1 DEPARTMENT OF EMPLOYMENT AND LABOUR UNEMPLOYMENT INSURANCE FUND

47 Slides2.17 MB

1 DEPARTMENT OF EMPLOYMENT AND LABOUR UNEMPLOYMENT INSURANCE FUND BRIEFING SCOPA ON DISBURSEMENT OF FUNDS DURING COVID 19 LOCKDOWN 26 June 2020 1

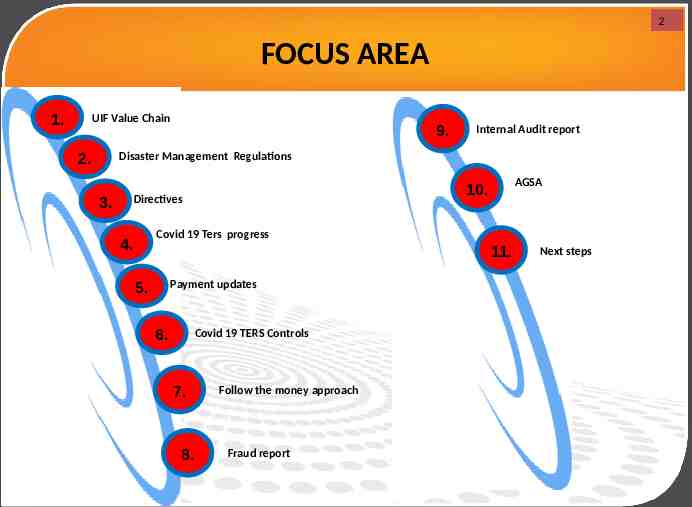

2 FOCUS AREA 1. UIF Value Chain 2. 9. Internal Audit report Disaster Management Regulations 3. AGSA 10. Directives Covid 19 Ters progress 4. 11. Payment updates 5. 6. Covid 19 TERS Controls 7. 8. Follow the money approach Fraud report Next steps

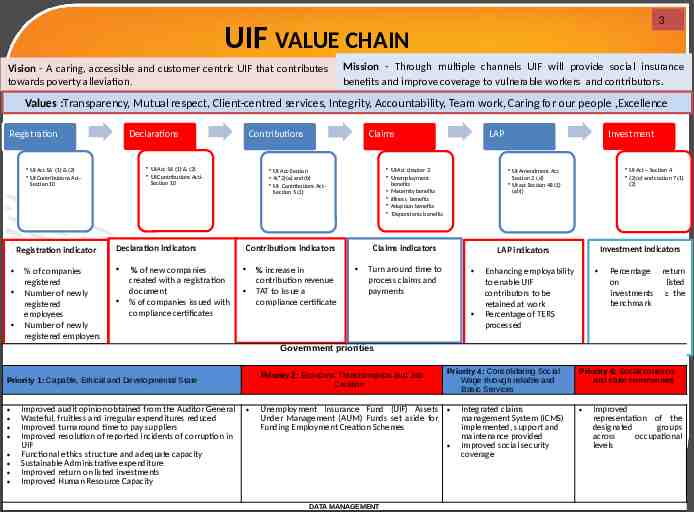

3 UIF VALUE CHAIN Vision - A caring, accessible and customer centric UIF that contributes towards poverty alleviation. Mission - Through multiple channels UIF will provide social insurance benefits and improve coverage to vulnerable workers and contributors. Values :Transparency, Mutual respect, Client-centred services, Integrity, Accountability, Team work, Caring for our people ,Excellence Declarations Registration UI Act 56 (1) & (2) UI Contributions ActiSection 10 UI Act 56 (1) & (2) UI Contributions ActSection 10 Registration indicator % of companies registered Number of newly registered employees Number of newly registered employers Contributions % of new companies created with a registration document % of companies issued with compliance certificates % increase in contribution revenue TAT to issue a compliance certificate UI Act – Section 4 (2)(e) and section 7 (1) (2) UI Amendment Act Section 2 ( d) UI act Section 48 (1) (a)(i) Claims indicators Contributions indicators Investment LAP UI Act chapter 3 Unemployment benefits Maternity benefits iIllness benefits Adoption benefits Dependents benefits UI Act-Section 4(*2)(a) and (b) UI Contributions ActSection 5 (1) Declaration indicators Claims Investment indicators LAP indicators Turn around time to process claims and payments Enhancing employability to enable UIF contributors to be retained at work Percentage of TERS processed Percentage return on listed investments the benchmark Government priorities Priority 2: Economic Transformation and Job Creation Priority 1: Capable, Ethical and Developmental State Improved audit opinion obtained from the Auditor General Wasteful, fruitless and irregular expenditures reduced Improved turnaround time to pay suppliers Improved resolution of reported incidents of corruption in UIF Functional ethics structure and adequate capacity Sustainable Administrative expenditure Improved return on listed investments Improved Human Resource Capacity Priority 4: Consolidating Social Wage through reliable and Basic Services Outcome indicators per priority Unemployment Insurance Fund (UIF) Assets Under Management (AUM) Funds set aside for Funding Employment Creation Schemes DATA MANAGEMENT Integrated claims management System (ICMS) implemented, support and maintenance provided Improved social security coverage Priority 6: Social cohesion and safer communities Improved representation of the designated groups across occupational levels

