UNDERSTANDING THE LAW – PROTECTING YOUR RATE C U S T O M E R D R I

43 Slides1.87 MB

UNDERSTANDING THE LAW – PROTECTING YOUR RATE C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

A “contributing” Employer’s state unemployment tax is “experience rated” C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

The “experience” is your history of benefit charges and unemployment tax payments. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

To the extent benefit charges can be controlled, so can your “experience” and thus your rate C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

The key to controlling charges is understanding how to avoid them. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

Understand how the qualifies monetarily. claimant Understand how the claimant can be disqualified or held ineligible and raise those issues if appropriate. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

Benefit Payments and Charges Disqualifications and Ineligibilities The Appeal process C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

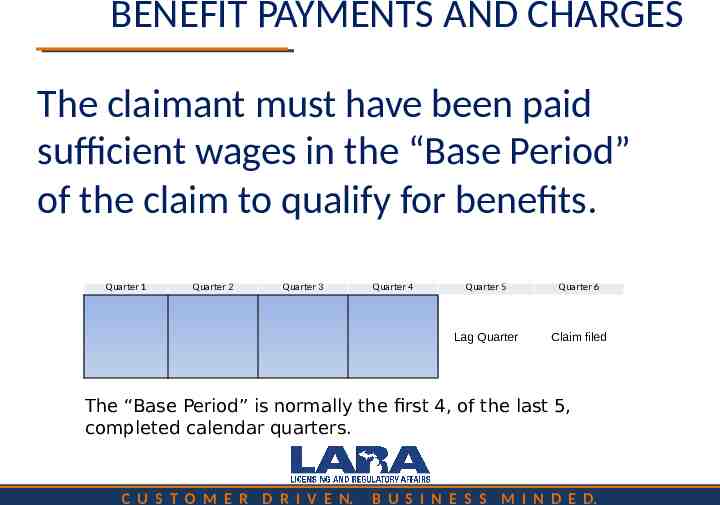

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 5 Quarter 6 Lag Quarter Claim filed The “Base Period” is normally the first 4, of the last 5, completed calendar quarters. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

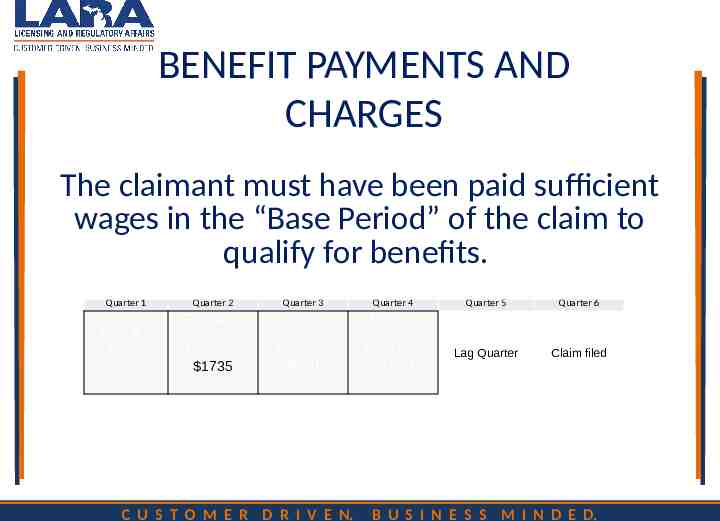

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Emp A 2500 Emp A 2850 Emp B 1735 Emp B 2350 Emp C 500 Emp C 3500 Emp D 1500 C U S T O M E R D R I V E N. Quarter 5 Quarter 6 Lag Quarter Claim filed B U S I N E S S M I N D E D.

