Workshop on the Insurance Core Principles IV Conference on Insurance

17 Slides349.00 KB

Workshop on the Insurance Core Principles IV Conference on Insurance Regulation and Supervision in Latin America Punta Cana, May 6-9 2003 Makoto Okubo, Advisor International Association of Insurance Supervisors (IAIS)

Main items I. IAIS Insurance Core Principles (ICPs) II. Revision of the ICPs III. Comparison of current and proposed ICPs IV. Questions 2 May 2003 Makoto Okubo 2 Workshop on the Insurance Core Principles

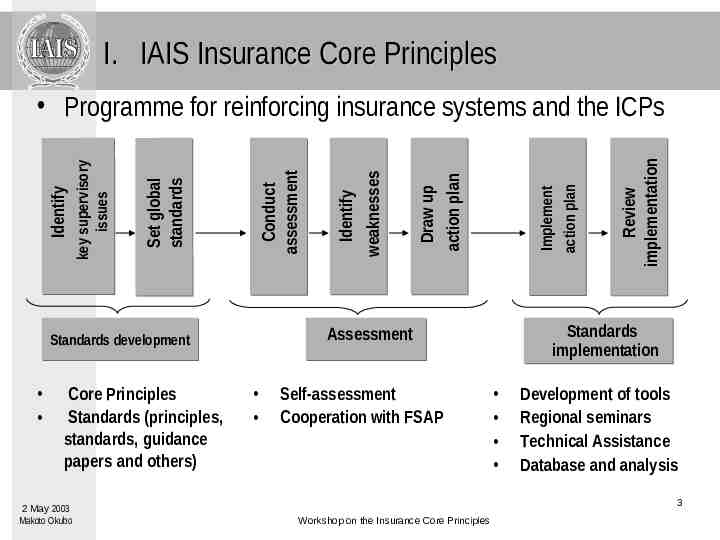

I. IAIS Insurance Core Principles Core Principles Standards (principles, standards, guidance papers and others) 2 May 2003 Makoto Okubo Self-assessment Cooperation with FSAP Review implementation Implement action plan Draw up action plan Standards implementation Assessment Standards development Identify weaknesses Conduct assessment Set global standards key supervisory issues Identify Programme for reinforcing insurance systems and the ICPs Development of tools Regional seminars Technical Assistance Database and analysis 3 Workshop on the Insurance Core Principles

I. IAIS Insurance Core Principles Background – IAIS established in 1994 – Insurance Supervisory Principles in 1997 – Secretariat set-up in Basel in 1998 – FSAP (the Financial Sector Assessment Program) started in 1999 2 May 2003 Makoto Okubo 4 Workshop on the Insurance Core Principles

I. IAIS Insurance Core Principles Background (cont.) – The Insurance Core Principles and Insurance Core Principles Methodology in 2000 – Self-assessment programme developed in 2000 – The Joint Forum comparison of the core principles in banking, insurance and securities sectors in 2001 2 May 2003 Makoto Okubo 5 Workshop on the Insurance Core Principles

