Successful Currency Trading – The Basics Presented by: In

53 Slides2.52 MB

Successful Currency Trading - The Basics Presented by: In association with www.Free4xtraining.com 2007

5 characteristics of a good trader Commitment Discipline Stewardship Continued Education Patience

Which brings us to habits If you always do, what you’ve always done You’ll always get what you always got! We become experts at what we practice!

What you are about to learn is a LEARNED SKILL Some get it quicker, but all can get it IF: You PRACTICE, PRACTICE, PRACTICE

The Basics

The Forex market on average has daily volume of 1.5 Trillion per day making it 150 times larger than the New York Stock Exchange! 1.9-3.7 Trillion

The market is moved by the BIG BOYS – Bankers and Big Corporations If you want to trade with the big boys you have to learn how they think and how they will REACT!

UBS Warburg Trading Floor

Major Corporations Use It! DaimlerChrysler Profit Got Lift From Currency Trades FRANKFURT -- DaimlerChrysler AG acknowledged Tuesday that more than half of its second-quarter operating profit was generated by favorable currency trades, indicating the German-U.S. concern made more money on foreign exchange than it did selling cars. Last month the auto maker reported quarterly operating profit of 641 million ( 712.7 million). Although that was down 62% from the second quarter of 2002, it beat some analysts' estimates. At the time, DaimlerChrysler said currency trading to soften the impact of the euro's rise against the dollar had had a "positive effect" but didn't detail the extent of its gains. That’s 55% Now the company says about 350 million in operating profit was generated through foreign-exchange transactions, confirming an article set to be published Thursday in a German newsmagazine. U.S. BUSINESS NEWS August 21, 2003

TIME LINE - EST JPY 7 PM to 4 AM USA 9 AM to 4 PM London 3 AM till NOON

Distribution of Currency Pairs EUR/GBP 2% EUR/OTH EUR/CHF 1% 2% OTHER 2% USD/EUR 29% EUR/JPY 3% USD/OTH 17% USD/AUD 4% USD/CAD 4% USD/CHF 5% USD/GBP 11% USD/JPY 20% Source: Stocks & Commodities Dec 03’

PIP Price Indicator Point A pip is the smallest movement a currency can move

A ‘pip’ (price indicator point) is the smallest unit of movement that a currency lot can have – the last one or two decimals The Bid is selling the Cross and the Ask is Buying the Cross The Difference is called the Spread and is the Brokers FEE

You are borrowing one currency and paying for it with another At the end of your trade if you made money you pay back your loan and have an increase in margin If not you pay back the loan with your margin

Prices in Dollars Who gets the difference? Currency SELL BUY USD/JPY 118.78 118.83 EUR/USD 1.2450 1.2454 GBP/USD 1.5558 1.5563 USD/CHF 1.4573 1.4578 Multiple Currency Crosses available These are called the 4 Majors

Will I get the price quoted on the charts?

Actual Price right now Bid Ask

The FOREX Broker gives us the right to trade: Go LONG - enter the market buying and exit the market selling our Lots Go SHORT - enter the market selling and exit the market buying our Lots

The Trading Process Buyer Seller Deposit Funds Place Order Place Order Broker FOREX InterBank Currency Market

Technical Traders Learn to Read Charts Successful technical traders read charts Charts are telling a story! Charts tell traders where the market is POTENTIALLY going!

Reading Japanese Candlesticks High High Close Open Open Close Low Low Candlesticks measure price fluctuations within a certain time frame

Japanese Candlesticks are telling a story Engulfing Candles Doji Stars Independent Candles (tweezers) Exhaustion Candles Opening and Closing a candlestick CAN be a big deal

Engulfing Candles An Engulfing Candle is one that follows a previous candle of the opposite color. The engulfing candle is much larger than the first.

