Governmental Accounting New Clerk – September 2022 Originally

42 Slides587.54 KB

Governmental Accounting New Clerk – September 2022 Originally written by Denise Williams Presented by Steve Hamel

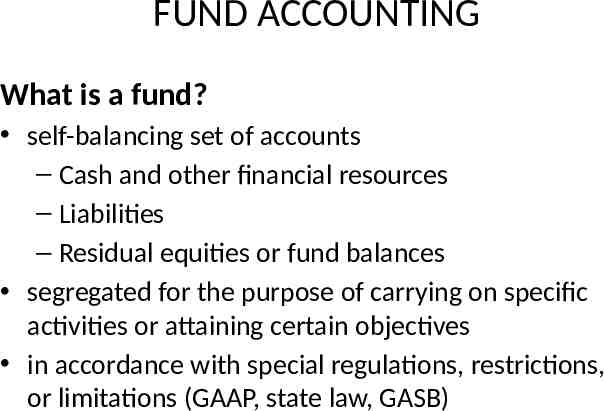

FUND ACCOUNTING What is a fund? self-balancing set of accounts – Cash and other financial resources – Liabilities – Residual equities or fund balances segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations, restrictions, or limitations (GAAP, state law, GASB)

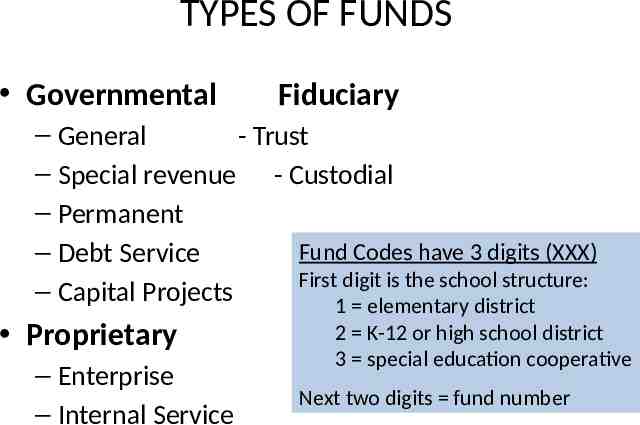

TYPES OF FUNDS Governmental Fiduciary – General - Trust – Special revenue - Custodial – Permanent Fund Codes have 3 digits (XXX) – Debt Service First digit is the school structure: – Capital Projects 1 elementary district Proprietary – Enterprise – Internal Service 2 K-12 or high school district 3 special education cooperative Next two digits fund number

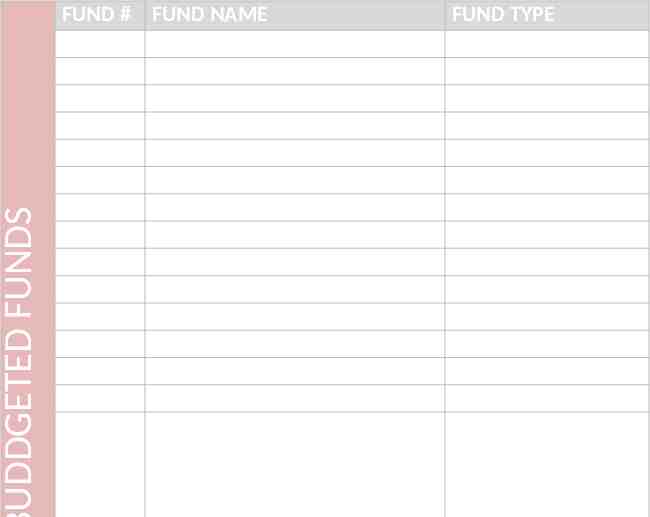

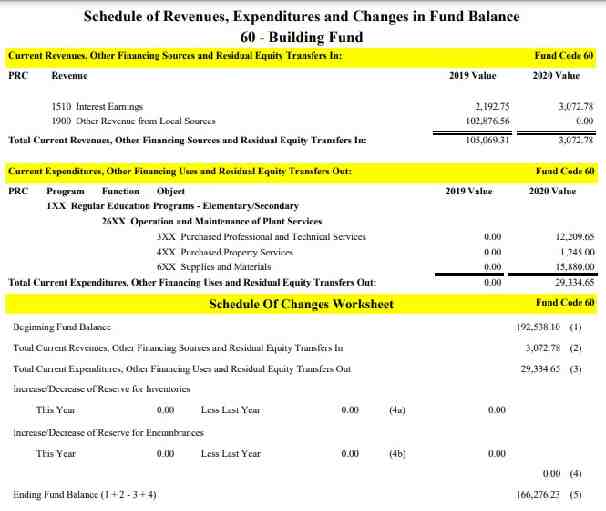

UDDGETED FUNDS FUND # FUND NAME 01 10 11 13 14 17 19 28 29 50 61 General Transportation Bus Depreciation Tuition Retirement Adult Education Non-Operating Technology Flexibility Debt Service Building Reserve FUND TYPE General Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Debt Service Capital Projects

