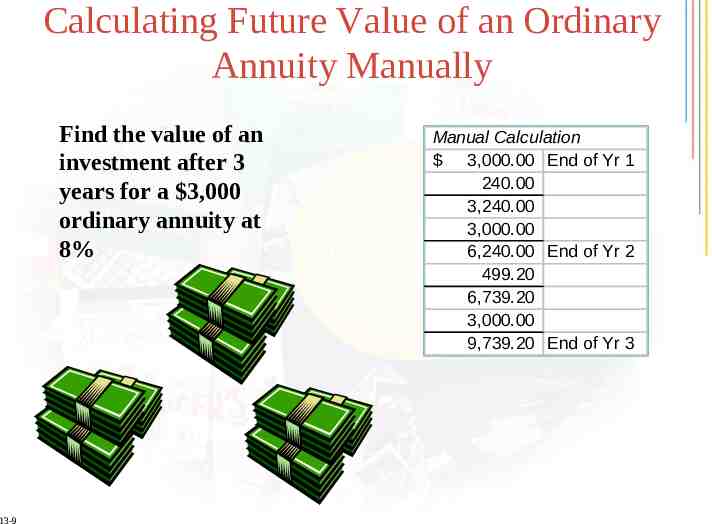

Calculating Future Value of an Ordinary Annuity Manually Find the value of an investment after 3 years for a 3,000 ordinary annuity at 8% 13-9 Manual Calculation 3,000.00 End of Yr 1 240.00 3,240.00 3,000.00 6,240.00 End of Yr 2 499.20 6,739.20 3,000.00 9,739.20 End of Yr 3

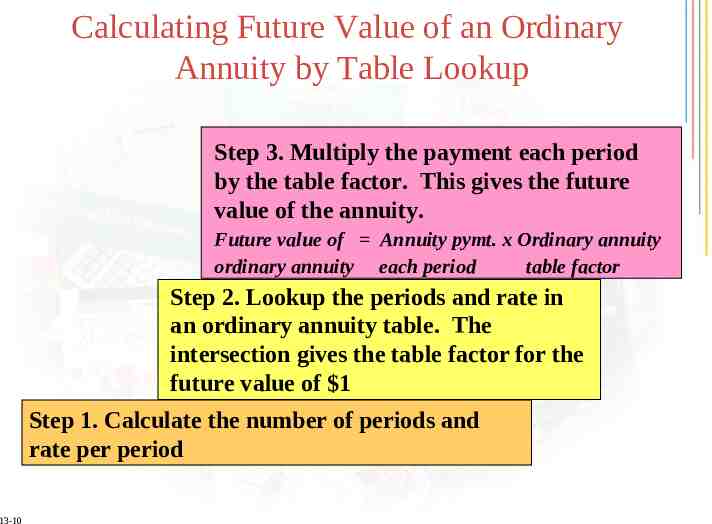

Calculating Future Value of an Ordinary Annuity by Table Lookup Step 3. Multiply the payment each period by the table factor. This gives the future value of the annuity. Future value of Annuity pymt. x Ordinary annuity ordinary annuity each period table factor Step 2. Lookup the periods and rate in an ordinary annuity table. The intersection gives the table factor for the future value of 1 Step 1. Calculate the number of periods and rate per period 13-10