4 DISASTER MANAGEMENT REGULATIONS MANDATE &RESPONSIBILITY OF THE MINISTER OF EMPLOYMENT AND LABOUR 4

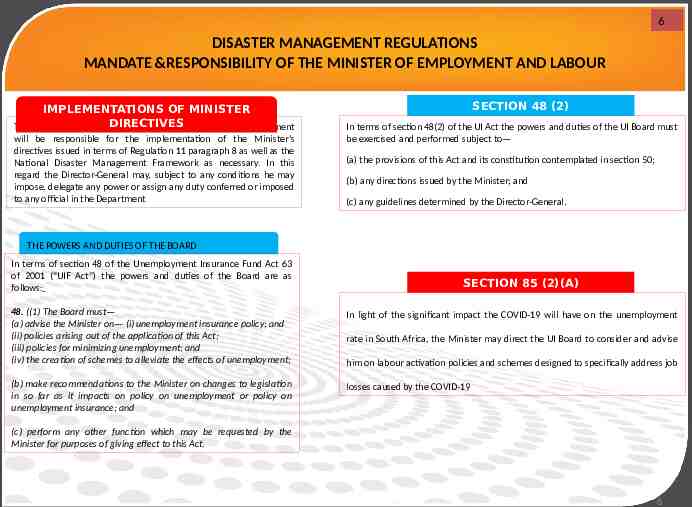

DISASTER MANAGEMENT REGULATIONS MANDATE &RESPONSIBILITY OF THE MINISTER OF EMPLOYMENT AND LABOUR DISASTER MANAGEMENT REGULATIONS – THE MANDATE AND RESPONSIBILITY OF THE MINISTER OF EMPLOYMENT AND LABOUR In terms of section 26(1) of the Disaster Management Act 57, 2002 (“Disaster Management Act”) the Minister of the National Department Employment and Labour (“the Department”) as the national executive is primarily responsible for the co-ordination and management of national disasters irrespective of whether a national state of disaster has been declared in term of section 27(2). 5 REGULATIONS 11 PARAGRAPH 8 The Minister of Employment and Labour, in terms of Regulation 11 paragraph 8: ‘ .may issue and vary directions, as required, within his or her mandate, to address, prevent and combat the spread of COVID-19, from time to time, as may be required, including— (a) disseminating information required for dealing with the national state of disaster; (b) implementing emergency procurement procedures; THE MINISTER IS REQUIRED TO DEAL WITH A NATIONAL DISASTER1. In terms of existing legislation and contingency arrangements, if a national state of disaster has not been declared in terms of section 37( 1 ): or 2. In terms of existing legislation and contingency arrangements as augmented by regulations or directions made or issued in terms of section 27(2) if a national state of disaster has been declared. COGTA REGULATIONS On 18 March 2020 the Minister of Cooperative Governance and Traditional Affairs (“COGTA”), Dr Nkosazana Zuma issued Regulations in terms of section 27(2) of the Disaster Management Act, 2002 (“Disaster Management Act”) to address and combat the spread of COVID-19. (c) taking any other steps that may be necessary to prevent an escalation of the national state of disaster, or to alleviate, contain and minimise the effects of the national state of disaster; or (d) taking steps to facilitate international assistance.” SECTION 85 (2)(A) The Minister performs his function in terms of the Disaster Management Act and the Regulations as an Executive Authority in terms of section 85(2)(a) of the Constitution of the Republic of South Africa ISSUING OF DIRECTIVES It is the responsibility of the Minister to ensure that the Department implements the National Disaster Management Framework, and in so doing he may issue directives as necessary within the ambit of the Disaster Management Act. This responsibility may not be devolved to the UI Board 5

6 DISASTER MANAGEMENT REGULATIONS MANDATE &RESPONSIBILITY OF THE MINISTER OF EMPLOYMENT AND LABOUR IMPLEMENTATIONS OF MINISTER The Director General asDIRECTIVES the Accounting Authority of the Department will be responsible for the implementation of the Minister’s directives issued in terms of Regulation 11 paragraph 8 as well as the National Disaster Management Framework as necessary. In this regard the Director-General may, subject to any conditions he may impose, delegate any power or assign any duty conferred or imposed to any official in the Department SECTION 48 (2) In terms of section 48(2) of the UI Act the powers and duties of the UI Board must be exercised and performed subject to— (a) the provisions of this Act and its constitution contemplated in section 50; (b) any directions issued by the Minister; and (c) any guidelines determined by the Director-General. THE POWERS AND DUTIES OF THE BOARD In terms of section 48 of the Unemployment Insurance Fund Act 63 of 2001 (“UIF Act”) the powers and duties of the Board are as follows: SECTION 85 (2)(A) 48. ((1) The Board must— (a) advise the Minister on— (i) unemployment insurance policy; and (ii) policies arising out of the application of this Act; (iii) policies for minimizing unemployment; and (iv) the creation of schemes to alleviate the effects of unemployment; In light of the significant impact the COVID-19 will have on the unemployment (b) make recommendations to the Minister on changes to legislation in so far as it impacts on policy on unemployment or policy on unemployment insurance; and losses caused by the COVID-19 rate in South Africa, the Minister may direct the UI Board to consider and advise him on labour activation policies and schemes designed to specifically address job (c) perform any other function which may be requested by the Minister for purposes of giving effect to this Act. 6

7 DEPARTMENT OF EMPLOYMENT AND LABOUR DIRECTIVES REGARDING COVID19 7

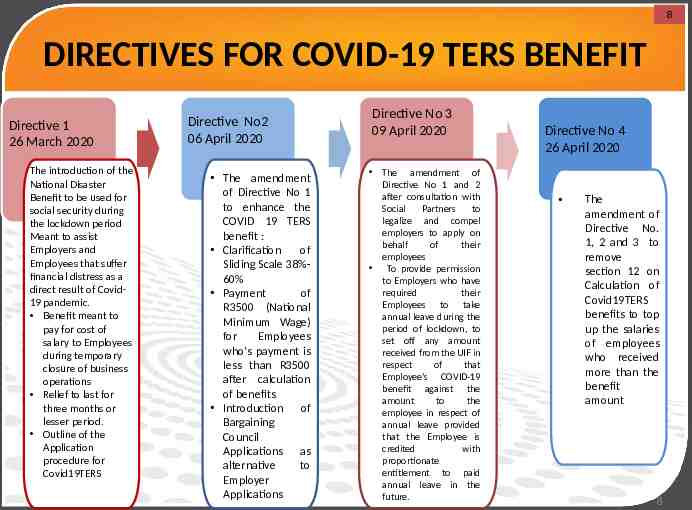

8 DIRECTIVES FOR COVID-19 TERS BENEFIT Directive 1 26 March 2020 The introduction of the National Disaster Benefit to be used for social security during the lockdown period Meant to assist Employers and Employees that suffer financial distress as a direct result of Covid19 pandemic. Benefit meant to pay for cost of salary to Employees during temporary closure of business operations Relief to last for three months or lesser period. Outline of the Application procedure for Covid19TERS Directive No2 06 April 2020 The amendment of Directive No 1 to enhance the COVID 19 TERS benefit : Clarification of Sliding Scale 38%60% Payment of R3500 (National Minimum Wage) for Employees who’s payment is less than R3500 after calculation of benefits Introduction of Bargaining Council Applications as alternative to Employer Applications Directive No 3 09 April 2020 The amendment of Directive No 1 and 2 after consultation with Social Partners to legalize and compel employers to apply on behalf of their employees To provide permission to Employers who have required their Employees to take annual leave during the period of lockdown, to set off any amount received from the UIF in respect of that Employee’s COVID-19 benefit against the amount to the employee in respect of annual leave provided that the Employee is credited with proportionate entitlement to paid annual leave in the future. Directive No 4 26 April 2020 The amendment of Directive No. 1, 2 and 3 to remove section 12 on Calculation of Covid19TERS benefits to top up the salaries of employees who received more than the benefit amount 8

9 DIRECTIVES FOR COVID-19 TERS BENEFIT cont. Prohibits Employers and Employees who fall within certain Bargaining Councils that entered into agreement with the UIF and will be paid through that process, from making their own applications for COVID19TERS Make provision for Employees to apply for COVID19TERS for themselves if their Employer is unable to or refuses to apply for them 5 Amendment of directive covid-19 temporary employer/ employee relief scheme (signed 30 April 2020 ) Definition of “Worker”: A) a contributor; or B) an employee as defined by the UI Act who should have received benefits under this Directive, but for circumstances beyond that employee’s control, namely that the employer failed to: (i) register as an employer, therefore contravening section 10(1) of the Unemployment Insurance Contributions Act, 2002 (Act No.4 of 2002); (ii) Provide details relating to the employees in contravention of section 10(3) of that Act and accordingly not registered as contributors; or (iii) Pay the contributions contemplated in section 5(1) of that Act in respect of employees. Amendment of Clause 2.1.1 (a): Payment of benefits to workers who have lost income or have been required to take annual leave in terms of section 20(10) of the Basic Conditions of employment Act, 1997 (Act No.75 of 1997) due to the COVID-19 pandemic 6 Amendment of directive covid-19 temporary employer/ employee relief scheme (signed 25 may 2020) 9

