Commonwealth Bank Investments & Insurance Services 29 July 2003

33 Slides290.00 KB

Commonwealth Bank Investments & Insurance Services 29 July 2003 www.commbank.com.au 1

Disclaimer The material that follows is a presentation of general background information about the Bank’s activities current at the date of the presentation, 29 July 2003. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice when deciding if an investment is appropriate. 2

Speaker’s Notes Speaker’s notes for this presentation are attached below each slide. To access them, you may need to save the slides in PowerPoint and view/print in “notes view.” 3

Discussion Outline Stuart Grimshaw IIS Strategy and Business Group Executive, Overview Investments and Insurance Services Peter Beck CommInsure Strategy Managing Director, John Pearce CFSI Strategy and Chief Executive Officer, and Business Overview CommInsure Business Overview Colonial First State Investments Stuart Grimshaw Conclusion Group Executive, Investments and Insurance Services Questions and Answers 4

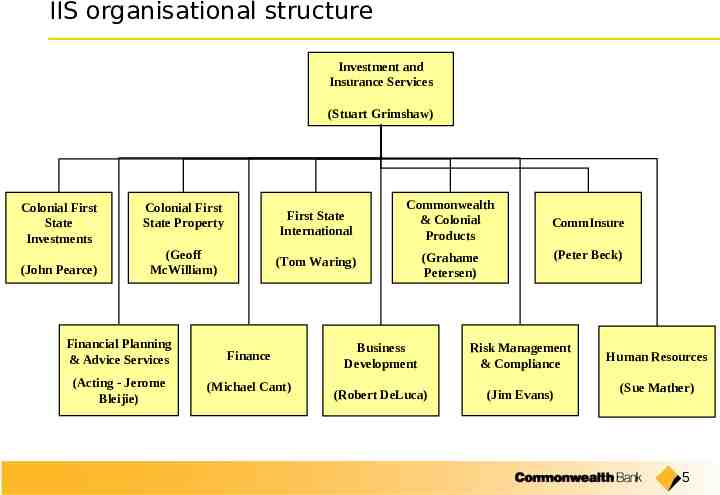

IIS organisational structure Investment and Insurance Services (Stuart Grimshaw) Colonial First State Investments (John Pearce) Colonial First State Property (Geoff McWilliam) First State International Commonwealth & Colonial Products (Tom Waring) (Grahame Petersen) Financial Planning & Advice Services Finance (Acting - Jerome Bleijie) (Michael Cant) CommInsure (Peter Beck) Business Development Risk Management & Compliance Human Resources (Robert DeLuca) (Jim Evans) (Sue Mather) 5

Key Messages There is significant value in having an end to end value chain presence We are building on our leading competitive position in investments and insurance manufacturing We are leveraging and extending our distribution strengths We are growing our platform capabilities 6

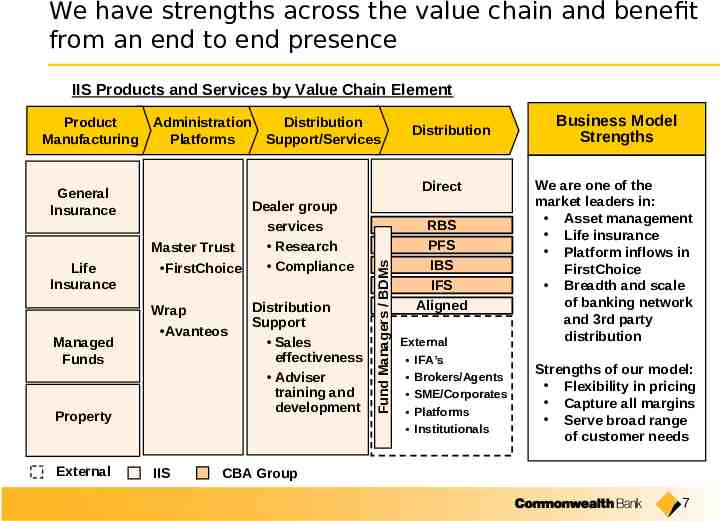

We have strengths across the value chain and benefit from an end to end presence IIS Products and Services by Value Chain Element General Insurance Life Insurance Administration Platforms Dealer group services Research Master Trust Compliance FirstChoice Avanteos Property External Distribution Direct Wrap Managed Funds Distribution Support/Services IIS Distribution Support Sales effectiveness Adviser training and development Fund Managers / BDMs Product Manufacturing RBS PFS IBS IFS Aligned External IFA’s Brokers/Agents SME/Corporates Platforms Institutionals Business Model Strengths We are one of the market leaders in: Asset management Life insurance Platform inflows in FirstChoice Breadth and scale of banking network and 3rd party distribution Strengths of our model: Flexibility in pricing Capture all margins Serve broad range of customer needs CBA Group 7

