Choosing and using your Anthem plan Your guide to open enrollment and

69 Slides9.14 MB

Choosing and using your Anthem plan Your guide to open enrollment and making the most of your benefits Please note that contents of this presentation may not apply to your clients’ needs and may need to be removed. Also note content in brackets may need to be personalized.

Why Anthem? 80 years of support and expertise National network of doctors and hospitals Thousands of ER alternatives A focus on simplifying health care Agenda What’s new this year? Choosing your plan Using your plan Tips and Tools 2

What’s new this year? New benefit and plan options LiveHealth Online - 5 copay after first 3 free visits on most plans! New pharmacy programs through our Anthem-owned, IngenioRx 3

Know your health care basics Copay A flat fee you pay for covered services, such as doctor visits. Deductible The set amount you pay before your plan begins to share the cost for covered health or prescription drug services. Your percentage of the costs (coinsurance) After you pay your deductible, this is your percentage of costs each time you get care. Out-of-pocket limit The maximum amount you can pay out of your pocket for covered services each year. Once you reach that limit, your plan covers the rest. 4

Choosing your plan 5

Before choosing a plan Consider your personal situation. Compare costs: Monthly payment Deductible – medical and pharmacy Coinsurance Copay Out-of-pocket limit Check to see if your doctors, hospitals and other health care professionals are covered by the plan. Choose the right plan for your needs. 6

Plans at a glance All plans include: Access to one of the nation’s largest networks of doctors and hospitals. Coverage for preventive care, like regular checkups, screenings and shots. A prescription drug plan with a convenient, optional home delivery. Benefits for urgent and emergency care wherever you are. Health and wellness tools that help you stay healthy and reach your health goals. 7

What’s the Health Maintenance Organization (HMO) plan? Key features Offers a unique network of doctors in your area. Must choose a primary care doctor in the network that helps you manage your care. Many costs are predictable – like set copays Your out-of-pocket costs are usually lower on this plan Things to consider Only covers services by, or referred by, your assigned primary doctor – except for certain services like emergency Requires you to select a primary care doctor If you need a specialist, you’ll need to get a referral from your primary care doctor 8

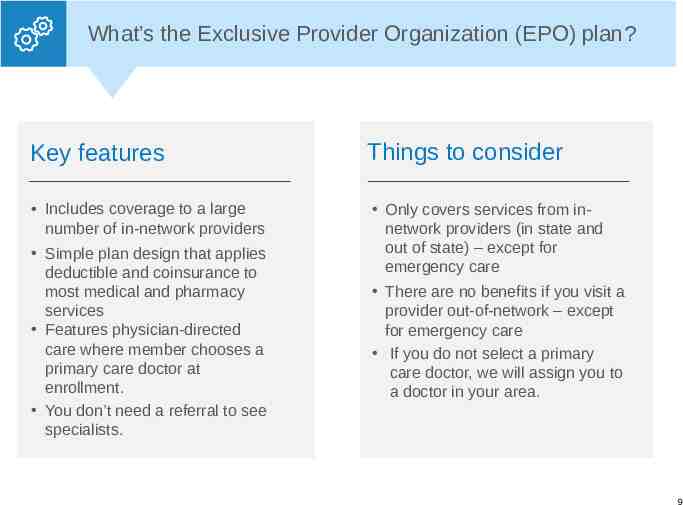

What’s the Exclusive Provider Organization (EPO) plan? Key features Things to consider Includes coverage to a large number of in-network providers Only covers services from innetwork providers (in state and out of state) – except for emergency care Simple plan design that applies deductible and coinsurance to most medical and pharmacy services Features physician-directed care where member chooses a primary care doctor at enrollment. You don’t need a referral to see specialists. There are no benefits if you visit a provider out-of-network – except for emergency care If you do not select a primary care doctor, we will assign you to a doctor in your area. 9

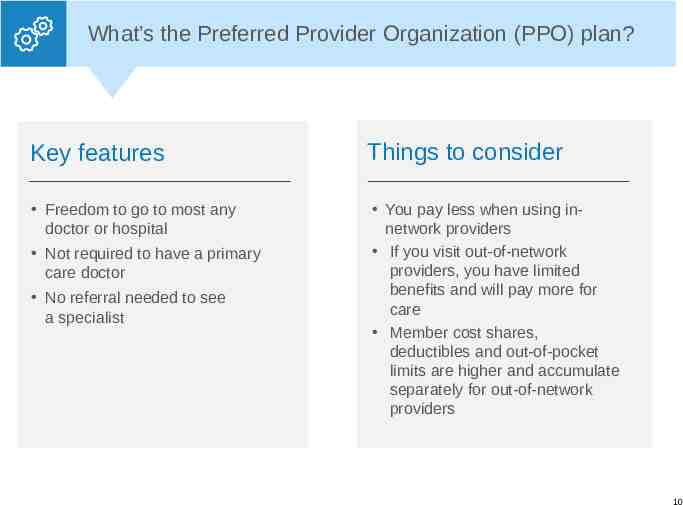

What’s the Preferred Provider Organization (PPO) plan? Key features Things to consider Freedom to go to most any doctor or hospital You pay less when using innetwork providers If you visit out-of-network providers, you have limited benefits and will pay more for care Member cost shares, deductibles and out-of-pocket limits are higher and accumulate separately for out-of-network providers Not required to have a primary care doctor No referral needed to see a specialist 10

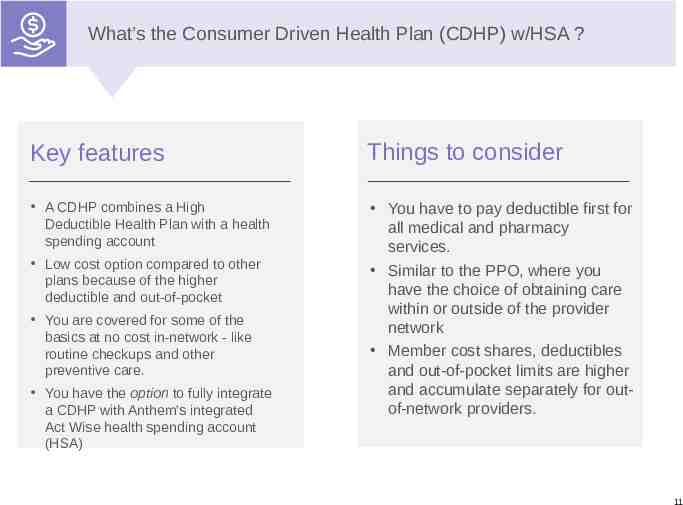

What’s the Consumer Driven Health Plan (CDHP) w/HSA ? Key features Things to consider A CDHP combines a High Deductible Health Plan with a health spending account You have to pay deductible first for all medical and pharmacy services. Similar to the PPO, where you have the choice of obtaining care within or outside of the provider network Member cost shares, deductibles and out-of-pocket limits are higher and accumulate separately for outof-network providers. Low cost option compared to other plans because of the higher deductible and out-of-pocket You are covered for some of the basics at no cost in-network - like routine checkups and other preventive care. You have the option to fully integrate a CDHP with Anthem’s integrated Act Wise health spending account (HSA) 11

