BUREAU OF INTERNAL REVENUE Revenue District Office No. 113 Davao

58 Slides4.23 MB

BUREAU OF INTERNAL REVENUE Revenue District Office No. 113 Davao City Orientation Seminar for New Registrants

Do you want to start your own business?

APPLY FOR BUSINESS REGISTRATION APPLY FOR REGISTRATION OF BOOKS APPLY FOR AUTHORITY TO PRINT YOU ARE NOW READY START YOUR BUSINESS FILE AND PAY YOUR TAXES UPDATE YOUR REGISTRATION RETIREMENT OF BUSINESS

APPLICATION FOR BUSINESS REGISTRATION

TYPES OF BUSINESS REGISTRATION VAT NON-VAT

VAT REGISTRATION Sale of goods, properties, or services in the ordinary course of trade or business, Sells, barters, exchanges, leases, or imports Gross sales/receipts exceed P1.5-M in a calendar year

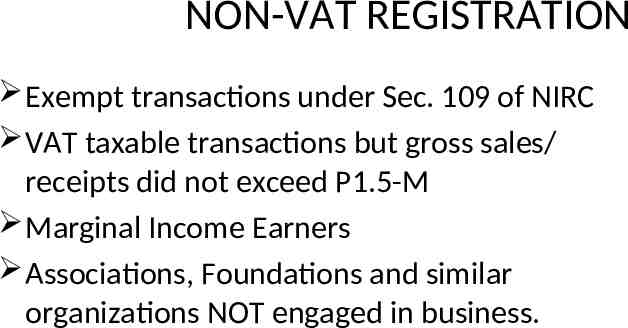

NON-VAT REGISTRATION Exempt transactions under Sec. 109 of NIRC VAT taxable transactions but gross sales/ receipts did not exceed P1.5-M Marginal Income Earners Associations, Foundations and similar organizations NOT engaged in business.

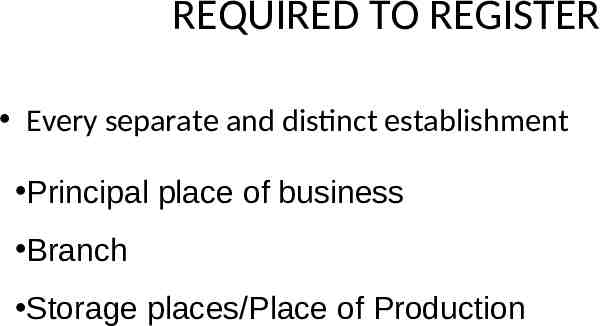

REQUIRED TO REGISTER Every separate and distinct establishment Principal place of business Branch Storage places/Place of Production

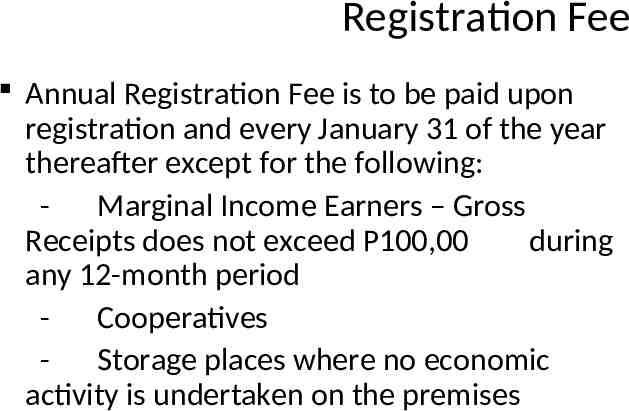

Registration Fee Annual Registration Fee is to be paid upon registration and every January 31 of the year thereafter except for the following: - Marginal Income Earners – Gross Receipts does not exceed P100,00 during any 12-month period - Cooperatives - Storage places where no economic activity is undertaken on the premises