There are a number of notable recent achievements across IIS Integration of Commonwealth Investment Management and First State Investments Good progress on legacy product and systems rationalisation Achieved leading market share position in Life Insurance Significant growth in Property Funds Under Management over last 12 months Successful launch and strong growth of FirstChoice 8

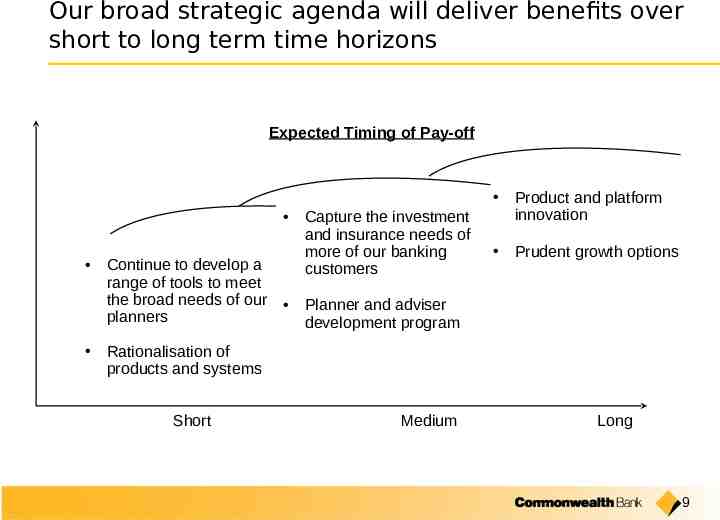

Our broad strategic agenda will deliver benefits over short to long term time horizons Expected Timing of Pay-off Continue to develop a range of tools to meet the broad needs of our planners Capture the investment and insurance needs of more of our banking customers Product and platform innovation Prudent growth options Planner and adviser development program Rationalisation of products and systems Short Medium Long 9

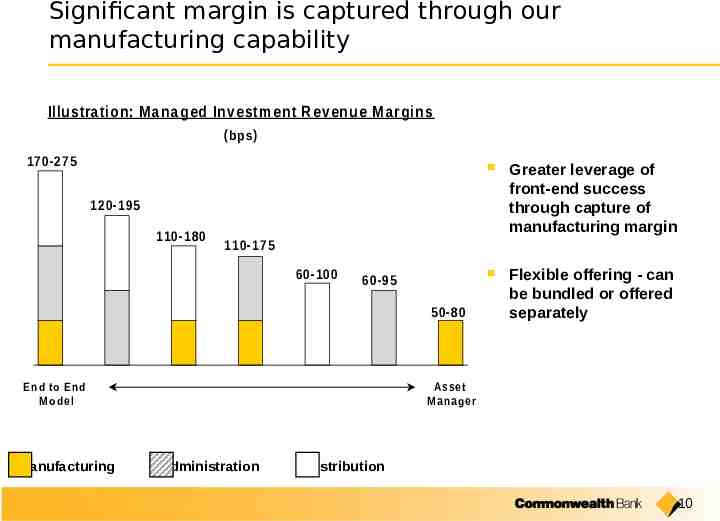

Significant margin is captured through our manufacturing capability Illu stration: M anaged Investm ent R evenue M argins (bps) 170-275 Greater leverage of front-end success through capture of manufacturing margin Flexible offering - can be bundled or offered separately 120-195 110-180 110-175 60-100 60-95 50-80 E nd to E nd M odel Manufacturing A sset M anager Administration Distribution 10

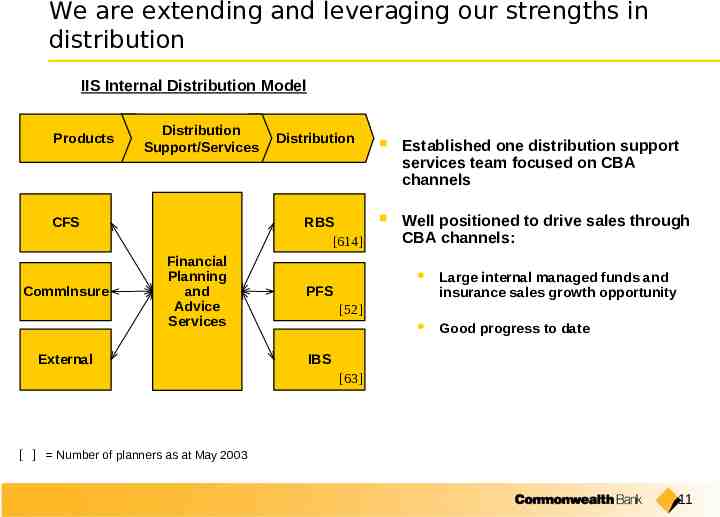

We are extending and leveraging our strengths in distribution IIS Internal Distribution Model Products Distribution Support/Services CFS CommInsure Distribution RBS [614] Financial Planning and Advice Services External Established one distribution support services team focused on CBA channels Well positioned to drive sales through CBA channels: Large internal managed funds and insurance sales growth opportunity Good progress to date PFS [52] IBS [63] [ ] Number of planners as at May 2003 11