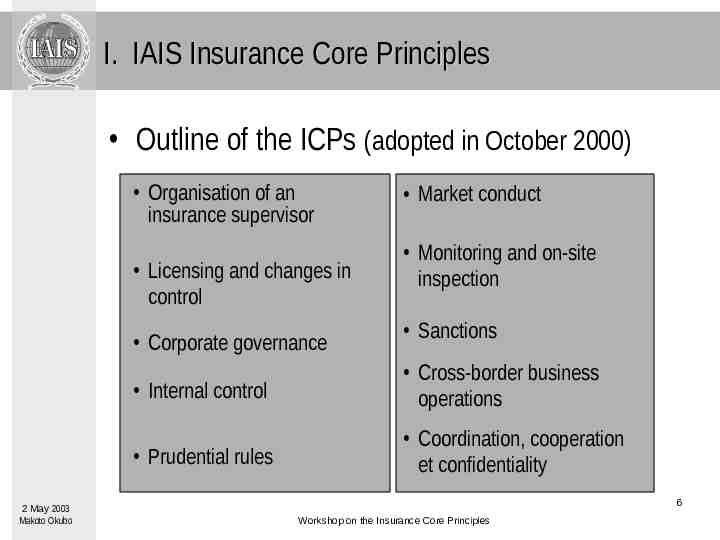

I. IAIS Insurance Core Principles Outline of the ICPs (adopted in October 2000) Organisation of an insurance supervisor Licensing and changes in control Corporate governance 2 May 2003 Makoto Okubo Market conduct Monitoring and on-site inspection Sanctions Internal control Cross-border business operations Prudential rules Coordination, cooperation et confidentiality 6 Workshop on the Insurance Core Principles

II. Revision to the ICPs The Workplan – The Task Force on the Revisions to the Insurance Core Principles and Methodology in January 2002 – A new overall framework in March 2002 – Draft for consultation completed by early 2003 – A final document for adoption in Singapore in October 2003 2 May 2003 Makoto Okubo 7 Workshop on the Insurance Core Principles

II. Revision to the ICPs The draft ICPs take into account: – Members’ experience in completing the selfassessment programme – The experience of members and international financial institutions in undertaking the FSAP – The report of the Joint Forum’s working group comparing the core principles in the three financial sectors – Other comments provided by members and observers 2 May 2003 Makoto Okubo 8 Workshop on the Insurance Core Principles

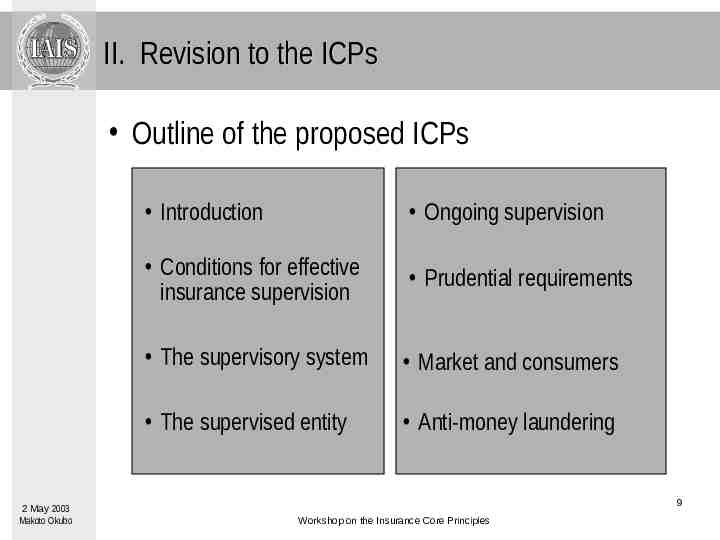

II. Revision to the ICPs Outline of the proposed ICPs 2 May 2003 Makoto Okubo Introduction Ongoing supervision Conditions for effective insurance supervision Prudential requirements The supervisory system Market and consumers The supervised entity Anti-money laundering 9 Workshop on the Insurance Core Principles

III. Comparison of current and proposed ICPs More principles are included: – The conversion of what were previously called “preconditions” into principles to emphasise their fundamental importance to the conduct of effective supervision. – The inclusion of new areas, for example, market analysis, consumer protection and anti-money laundering. – The reordering and further breaking down of some principles 2 May 2003 Makoto Okubo 10 Workshop on the Insurance Core Principles