UDDGETED FUNDS FUND # FUND NAME FUND TYPE 12 15 18 20 21 24 25 26 27 45 60 70-72 73-79 82 81-85 Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Special Revenue Permanent Capital Projects Proprietary Proprietary Fiduciary or General Fiduciary School Foods Miscellaneous Programs Traffic Education Lease Rental Agreement Compensated Absences Metal Mines Tax Reserve State Mining Impact Impact Aid Litigation Reserve Permanent Endowment Building Enterprise Internal Service Interlocal Cooperative Other Trust Funds

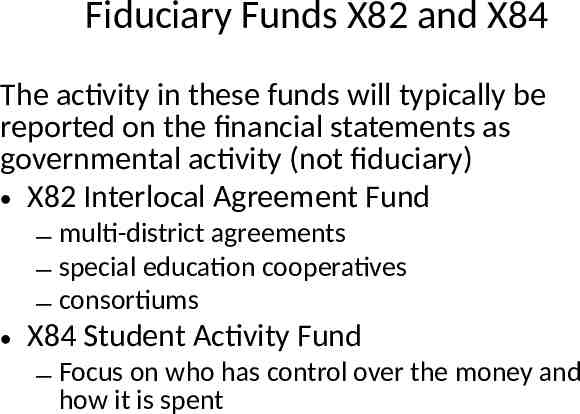

Fiduciary Funds X82 and X84 The activity in these funds will typically be reported on the financial statements as governmental activity (not fiduciary) X82 Interlocal Agreement Fund – multi-district agreements – special education cooperatives – consortiums X84 Student Activity Fund – Focus on who has control over the money and how it is spent

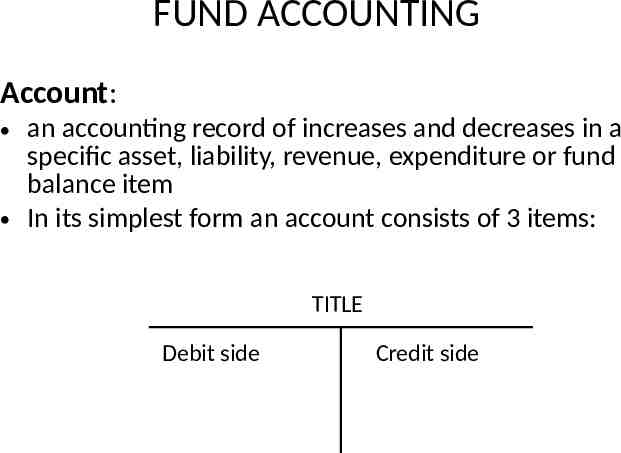

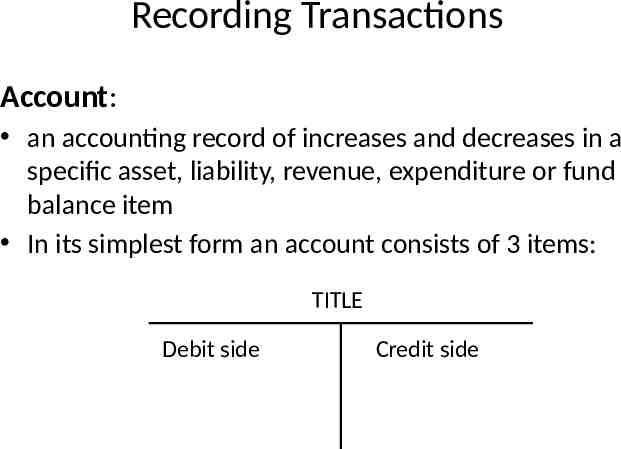

FUND ACCOUNTING Account: an accounting record of increases and decreases in a specific asset, liability, revenue, expenditure or fund balance item In its simplest form an account consists of 3 items: TITLE Debit side Credit side

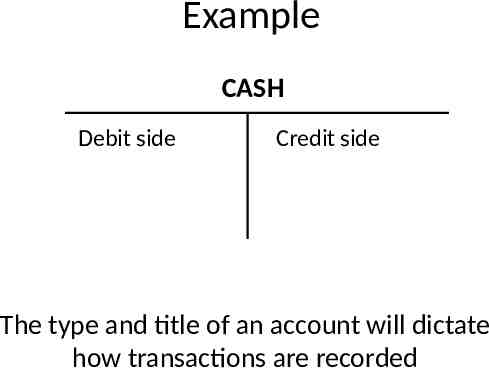

Example CASH Debit side Credit side The type and title of an account will dictate how transactions are recorded