Doji Stars The Doji Star signifies indecision or a turning point. DOJI

Significant at the end of a run

Exhaustion Candles The Exhaustion candle signifies a turning point. Find on the 30/60 minute chart for best results

Independent Candles Tweezer Tops or Bottoms (Twins)

Let’s look at a run and see if the candles were “talking”

Your Charting software- your tool to reading charts

As you use the tools of your charts they will become clear

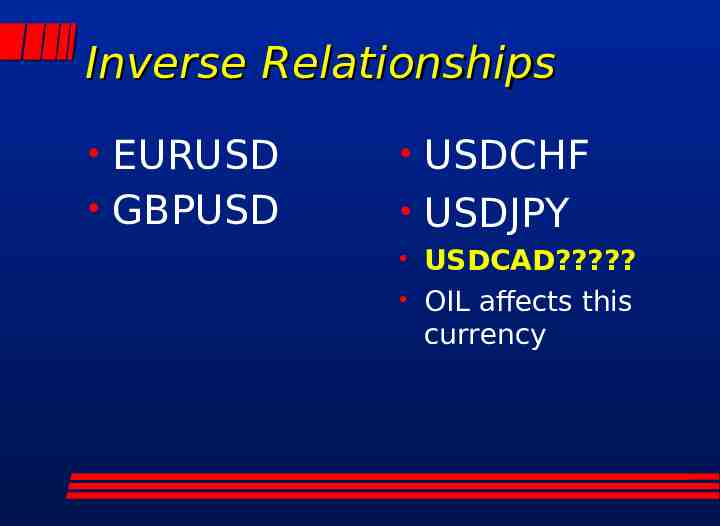

Inverse Relationships

Inverse Relationships EURUSD GBPUSD USDCHF USDJPY USDCAD? OIL affects this currency

Ok now that we know about the Market, how do we actually trade it? Be sure and familiarize yourself with your dealing station basics They all have a tutorial and all will give you a one on one class if you ask

Successful Currency Trading Requires Various Skills Ability to MECHANICALLY make a trade on a Brokers platform Ability to determine the proper trend Overall trend Trend of the day Ability to forecast future “BIG BOY” targets HSI TARGETS and /or Fibonacci levels Past Support and Resistance Ability to psychologically handle risk

Successful Currency Trading Requires Various Skills Ability to Spot Chart Harmony HAR MONEY Ability to PAPER TRADE the past so you gain EXPERIENCE Ability to spot predictable chart patterns Head and Shoulders Wedges Ability to Manage your Margin Ability to determine Margin Risk and Trade Risk

Let’s just look at a few of these to see if these skills have value We will learn each of these pieces and more in lessons posted at free4xtraaining.com

Find the Trend The Trend is your Friend The Trend give us the overall direction of the market As good as that is, we still have to find the TREND OF TODAY! To find the OVERALL trend we use a 240 min or Day chart – this tells us what the big Boys are doing

This chart is a 240 chart showing the Trend is DOWN!

But had you traded this currency Down you would have lost since the TREND OF THE DAY has been UP!

In Trading the PAST foretells the FUTURE!

Big Boy Targets The big boys use Fibonacci levels as their targets Fibonacci levels are a tool built into ALL charts Their values are mathematical equations that the Big Boys use on every chart. Although the market moves in up and down patterns, the destinations remain the same a mathematical future target – for ProAct Traders this is called the HSI Target

Click here and here The Past movement foretells the future targets

This is what a HSI Target looks like Simply find a Bottom or Top ( depending on direction ) and the HSI TOOL calculates the future target for Profit

Click on the HSI TOOL then find the bottom and click

Result are these targets HSI TARGETS – Up Resistances and Down Supports

Once you have the Trend and the Targets of the Big Boys You can the “predict” the movement of the market down at a level you can trade and capitalize on You will trade the TREND OF THE DAY to the Big Boys TARGETS

These techniques plus others will be taught in the future As you learn and internalize the lessons several things happen: You can make money You gain confidence You understand HOW THE MARKET moves You get to the next level Stay with us as we learn together

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Traders should confirm entries before making a decision to enter the market. We recommend that traders should always be very selective with entries while using tight stops. encourages traders to become more selective with entries to learn how to increase the profit gain per lot and decrease the size of protection in order to