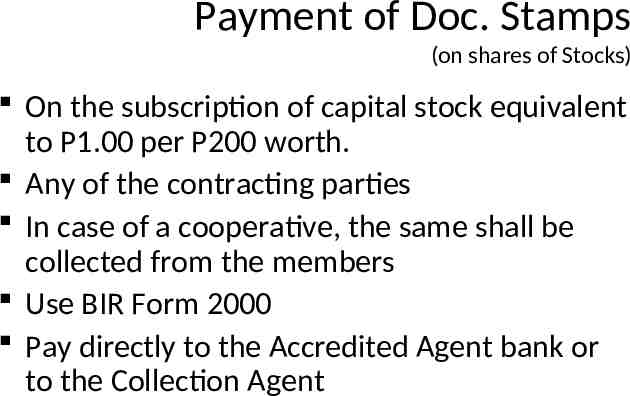

Payment of Doc. Stamps (on shares of Stocks) On the subscription of capital stock equivalent to P1.00 per P200 worth. Any of the contracting parties In case of a cooperative, the same shall be collected from the members Use BIR Form 2000 Pay directly to the Accredited Agent bank or to the Collection Agent

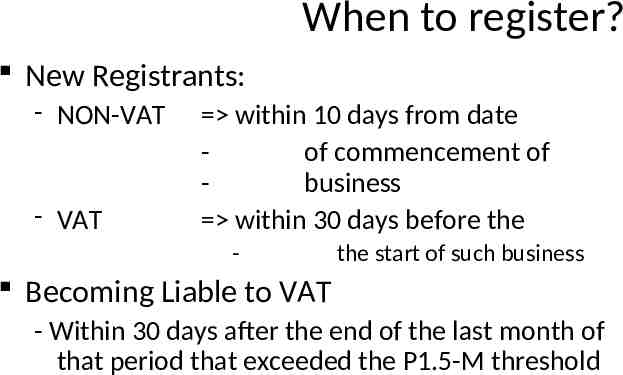

When to register? New Registrants: - NON-VAT - VAT within 10 days from date of commencement of business within 30 days before the - the start of such business Becoming Liable to VAT - Within 30 days after the end of the last month of that period that exceeded the P1.5-M threshold

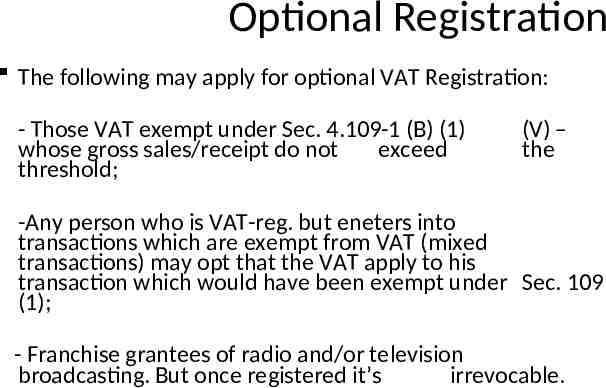

Optional Registration The following may apply for optional VAT Registration: - Those VAT exempt under Sec. 4.109-1 (B) (1) whose gross sales/receipt do not exceed threshold; (V) – the -Any person who is VAT-reg. but eneters into transactions which are exempt from VAT (mixed transactions) may opt that the VAT apply to his transaction which would have been exempt under Sec. 109 (1); - Franchise grantees of radio and/or television broadcasting. But once registered it’s irrevocable.

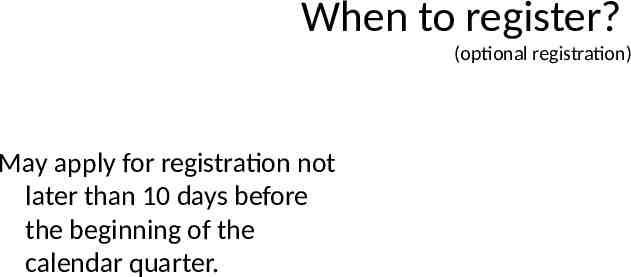

When to register? (optional registration) May apply for registration not later than 10 days before the beginning of the calendar quarter.

