An Introduction to Managing Your Business Finances A Guide to the

50 Slides5.38 MB

An Introduction to Managing Your Business Finances A Guide to the Essentials QB 10/2004 01

Financial Management Essentials 1. Introduction to Financial Management 2. Why Accounts are Important 3. Using Reports 4. Managing Essential Tasks: Practice Session 5. Tips and Resources 6. Appendix: Additional Concepts & Terms 2

1. What is Financial Management? Process of: Running your business Recording money coming in Recording money going out Using reports to: Understand how your business is doing Make decisions 3

Six Ways Financial Management Helps Your Business Succeed 2. Manage Customers and Sales. Know and understand your customers through consolidated records. 1. Cash Flow. Track the money going in and out of your business. YOUR BUSINESS 6. Funding. To be considered for a loan or investment, you’ll need complete financial statements. 3. Production. Obtain goods and services. Apply for and establish credit with your vendors. 4. Compliance. Report your company’s incomes, expenses, and payroll accurately to the IRS. 5. Insight and Decision Making. Make informed decisions – and price your product or service for profitability – with financial reports 4

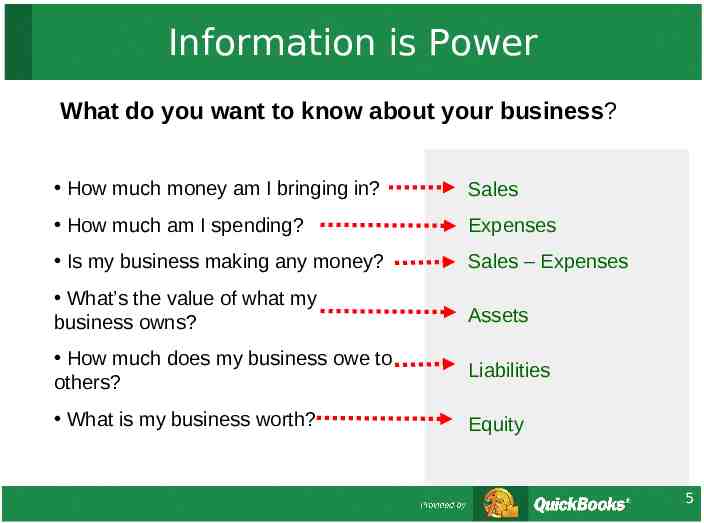

Information is Power What do you want to know about your business? How much money am I bringing in? Sales How much am I spending? Expenses Is my business making any money? Sales – Expenses What’s the value of what my business owns? Assets How much does my business owe to others? Liabilities What is my business worth? Equity 5

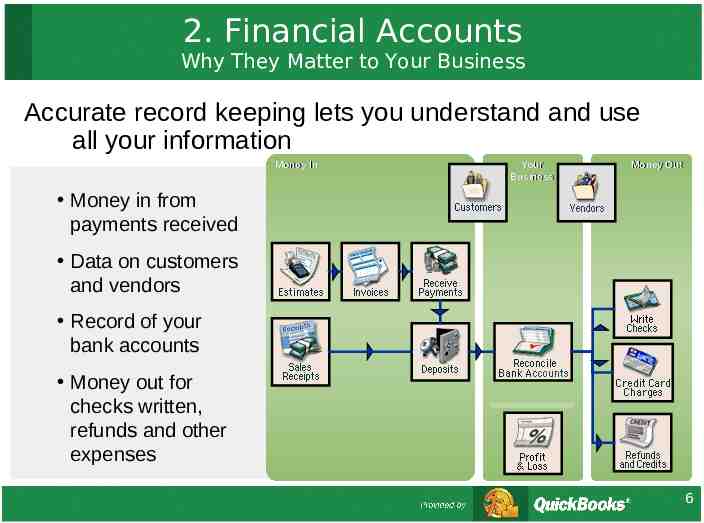

2. Financial Accounts Why They Matter to Your Business Accurate record keeping lets you understand and use all your information Money In Your Business Money Out Money in from payments received Data on customers and vendors Record of your bank accounts Money out for checks written, refunds and other expenses 6

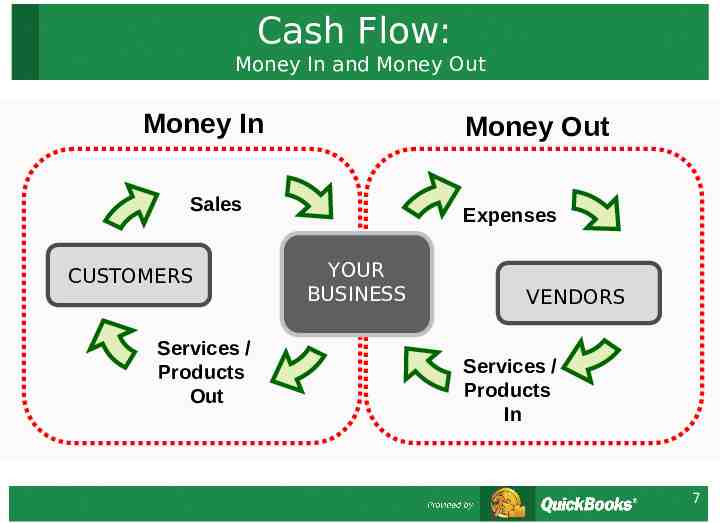

Cash Flow: Money In and Money Out Money In Money Out Sales CUSTOMERS Services / Products Out Expenses YOUR BUSINESS VENDORS Services / Products In 7

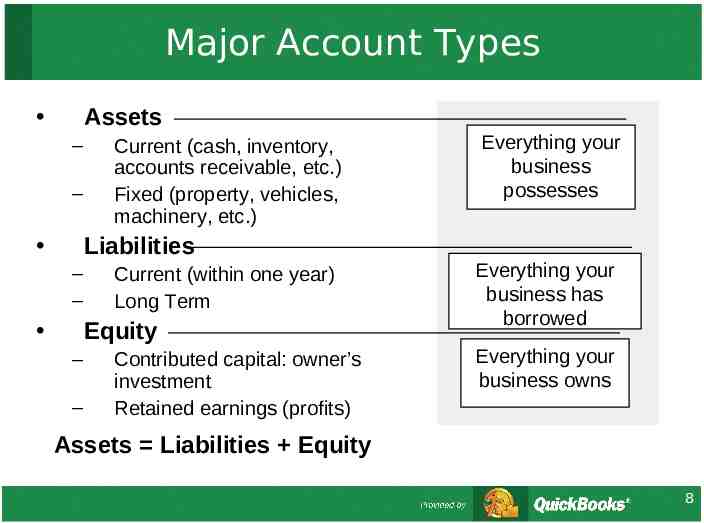

Major Account Types Assets – – Current (cash, inventory, accounts receivable, etc.) Fixed (property, vehicles, machinery, etc.) Everything your business possesses Liabilities – – Current (within one year) Long Term Equity – – Contributed capital: owner’s investment Retained earnings (profits) Everything your business has borrowed Everything your business owns Assets Liabilities Equity 8