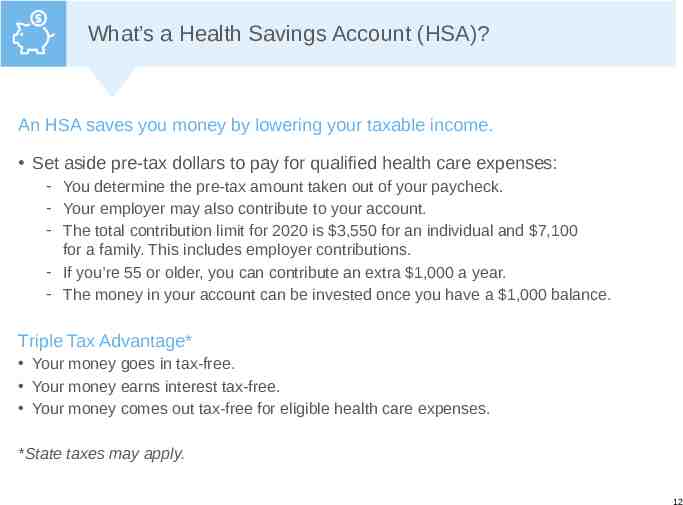

What’s a Health Savings Account (HSA)? An HSA saves you money by lowering your taxable income. Set aside pre-tax dollars to pay for qualified health care expenses: - You determine the pre-tax amount taken out of your paycheck. - Your employer may also contribute to your account. - The total contribution limit for 2020 is 3,550 for an individual and 7,100 for a family. This includes employer contributions. - If you’re 55 or older, you can contribute an extra 1,000 a year. - The money in your account can be invested once you have a 1,000 balance. Triple Tax Advantage* Your money goes in tax-free. Your money earns interest tax-free. Your money comes out tax-free for eligible health care expenses. *State taxes may apply. 12

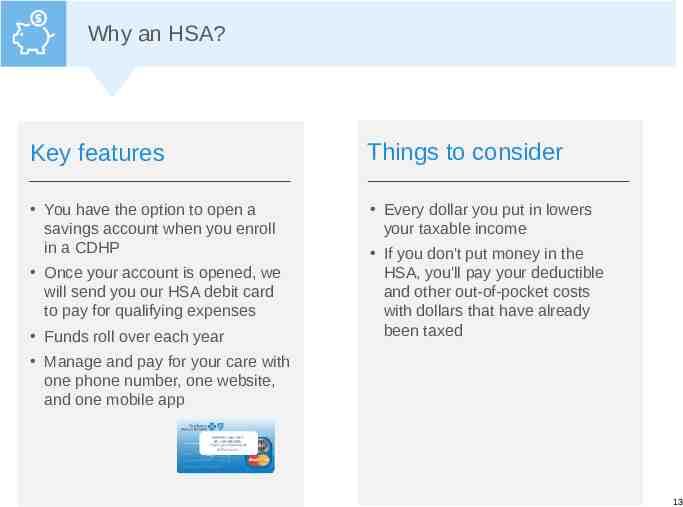

Why an HSA? Key features Things to consider You have the option to open a savings account when you enroll in a CDHP Every dollar you put in lowers your taxable income Once your account is opened, we will send you our HSA debit card to pay for qualifying expenses Funds roll over each year If you don't put money in the HSA, you'll pay your deductible and other out-of-pocket costs with dollars that have already been taxed Manage and pay for your care with one phone number, one website, and one mobile app 13

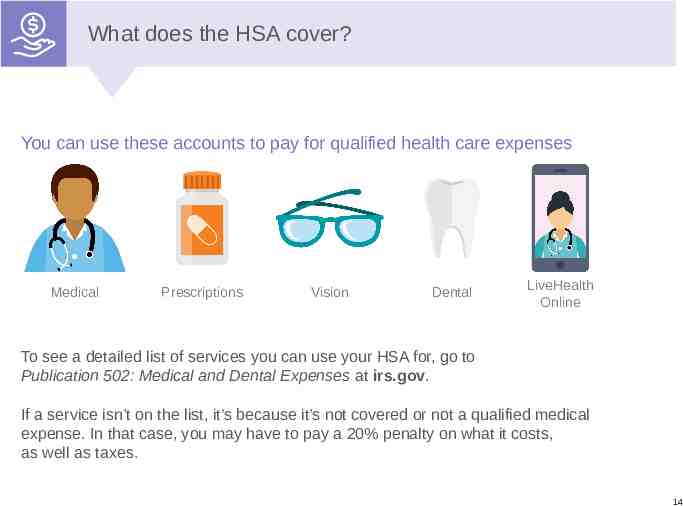

What does the HSA cover? You can use these accounts to pay for qualified health care expenses Medical Prescriptions Vision Dental LiveHealth Online To see a detailed list of services you can use your HSA for, go to Publication 502: Medical and Dental Expenses at irs.gov. If a service isn’t on the list, it’s because it’s not covered or not a qualified medical expense. In that case, you may have to pay a 20% penalty on what it costs, as well as taxes. 14

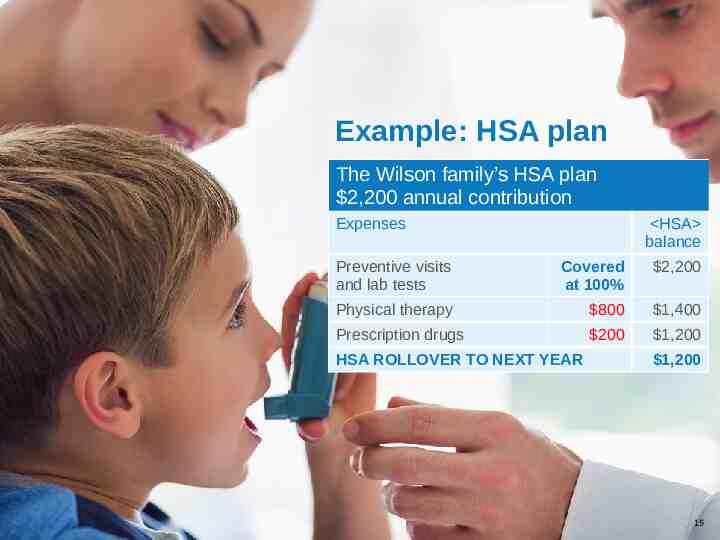

Example: HSA plan The Wilson family’s HSA plan 2,200 annual contribution Expenses HSA balance Preventive visits and lab tests Covered at 100% 2,200 Physical therapy 800 1,400 Prescription drugs 200 1,200 HSA ROLLOVER TO NEXT YEAR 1,200 15

