The Texas A&M University System Budget/Payroll/Personnel Operations

19 Slides2.29 MB

The Texas A&M University System Budget/Payroll/Personnel Operations Center (B/P/P) Insurance Billing Account Reconciliation February 2013

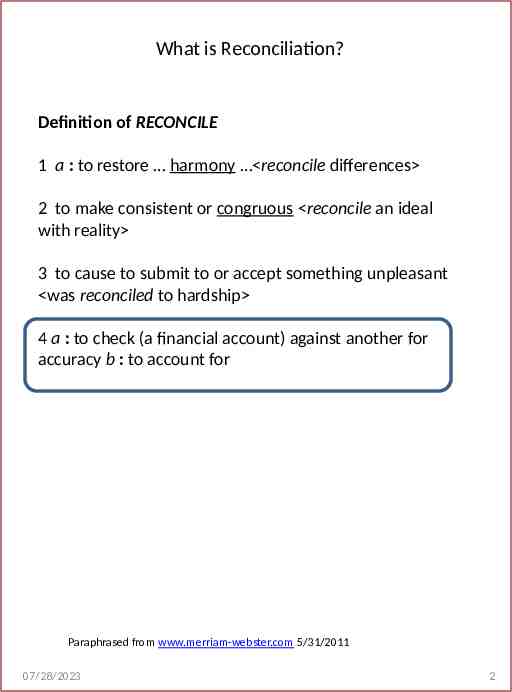

What is Reconciliation? Definition of RECONCILE 1 a : to restore harmony reconcile differences 2 to make consistent or congruous reconcile an ideal with reality 3 to cause to submit to or accept something unpleasant was reconciled to hardship 4 a : to check (a financial account) against another for accuracy b : to account for Paraphrased from www.merriam-webster.com 5/31/2011 07/28/2023 2

Simple Reconciliation Example Mary needs to purchase a new air conditioner for the house. Cost is 10,000. Last Friday her bank account balance was 50,000, so she knew she had enough money. However her debit card is declined. She checks her account balance and it shows 2,000. The bank is wrong and she wants her money back! The reconciliation question is: Where’s the other 48,000?! The reconciliation answer is: Her husband forgot to tell her he bought a new truck over the weekend. Now Mary knows where all the money has gone and what she really has in the bank. All money is accounted for, so her bank account is reconciled. However, now Mary’s husband has to find a way to reconcile with Mary! 07/28/2023 3

What are you reconciling? 1. “Prepay” account? 2. Other accounts? 3. Other activity? 07/28/2023 4

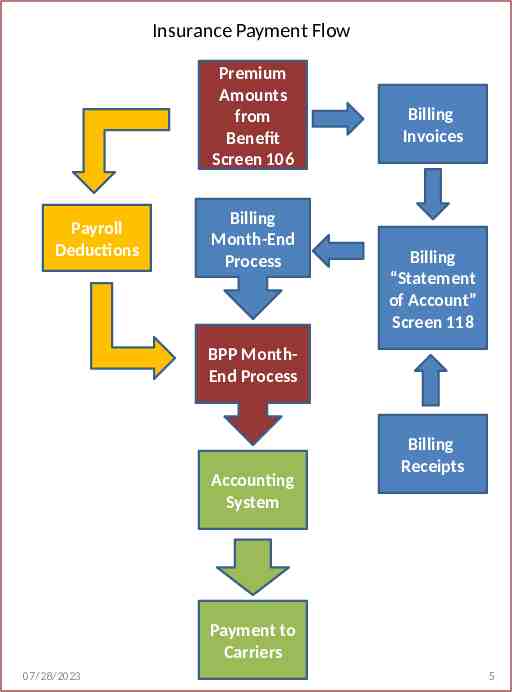

Insurance Payment Flow Premium Amounts from Benefit Screen 106 Payroll Deductions Billing Month-End Process Billing Invoices Billing “Statement of Account” Screen 118 BPP MonthEnd Process Accounting System Billing Receipts Payment to Carriers 07/28/2023 5

Keep in Mind 1. BPP Billing activity is reported as it was at Billing Month End (around 19th) 2. Accounting activity (FAMIS) continues thru end of month; so could be 8 days of payments received and entered into accounting system, and perhaps into BPP, that are not shown on the reports. That causes differences in the systems and those differences must be found so they are no longer “unknown”. 3. Any adjustments/receipts entered in BPP billing after Billing month end will not appear on the reports until NEXT month 4. BILL0019 Billing spreadsheet of information (by participant) for current monthly activity; file available on FileDepot, under PrePay; named Prepay [email protected], where @ is your workstation letter (e.g. TFS is F). This file is produced at Billing Month End (around the 19th). 07/28/2023 8