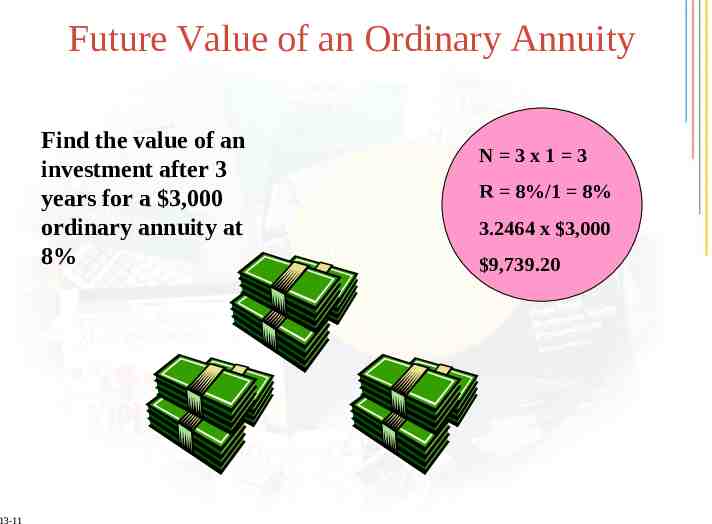

Future Value of an Ordinary Annuity Find the value of an investment after 3 years for a 3,000 ordinary annuity at 8% 13-11 N 3x1 3 R 8%/1 8% 3.2464 x 3,000 9,739.20

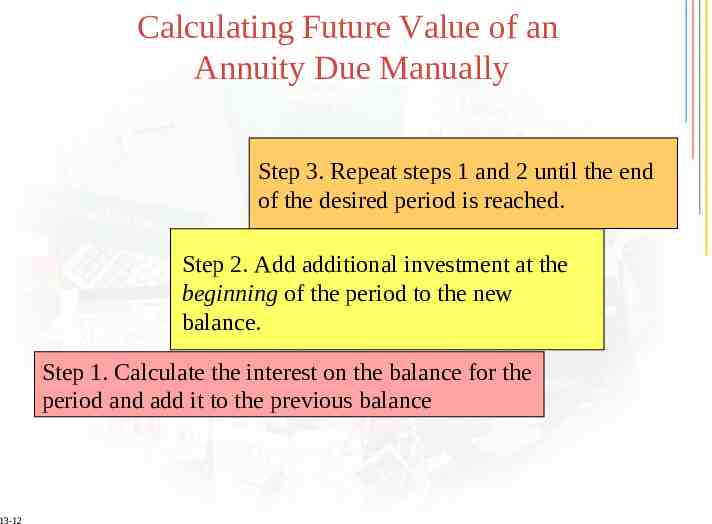

Calculating Future Value of an Annuity Due Manually Step 3. Repeat steps 1 and 2 until the end of the desired period is reached. Step 2. Add additional investment at the beginning of the period to the new balance. Step 1. Calculate the interest on the balance for the period and add it to the previous balance 13-12

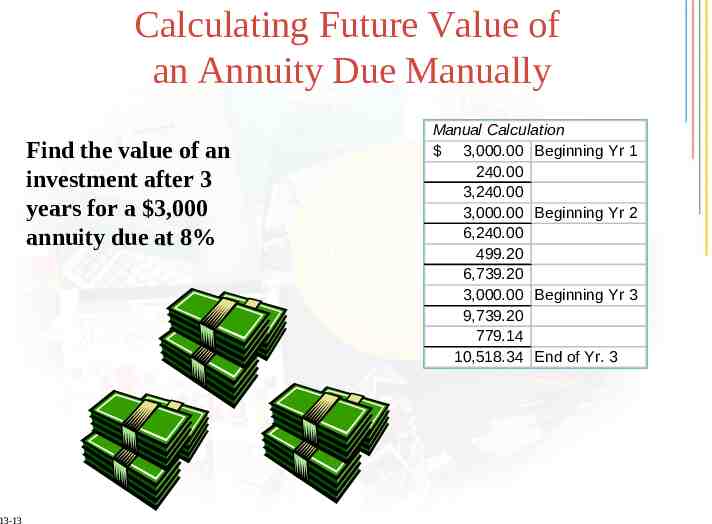

Calculating Future Value of an Annuity Due Manually Find the value of an investment after 3 years for a 3,000 annuity due at 8% 13-13 Manual Calculation 3,000.00 Beginning Yr 1 240.00 3,240.00 3,000.00 Beginning Yr 2 6,240.00 499.20 6,739.20 3,000.00 Beginning Yr 3 9,739.20 779.14 10,518.34 End of Yr. 3