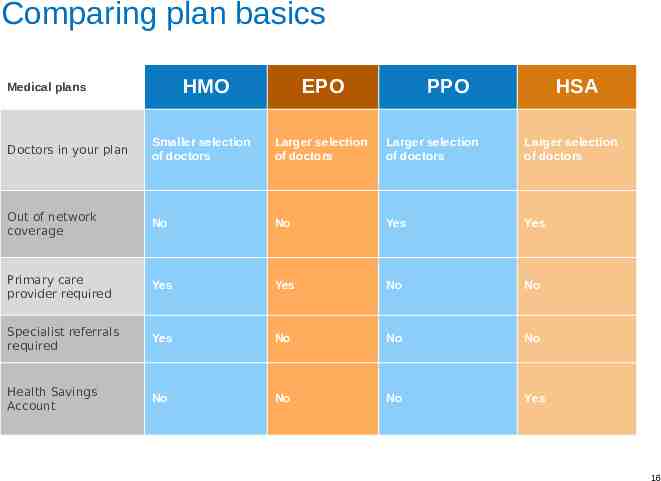

Comparing plan basics HMO Medical plans EPO PPO HSA Doctors in your plan Smaller selection of doctors Larger selection of doctors Larger selection of doctors Larger selection of doctors Out of network coverage No No Yes Yes Primary care provider required Yes Yes No No Specialist referrals required Yes No No No Health Savings Account No No No Yes 16

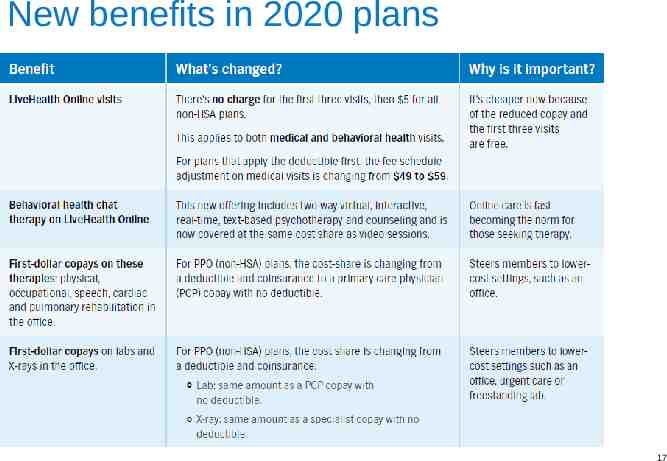

New benefits in 2020 plans 17

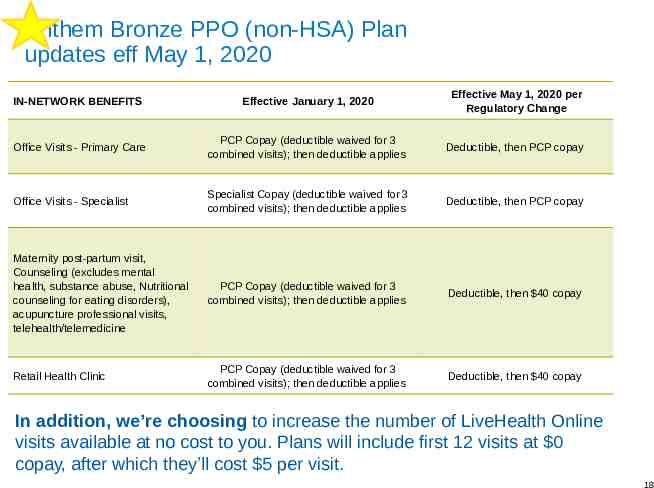

Anthem Bronze PPO (non-HSA) Plan updates eff May 1, 2020 IN-NETWORK BENEFITS Effective January 1, 2020 Effective May 1, 2020 per Regulatory Change Office Visits - Primary Care PCP Copay (deductible waived for 3 combined visits); then deductible applies Deductible, then PCP copay Office Visits - Specialist Specialist Copay (deductible waived for 3 combined visits); then deductible applies Deductible, then PCP copay Maternity post-partum visit, Counseling (excludes mental health, substance abuse, Nutritional counseling for eating disorders), acupuncture professional visits, telehealth/telemedicine PCP Copay (deductible waived for 3 combined visits); then deductible applies Deductible, then 40 copay Retail Health Clinic PCP Copay (deductible waived for 3 combined visits); then deductible applies Deductible, then 40 copay In addition, we’re choosing to increase the number of LiveHealth Online visits available at no cost to you. Plans will include first 12 visits at 0 copay, after which they’ll cost 5 per visit. 18

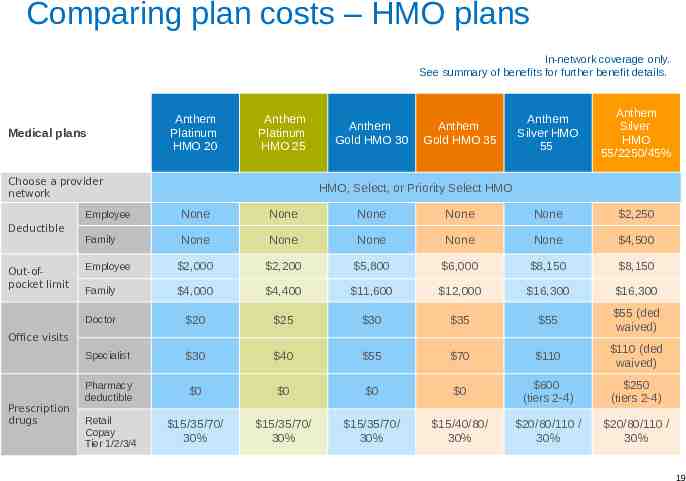

Comparing plan costs – HMO plans In-network coverage only. See summary of benefits for further benefit details. Medical plans Anthem Platinum HMO 20 Anthem Platinum HMO 25 Choose a provider network Deductible Out-ofpocket limit Anthem Gold HMO 30 Anthem Gold HMO 35 Anthem Silver HMO 55 Anthem Silver HMO 55/2250/45% HMO, Select, or Priority Select HMO Employee None None None None None 2,250 Family None None None None None 4,500 Employee 2,000 2,200 5,800 6,000 8,150 8,150 Family 4,000 4,400 11,600 12,000 16,300 16,300 Doctor 20 25 30 35 55 55 (ded waived) Specialist 30 40 55 70 110 110 (ded waived) Pharmacy deductible 0 0 0 0 600 (tiers 2-4) 250 (tiers 2-4) Retail Copay Tier 1/2/3/4 15/35/70/ 30% 15/35/70/ 30% 15/35/70/ 30% 15/40/80/ 30% 20/80/110 / 30% 20/80/110 / 30% Office visits Prescription drugs 19

