ACQUISITION/REHABILITATION: THE 50% ANTI-CHURNING RULE James F. Duffy,

21 Slides178.50 KB

ACQUISITION/REHABILITATION: THE 50% ANTI-CHURNING RULE James F. Duffy, Esquire Nixon Peabody LLP 100 Summer Street Boston, MA 02110-2131 (617) 345-1129 (866) 947-1697 (fax) [email protected] LEARNING THE BASICS: HOUSING TAX CREDITS “101” IPED, INC. Boston, Massachusetts October 16-17, 2008

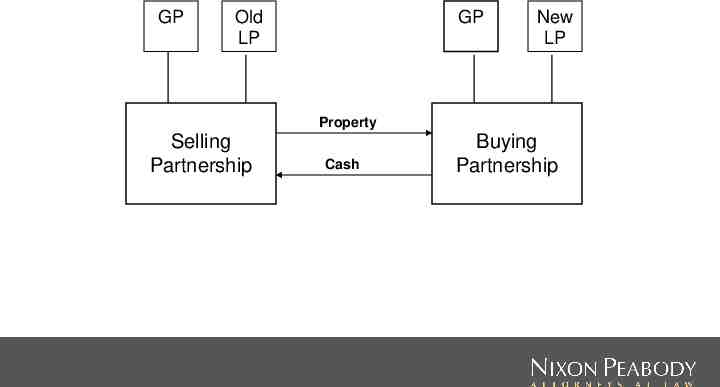

GP Old LP GP New LP Property Selling Partnership Cash Buying Partnership

THE RULE Section 42(d)(2)(B)(iii) of the Code provides that in order to receive acquisition credits, the building cannot previously been placed in service by the taxpayer or by a related person Note: This is a “cliff test” where if you fail the test, you lose ALL of your acquisition tax credits.

RELATED PERSON TEST Under pre-existing law, the standard for determining if parties were related was 10% or greater common ownership (in fact, the brochure for this conference refers to the “10% anti-churning test”) However, the Housing and Economic Recovery Act of 2008 changed the relevant percentage from 10% to 50% for properties placed in service after July 30, 2008, substantially lessening the problem, but not eliminating it

How do you determine your percentage ownership in a LIHTC Partnership? LIHTC Partnerships are structured with partners receiving different percentage interests in different items: - Tax Credits - Cash Flow - Sale/Refinancing Proceeds - Maybe State Tax Credits

The LIHTC industry has prudently decided that if you have a 50% or greater interest in any item in the seller, you have to have less than a 50% interest in all items in the buyer

Since a General Partner tends to have more than a 50% interest in Cash Flow or Sale/Refinancing Proceeds in the old Partnership (the seller), the General Partner will be required to have no more than a 49.9% interest in Cash Flow and in Sale/Refinancing Proceeds in the new Partnership (the buyer)

This is not necessarily your typical LIHTC business deal if the syndicator/investor has 50.1% of Cash Flow and Sale/Refinancing Proceeds But it is far less onerous than under the old law, where we were talking about the syndicator/investor having a 90.1% interest in Cash Flow and Sale/Refinancing Proceeds

So, what typically happens? - Partnership Management Fee - Incentive Management Fee

The question is whether or not these fees exceed a reasonable fee which would be paid to a third-party service provider performing the same services Anything paid (or payable if there were Cash Flow) in excess of a reasonable fee could be reclassified as additional Cash Flow to the General Partner

And, since we’re already at 49.9% of the Cash Flow going to the General Partner, there’s no room for error The risk is the loss of all of the Acquisition Credits if the General Partner is deemed to really have a 50.01% interest in Cash Flow in the new partnership

Look at these Cash Flow fees to see if they’re “reasonable” How much would a third party company in the industry charge for the services? Would a third-party service provider agree to be paid only if there were sufficient Cash Flow at that point in the Cash Flow waterfall?

A Cash Flow fee looks more like a real fee, rather than like a Cash Flow distribution, if it accrues, even if there is no Cash Flow available to pay it currently

Creative Techniques: Higher Property Management Fees A property management fee equal to, say, 14% of gross rental income, with the argument that there are very low rents (e.g., 30% of Area Median Income) The property manager is affiliated with the General Partner

Purchase Money Notes Payable by the buying partnership to the selling partnership out of the buyer’s Cash Flow as payment of the purchase price for the property A good appraisal is important, as the purchase price for the property must be properly supported so that a portion of the purchase price is not re-characterized as a distribution of the buyer’s cash flow

New Co-GP to Receive Cash Flow General Partner has 49.9% of Cash Flow in the buyer and a new Co-General Partner (which was not a General Partner in the seller) has 30-40% of Cash Flow in the buyer Need to closely examine the full relationship between the two General Partners

Ground Lease The seller ground leases the property to what would otherwise be the buying partnership, charging the “buyer” (here, actually the ground lessee) an annual ground lease The structure creates an appraisal issue as to the proper value of the leasehold estate and the market value of the annual leasehold rents (often difficult to evaluate)

Development Fee for the Rehabilitation If paid to an affiliate of the General Partner (the usual arrangement), the fee must be reasonable This can be especially problematic if there is a minimal rehabilitation (even under the recently increased minimum requirements) There is a similar issue (the reasonableness of the fee) with a construction fee for the rehabilitation work payable to a general contractor affiliated with the General Partner

Some investors are more risk adverse than others, so find out early on what is acceptable to your investor

The Investor as a “Related Party” Also, don’t forget this 50% test from the investor side It’s usually OK to use the same syndicator for the buyer as was used for the seller, as long as the ultimate investor(s) don’t cause a 50% related party problem 11173784.2