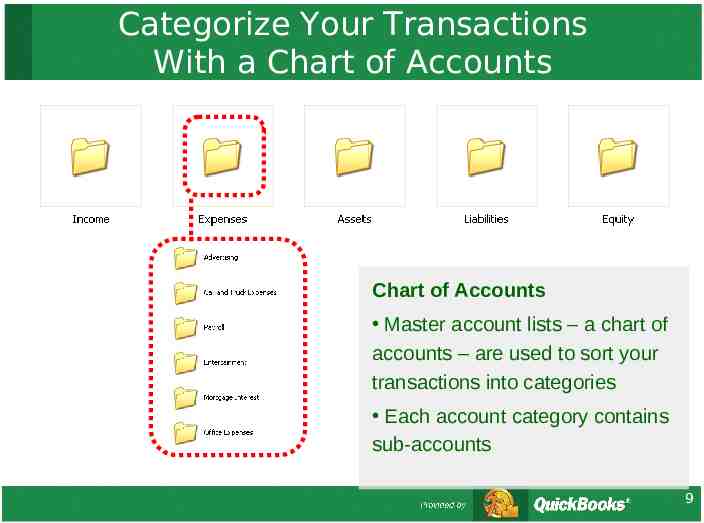

Categorize Your Transactions With a Chart of Accounts Chart of Accounts Master account lists – a chart of accounts – are used to sort your transactions into categories Each account category contains sub-accounts 9

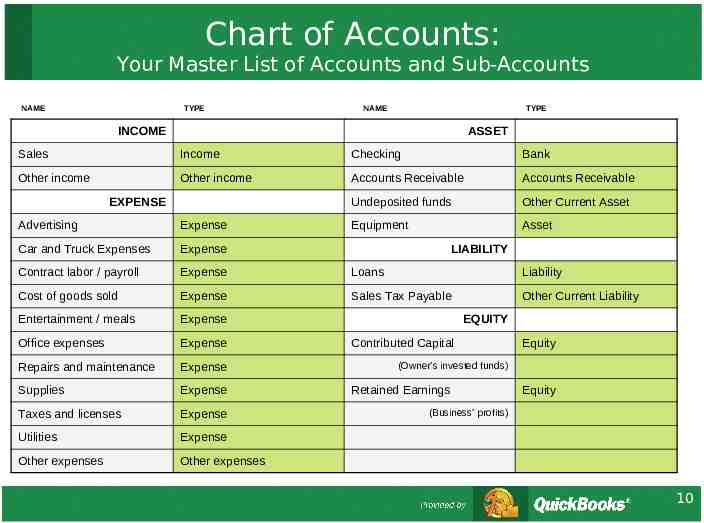

Chart of Accounts: Your Master List of Accounts and Sub-Accounts NAME TYPE NAME TYPE INCOME ASSET Sales Income Checking Bank Other income Other income Accounts Receivable Accounts Receivable Undeposited funds Other Current Asset Equipment Asset EXPENSE Advertising Expense Car and Truck Expenses Expense Contract labor / payroll Expense Loans Liability Cost of goods sold Expense Sales Tax Payable Other Current Liability Entertainment / meals Expense Office expenses Expense Repairs and maintenance Expense Supplies Expense Taxes and licenses Expense Utilities Expense Other expenses Other expenses LIABILITY EQUITY Contributed Capital Equity (Owner’s invested funds) Retained Earnings Equity (Business’ profits) 10

Accounts: What We’ve Learned Consolidate your record keeping Use a standard set of accounts or categories to “file away” transactions—there is a common language Keep it simple: Significant accounts only Use Industry Specific Accounts Master account lists – a chart of accounts – are readily available for most types of business. Choose one specific to your industry, and make minor changes if needed. 11

3. Reports Understanding Your Business and Decision-Making Reports help you understand how your business is doing Use reports as a planning tool – – – Gain insight into your sales Income statement (P&L) shows your profitability Balance sheet shows assets, liabilities and equity Regularly monitor your profitability – and your cash flow 12

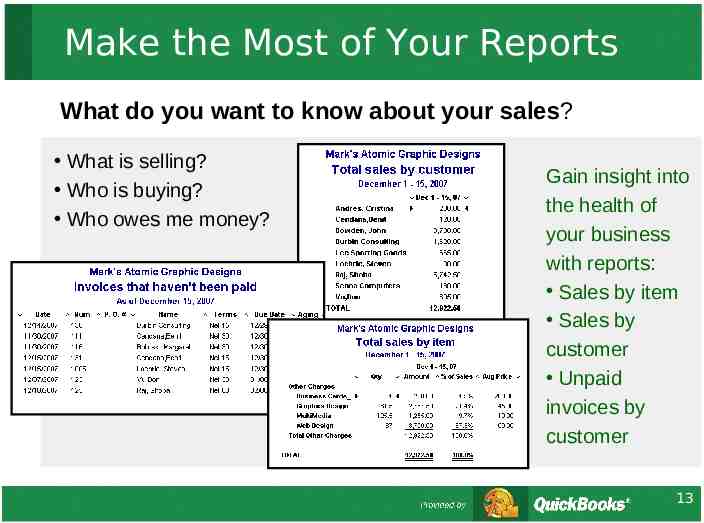

Make the Most of Your Reports What do you want to know about your sales? What is selling? Who is buying? Who owes me money? Gain insight into the health of your business with reports: Sales by item Sales by customer Unpaid invoices by customer 13

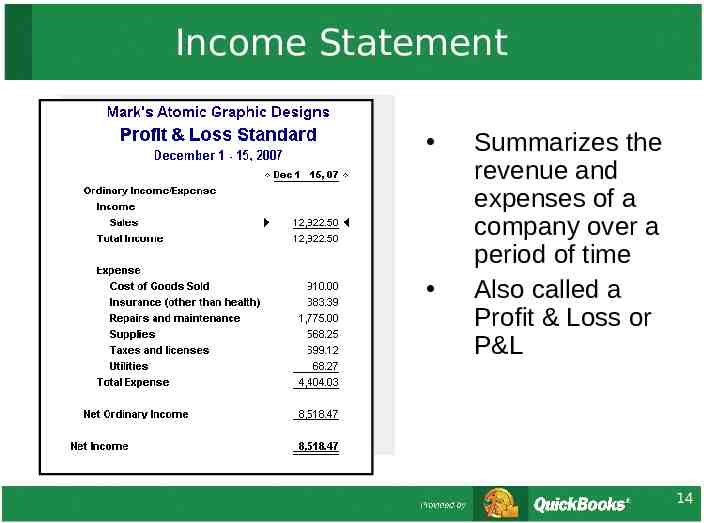

Income Statement Summarizes the revenue and expenses of a company over a period of time Also called a Profit & Loss or P&L 14