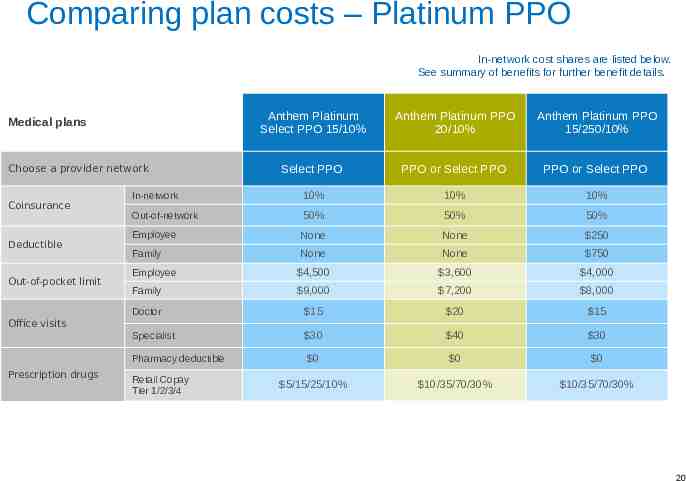

Comparing plan costs – Platinum PPO In-network cost shares are listed below. See summary of benefits for further benefit details. Anthem Platinum Select PPO 15/10% Anthem Platinum PPO 20/10% Anthem Platinum PPO 15/250/10% Select PPO PPO or Select PPO PPO or Select PPO In-network 10% 10% 10% Out-of-network 50% 50% 50% Employee None None 250 Family None None 750 Employee 4,500 3,600 4,000 Family 9,000 7,200 8,000 Doctor 15 20 15 Specialist 30 40 30 0 0 0 5/15/25/10% 10/35/70/30% 10/35/70/30% Medical plans Choose a provider network Coinsurance Deductible Out-of-pocket limit Office visits Pharmacy deductible Prescription drugs Retail Copay Tier 1/2/3/4 20

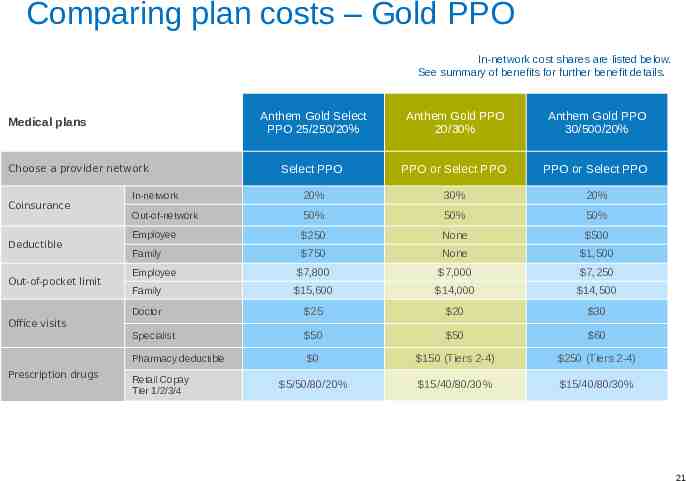

Comparing plan costs – Gold PPO In-network cost shares are listed below. See summary of benefits for further benefit details. Anthem Gold Select PPO 25/250/20% Anthem Gold PPO 20/30% Anthem Gold PPO 30/500/20% Select PPO PPO or Select PPO PPO or Select PPO In-network 20% 30% 20% Out-of-network 50% 50% 50% Employee 250 None 500 Family 750 None 1,500 Employee 7,800 7,000 7,250 Family 15,600 14,000 14,500 Doctor 25 20 30 Specialist 50 50 60 0 150 (Tiers 2-4) 250 (Tiers 2-4) 5/50/80/20% 15/40/80/30% 15/40/80/30% Medical plans Choose a provider network Coinsurance Deductible Out-of-pocket limit Office visits Pharmacy deductible Prescription drugs Retail Copay Tier 1/2/3/4 21

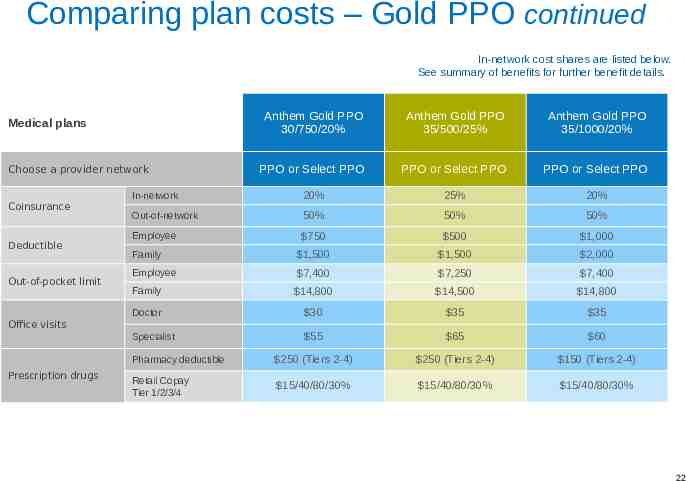

Comparing plan costs – Gold PPO continued In-network cost shares are listed below. See summary of benefits for further benefit details. Anthem Gold PPO 30/750/20% Anthem Gold PPO 35/500/25% Anthem Gold PPO 35/1000/20% PPO or Select PPO PPO or Select PPO PPO or Select PPO In-network 20% 25% 20% Out-of-network 50% 50% 50% Employee 750 500 1,000 Family 1,500 1,500 2,000 Employee 7,400 7,250 7,400 Family 14,800 14,500 14,800 Doctor 30 35 35 Specialist 55 65 60 Pharmacy deductible 250 (Tiers 2-4) 250 (Tiers 2-4) 150 (Tiers 2-4) Retail Copay Tier 1/2/3/4 15/40/80/30% 15/40/80/30% 15/40/80/30% Medical plans Choose a provider network Coinsurance Deductible Out-of-pocket limit Office visits Prescription drugs 22

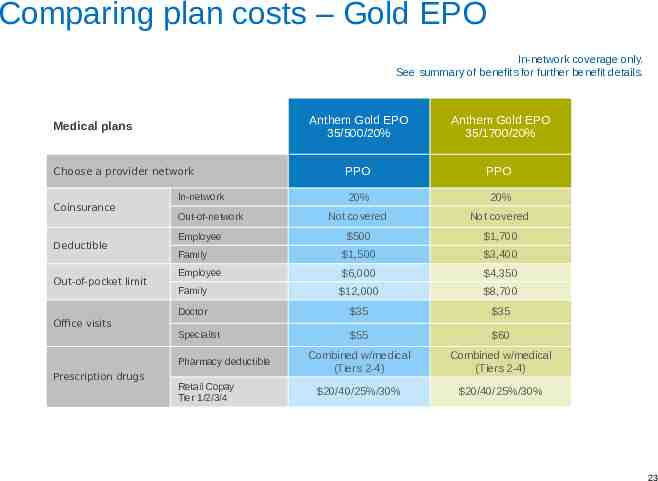

Comparing plan costs – Gold EPO In-network coverage only. See summary of benefits for further benefit details. Anthem Gold EPO 35/500/20% Anthem Gold EPO 35/1700/20% PPO PPO 20% 20% Not covered Not covered 500 1,700 Family 1,500 3,400 Employee 6,000 4,350 Family 12,000 8,700 Doctor 35 35 Specialist 55 60 Combined w/medical (Tiers 2-4) Combined w/medical (Tiers 2-4) 20/40/25%/30% 20/40/25%/30% Medical plans Choose a provider network Coinsurance Deductible Out-of-pocket limit In-network Out-of-network Employee Office visits Pharmacy deductible Prescription drugs Retail Copay Tier 1/2/3/4 23

