Chartered Financial Analyst® A Symbol of Integrity and

46 Slides3.72 MB

Chartered Financial Analyst A Symbol of Integrity and Professional Excellence CFA Program 1

2006 CFA PROGRAM Sponsored by: CFA Program 2

Benefits of the CFA Program Knowledge CFA Program 3

Chartered Financial Analyst “Whereas there are tens of thousands of finance degrees available around the world, ranging from the excellent to the worthless, there is only one CFA, managed and examined by an American association of financial professionals, the CFA Institute. It used to be just an American qualification. But explosive growth has made it, in effect, global currency.” The Economist Feb. 26-Mar 4, 2005 CFA Program 4

Chartered Financial Analyst Switzerland CFA charterholders or candidates in the CFA program are to be favored CFA Program 5

Chartered Financial Analyst The Chartered Financial Analyst (CFA) designation is strongly preferred CFA Program 6

Benefits of the CFA Program Respect and Credibility Most common occupations of CFA charterholders CEO/Principal Chief Investment Officer Equity Analyst Fixed Income Analyst Investment Banker Professional CFA Program Investment Counselor Investment Firm Manager Portfolio Manager Portfolio Strategist Sales/Marketing 7

Benefits of the CFA Program Diverse Career Opportunities Mutual Funds / Investment Companies 25% Brokerage / Investment Banks 19% Investment Management Counselors 14% Commercial Banks / Trust Companies 13% Consulting Firms 6% Insurance Companies 5% Other 18% CFA Program 8

Benefits of the CFA Program Opportunity – Top 24 Employers Bank of America Barclays BMO Nesbitt Burns, Inc. CIBC World Markets Citigroup Credit Suisse Group Deutsche Bank Fidelity Investments Goldman Sachs ING Groep N.V. J.P. Morgan Chase & Co. Lehman Brothers CFA Program Mellon Financial Corporation Merrill Lynch & Co., Inc. Morgan Stanley Northern Trust Corporation PricewaterhouseCoopers Prudential Financial Putnam Investments RBC Financial Group Scotia Capital State Street UBS AG Wellington Management 9

Benefits of the CFA Program Earning Power – The CFA Premium The CFA Premium: US 48,000 248,000 Median Total Compensation for U.S.-based CFA Institute members with 10 years experience 200,000 Source: 2005 Compensation Survey Not to scale NonCharterholders CFA Program CFA Charterholders 10

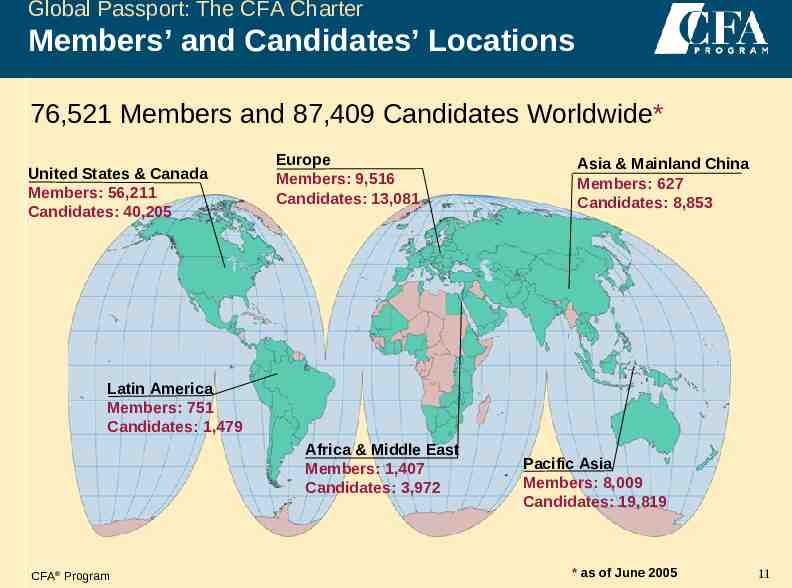

Global Passport: The CFA Charter Members’ and Candidates’ Locations 76,521 Members and 87,409 Candidates Worldwide* United States & Canada Members: 56,211 Candidates: 40,205 Europe Members: 9,516 Candidates: 13,081 Asia & Mainland China Members: 627 Candidates: 8,853 Latin America Members: 751 Candidates: 1,479 Africa & Middle East Members: 1,407 Candidates: 3,972 CFA Program Pacific Asia Members: 8,009 Candidates: 19,819 * as of June 2005 11