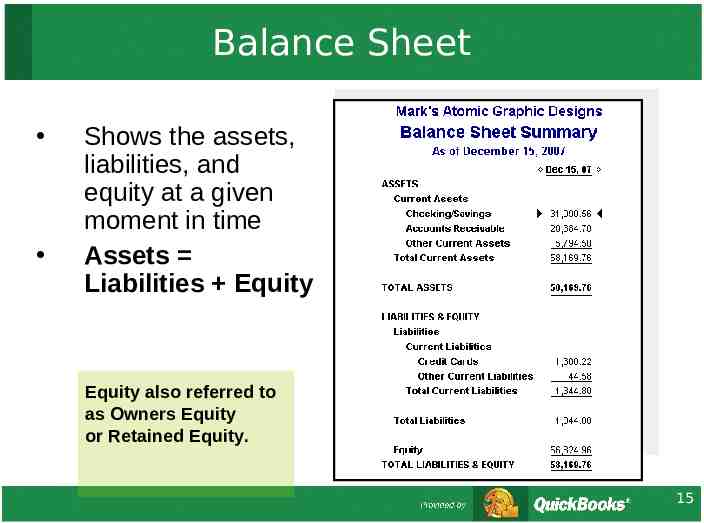

Balance Sheet Shows the assets, liabilities, and equity at a given moment in time Assets Liabilities Equity Equity also referred to as Owners Equity or Retained Equity. 15

4. Manage Essential Tasks Practice Session: Mark’s Atomic Graphic Designs Money in A. Record a sale B. Invoice a customer C. Receive a payment D. Make a deposit Money Out E. Write a check / record an expense F. Use a credit card / record an expense Remember, the better you understand your cash flow situation, the better you’ll be prepared to make the right business decisions. 16

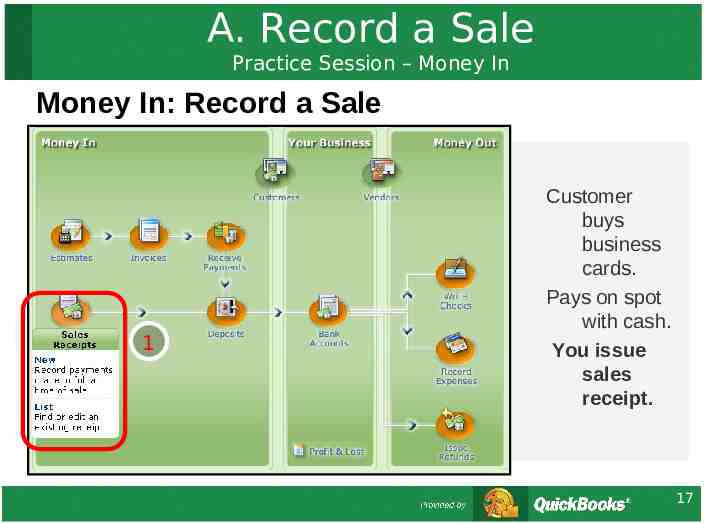

A. Record a Sale Practice Session – Money In Money In: Record a Sale 1 Customer buys business cards. Pays on spot with cash. You issue sales receipt. 17

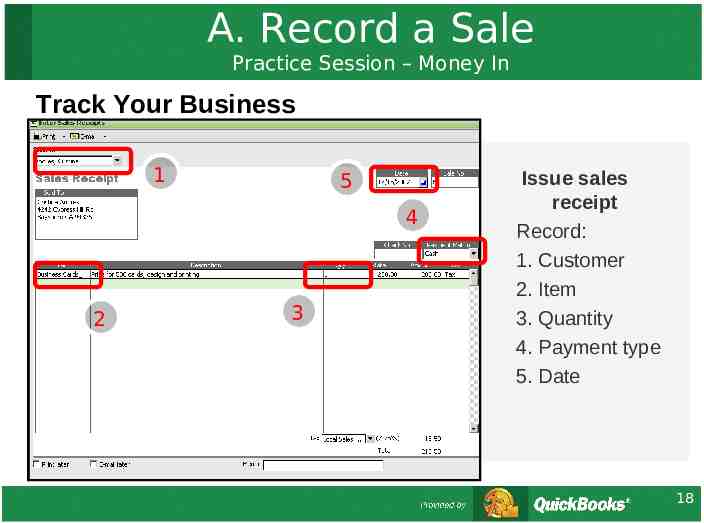

A. Record a Sale Practice Session – Money In Track Your Business 1 5 4 2 3 Issue sales receipt Record: 1. Customer 2. Item 3. Quantity 4. Payment type 5. Date 18

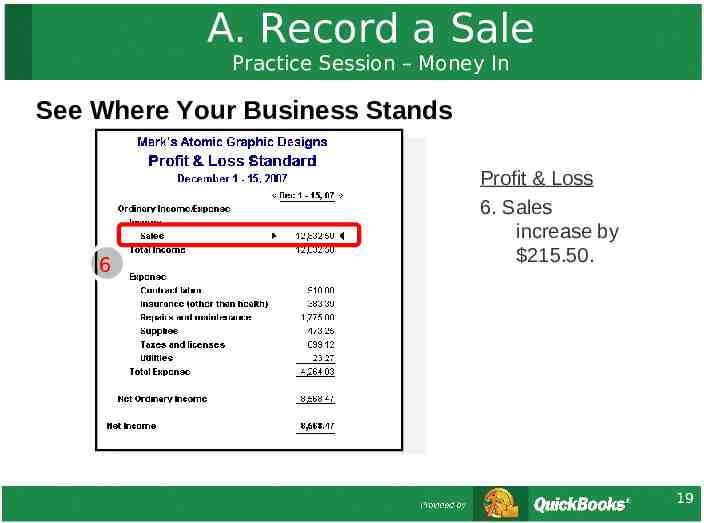

A. Record a Sale Practice Session – Money In See Where Your Business Stands 6 Profit & Loss 6. Sales increase by 215.50. 19

