LATEST MCA UPDATES AND AMENDMENTS Presented by: CA Madhukuttan Pillai

76 Slides3.25 MB

LATEST MCA UPDATES AND AMENDMENTS Presented by: CA Madhukuttan Pillai

OVERVIEW Topics covered in todays session : Form DPT-3 Form STK-2 Form INC-22A Form INC-20A Form MSME-1 Form BEN Amendments in Companies(Incorporation)Rules, 2014

VUCA VUCA V- Volatility U-Uncertainty C-Complexity A- Ambiguity UDIN – More than a million UDINs generated so far Due Diligence

FORM DPT-3

DPT-3 As per Rule 16A(3) of the Companies (Acceptance of deposit) Rules, 2014 "every company other than Government company shall file a onetime return of outstanding receipt of money or loan by a company but not considered as deposits, in terms of clause (c) of sub-rule 1 of rule 2 from the 01st April, 2014 to the date of publication of the notification in the Official Gazette, as specified in Form DPT-3 within ninety days from the date of said publication of this notification along with the fee as provided in the Companies (Registration Offices and Fees) Rules, 2014". Data on deposits should be filed up to 31st March, 2019 Pending the deployment of DPT-3 Form on MCA 21 portal and in order to avoid inconvenience to stakeholders on account of various factors, it is stated that the additional fee, as provided under the Companies (Registration Offices and Fees) Rules, 2014, shall be levied after 30 days from the date of deployment of the DPT- 3 form on MCA 21 portal.

Diving In Deeper A simple analysis of the above legal pronouncement is very simple and for a private limited company following are the new requirements 1. Prepare the financial statement 2. Ascertain if there is any money received from any source whatsoever which is pending and is showing in the credit side of the balance sheet or is there any load in the books 3. File DPT-3 to the ROC within 30 days, when the form is notified. In the final financial statement, a note must be appended with details of money received from the director or its relatives. The relative has been defined in section 2(77) which is further elaborated by the rules.

Who Is Required To File DPT-3? 1. To be filed by all companies other than Government Companies; 2. DPT-3 needs to be filed for both secured and unsecured Loan; 3. This is applicable for ECB loan availed from foreign holders as well; 4. For outstanding amounts up to 31.03.2019 to be disclosed; 5. A company is required to file e-form DPT-3 even for loan received from Holding, Subsidiary and Associate; 6. If some outstanding receipt of money or loan had become due before 01st April 2014, is still outstanding in the records of the Company, the same is required to be reported to ROC in e-form DPT-3.

Transactions For Which DPT-3 Has To Be Filed Every company shall file form DPT -3 to ROC for the following transactions, if any, transacted by the Company: 1. Particulars of unsecured loan received from directors or relative of directors; 2. Particulars of advance received from customers; 3. Particulars of any deposits in the nature of security deposits; 4. Particulars of credit facilities obtained from banks and financial institutions; 5. Particulars of any inter-corporate loans; 6. Particulars of any unsecured loans received from shareholders.

Attachments Required With The Form Auditor’s certificate; Copy of trust deed – Mandatory if company has trust deed and details of same are mentioned in the form; Copy of instrument creating charge – Mandatory if company has trust deed and details of same are mentioned in the form; List of depositors – List of deposits matured, cheques issued but not yet cleared to be shown separately – Mandatory if company has balance of deposits outstanding at the end of the year; Details of liquid assets.

Who is authorised to sign the form Digitally? Any of the following can digitally sign the form: 1. Director 2. Manager 3. Company Secretary 4. CEO 5. CFO

Fees For a company with Share Capital : Nominal Share Capital Fee Applicable Less than 1,00,000 Rs. 200 per document 1,00,000 to 4,99,999 Rs. 300 per document 5,00,000 to 24,99,999 Rs. 400 per document 25,00,000 to 99,99,999 Rs. 500 per document 1,00,00,000 or more Rs. 600 per document For a company with no Share Capital : Fee Applicable Rs. 200 per document

Additional Fees Period of Days All Forms Up to 30 days 2 times the normal fees More than 30 days and up to 60 days 4 times the normal fees More than 60 days and up to 90 days 6 times the normal fees More than 90 days and up to 18 days 10 times the normal fees More than 180 days 12 times the normal fees

Some Important Points Form DPT-3 is exempted for Government Companies and NBFC Companies. NIL RETURN IS ALSO COMPULSORY; Audit of Financials for FY 2018-19 is not compulsory for filing Form DPT-3; As per Rule 16, Figures filled in Form DPT-3 should be an audited one; for that Auditor Certificate may be obtained. Difference between One time Return and Annual Return: In One time Return we need to fill the amount received after 01/04/2014 and outstanding on 31/03/2019 but in Annual return, date of receipt of amount is not important, it covers every amount outstanding on 31/03/2019 whether received on or before 01/04/2014. In One time return only amount outstanding is required to be filled, no detail for that amount is required but in annual return detail for the outstanding amount is required to be filled. It is mandatory to bifurcate the amount of Deposit and amount exempted from Deposit in annual return, but in One time return no such bifurcation is required. One time return is need to be filed on or before 29th June, 2019 and annual return on or before 30th June