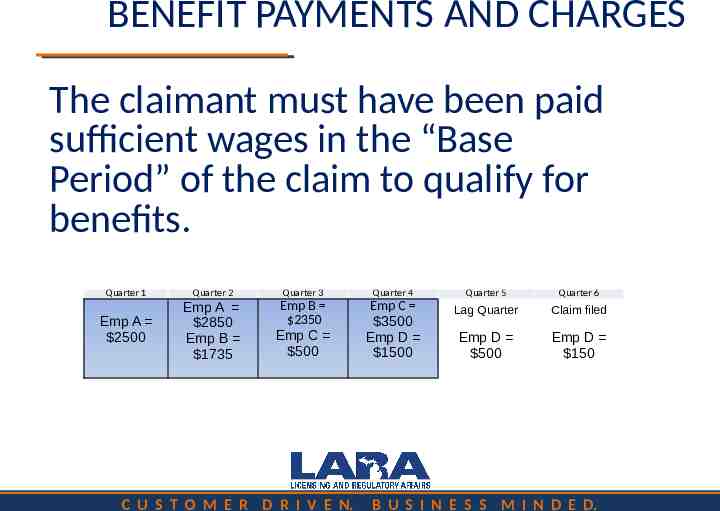

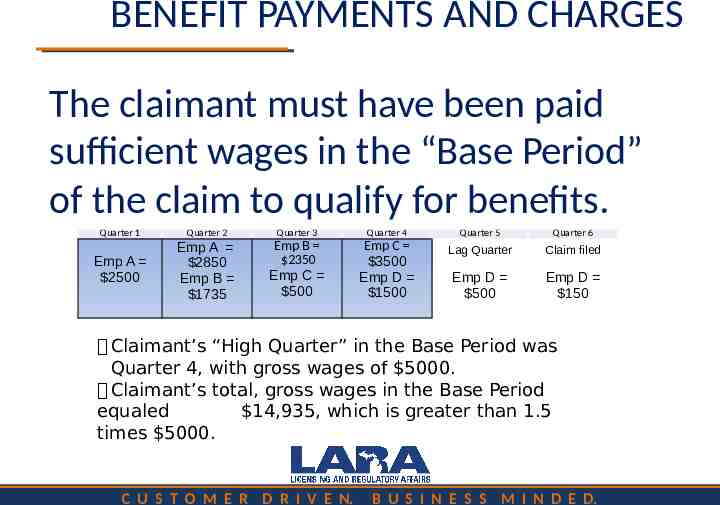

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 5 Quarter 6 Emp A 2500 Emp A 2850 Emp B 1735 Emp B 2350 Emp C 500 Emp C 3500 Emp D 1500 Lag Quarter Claim filed Emp D 500 Emp D 150 C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

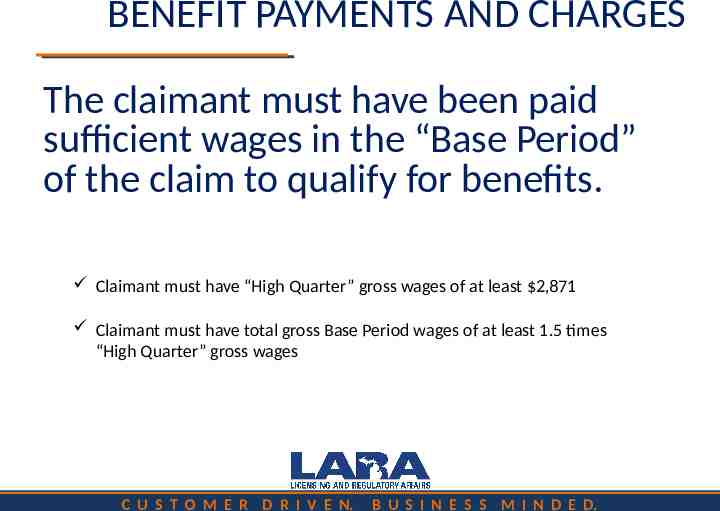

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. Claimant must have “High Quarter” gross wages of at least 2,871 Claimant must have total gross Base Period wages of at least 1.5 times “High Quarter” gross wages C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 5 Quarter 6 Emp A 2500 Emp A 2850 Emp B 1735 Emp B 2350 Emp C 500 Emp C 3500 Emp D 1500 Lag Quarter Claim filed Emp D 500 Emp D 150 Claimant’s “High Quarter” in the Base Period was Quarter 4, with gross wages of 5000. Claimant’s total, gross wages in the Base Period equaled 14,935, which is greater than 1.5 times 5000. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

