Acupuncture Coverage Overview Florida Medicaid Managed Care Plans

36 Slides269.94 KB

Acupuncture Coverage Overview Florida Medicaid Managed Care Plans and Medicare Advantage plans: Medicare Part C Presented by: FSOMA Vice Pres. David Bibbey, L.Ac. Vice Pres.

Quick History of State Medicaid Plans Medicaid began as part of the Social Security Act of 1965. The original law gave states the option of receiving federal funding to help provide health care coverage to children whose families have a low income, their caregiver relatives, people who are blind and people who are disabled. The federal government has since strengthened the rules and requirements for states administering Medicaid. Through Medicaid expansion some states now extend coverage to other low-income adults.

Overview: Florida Medicaid Medicaid is a federal and state program that provides health care coverage to qualified individuals. Medicaid programs are state-run. However, the federal government has rules and regulations under which all states must comply. The federal government also provides at least 50% of the funding for their Medicaid requirements. Based on federal regulations, states create and run their own Medicaid program to best serve their residents who qualify. States may choose to provide more services than the federal government requires, and they may also choose to provide coverage to larger groups of people. Medicaid provides health care coverage for people who qualify, based on income and assets.

Who is covered under Florida Medicaid? Pregnant women with low income Children of low-income families Children in foster care People with disabilities Seniors with low income Parents or caregivers with low income States may choose to expand eligibility to additional groups, such as people with low income who may or may not have children

How do Floridians Qualify for Medicaid? Medicaid qualification is based primarily on the financial need of children, disabled adults, and qualified seniors. The Federal Poverty Level (FPL) is an index used to calculate a family’s minimum amount of gross income needed to afford food, clothing, transportation, shelter and other necessities. The calculation is used to determine eligibility in multiple federal assistance programs, including Medicaid eligibility. It is recalculated every year.

What Medicaid Plans are available in Florida Two basic Medicaid options exist in Florida Florida Medicaid State NO operated insurance program Acupuncture coverage: currently FSOMA is working on it Florida Statewide Medicaid Managed Care Privately managed insurance plans Acupuncture Coverage on all plans for adults Determined by County: Find Florida Medicaid by County

Florida – full list Statewide Medicaid Managed Care United Health Care Staywell Health Plan Sunshine State Health Plan Humana Medical Plan Florida Community Care Simply Healthcare Plans Aetna Better Health Plan Clear Health Molina Healthcare Prestige Health Choice

Acupuncture Coverage Benefits Molina Healthcare Molina Healthcare Plan Prestige Prestige Health Choice Coverage Simply Simply Health Choice Healthcare Plans Healthcare Acupuncture Coverage

What is Medicare Medicare is the federal health insurance program created in 1965 for people ages 65 and over, regardless of income, medical history, or health status. The program was expanded in 1972 to cover certain people under age 65 who have a long-term disability. Today, Medicare plays a key role in providing health and financial security to 60 million older people and younger people with disabilities. The program helps to pay for many medical care services, including hospitalizations, physician visits, prescription drugs, preventive services, skilled nursing facility and home health care, and hospice care. In 2017, Medicare spending accounted for 15 percent of total federal spending and 20 percent of total national health spending.

Medicare Coverage Most people ages 65 and over are entitled to Medicare Part A if they or their spouse are eligible for Social Security payments, and do not have to pay a premium for Part A if they paid payroll taxes for 10 or more years. People under age 65 who receive Social Security Disability Insurance (SSDI) payments generally become eligible for Medicare after a two-year waiting period, while those diagnosed with end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS) become eligible for Medicare with no waiting period. Medicare When has 2 main coverage options people enroll, they decide between: Original Medicare Medicare Advantage

The A, B, and C’s of Medicare Part A covers inpatient hospital stays, skilled nursing facility (SNF) stays, some home health visits, and hospice care. Part A benefits are subject to a deductible ( 1,364 per benefit period in 2019). Part A also requires coinsurance for extended inpatient hospital and SNF stays. Part B covers physician visits, outpatient services, preventive services, and some home health visits. Many Part B benefits are subject to a deductible ( 185 in 2019), and, typically, coinsurance of 20 percent. No coinsurance or deductible is charged for an annual wellness visit or for preventive services that are rated ‘A’ or ‘B’ by the U.S. Preventive Services Task Force, such as mammography or prostate cancer screenings. Part C refers to the Medicare Advantage program, through which beneficiaries can enroll in a private health plan, such as a health maintenance organization (HMO) or preferred provider organization (PPO), and receive all Medicare-covered Part A and Part B benefits and typically also Part D benefits. More than 4.6 million Floridians are Medicare beneficiaries, nearly 50% are enrolled in Medicare Advantage plans in 2020.

