Tarleton Travel Cards By: Accounts Payable Department

15 Slides409.40 KB

Tarleton Travel Cards By: Accounts Payable Department [email protected] 254-968-9434

How to apply for a Travel Card: Fill out the Travel Card Application which can be found on the website below http://www.tarleton.edu/business/ facultystaff/travel-credit-cards.html Please send form to [email protected] Please allow 10-14 business days for card to arrive.* *May take longer depending on Citibank’s order load

Before you Travel General Information to know: Follow Texas A & M Disbursement of Funds Guidelines as well as the State of Texas Travel Guidelines http://www.window.state.tx.us/procurement/prog/s tmp / http:// www.tamus.edu/assets/files/budgets-acct/pdf/Disbu rsementManual.pdf Meal and Hotel rates can be found on GSA website http://www.gsa.gov/portal/category/100120 Shorts Travel is the State Contracted travel agent for Concur Travel.

90 Day Safe Harbor Ruling The IRS, State of Texas, and the Texas A&M University System require expenses to be substantiated within a reasonable amount of time from the date of the transaction. The IRS and the State of Texas are not specific about the amount of time, but beginning 9/1/2014 the Texas A&M University System has determined and adopted that 90 days is a reasonable amount of time to substantiate expenses. Travel Reimbursements All expense reports must be submitted for reimbursement (whether out of pocket or on a university liability card) within 90 days of the end of the travel. Any expense report that is past the 90 days, will become taxable income to the employee. It is important that upon your return from business travel that you complete your expense reports and get them submitted for reimbursement. It is also important for all approvers to be vigilant and approve the expense reports in a timely manner. Other Operating Expense Reimbursements This pertains to non-travel reimbursements (out of pocket expenses, such as business meals). It is important to seek reimbursement for any non-travel reimbursement within 90 days of the transaction, otherwise this will become taxable income to the employee.

What can I purchase with travel card? Airfare Hotel Car Rental Restaurants Parking Incidental expenses related to travel

Airfare Requirements Economy fare only unless prior approval from Department Head or Dean Approval documentation must be attached to the expense report in Concur. When using State Funds contract airlines must be used unless you have a cost savings to the University. Receipts are required and must contain: Name of passenger Method of payment Amount Airline information. Please note that if booking airfare in Concur, travel agent fees will apply.

Airline Fee Requirements Fee for 1 checked bag allowed. More than 1 checked bag will require business justification. Early boarding must have business justification Upgrade fees must also have business or medical purpose and be documented on the expense report.

Car Rental Requirements There are several contracted vendors-see contract venders and codes 1. Avis –F999713 2. Enterprise-UTS 713 3. National- UTS 713 4. Hertz- 445089 The contract car rental companies listed are required when using state funds, but should be used with local funds because of the excellent rates which include the required liability insurance. Receipts are required and must include: Name of renter Dates of rental Itemization charges Method of payment Please note that LDW/CDW is the only reimbursable insurance as it is included in the contract. Please note: when paying with a credit card you will need to give the DMV Tax Exempt Form to prevent state taxes from being claimed.

Hotel Requirements No personal charges such as entertainment (games, movies, etc.). Charges such as phone or internet must include a business purpose. When using state funds you must have a contract hotel, unless there is a cost savings to the University. When traveling in state you must have the traveler submit a Texas Hotel Occupancy Tax Exempt Form upon checking into hotel. (this form can be found on Business Services website) http:// www.tarleton.edu/business/facultystaff/hoteltaxexe mpt.pdf Receipts are required and must include name of guest, itemization of all expenses charged day by day and method of payment.

Restaurant Requirements Meals must not exceed the daily maximum per city/location and may be found on the GSA website. Tip reimbursement up to 20% is allowed on local funds only. Meals are not allowed on travel cards when using state funded accounts. No alcohol may be put on the travel card.

Gasoline/ Transportation Gasoline: Receipts are required and must contain: Name of traveler Amount of purchase When claiming gasoline for mileage reimbursement the amount must not exceed the allowable amount of mileage based on federal mileage rate. Taxis/Shuttles: Receipts are required, must contain: Name of traveler Method of payment Amount. Tip reimbursement is allowed up to 20% on local funds only.

Parking & Incidentals PARKING: Receipts are required and must contain: Location Date Amount of purchase. Incidental expenses to include: (phone/internet/ tolls) any other travel related expense. Must document expense was incurred for a business use and must document date and amount of purchase.

Conference Registration Conference Registration is allowed on the Travel Card. The receipts are required and must contain: Name of person attending Full name of conference Dates of conference Itinerary or business purpose of attending conference.

Information to Know Please protect the card and card number at all times to prevent unauthorized use. Immediately notify Citibank at 800-248-4553 or 800-790-7206 and the travel office 254-968-9434 or [email protected] if the card is lost or stolen. If outside the United States call collect to 904-954-7314. Fraudulent charges must be disputed within 60 days of the statement date in which the transaction appears. Therefore it is imperative to notify someone immediately.

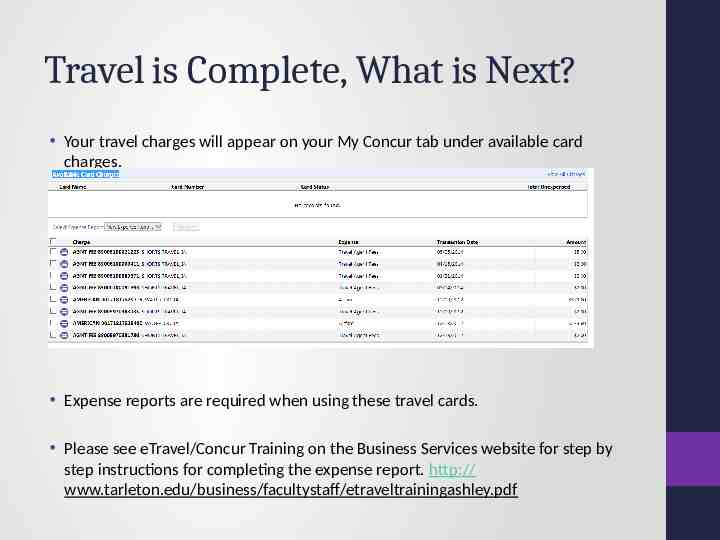

Travel is Complete, What is Next? Your travel charges will appear on your My Concur tab under available card charges. Expense reports are required when using these travel cards. Please see eTravel/Concur Training on the Business Services website for step by step instructions for completing the expense report. http:// www.tarleton.edu/business/facultystaff/etraveltrainingashley.pdf