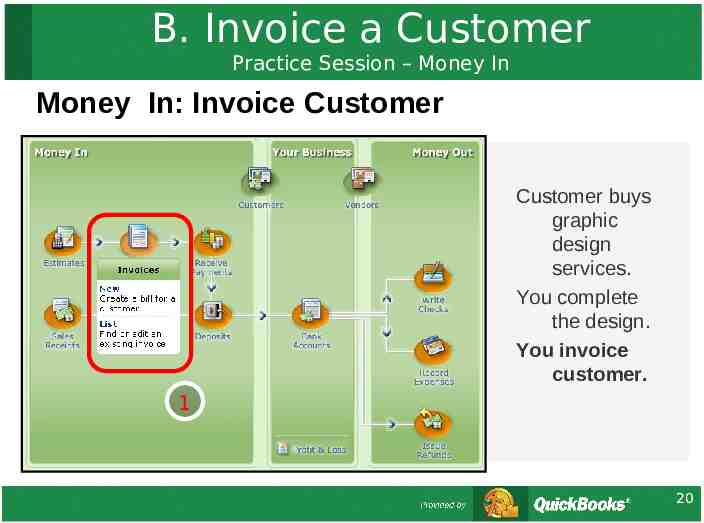

B. Invoice a Customer Practice Session – Money In Money In: Invoice Customer Customer buys graphic design services. You complete the design. You invoice customer. 1 20

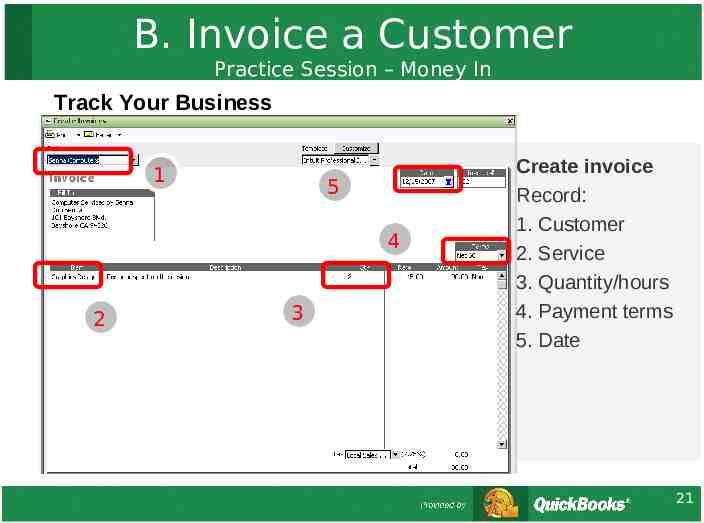

B. Invoice a Customer Practice Session – Money In Track Your Business 1 5 4 2 3 Create invoice Record: 1. Customer 2. Service 3. Quantity/hours 4. Payment terms 5. Date 21

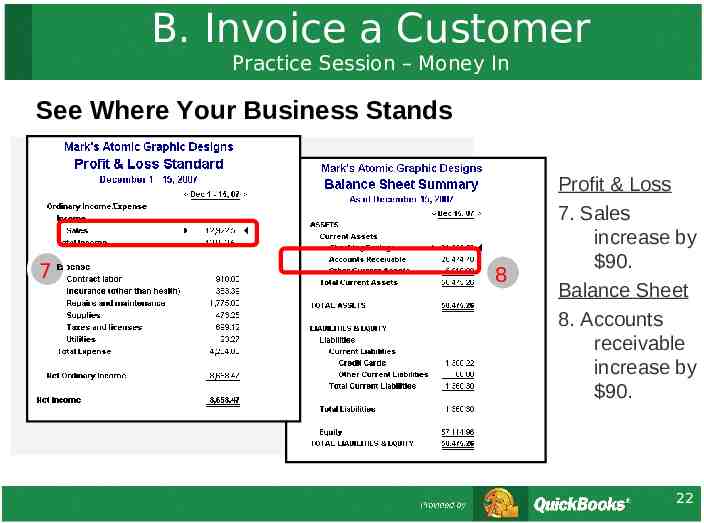

B. Invoice a Customer Practice Session – Money In See Where Your Business Stands 7 8 Profit & Loss 7. Sales increase by 90. Balance Sheet 8. Accounts receivable increase by 90. 22

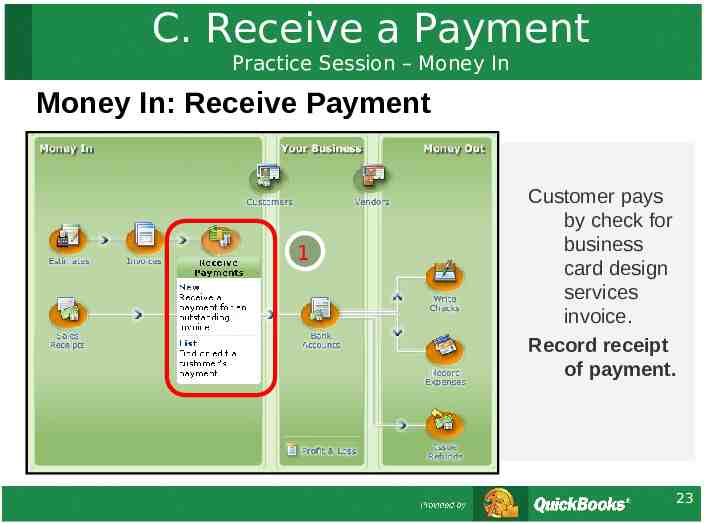

C. Receive a Payment Practice Session – Money In Money In: Receive Payment 1 Customer pays by check for business card design services invoice. Record receipt of payment. 23

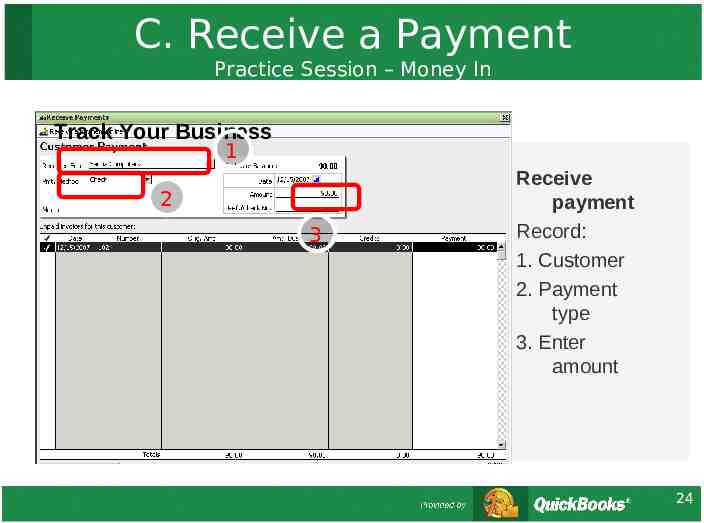

C. Receive a Payment Practice Session – Money In Track Your Business 1 2 3 Receive payment Record: 1. Customer 2. Payment type 3. Enter amount 24

