Accounts Receivable U S I N G E XAM P L E S, W E W I L L WA L K T H R

18 Slides149.62 KB

Accounts Receivable U S I N G E XAM P L E S, W E W I L L WA L K T H R O U G H H O W A C C O U N T S R E C E I VA B L E A R E R ECOR DED, WR ITT EN OFF O R H O W A N A L L O WA N C E F O R B A D D E B T S I S C A L C U L AT E D

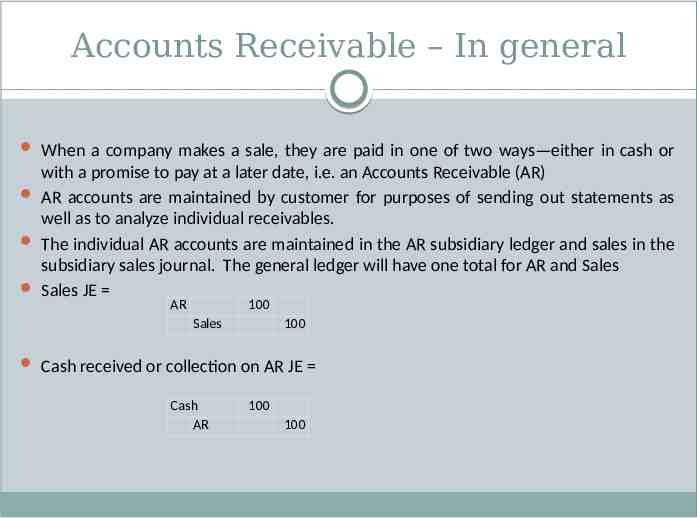

Accounts Receivable – In general When a company makes a sale, they are paid in one of two ways—either in cash or with a promise to pay at a later date, i.e. an Accounts Receivable (AR) AR accounts are maintained by customer for purposes of sending out statements as well as to analyze individual receivables. The individual AR accounts are maintained in the AR subsidiary ledger and sales in the subsidiary sales journal. The general ledger will have one total for AR and Sales Sales JE AR 100 Sales 100 Cash received or collection on AR JE Cash AR 100 100

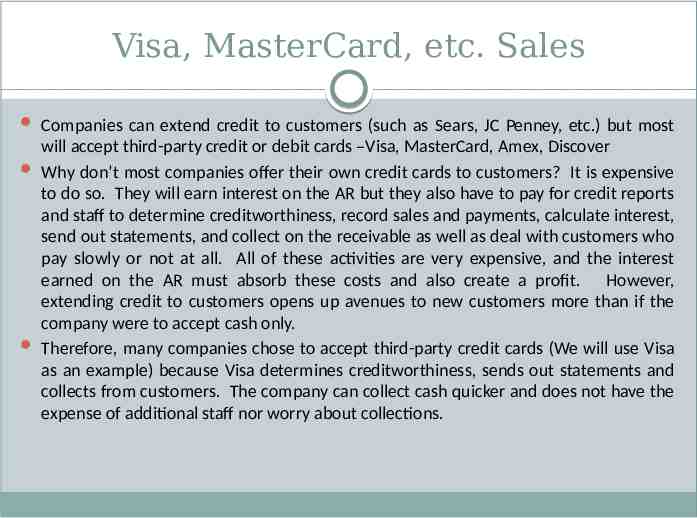

Visa, MasterCard, etc. Sales Companies can extend credit to customers (such as Sears, JC Penney, etc.) but most will accept third-party credit or debit cards –Visa, MasterCard, Amex, Discover Why don’t most companies offer their own credit cards to customers? It is expensive to do so. They will earn interest on the AR but they also have to pay for credit reports and staff to determine creditworthiness, record sales and payments, calculate interest, send out statements, and collect on the receivable as well as deal with customers who pay slowly or not at all. All of these activities are very expensive, and the interest earned on the AR must absorb these costs and also create a profit. However, extending credit to customers opens up avenues to new customers more than if the company were to accept cash only. Therefore, many companies chose to accept third-party credit cards (We will use Visa as an example) because Visa determines creditworthiness, sends out statements and collects from customers. The company can collect cash quicker and does not have the expense of additional staff nor worry about collections.