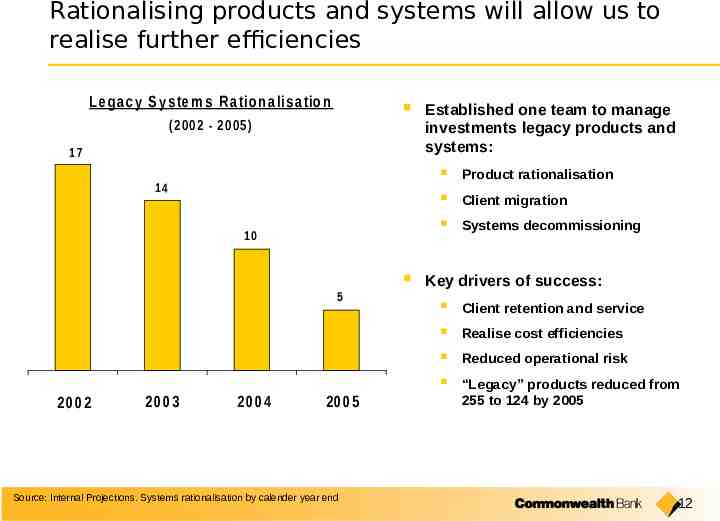

Rationalising products and systems will allow us to realise further efficiencies L e g a c y S y s te m s R a tio n a lis a tio n (2 0 0 2 - 2 0 0 5 ) 17 Established one team to manage investments legacy products and systems: Product rationalisation Client migration Systems decommissioning 14 10 5 2002 2003 2004 2005 Source: Internal Projections. Systems rationalisation by calender year end Key drivers of success: Client retention and service Realise cost efficiencies Reduced operational risk “Legacy” products reduced from 255 to 124 by 2005 12

Discussion Outline Stuart Grimshaw IIS Strategy and Business Group Executive, Overview Investments and Insurance Services Peter Beck CommInsure Strategy Managing Director, John Pearce CFSI Strategy and Chief Executive Officer, and Business Overview CommInsure Business Overview Colonial First State Investments Stuart Grimshaw Conclusion Group Executive, Investments and Insurance Services Questions and Answers 13

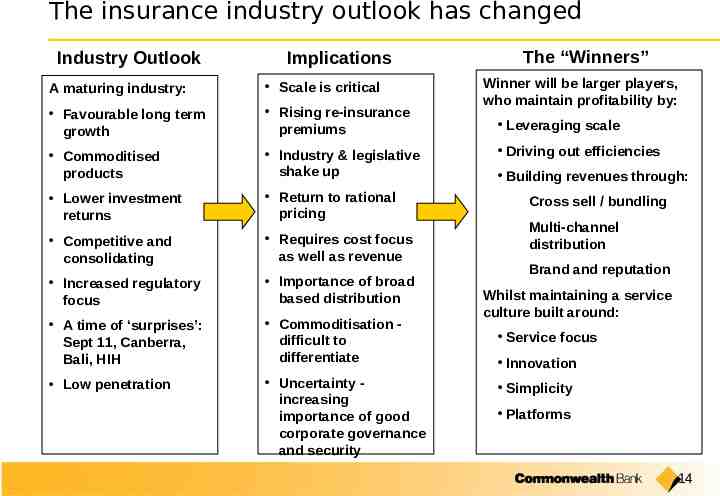

The insurance industry outlook has changed Industry Outlook Implications A maturing industry: Scale is critical Favourable long term growth Rising re-insurance premiums Commoditised products Industry & legislative shake up Lower investment returns Return to rational pricing Competitive and consolidating Requires cost focus as well as revenue Increased regulatory focus Importance of broad based distribution A time of ‘surprises’: Sept 11, Canberra, Bali, HIH Commoditisation difficult to differentiate Low penetration Uncertainty increasing importance of good corporate governance and security The “Winners” Winner will be larger players, who maintain profitability by: Leveraging scale Driving out efficiencies Building revenues through: Cross sell / bundling Multi-channel distribution Brand and reputation Whilst maintaining a service culture built around: Service focus Innovation Simplicity Platforms 14