Some Important Points Object clause in form will be pre-filled from last AOC-4 or in case change in object activity from latest MGT-14 filed, So please check the same before filing form if there is any difference then raise Query on MCA. In point 8 of Form DPT-3, Net Worth should be calculated as per preceding audited statement for this time it will be Audited financial statement for the year ended on 31.03.2018. Net Worth as per Form DPT-3 considers intangible assets but as per definition of Net Worth, Net Worth does not consider intangible assets, so there are chances that Net Worth filled in Form AOC-4 and in Form DPT-3 could be different, So Advisable to attach Clarification on that. Auditor Certificate is not Compulsory but advisable to comply the words of Rule 16 even in case of NIL Return. Some important examples of What is deposit and what is Exempted: Inter-corporate Deposit is Exempted one but Loan from LLP is not Exempted one it is Deposit. Loan from Director’s Owned Fund is exempted but from relative of Directors is not exempted Amount from HUF is also Deposit as HUF is not any Body Corporate Any Trade Advance for less than 365 days is Exempted one and Trade advance for more than 365 days is Deposit Share Application Money due for less than 60 days is Exempted one and for more than 60 days is Deposit

FORM DPT- 3

FORM DPT- 3

FORM STK-2

STK-2 After filing of Form STK-2 by the company, the Registrar has the powers and duty to satisfy him/herself that sufficient provision has been made for the realisation of all amount due to the company and for the payment or discharge of its liabilities and obligations by the company within a reasonable time. If necessary, the ROC can also obtain necessary undertakings from the managing director, director or other persons in charge of the management of the company. On completion of the above formalities, the ROC would cause a public notice to be issued regarding the intended closure of the company. After expiry of the time mentioned in the notice, the Registrar can, strike off its name from the register of companies, and publish notice of striking-off of name of company in the Official Gazette. On publication in the Official Gazette of this notice, the company is held to be dissolved.

Requirements for Filing Form STK-2 All types of companies like private limited company, one person company, limited company can apply for closure using Form STK-2. The following are the enclosures that must be attached with Form STK-2: Indemnity bond duly notarized by every director in Form STK 3; A statement of accounts comprising assets and liabilities of the company made up to a day, not exceeding thirty days before the date of application and certified by a Chartered Accountant; An affidavit in Form STK 4 by every director of the company; A copy of the special resolution accordingly certified by each of the directors of the company or approval of 75 % of the members of the company in terms of paid up share capital as on the date of application A statement with reference to pending litigations, if any, involving the company.

STK-2 In Form STK-2, the Managing Director or Director of the company is required to declare that: There is no inspection or investigation ordered and carried out or yet to be carried out or being carried out against the company and where inspection or investigation have been carried out, no prosecution is pending in any court arising out of such inspection or investigation; The company is neither having any public deposits which are outstanding nor the company is in default in its repayment or interest thereon; The company does not have any outstanding loans, secured or unsecured; The company does not have any dues towards income tax, VAT, excise duty, service tax or any other tax or duty, by whatever name called, payable to the Central or any State Government, statutory authority or local authority; All the other liabilities of the company have been settled or discharged or extinguished; All the requirements of the Companies Act and rules made thereunder relating to removing the name of the company from the register of companies and matters incidental or supplemental thereto have been complied with;

STK-2 If a company satisfies any of the following condition, form STK-2 cannot be filed: The company changed its name or shifted its registered office from one State to another before three months of filing of Form STK-2; The company disposed property or rights held by it, before three months of filing of Form STK-2. This provision is not applicable for trade wherein disposal of property for gain is in the normal course of trading or carrying on of business; The company engaged in any other activity except the one which is provided in the MOA or expedient before three months of filing of Form STK-2. The company has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; The company is being wound up under Companies Act or under the Insolvency and Bankruptcy Code, 2016. Certification of Form Form STK 2 should be certified by a Chartered Accountant in full-time practice or Company Secretary in full-time Practice or Cost Accountant in whole time practice.

FORM STK-2

FORM STK-2

FORM INC-22A

What is Form INC – 22A? The MCA introduced INC-22A for validating the addresses of all registered companies under the Companies Act, 2013. The form goes by the name tag ACTIVE (Active Company Tagging Identities and Verification). The KYC form was introduced with the idea to ensure that the companies E-file their details accurately so that a proper check is maintained, and also, to ensure that the creation of shell companies is prevented in the years to come. The due date for filing this form is 15th June 2019.