REGISTRATION OF BOOKS OF ACCOUNTS

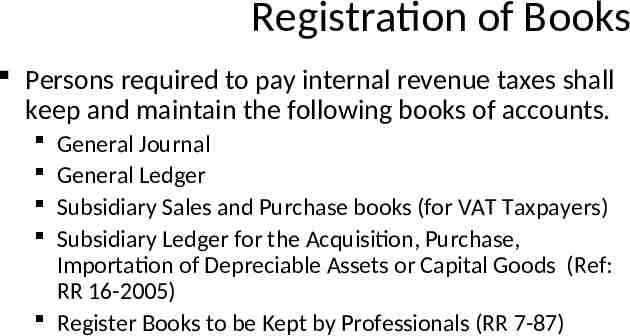

Registration of Books Persons required to pay internal revenue taxes shall keep and maintain the following books of accounts. General Journal General Ledger Subsidiary Sales and Purchase books (for VAT Taxpayers) Subsidiary Ledger for the Acquisition, Purchase, Importation of Depreciable Assets or Capital Goods (Ref: RR 16-2005) Register Books to be Kept by Professionals (RR 7-87)

Registration of Books Subsidiary Books (depending on the needs of the taxpayer) Sales Book Purchase Book Cash Receipts Book Disbursements Book

Registration of Books Taxpayers whose quarterly gross sales/receipts do not exceed P50,000 shall keep and use Simplified set of Bookkeeping Records. Books of Accounts shall first be registered before use.

Books of Accounts TP whose quarterly gross sales/receipts exceed P150,000 shall have their books audited and examined yearly by independent CPA.

Deadline for Registration of Books of Accounts (RMC 82-2008) For new registrants – Before commencement of business For old registrants – Manual Books previously registered but whose pages are not fully exhausted can still be used without need of reregistering – Registration of new sets shall only be at the time when the pages of the previously registered books have all been exhausted

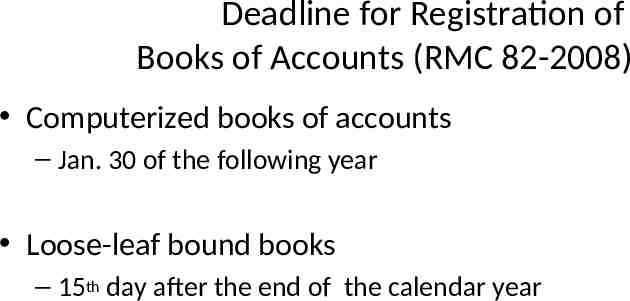

Deadline for Registration of Books of Accounts (RMC 82-2008) Computerized books of accounts – Jan. 30 of the following year Loose-leaf bound books – 15th day after the end of the calendar year

Preservation of Books of Accounts Books of Accounts and other accounting records shall be preserved within three (3) years from the last day prescribed by law for the filing of return.

Loose Leaf Books of Accounts (RMC 13-82) Loose leaf books of accounts should secure prior approval before use. It is required to be bound and registered within fifteen (15) days after the end of his taxable year.

COMPUTERIZED BOOKS OF ACCOUNTS (RMO 21-2000) Computerized accounting system and/or components thereof need to apply for permit before using the same.

INVOICING REQUIREMENTS

Application for ATP Application for Authority to Print (ATP) shall be submitted to TSS using BIR Form 1906. Attachments: - Photocopy of COR (BIR Form 1556)/ 1901/1903 - Business Permit - DTI Registration, if available already - Annual Registration Fee - Sample Invoice - Job Order

Invoicing Requirements For sale of goods – Issue Sales Invoice For sale of services – Issue Official Receipt Non-VAT Acknowledgement Receipt (ex: for security agencies)

Invoicing Requirement For Non-VAT Seller – 25.00 or more – When the customer demands for it – Issue single receipt at the end of the day for those sales below P25.00 not covered with receipt

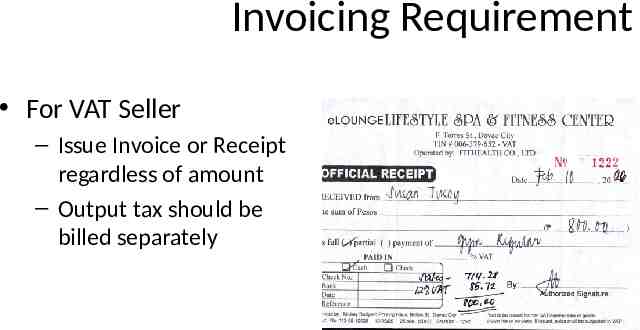

Invoicing Requirement For VAT Seller – Issue Invoice or Receipt regardless of amount – Output tax should be billed separately

CRM / POS Machines CRM / POS Machines should be registered with the BIR prior to its use.