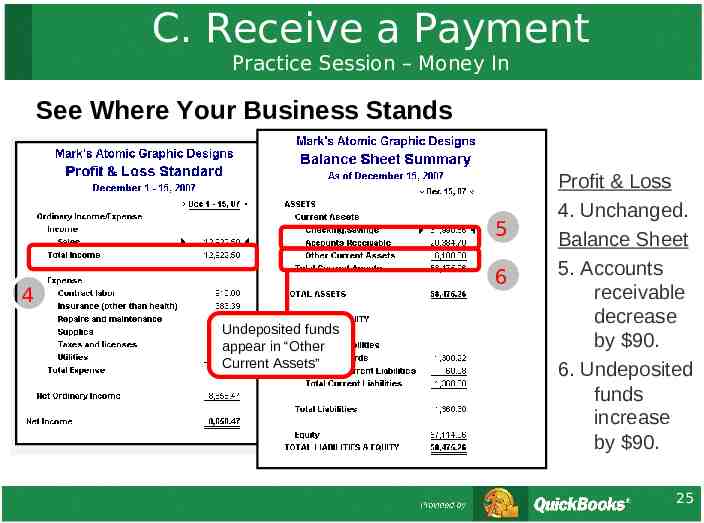

C. Receive a Payment Practice Session – Money In See Where Your Business Stands 5 6 4 Undeposited funds appear in “Other Current Assets” Profit & Loss 4. Unchanged. Balance Sheet 5. Accounts receivable decrease by 90. 6. Undeposited funds increase by 90. 25

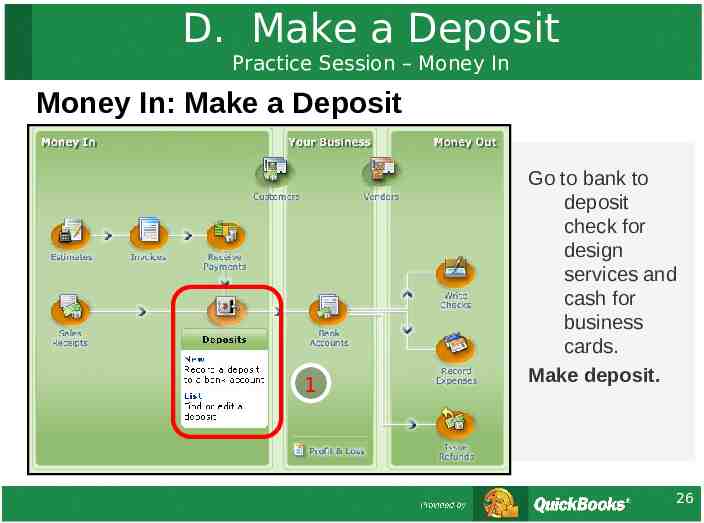

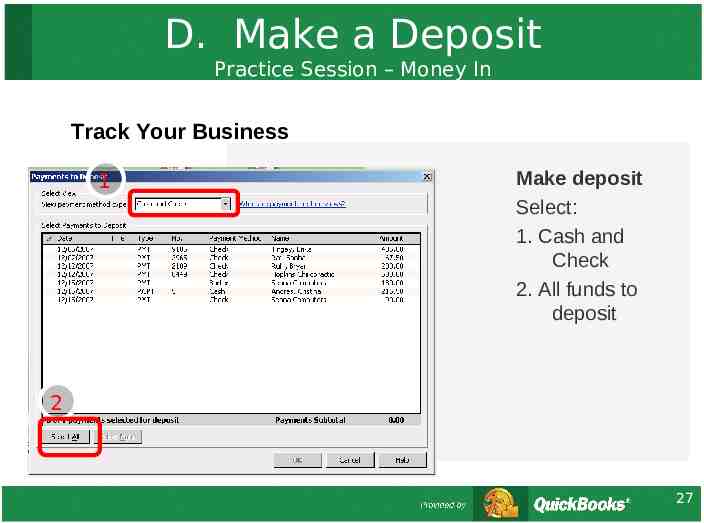

D. Make a Deposit Practice Session – Money In Money In: Make a Deposit 1 Go to bank to deposit check for design services and cash for business cards. Make deposit. 26

D. Make a Deposit Practice Session – Money In Track Your Business 1 Make deposit Select: 1. Cash and Check 2. All funds to deposit 2 27

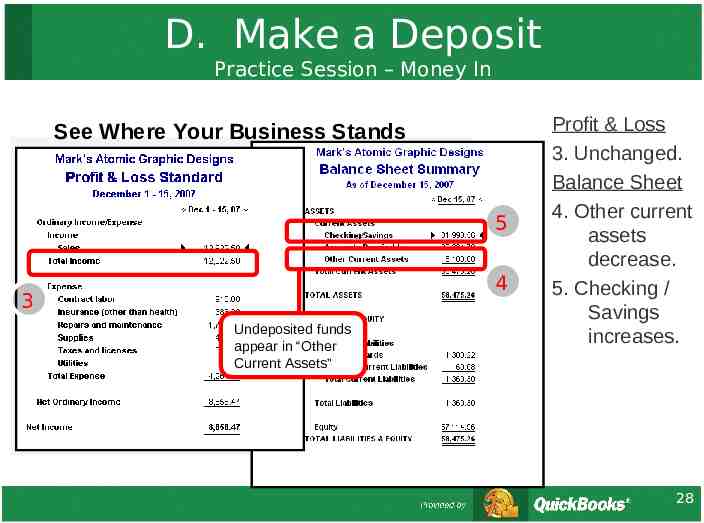

D. Make a Deposit Practice Session – Money In See Where Your Business Stands 5 4 3 Undeposited funds appear in “Other Current Assets” Profit & Loss 3. Unchanged. Balance Sheet 4. Other current assets decrease. 5. Checking / Savings increases. 28