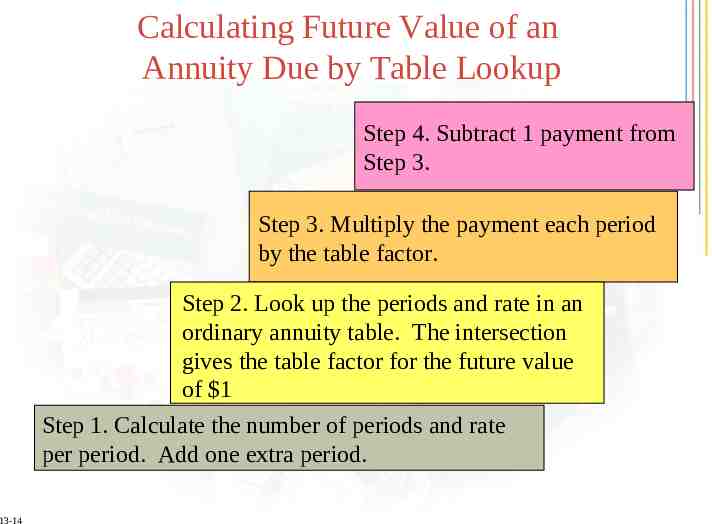

Calculating Future Value of an Annuity Due by Table Lookup Step 4. Subtract 1 payment from Step 3. Step 3. Multiply the payment each period by the table factor. Step 2. Look up the periods and rate in an ordinary annuity table. The intersection gives the table factor for the future value of 1 Step 1. Calculate the number of periods and rate per period. Add one extra period. 13-14

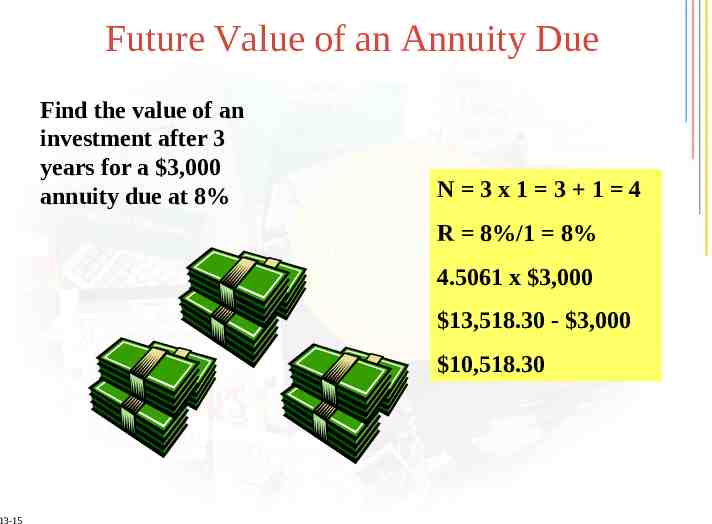

Future Value of an Annuity Due Find the value of an investment after 3 years for a 3,000 annuity due at 8% N 3x1 3 1 4 R 8%/1 8% 4.5061 x 3,000 13,518.30 - 3,000 10,518.30 13-15