Global Passport: The CFA Charter Global Perspective CFA Program 12

Global Passport: The CFA Charter International Recognition CFA Program 13

What is the CFA Program? Rigorous Self-Study Program CFA Program 14

What is the CFA Program? Three Levels and Three Exams Level I – Knowledge and comprehension of fundamental investment tools and concepts Level II – Application and analysis focused on asset valuation Level III – Synthesis and evaluation of client needs and portfolio management issues Ethical and professional standards are emphasized at every level. Surveys reveal that successful CFA candidates spend, on average, in excess of 250 hours per level preparing for the examinations. There is no substitute for spending the requisite time mastering the curriculum. But, success on the CFA examinations is not merely achieved by committing the requisite hours. CFA Program 15

What is the CFA Program? Practical, Relevant Education Practitioners at every step of the process CCC COE Curriculum Examinations Body of Knowledge Grading Practice Analysis Leaders in the Investment Community CFA Program Setting of Minimum Passing Score (MPS) by CFA Institute Governors CCC: Candidate Curriculum Committee COE: Council of Examiners 16

What is the CFA Program? Learning Tied to Current Practice: The Practice Analysis Survey Determines topics taught in the CFA Program 2005-2006 Survey now underway Involves investment practitioners worldwide: Regional Expert Panels and member surveys “What knowledge and skills are needed by an investment professional?” CBOK, curriculum, LOS and exams all based on what practitioners need to know CBOK: Candidate Body of Knowledge LOS: Learning Outcome Statement CFA Program 17

The CFA Course of Study CFA Body of Knowledge Ethical and Professional Standards Quantitative Methods Economics Financial Statement Analysis Corporate Finance Investment Tools Analysis of Equity Investments Analysis of Debt Investments Analysis of Derivatives Analysis of Alternative Investments Asset Valuation Portfolio Management CFA Program 18

The CFA Course of Study Three Levels – Topic Areas Approximate Percentage Breakdown 5% 5% 10% 15% 10% 30% Asset Valuation 50% Investment Tools 40% Investment 40% Tools Asset Valuation 50% Portfolio Mgt. 35% Asset Valuation 10% Level I Level II Level III Investment Tools Asset Valuation Portfolio Management Ethics & Professional Standards CFA Program 19

Preparation for the CFA Exams Self-Study Materials CFA Program 20

Preparation for the CFA Exams 2006 Level I Primary Textbooks Standards of Practice Handbook 9e (AIMR, 2005) Quantitative Methods for Investment Analysis 2e Defusco, McLeavey, Pinto, & Runkle (CFA Institute, 2004) Economics: Private and Public Choice 10e Gwartney, Stroup, Sobel, & Macpherson (South-Western, 2003) International Investments 5e Solnik & McLeavey (Addison Wesley, 2003) The Analysis and Use of Financial Statements 3e White, Sondhi, & Fried (Wiley, 2003) Fundamentals of Financial Management 8e Brigham & Houston (Dryden, 1998) Investment Analysis and Portfolio Management 7e Reilly & Brown (South-Western, 2003) Fixed Income Analysis for the CFA Program 2e Fabozzi (Frank J. Fabozzi Assoc., 2004) Analysis of Derivatives for the CFA Program Chance (AIMR, 2003) CFA Program 21

Preparation for the CFA Exams 2006 Level I Primary Textbooks Beginning in 2006, the Level I Curriculum is modularized, with the relevant readings for each Study Session bundled with its topics and Learning Outcomes Statements. SOFT/HARD COVER: SOFTBOUND VOL 1: 798 pages, VOL 2: 1150 pages, VOL 3: 816 pages, VOL 4: 1034 pages PUBLISHER: CFA INSTITUTE DATE PUBLISHED: JUNE 2005 CFA Program 22

The CFA Examinations 2006 Exam Format Multiple Choice Level I Item Set Constructed (Objective) Response (Essay) 100% Level II 100% Level III 50% CFA Program 50% 23

The CFA Examinations Graded with Great Care 350 CFA charterholders gathered in Charlottesville in 2005 to grade the examinations Teams of practitioners and academics Rigorous and thorough process Consistency and fairness across all papers CFA Program 24

The CFA Examinations Historic Pass Rates Pass Rates: 2005 Pass Rates: 1963-2004 100% 100% 90% 90% 80% 80% 70% 70% 56% 60% 55% 40% 60% 50% 50% 36% 30% 20% 20% 10% 10% 0% 0% CFA Program 49% 52% I II 40% 30% I 68% II III III 25