10 COVID 19 TERS Payments to Date 10

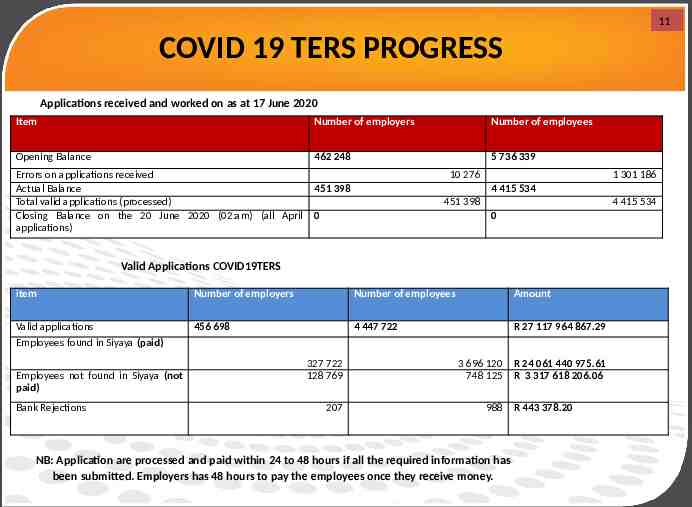

11 COVID 19 TERS PROGRESS Applications received and worked on as at 17 June 2020 Item Number of employers Number of employees Opening Balance 462 248 5 736 339 Errors on applications received Actual Balance Total valid applications (processed) Closing Balance on the 20 June 2020 (02:am) (all April applications) 10 276 451 398 1 301 186 4 415 534 451 398 0 4 415 534 0 Valid Applications COVID19TERS item Number of employers Number of employees Amount Valid applications Employees found in Siyaya (paid) 456 698 4 447 722 R 27 117 964 867.29 Employees not found in Siyaya (not paid) Bank Rejections 327 722 128 769 207 3 696 120 R 24 061 440 975.61 748 125 R 3 317 618 206.06 988 R 443 378.20 NB: Application are processed and paid within 24 to 48 hours if all the required information has been submitted. Employers has 48 hours to pay the employees once they receive money.

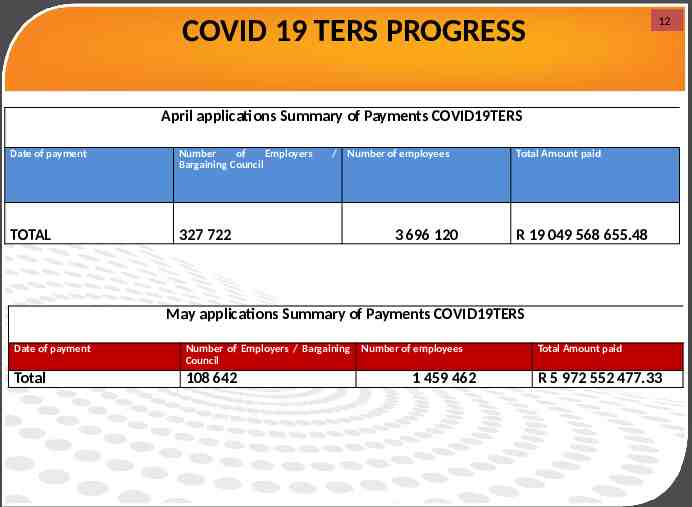

12 COVID 19 TERS PROGRESS April applications Summary of Payments COVID19TERS Date of payment Number of Employers Bargaining Council TOTAL 327 722 / Number of employees 3 696 120 Total Amount paid R 19 049 568 655.48 May applications Summary of Payments COVID19TERS Date of payment Number of Employers / Bargaining Council Total 108 642 Number of employees 1 459 462 Total Amount paid R 5 972 552 477.33

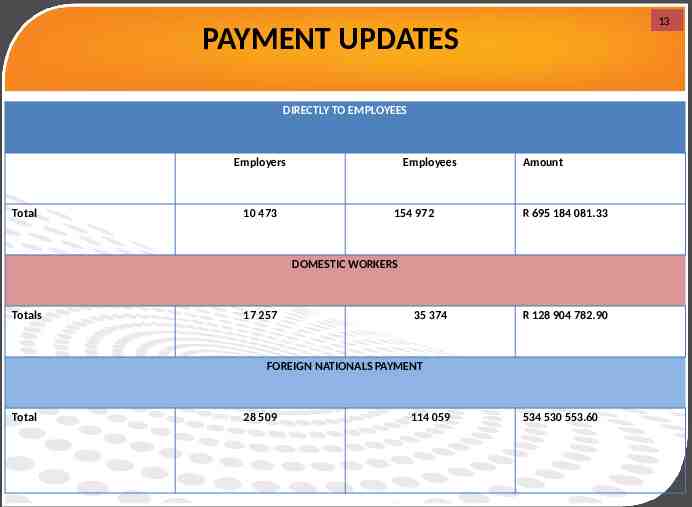

13 PAYMENT UPDATES DIRECTLY TO EMPLOYEES Employers Total 10 473 Employees 154 972 Amount R 695 184 081.33 DOMESTIC WORKERS Totals 17 257 35 374 R 128 904 782.90 FOREIGN NATIONALS PAYMENT Total 28 509 114 059 534 530 553.60

14 Foreign Nationals Payment UIF processes all applications received, including foreign nationals who are Contributors to the UIF Foreign Nationals have to be verified through Dept. of Home Affairs and also SARS Clear communication was sent out by UIF regarding documents that employers have to submit in support of applications for their foreign nationals employees; inc: passport number or work permit number, proof of employer's declaration with UIF or SARS; etc

15 Normal Claims Payment Status to date 15

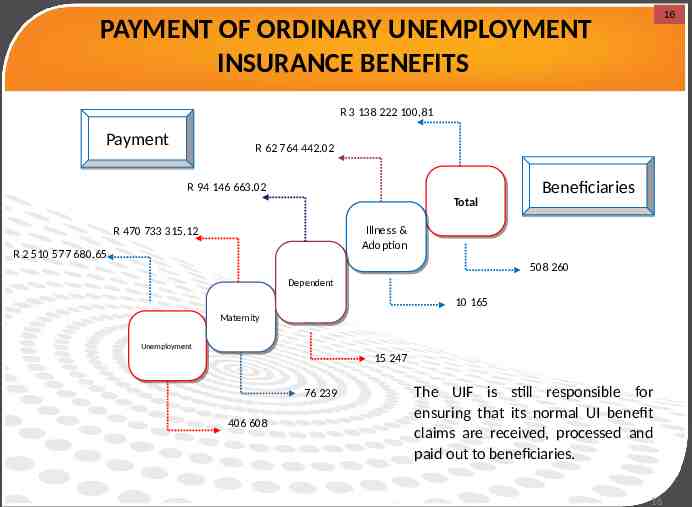

16 PAYMENT OF ORDINARY UNEMPLOYMENT INSURANCE BENEFITS R 3 138 222 100.81 Payment R 62 764 442.02 R 94 146 663.02 Total Total Beneficiaries Illness Illness & & Adoption Adoption R 470 733 315.12 R 2 510 577 680.65 508 260 Dependent Dependent 10 165 Maternity Maternity Unemployment Unemployment 15 247 76 239 406 608 The UIF is still responsible for ensuring that its normal UI benefit claims are received, processed and paid out to beneficiaries. 16