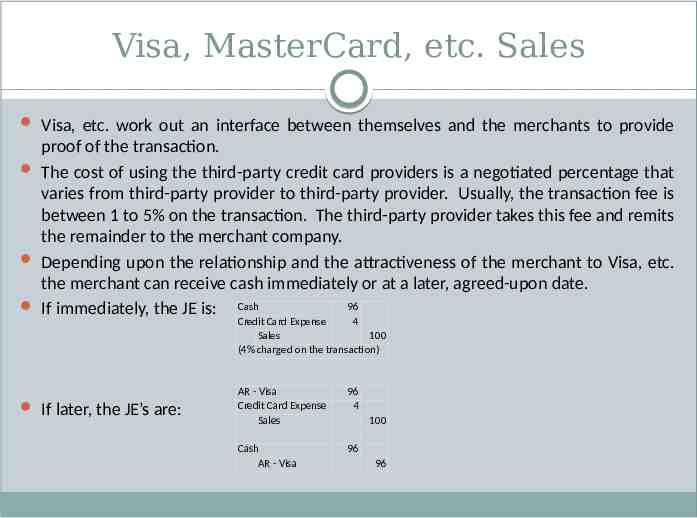

Visa, MasterCard, etc. Sales Visa, etc. work out an interface between themselves and the merchants to provide proof of the transaction. The cost of using the third-party credit card providers is a negotiated percentage that varies from third-party provider to third-party provider. Usually, the transaction fee is between 1 to 5% on the transaction. The third-party provider takes this fee and remits the remainder to the merchant company. Depending upon the relationship and the attractiveness of the merchant to Visa, etc. the merchant can receive cash immediately or at a later, agreed-upon date. 96 If immediately, the JE is: Cash Credit Card Expense 4 Sales 100 (4% charged on the transaction) If later, the JE’s are: AR - Visa Credit Card Expense Sales 96 4 Cash AR - Visa 96 100 96

Merchant Offers In-House Credit Card When merchants extend credit to customers, it must record any bad debts as an expense of doing business. There are two methods The Direct Write Off Method The Allowance Method Calculated three ways Percentage of Sales Percentage of Receivables Aging of Receivables

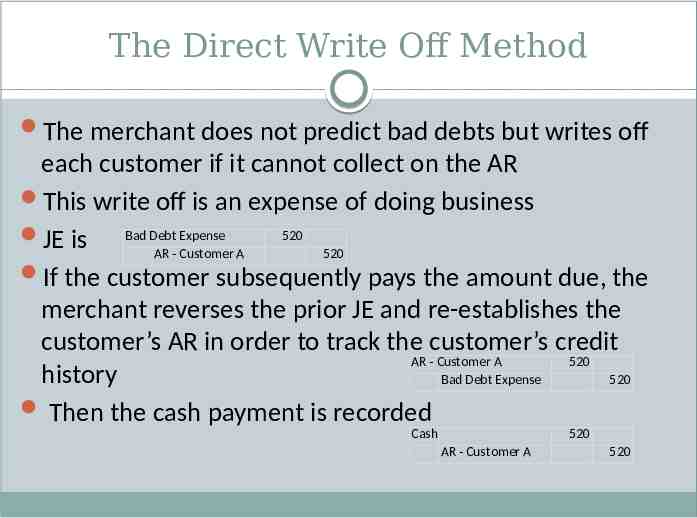

The Direct Write Off Method The merchant does not predict bad debts but writes off each customer if it cannot collect on the AR This write off is an expense of doing business Bad Debt Expense 520 JE is AR - Customer A 520 If the customer subsequently pays the amount due, the merchant reverses the prior JE and re-establishes the customer’s AR in order to track the customer’s credit AR - Customer A 520 history Bad Debt Expense 520 Then the cash payment is recorded Cash 520 AR - Customer A 520