Applicability of Form INC – 22A All companies incorporated on or before 31st of December, 2017 shall file the particulars of the company and the address validation of the registered office in E-Form INC – 22A on or before the 15th of June, 2019 with the Registrar. Certain companies that are exempted from filing this form: Companies incorporated after 01.01.2018 Companies struck off from the Register Companies under the process of strike off Companies under amalgamation Companies under liquidation Companies that are dissolved

Who is restricted from filing E-Form INC – 22A? Any company which has not filed its due financial statements under Section 137(Copy of financial statement to be filed with Registrar ) or due annual returns under Section 92(Annual Return) or both with the Registrar shall be restricted from filing the ACTIVE form. However, if the company is under management dispute and the same has been recorded by the Registrar, then it shall be allowed to file e-Form INC – 22A.

Information required to file E-Form INC–22A Prior to filing INC–22A, all compliances with regard to the filing of Financial Statements (Section 137) and Annual Returns (Section 92) for the financial year 2017-18 must be completed by the company. CIN of the Company The CIN shall be obtained from the Certificate of Incorporation issued to the company. Address of the Registered Office of the Company The address of the registered office of the company will be auto-filled on submission of the CIN. Location of the Registered Office Enter the latitude and longitude in which the registered office is situated, which shall be obtained using maps. Email ID and Mobile Number for verification The email ID and mobile number that belong to the company must be provided accordingly. Once the entire form is completed and is error-free, the “Send OTP” button shall be active.

—Number of Directors and their details The details of all the directors associated with the company must be entered accordingly. Additionally, it is to be noted that the DIN of every associated director must be active and in an “Approved” status and not marked for disqualification. Details of the Auditor The company must have filed ADT – 1 for the appointment of the auditor for the financial year 2018-19. The details pertaining to the auditor include the following: Whether Individual/Firm Name of the Firm PAN of the Auditor/Firm Membership Number/Firm Registration Number, as the case may be Period of Appointment Details of Cost Auditor (Where applicable)

Details of the CEO/CFO/Key Managerial Personnel MD/CEO/Manager/Whole Time Director Name DIN/PAN Designation Company Secretary, where applicable Name PAN Membership Number Chief Financial Officer, where applicable Name PAN Details of the Certifying Authority (CS/CA) DSC of the Certifying Authority Membership Number CA/CS/Cost Accountant

The company must have filed Form CRA – 2 for the appointment of the auditor for the financial year 2018-19. The details pertaining to the auditor include the following: Whether Individual/Firm/LLP Name of the Individual/Firm Membership Number/Firm Registration Number, as the case may be Financial Year to be covered Details of AOC – 4 and MGT – 7 filed for the Financial Year 2017-18 SRN for both AOC- 4 and MGT – 7 must be furnished with this form. In order to have an SRN, both the forms must be filed within the specified time period. Required attachments A photograph of the registered office of the Company in which one of the Directors of the Company is the present (internal and external photo)

Consequences of non-filing of Form INC – 22A Where the company does not file the ACTIVE form by the 15th of June, 2019, it shall be marked as “ACTIVE non-compliant”, and shall be liable for action as per the Companies Act, 2013. Further, until the e-Form ACTIVE is filed, the Registrar shall not record any of the following changes/events pertaining to the company: SH – 07 (Changes in Authorised Capital) PAS – 03 (Changes in Paid-up Capital) DIR – 12 (Changes in Director except for cessation) INC – 22 (Change in the Registered Office) INC – 28 (Amalgamation, de-merger)

Fees for Filing E-Form INC – 22A Particulars Fees INC – 22A filed on or before 25th of April, 2019 Nil Companies that get “ACTIVE non-compliant” status Rs. 10,000

FORM INC-22A

FORM INC-22A

FORM INC-20A

Declaration Before Commencement Of Business Section – 10A “A company incorporated after commencement of the companies (amendment) ordinance, 2018, i.e. 02-11-2018 and having share capital shall not commence any business or exercise any borrowing powers unless(a) a declaration filed by a director within a period of 180 days of the date of incorporation of the company in FORM INC- 20A and verified in such a manner as may be prescribed, with the registrar that every subscriber to the memorandum has paid the value of the shares agreed to be taken by him on the date of making of such declaration; and (b) The company has filed with the registrar a verification of its registered office as provided in sub-section (2) of section 12 in FORM INC-22. Vide MCA notification dated 18/12/2018 Companies (Incorporation) fourth amendment Rules, 2018 has come into force wherein after rule 23, “rule 23A has been inserted” stating that the declaration to obtain certificate of commencement of business is required to be filed in Form INC- 20A.

Who needs to apply? Companies having share capital which are Incorporated on or after 02/11/2018. Documents Required Bank statement of company having all credit entries for receipt of subscription money received from all subscribers to MOA. Non-Compliance Company can’t start Business activity and Exercise any borrowing power (section 10A). Penalty to be levied Company – Rs. 50000 Director –Rs. 10000 Per Day up to Rs. 100000

Documents / Information Required Subscribers proof of payment for value of shares. Bank Statement of Company having all credit entries for receipt of subscription money from Subscribers. If Company is regulated by any sectorial regulator, Information Required: Name of the regulator Letter number/registration number Date of approval/registration Certificate of Registration issued by the RBI is Required also in case of Non-Banking Financial Companies) /from other regulators

FORM INC-20A

FORM MSME-1

Relevant Sections Definition of the Day of Acceptance: Explanation (i) to Section 2(b) of the Act provides that day of acceptance means: a. The day of the actual delivery of goods or the rendering of services; or b. Where any objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier Definition of the Day of Deemed Acceptance: Explanation (ii) to Section 2(b) of the Act provides that day of acceptance means the day of the actual delivery of goods or the rendering of services, where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services.