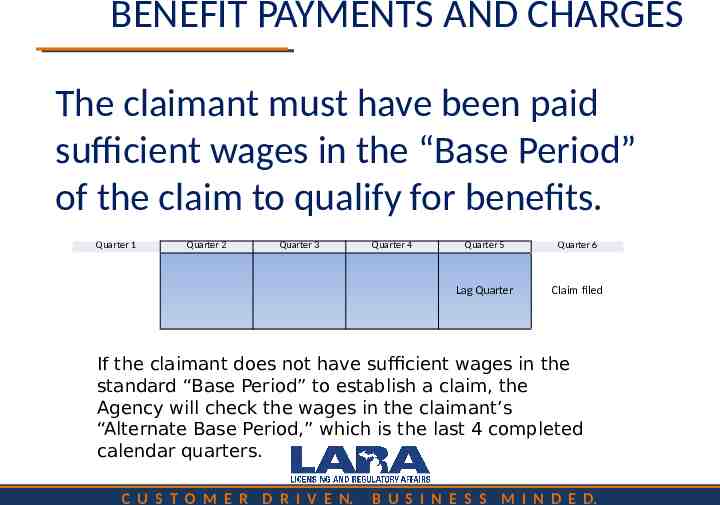

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 5 Quarter 6 Lag Quarter Claim filed If the claimant does not have sufficient wages in the standard “Base Period” to establish a claim, the Agency will check the wages in the claimant’s “Alternate Base Period,” which is the last 4 completed calendar quarters. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES The claimant must have been paid sufficient wages in the “Base Period” of the claim to qualify for benefits. Quarter 1 Quarter 2 Quarter 3 C U S T O M E R D R I V E N. Quarter 4 Quarter 5 Quarter 6 Lag Quarter Claim filed B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES Once the claimant has qualified for a claim based on Base Period wages, the Agency calculates the claimant’s weekly benefit amount: The gross, high quarter wage is multiplied by 4.1% (0.041). In addition, 6.00 is added for each claimed dependent, up to 5. Then the result is rounded down to the next lower dollar amount. That is the worker’s weekly benefit amount. But the weekly benefit amount is capped by law at 362. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES For a claimant with high quarter wages of 5,000 and 2 dependents, the weekly benefit amount would be calculated as follows: 5,000 x 0.041 205. Adding 12 for the 2 dependents gives a weekly benefit amount of 217. Any cents are rounded down to the next lower dollar amount. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES Once the claimant’s weekly benefit amount is calculated, the maximum number of weeks allowed on the regular state claim is calculated. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES Once the claimant’s weekly benefit amount is calculated, the maximum number of weeks allowed on the regular state claim is calculated. So, for a claimant who has base period wages of 14,935 and a weekly benefit amount of 217.00 the calculation is: 14,935 x 0.43 6,442.05 217 29.59 rounded down to 29.5 weeks, but the cap set by law is 20 weeks. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

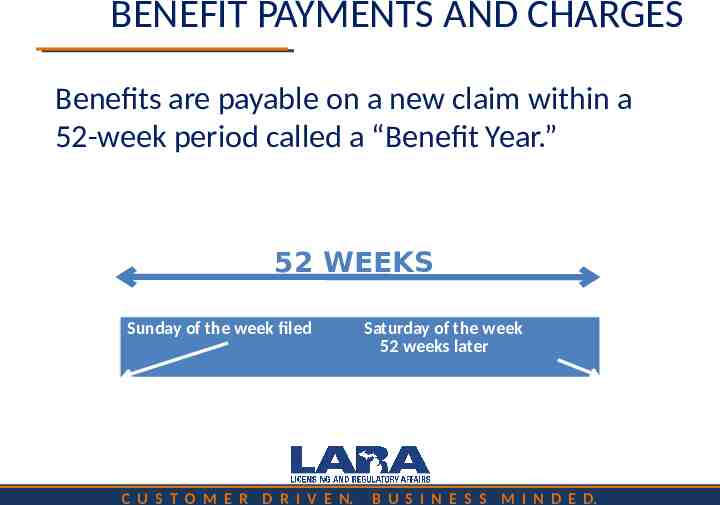

BENEFIT PAYMENTS AND CHARGES Benefits are payable on a new claim within a 52-week period called a “Benefit Year.” 52 WEEKS Sunday of the week filed C U S T O M E R D R I V E N. Saturday of the week 52 weeks later B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES Benefits payable to the claimant in a week are reduced by the following kinds of payments: C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES Benefits payable to the claimant in a week are reduced by the following kinds of payments: Earnings for services performed in the week (even if not paid during that week). Vacation pay, holiday pay, or severance pay paid in the week Vacation pay, holiday pay, or severance pay allocated by the employer to the week, even if not actually paid in that week. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

