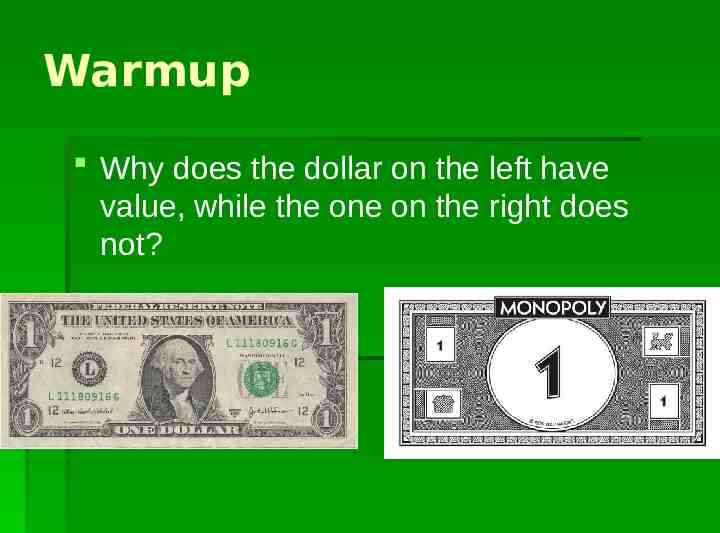

Warmup Why does the dollar on the left have value, while the one on

36 Slides1.79 MB

Warmup Why does the dollar on the left have value, while the one on the right does not?

Money, Banking and Finance Economics Unit IV

What functions does money have? Medium of exchange – traded for goods and services Store of value – hold wealth in form of money until ready to use Measure of value – measuring stick used to assign value to a good or service

What types of money can be used? Historically – salt, animal hides, gems, and tobacco Today (Currency) – coins and paper money.

What gives money value? We do; we have confidence that someone else will accept our money as payment. A 10 bill costs a few cents to make and has no other value or use Checking and savings accounts are just numbers on a computer that we have given value to.

What types of institutions work within our financial system? Commercial Banks – financial institutions that offer full banking to individuals and businesses. Savings and Loan associations (S&L) – similar to banks, they loan money for buying homes. Credit Unions – not-for-profit, open only to members of the group sponsoring them.

What makes our financial system safe? FDIC – Federal Deposit Insurance corporation, insures accounts up to 100,000. Government Regulation – banks must answer to many rules and regulations

What is the Federal Reserve System? When banks need money, they borrow from the Fed.

What are the main functions of the Federal Reserve? Regulator Government’s bank Monetary Policy

What are the main functions of the Federal Reserve? Regulator. Approves mergers of large banks controls international banking and US banking relations regulates loan contracts

What are the main functions of the Federal Reserve? Government’s Bank Holds govt’s money that is used to buy goods sells government bonds and Treasury bills manages nation’s currency

What are the main functions of the Federal Reserve? Monetary Policy – controlling of the supply of money and the cost of borrowing money Loose Monetary Policy – lowering interest rates, raising money supply Tight Monetary Policy – raising interest rates, decreasing money supply

What tools does the fed use to conduct its monetary policy? Discount rate – rate the fed charges member banks for loans Higher discount rate less money supply Lower discount rate more money supply

Reserve Requirements Banks must leave a certain amount of their money in the Fed’s banks Increase reserve requirement lower money supply Decrease reserve requirement higher money supply

Open Market Operations Changing the money supply Buying bonds higher money supply Selling bonds lower money supply

How do interest rates affect business activity? Increase in interest rates less business activity decreases the money supply Decrease in interest rates more business activity increase in money supply

How did the Great depression of the 1930’s affect the banking industry? Banks closed because they did not have the funds to repay investor’s savings accounts (too many loans) Led to stricter regulation

Warmup : What purpose does money serve for us?

Part II – Personal Finance

Within the free enterprise system, individuals have certain rights The right to: enter most any profession you wish The right to: buy the products you want and reject those you do not want.

Types of income Disposable Income – money left after paying for taxes; used to pay for necessities such as food, clothing, shelter. Discretionary Income – money left after paying necessities; used to satisfy wants

Caveat emptor “let the buyer beware”

Food Drug and Cosmetic Act Requires packages to list their ingredients according to the amount of each

Pure Food and Drug Act Manufacturers must prove that their product is safe.

Fair Packaging and Labeling Act Every package must have a label identifying its contents and weight

Better Business Bureau Provide information about businesses Warn consumers about dishonest business practices.

Consumer Bill of Rights Right to a safe product Right to be informed Right to choose (competition) Right to be heard Right to redress (payment for damages)

What responsibilities do consumers have? Make smart buying decisions Stay informed about businesses Report faulty products Make fair complaints Seek help for unsettled claims

Personal Economics Terms Budget – a record of the money you earn and spend Income – the money you make from working Expenses – things you spend money on, even saving accounts

The Budget Balanced budget – expenses income Budget surplus – expenses income Budget deficit – expenses income

What is credit? Borrowing money to pay for something now while promising to repay it later

Where do people go to borrow credit? Banks, Credit unions, Finance companies Stores and businesses

Why should people save money? To make large purchases Emergencies Luxuries

What is the advantage of putting savings in a bank? Offers easy availability of funds Withdraw funds at any time without paying a penalty or fee Earn interest on savings

What are investments? Putting your money at risk in order to make more money ***Stocks, bonds, and mutual funds carry more risk than savings accounts, but they can provide greater reward.*** OR

What are other ways to invest money? Stocks – partial ownership of a company Dividend – payment of company earnings to investors Bonds – lending money to a company or government Mutual funds – money from many people is pooled and invested in a selection of stocks and bonds.