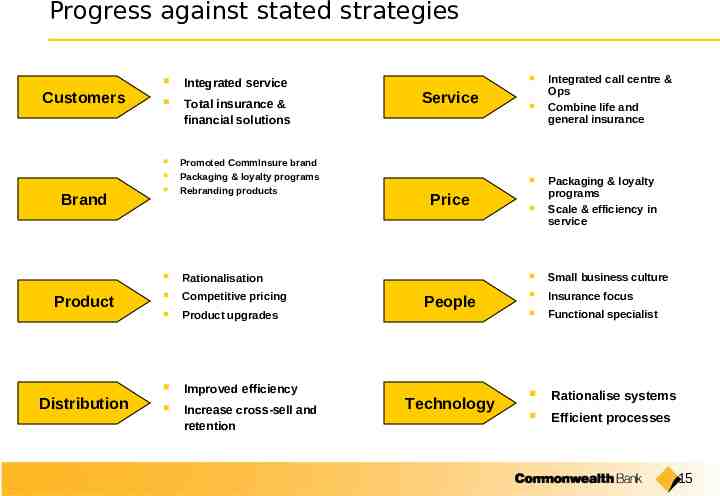

Progress against stated strategies Customers Integrated service Total insurance & financial solutions Brand Product Distribution Promoted CommInsure brand Packaging & loyalty programs Rebranding products Rationalisation Competitive pricing Product upgrades Improved efficiency Increase cross-sell and retention Service Price People Technology Integrated call centre & Ops Combine life and general insurance Packaging & loyalty programs Scale & efficiency in service Small business culture Insurance focus Functional specialist Rationalise systems Efficient processes 15

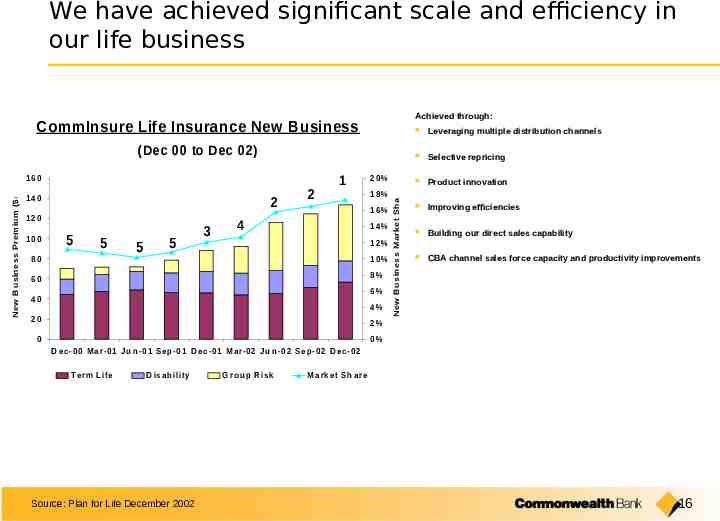

We have achieved significant scale and efficiency in our life business Achieved through: CommInsure Life Insurance New Business (Dec 00 to Dec 02) 140 2 120 100 5 5 80 5 5 3 2 1 20% 18% 16% 4 14% 12% 10% 8% 60 6% 40 4% 20 N ew B usiness Market Share N ew B usiness Premium ( m) 160 Leveraging multiple distribution channels Selective repricing Product innovation Improving efficiencies Building our direct sales capability CBA channel sales force capacity and productivity improvements 2% 0 0% D e c -0 0 M a r-0 1 J u n -0 1 S e p -0 1 D e c -0 1 M a r-0 2 J u n -0 2 S e p -0 2 D e c -0 2 T e rm L ife D is a b ility Source: Plan for Life December 2002 G ro u p R is k M a rk e t S h a re 16

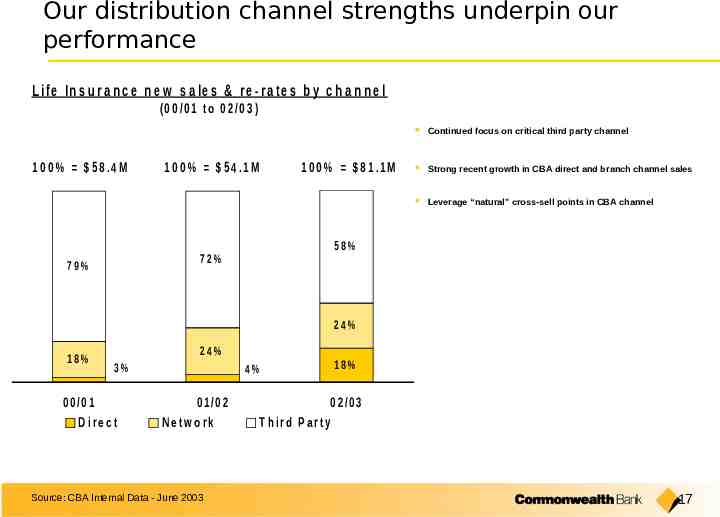

Our distribution channel strengths underpin our performance L if e In s u r a n c e n e w s a le s & r e - r a t e s b y c h a n n e l (0 0 /0 1 t o 0 2 /0 3 ) 1 0 0 % 5 8 .4 M 1 0 0 % 5 4 .1 M 1 0 0 % 8 1 .1 M Continued focus on critical third party channel Strong recent growth in CBA direct and branch channel sales Leverage “natural” cross-sell points in CBA channel 58% 72% 79% 24% 18% 24% 3% 0 0 /0 1 D ire c t 4% 0 1 /0 2 N e tw o rk Source: CBA Internal Data - June 2003 18% 0 2 /0 3 T h ird P a rty 17