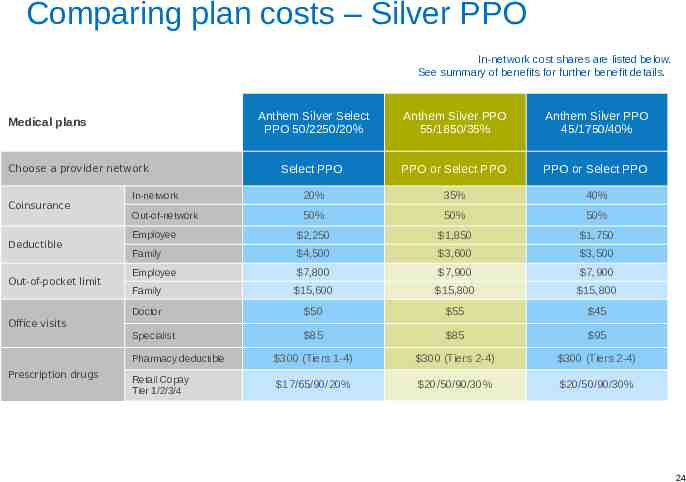

Comparing plan costs – Silver PPO In-network cost shares are listed below. See summary of benefits for further benefit details. Anthem Silver Select PPO 50/2250/20% Anthem Silver PPO 55/1850/35% Anthem Silver PPO 45/1750/40% Select PPO PPO or Select PPO PPO or Select PPO In-network 20% 35% 40% Out-of-network 50% 50% 50% Employee 2,250 1,850 1,750 Family 4,500 3,600 3,500 Employee 7,800 7,900 7,900 Family 15,600 15,800 15,800 Doctor 50 55 45 Specialist 85 85 95 Pharmacy deductible 300 (Tiers 1-4) 300 (Tiers 2-4) 300 (Tiers 2-4) Retail Copay Tier 1/2/3/4 17/65/90/20% 20/50/90/30% 20/50/90/30% Medical plans Choose a provider network Coinsurance Deductible Out-of-pocket limit Office visits Prescription drugs 24

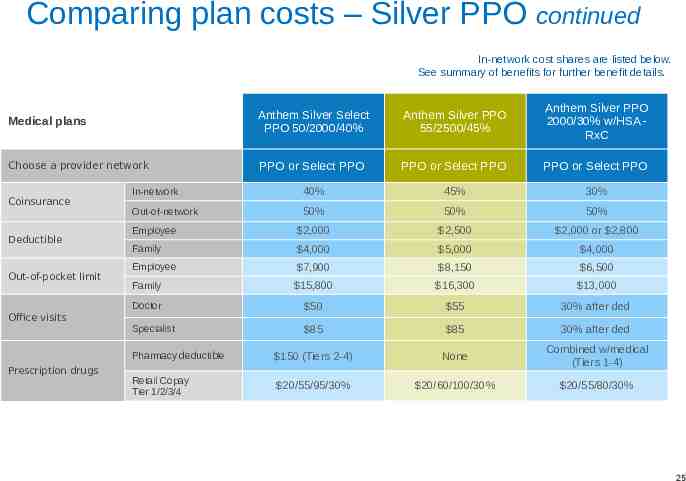

Comparing plan costs – Silver PPO continued In-network cost shares are listed below. See summary of benefits for further benefit details. Medical plans Anthem Silver Select PPO 50/2000/40% Anthem Silver PPO 55/2500/45% Anthem Silver PPO 2000/30% w/HSA RxC Choose a provider network PPO or Select PPO PPO or Select PPO PPO or Select PPO In-network 40% 45% 30% Out-of-network 50% 50% 50% Employee 2,000 2,500 2,000 or 2,800 Family 4,000 5,000 4,000 Employee 7,900 8,150 6,500 Family 15,800 16,300 13,000 Doctor 50 55 30% after ded Specialist 85 85 30% after ded Pharmacy deductible 150 (Tiers 2-4) None Combined w/medical (Tiers 1-4) Retail Copay Tier 1/2/3/4 20/55/95/30% 20/60/100/30% 20/55/80/30% Coinsurance Deductible Out-of-pocket limit Office visits Prescription drugs 25

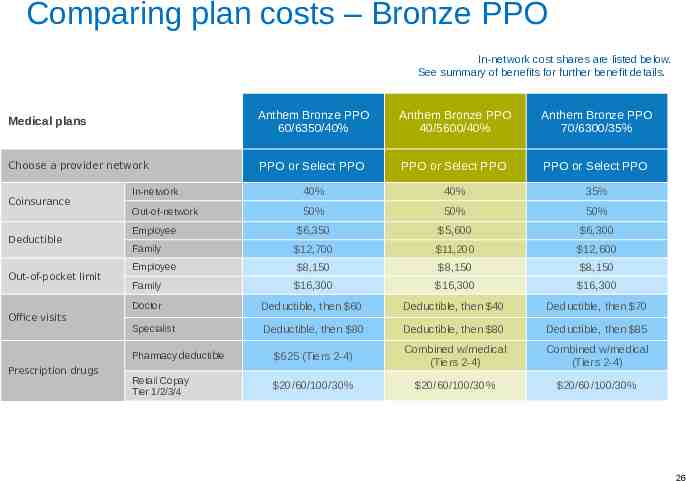

Comparing plan costs – Bronze PPO In-network cost shares are listed below. See summary of benefits for further benefit details. Medical plans Anthem Bronze PPO 60/6350/40% Anthem Bronze PPO 40/5600/40% Anthem Bronze PPO 70/6300/35% Choose a provider network PPO or Select PPO PPO or Select PPO PPO or Select PPO In-network 40% 40% 35% Out-of-network 50% 50% 50% Employee 6,350 5,600 6,300 Family 12,700 11,200 12,600 Employee 8,150 8,150 8,150 Family 16,300 16,300 16,300 Doctor Deductible, then 60 Deductible, then 40 Deductible, then 70 Specialist Deductible, then 80 Deductible, then 80 Deductible, then 85 Pharmacy deductible 625 (Tiers 2-4) Combined w/medical (Tiers 2-4) Combined w/medical (Tiers 2-4) Retail Copay Tier 1/2/3/4 20/60/100/30% 20/60/100/30% 20/60/100/30% Coinsurance Deductible Out-of-pocket limit Office visits Prescription drugs 26