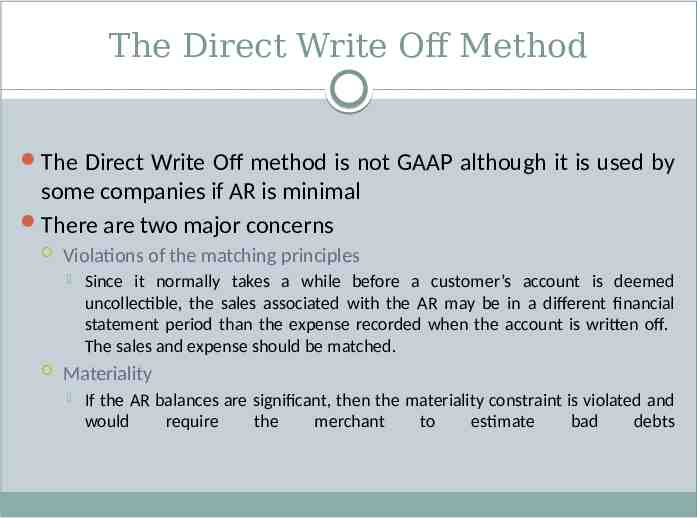

The Direct Write Off Method The Direct Write Off method is not GAAP although it is used by some companies if AR is minimal There are two major concerns Violations of the matching principles Since it normally takes a while before a customer’s account is deemed uncollectible, the sales associated with the AR may be in a different financial statement period than the expense recorded when the account is written off. The sales and expense should be matched. Materiality If the AR balances are significant, then the materiality constraint is violated and would require the merchant to estimate bad debts

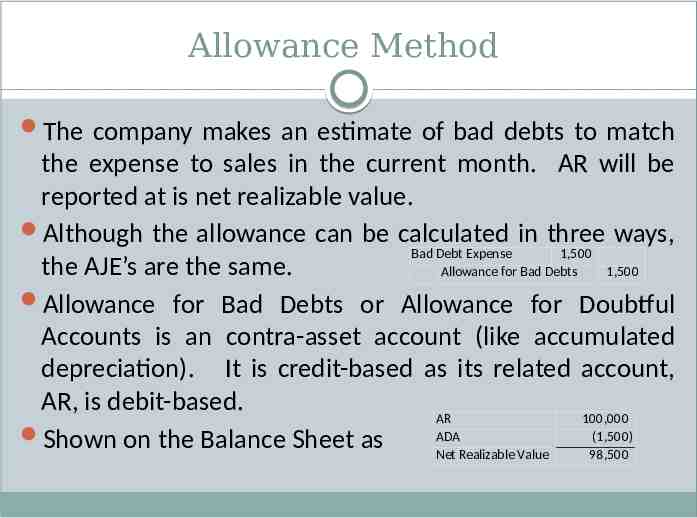

Allowance Method The company makes an estimate of bad debts to match the expense to sales in the current month. AR will be reported at is net realizable value. Although the allowance can be calculated in three ways, Bad Debt Expense 1,500 the AJE’s are the same. Allowance for Bad Debts 1,500 Allowance for Bad Debts or Allowance for Doubtful Accounts is an contra-asset account (like accumulated depreciation). It is credit-based as its related account, AR, is debit-based. AR 100,000 ADA (1,500) Shown on the Balance Sheet as Net Realizable Value 98,500

