Chapter 11 Tax Invoice, Credit and Debit Notes

24 Slides79.88 KB

Chapter 11 Tax Invoice, Credit and Debit Notes

An invoice is a document issued by supplier of goods and services to recipient and describes the various details like parties involved; description of item sold/services supplied, price and discount, rate, etc. Under GST an invoice means “tax invoice”.

14.1 Tax invoice has the foll. Significance under GST taxation system: a. Ensures transparency b. ITC availability c. Evidence of payment d. Evidence of transaction e. Invoice matching mechanism

14.5 Tax invoice VS bill of supply An invoice is usually sent after the products/services are shipped or performed. Original paper based invoices have been replaced by electronic ones. Bills" are received from vendors. They record expenses (or costs or inventory), and they record that the business owes the vendor the amount of money that appears on the bill. Bills can be included with various status. Draft, Pending and Sent. Cool feature to manage all your Bills online. A business registered under GST issues a tax invoice to the buyer. Such an invoice mentions the GST rate charged on the goods and services sold. However, some businesses even though registered under GST cannot charge any tax on the invoice issued by them. Such dealers have to issue a Bill of Supply. A Bill of Supply is issued when GST is not applicable on a transaction or when GST is not to be recovered from the customer.

Ill. S has opted for composition levy scheme in the current financial year under sec. 10 of CGST Act. It has approached you for advice whether it is mandatory for it to issue a tax invoice. You are required to advise him regarding the same. Ans. Bill of supply shall be issued.

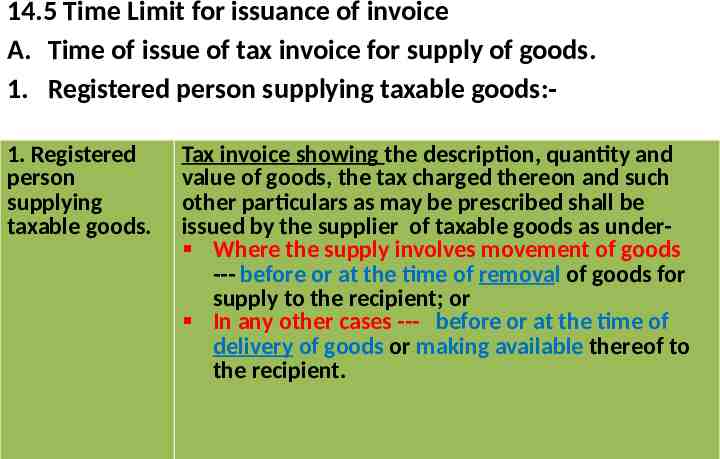

14.5 Time Limit for issuance of invoice A. Time of issue of tax invoice for supply of goods. 1. Registered person supplying taxable goods:1. Registered person supplying taxable goods. Tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as may be prescribed shall be issued by the supplier of taxable goods as under Where the supply involves movement of goods --- before or at the time of removal of goods for supply to the recipient; or In any other cases --- before or at the time of delivery of goods or making available thereof to the recipient.

e.g. K. Delhi entered in to a contract with R, Delhi for supply of a high tech machine on 25th March, 2018. The machine is to be delivered on 5.4.18. The k Machine removed the machine from its factory on 30th March, 2018. Advise, whether this transaction will be included in outward supplies for the month of March to April. Also comment on the date by which invoice must be issued by the supplier i.e. K to R under GST Laws. Ans. Issue tax invoice on or before 30.3.18.