Original Medicare Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). Patients pay a deductible at the start of each year, and usually pay 20% of the cost of the Medicare-approved service, called coinsurance at the point of care. Patients wanting drug coverage, can add a separate drug plan (Part D). Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. Original Medicare INCLUDES acupuncture effective January 21, 2020 but requires DIRECT SUPERVISION for billing Acupuncture services.

2020 Medicare National Coverage Determination (NCD) - Acupuncture The Centers for Medicare & Medicaid Services (CMS) will cover acupuncture for chronic low back pain under section 1862(a)(1)(A) of the Social Security Act. Up to 12 visits in 90 days are covered for Medicare beneficiaries under the following circumstances: For the purpose of this decision, chronic low back pain (cLBP) is defined as: o Lasting 12 weeks or longer; o nonspecific, in that it has no identifiable systemic cause (i.e., not associated with metastatic, inflammatory, infectious, etc. disease); o not associated with surgery; and o not associated with pregnancy.

2020 Medicare National Coverage Determination (NCD) - Acupuncture In an outpatient hospital/CAH setting, services would be furnished under general supervision (per §410.27(a)(1)(iv), as amended by the recent CY 2020 OPPS/ASC rule). o Per §410.26(a)(3), general supervision means the service is furnished under the physician's (or other practitioner's) overall direction and control, but the physician's (or other practitioner's) presence is not required during the performance of the service. In office settings, services would be furnished under direct supervision (per §410.26(b)(5)). o Per §410.32(b)(3)(ii), direct supervision in the office setting means the physician must be present in the office suite and immediately available to furnish assistance and direction throughout the performance of the procedure. It does not mean that the physician must be present in the room when the procedure is performed.

Part C: Medicare Advantage Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D (Prescription Plan). Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year. Each Medicare Advantage Plan can charge different out-of-pocket costs. They can also have different rules for how you get services. Medicare Advantage Plans cover Acupuncture services based on the plan guidelines, BUT no supervision is generally required for these acupuncture services. Patients pay copay and carrier billed for care.

Understanding Medicare Advantage Plans Acupuncture coverage 1 of 2 Medicare Advantage plans are meant to replace Original Medicare Parts A and B, and so they're required to provide all the same benefits as Part A and Part B as a baseline, with some room to expand services. That means that every Medicare Advantage plan provides the same 12 to 20 acupuncture sessions for qualified cLBP per year as Original Medicare.

Understanding Medicare Advantage Plans Acupuncture coverage 2 of 2 Since Medicare Advantage policies are provided by private insurers, Medicare Advantage plans vary from state to state, so the details of plans offered in Massachusetts are likely to differ from those available in California, Texas and Florida. Some of these plans are more likely to cover alternative therapies than others, although it may take some research to find a state-specific plan that has the necessary coverage.

Which Medicare Advantage Plans Cover Acupuncture? There are 4 basic types of Advantage Plans Health Maintenance Organization Plans (HMO’s) Preferred Provider Organization Plans (PPO’s) Private Fee-for-Service Plans (PFSP’s) Special Needs Plans

Health Maintenance Organization Plans (HMO’s) HMO plans are by far the most popular form of Medicare Advantage coverage because all services offered by the network are generally covered by the insurance. An HMO network that offers acupuncture should also have a corresponding insurance plan that pays for it, though only a member services representative can definitively say which plan does.

Preferred Provider Organization Plans (PPO’s) PPOs operate with a network of preferred providers, but the plans usually include coverage for beneficiaries who go outside the network for specialist care. If a given Medicare Advantage plan has a preferred network that includes an acupuncture provider, the plan likely includes coverage for that service. PPO participants who wish to go outside their network for acupuncture treatment are likely to have more flexibility than HMO plan participants.

Private Fee-for-Service Plans (PFFS plan) Some PFFS plans have loose networks of preferred providers, just like PPO plans, while others cover care with any qualified practitioner. These plans are typically very flexible in the services they cover, and so they might be a good choice for patients who need expanded coverage for acupuncture.

Special Needs Plans (SNP’s) SNPs provide focused benefits to treat seniors with certain chronic health conditions, including some neurological conditions that cause back pain. SNP enrollees are usually required to have a primary care doctor who can diagnosis the patient with chronic low back pain and recommend acupuncture for the number of sessions the SNP allows.