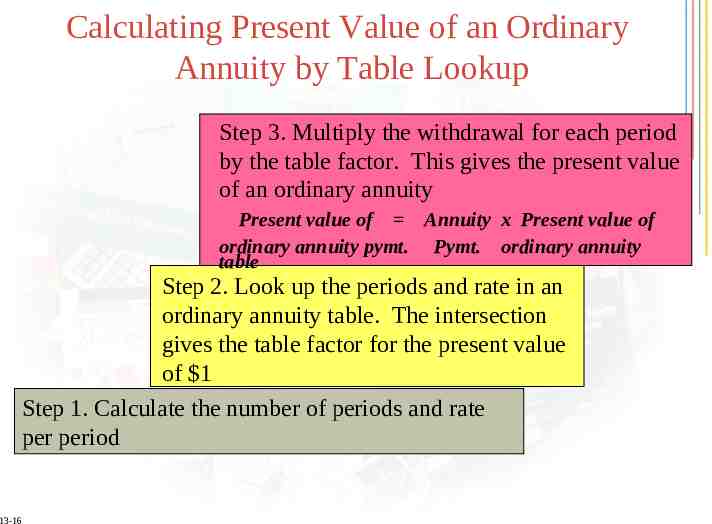

Calculating Present Value of an Ordinary Annuity by Table Lookup Step 3. Multiply the withdrawal for each period by the table factor. This gives the present value of an ordinary annuity Present value of Annuity x Present value of ordinary annuity pymt. Pymt. ordinary annuity table Step 2. Look up the periods and rate in an ordinary annuity table. The intersection gives the table factor for the present value of 1 Step 1. Calculate the number of periods and rate per period 13-16

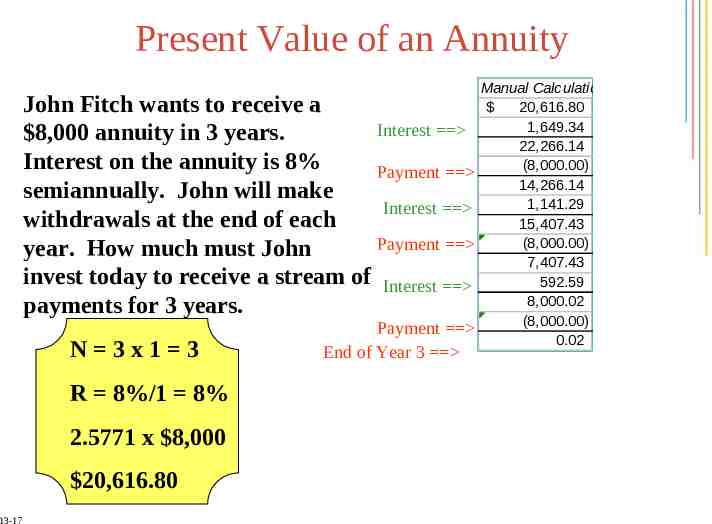

Present Value of an Annuity John Fitch wants to receive a Interest 8,000 annuity in 3 years. Interest on the annuity is 8% Payment semiannually. John will make Interest withdrawals at the end of each Payment year. How much must John invest today to receive a stream of Interest payments for 3 years. N 3x1 3 R 8%/1 8% 2.5771 x 8,000 20,616.80 13-17 Payment End of Year 3 Manual Calculation 20,616.80 1,649.34 22,266.14 (8,000.00) 14,266.14 1,141.29 15,407.43 (8,000.00) 7,407.43 592.59 8,000.02 (8,000.00) 0.02

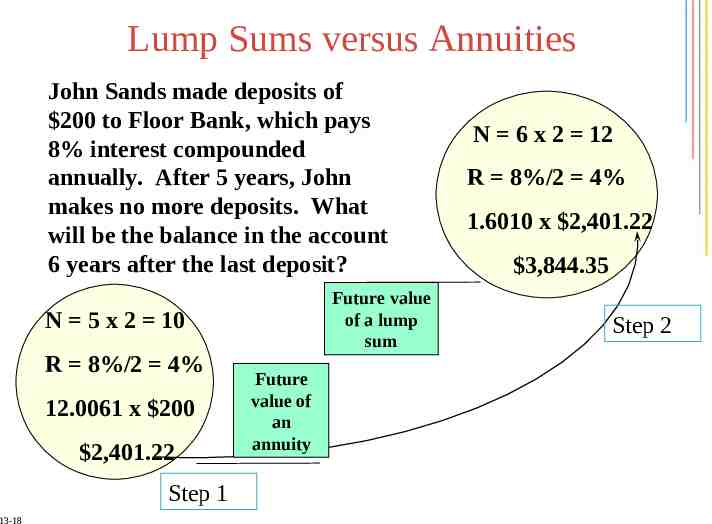

Lump Sums versus Annuities John Sands made deposits of 200 to Floor Bank, which pays 8% interest compounded annually. After 5 years, John makes no more deposits. What will be the balance in the account 6 years after the last deposit? Future value of a lump sum N 5 x 2 10 R 8%/2 4% 12.0061 x 200 2,401.22 Step 1 13-18 Future value of an annuity N 6 x 2 12 R 8%/2 4% 1.6010 x 2,401.22 3,844.35 Step 2