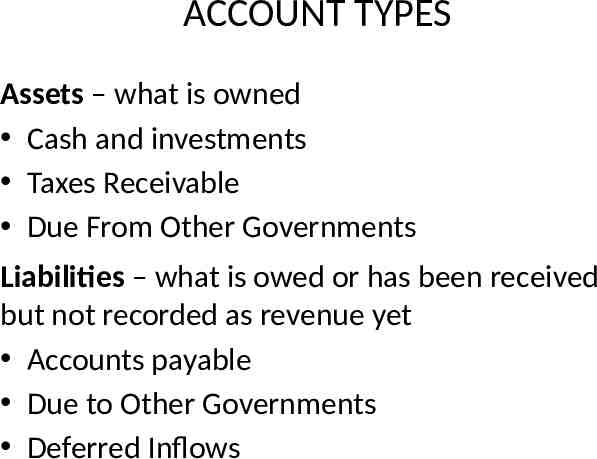

ACCOUNT TYPES Assets – what is owned Cash and investments Taxes Receivable Due From Other Governments Liabilities – what is owed or has been received but not recorded as revenue yet Accounts payable Due to Other Governments Deferred Inflows

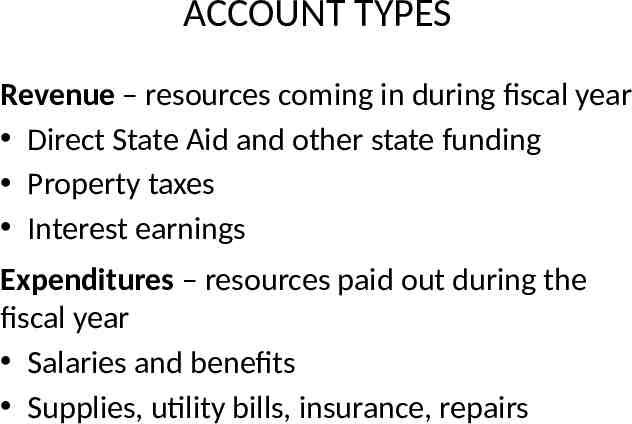

ACCOUNT TYPES Revenue – resources coming in during fiscal year Direct State Aid and other state funding Property taxes Interest earnings Expenditures – resources paid out during the fiscal year Salaries and benefits Supplies, utility bills, insurance, repairs

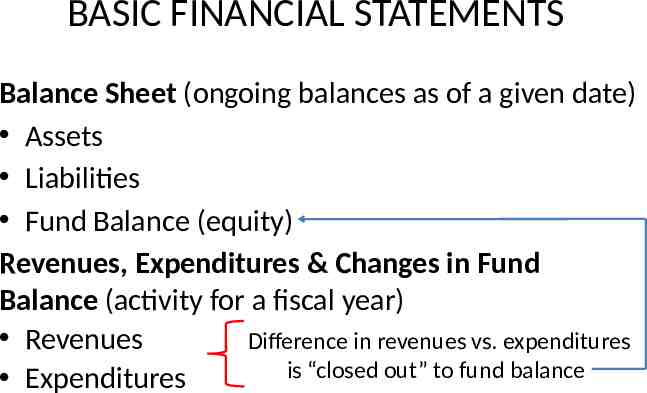

BASIC FINANCIAL STATEMENTS Balance Sheet (ongoing balances as of a given date) Assets Liabilities Fund Balance (equity) Revenues, Expenditures & Changes in Fund Balance (activity for a fiscal year) Revenues Difference in revenues vs. expenditures is “closed out” to fund balance Expenditures

Recording Transactions Account: an accounting record of increases and decreases in a specific asset, liability, revenue, expenditure or fund balance item In its simplest form an account consists of 3 items: TITLE Debit side Credit side