To allocate vacation pay to a week the employer must inform the claimant, in writing, before the last day of work prior to the period of allocation, of the fact of the allocation and the period it will cover, and of the fact that the allocation could render the claimant ineligible for unemployment benefits for the week(s) in that period. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

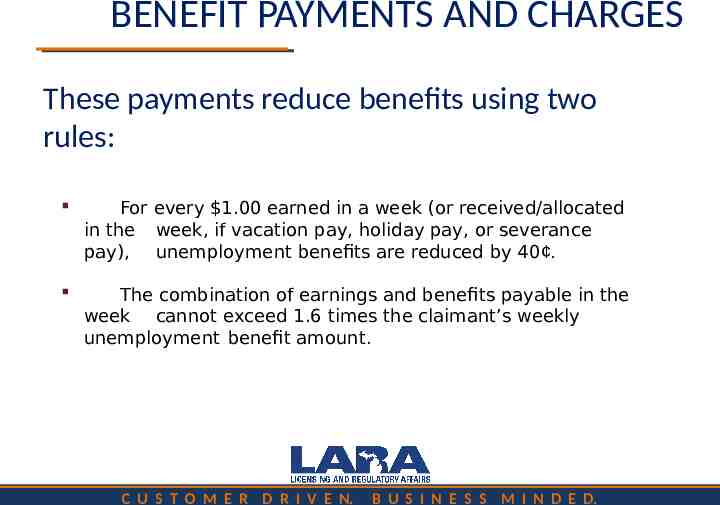

BENEFIT PAYMENTS AND CHARGES These payments reduce benefits using two rules: For every 1.00 earned in a week (or received/allocated in the week, if vacation pay, holiday pay, or severance pay), unemployment benefits are reduced by 40 . The combination of earnings and benefits payable in the week cannot exceed 1.6 times the claimant’s weekly unemployment benefit amount. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

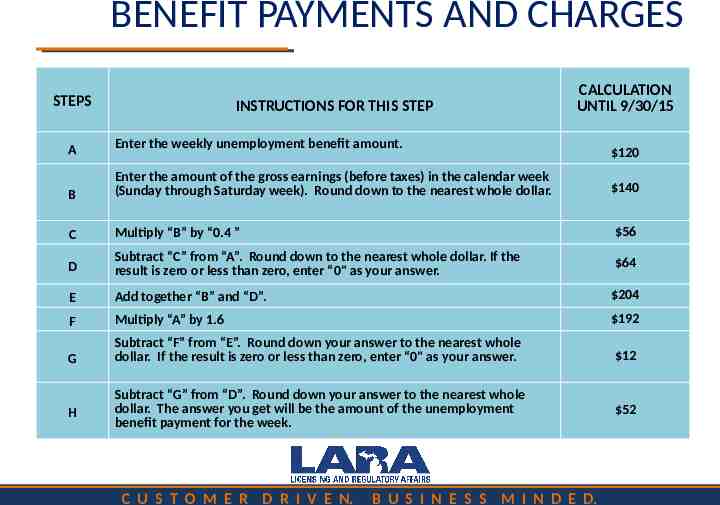

BENEFIT PAYMENTS AND CHARGES STEPS INSTRUCTIONS FOR THIS STEP CALCULATION UNTIL 9/30/15 A Enter the weekly unemployment benefit amount. B Enter the amount of the gross earnings (before taxes) in the calendar week (Sunday through Saturday week). Round down to the nearest whole dollar. 140 C Multiply “B” by “0.4 ” 56 D Subtract “C” from “A”. Round down to the nearest whole dollar. If the result is zero or less than zero, enter “0" as your answer. 64 E Add together “B” and “D”. 204 F Multiply “A” by 1.6 192 G Subtract “F” from “E”. Round down your answer to the nearest whole dollar. If the result is zero or less than zero, enter “0" as your answer. 12 Subtract “G” from “D”. Round down your answer to the nearest whole dollar. The answer you get will be the amount of the unemployment benefit payment for the week. 52 H C U S T O M E R D R I V E N. B U S I N E S S M I N D E D. 120