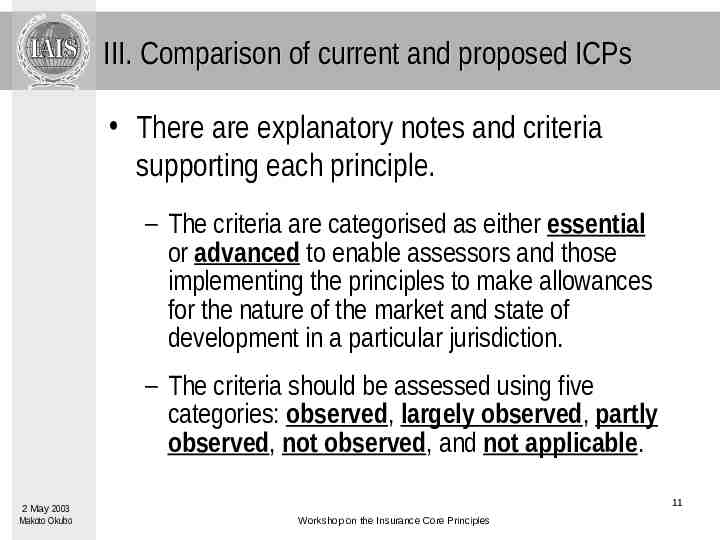

III. Comparison of current and proposed ICPs There are explanatory notes and criteria supporting each principle. – The criteria are categorised as either essential or advanced to enable assessors and those implementing the principles to make allowances for the nature of the market and state of development in a particular jurisdiction. – The criteria should be assessed using five categories: observed, largely observed, partly observed, not observed, and not applicable. 2 May 2003 Makoto Okubo 11 Workshop on the Insurance Core Principles

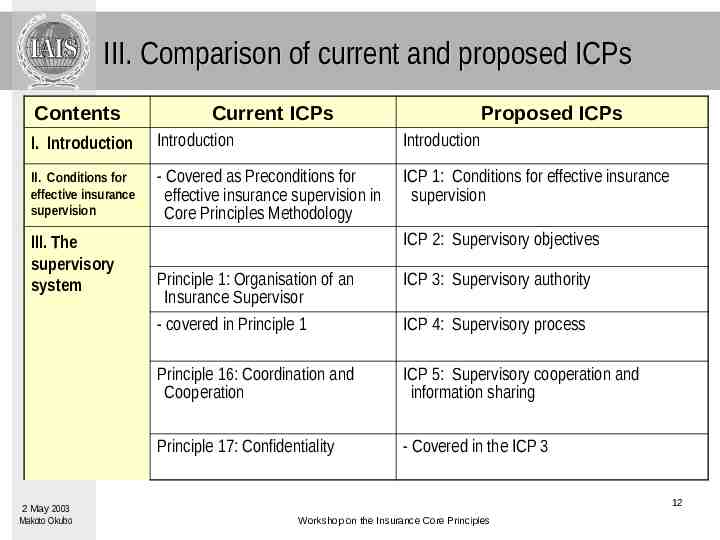

III. Comparison of current and proposed ICPs Contents Current ICPs Proposed ICPs I. Introduction Introduction Introduction II. Conditions for effective insurance supervision - Covered as Preconditions for effective insurance supervision in Core Principles Methodology ICP 1: Conditions for effective insurance supervision III. The supervisory system 2 May 2003 Makoto Okubo ICP 2: Supervisory objectives Principle 1: Organisation of an Insurance Supervisor ICP 3: Supervisory authority - covered in Principle 1 ICP 4: Supervisory process Principle 16: Coordination and Cooperation ICP 5: Supervisory cooperation and information sharing Principle 17: Confidentiality - Covered in the ICP 3 12 Workshop on the Insurance Core Principles