17 COVID 19 TERS CONTROLS IMPLEMENTED 17

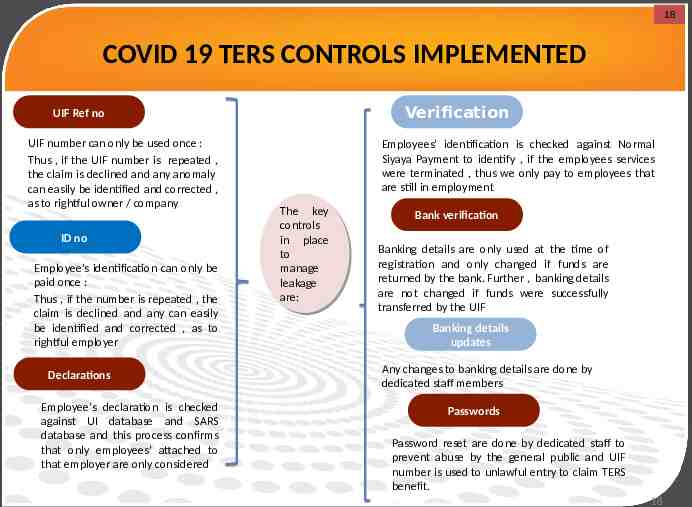

18 COVID 19 TERS CONTROLS IMPLEMENTED Verification UIF Ref no UIF number can only be used once : Thus , if the UIF number is repeated , the claim is declined and any anomaly can easily be identified and corrected , as to rightful owner / company ID no Employee’s identification can only be paid once : Thus , if the number is repeated , the claim is declined and any can easily be identified and corrected , as to rightful employer Declarations Employee’s declaration is checked against UI database and SARS database and this process confirms that only employees’ attached to that employer are only considered Employees’ identification is checked against Normal Siyaya Payment to identify , if the employees services were terminated , thus we only pay to employees that are still in employment The The key key controls controls in in place place to to manage manage leakage leakage are: are: Bank verification Banking details are only used at the time of registration and only changed if funds are returned by the bank. Further , banking details are not changed if funds were successfully transferred by the UIF Banking details updates Any changes to banking details are done by dedicated staff members Passwords Password reset are done by dedicated staff to prevent abuse by the general public and UIF number is used to unlawful entry to claim TERS benefit. 18

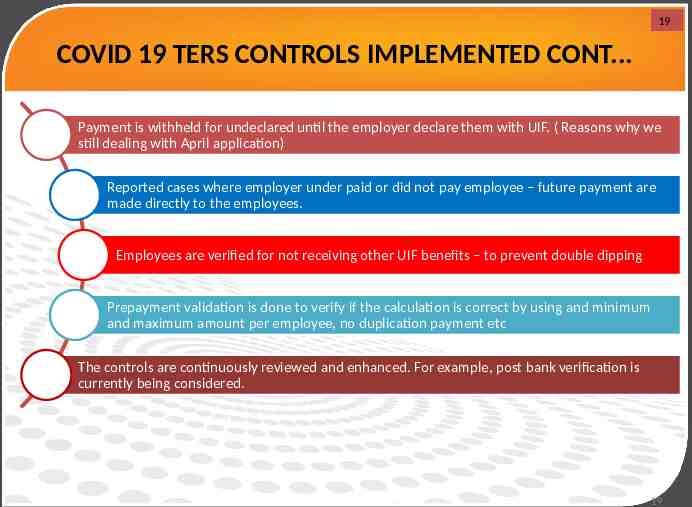

19 COVID 19 TERS CONTROLS IMPLEMENTED CONT. Payment is withheld for undeclared until the employer declare them with UIF. ( Reasons why we still dealing with April application) Reported cases where employer under paid or did not pay employee – future payment are made directly to the employees. Employees are verified for not receiving other UIF benefits – to prevent double dipping Prepayment validation is done to verify if the calculation is correct by using and minimum and maximum amount per employee, no duplication payment etc The controls are continuously reviewed and enhanced. For example, post bank verification is currently being considered. 19

20 FOLLOW THE MONEY APPROACH 20

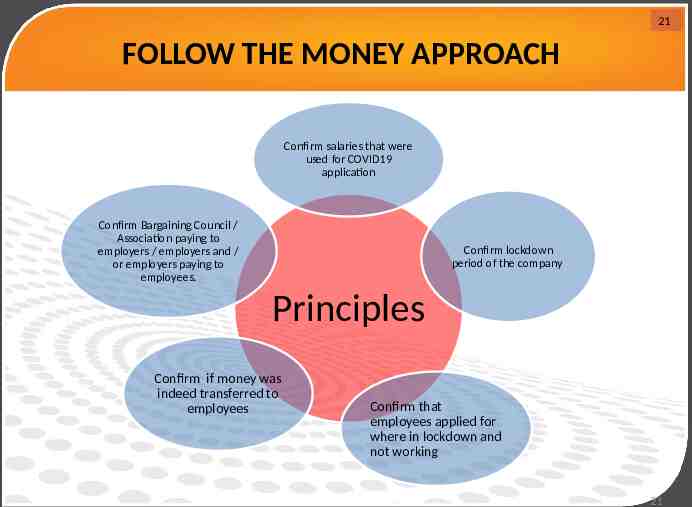

21 FOLLOW THE MONEY APPROACH Confirm salaries that were used for COVID19 application Confirm Bargaining Council / Association paying to employers / employers and / or employers paying to employees. Confirm lockdown period of the company Principles Confirm if money was indeed transferred to employees Confirm that employees applied for where in lockdown and not working 21

