Actuaries & Risk Management Developments in Australia Greg Martin,

30 Slides410.00 KB

Actuaries & Risk Management Developments in Australia Greg Martin, President Institute of Actuaries of Australia

Agenda What is risk management? – Is it relevant to us (actuaries)? Insurance developments in Australia Where do we stand? – Some more observations on Aus Do we need to do anything? What are the “Associations” doing?

What is RM? RM historically focused on avoiding adverse outcomes. This view is largely reflected in regulatory focus: RM is the process by which an organisation controls, finances and monitors risks to avoid unsustainable losses.

What is ERM? These days, business focus is on Enterprise Risk Management (ERM) Something like the CAS definition: ERM is the discipline by which an organisation assesses, controls, exploits, finances and monitors risks from all sources for the purpose of increasing the organisation's value to its stakeholders.

What does ERM consist of? Comprehensive risk measurement using a consistent modern framework and techniques Not just financial and insured risks, but operational and strategic risks Integrated approach – not silo risk management Not focused on constraints or compliance – primarily driven by maximising business value Data & Analysis: enterprise exposure to all risks Input: risk appetite and tolerances Output: risk-informed decision-making

Is it relevant to us? Actuaries advise on the sound and sustainable financial management of institutions and their products that protect and support individuals and society1 RM and ERM cuts straight across our “space” in insurance, pensions etc, and “what we do” 1: From G. Martin 2008 presidential address

Is it relevant to us? (cont) ERM is an increasing business focus – And recent “sub-prime” crisis events well be adding further pressure now! It is an increasing key regulator focus – International Association of Insurance Supervisors: 3 Pillars Corporate governance & risk management Risk based capital requirements, principles based Supervision, disclosure etc (license, monitor, enforce) – Supervision itself starts with a “risk management assessment” – Risk management clearly at the heart of international regulatory direction

Recent Developments in Aus (on regulatory front) Australian FS Prudential Regulator (APRA): – Regulates banks, insurers, other deposit takers, pension funds – Convergence of regulation across the financial sector. Focus not just on capital now (IAIS 3 Pillars): Good governance. Reputable management Comprehensive risk management Quality, transparent reporting Capital management: adequacy risks and risk management

Recent Developments in Aus APRA now requires insurers (Life & GI) to have a Board approved Risk Management Framework (“RMF”) – Assets & ALM: Market risk, credit risk – Liability: Insurance risk – Operational: Operations, BCP, strategic risk RMF includes: – – – – – – Risk Management Strategy (“RMS”) Risk management function in the business Business plan Capital management plan Monitor & reporting of risks (internal) Board governance oversight and annual declaration to APRA

Recent Developments in Aus Risk Management Framework Business Plan Risk Mangement Strategy High level documentation Capital Management Plan Processes, procedures, assessments Mitigation, reinsurance, measurement, Business Continuity Mangement / BCP Monitoring, reporting, MIS, registers Strategy, policies, risk tolerances, key elements People & managerial responsibility Controls, RMF / BCM reviews/audits

Recent Developments in Aus In terms of relevance to actuaries “Appointed Actuaries” (AA) in Life & GI – Both do Financial Condition Report (FCR) APRA requires AA’s to review and report on RMF in FCR Actuaries in middle of RM in insurance regulation in Australia – Note: AA’s do lots of other things as well

On Business Front Many financial service groups (including insurance) worldwide now have a Chief Risk Officer (CRO): – Role is influential and expanding – Optimises return on capital – Optimises cost of capital

On Business Front (cont) CRO’s in Australia: – Have been seen historically in some banks – Now being seen in general insurers more generally – Appearing in life insurers and funds managers also Actuaries are holding a number of these roles (including some bank roles!) Similar pattern in other regions of the world ERM is leading financial service organisations’ approach to risk

A key RM (ERM) Conclusion ERM is not a fashion it has a long way to go Opportunity for growth of profession if participate in ERM developments! Risk for the broader profession of being sidelined if we don’t participate! Success for the profession in ERM is an imperative2 2: From G. Martin 2008 presidential address

So Where do we stand? We clearly have skills in RM What we do day-to-day in insurance, for example, has many RM dimensions: – – – – – – Pricing adequacy cost of capital Reinsurance strategies Asset/liability modelling & management Managing and costing guarantees and options Capital management Reporting on financial condition

So Where do we stand? Also, some clear initial involvement and success in RM more generally: – CRO roles – Regulator expectations Non-actuaries in RM not necessarily doing a strong job in our traditional fields

E.g.: Aus Insurance Initial insurer RMF’s seen: – Many based on general RM standards For a “widget maker” (manufacturer) – Not insurance, not financial services! – Say: Consider upside & downside risk But: Focus on risk reduction & control Value: cost of risk cost of reduction Actuaries have helped to “extend” to fit financial services