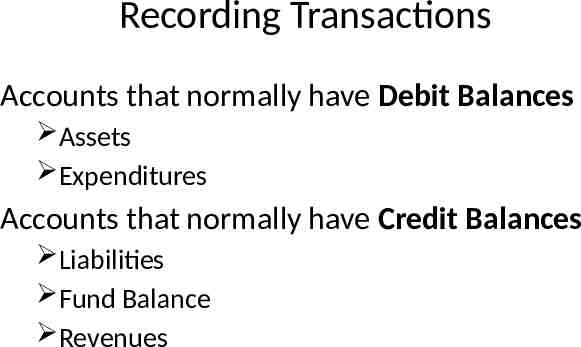

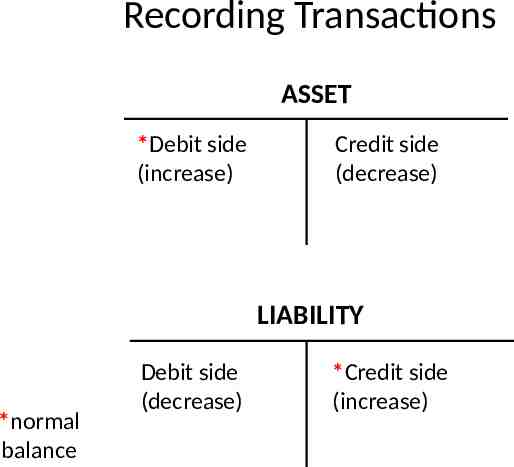

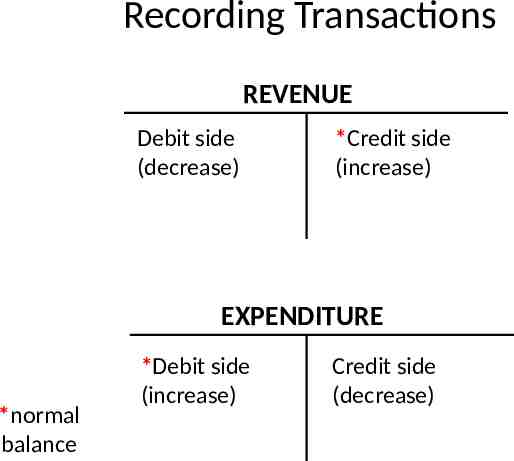

Recording Transactions Accounts that normally have Debit Balances Assets Expenditures Accounts that normally have Credit Balances Liabilities Fund Balance Revenues

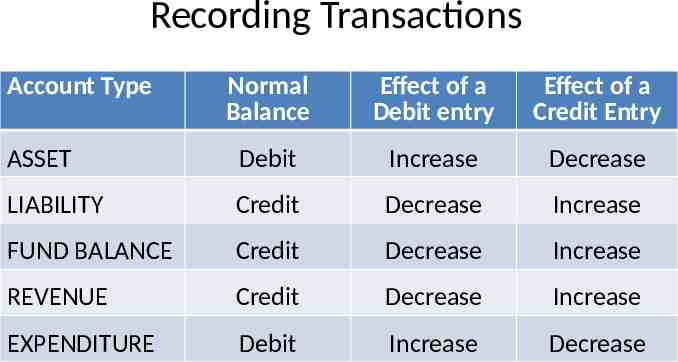

Recording Transactions Account Type Normal Balance Effect of a Debit entry Effect of a Credit Entry ASSET Debit Increase Decrease LIABILITY Credit Decrease Increase FUND BALANCE Credit Decrease Increase REVENUE Credit Decrease Increase EXPENDITURE Debit Increase Decrease

Recording Transactions ASSET *Debit side (increase) Credit side (decrease) LIABILITY *normal balance Debit side (decrease) *Credit side (increase)

Recording Transactions REVENUE Debit side (decrease) *Credit side (increase) EXPENDITURE *normal balance *Debit side (increase) Credit side (decrease)

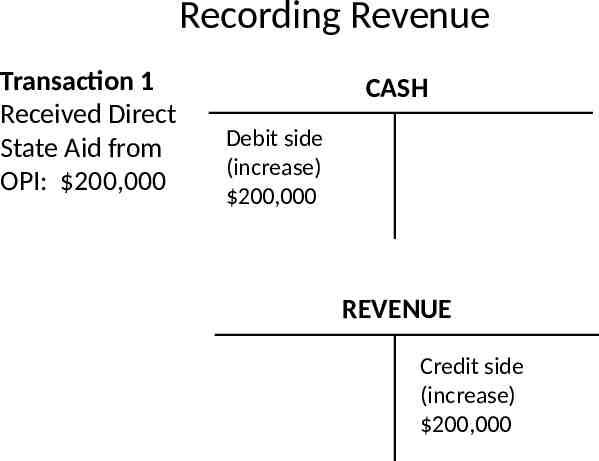

Recording Revenue Transaction 1 Received Direct State Aid from OPI: 200,000 CASH Debit side (increase) 200,000 REVENUE Credit side (increase) 200,000

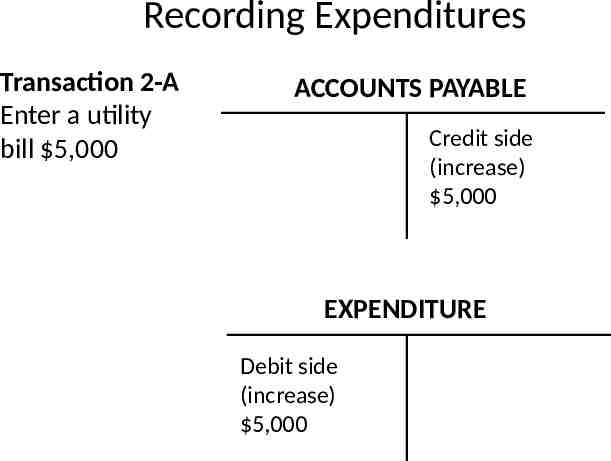

Recording Expenditures Transaction 2-A Enter a utility bill 5,000 ACCOUNTS PAYABLE Credit side (increase) 5,000 EXPENDITURE Debit side (increase) 5,000