Registering for the CFA Program Bachelor’s Degree Requirement Candidates’ Highest Degree 2%1% 31% Master’s CFA Program 66% Bachelor’s Bachelor’s Master’s Doctorate Law 26

Registering for the CFA Program Three Ways to Register CFA Exam Date: June 3, 2006 (see signup deadlines) Register online at: www.cfainstitute.org Download forms from the CFA Institute website and register by mail Or Contact CFA Institute for a paper CFA exam registration and enrollment package CFA Program 27

Registering for the CFA Program CFA Charter Requirements Sequentially pass Level I, II, and III exams Have four years of acceptable work experience Provide professional references (Level III) Join CFA Institute as a member and apply for membership in a local CFA Institute society Submit professional conduct statement CFA Program 28

Registering for the CFA Program 1st Year Program Costs – 2006 Approximate Costs for New Level I Candidates Registration fee to enter CFA Program US 375* Enrollment fee for Level I examination US 360* Level I Curriculum (members’ and candidates’ price) US 350 Approximate Total Costs for Level I US 1,085 *Registration & Enrollment by 1st fee deadline. CFA Program 29

Registering for the CFA Program Important Deadlines June 2006 Examinations (Levels I, II, & III)* 15 September 2005 – Early registration deadline 15 February 2006 – Second deadline 15 March 2006 – Final deadline December 2006 Examinations (Level I only)* 17 March 2006 – Early registration deadline * Check the CFA Institute website for the most recently-announced dates. 15 August 2006 – Second deadline 15 September 2006 – Final deadline CFA Program 30

Registering for the CFA Program Important Deadlines 2006 REGISTRATION AND ENROLLMENT FEE SCHEDULE for June Examination Dates Received Received Received on or before on or before on or before 15-Sep-05 15-Feb-06 15-Mar-06 Registration (first time candidates only) US 375 US 375 US 450 Enrollment (all candidates) US 360 US 440 US 670 Total fee US 735 US 815 US 1120 * Check the CFA Institute website for the most recently-announced dates. CFA Program 31

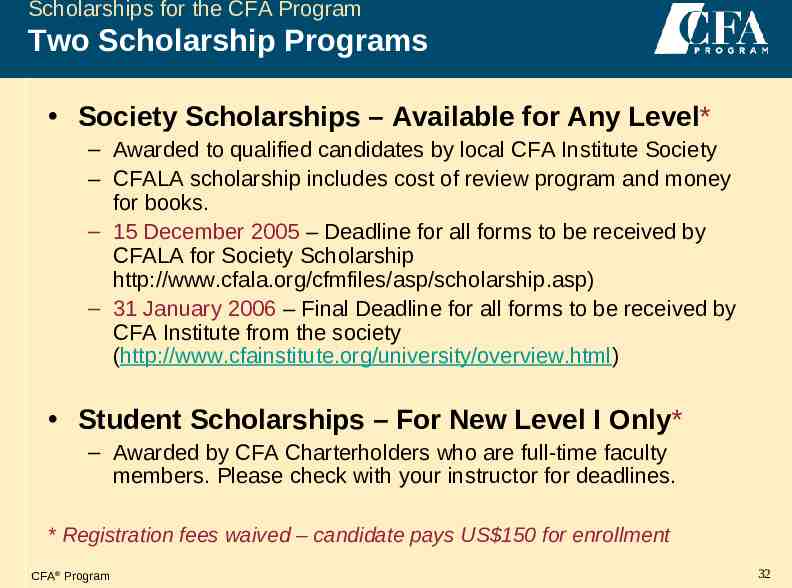

Scholarships for the CFA Program Two Scholarship Programs Society Scholarships – Available for Any Level* – Awarded to qualified candidates by local CFA Institute Society – CFALA scholarship includes cost of review program and money for books. – 15 December 2005 – Deadline for all forms to be received by CFALA for Society Scholarship http://www.cfala.org/cfmfiles/asp/scholarship.asp) – 31 January 2006 – Final Deadline for all forms to be received by CFA Institute from the society (http://www.cfainstitute.org/university/overview.html) Student Scholarships – For New Level I Only* – Awarded by CFA Charterholders who are full-time faculty members. Please check with your instructor for deadlines. * Registration fees waived – candidate pays US 150 for enrollment CFA Program 32