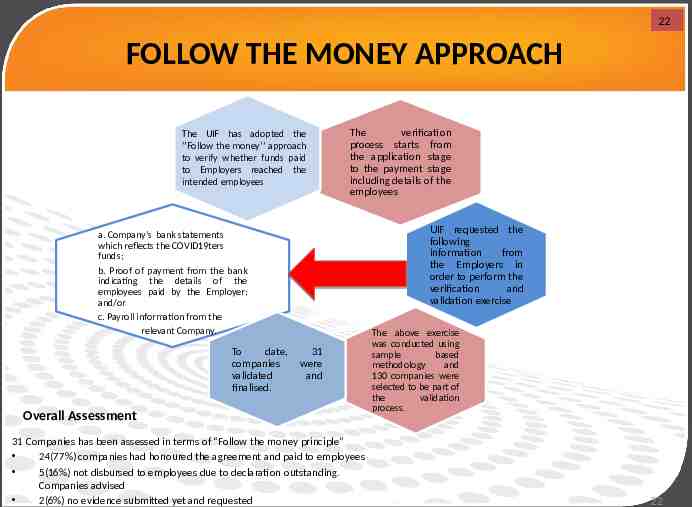

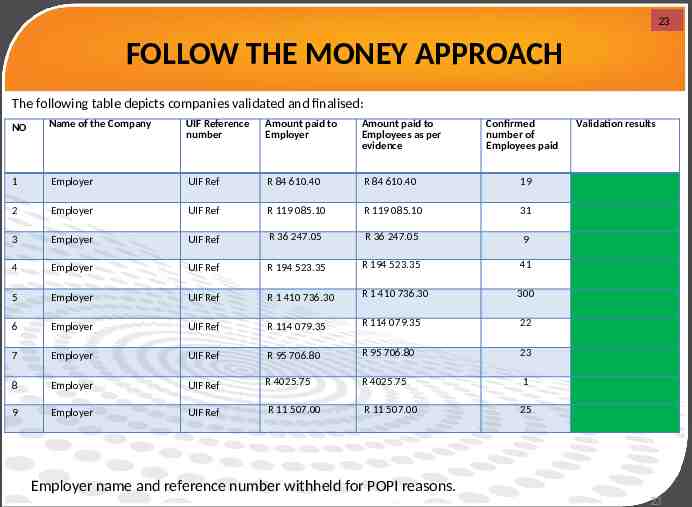

22 FOLLOW THE MONEY APPROACH The UIF has adopted the ‘’Follow the money’’ approach to verify whether funds paid to Employers reached the intended employees The verification process starts from the application stage to the payment stage including details of the employees UIF requested the following information from the Employers in order to perform the verification and validation exercise a. Company’s bank statements which reflects the COVID19ters funds; b. Proof of payment from the bank indicating the details of the employees paid by the Employer; and/or c. Payroll information from the relevant Company. To date, companies validated finalised. 31 were and Overall Assessment 31 Companies has been assessed in terms of “Follow the money principle” 24(77%) companies had honoured the agreement and paid to employees 5(16%) not disbursed to employees due to declaration outstanding. Companies advised 2(6%) no evidence submitted yet and requested The above exercise was conducted using sample based methodology and 130 companies were selected to be part of the validation process. 22

23 FOLLOW THE MONEY APPROACH The following table depicts companies validated and finalised: NO Name of the Company UIF Reference number Amount paid to Employer Amount paid to Employees as per evidence Confirmed number of Employees paid 1 Employer UIF Ref R 84 610.40 R 84 610.40 19 2 Employer UIF Ref R 119 085.10 R 119 085.10 31 3 Employer UIF Ref R 36 247.05 R 36 247.05 9 4 Employer UIF Ref R 194 523.35 R 194 523.35 41 5 Employer UIF Ref R 1 410 736.30 R 1 410 736.30 300 6 Employer UIF Ref R 114 079.35 R 114 079.35 22 7 Employer UIF Ref R 95 706.80 R 95 706.80 23 8 Employer UIF Ref R 4025.75 R 4025.75 1 9 Employer UIF Ref R 11 507.00 R 11 507.00 25 Validation results Employer name and reference number withheld for POPI reasons. 23

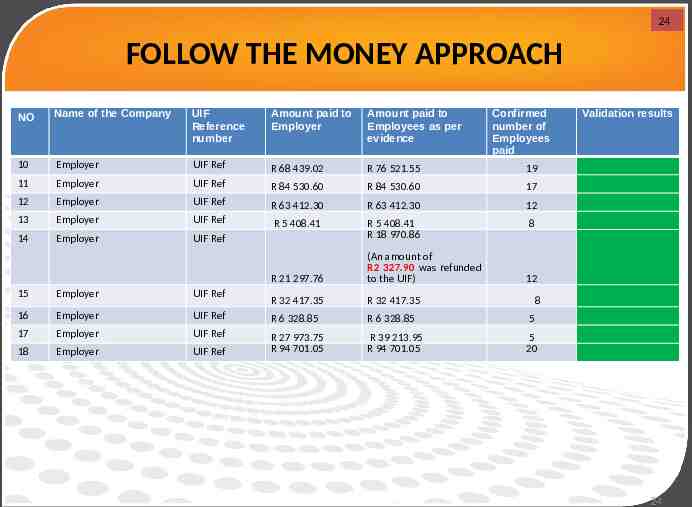

24 FOLLOW THE MONEY APPROACH NO Name of the Company UIF Reference number Amount paid to Employer Amount paid to Employees as per evidence Confirmed number of Employees paid 10 Employer UIF Ref R 68 439.02 R 76 521.55 19 11 Employer UIF Ref R 84 530.60 R 84 530.60 17 12 Employer UIF Ref R 63 412.30 R 63 412.30 12 13 Employer UIF Ref R 5 408.41 8 14 Employer UIF Ref R 5 408.41 R 18 970.86 R 21 297.76 (An amount of R2 327.90 was refunded to the UIF) R 32 417.35 R 32 417.35 UIF Ref R 6 328.85 R 6 328.85 5 Employer UIF Ref Employer UIF Ref R 27 973.75 R 94 701.05 R 39 213.95 R 94 701.05 5 20 15 Employer UIF Ref 16 Employer 17 18 Validation results 12 8 24

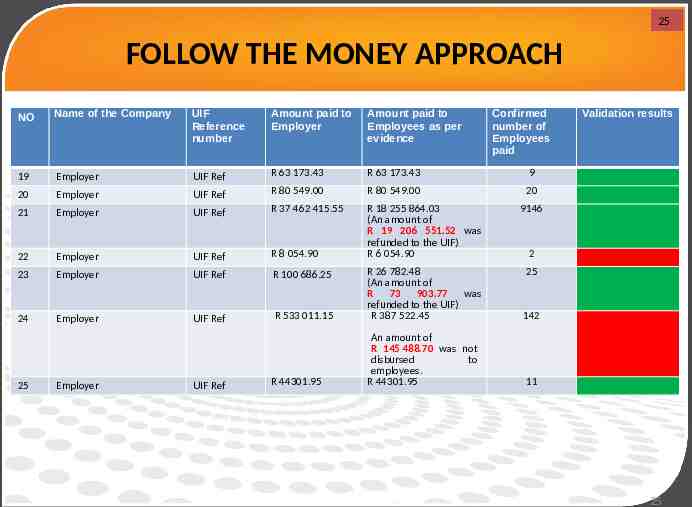

25 FOLLOW THE MONEY APPROACH NO Name of the Company UIF Reference number Amount paid to Employer Amount paid to Employees as per evidence 19 Employer UIF Ref R 63 173.43 R 63 173.43 9 20 Employer UIF Ref R 80 549.00 R 80 549.00 20 21 Employer UIF Ref R 37 462 415.55 9146 22 Employer UIF Ref R 8 054.90 R 18 255 864.03 (An amount of R 19 206 551.52 was refunded to the UIF) R 6 054.90 23 Employer UIF Ref R 100 686.25 25 24 Employer UIF Ref R 533 011.15 R 26 782.48 (An amount of R 73 903.77 was refunded to the UIF) R 387 522.45 142 An amount of R 145 488.70 was not disbursed to employees. R 44301.95 11 25 Employer UIF Ref R 44301.95 Confirmed number of Employees paid Validation results 2 25