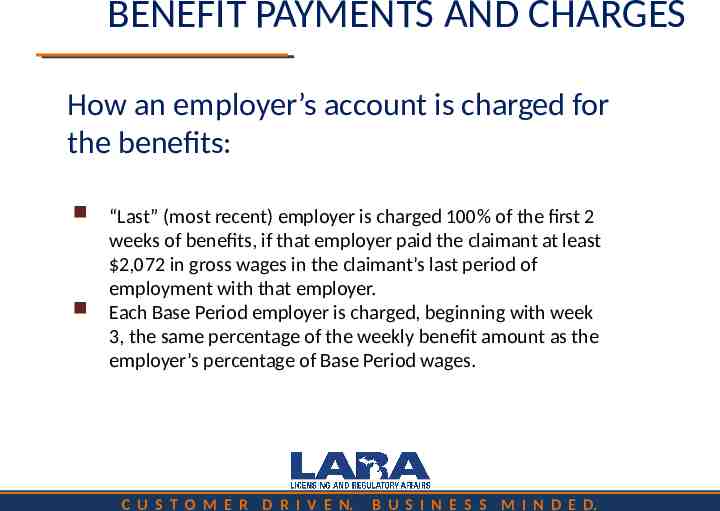

BENEFIT PAYMENTS AND CHARGES How an employer’s account is charged for the benefits: “Last” (most recent) employer is charged 100% of the first 2 weeks of benefits, if that employer paid the claimant at least 2,072 in gross wages in the claimant’s last period of employment with that employer. Each Base Period employer is charged, beginning with week 3, the same percentage of the weekly benefit amount as the employer’s percentage of Base Period wages. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

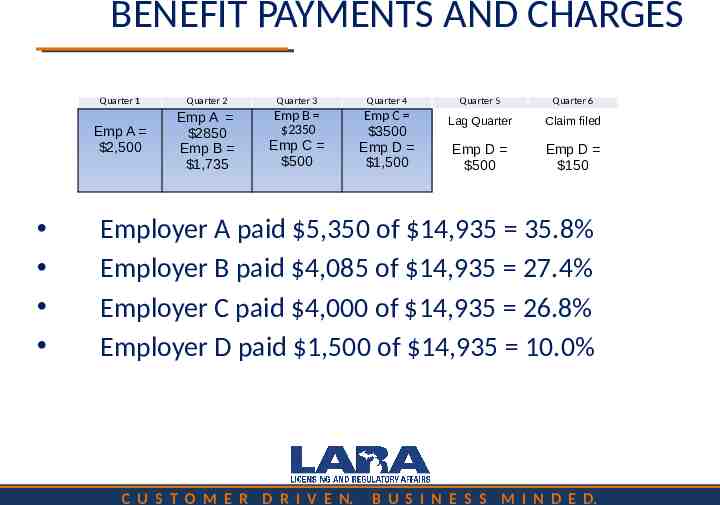

BENEFIT PAYMENTS AND CHARGES Quarter 1 Quarter 2 Quarter 3 Quarter 4 Emp A 2,500 Emp A 2850 Emp B 1,735 Emp B 2350 Emp C 500 Emp C 3500 Emp D 1,500 Quarter 5 Quarter 6 Lag Quarter Claim filed Emp D 500 Emp D 150 Employer A paid 5,350 of 14,935 35.8% Employer B paid 4,085 of 14,935 27.4% Employer C paid 4,000 of 14,935 26.8% Employer D paid 1,500 of 14,935 10.0% C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