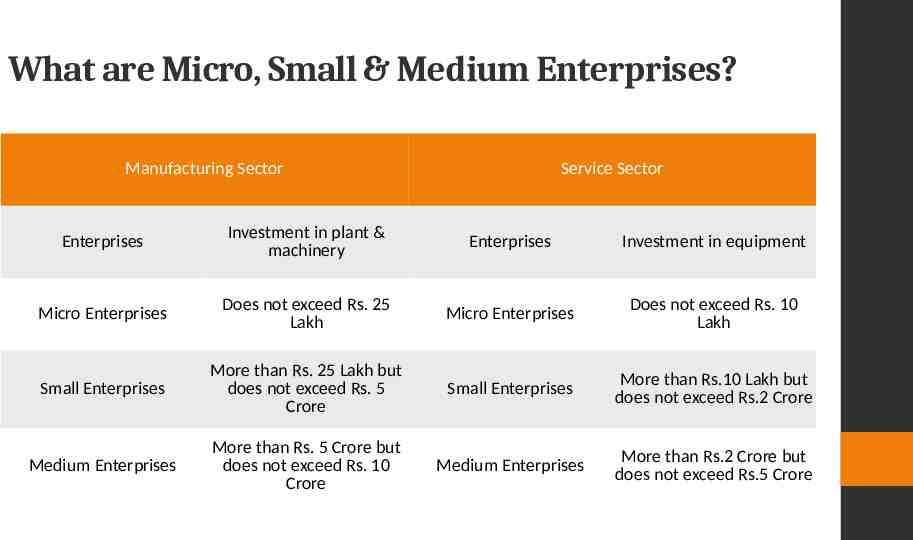

What are Micro, Small & Medium Enterprises? Manufacturing Sector Service Sector Enterprises Investment in plant & machinery Enterprises Investment in equipment Micro Enterprises Does not exceed Rs. 25 Lakh Micro Enterprises Does not exceed Rs. 10 Lakh Small Enterprises More than Rs. 25 Lakh but does not exceed Rs. 5 Crore Small Enterprises More than Rs.10 Lakh but does not exceed Rs.2 Crore Medium Enterprises More than Rs. 5 Crore but does not exceed Rs. 10 Crore Medium Enterprises More than Rs.2 Crore but does not exceed Rs.5 Crore

What is Due date of Filing Form MSME-1 ? As per General Circular No. 01/ 2019 dated 21.02.2019 the period of thirty days for filing initial return in MSME Form 1 shall be reckoned from the date the said e-form is deployed on MCA 21 portal. Due date of subsequent returns is mentioned below: For Half year period ‘April to September’ 31st October For half year period ‘October to March’ 30th April

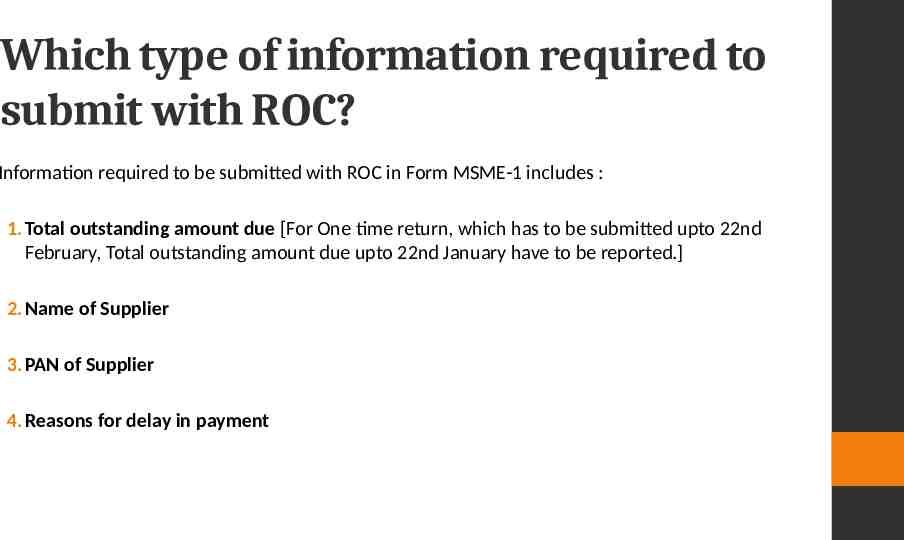

Which type of information required to submit with ROC? Information required to be submitted with ROC in Form MSME-1 includes : 1. Total outstanding amount due [For One time return, which has to be submitted upto 22nd February, Total outstanding amount due upto 22nd January have to be reported.] 2. Name of Supplier 3. PAN of Supplier 4. Reasons for delay in payment