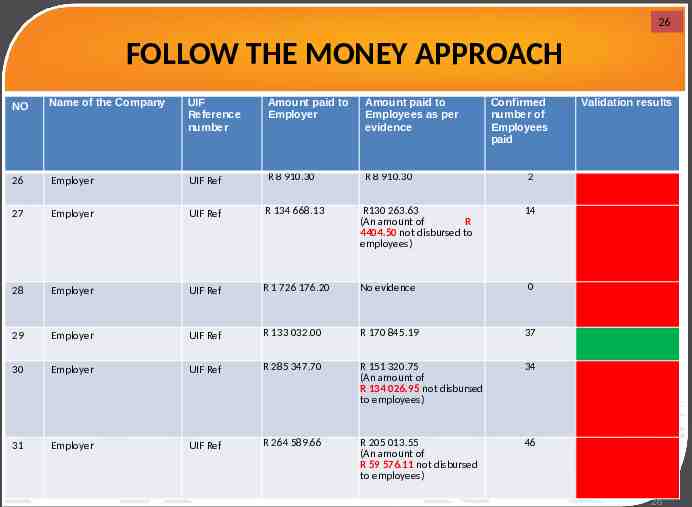

26 FOLLOW THE MONEY APPROACH NO Name of the Company UIF Reference number Amount paid to Employer Amount paid to Employees as per evidence Confirmed number of Employees paid 26 Employer UIF Ref R 8 910.30 R 8 910.30 27 Employer UIF Ref R 134 668.13 R130 263.63 (An amount of R 4404.50 not disbursed to employees) 14 28 Employer UIF Ref R 1 726 176.20 No evidence 0 29 Employer UIF Ref R 133 032.00 R 170 845.19 37 30 Employer UIF Ref R 285 347.70 R 151 320.75 (An amount of R 134 026.95 not disbursed to employees) 34 31 Employer UIF Ref R 264 589.66 R 205 013.55 (An amount of R 59 576.11 not disbursed to employees) 46 Validation results 2 26

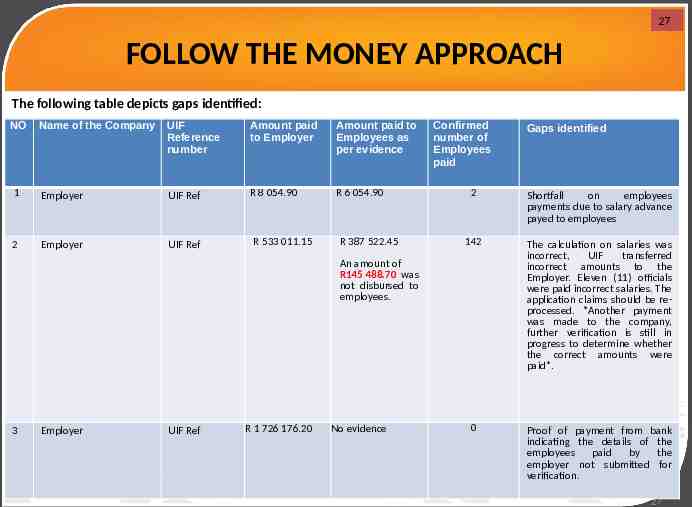

27 FOLLOW THE MONEY APPROACH The following table depicts gaps identified: NO Name of the Company UIF Reference number Amount paid to Employer Amount paid to Employees as per evidence 1 Employer UIF Ref R 8 054.90 R 6 054.90 2 Employer UIF Ref R 533 011.15 R 387 522.45 Confirmed number of Employees paid 2 Shortfall on employees payments due to salary advance payed to employees 142 The calculation on salaries was incorrect, UIF transferred incorrect amounts to the Employer. Eleven (11) officials were paid incorrect salaries. The application claims should be reprocessed. *Another payment was made to the company, further verification is still in progress to determine whether the correct amounts were paid*. 0 Proof of payment from bank indicating the details of the employees paid by the employer not submitted for verification. An amount of R145 488.70 was not disbursed to employees. 3 Employer UIF Ref R 1 726 176.20 No evidence Gaps identified 27

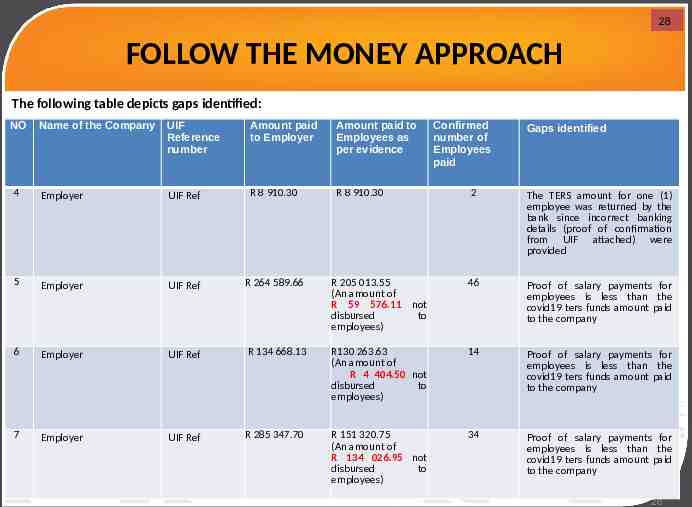

28 FOLLOW THE MONEY APPROACH The following table depicts gaps identified: NO Name of the Company UIF Reference number Amount paid to Employer Amount paid to Employees as per evidence 4 Employer UIF Ref R 8 910.30 R 8 910.30 5 Employer UIF Ref R 264 589.66 6 Employer UIF Ref 7 Employer UIF Ref Confirmed number of Employees paid Gaps identified 2 The TERS amount for one (1) employee was returned by the bank since incorrect banking details (proof of confirmation from UIF attached) were provided R 205 013.55 (An amount of R 59 576.11 not disbursed to employees) 46 Proof of salary payments for employees is less than the covid19 ters funds amount paid to the company R 134 668.13 R130 263.63 (An amount of R 4 404.50 not disbursed to employees) 14 Proof of salary payments for employees is less than the covid19 ters funds amount paid to the company R 285 347.70 R 151 320.75 (An amount of R 134 026.95 not disbursed to employees) 34 Proof of salary payments for employees is less than the covid19 ters funds amount paid to the company 28

29 FRAUD REPORT 29

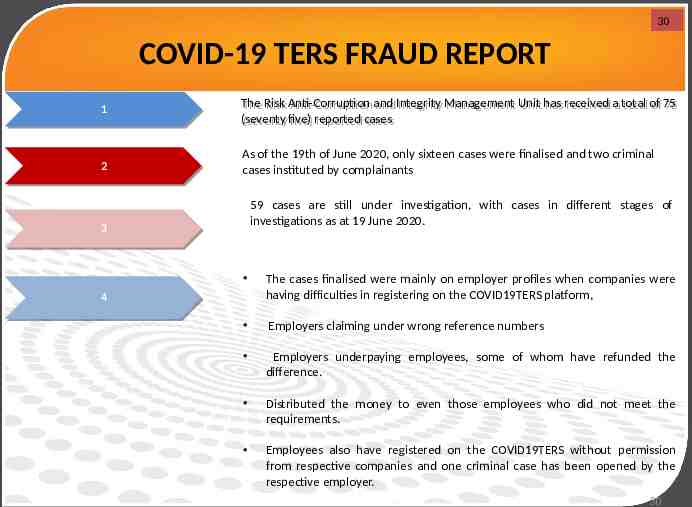

30 COVID-19 TERS FRAUD REPORT 11 The The Risk Risk Anti-Corruption Anti-Corruption and and Integrity Integrity Management Management Unit Unit has has received received aa total total of of 75 75 (seventy (seventy five) five) reported reported cases cases 22 As of the 19th of June 2020, only sixteen cases were finalised and two criminal cases instituted by complainants 59 cases are still under investigation, with cases in different stages of investigations as at 19 June 2020. 33 The cases finalised were mainly on employer profiles when companies were having difficulties in registering on the COVID19TERS platform, Employers claiming under wrong reference numbers Employers underpaying employees, some of whom have refunded the difference. Distributed the money to even those employees who did not meet the requirements. Employees also have registered on the COVID19TERS without permission from respective companies and one criminal case has been opened by the respective employer. 44 30