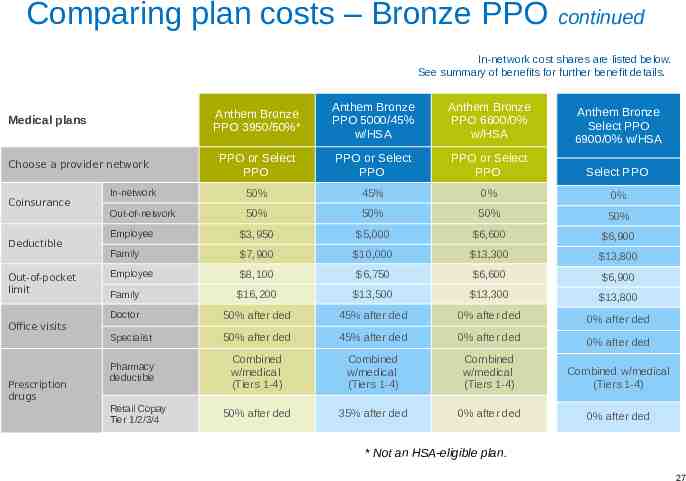

Comparing plan costs – Bronze PPO continued In-network cost shares are listed below. See summary of benefits for further benefit details. Anthem Bronze PPO 3950/50%* Anthem Bronze PPO 5000/45% w/HSA Anthem Bronze PPO 6600/0% w/HSA Anthem Bronze Select PPO 6900/0% w/HSA PPO or Select PPO PPO or Select PPO PPO or Select PPO Select PPO In-network 50% 45% 0% 0% Out-of-network 50% 50% 50% 50% Employee 3,950 5,000 6,600 6,900 Family 7,900 10,000 13,300 13,800 Employee 8,100 6,750 6,600 6,900 Family 16,200 13,500 13,300 13,800 Doctor 50% after ded 45% after ded 0% after ded 0% after ded Specialist 50% after ded 45% after ded 0% after ded 0% after ded Pharmacy deductible Combined w/medical (Tiers 1-4) Combined w/medical (Tiers 1-4) Combined w/medical (Tiers 1-4) Combined w/medical (Tiers 1-4) 50% after ded 35% after ded 0% after ded 0% after ded Medical plans Choose a provider network Coinsurance Deductible Out-of-pocket limit Office visits Prescription drugs Retail Copay Tier 1/2/3/4 * Not an HSA-eligible plan. 27

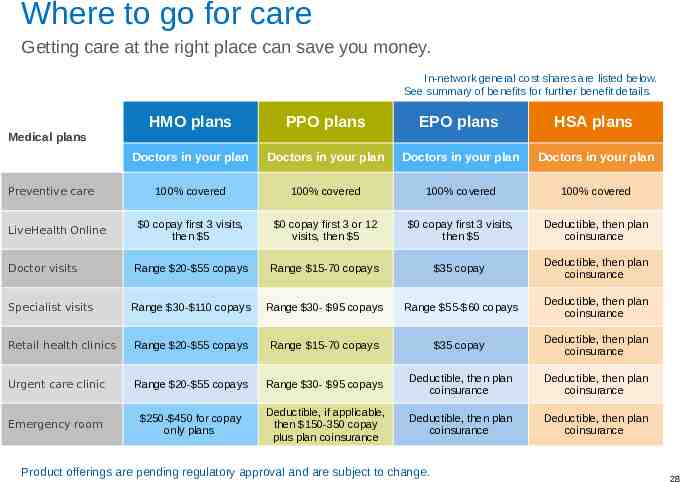

Where to go for care Getting care at the right place can save you money. In-network general cost shares are listed below. See summary of benefits for further benefit details. HMO plans PPO plans EPO plans HSA plans Doctors in your plan Doctors in your plan Doctors in your plan Doctors in your plan 100% covered 100% covered 100% covered 100% covered 0 copay first 3 visits, then 5 0 copay first 3 or 12 visits, then 5 0 copay first 3 visits, then 5 Deductible, then plan coinsurance Doctor visits Range 20- 55 copays Range 15-70 copays 35 copay Deductible, then plan coinsurance Specialist visits Range 30- 110 copays Range 30- 95 copays Range 55- 60 copays Deductible, then plan coinsurance Retail health clinics Range 20- 55 copays Range 15-70 copays 35 copay Deductible, then plan coinsurance Urgent care clinic Range 20- 55 copays Range 30- 95 copays Deductible, then plan coinsurance Deductible, then plan coinsurance Emergency room 250- 450 for copay only plans Deductible, if applicable, then 150-350 copay plus plan coinsurance Deductible, then plan coinsurance Deductible, then plan coinsurance Medical plans Preventive care LiveHealth Online Product offerings are pending regulatory approval and are subject to change. 28

Your pharmacy benefits Your plan will cover: Medicines on the Select 4-tier Drug List, including brand-name and generic drugs that are covered by your benefits. Some preventive drugs at little or no cost to you. Most specialty drugs if you have an ongoing health issue or serious illness. If something’s not covered, talk to your doctor or pharmacist about: Finding another drug. Switching to a generic or over-the-counter drug. Our prescription discount program for non-covered drugs Getting the drugs you need is important for your health. 29

Your pharmacy benefits Save money 68,000 pharmacies across the country, plus an easy home delivery option Ask your doctor about generic options. Use a pharmacy in your plan. Get up to a 90-day supply of drugs you take regularly by mail for less. Save time Refill your prescriptions online or over the phone. Use home delivery or get up to a 90-day supply at a retail location. 30

Your pharmacy benefits Your deductible Once you meet your deductible After you meet your deductible, you’ll pay a copay or percentage of the cost for your medicine. A pharmacy deductible A set amount you pay for medicine out of pocket before your plan starts to share the cost Or No pharmacy deductible Your plan helps pay for medicine before you reach your deductible Or a combined deductible You pay the full cost for your covered drugs until you meet 100% of your deductible. However, the cost you pay out of your pocket for covered drugs and covered medical care will go toward meeting your deductible. Your plan will start to share the cost of your covered medicine and covered medical care after you reach your deductible. Out-of-pocket maximum Once you reach this limit, the plan pays 100% for everything else that’s covered the rest of the year. Once you’re a member, you can check the prices of drugs at different pharmacies at www.anthem.com/ca and see if there are lowercost choices. 31

Embedded Vision and Dental Benefits with every plan For employers that offer medical plans Embedded Vision Embedded Pediatric Dental Anthem Blue View VisionSM offers members access to one of the largest networks in the nation Our Dental benefits offer members up to age 19 easy access to a large number of dentists helping them keep up their dental health and prevent long-term problems. Essential health benefits (up to age 19) including: Vision exam Frames Lenses Contact lenses Adult Vision exam Essential health benefits (up to age 19) including: Diagnostic and preventive care (cleanings and xrays) Basic and major services Medically necessary Orthodontia services 32

Behavioral Health Resource Work with licensed mental health professionals, 24/7, to overcome stress, anxiety or other mental health issues. 33