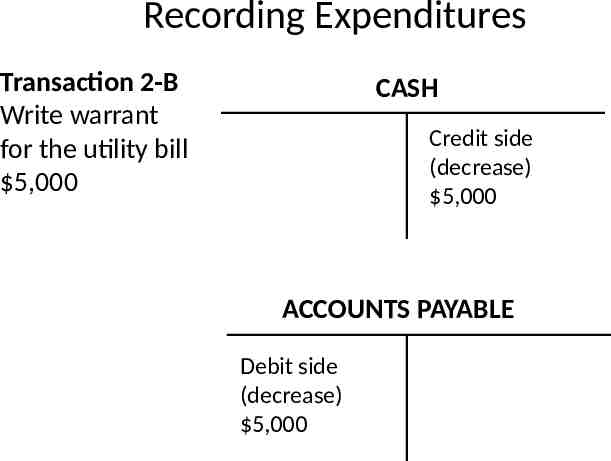

Recording Expenditures Transaction 2-B Write warrant for the utility bill 5,000 CASH Credit side (decrease) 5,000 ACCOUNTS PAYABLE Debit side (decrease) 5,000

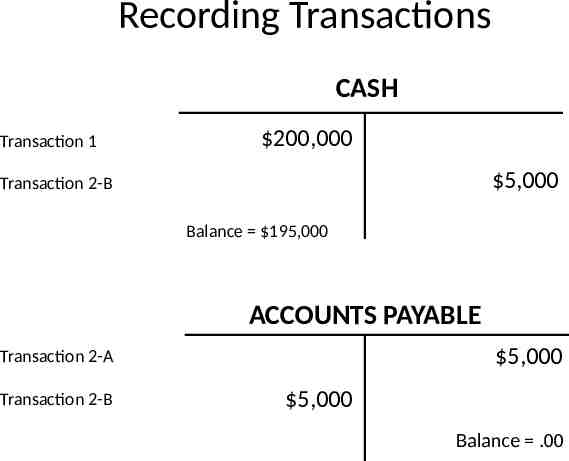

Recording Transactions CASH Transaction 1 200,000 5,000 Transaction 2-B Balance 195,000 ACCOUNTS PAYABLE 5,000 Transaction 2-A Transaction 2-B 5,000 Balance .00

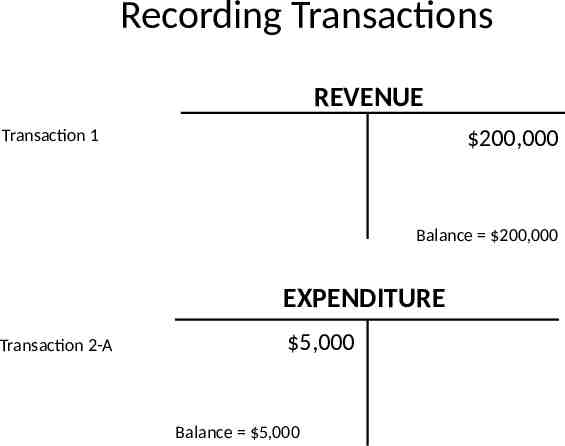

Recording Transactions REVENUE Transaction 1 200,000 Balance 200,000 EXPENDITURE Transaction 2-A 5,000 Balance 5,000