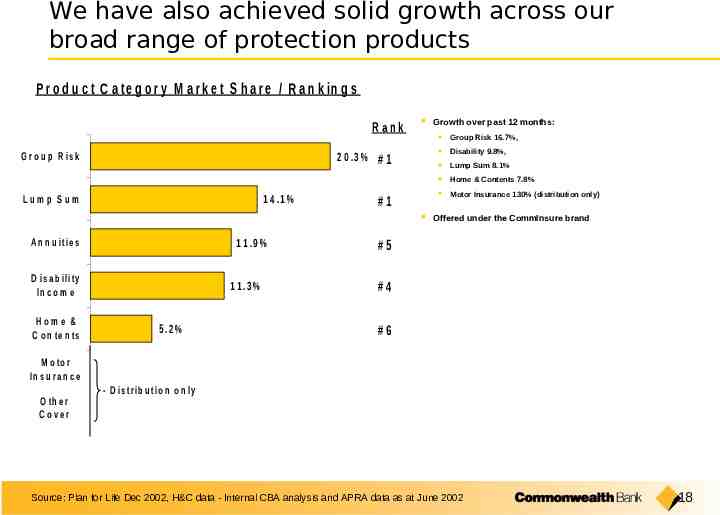

We have also achieved solid growth across our broad range of protection products P r o d u c t C a t e g o r y M a r k e t S h a r e / R a n k in g s R ank G r o u p R is k 2 0 .3 % # 1 1 4 .1 % Lum p Sum #1 A n n u it ie s 1 1 .9 % D is a b ilit y In c o m e Hom e & C o n te n ts 1 1 .3 % 5 .2 % Growth over past 12 months: Group Risk 16.7%, Disability 9.8%, Lump Sum 8.1% Home & Contents 7.8% Motor Insurance 130% (distribution only) Offered under the CommInsure brand #5 #4 #6 M o to r In s u r a n c e O th e r C over - D is t r ib u t io n o n ly Source: Plan for Life Dec 2002, H&C data - Internal CBA analysis and APRA data as at June 2002 18

Further opportunities exist to enhance the efficiency and scale of our Insurance business Build scale and grow the business: Competitive, rational pricing Optimised, multi-channel distribution Meet insurance needs of more of our banking customers Customising products for customer needs/channels Build direct sales capabilities Drive efficiencies: Process improvements Integrated technology solutions High performing teams Build capabilities: Platform for simple, convenient interactions with advisers & customers Product enhancements Customer service culture 19

Discussion Outline Stuart Grimshaw IIS Strategy and Business Group Executive, Overview Investments and Insurance Services Peter Beck CommInsure Strategy Managing Director, John Pearce CFSI Strategy and Chief Executive Officer, and Business Overview CommInsure Business Overview Colonial First State Investments Stuart Grimshaw Conclusion Group Executive, Investments and Insurance Services Questions and Answers 20

A tough new era for funds management Industry Outlook Implications A maturing industry: Industry shake up Slowing, but favourable, long term growth Scale is critical Lower investment returns Concentration of power Picking investment management winners difficult Potential for margin squeeze Growth of platforms Requires cost focus as well as revenue Institutionalisation of distribution Importance of broad based distribution Increased regulatory focus Commoditisation – difficult to differentiate Greater activism among consumers / investors / ‘others’ The “Winners” Larger players, particularly those with distribution networks, who maintain profitability by: Leveraging scale to drive down costs Maintaining revenues through: Offering compelling customer propositions that leverage their portfolios of businesses; and Differentiating themselves based on brand, service and performance High performing specialised / niche manufacturers will also thrive. 21