For employers that offer medical plans Embedded with every medical plan Employee Assistance Program with myStrength When you’re having a hard time and aren’t sure where to turn, your Employee Assistance Program (EAP) is here for you 24/7/365. Get support for various personal and work-related issues. Consult with legal, financial and crisis counselors. Reach us by phone and receive referral to 3 free counseling visits (face to face or online) NEW Our evidence-based, digital self-help tool, myStrength, supports emotional health through self-guided digital interventions, inspiration resources & much more 34

Other Stand-Alone Products customize to client Dental Vision Life Disability 35

Dental Plans customize to client, if client offers stand-alone Our dental plans offer: Choice between PPO and HMO networks Most preventive and diagnostic services at 100% for enrolled members. That includes things like regular cleanings and X-rays. Easy access to a large number of plan dentists and specialists. More dental services, including an extra cleaning if you’re pregnant, have diabetes or another qualifying condition. Online tools, including Dental Health Assessment, Dental Care Cost Estimator and Ask a Hygienist. 36

Dental HMO customize to client, if client offers stand-alone The Dental HMO covers: Most preventive and diagnostic services – like cleanings and X-rays – at 100% Periodontal maintenance and fluoride treatments Teeth whitening and veneers Online tools such as Dental Care Cost Estimator, Dental Health Assessment and Ask a Hygienist 37

Dental PPO customize to client, if client offers stand-alone The Dental PPO covers: Most preventive and diagnostic services – like cleanings and X-rays – at 100% A large number of dentists and specialists More dental services, including an extra cleaning if you’re pregnant, have diabetes or another qualifying condition A brush biopsy benefit to help diagnose oral cancer Online tools such as Dental Care Cost Estimator, Dental Health Assessment and Ask a Hygienist 38

Blue View Vision SM customize to client, if client offers stand-alone More doctors 38,000 doctors at more than 27,000 locations nationwide More options Get your eye exam at one place and buy eyewear at another. More freedom Whether or not you need vision correction, you should have routine eye exams. Eye doctors can be the first to see signs of chronic health conditions. Routine eye exams can reveal problems before they get serious. Select the brands you like. There are no restrictions on eyeglass frames or contact lenses. Early diagnosis leads to faster treatment and better outcomes. 39

Blue View Vision SM customize to client, if client offers stand-alone Choose one of the many independent eye doctors from your plan. Select a time that works best for you with convenient evening and weekend hours. Order contact lenses 24/7 from ContactsDirect or 1800contacts. 40

Life Benefits customize to client, if client offers stand-alone Your plan includes benefits you and your family can use now — and your beneficiary can use later. Resource Advisor: counseling when you need it Emergency travel assistance Living Benefits: early benefit payment for terminal illness Accidental injury or death benefits Support for your surviving beneficiary Identity theft victim recovery services 41

Short- and long-term disability customize to client, if client offers stand-alone Helping you get back to work — and back to life Short-term disability gives you a temporary benefit if you can’t work because of an accident, illness or pregnancy. Long-term disability is there for you when you get a more serious injury or illness and can’t work for a long time. Both include psychological, legal and financial counseling. 42

Tools to help you choose Open enrollment brochure Read this guide for key benefit information, so you can easily compare your plan options. Open enrollment website Get benefit details, medication lists and more — anytime, at work or at home. Find a Doctor Search for local doctors, hospitals and health care providers before you choose a plan. Helpful videos Learn more about your health plan options and how to use them. 43

Enrolling is easy 1 Log in to benefits website . 2 Choose your benefit options. 3 Submit your plan selections. 4 Print your confirmation of benefits and check for errors. 5 Get ready. Your plan goes into effect on date . 44

Using your plan

Get personalized information Register on the Sydney mobile app or at www.anthem.com/ca Find a doctor. Check the price of a medicine or refill a prescription. Update your email address for easy access to plan information you need. Take a health assessment and get tips for how to get or stay healthy. Estimate your costs before you go to the doctor. View your claims and EOB. If you have an Anthem HSA , view account balance, pay your bills, and reimburse yourself if you paid out of your own pocket for any health care. 46

Sydney mobile app It’s personalized so you can: See what’s covered, what it costs and where you’ve spent your health care dollars. Find doctors in your plan. Get ratings and reviews. Always have your ID card with you. 47

Looking for a doctor? Use the Find a Doctor tool on the Sydney mobile app or on www.anthem.com/ca to look up: Doctors, Dentists, Eye Doctors or hospitals, labs and other health care providers in your area. Doctor profiles, their affiliations and patient reviews. Directions to pharmacies, urgent care centers and other health care facilities. 48

Estimate your costs before you get care Register online and use the Estimate Your Cost tool. See the average costs for common procedures in almost 400 categories — plus, get quality information for hospitalbased procedures. Compare doctors and facilities based on cost and qualityof-care ratings. Stay informed so you can make the right choice for your health and your budget. 49

Blue Distinction: quality and peace of mind Blue Distinction Centers Excellent care Faster recovery times If you’re facing major surgery or a serious medical condition, Anthem’s Blue Distinction Centers offer quality outcomes and important peace of mind. These are the best of the best, and each Blue Distinction Center meets or exceeds rigorous, evidence-based criteria established in collaboration with expert doctors and medical organizations. Best of all — you don’t pay extra for access to a Blue Distinction Center. It’s part of your plan. 50

See a doctor anytime at home or on the go Have a private video appointment with a doctor on your mobile phone, tablet or computer with a webcam. Doctors are available 24/7 for advice, treatment and prescriptions, if needed. See a licensed therapist or psychiatrist. Appointments are available 7 days a week and usually cost less than an inperson office visit. Sign up at livehealthonline.com today or download the free app. 51

Health and Wellness Programs Your plan goes way beyond covering doctor visits. Become more engaged in your health. Make better health care decisions. After your benefits start, go to www.anthem.com/ca or call the Member Services number on your ID card or mobile app to take part in our programs. Reach your health goals. Save money on health-related products and services. 52

24/7 NurseLine Get answers to your health questions — wherever you are, day or night. 53

Autism Spectrum Disorder program Community resources, family support and coordinated care Here for your whole family Makes it easier to understand how to use available care Guides your whole family through the health care system Helps you use your benefits effectively to get the best outcomes 54

Case Management If you’re in the hospital or have a serious health problem, a nurse care manager can: Help answer your questions. Coordinate your care with different doctors. Show you how to use your health benefits. Educate you about your health issue and treatment options. Give you tips on saving money and connecting with local resources. 55

ConditionCare Get support from a dedicated nurse team if you have: Asthma Diabetes Heart disease / heart failure Chronic obstructive pulmonary disease (COPD) Work with dietitians, health educators and pharmacists. 56

ConditionCare End-stage Renal Disease A registered nurse can help you: Schedule dialysis and doctors visits Follow your treatment plan Explain how to use your medical equipment Find helpful information and resources 57

Future Moms Get screenings and resources during pregnancy. Enjoy toll-free, 24/7 access to specially trained nurses. Receive free breastfeeding support at LiveHealth Online. 58

MyHealth Advantage Make the most of your health care benefits and dollars. Get reminders about screenings, tests and programs to help you stay healthy. Learn about possible gaps in your care and how to avoid serious health problems. Find cost-saving tips for health expenses. 59

Online Wellness Toolkit Set and achieve your unique health goals with: A health assessment to identify your health risks. A Health Assistant to help you lower your risks and meet your health goals. Tools, trackers and wellness challenges to keep you motivated.