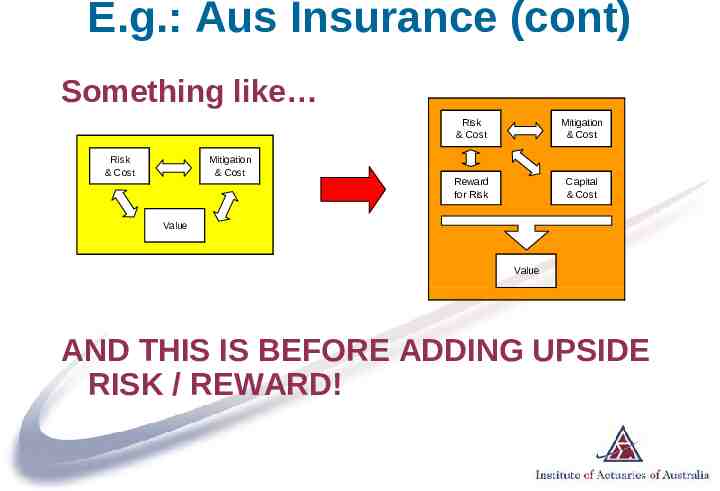

E.g.: Aus Insurance (cont) For financial services – Need to recognise subtlety: Risks that generate no economic reward – Typical widget maker risks – Risk is an involuntary component of activities Risks that generate economic reward – These are “the business”, are “the product” – Taking the risk is the activity and is voluntary – Size / management can be different – Role of, interaction with, capital

E.g.: Aus Insurance (cont) Something like Risk & Cost Mitigation & Cost Risk & Cost Mitigation & Cost Reward for Risk Capital & Cost Value Value AND THIS IS BEFORE ADDING UPSIDE RISK / REWARD!

E.g.: Aus Sub-Prime Recent sub-prime fall out has led to some large losses: – Some observations: Good RM not apparent in some cases In others, deep understanding of underlying risks (ALM or strategic risks) not apparent – Follows similar “debenture” problems in Aus in 2006/7 IAAust thinks actuaries could have helped better manage some of these risks: – Better understand the complex underlying structures – Has promoted this view publicly

So Where do we stand? (cont) OK so: – – – – – ERM is in our space Some CRO successes (individuals) Some good contribution in financial RM Regulators already have some expectations Some scope to contribute in non-traditional BUT

Where do we stand? (cont) ERM goes beyond our traditional work and skills. As a profession we have things to learn, e.g.: – Non-financial & non-insurance risk skills – RM process & framework construction skills Actuaries will be better equipped to compete for CRO roles if: – CRO skills are within our normal skill set – Actuaries are widely recognised as RM experts This has a designation dimension!

Where do we stand? (cont) Actuaries must keep up and comply with regulatory requirements (driven by IAIS / Solvency II etc) if we wish to keep existing trusted positions Risk: Lots of competition .other “professions” in ERM may outgrow the Actuarial profession

Do we need to do anything? We have concluded (in Australia) that as a profession we need: – – – – – Education programs updated for ERM CPD on ERM for FIAA’s Promote our skills to market Support ERM R&D – recent event ramifications To consider designation recognition and development Other associations seem to have come to similar conclusions

What are “Associations” doing? Globally, profession is responding . Education “Associations” changing their courses – US, UK, Aus, etc, etc “IAA” Initiative – Oct 2007 Lots of actuarial RM focused conferences!

US, UK, etc US – – – – SoA: Professional positioning SoA: CERA qualification established All US associations enhancing ERM focus Also: Communication, business acumen UK – “all actuaries are risk managers now” – Actuaries “primarily as quantitative risk professionals” – Process to modify education in this direction

Australia Launched a 5 day ERM CPD course 2007 – Just finished second round in March 2008 – Looking to work with regional associations to provide outside Australia Next (work commenced): – Basic ERM into Part II in 2008 (for 2009) – ERM into existing Part III in 2009 (for 2010) – Part III ERM specialist - target 2010 Working (with others) on global qualification – Pencilled in target 2010 (see next slide) Institute risk management strategy – Include actuary “disaster recovery plan”

IAA & Global Oct 07: 8 Associations signed statement of intention – – – – UK: FoA, IoA Nth Am: CAS, CIA, CNA, SOA ASSA, IAAust 2 more have now joined since Oct 07 (Philippines and Spain) Intention: Develop a Global ERM Qualification – Syllabus, Standard, Mutual Recognition – Common description (letters) – “XRX” Work now commencing – multiple streams – Treaty progressing discussing accreditation approaches – Syllabus progressing have a set of knowledge/data work though now More interested to join in – Europe, Asia

Summing Up Risk management is a core aspect of being an actuary and a key part of our role in insurance – – – However: – – – Typically our skills are not “business” comprehensive RM is not clearly articulated in our syllabus The “science” of RM is evolving. We must keep up. If we can address these issues, there are great opportunities for actuaries in RM (ERM) – – Regulators & business driving focus on ERM Recent events serve to highlight needs Recent success of actuaries in RM in Australia as an e.g. Regulators and business are already looking our way! It is complex, and getting more so – good for us! Huge activity & focus by “Associations”

Actuaries & Risk Management Developments in Australia Greg Martin, President Institute of Actuaries of Australia