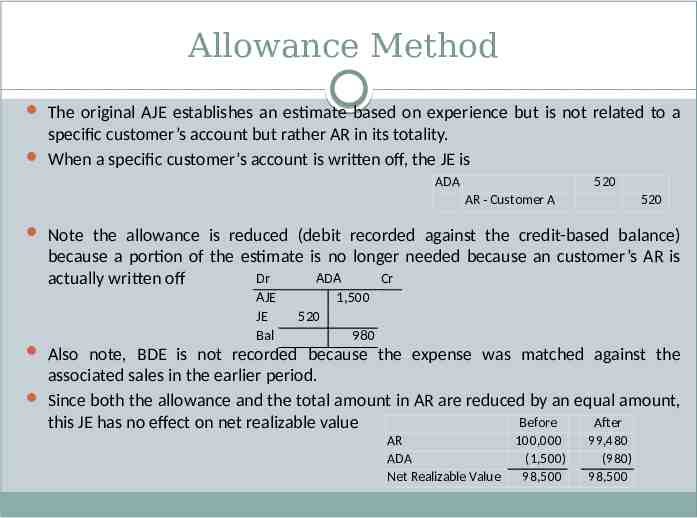

Allowance Method The original AJE establishes an estimate based on experience but is not related to a specific customer’s account but rather AR in its totality. When a specific customer’s account is written off, the JE is ADA 520 AR - Customer A 520 Note the allowance is reduced (debit recorded against the credit-based balance) because a portion of the estimate is no longer needed because an customer’s AR is Dr ADA Cr actually written off AJE JE Bal 1,500 520 980 Also note, BDE is not recorded because the expense was matched against the associated sales in the earlier period. Since both the allowance and the total amount in AR are reduced by an equal amount, Before After this JE has no effect on net realizable value AR ADA Net Realizable Value 100,000 (1,500) 98,500 99,480 (980) 98,500

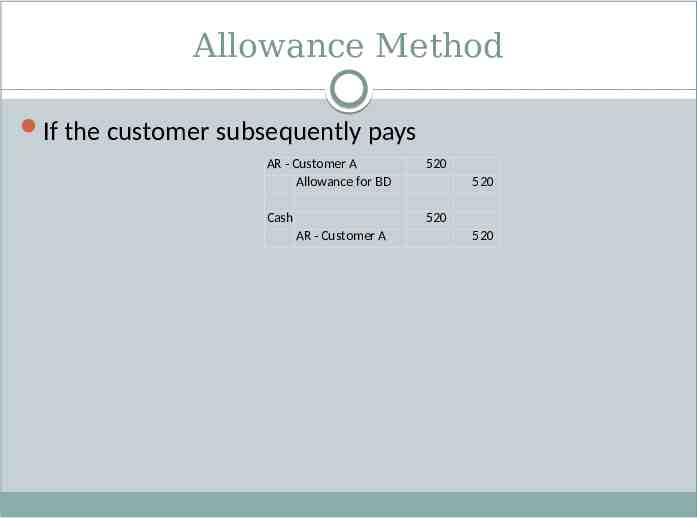

Allowance Method If the customer subsequently pays AR - Customer A Allowance for BD 520 Cash 520 AR - Customer A 520 520

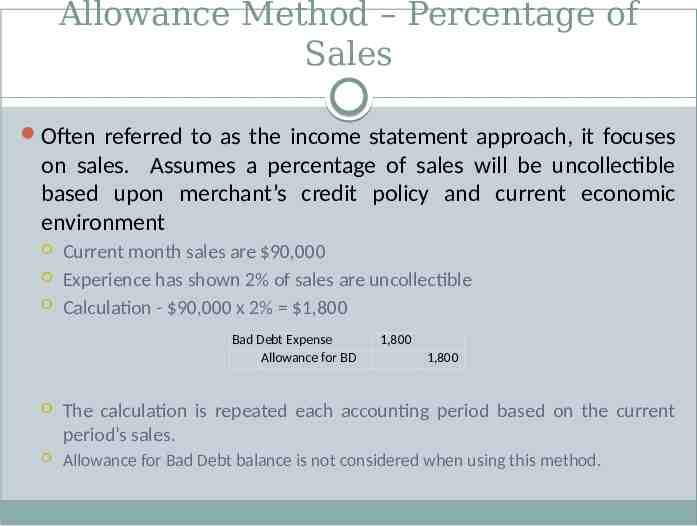

Allowance Method – Percentage of Sales Often referred to as the income statement approach, it focuses on sales. Assumes a percentage of sales will be uncollectible based upon merchant’s credit policy and current economic environment Current month sales are 90,000 Experience has shown 2% of sales are uncollectible Calculation - 90,000 x 2% 1,800 Bad Debt Expense Allowance for BD 1,800 1,800 The calculation is repeated each accounting period based on the current period’s sales. Allowance for Bad Debt balance is not considered when using this method.