Differences: Medicaid vs. Medicare Medicaid Medicare Provides health insurance to low-income children and some parents, seniors and disabled individuals Provides health insurance for seniors aged 65 years and older, and for some people with disabilities Provides medical care and long-term care coverage Provides medical care coverage, but very limited long-term care coverage Has eligibility rules based on income and categorical criteria Has no income limit Receives state and federal funding Receives federal funding collected by payroll deduction Administered on a state level, within federal guidelines Administered on a federal level

Florida Medicaid and Medicare Statistics Florida Medicaid: Adults FL Statewide Medicaid Managed Care: 900,000 (1:14 FL adults have direct access acupuncture coverage FL Medicare Original 4,300,000 (No Acupuncture coverage) 2,400,000 (Supervised Acu coverage) FL Medicare Advantage Plans 2,200,000 (1:6 FL adults have direct access Acupuncture coverage) * 08/2020 source FL Medicaid

Medicare Advantage Plans in Florida Medicare DE Before Advantage Plans - Available by ZIP CO credentialing individual insurance plans!! Go What To: CAQH ProView Provider Portal is CAQH? CAQH CAQH Fact Sheet is a database containing all the necessary provider details used to streamline credentialing

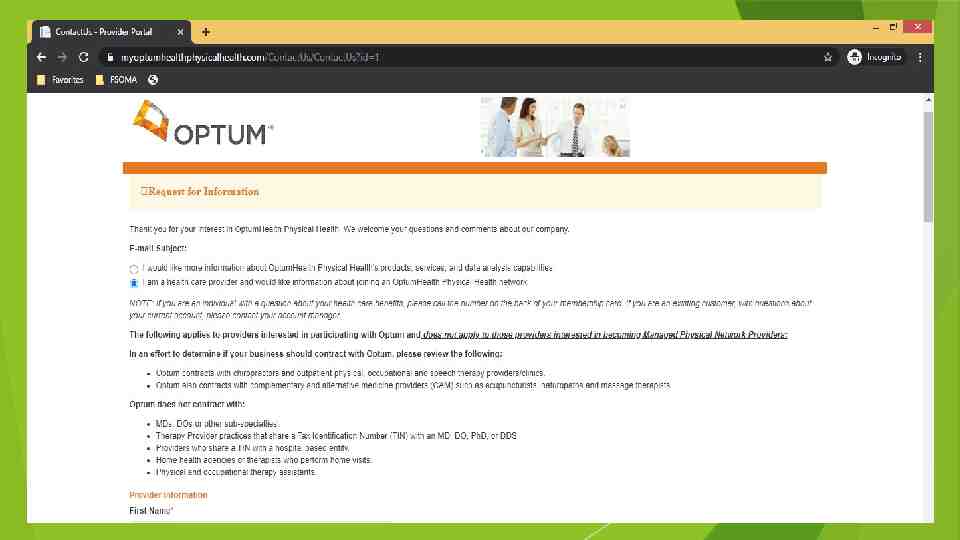

Florida Statewide Medicaid Managed Care OptumHealth Physical Health Provider Network United Health Care Staywell Health Plan Sunshine Humana State Health Plan Medical Plan OptumHealth Credentialing Contact Link

Contact for Credentialing Florida Community Care Simply Healthcare Plans Aetna Better Health Plan Clear Health Molina Healthcare Prestige Health Choice FCC Network Join Simply Health Care Join Aetna Better Health Join *Simply Health Care Join Molina Healthcare Join Prestige Health Choice Join

Florida Medicaid and Medicare Statistics Florida Medicaid: Adults REMINDER FL Statewide Medicaid Managed Care: 900,000 (1:14 FL adults have direct access acupuncture coverage FL Medicare Original 4,300,000 (No Acupuncture coverage) 2,400,000 (Supervised Acu coverage) FL Medicare Advantage Plans 2,200,000 (1:6 FL adults have direct access Acupuncture coverage) * 08/2020 source FL Medicaid