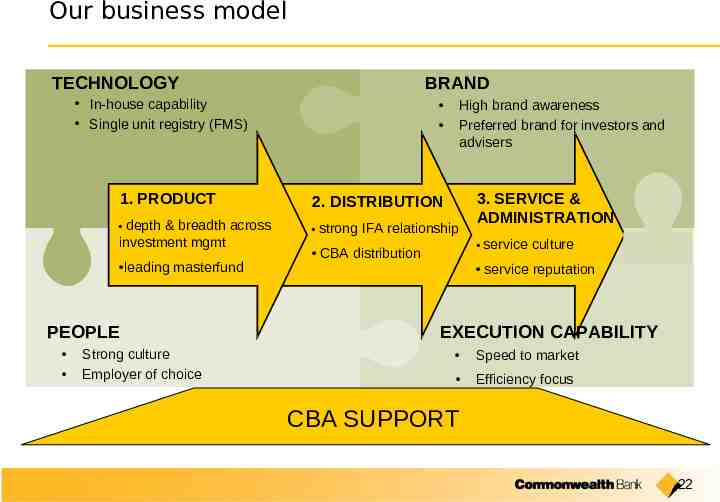

Our business model BRAND TECHNOLOGY In-house capability Single unit registry (FMS) High brand awareness Preferred brand for investors and advisers 1. PRODUCT 2. DISTRIBUTION depth & breadth across strong IFA relationship investment mgmt leading masterfund PEOPLE Strong culture Employer of choice 3. SERVICE & ADMINISTRATION service culture CBA distribution service reputation EXECUTION CAPABILITY Speed to market Efficiency focus CBA SUPPORT 22

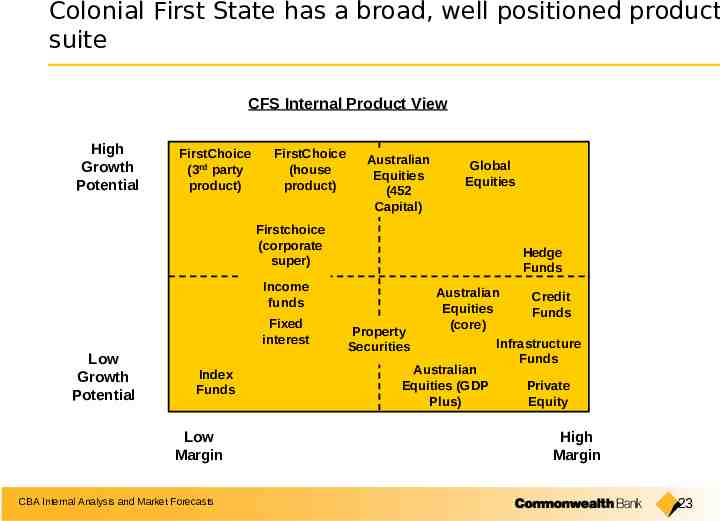

Colonial First State has a broad, well positioned product suite CFS Internal Product View High Growth Potential FirstChoice (3rd party product) FirstChoice (house product) Firstchoice (corporate super) Income funds Fixed interest Low Growth Potential Index Funds Low Margin CBA Internal Analysis and Market Forecasts Australian Equities (452 Capital) Global Equities Hedge Funds Australian Credit Equities Funds (core) Property Infrastructure Securities Funds Australian Equities (GDP Private Plus) Equity High Margin 23

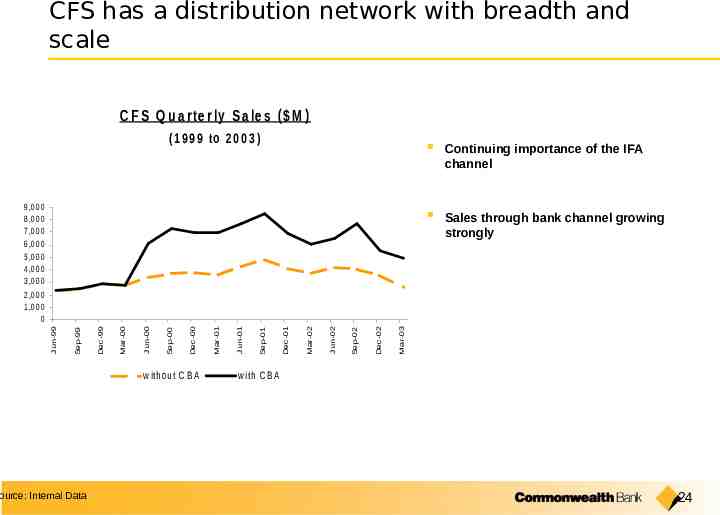

CFS has a distribution network with breadth and scale C F S Q u a r te r ly S a le s ( M ) (1 9 9 9 to 2 0 0 3 ) ource: Internal Data w ith o u t C B A Continuing importance of the IFA channel Sales through bank channel growing strongly Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 9 ,0 0 0 8 ,0 0 0 7 ,0 0 0 6 ,0 0 0 5 ,0 0 0 4 ,0 0 0 3 ,0 0 0 2 ,0 0 0 1 ,0 0 0 0 w ith C B A 24