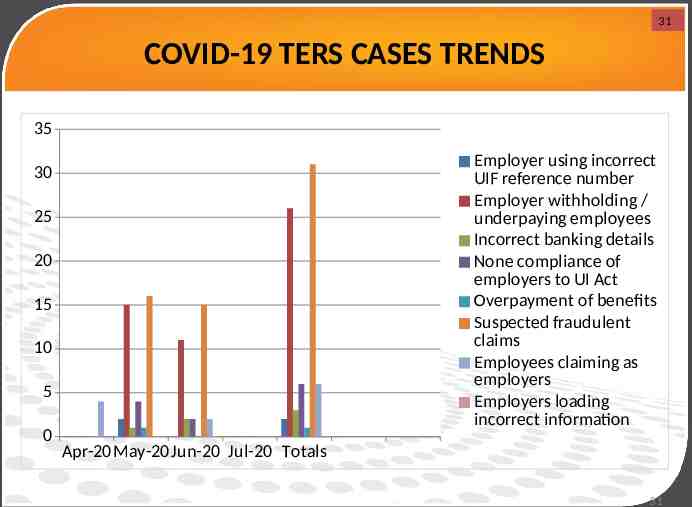

31 COVID-19 TERS CASES TRENDS 35 Employer using incorrect UIF reference number Employer withholding / underpaying employees Incorrect banking details None compliance of employers to UI Act Overpayment of benefits Suspected fraudulent claims Employees claiming as employers Employers loading incorrect information 30 25 20 15 10 5 0 Apr-20 May-20 Jun-20 Jul-20 Totals 31

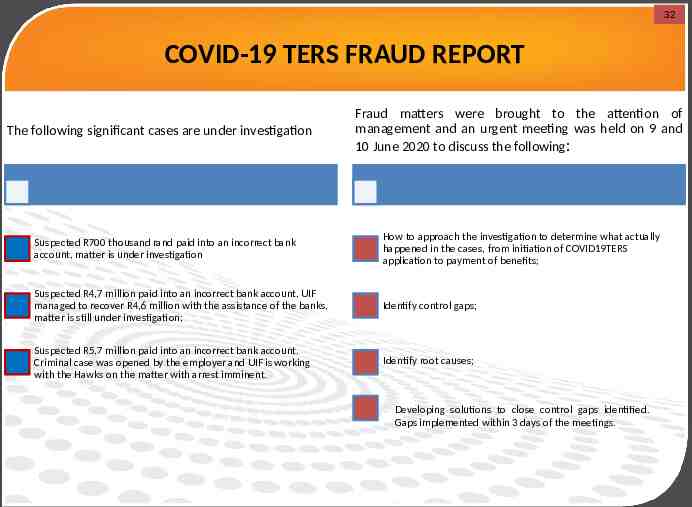

32 COVID-19 TERS FRAUD REPORT The following significant cases are under investigation Fraud matters were brought to the attention of management and an urgent meeting was held on 9 and 10 June 2020 to discuss the following: Suspected R700 thousand rand paid into an incorrect bank account, matter is under investigation How to approach the investigation to determine what actually happened in the cases, from initiation of COVID19TERS application to payment of benefits; Suspected R4,7 million paid into an incorrect bank account, UIF managed to recover R4,6 million with the assistance of the banks, matter is still under investigation; Identify control gaps; Suspected R5,7 million paid into an incorrect bank account. Criminal case was opened by the employer and UIF is working with the Hawks on the matter with arrest imminent. Identify root causes; Developing solutions to close control gaps identified. Gaps implemented within 3 days of the meetings.

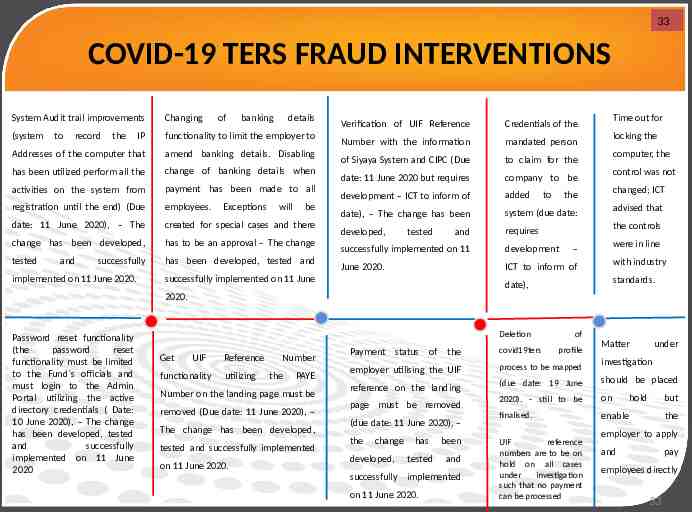

33 COVID-19 TERS FRAUD INTERVENTIONS System Audit trail improvements Changing (system IP functionality to limit the employer to Addresses of the computer that amend banking details. Disabling has been utilized perform all the change of banking details when activities on the system from payment has been made to all registration until the end) (Due employees. date: 11 June 2020), – The created for special cases and there change has been developed, has to be an approval – The change tested has been developed, tested and to record and the successfully implemented on 11 June 2020. of banking Exceptions details will be Verification of UIF Reference Credentials of the Number with the information mandated person of Siyaya System and CIPC (Due to claim for the date: 11 June 2020 but requires company to be development – ICT to inform of added date), – The change has been system (due date: developed, requires tested and to locking the computer, the control was not changed; ICT the advised that the controls successfully implemented on 11 development June 2020. ICT to inform of successfully implemented on 11 June Time out for were in line – with industry standards. date), 2020. Password reset functionality (the password reset functionality must be limited to the Fund s officials and must login to the Admin Portal utilizing the active directory credentials ( Date: 10 June 2020), – The change has been developed, tested and successfully implemented on 11 June 2020 Deletion Get UIF functionality Reference utilizing Number the PAYE Number on the landing page must be removed (Due date: 11 June 2020), – The change has been developed, tested and successfully implemented on 11 June 2020. of under covid19ters employer utilising the UIF process to be mapped reference on the landing (due date: 19 June should be placed 2020), - still to be on finalised. enable page must be removed (due date: 11 June 2020), – the change developed, has been tested and successfully implemented on 11 June 2020. profile Matter Payment status of the UIF reference numbers are to be on hold on all cases under investigation such that no payment can be processed investigation hold but the employer to apply and pay employees directly 33

34 COVID-19 TERS FRAUD REPORT The Risk Anti-Corruption and Integrity Management Unit has provided a list of alleged/suspicions fraud cases to management to place a hold on UIF reference numbers and related payment subject to investigation on the 11 June 2020 and this was done for all cases. In light of the increased fraud risk faced by the UIF in paying COVID19TERS benefits, the UIF has appointed Forensic Investigation, Risk and Recovery Management (Pty) Ltd on 29 May 2020. The forensic investigators increased our capacity to deal with fraud related matters. 11 Hawks are currently concluding UIF first case with arrest imminent 44 22 The UIF has also established a relationship with the Hawks which has Committee that is focused on COVID19 fraud related matters. UIF is invited to attend weekly Committee meetings. COVID19 fraud related matters are streamlined by the Committee to ensure efficiency and speedily conclusion of COVID19 fraud related cases 55 33 66 Hawks has invited UIF to form part of the weekly meeting on COVID 19 Fraud reporting and progress UIF is also engaging the Hawks to utilise the hotline/ contact line for the public to report COVID19TERS fraud related matters. 34