Procedure 1. Firstly identify your MSME registered suppliers and ask for their registration certificate. 2. If there are any such suppliers who are Registered under MSME Act and if the payments to them are due for more than 45 days from the date of acceptance of the goods and services, then details of such suppliers shall be furnished in Form MSME-1 3. 4. Information required in respect of such supplier to be submitted with ROC in Form MSME-1 Total outstanding amount due on 22nd January 2019 [For One time return, which has to be submitted by 21stFebruary 2019] Name of Supplier PAN of Supplier Date from which such amount is due Reasons for delay in payment

What is the Penalty for Non-Filing of Form MSME-1 ? Non-compliance will lead to punishment and penalty under the provision of the Companies Act. As per Penalty Provision of Section 405 (4) of the Companies Act, 2013 Fine will be as follows : On Company – upto Rs. 25,000 On Directors, CFO and CS Imprisonment – up to 6 Months or Fine – not less than Rs. 25,000 upto Rs. 3,00,000 per person

Exemption 1. Form MSME-1 is not applicable in the case of Medium Enterprises; Particulars Medium Enterprises 2. 3. Manufacturing Sector (Investment in plant & machinery) Service Sector (Investment in equipment) More than Rs. 5 Crore but does not exceed Rs. 10 Crore More than Rs. 2 Crore but does not exceed Rs. 5 Crore This Rule applicable only for those Specified Companies whose payment to Micro & Small Enterprises exceed 45 days from the date of acceptance or the date of deemed acceptance of the goods or services as per the provisions of section 9 of the MSME Development Act, 2006; If payment Exceed 45 days but supplier/Creditors given a declaration that they do not fall under Micro or small Enterprises.

FORMM SME-1

FORM BEN

Form BEN 1. These rules may be called the Companies (Significant Beneficial Owners) Amendment Rules, 2019. 2. In the Companies (Significant Beneficial Owners) Rules, 2018, in rule 2, in sub-rule (1), for clauses (b) to (e), the following clauses shall be substituted, namely:(b) “control” means control as defined in clause (27) of section 2 of the Act; (c) "form" means the form specified in Annexure to these rules; (d) “majority stake” means;i. holding more than one-half of the equity share capital in the body corporate; or ii. holding more than one-half of the voting rights in the body corporate; or iii. having the right to receive or participate in more than one-half of the distributable dividend or any other distribution by the body corporate; (e) “partnership entity” means a partnership firm registered under the Indian Partnership Act, 1932 (9 of 1932) or a limited liability partnership registered under the Limited Liability Partnership Act, 2008 (6 of 2009);

Form BEN (f) “reporting company” means a company as defined in clause (20) of section 2 of the Act, required to comply with the requirements of section 90 of the Act; (g) “section” means a section of the Act; (h) “significant beneficial owner” in relation to a reporting company means an individual referred to in subsection (1) of section 90, who acting alone or together, or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting company, namely:i. holds indirectly, or together with any direct holdings, not less than ten per cent. of the shares; ii. holds indirectly, or together with any direct holdings, not less than ten per cent. of the voting rights in the shares; iii. has right to receive or participate in not less than ten per cent. of the total distributable dividend, or any other distribution, in a financial year through indirect holdings alone, or together with any direct holdings; iv. has right to exercise, or actually exercises, significant influence or control, in any manner other than through direct holdings alone:

Who is a Significant Beneficial Owner(SBO)? A person is considered as a Significant Beneficial Owner (SBO) if he/she, whether acting alone, together or through one or more individuals or trust holds a beneficial interest of at least 10% (25% previously). The Amended SBO Rules provide that a Significant Beneficial Owner is an individual, who: Holds indirectly, or along with any direct holdings, at least 10% per cent of the shares of the company. Holds indirectly, or along with any direct holdings, at least 10% of the voting rights in the shares of the company. Has been vested with the right to receive or participate in at least 10% of the total distributable dividend, or any other distribution in a financial year solely through indirect holdings, or along with any direct holdings. Has been vested with the right of exercising significant influence or control through directholdings and other means.

Timeline as per Amendment Rules Form Timeline Particulars One Time Filing under SBO Rules Form BEN-1 90 days from the date of notification in official gazette viz. on or before May 8, 2019 Ever Individual who is a significant beneficial owner needs to file form BEN -1 as per revised format to the Reporting Company. eForm BEN-2 30 days from receipt of BEN-1 by the Company Upon receipt of declaration by the Company in form BEN-1, the Company is required to file eForm BEN-2 with ROC. Regular Filings Form BEN-1 30 days on subsequently becoming Significant Beneficial Owners * Every individual, who subsequently becomes a significant beneficial owner, or where his significant beneficial ownership undergoes any change shall file a declaration in Form No. BEN-1 to the reporting company, within thirty days of acquiring such significant beneficial ownership or any change therein. eForm BEN-2 30 days from receipt of BEN-1 by the Company Upon receipt of declaration by the Company in form BEN-1, the Company is required to file eForm BEN-2 with ROC.