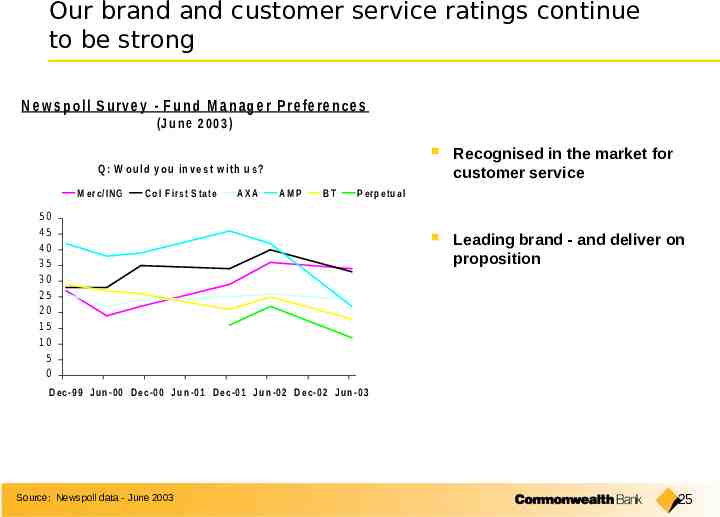

Our brand and customer service ratings continue to be strong N e w s p o ll S u rv e y - F u n d M a n a g e r P re fe re n c e s (J u n e 2 0 0 3 ) Recognised in the market for customer service Leading brand - and deliver on proposition Q : W o u ld y o u in v e s t w ith u s ? M e rc /IN G C o l F irs t S ta te AXA AM P BT P e rp e tu a l 50 45 40 35 30 25 20 15 10 5 0 D e c -9 9 J u n -0 0 D e c -0 0 J u n -0 1 D e c -0 1 J u n -0 2 D e c -0 2 J u n -0 3 Source: Newspoll data - June 2003 25

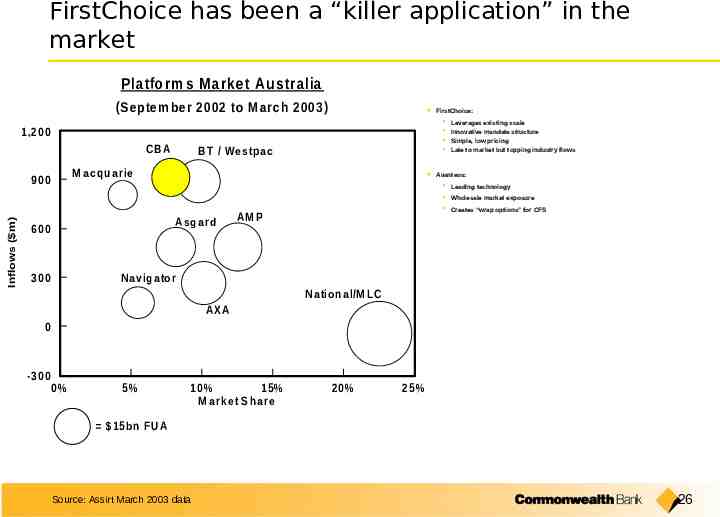

FirstChoice has been a “killer application” in the market P latfo rm s M arket A ustralia (S eptem ber 2002 to M arch 2003) FirstChoice: 1 ,2 0 0 CBA M a c q u a rie 900 Inflows ( m) B T / We s tp a c As g a rd 600 AM P Leverages existing scale Innovative mandate structure Simple, low pricing Late to market but topping industry flows Avanteos: Leading technology Wholesale market exposure Creates “wrap options” for CFS Na v ig a to r 300 Na tio n a l/M L C AX A 0 -3 0 0 0% 5% 10% 15% M a rk e t S h a re 20% 25% 15b n FU A Source: Assirt March 2003 data 26

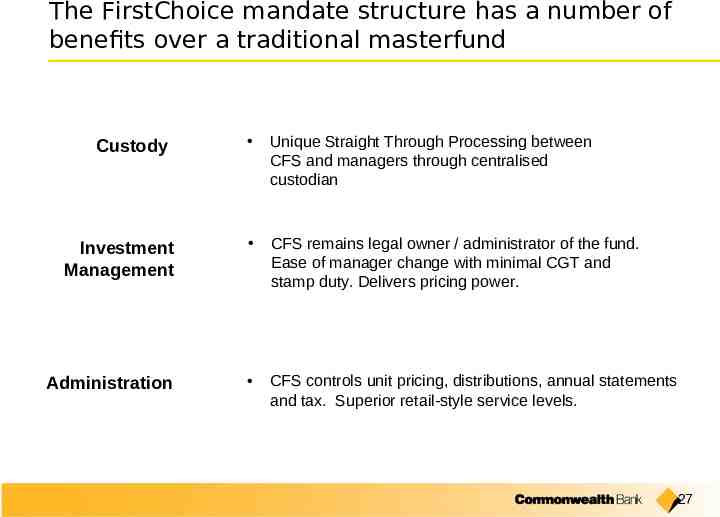

The FirstChoice mandate structure has a number of benefits over a traditional masterfund Unique Straight Through Processing between CFS and managers through centralised custodian Investment Management CFS remains legal owner / administrator of the fund. Ease of manager change with minimal CGT and stamp duty. Delivers pricing power. Administration CFS controls unit pricing, distributions, annual statements and tax. Superior retail-style service levels. Custody 27