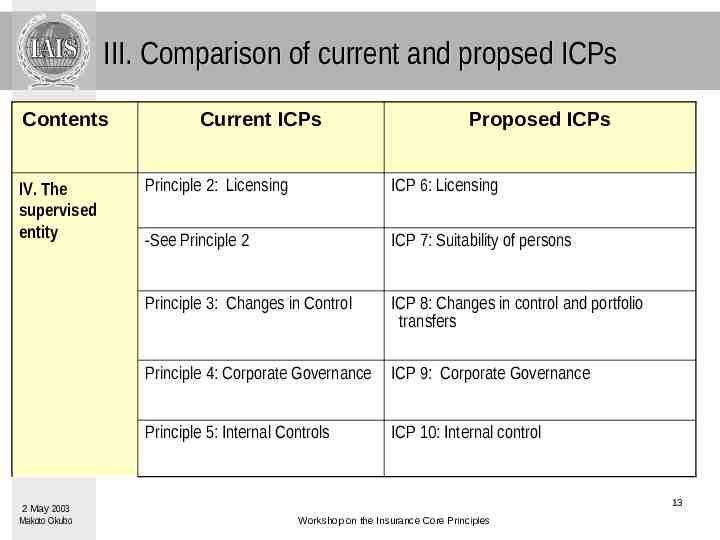

III. Comparison of current and propsed ICPs Contents IV. The supervised entity 2 May 2003 Makoto Okubo Current ICPs Proposed ICPs Principle 2: Licensing ICP 6: Licensing -See Principle 2 ICP 7: Suitability of persons Principle 3: Changes in Control ICP 8: Changes in control and portfolio transfers Principle 4: Corporate Governance ICP 9: Corporate Governance Principle 5: Internal Controls ICP 10: Internal control 13 Workshop on the Insurance Core Principles

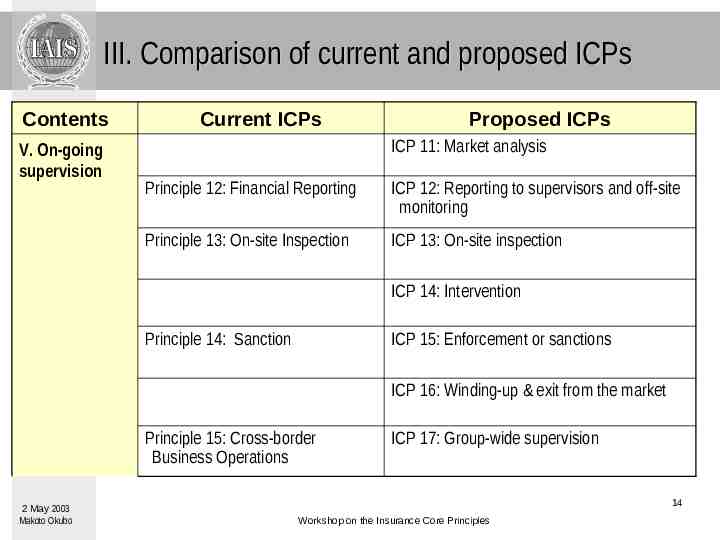

III. Comparison of current and proposed ICPs Contents V. On-going supervision Current ICPs Proposed ICPs ICP 11: Market analysis Principle 12: Financial Reporting ICP 12: Reporting to supervisors and off-site monitoring Principle 13: On-site Inspection ICP 13: On-site inspection ICP 14: Intervention Principle 14: Sanction ICP 15: Enforcement or sanctions ICP 16: Winding-up & exit from the market Principle 15: Cross-border Business Operations 2 May 2003 Makoto Okubo ICP 17: Group-wide supervision 14 Workshop on the Insurance Core Principles

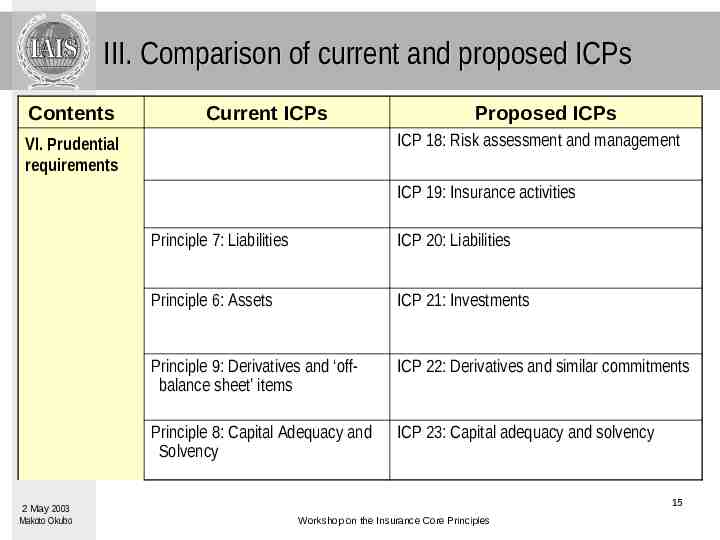

III. Comparison of current and proposed ICPs Contents Current ICPs Proposed ICPs ICP 18: Risk assessment and management VI. Prudential requirements ICP 19: Insurance activities 2 May 2003 Makoto Okubo Principle 7: Liabilities ICP 20: Liabilities Principle 6: Assets ICP 21: Investments Principle 9: Derivatives and ‘offbalance sheet’ items ICP 22: Derivatives and similar commitments Principle 8: Capital Adequacy and Solvency ICP 23: Capital adequacy and solvency 15 Workshop on the Insurance Core Principles