Responsibilities of the Reporting Company Reporting Companies, as per the amended rules, are required to identify the existence of a SBO associated with it and necessitate him/her to file a declaration in Form Ben-1. The Reporting Company may issue a notice to a member seeking information in Form BEN-4 if the latter holds at least 10% of the former’s shares, voting rights or right to receive or partake in the dividend or any other distribution payable in a financial year. Apart from these, a Reporting Company is obligated to: File a return in Form BEN-2 with the Registrar with respect to any declaration made by a Significant Beneficial Owner and any changes in the Significant Beneficial Ownership. Maintain a register of Significant Beneficial Owners in Form BEN-3. The register must include their respective names, addresses, date of birth and details of ownership. Issue notice to all its non-individual members who are holding more than 10% of the shares requiring them to disclose information of the SBO of such member (in Form BEN4). File an application to the National Company Law Tribunal (NCLT) to impose restrictions on the shares if a person doesn’t provide the required information.

Forms & Purposes Form under SBO Rules Purpose and Details Form BEN 1 Declaration by the beneficial owner who holds or acquires significant beneficial ownership in shares eForm BEN 2 Return to the Registrar in respect of declaration under section 90 Form BEN 3 Register of beneficial owners holding significant beneficial interest Form BEN 4 Notice seeking information about significant beneficial owners

Non-applicability of Rules: a) the authority constituted under sub-section (5) of section 125 of the Act; b)its holding reporting company: Provided that the details of such holding reporting company shall be reported in Form No. BEN-2. c) the Central Government, State Government or any local Authority; d) i. a reporting company, or ii. a body corporate, or iii. an entity controlled by the Central Government or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments; e)Securities and Exchange Board of India registered Investment Vehicles (such as mutual funds, alternative investment funds (AIF), Real Estate Investment Trusts (REITs) ) f) Investment Vehicles regulated by RBI or IRDA or Pension Fund Regulatory and Development Authority.

Penalties SBO’s not filing Form BEN-1 would be imposed a fine ranging between INR 1,00,000 to INR 10,00,000 lakhs; and for a continuing offence, an additional fine of INR 1000 would be imposed for every day of default. Companies which are not compliant with the respective norms would be penalized with a sum of INR 10,00,000 to INR 50,00,000 (also applies to the people in-charge); and for continued offences, an additional fine of Rs. 1000 would be imposed for every day of default.

Practical Issues in Form BEN Q. If Mr. X holds 5% of equity shares in XYZ Pvt. Ltd., but he has no beneficial interest in such shares. Mr. M is the beneficial owner of these shares. A. In this case section 89 is applicable. Mr. X will have to file declaration in Form No.MGT-4 with in a period of 30 days from the date on which his/her name is entered in the Register of Members of such company and Mr. M will have to file declaration in Form No.MGT-5 with the company within 30 days after acquiring such beneficial interest in the shares of the company. The company will have to file declaration with the ROC in Form No.MGT-6 within 30 days of receipt of the Forms MGT-4 and MGT-5. Q. PB Pvt. Ltd. Is holding 8% of the Equity shares of XYZ Ltd and Mr. P is holding 4% of the equity shares in XYZ Ltd. P is also holding 51% of equity shares of PB Pvt. Ltd. A. In this case Mr. P will be deemed to be holding significant beneficial ownership in shares of XYZ Ltd, as he is indirectly holding interest in 8% equity shares (through PB Pvt. Ltd.) and directly holding 45 of equity shares. In this case Mr. P will have to file declaration in Form No. BEN-1 with XYZ Ltd. Q. AB Pvt. Ltd. Is holding 15% of equity shares of XYZ Ltd. Mr. A is holding 55% of equity shares in AB Ltd. A. In this case Mr. A will be considered as holding significant beneficial ownership of more than 10% of equity shares of XYZ Ltd. This is because Mr. A will be considered to have 15% indirect ownership of shares of XYZ Ltd. through AB Pvt. Ltd. There for Mr. A will have to file declaration in Form No. BEN-1

Practical Issues in Form BEN Q. ABC (HUF) through Karta Mr. B is the owner of 12% equity shares of XYZ Ltd. A. In this case Mr B will be considered as indirect owner of the shares and he will have to file declaration in Form No. BEN-1.No other member of HUF has to file this declaration Q. Mrs .N is the Trustee of NPS Trust There are two beneficiaries of the trust who have equal share Mrs. N in her capacity of Trustee is holding 20% equity shares in ABC Ltd A. In this case each beneficiary will be deemed to have significant beneficial ownership in shares of ABC Ltd. There for each beneficiary will have to file declaration in Form No. BEN-1.if the Trust is a discretionary Trust the above declaration is to filed by the trustee only. If the Trust is a revocable Trust such declaration is to be filed only by the settler of Trust. Q. JDS LLP is holding 25% equity shares of ABC Ltd. Mr. J Mr. D Mr. S and JDS Pvt. Ltd. Are partners of JDS LLP. A. In this case Mr. J Mr. D Mr. S will be deemed to be significant beneficial owners of the shares and each of them will have to file declaration in Form No.BEN-1. There is one Mr. R who holds 60% of equity shares of JDS Pvt. Ltd (one of the partners of JDS LLP) there for Mr. R will also be considered as significant beneficial owner of shares of ABC Ltd and he will also be required to file declaration in Form No.BEN-1