CFALA Mission and Goals Established in 1931, the CFA Society of Los Angeles (the Society) is a network of investment management professionals in the greater Los Angeles area, CFA Society of Los Angeles is a member society of CFA Institute. The mission of the Society is to provide access to information, expertise and personal interaction to further members' professional development and to promote the value of the profession and the CFA designation. The Society strives to fulfill this purpose as: a local Forum bringing together people, knowledge and practical experience a respected Partner with other organizations for the purpose of serving mutual interests and the meaningful exchange of ideas a Premier Source for professional resources and development a powerful Voice representing ethical standards of practice and the interests and value of the profession. CFA Program 33

The CFA Society of Los Angeles currently has 1,773 members. CFA Charterholder Information Percent CFA charterholder 78% Non-charterholder 22% 15% of our members are CFA program candidates at some level Industry Classifications Percent Investment Company/Mutual Fund 29% Investment Management Counseling 24% Broker Dealer, Investment Banking 12% Commercial/Retail Banking, Bank Trust Departments 11% Consulting Firm 10% Other businesses including government, academic, and miscellaneous 9% Insurance Company 3% Corporate/Public Sponsor & Foundation/Endowment 2% CFA Program 34

Topical Programs Current issues in the investment industry are presented at luncheons or dinners throughout the Los Angeles area. Previous presentations include topics on Wealth Management, Time Diversification and Behavioral Finance. Corporate Presentations Corporate presentations to members are held as luncheons at local downtown venues. Presentations have included Colgate-Palmolive, Tag-It Pacific, Sysco Corp., Boise Corp. and Novartis Inc., among many others. Continuing Education Programs Educational classes are available to members at a discounted rate. Courses have included the Foundations of Investments, Fixed Income Analysis, and Hedge Fund Investments. CFA Program 35

Social Gatherings An open forum to meet with other members in the industry, and their families in a non-business environment. Events have included “A Night at the Hollywood Bowl” and Wine Tasting. Being a member of CFALA has its rewards - we have hosted resume writing workshops and other career discussion panels for our members. CFA Program 36

Job Placement Listings Members have access to employment opportunities in the Southern California area via the subscription job listings on the CFALA website. It’s free for CFALA members - you just need to enter your User ID and password to access the site. Non-members pay a fee. The jobs featured are for internships and relatively new graduates, all the way up to senior manager and executive levels. As of 11/7/2005 there were approximately 100 jobs listed. Soon it may include listings for the Western United States. CFA Program 37

Annual Career Expo Usually takes place in late April and in 2006, we will be celebrating our 10th anniversary! The aim is to provide information about various career tracks and the many types of financial jobs that are open to people entering the industry. One of the panel discussions relates to tips and strategies on how to start a career in the industry. The main highlight for many folks who come to the Expo is our networking reception, where we have about 30 analysts, portfolio managers, financial advisors, bankers, consultants, trust managers, and recruiters available. This gives the audience a chance to ask questions and interact. We have heard of success stories from members who have hired interns. More and more, we are bringing in folks who are actively recruiting college level graduates. We must be doing something right (or wrong) - a lot of folks in the Expo are repeat attendees. CFA Program 38