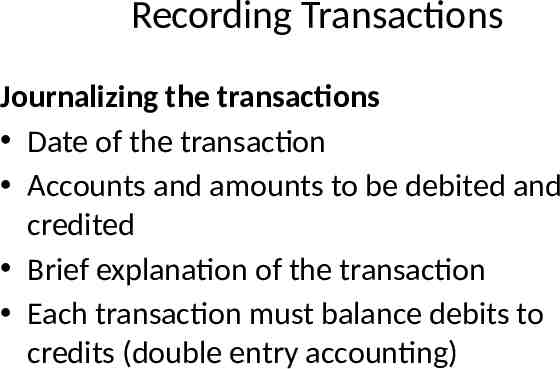

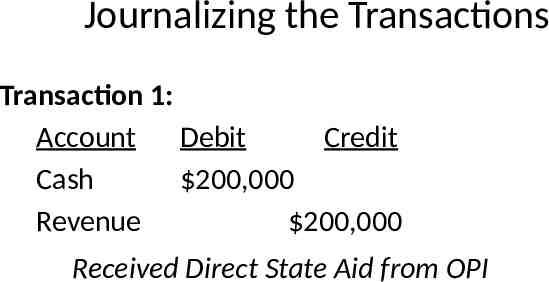

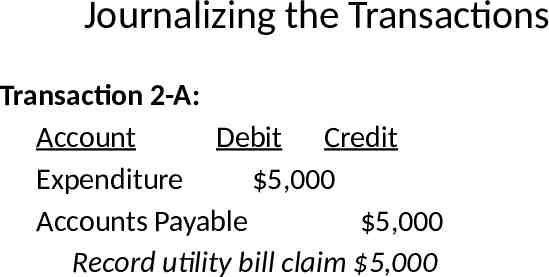

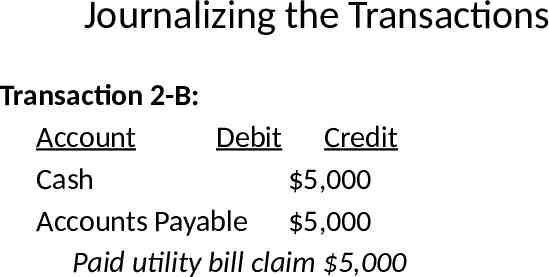

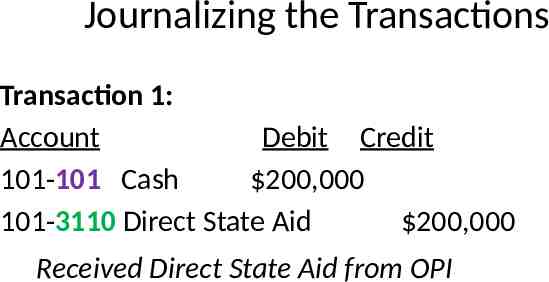

Recording Transactions Journalizing the transactions Date of the transaction Accounts and amounts to be debited and credited Brief explanation of the transaction Each transaction must balance debits to credits (double entry accounting)

Journalizing the Transactions Transaction 1: Account Debit Credit Cash 200,000 Revenue 200,000 Received Direct State Aid from OPI

Journalizing the Transactions Transaction 2-A: Account Debit Credit Expenditure 5,000 Accounts Payable 5,000 Record utility bill claim 5,000

Journalizing the Transactions Transaction 2-B: Account Debit Credit Cash 5,000 Accounts Payable 5,000 Paid utility bill claim 5,000

Journalizing the Transactions Transaction 1: Account Debit Credit 101-101 Cash 200,000 101-3110 Direct State Aid 200,000 Received Direct State Aid from OPI

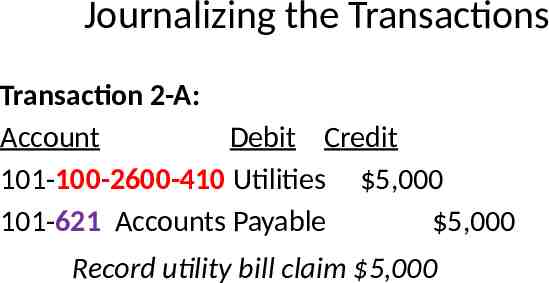

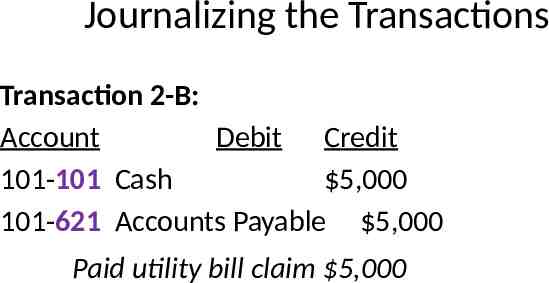

Journalizing the Transactions Transaction 2-A: Account Debit Credit 101-100-2600-410 Utilities 5,000 101-621 Accounts Payable 5,000 Record utility bill claim 5,000

Journalizing the Transactions Transaction 2-B: Account Debit Credit 101-101 Cash 5,000 101-621 Accounts Payable 5,000 Paid utility bill claim 5,000

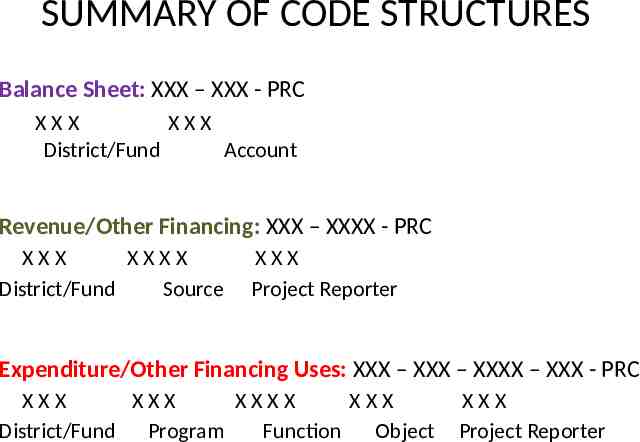

SUMMARY OF CODE STRUCTURES Balance Sheet: XXX – XXX - PRC XXX XXX District/Fund Account Revenue/Other Financing: XXX – XXXX - PRC XXX XXXX District/Fund Source XXX Project Reporter Expenditure/Other Financing Uses: XXX – XXX – XXXX – XXX - PRC XXX XXX XXXX XXX District/Fund Program Function Object XXX Project Reporter