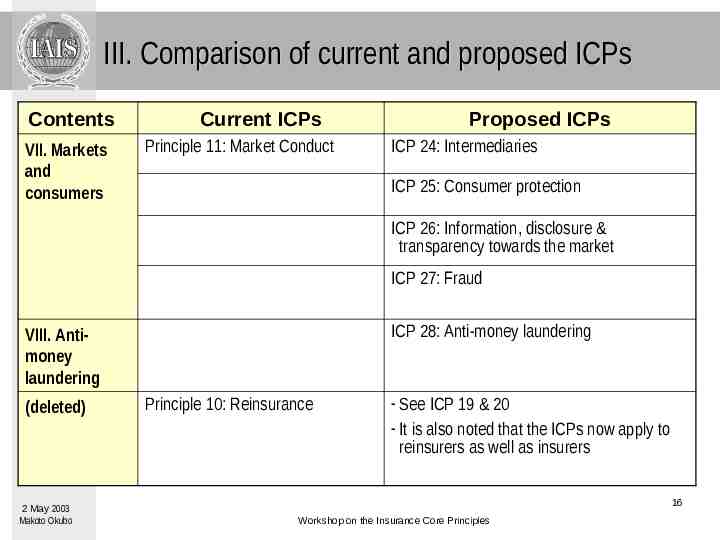

III. Comparison of current and proposed ICPs Contents VII. Markets and consumers Current ICPs Principle 11: Market Conduct Proposed ICPs ICP 24: Intermediaries ICP 25: Consumer protection ICP 26: Information, disclosure & transparency towards the market ICP 27: Fraud ICP 28: Anti-money laundering VIII. Antimoney laundering (deleted) 2 May 2003 Makoto Okubo Principle 10: Reinsurance - See ICP 19 & 20 - It is also noted that the ICPs now apply to reinsurers as well as insurers 16 Workshop on the Insurance Core Principles

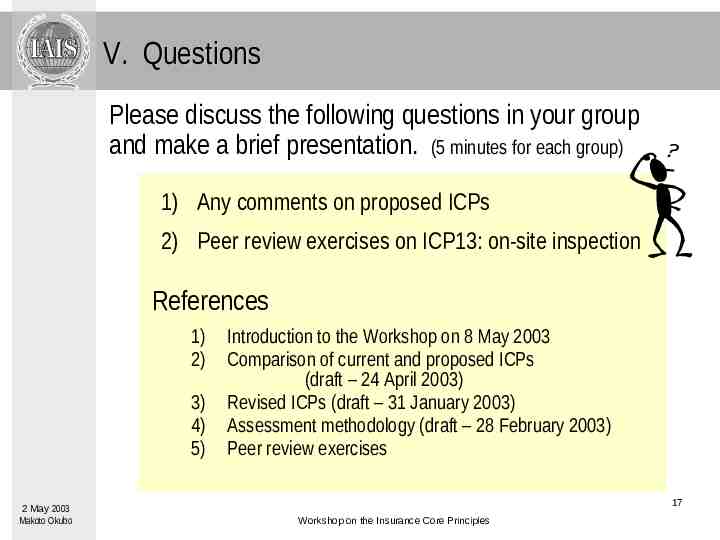

V. Questions Please discuss the following questions in your group and make a brief presentation. (5 minutes for each group) 1) Any comments on proposed ICPs 2) Peer review exercises on ICP13: on-site inspection References 1) 2) 3) 4) 5) 2 May 2003 Makoto Okubo Introduction to the Workshop on 8 May 2003 Comparison of current and proposed ICPs (draft – 24 April 2003) Revised ICPs (draft – 31 January 2003) Assessment methodology (draft – 28 February 2003) Peer review exercises 17 Workshop on the Insurance Core Principles