2. Continuous supply of goods Where successive statements of accounts or successive payments are involved the invoice shall be---------issued before or at the time each such statement is issued or, as the case may be, each such payment is received. 3. Goods sent or The invoice shall be issued— taken on approval whichever is earlier for sale or return Before or at the time of supply are removed or before the supply 6 months from the date of takes place. removal,

E.G. B has started the supply of filter water canes in a office from 12th November, 2017 on daily basis. It has been agreed upon between the parties that billing will be done on 7th of every month. The first statement was generated on 7th December, (issue of statement). If the payment is received by B on 2nd December, then the invoice is required to be issued on 2nd December.

e.g. A. R, a registered person send goods to G on 10.9.2017 on approval or return basis. G gives his approval to the goods on 20.11.17. In this case, the invoice should be issued on: i. 20.11.17 ii. 9.3.18 i.e. 6 months from the date of approval. whichever is earlier. 20.11.17 B. What will be the answer if the approval is given by G on 20.4.18 instead of 20.11.17? Ans. 6 months from the date of removal ends 9.3.18 i.e. Before the TOS on 20.4.18. Invoice should be issued on 9.3.18.

14.9.2 B. Time of issue of tax invoice for supply of service. 1. Register Person Supplyin g Taxable services. Tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as may be prescribed shall be issued by the supplier of taxable services as under ---Before or after the provision of service but within 30 days from the date of supply of service [45 days in case of an insurer or banking co. Or financial institution, including a non-banking financial co. (a) Any other document issued in relation to the supply shall be deemed to be a tax invoice; or (b) Tax invoice may not be issued.

2. Continuous supply of goods The invoice shall be issued— a) Where the due date of payment is ascertainable from the contract, -- on or before the due date of payment; b) Where the due date of payment is not ascertainable from the contract, -before or at the time when the supplier of service receives the payment; c) Where the payment is linked to the completion of an event,--- on or before the date of completion of that event.

e.g. Manish, a C.A. In practice enters into an agreement on 1.10.17 with RG Ltd. To provide consultancy services for a period of one year for a fee of Rs.6 lakh. The due date of payment is 10th of every month, the first payment becoming due on 10.11.17. In this case, a invoice shall be issued on or before 10th of the every month starting from 10th November 2017. Ans. In the above case, if the due date of payment is not ascertainable, the invoice will be raised at the time he received the payment.

3. Cessation of supply of services under a contract before the completion of supply. The invoice shall be issued at the time when the supply ceases and such invoice will be issued to the extent of the supply made before such cessation.

C. Consolidated tax invoice – if value of each supply is less than Rs.200. Registered person may not issue tax invoice for each supply of goods or services if value of goods or services or both per invoice is less than Rs.200 but can issue a consolidated tax invoice at close of each day. Registered person may issue a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies provided the foll. Conditions are satisfied. a) The recipient is not a registered person; and b) The recipient does not require such invoice. Tax invoice shall have to be issued if any of the above conditions is not satisfied.

Ill T deals in stationery items. It is registered under GST and has undertaken the foll. Sales during the day. Particulars of recipient of supply Amount 1 Mukesh – a student (unregistered) 190 2 Rajesh – unregistered 250 3 Arun imaging centre – registered dealer 419 4 ABC traders – unregistered 150 5 Matra chhaya – unregistered society 170 6 entities – registered dealer NoneRagav of the recipients require a tax invoice. 100 Determine in respect of which of the above supplies. T stationers may issue a consolidated tax invoice, instead of tax invoice, at the end of the day?

Ans. Particulars of recipient of supply Amount a Mukesh – a student (unregistered) 190 b ABC traders – unregistered 150 c Matra chhaya – unregistered society 170 Consolidated tax invoice 510

D. Type of tax invoice under other special circumstances 1. Revis ed invoic es after time regist ration under CGST act A registered person may, within one month from the date of issuance of certificate of registration and in such manner as may be prescribed, issue a revised invoice against the invoice already issued without collection of tax during the period beginning with the effective date of registration till the date of issuance of certificate of registration to him. Consolidated revised tax invoices in certain cases. A registered person may issue a consolidated revised tax invoice in respect of all taxable supplies made to an unregistered recipient during such period. However, in case of inter-state supplies, a consolidated revised tax invoice cannot be issued in respect of all unregistered recipients if the value of a supply exceeds Rs.2,50,000.

e.g. R started business of dealing in computer parts on 1.12.17. his turnover exceeded Rs.2 lakh. On 15.2.17 and he therefore becomes liable to get registration under GST. He applies for registration on 25.2.18 and the certificate of registration is granted to him on 5.3.18. certificate effective from 15.2.18. revised tax invoices made during the period 15.2.18 to 5.3.18.