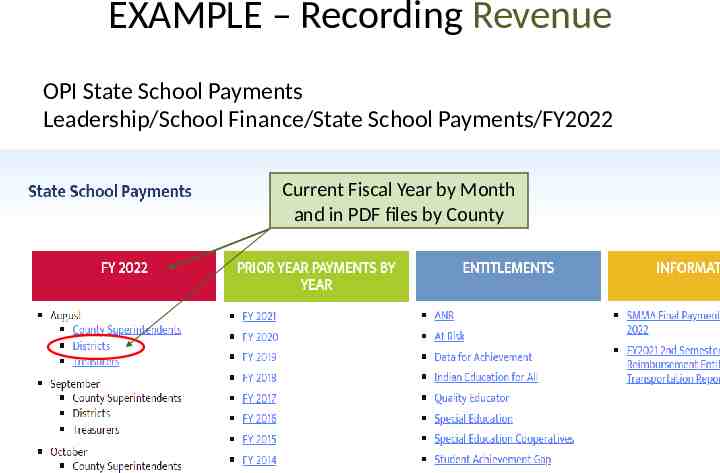

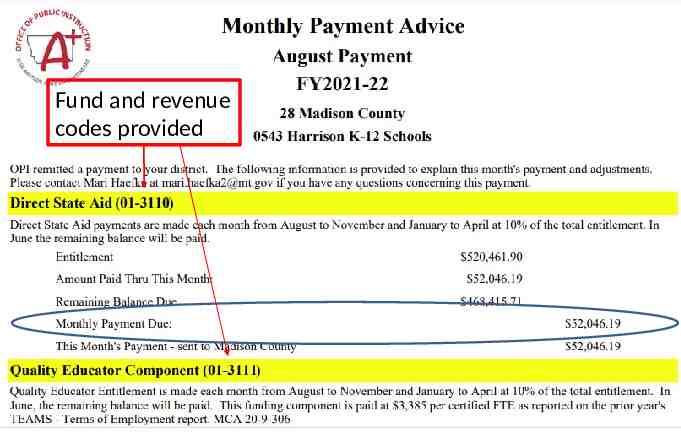

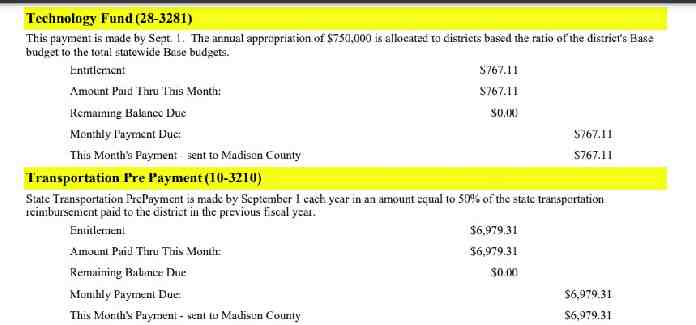

EXAMPLE – Recording Revenue OPI State School Payments Leadership/School Finance/State School Payments/FY2022 Current Fiscal Year by Month and in PDF files by County

Fund and revenue codes provided

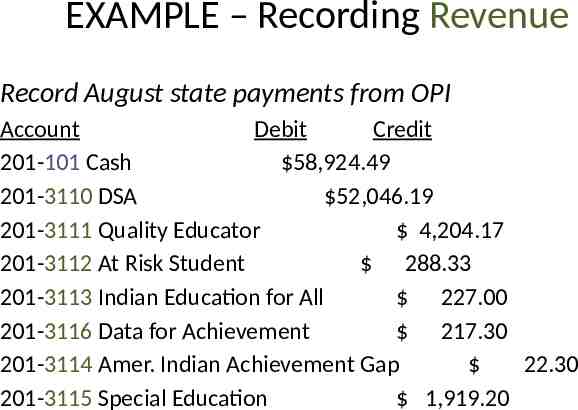

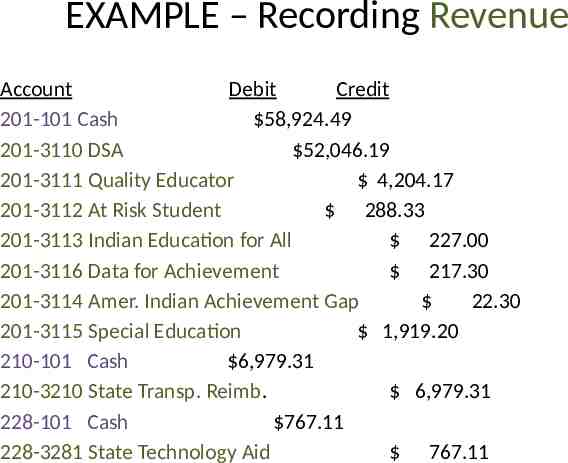

EXAMPLE – Recording Revenue Record August state payments from OPI Account Debit Credit 201-101 Cash 58,924.49 201-3110 DSA 52,046.19 201-3111 Quality Educator 4,204.17 201-3112 At Risk Student 288.33 201-3113 Indian Education for All 227.00 201-3116 Data for Achievement 217.30 201-3114 Amer. Indian Achievement Gap 22.30 201-3115 Special Education 1,919.20