35 INTERNAL AUDIT COVID TERS REVIEW 35

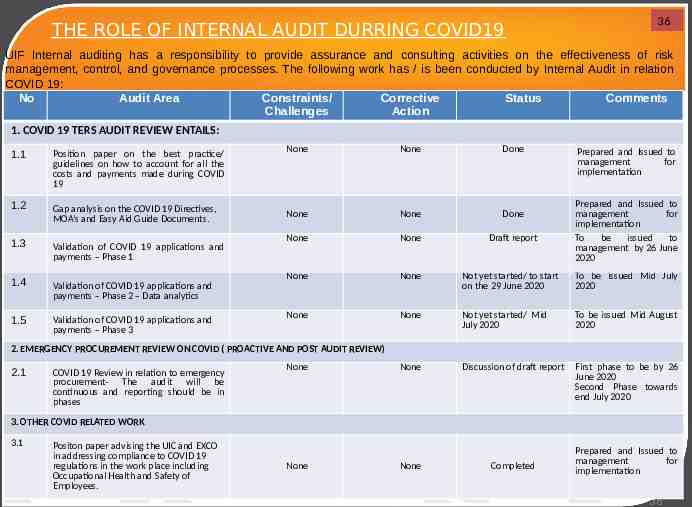

THE ROLE OF INTERNAL AUDIT DURRING COVID19 36 UIF Internal auditing has a responsibility to provide assurance and consulting activities on the effectiveness of risk management, control, and governance processes. The following work has / is been conducted by Internal Audit in relation COVID 19: No Audit Area Constraints/ Corrective Status Comments Challenges Action 1. COVID 19 TERS AUDIT REVIEW ENTAILS: 1.1 1.2 1.3 1.4 1.5 Position paper on the best practice/ guidelines on how to account for all the costs and payments made during COVID 19 Gap analysis on the COVID 19 Directives, MOA’s and Easy Aid Guide Documents. Validation of COVID 19 applications and payments – Phase 1 Validation of COVID 19 applications and payments – Phase 2 – Data analytics Validation of COVID 19 applications and payments – Phase 3 None None Done None None Done None None Draft report None None Not yet started/ to start on the 29 June 2020 To be issued Mid July 2020 None None Not yet started/ Mid July 2020 To be issued Mid August 2020 None Discussion of draft report First phase to be by 26 June 2020 Second Phase towards end July 2020 Prepared and Issued to management for implementation Prepared and Issued to management for implementation To be issued to management by 26 June 2020 2. EMERGENCY PROCUREMENT REVIEW ON COVID ( PROACTIVE AND POST AUDIT REVIEW) 2.1 COVID 19 Review in relation to emergency procurement- The audit will be continuous and reporting should be in phases None 3. OTHER COVID RELATED WORK 3.1 Positon paper advising the UIC and EXCO in addressing compliance to COVID 19 regulations in the work place including Occupational Health and Safety of Employees. None None Completed Prepared and Issued to management for implementation 36

37 AGSA INTERIM AUDIT 37

38 AGSA INTERIM AUDIT FOCUS The AGSA will provide this assistance through the performance of an interim audit, as part of the current annual audit, on the transactions which will be included in the financial statements for the next financial year and the controls implemented to prevent any fraud, misuse, non-compliance or misstatements. The focus will be on Covid-19 related account balances and classes of transactions Compliance with key legislation applicable to the Covid-19 related transactions, funds and processes The AGSA has started with the audit 38

39 NEXT STEPS 39

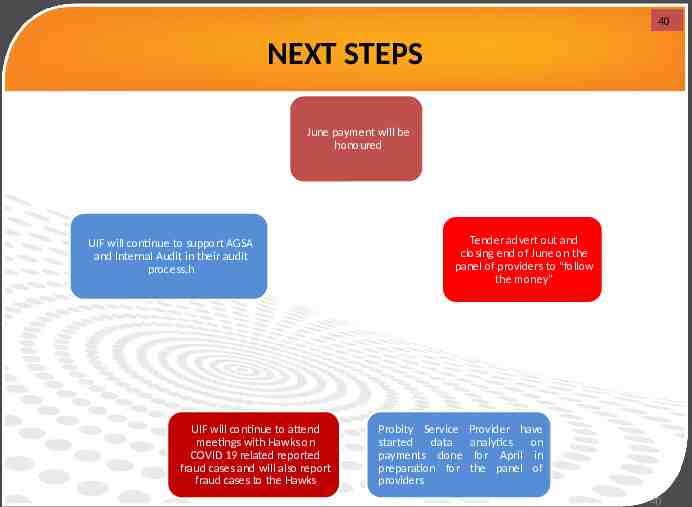

40 NEXT STEPS June payment will be honoured UIF will continue to support AGSA and Internal Audit in their audit process.h UIF will continue to attend meetings with Hawks on COVID 19 related reported fraud cases and will also report fraud cases to the Hawks Tender advert out and closing end of June on the panel of providers to “follow the money” Probity Service started data payments done preparation for providers Provider have analytics on for April in the panel of 40

41 PROBITY REVIEW FOR COVID19ters PROCESS 41

42 PROBITY REVIEW UIF has partnered with a service provider to perform probity review on the payment process for April applications. The review is focusing on the following areas: APPLICATION COMPLIANCE TO THE DIRECTIVES: Assess compliance level for each application on benefit amount, the calculation and the payment of benefits. COMPLETENESS AND ACCURACY OF EMPLOYERS’ TERS SUBMISSIONS Assess the completeness and accuracy of employers’ submissions against existing information available within the UIF. PROBITY ADMINISTRATION OF COVID19ters Determine whether the UIF has managed the TERS application and administration efficiently, effectively as well as accurately. CORRECTIVE MEASURES Based on the above work, the team will assist UIF to enhance internal processes and controls for May and June applications. NB: The above work is the first phase which will then guide the scope work to be performed by a panel of service providers, being appointed to verify receipt of payments by employees. 42

43 Enhancing Fraud Reporting and Management for COVID 19 TERS 43

44 Purpose of Toll Free Hotline services To report all fraud and corruption allegations including Covid19 Ters fraudulent allegations. The toll free hotline would be utilised to receive calls, faxes, post, e-mail and or web-based queries from all UIF stakeholders including its employees and members of the public who wish to report fraud and corruption activities associated with the Fund

45 How will the hotline operate? a) All calls will be handled by a call centre agent who will transcribe the information provided through the call into written reports. (No answering machines are allowed) b) 3 Call Centre agents, a Supervisor and a Manager will be available at all times (08h00 – 18h00) to handle incoming calls. c) The toll free number will cater for all the eleven (11) official South African Official languages. d) All calls received will be electronically and digitally recorded. 45

Status of Procurement 46 Issue date of RFQ – 12/06/2020 Initial Closing date of the RFQ – 17/06/2020 Extended Closing date of RFQ- 26/06/2020 46

47 Thank You 47