BUSINESS PROPER

Reminders: Display Certificate of Registration (COR) at the establishment (BIR Form 1556)

Display “Ask For Receipt Poster” which shall be issued upon release of COR

Always issue invoices / receipts

Proper maintenance of books of accounts

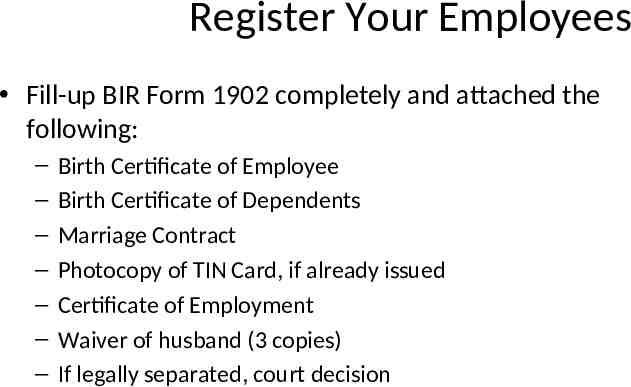

REGISTER YOUR EMPLOYEES Register employees within 10 days from date of employment.

Register Your Employees Fill-up BIR Form 1902 completely and attached the following: – – – – – – – Birth Certificate of Employee Birth Certificate of Dependents Marriage Contract Photocopy of TIN Card, if already issued Certificate of Employment Waiver of husband (3 copies) If legally separated, court decision

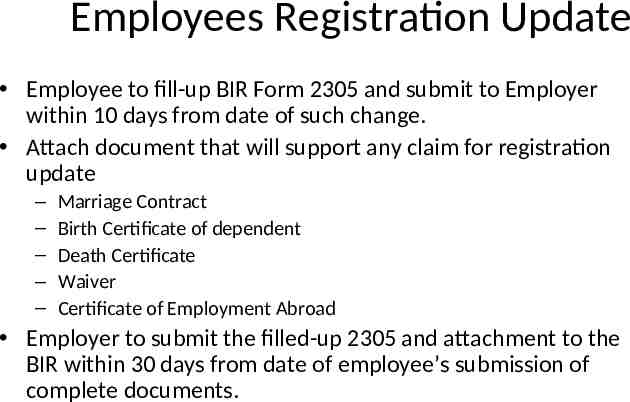

Employees Registration Update Employee to fill-up BIR Form 2305 and submit to Employer within 10 days from date of such change. Attach document that will support any claim for registration update – – – – – Marriage Contract Birth Certificate of dependent Death Certificate Waiver Certificate of Employment Abroad Employer to submit the filled-up 2305 and attachment to the BIR within 30 days from date of employee’s submission of complete documents.

Tax Compliance Verification Drive Revenue Officers are tasked to regularly conduct Tax Mapping Operation to check on the taxpayers’ compliance of the ff: B - Books of Accounts I - Invoicing Requirements R - Registration Requirements

Inventory List Inventory list of goods intended for sale shall be submitted within ten days after starting the business and the subsequent inventories shall be submitted not later than 30 days after the close of the accounting period.

FILE AND PAY YOUR TAXES CORRECTLY AND PROMPTLY

Filing of Returns Know your taxability and their deadlines to avoid penalties!

Filing and Payment of Taxes Income Tax Return – For Individual First Quarter April 15 of the current year Second Quarter - August 15 -doThird Quarter - November 15 -doAnnual Return - April 15 of the following year – Forms to be used: Quarterly returns - BIR Form 1701Q Annual Return - BIR Form 1701

Filing and Payment of Taxes Income Tax Return – For Taxable Juridical Entities 1st qtr 2nd qtr 3rd qtr Final Return within 60 days after the close the quarter - on or before the 15th day of the fourth month following the close of the accounting period. – Tax Rate 35% effective Nov. 1, 2005 (RA 9337) and 30% effective Jan. 1, 2009.