SpecialOffers Visit www.anthem.com/ca and choose discounts to: Save money on glasses, weightloss programs, gym memberships, vitamins and much more. 61

Shop. Earn. Save. Spend. PayForward rewards With this unique program, Anthem members can earn like no other. up to 15% cash back at more than 12,000 participating retailers — including Home Depot, The Gap and Target.com. They can use their cash to: * Spend or save however they want. Spend it, keep it in their PayForward account, or transfer it to a bank account. Pay for health care. Use it to help pay for health care costs, such as copays, medications, and more. Share with others — at no cost. Send money to family and friends or donate to any charity, with no fees or surcharges. The best part? PayForward is free to join! AND it’s a reward your employees won’t get from any other health plan. * Examples of brands currently undergoing approval process.

Save money with discounts at anthem.com through our SpecialOffers program Vision and hearing Glasses.comTM and 1-800-CONTACTS — Get the latest, brand-name frames for just a fraction of the cost at typical retailers — every day. Plus, you get an additional 20 off orders of 100 or more, free shipping and free returns. Premier LASIK — Save 800 on LASIK when you choose any ‘featured’ Premier LASIK Network provider. Save 15% with all other in-network providers. Nations Hearing — Get hearing screenings and in-home service at no additional cost, and up to 50% off all hearing aids from Nations Hearing, powered by the Beltone network. Hearing Care Solutions — Digital instruments starting at 500. Free hearing exam. Thirty-one hundred locations and eight manufacturers. Three-year warranty, two years of batteries, unlimited visits for one year, from Hearing Care Solutions. Fitness and health Active&Fit DirectTM — Active&Fit Direct allows you to choose from 9,000 participating fitness centers nationwide for 25 i a month (plus a 25 enrollment fee and applicable taxes). Offered through American Specialty Health Fitness, Inc. Jenny Craig — Receive a free 3 month program and 70 in food savings OR save 50% off premium programs (food costs separate). With one on one support and nearly 100 Jenny Craig foods, you can lose three times more weight than dieting on your own with Jenny Craig’s scientifically proven i program. Restrictions apply. SelfHelpWorks — Choose one of the online Living programs and save over 60% on coaching to help you lose weight, stop smoking, manage stress or face an alcohol problem. GlobalFitTM — Discounts on gym memberships, fitness equipment, coaching, and more from Global Fit. * All discounts are subject to change without notice. 63

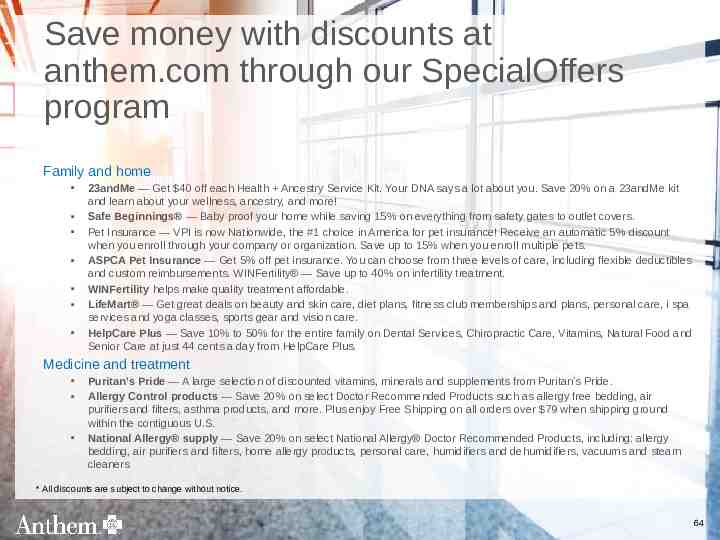

Save money with discounts at anthem.com through our SpecialOffers program Family and home 23andMe — Get 40 off each Health Ancestry Service Kit. Your DNA says a lot about you. Save 20% on a 23andMe kit and learn about your wellness, ancestry, and more! Safe Beginnings — Baby proof your home while saving 15% on everything from safety gates to outlet covers. Pet Insurance — VPI is now Nationwide, the #1 choice in America for pet insurance! Receive an automatic 5% discount when you enroll through your company or organization. Save up to 15% when you enroll multiple pets. ASPCA Pet Insurance — Get 5% off pet insurance. You can choose from three levels of care, including flexible deductibles and custom reimbursements. WINFertility — Save up to 40% on infertility treatment. WINFertility helps make quality treatment affordable. LifeMart — Get great deals on beauty and skin care, diet plans, fitness club memberships and plans, personal care, i spa services and yoga classes, sports gear and vision care. HelpCare Plus — Save 10% to 50% for the entire family on Dental Services, Chiropractic Care, Vitamins, Natural Food and Senior Care at just 44 cents a day from HelpCare Plus. Medicine and treatment Puritan’s Pride — A large selection of discounted vitamins, minerals and supplements from Puritan’s Pride. Allergy Control products — Save 20% on select Doctor Recommended Products such as allergy free bedding, air purifiers and filters, asthma products, and more. Plus enjoy Free Shipping on all orders over 79 when shipping ground within the contiguous U.S. National Allergy supply — Save 20% on select National Allergy Doctor Recommended Products, including: allergy bedding, air purifiers and filters, home allergy products, personal care, humidifiers and dehumidifiers, vacuums and steam cleaners * All discounts are subject to change without notice. 64

Tips and tools 65

Tips and tools to save time and money Save emergency room (ER) visits for emergencies If you have a real emergency, go straight to the ER or call 911. Otherwise, consider an urgent care center, retail clinic or walk-in doctor’s office. See doctors in your plan Go to doctors in your plan and pay less out of pocket. Pre-approve hospital services (PPO plans) Call to pre-approve services before you get stuck with unnecessary charges. Use the Estimate Your Cost tool to check costs and quality ratings Comparison shop for health care. Find cost ranges for services with different doctors and check quality reviews. Save money on stuff that’s good for you Get discounts on health-related products and services for you, your family and your home. 66

Stay connected Download our free mobile app. Join our Facebook group: AskAnthem. Follow us on Twitter: @AskAnthem. Sign up for a weekly health-related text message. 67

We’re here to help By phone: call the Member Services number on your ID card. Online: register at www.anthem.com/ca or download the mobile app to chat with a team member. 68

Thank you! Medical plans are offered by Anthem Blue Cross. 02/2020 Anthem Blue Cross Life and Health Insurance Company is an independent licensee of the Blue Cross Association. Anthem is a registered trademark of Anthem Insurance Companies, Inc. 114351MUMENMUB 3/19