Practical Issues in Form BEN Q. There are following members in PR Ltd. Sl. No 1 2 3 4 5 6 Name CD Pvt. Ltd ABC(HUF) (through Karta) PDS LLP DC (Trust)(Discretionary Trust) XYZ and Co.(partnership firm)(through its partner A) Others Total Percentage 2% 4% 3% 5% 8% 78% 100% Mr. A holds 55% equity shares in CD Pvt. Ltd. he is the Karta of ABC (HUF) He is also a partner of PDS LLP and XYZ co. And a Trustee of DC Trust. All these entities together own 22% of equity shares in PR Ltd. There for Mr a will be treated as having significant beneficial ownership of more than 10% of equity shares of PR Ltd. And he will have to file declaration in FormNo.BEN-1.

Summing Up All individuals who are having investments in shares of companies directly or indirectly will have to study these provisions and file declaration in Form No. BEN-1 within the prescribed time limit. These provisions are made to locate persons who hold control in a company through benami holdings. There provisions are brought about with a hope to curb some unethical practices which are at present adopted by certain individuals and companies for exercising control over and to influence certain corporate decisions.

FORM INC-35 AGILE

Laws Governing the eForm AGILE INC-35 eForm AGILE INC-35 is required to be filed according to rule 38(A) of the Companies (Incorporation) Rules, 2014. Rule 38A : Application for registration of Goods and Service Tax Identification Number (GSTIN), Employee State Insurance Corporation (ESIC) registration and Employees' Provident Fund Organisation (EPFO) registration. The application for incorporation of a company under rule 38 shall be accompanied by e-form AGILE (INC-35) containing an application for registration of the following numbers, namely:a) GSTIN with effect from 31st March, 2019 b) EPFO with effect from 8th April, 2019 c) ESIC with effect from 15th April, 2019

Purpose Any user who intends to incorporate company through SPICe eform can now also apply for GSTIN / Establishment code as issued by EPFO through this eform (INC-35). User is required to file application (SPICe) for incorporation of a company accompanying linked e-form AGILE “Application for Goods and services tax Identification number, employees state Insurance corporation registration pLus Employees provident fund organisation registration” along with eform SPICe MOA (INC-33) and eForm SPICe AOA (INC-34) to obtain GSTIN / Establishment Code. This process will be applicable only for Companies incorporated by MCA through SPICe application. Other categories of applicants (Tax Deductor, Tax Collector, Casual Taxable person, ISD, etc.) for GSTIN shall follow the existing process of registration through Common Portal for GST registration Similarly, other type of establishment such as Factory shall follow the existing process of registration through Common Portal for EPFO registration

INSTRUCTIONS SL No. / Section Name 1 Field Name Do you want to apply for Applying for GSTIN / EPFO at the time of incorporation is not mandatory. additional services like In case you wish to apply for any additional services at the time of incorporation, user GSTIN / EPFO can select the type of service and proceed. Based on service checkbox selected by user, all the relevant fields as applicable to the respective service shall be displayed in editable mode in the form. 3 State 4 District 5 6 Instructions Select the state for which GST / EPFO registration needs to be obtained. Please note that it should be same as entered in SPICe eform. Select the district in which user need to apply for GSTIN / EPFO. Please note that it should be same as entered in SPICe eform. State Jurisdiction Sector / Select the value from the dropdown – Sector / Circle / Ward /Charge / Unit Circle / Ward /Charge / In case you do not know state jurisdiction, please refer your state website to know Unit your Sector / Circle / Ward /Charge / Unit. Centre Jurisdiction In the Commissionerate Code, Division Code and Range Code drop-down list, select the appropriate value.