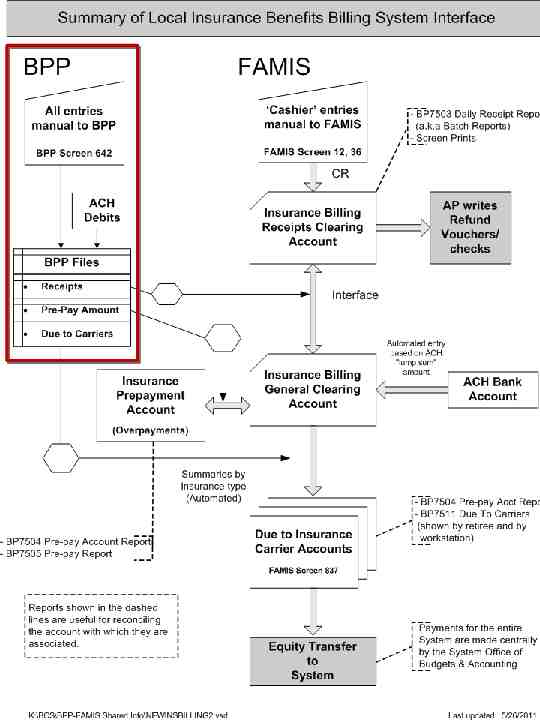

Accounts to Reconcile 1. Insurance Billing Receipts Clearing Account 2. Insurance Billing General Clearing Account 3. Insurance Liability Accounts (Due To System Offices for Carriers) 4. Insurance Pre-Payment Account 07/28/2023 9

BPP REPORTS FOR BILLING Report Identification and Description BILL0008 BP7500 – Error Report for Monthly Billing - Bills (to send to participants) - Bank Draft Report (lists bank draft ACH participants & amount drafted) BP7501 – Billing Registers (informational only) BP7508 – Draft Debit Report (shows all ACH information for drafts done: routing, trace #, etc.) BILL0006 BP7502 – Past Due Reports BILL0009 BP7512 – List of cancellation notices produced BP7513N - Shows coverage before and after cancellation/reduction process; Errors encountered BILL0007 BP7503 – Receipt Summary BP7504 – Shows what is due (includes several reports) BP7511 – Splits State and Local (informational report) - SGIP BILL0019 Billing spreadsheet of information (by participant) for current monthly activity; file available on FileDepot, under PrePay. BILL0010 BP7505 - Last Day Prepay Report; run the last business day of the month; shows for each person: current credit amount, charges pending, available in prepay account. 07/28/2023 10

FAMIS REPORTS FOR BILLING Employer Benefits (SGIP) 1. 2. 3. 4. 5. FBPR090 FBPR091 FBPR096 FBPR020 FBPR025 Employee Deduction, Ins/Benefit Liability 6. FBPR014 7. FBPR091 07/28/2023 11