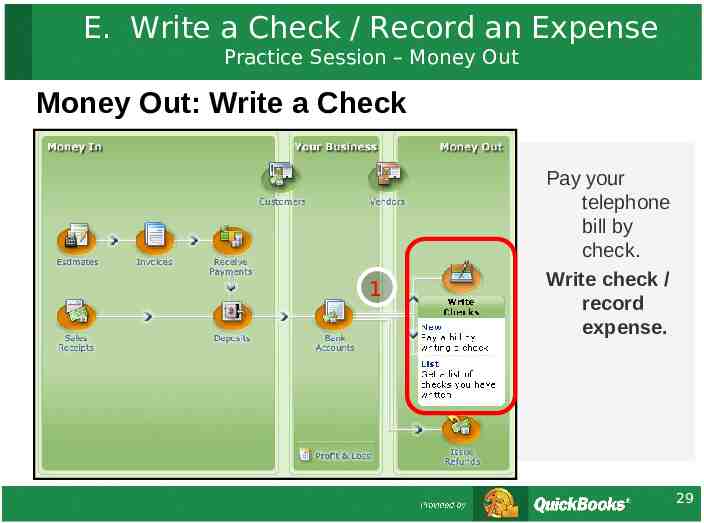

E. Write a Check / Record an Expense Practice Session – Money Out Money Out: Write a Check 1 Pay your telephone bill by check. Write check / record expense. 29

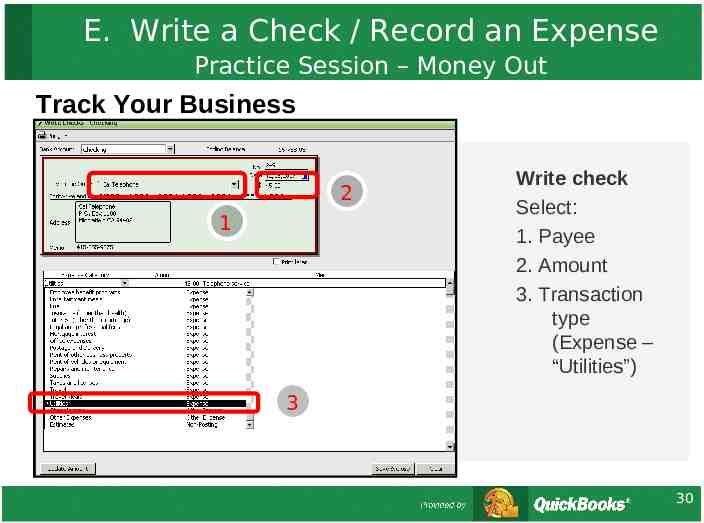

E. Write a Check / Record an Expense Practice Session – Money Out Track Your Business 2 1 Write check Select: 1. Payee 2. Amount 3. Transaction type (Expense – “Utilities”) 3 30

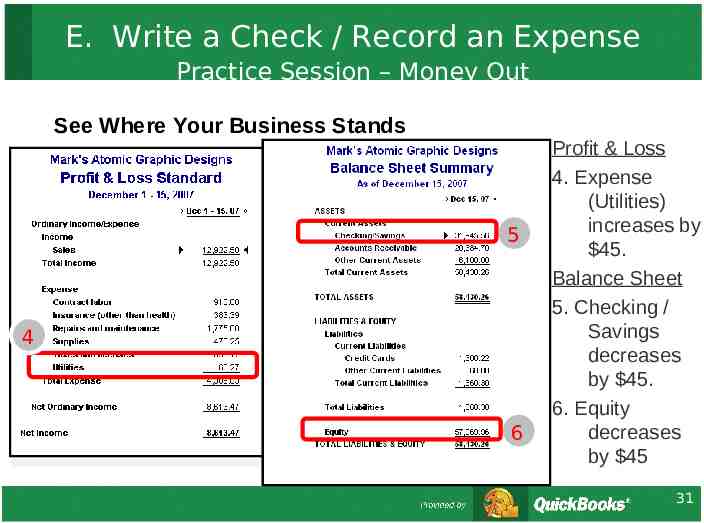

E. Write a Check / Record an Expense Practice Session – Money Out See Where Your Business Stands 5 4 6 Profit & Loss 4. Expense (Utilities) increases by 45. Balance Sheet 5. Checking / Savings decreases by 45. 6. Equity decreases by 45 31

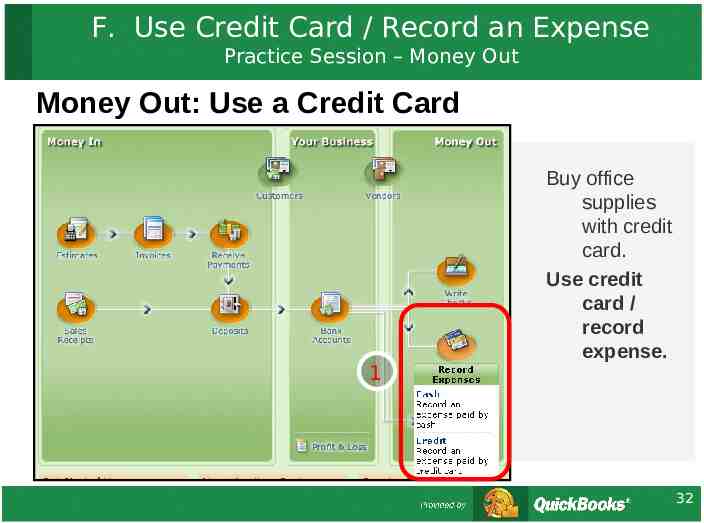

F. Use Credit Card / Record an Expense Practice Session – Money Out Money Out: Use a Credit Card 1 Buy office supplies with credit card. Use credit card / record expense. 32

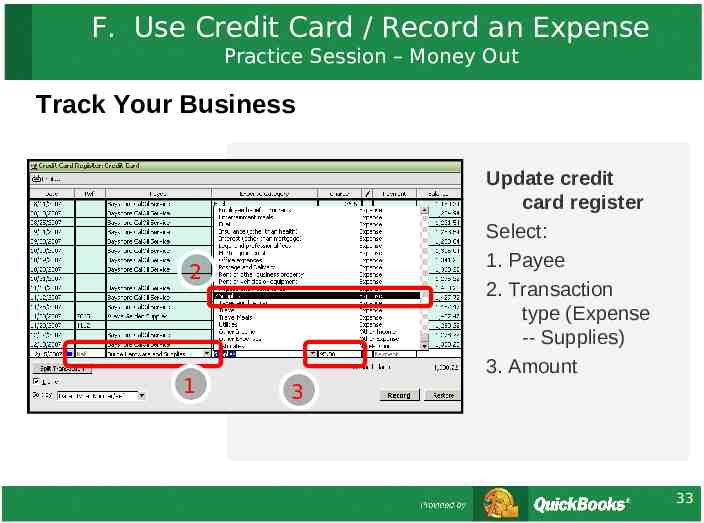

F. Use Credit Card / Record an Expense Practice Session – Money Out Track Your Business Update credit card register Select: 1. Payee 2. Transaction type (Expense -- Supplies) 3. Amount 2 1 3 33