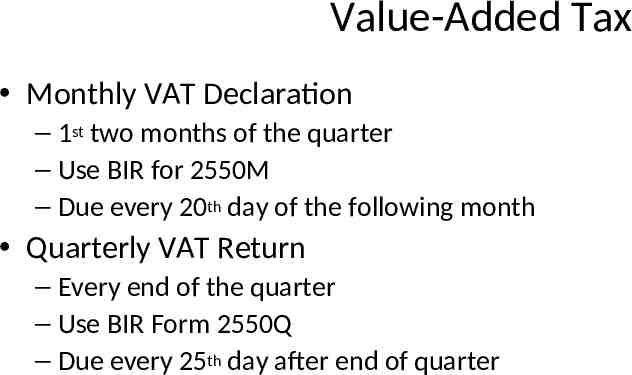

Value-Added Tax Monthly VAT Declaration – 1st two months of the quarter – Use BIR for 2550M – Due every 20th day of the following month Quarterly VAT Return – Every end of the quarter – Use BIR Form 2550Q – Due every 25th day after end of quarter

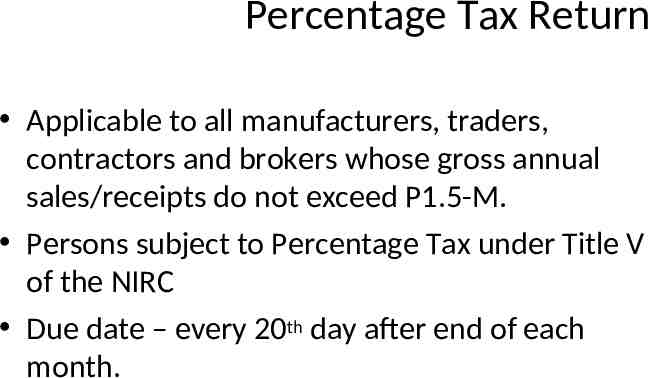

Percentage Tax Return Applicable to all manufacturers, traders, contractors and brokers whose gross annual sales/receipts do not exceed P1.5-M. Persons subject to Percentage Tax under Title V of the NIRC Due date – every 20th day after end of each month.

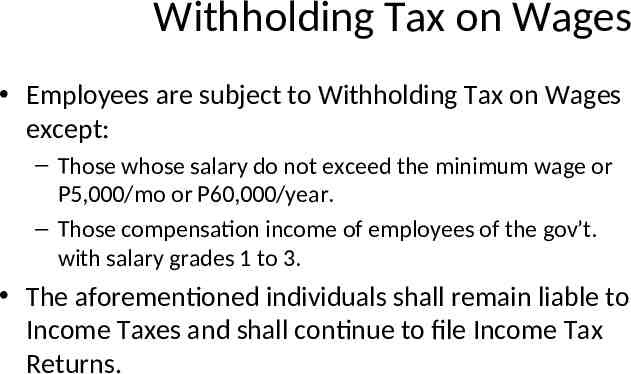

Withholding Tax on Wages Employees are subject to Withholding Tax on Wages except: – Those whose salary do not exceed the minimum wage or P5,000/mo or P60,000/year. – Those compensation income of employees of the gov’t. with salary grades 1 to 3. The aforementioned individuals shall remain liable to Income Taxes and shall continue to file Income Tax Returns.

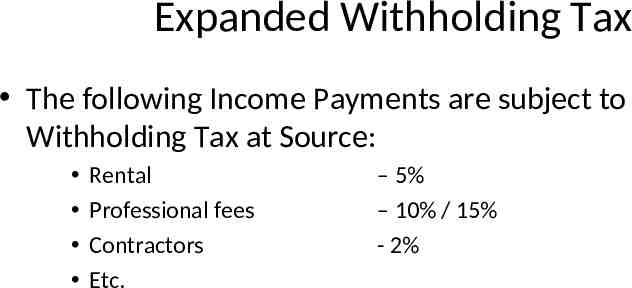

Expanded Withholding Tax The following Income Payments are subject to Withholding Tax at Source: Rental Professional fees Contractors Etc. – 5% – 10% / 15% - 2%