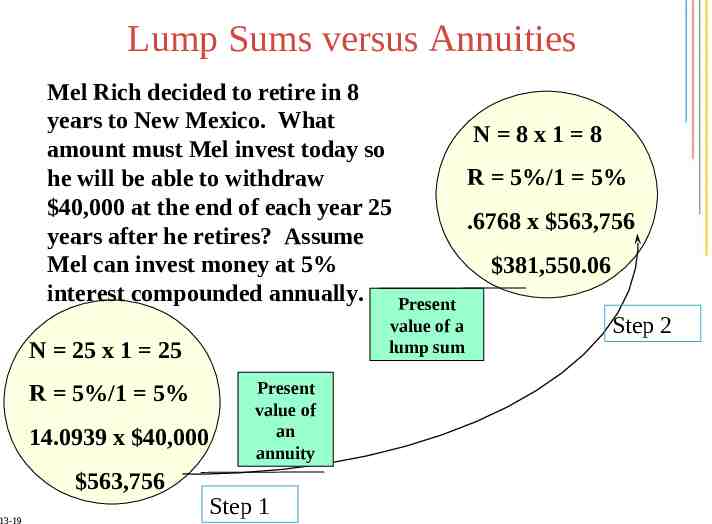

Lump Sums versus Annuities Mel Rich decided to retire in 8 years to New Mexico. What N 8x1 8 amount must Mel invest today so R 5%/1 5% he will be able to withdraw 40,000 at the end of each year 25 .6768 x 563,756 years after he retires? Assume Mel can invest money at 5% 381,550.06 interest compounded annually. Present value of a Step 2 lump sum N 25 x 1 25 R 5%/1 5% 14.0939 x 40,000 563,756 13-19 Present value of an annuity Step 1

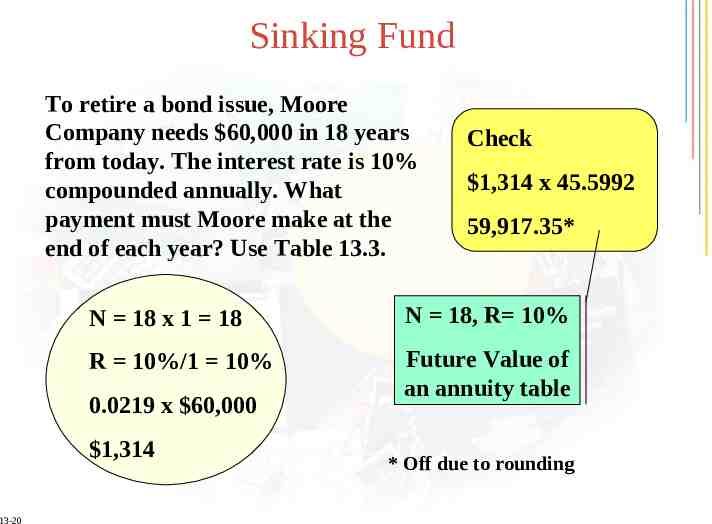

Sinking Fund To retire a bond issue, Moore Company needs 60,000 in 18 years from today. The interest rate is 10% compounded annually. What payment must Moore make at the end of each year? Use Table 13.3. 1,314 x 45.5992 59,917.35* N 18 x 1 18 N 18, R 10% R 10%/1 10% Future Value of an annuity table 0.0219 x 60,000 1,314 13-20 Check * Off due to rounding