2. Bill of supply in case of supply of exempted goods or services both Or Supply by a composition dealer A registered person shall issue , instead of tax invoice, a bill of supply containing such particulars and in such manner as may be prescribed. Provided that the registered person may not issue a bill of supply if the value of the goods or services or both supplied is less than Rs.200 subject to such conditions and in such manner as may be prescribed.

3. Receipt voucher A registered person shall, issue a receipt voucher on receipt of or any other document, containing such advanced payment particulars as may be prescribed, evidencing receipt of such payment. Further, where at the time of receipt of advance – 1. The rate of tax is not determinable – tax rate 18% 2. The nature of supply is not determinable – same shall be treated as inter-state supply. 4. Refund voucher The said registered person may issue to the if not supply is person who made the payment a refund voucher made after issue of against such payment. receipt voucher and no supply and tax invoice is issued in pursuance thereof

5. Recipient to issue (i) invoice in case of supply on reverse charge basis and (ii)Payment voucher at the time of making payment. A registered person shall issue an invoice in respect of goods or services or both received by him from the supplier who is not registered on the date of receipt of goods or services or both.

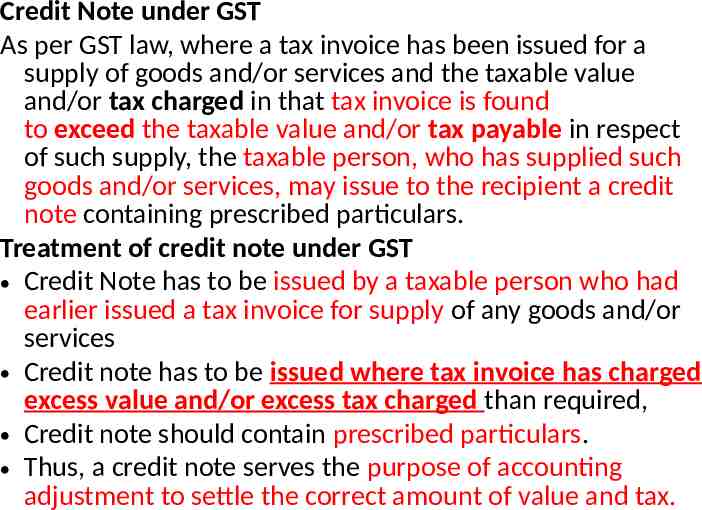

Credit Note under GST As per GST law, where a tax invoice has been issued for a supply of goods and/or services and the taxable value and/or tax charged in that tax invoice is found to exceed the taxable value and/or tax payable in respect of such supply, the taxable person, who has supplied such goods and/or services, may issue to the recipient a credit note containing prescribed particulars. Treatment of credit note under GST Credit Note has to be issued by a taxable person who had earlier issued a tax invoice for supply of any goods and/or services Credit note has to be issued where tax invoice has charged excess value and/or excess tax charged than required, Credit note should contain prescribed particulars. Thus, a credit note serves the purpose of accounting adjustment to settle the correct amount of value and tax.

Debit Note under GST As per GST law, where tax invoice has been issued for supply of any goods and/or services and the taxable value and/or tax charged in that tax invoice is found to be less than the taxable value and/or tax payable in respect of such supply, the taxable person, who has supplied such goods and/or services, shall issue to the recipient, a debit note containing prescribed particulars. Treatment of debit note under GST The debit note has to be issued by a taxable person who had earlier issued a tax invoice for the supply of any goods and/or services, A debit note has to be issued where tax invoice has charged short value and/or short tax charged than required, Debit note should contain prescribed particulars. Thus, a debit note serves the purpose of accounting adjustment to settle the correct amount of value and tax.