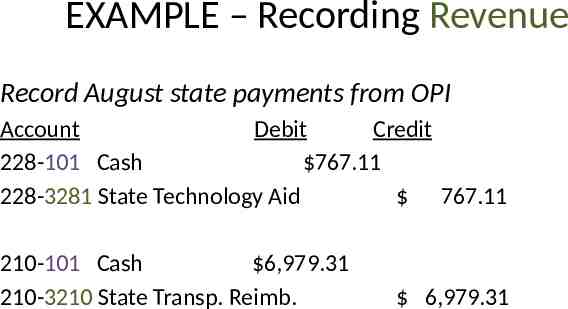

EXAMPLE – Recording Revenue Record August state payments from OPI Account Debit Credit 228-101 Cash 767.11 228-3281 State Technology Aid 767.11 210-101 Cash 6,979.31 210-3210 State Transp. Reimb. 6,979.31

EXAMPLE – Recording Revenue Account Debit Credit 201-101 Cash 58,924.49 201-3110 DSA 52,046.19 201-3111 Quality Educator 4,204.17 201-3112 At Risk Student 288.33 201-3113 Indian Education for All 227.00 201-3116 Data for Achievement 217.30 201-3114 Amer. Indian Achievement Gap 22.30 201-3115 Special Education 1,919.20 210-101 Cash 6,979.31 210-3210 State Transp. Reimb. 6,979.31 228-101 Cash 767.11 228-3281 State Technology Aid 767.11

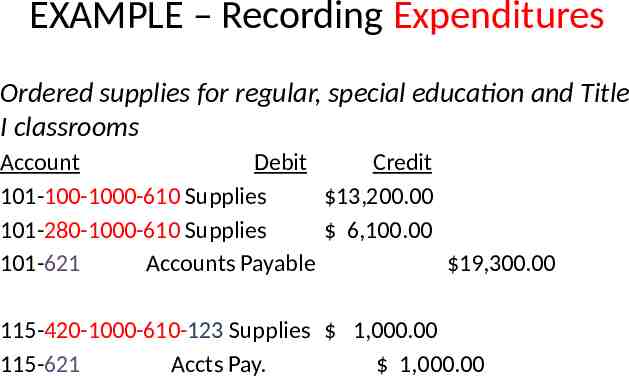

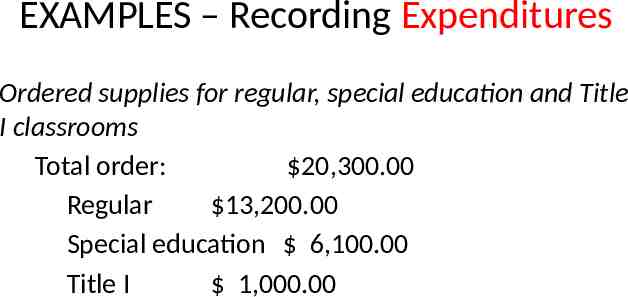

EXAMPLES – Recording Expenditures Ordered supplies for regular, special education and Title I classrooms Total order: 20,300.00 Regular 13,200.00 Special education 6,100.00 Title I 1,000.00

EXAMPLE – Recording Expenditures Ordered supplies for regular, special education and Title I classrooms Account Debit Credit 101-100-1000-610 Supplies 13,200.00 101-280-1000-610 Supplies 6,100.00 101-621 Accounts Payable 19,300.00 115-420-1000-610-123 Supplies 1,000.00 115-621 Accts Pay. 1,000.00

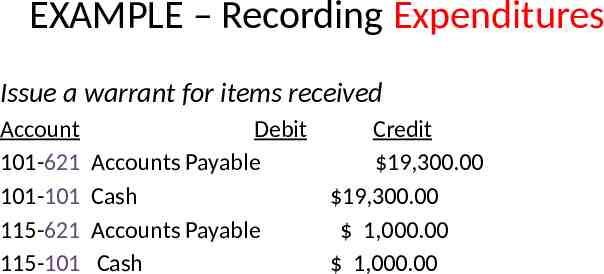

EXAMPLES – Recording Expenditures Items are received, packing slip matches order and invoice and you’re ready to issue a warrant for payment. Total invoice: 20,300.00 Regular 13,200.00 Special education 6,100.00 Title I 1,000.00

EXAMPLE – Recording Expenditures Issue a warrant for items received Account 101-621 101-101 115-621 115-101 Debit Credit Accounts Payable 19,300.00 Cash 19,300.00 Accounts Payable 1,000.00 Cash 1,000.00