Allowance Method – Percentage of Receivables Often referred to as the balance sheet approach, the balance in AR is considered and the AJE calibrated to match the current balance in Allowance for Bad Debts Assumes a portion of AR will be uncollectible based on company experience and current business environment.

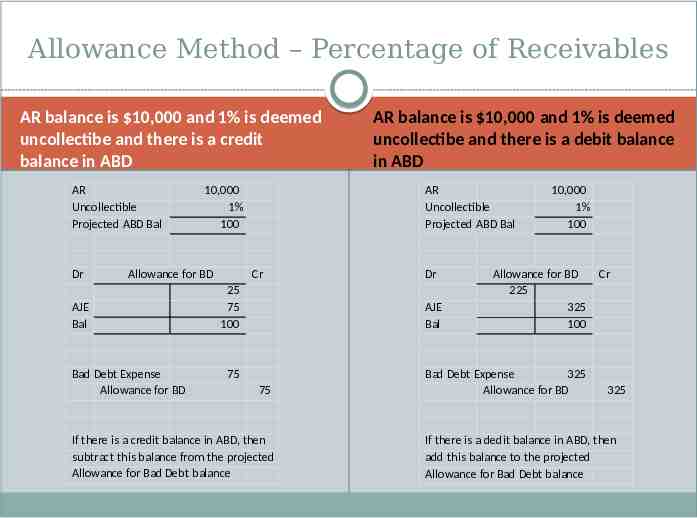

Allowance Method – Percentage of Receivables AR balance is 10,000 and 1% is deemed uncollectibe and there is a credit balance in ABD AR Uncollectible Projected ABD Bal Dr 10,000 1% 100 Allowance for BD AJE Bal Bad Debt Expense Allowance for BD AR balance is 10,000 and 1% is deemed uncollectibe and there is a debit balance in ABD AR Uncollectible Projected ABD Bal Cr 25 75 100 Dr AJE Bal 75 75 If there is a credit balance in ABD, then subtract this balance from the projected Allowance for Bad Debt balance 10,000 1% 100 Allowance for BD 225 325 100 Bad Debt Expense 325 Allowance for BD Cr 325 If there is a dedit balance in ABD, then add this balance to the projected Allowance for Bad Debt balance

Allowance Method – Aging of Receivables The journal entries are not different from the Percentage of Receivables method but the calculation is more complex. The focus is on layers of AR based upon how long the AR has been due. Various percentages are applied with the larger percentages applied to those balances that have been outstanding longer. Percentages are based upon the company’s experience and current economic climate. The percentages are applied against each layer, added together and become the basis for the AJE. All of the dynamics depicted earlier for the percentage of receivable method apply for this method.

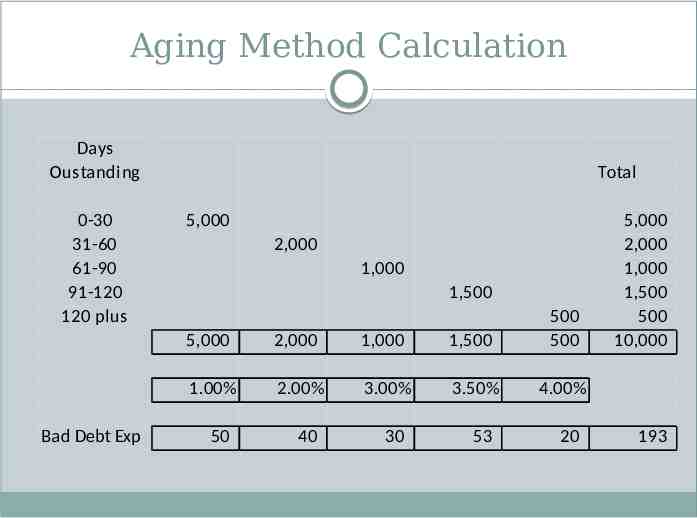

Aging Method Calculation Days Oustanding 0-30 31-60 61-90 91-120 120 plus Bad Debt Exp Total 5,000 2,000 1,000 1,500 5,000 2,000 1,000 1,500 500 500 1.00% 2.00% 3.00% 3.50% 4.00% 50 40 30 53 20 5,000 2,000 1,000 1,500 500 10,000 193