8 Whether the Establishment On Lease 9 Option for Composition 10 12 Select ‘Yes’ in case you want to opt for the composition scheme, or else select No. In case of Yes Select the checkbox for accepting the declaration for opting for Composition. Select the “Category of Registered Person” opting for composition Nature of Business Activity being Select the checkbox for “Nature of Business Activity” being carried out. carried out at above mentioned Multiple checkbox can be selected. Premises A 11 Select ‘Yes’ in case Establishment is on lease or else ‘No”. In case of ‘Yes’ Enter Leased From Date to date. Primary Business Activity Select the Primary Business Activity as applicable. Details of the Goods supplied by the For HSN code: kindly refer HSN Code as provided on CBIC website (www.cbic.gov.in ) Business and enter the HSN Code and click on prefill button HSN code (4 Digit) Description shall be auto populated based on HSN entered Details of Services supplied by the Business. For SAC code: kindly refer SAC Code as provided on CBIC website (www.cbic.gov.in ) and enter the SAC Code and click on prefill button Description shall be auto populated based on HSN

13 Director / Primary Owners Details Number of Director / Primary Owner details to be entered 1. Enter the number of director / Primary Owners details. Based on the number entered, blocks would be generated dynamically. 2. Value to be entered in this field shall be less than or equal to 5 3. Minimum number of proposed directors’ details to be entered for OPC shall be 1, 2 in case of private company, 3 in case of public limited company and 5 in case of Producer Company. 13 A Enter Director / Primary Note: Details of the Proposed Director / Primary Owner who will act as the Authorised signatory for the Owners details who is also an purpose of applying GSTIN / EPFO shall be entered here. Authorised Signatory Note that the details of such proposed director entered here should match the details as entered in the SPICe form for the same person. Note that the Director / Primary Owners cum Authorised signatory must have valid PAN and he must be Citizen & Resident of India. Either DIN / PAN should be entered. In case DIN is entered, click on Prefill button. PAN and applicant’s full name will be prefilled based on / Primary Owners the information available in the MCA records. In case PAN is entered, all details must be entered by the applicant. Enter valid Indian mobile number and email Id and click on “Send OTP” button. Enter the OTP sent on mobile number and email id as entered above and click on Verify button. Attach Photo of proposed director cum authorised signatory. – Size of photo shall not exceed 100KB. – Only .JPG format is allowed. 13 (B) Director Details / Primary Owners other than Authorised Signatory Note: Details of the Proposed Director / Primary Owner other than Authorised signatory mentioned in 13 (A) above but limited to 1 in case of private (other than OPC), 2 in case of public and 4 in case of producer company shall be entered here. Note that the details of such proposed director entered here should match the details as entered in the SPICe form for the same person. Attach Photo of proposed director other than authorised signatory. – Size of photo shall not exceed 100KB. – Only .JPG format is allowed.

Attachments Proof of Principal place of business Proof of appointment of Authorized Signatory Attach the proof of principal place of business based on the value selected in field 8 (a). Maximum Size of document to be attached · Property Tax Receipt – 100 KB · Municipal Khata copy – 100KB · Electricity Bill – 100 KB · Rent/ Lease Agreement – 2MB · Consent Letter – 100KB · Rent receipt with NOC (In case of no/expired agreement) – 1MB · Legal ownership document – 1MB Document should be attached in PDF. . Attach the proof for appointment of Authorised signatory. Maximum Size of document to be attached · Letter of Authorisation – 100 KB · Copy of Resolution passed by BoD/Managing Committee and Acceptance letter – 100KB Declaration Declaration shall be made by director / Primary Owner who is also an Authorised Signatory To be Digitally Signed By DSC Ensure that the eForm is digitally signed by the Proposed Director / Primary Owner who has signed the SPICe eform. Both SPICe form and AGILE form shall be signed by same director who is also the authorised signatory. The eForm should be digitally signed by Authorised Signatory who is citizen and resident of India and have PAN.

FOR M INC-35

FOR M INC-35

FOR M INC-35

AMENDMENTS IN COMPANIES (INCORPORATION) RULES, 2014

Amendments in Companies (Incorporation) Rules, 2014 There has been recent amendments to the rules by the Corporate Affairs Ministry in order to bring about uniformity and clarity to the process of naming a company. This was brought about as there have been many instances where company names were rejected due to trademark issues, proposed names being to general etc. With these amendments, they expect to ensure more clarity, uniformity and transparency in the naming process.

ILLUSTRATIONS Few examples of the things to be avoided while naming a company are as follows: The plural or singular form of words in one or both names; for example i. Green Technology Ltd. is same as Greens Technology Ltd. and Greens Technologies Ltd. ii. Pratap Technology Ltd. is same as Prataps Technology Ltd. and Prataps Technologies Ltd. iii. SM Computers Ltd. is not same as SMS Computers Ltd Type and case of letters, spacing between letters, punctuation marks and special characters used in one or both names; for example i. ABC Ltd. is same as A.B.C. Ltd. and A B C Ltd. ii. TeamWork Ltd. is same as Team@Work Ltd. and Team-Work Ltd. the order of words in the names; for example i. ii. Ravi Builders and Contractors Ltd. is same as Ravi Contractors and Builders Ltd. Ravi Builders and Contractors Limited is not the same as Ravi Shankar Builders and Contractors Limited.

THANK YOU Presented by : CA MADHUKUTTAN PILLAI V K G & Associates Chartered Accountants CC 37/1252, "Jyothy" Palathuruthu, Kadavanthra Ernakulam,Kerala - 682020 Mob: 94 9400 81 3410 Office LL: 0484-4015549 Office Mob: 91 6282 12 4515 Email : [email protected]