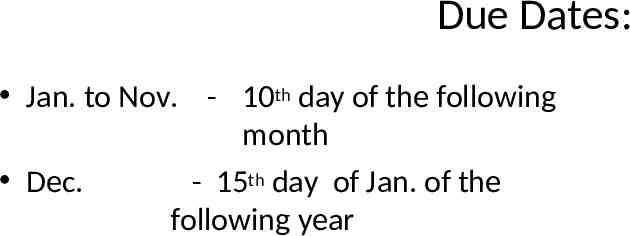

Due Dates: Jan. to Nov. - 10th day of the following month Dec. - 15th day of Jan. of the following year

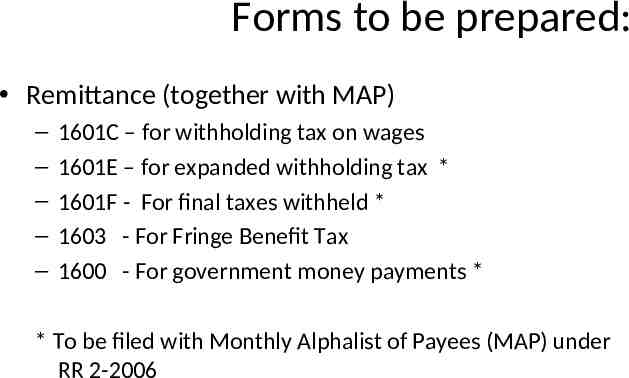

Forms to be prepared: Remittance (together with MAP) – – – – – 1601C – for withholding tax on wages 1601E – for expanded withholding tax * 1601F - For final taxes withheld * 1603 - For Fringe Benefit Tax 1600 - For government money payments * * To be filed with Monthly Alphalist of Payees (MAP) under RR 2-2006

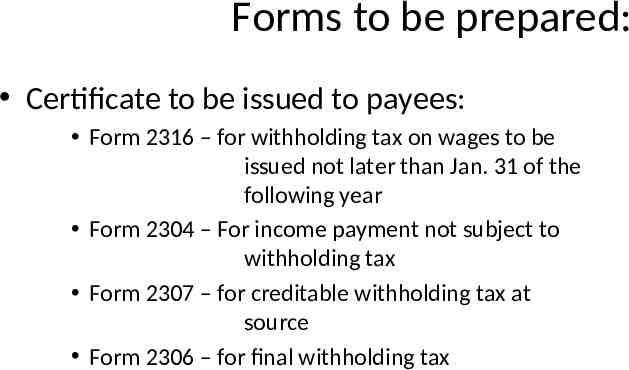

Forms to be prepared: Certificate to be issued to payees: Form 2316 – for withholding tax on wages to be issued not later than Jan. 31 of the following year Form 2304 – For income payment not subject to withholding tax Form 2307 – for creditable withholding tax at source Form 2306 – for final withholding tax

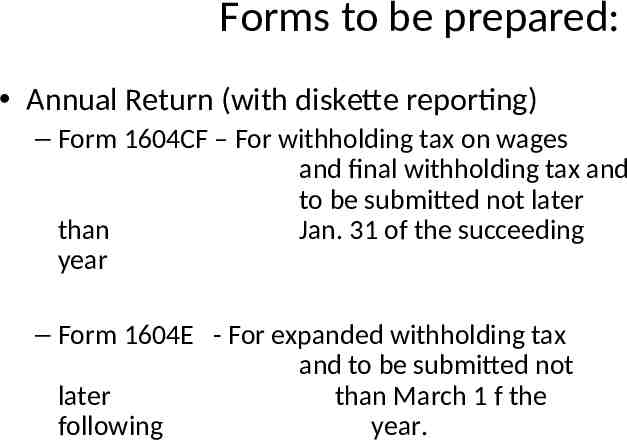

Forms to be prepared: Annual Return (with diskette reporting) – Form 1604CF – For withholding tax on wages and final withholding tax and to be submitted not later than Jan. 31 of the succeeding year – Form 1604E - For expanded withholding tax and to be submitted not later than March 1 f the following year.