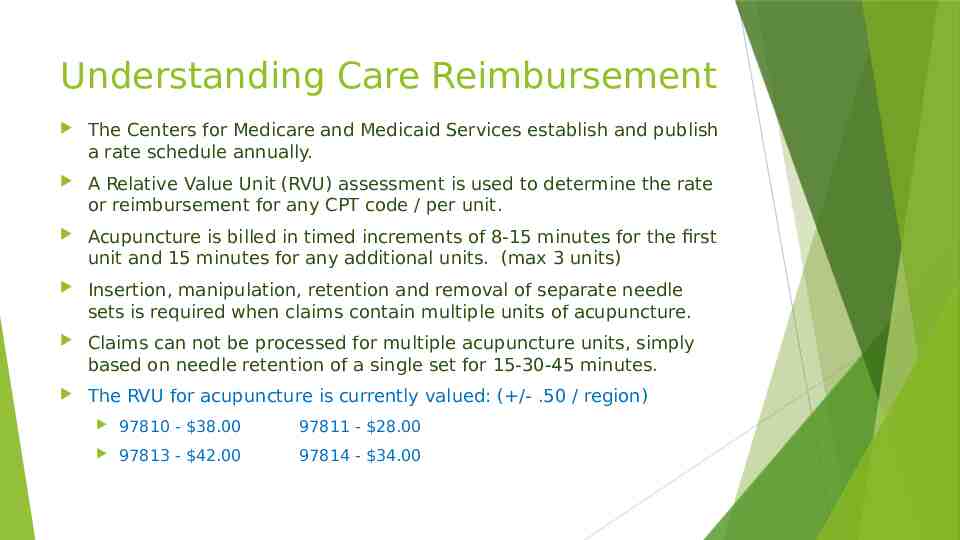

Understanding Care Reimbursement The Centers for Medicare and Medicaid Services establish and publish a rate schedule annually. A Relative Value Unit (RVU) assessment is used to determine the rate or reimbursement for any CPT code / per unit. Acupuncture is billed in timed increments of 8-15 minutes for the first unit and 15 minutes for any additional units. (max 3 units) Insertion, manipulation, retention and removal of separate needle sets is required when claims contain multiple units of acupuncture. Claims can not be processed for multiple acupuncture units, simply based on needle retention of a single set for 15-30-45 minutes. The RVU for acupuncture is currently valued: ( /- .50 / region) 97810 - 38.00 97811 - 28.00 97813 - 42.00 97814 - 34.00

Understanding Care Reimbursement Original Medicare No E/M or manual therapy CPT claims under acupuncture services Medicare Advantage This depends on the benefits included under the Member’s plan Some Plans will include additional alternative care options, massage therapy, and other manual therapies common to a treatment plan. So, when verifying the member’s benefits, be sure to ask if 97140 or 97124 are available. Include all CPT codes in your verification request that are medically necessary under your plan of care.

Example of Claim and Reimbursement Acupuncture Services 45 min without manual therapy: Dx: cLBP M54.5 – Tx: 97810-1, 97811-2, EOB: 97810-1 38.00, 97811-2 28.00 (56.00) 94.00 Electro-Acupuncture 45 min without manual therapy: Dx: cLBP M54.5 – Tx 97813-1, 97814-2 EOB: 97813-1 42.00, 97814-2 34.00 (68.00) 110.00 Always choose the correct and best treatment prescription for a patient based on their needs. The info above is provided for illustrative purposes only.

Value of Higher Volume Low Cost Care Access to millions of additional patients through joining provider networks Services advertised and catalogued on the Insurance Companies website Local patients search Insurance Provider Network databases to find local specialists Use local advertising to communicate you are credentialed with Now Accepting Humana Gold and Aetna Better Health Reduce cost barriers for new patients and returning patients Greater patient compliance with completing their plan of care Greater number of patients and referrals Less income volatility

Other Considerations Must be familiar with Acupuncture policies in the individual plans Creating and managing more documentation Understanding and following the rules will make life a lot easier This should not really be the case, but if you are new to managing insured patients and submitting claims – this will likely create additional work depending on your office software. Reviewing office policies and procedures to reflect changes in staff expectations and patient trends and needs

Takeaways Serving Medicare Advantage and Medicaid Managed Care beneficiaries can be a welcome opportunity for many providers to build the kind reputation and practice they always envisioned for themselves and their Community: A Busy Practice – Thriving Patient Centered Community Minded Respected Valued Modelled Successful in Every Way

Comments and Questions: Thank Holistic to Any you to Everyone for Joining tonight Billing Services has agreed to join tonight: fact-check and add comments questions for David Bibbey – [email protected] Thank: Ellen Teeter, AP – FSOMA Executive Director Natalia Morrison, L.Ac – FSOMA Comm. Director