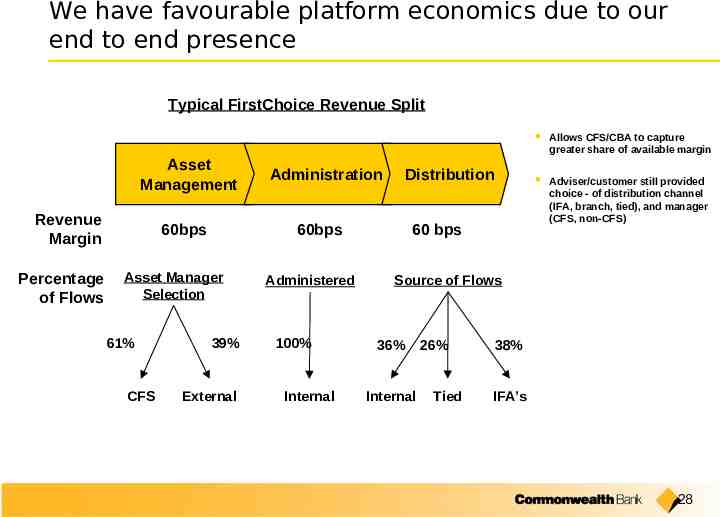

We have favourable platform economics due to our end to end presence Typical FirstChoice Revenue Split Asset Management Revenue Margin Percentage of Flows 60bps CFS Distribution 60bps Asset Manager Selection 61% Administration 39% External Administered 100% Internal 60 bps Allows CFS/CBA to capture greater share of available margin Adviser/customer still provided choice - of distribution channel (IFA, branch, tied), and manager (CFS, non-CFS) Source of Flows 36% Internal 26% Tied 38% IFA’s 28

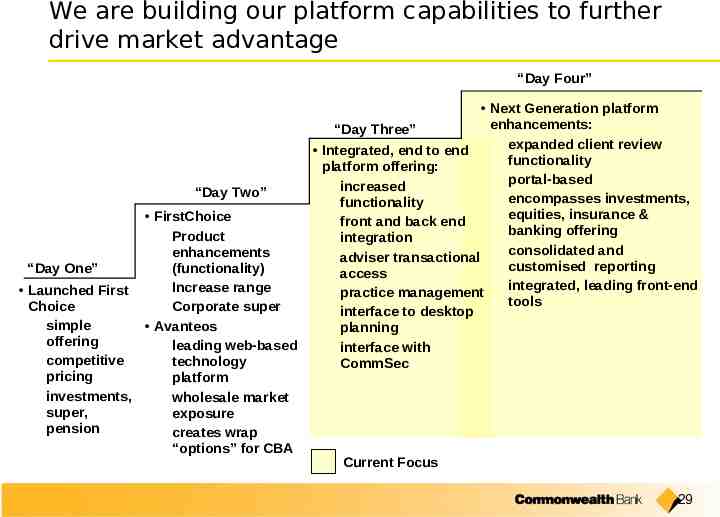

We are building our platform capabilities to further drive market advantage “Day Four” “Day Two” FirstChoice Product enhancements “Day One” (functionality) Increase range Launched First Choice Corporate super simple Avanteos offering leading web-based competitive technology pricing platform investments, wholesale market super, exposure pension creates wrap “options” for CBA Next Generation platform enhancements: “Day Three” expanded client review Integrated, end to end functionality platform offering: portal-based increased encompasses investments, functionality equities, insurance & front and back end banking offering integration adviser transactional consolidated and customised reporting access practice management integrated, leading front-end tools interface to desktop planning interface with CommSec Current Focus 29

Discussion Outline Stuart Grimshaw IIS Strategy and Business Group Executive, Overview Investments and Insurance Services Peter Beck CommInsure Strategy Managing Director, John Pearce CFSI Strategy and Chief Executive Officer, and Business Overview CommInsure Business Overview Colonial First State Investments Stuart Grimshaw Conclusion Group Executive, Investments and Insurance Services Questions and Answers 30

Key Messages There is significant value in having an end to end value chain presence We are building on our leading competitive position in investments and insurance manufacturing We are leveraging and extending our distribution strengths We are growing our platform capabilities 31

Discussion Outline Stuart Grimshaw IIS Strategy and Business Group Executive, Overview Investments and Insurance Services Peter Beck CommInsure Strategy Managing Director, John Pearce CFSI Strategy and Chief Executive Officer, and Business Overview CommInsure Business Overview Colonial First State Investments Stuart Grimshaw Conclusion Group Executive, Investments and Insurance Services Questions and Answers 32

Commonwealth Bank Investments & Insurance Services 29 July 2003 www.commbank.com.au 33