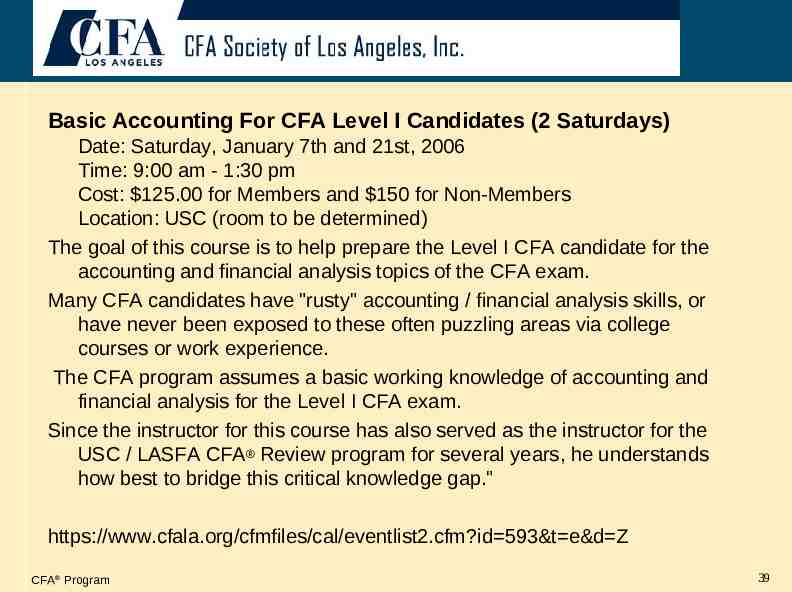

Basic Accounting For CFA Level I Candidates (2 Saturdays) Date: Saturday, January 7th and 21st, 2006 Time: 9:00 am - 1:30 pm Cost: 125.00 for Members and 150 for Non-Members Location: USC (room to be determined) The goal of this course is to help prepare the Level I CFA candidate for the accounting and financial analysis topics of the CFA exam. Many CFA candidates have "rusty" accounting / financial analysis skills, or have never been exposed to these often puzzling areas via college courses or work experience. The CFA program assumes a basic working knowledge of accounting and financial analysis for the Level I CFA exam. Since the instructor for this course has also served as the instructor for the USC / LASFA CFA Review program for several years, he understands how best to bridge this critical knowledge gap." https://www.cfala.org/cfmfiles/cal/eventlist2.cfm?id 593&t e&d Z CFA Program 39

USC/CFALA CFA Review Program Since 1984, CFA Society of Los Angeles, Inc. (“CFALA”) in partnership with the University of Southern California, Marshall School of Business (“USC”) has offered CFA Review Programs for each level of the CFA Study and Examination Program. In the Spring, we offer both Weekday and Saturday Review Courses for Level I and Level II and a Weekday Review Course for Level III candidates. CFALA also offers a Saturday Review Course for candidates preparing to take the December Level I examination. While live instruction is the cornerstone of our program, candidates are provided with supplemental study tools including a full-length practice examination, access to recorded classroom lectures via the CFALA website, and Schweser Notes and Schweser Pro software. CFA Program 40

Weekly Review Course: begins in January. Classes are held once a week and end in late May on the USC Campus. I: Tuesdays starting January 3 (5:00-8:00 pm) II: Thursdays starting January 5 (5:00-8:00 pm) III: Wednesdays starting January 4 (6:30-8:30 pm) Saturday Review Course (Levels I & II only): begins in January Will be held on 10 Saturdays before the 6/03/06 exam. Classes begin at 9:00 am and will end at 5:00 pm. (Lunch will not be provided.) First class sessions are schedule for Saturday, 14 January Please note: if you miss a weekly class you can attend the Saturday class as a makeup and vice versa. All classes will be digitally recorded and posted online for review via ID and password. Cost: 1299 Non-members, 1149 CFALA members. Register and pay by December 31, 2005 and receive a 100 discount. CFA Program 41

The registration fee for the Review Course includes: the Schweser Study Notes, Schweser Pro, the full length practice exam and access to online recordings of the Review Classes. Mentor Program: Each Level I candidate may choose to be assigned a mentor (a CFALA member who is a CFA Charterholder) who will periodically provide support and answer questions regarding the candidates exam preparation. Candidates who wish to be assigned a CFALA Mentor please contact [email protected]. Text Book & Assigned Reading: Tuition for the USC/CFALA CFA Review Program does not include the cost of text books. All text material should be purchased before the start of class by using the order form in the back of your CFA Institute Study Guide. Class sessions will cover the material in your study guide but NOT NECESSARILY IN STUDY GUIDE ORDER. Please refer to the class schedule when preparing for class sessions. Candidates are expected to read and study the appropriate materials BEFORE each review session. CFA Program 42

CFA Program 43 Example of Online Presentation

Contact Us: CFA Society of Los Angeles, Inc 555 W. 5th St., 31st Fl. Los Angeles, CA 90013 Telephone (213) 627-1500 Fax: (213) 947-4855 Email: [email protected] Web: www.cfala.org USC/CFALA CFA Review Program 555 W. 5th St., 31st Fl. Los Angeles, CA 90013 Telephone: (213) 627-1230 Fax: (213) 947-4855 Email: [email protected] CFA Program 44

More Information About the CFA Program www.cfainstitute.org The Americas P.O. Box 3668 560 Ray C. Hunt Drive Charlottesville, VA 22903 USA Phone: 800-247-8132 or 434-951-5499 Fax: 434-951-5262 E-mail: [email protected] Asia-Pacific Suite 3407 Two Exchange Square 8 Connaught Place Central Hong Kong, SAR Phone: 852-2868-2700 or 852-8228-8820 Fax: 852-2868-9912 E-mail: [email protected] Europe 29th Floor One Canada Square Canary Wharf London E14 5DY United Kingdom CFA Program Phone: 44-20-7712-1719 Fax: 44-20-7712-1601 E-mail: [email protected] 45

Chartered Financial Analyst A Symbol of Integrity and Professional Excellence CFA Program 46