UPDATING OF REGISTRATION

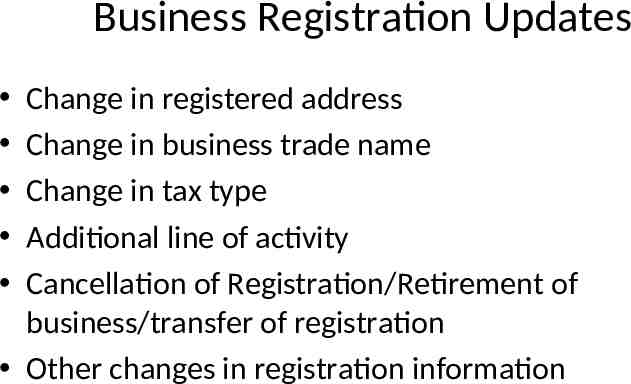

Business Registration Updates Change in registered address Change in business trade name Change in tax type Additional line of activity Cancellation of Registration/Retirement of business/transfer of registration Other changes in registration information

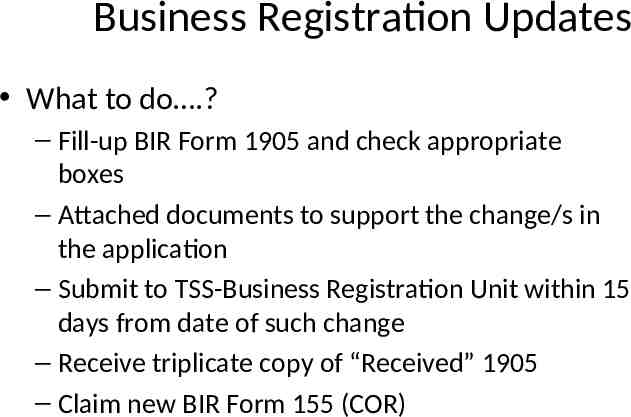

Business Registration Updates What to do .? – Fill-up BIR Form 1905 and check appropriate boxes – Attached documents to support the change/s in the application – Submit to TSS-Business Registration Unit within 15 days from date of such change – Receive triplicate copy of “Received” 1905 – Claim new BIR Form 155 (COR)

RETIREMENT OF BUSINESS

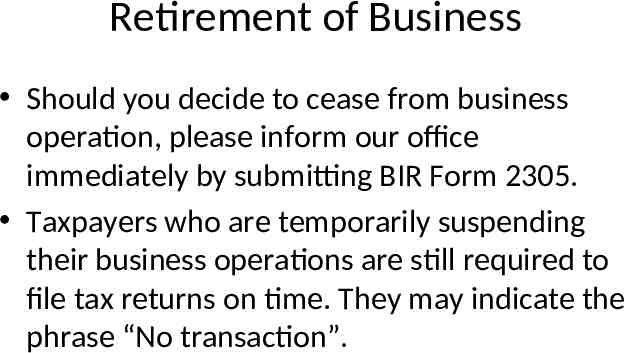

Retirement of Business Should you decide to cease from business operation, please inform our office immediately by submitting BIR Form 2305. Taxpayers who are temporarily suspending their business operations are still required to file tax returns on time. They may indicate the phrase “No transaction”.

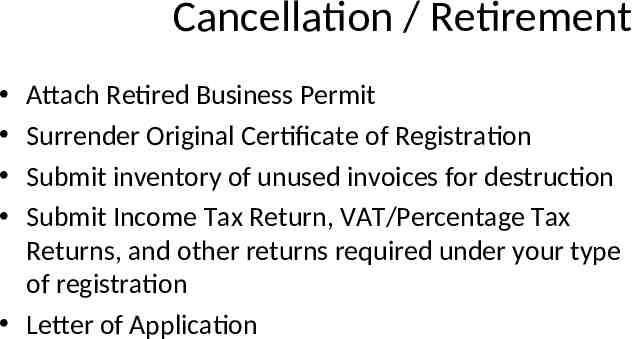

Cancellation / Retirement Attach Retired Business Permit Surrender Original Certificate of Registration Submit inventory of unused invoices for destruction Submit Income Tax Return, VAT/Percentage Tax Returns, and other returns required under your type of registration Letter of Application

For more information Taxpayer Service Section Revenue District Office No.113 RDL Bldg., F. Torres St., Davao City Tel. Nos. 222-3318 to 19 Website: www.bir.gov.ph