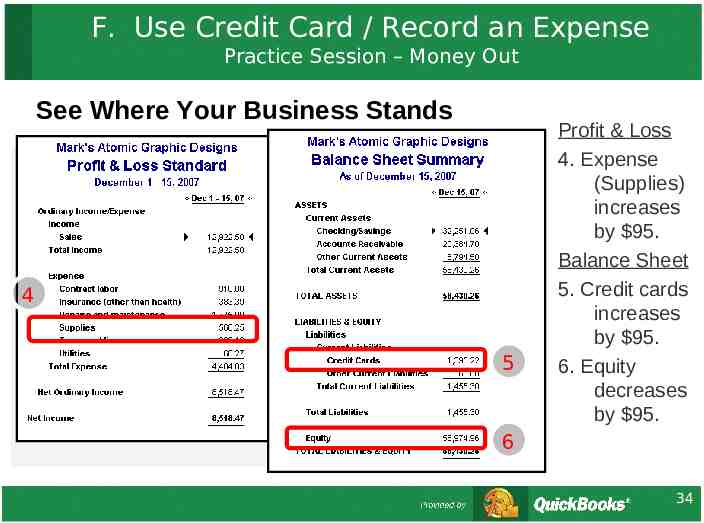

F. Use Credit Card / Record an Expense Practice Session – Money Out See Where Your Business Stands 4 5 Profit & Loss 4. Expense (Supplies) increases by 95. Balance Sheet 5. Credit cards increases by 95. 6. Equity decreases by 95. 6 34

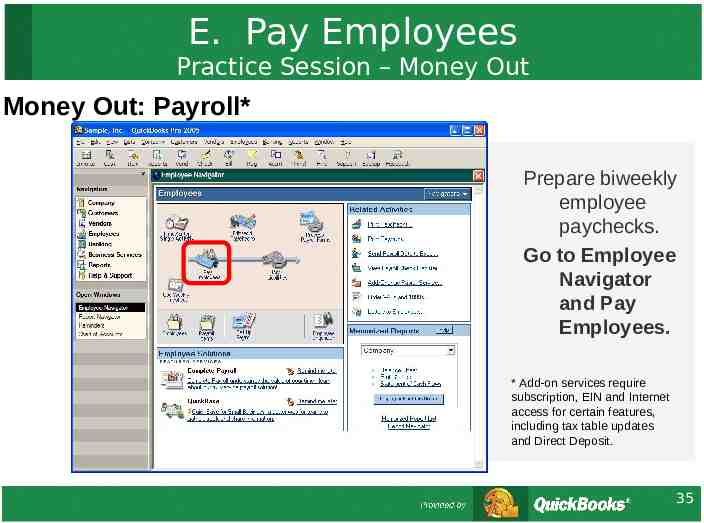

E. Pay Employees Practice Session – Money Out Money Out: Payroll* Prepare biweekly employee paychecks. Go to Employee Navigator and Pay Employees. * Add-on services require subscription, EIN and Internet access for certain features, including tax table updates and Direct Deposit. 35

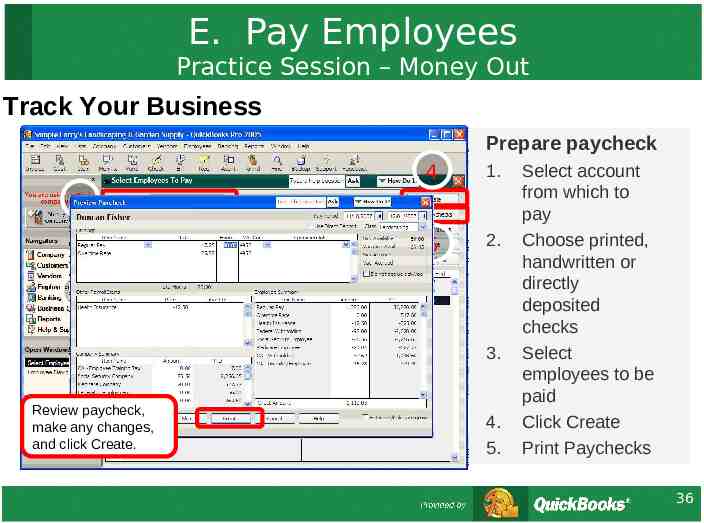

E. Pay Employees Practice Session – Money Out Track Your Business Prepare paycheck 4 1. 5 2. 1 2 3 3. Review paycheck, make any changes, and click Create. 4. 5. Select account from which to pay Choose printed, handwritten or directly deposited checks Select employees to be paid Click Create Print Paychecks 36

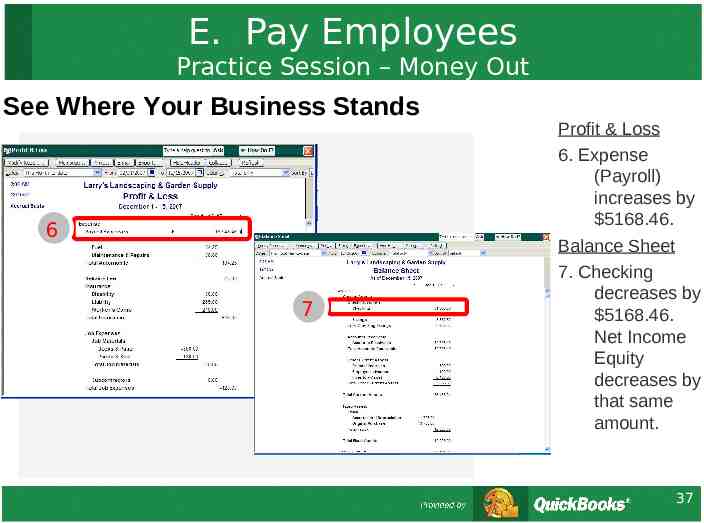

E. Pay Employees Practice Session – Money Out See Where Your Business Stands 6 7 Profit & Loss 6. Expense (Payroll) increases by 5168.46. Balance Sheet 7. Checking decreases by 5168.46. Net Income Equity decreases by that same amount. 37

6. Tips and Advice 1. 2. 3. 4. Getting Started Helpful Resources Online Resources Congratulations! 38

Getting Started Establish Good Accounting Habits 1. Record transactions regularly 2. Accuracy and consistency are essential 3. Fix mistakes as they happen 4. Manage and reconcile bank account regularly 1. Build your toolkit – 2. Structure your accounts – 3. Start with a minimum # of accounts and add as needed Establish an accounting routine – and stick to it – – 4. Consider software packages such as QuickBooks Simple Start (Trial Edition is available) Reconcile accounts monthly Update financial statements quarterly Work closely with your Accountant throughout the year 39