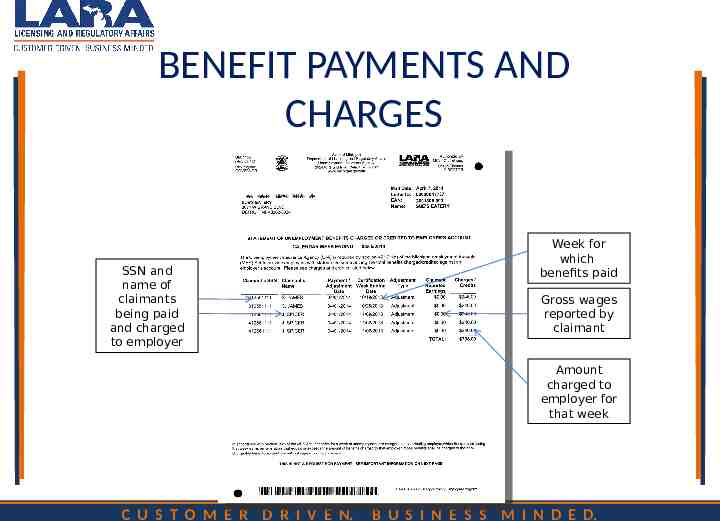

BENEFIT PAYMENTS AND CHARGES SSN and name of claimants being paid and charged to employer Week for which benefits paid Gross wages reported by claimant Amount charged to employer for that week C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

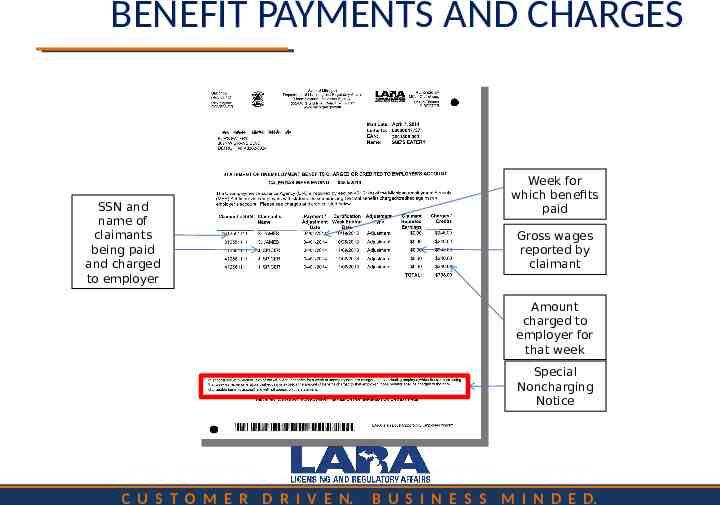

BENEFIT PAYMENTS AND CHARGES SSN and name of claimants being paid and charged to employer Week for which benefits paid Gross wages reported by claimant Amount charged to employer for that week Special Noncharging Notice C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

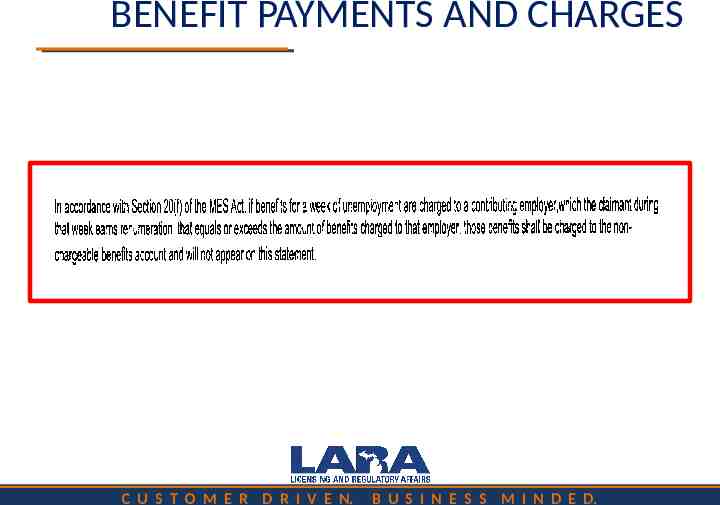

BENEFIT PAYMENTS AND CHARGES C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