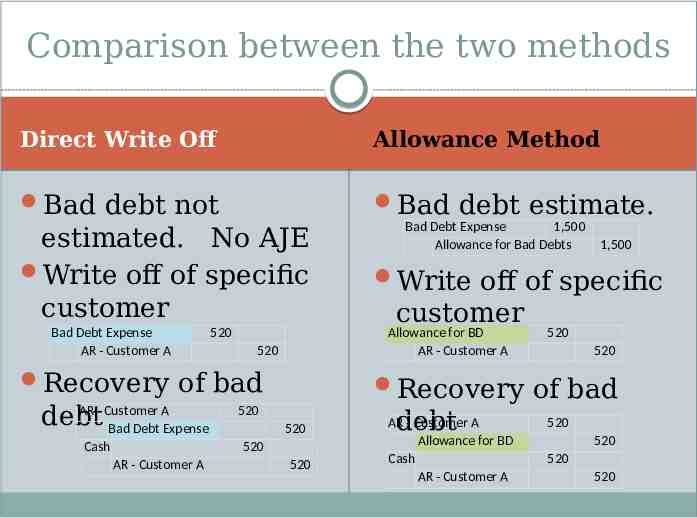

Comparison between the two methods Direct Write Off Allowance Method Bad debt not Bad debt estimate. estimated. No AJE Write off of specific customer Bad Debt Expense AR - Customer A 520 520 Cash customer 520 520 Recovery of bad 520 520 520 AR - Customer A 1,500 Write off of specific Allowance for BD AR - Customer A Recovery of bad AR - Customer A debt Bad Debt Expense Bad Debt Expense 1,500 Allowance for Bad Debts 520 debt AR - Customer A Allowance for BD Cash AR - Customer A 520 520 520 520

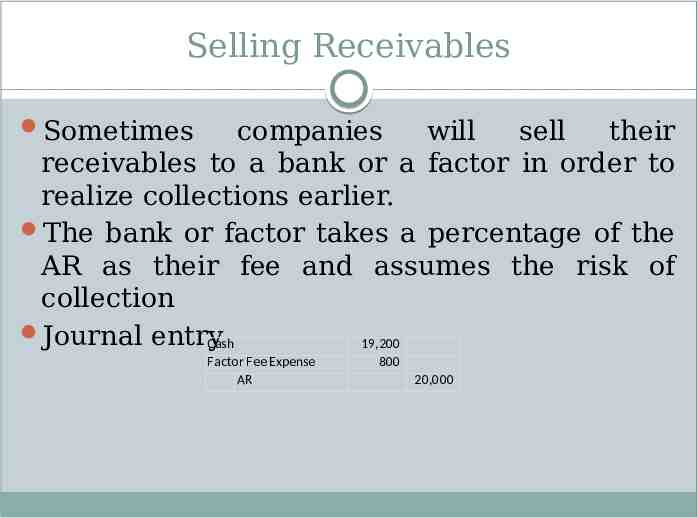

Selling Receivables Sometimes companies will sell their receivables to a bank or a factor in order to realize collections earlier. The bank or factor takes a percentage of the AR as their fee and assumes the risk of collection Journal entry Cash 19,200 Factor Fee Expense AR 800 20,000

Pledging Receivables Companies can also pledge their receivables as security for a loan. Company still has collection responsibilities No journal entry is required since ownership does not pass to the bank. However, these facts must be disclosed in the notes to the financial statements.