Helpful Resources Advance Your Knowledge Professional Help – Accountants Look for knowledge of your industry – QuickBooks ProAdvisors Expert set-up can save you time Free 1-hour consultation – Small Business Development Center (SBDC) counselors Training Tools – Take classes (either online or at local colleges) – Attend local business seminars – Build a network with other business owners – Use QuickBooks learning solutions Expert help can make the process of settingup and maintaining your books much easier. Be sure to look for a professional with knowledge of your industry – and of course, don’t be afraid to ask for references. 40

Online Resources Small Business Development Centers http://www.asbdc-us.org/ Start and Grow Your Business http://jumpup.intuit.com/ Internal Revenue Service www.irs.gov/businesses/s mall/ U.S. Chamber of Commerce www.uschamber.com Try QuickBooks Simple Start Edition (Free Trial) www.quickbooks.com Find a QuickBooks ProAdvisor www.usequickbooks.com/l ocateadvisor 41

Congratulations! You now know: Why financial management is critical to effectively run a business How to set-up and manage your accounts The usefulness of financial reports Time to put your knowledge to work! Good luck! 42

Appendix: Additional Terms and Concepts A Simple Start to Managing Your Business Finances

Financial Management Terms and Concepts 1. 2. 3. 4. 5. Business types Cash or accrual Debits and credits Journal Ledger 44

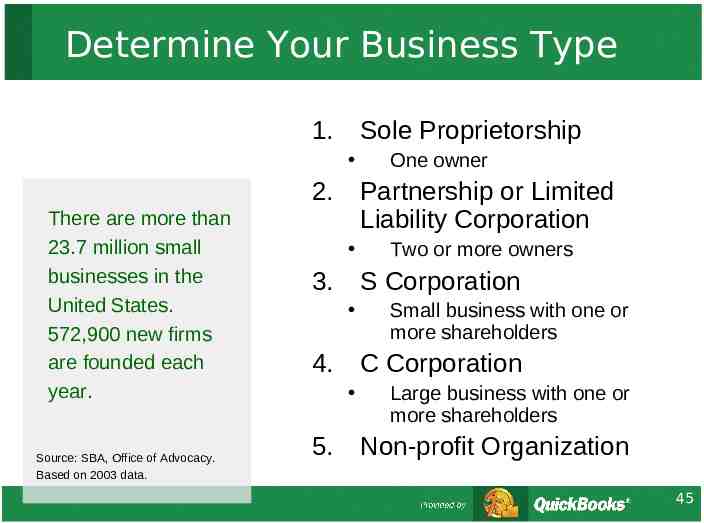

Determine Your Business Type 1. Sole Proprietorship 2. There are more than 23.7 million small businesses in the United States. 572,900 new firms are founded each year. Source: SBA, Office of Advocacy. Based on 2003 data. Partnership or Limited Liability Corporation 3. Two or more owners S Corporation 4. Small business with one or more shareholders C Corporation 5. One owner Large business with one or more shareholders Non-profit Organization 45

Choosing an Accounting Type Cash or Accrual? A. Cash accounting The practice of recording sales and expenses only when cash is actually received or paid out B. Accrual accounting The practice of reporting income when earned and expenses when incurred Businesses with inventory (e.g. retailers) must use this method Choose whichever accounting method works best for you – the important thing is to be consistent once you’ve selected an accounting type Most businesses opt for accrual method of accounting At any given time, gives a more realistic picture of the health of the business 46

Debits and Credits Double Entry Accounting Accountants use “debits and credits” to describe how transactions are recorded in the general ledger Each transaction increases one account and decreases another System balances itself You don’t need to be too concerned with the mechanics of double entry accounting, debits and credits, as software programs handle automatically. But as a business owner, you might run into these terms. 47

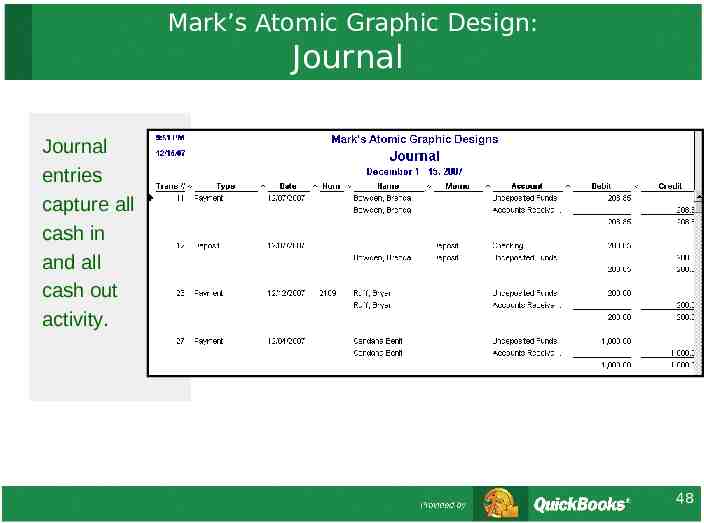

Mark’s Atomic Graphic Design: Journal Journal entries capture all cash in and all cash out activity. 48

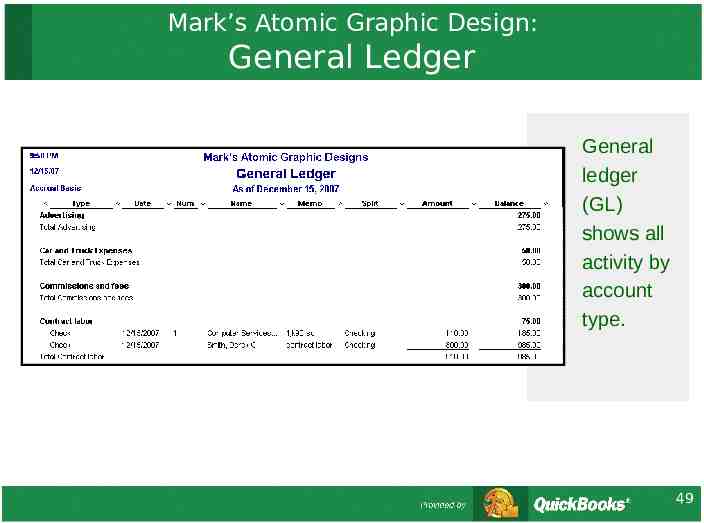

Mark’s Atomic Graphic Design: General Ledger General ledger (GL) shows all activity by account type. 49

Acknowledgements Intuit would like to thank the following advisors for their help developing this presentation: Peter Pappas, Regional Director, Connecticut Small Business Development Center, Groton, CT Neal Nelson, Counselor, Maricopa Community College Small Business Development Center, Phoenix, AZ Charles Eason, Director, Solano College Small Business Development Center, Fairfield, CA Do you have feedback, success stories or suggestions for improving this course? Email us at [email protected]. 50