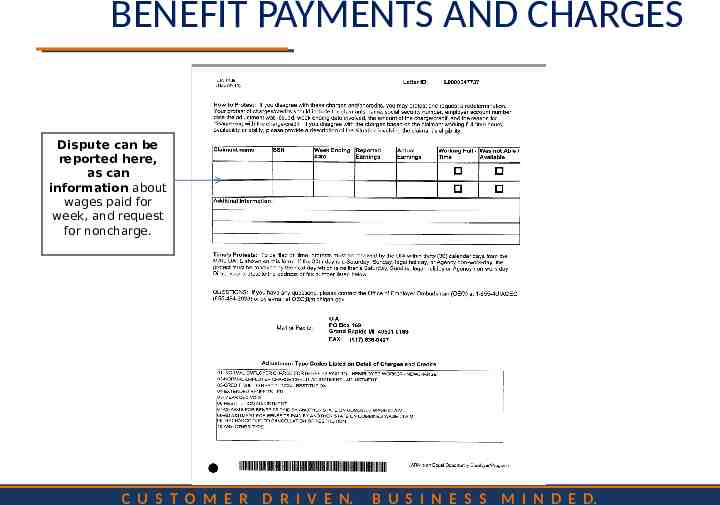

BENEFIT PAYMENTS AND CHARGES Dispute can be reported here, as can information about wages paid for week, and request for noncharge. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

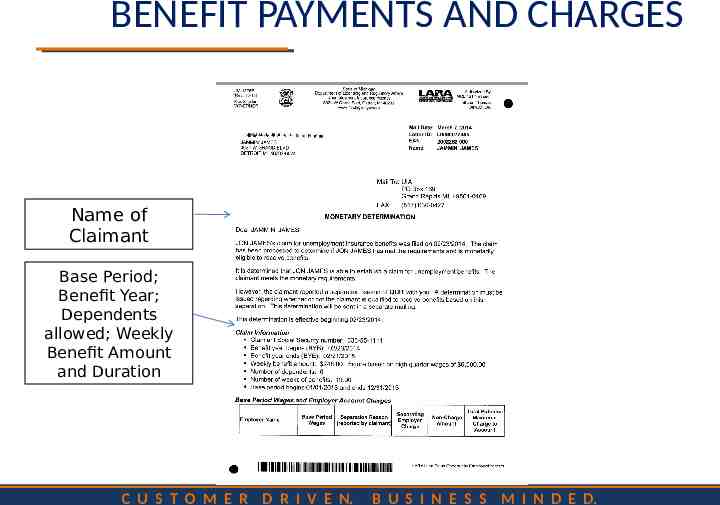

BENEFIT PAYMENTS AND CHARGES Name of Claimant Base Period; Benefit Year; Dependents allowed; Weekly Benefit Amount and Duration C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

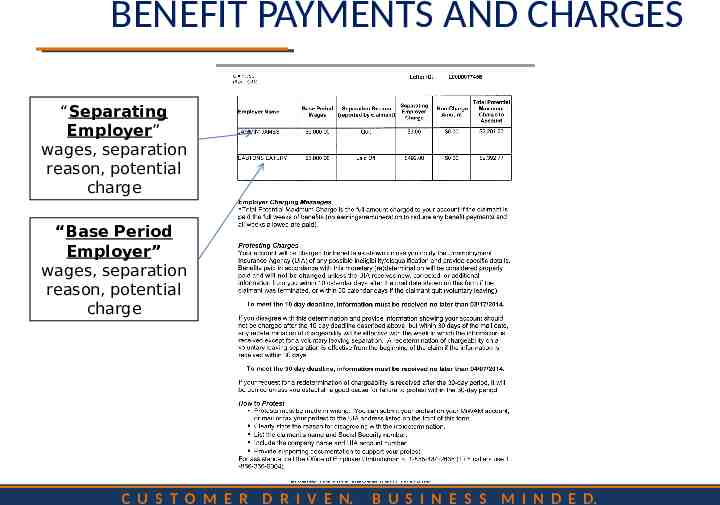

BENEFIT PAYMENTS AND CHARGES “Separating Employer” wages, separation reason, potential charge “Base Period Employer” wages, separation reason, potential charge C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

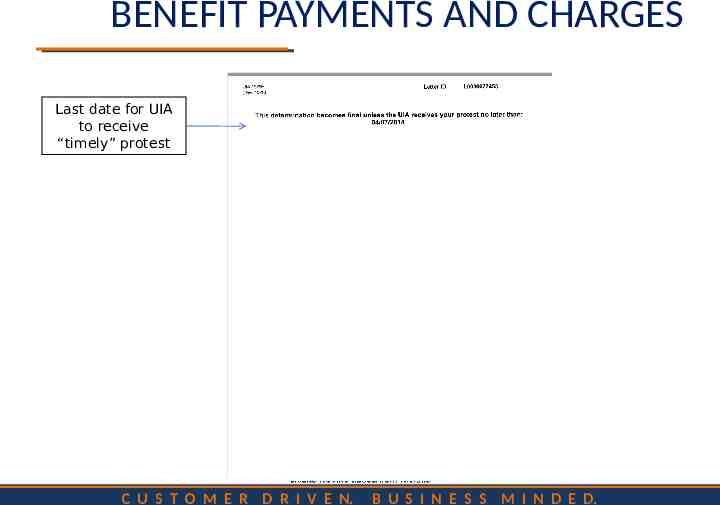

BENEFIT PAYMENTS AND CHARGES Last date for UIA to receive “timely” protest C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

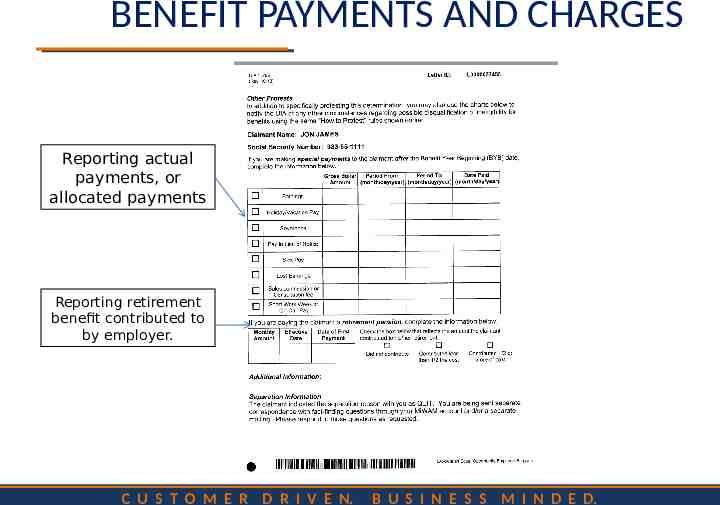

BENEFIT PAYMENTS AND CHARGES Reporting actual payments, or allocated payments Reporting retirement benefit contributed to by employer. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES SHARED WORK PLAN Employers can reduce work hours and wages of all employees in a work unit and they will become entitled to reduced unemployment benefits, if they otherwise have enough wages to qualify for benefits. The reduced weekly benefit amount will be equal to the claimant’s full weekly benefit amount multiplied by the % wages/hours were reduced. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES SHARED WORK PLAN Weekly benefit amount: 362 Hours reduced: 20% Reduced Benefit payment 360 x .20 72 C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES SHARED-WORK PLAN Be current in payment of unemployment taxes Have a “positive” reserve balance Have paid wages in all 12 previous quarters Not hire or transfer workers into the Unit, nor reduce wages/hours in the Unit further Certify plan participation reducing normal hours by15-45% is in lieu of a temporary layoff C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES SHARED-WORK PLAN The Plan does not apply to seasonal, temporary, or intermittent workers. The employer must maintain the fringe benefits during the Plan All workers in the Unit must participate, and there must be at least 2 participants An employer can have more than one Plan. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES SHARED-WORK PLAN The federal government will pay 92.8% of the cost of the reduced benefit as a result of the Shared-Work Plan, and the employer will be charged 7.2%. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

BENEFIT PAYMENTS AND CHARGES SHARED-WORK PLAN An employer can apply to participate in the plan by means of the employer’s MiWAM account. If approved, the employer will be required to file the bi-weekly certifications on behalf of all workers in the certified work unit. C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.

www.michigan.gov/uia C U S T O M E R D R I V E N. B U S I N E S S M I N D E D.