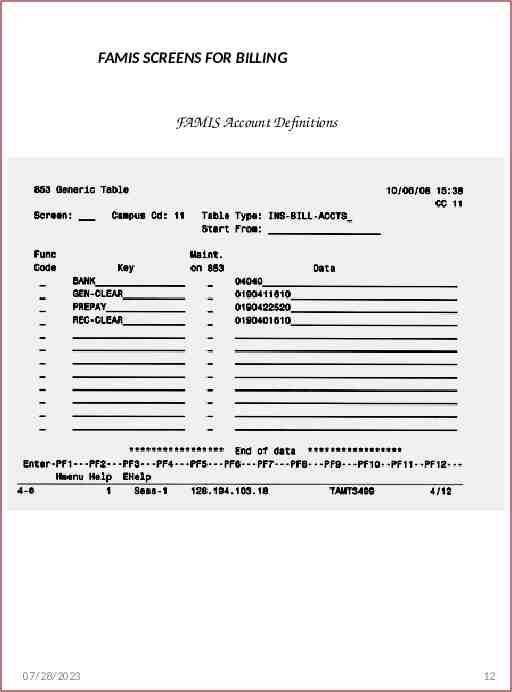

FAMIS SCREENS FOR BILLING FAMIS Account Definitions 07/28/2023 12

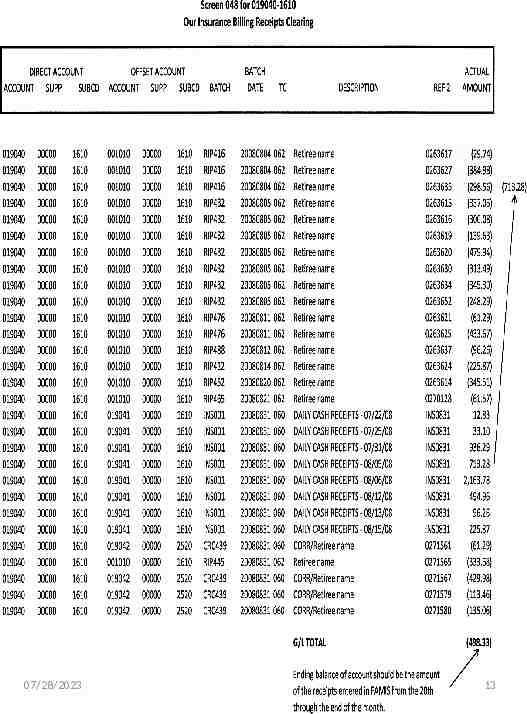

07/28/2023 13

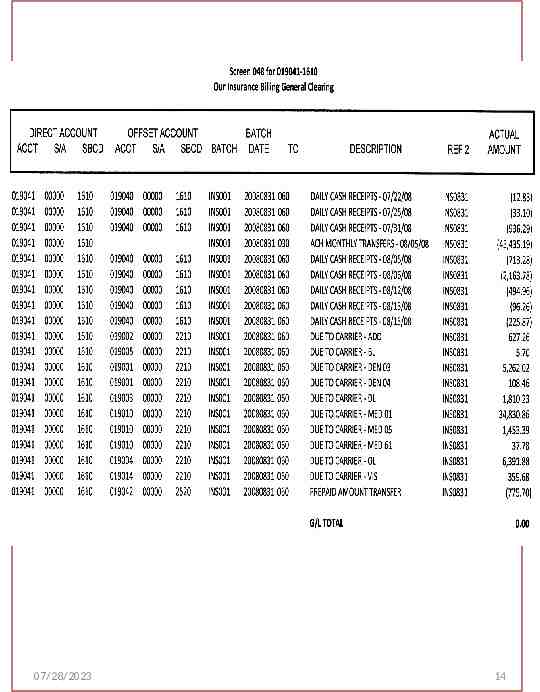

07/28/2023 14

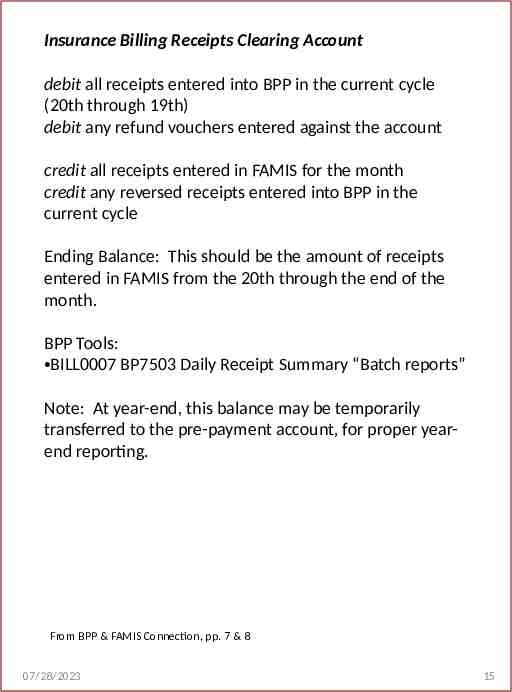

Insurance Billing Receipts Clearing Account debit all receipts entered into BPP in the current cycle (20th through 19th) debit any refund vouchers entered against the account credit all receipts entered in FAMIS for the month credit any reversed receipts entered into BPP in the current cycle Ending Balance: This should be the amount of receipts entered in FAMIS from the 20th through the end of the month. BPP Tools: BILL0007 BP7503 Daily Receipt Summary “Batch reports” Note: At year-end, this balance may be temporarily transferred to the pre-payment account, for proper yearend reporting. From BPP & FAMIS Connection, pp. 7 & 8 07/28/2023 15

Insurance Billing General Clearing Account debit ACH reversals debit amount to pay the insurance carriers credit all receipts entered into BPP in the current cycle credit ACH transactions Ending Balance: This should be zero. Note: The net of these debits /credits would have been transferred to/from the prepayment account. BPP Tools: All the billing reports BILL0019 Spreadsheet from FileDepot From BPP & FAMIS Connection, pp. 7 & 8 07/28/2023 16

Insurance Liability Accounts (Due To System Offices for Carriers) debit vouchers to the carriers -- not sure how this is handled now that all carriers are paid from the System Offices credit amounts due the carriers - transferred from the Insurance General Clearing Ending balance: This balance should be zero if vouchers are written in the same month and no other activity is run through these accounts. BPP Tools: BILL0007 BP7504 Billed Status Participants Due to Carriers Report Summary BILL0007 BP7511 Retiree Employer Contribution from State Funds From BPP & FAMIS Connection, pp. 7 & 8 07/28/2023 17

Insurance Pre-Payment Account debit/credit monthly balance change in the prepayment account Ending Balance: The amount of pre-payments held for retirees; this should match the amount from the BPP report. BPP Tools: BILL0007 BP7504 Pre-pay Account Report BILL0010 BP7505 Pre-Pay Report (last day of month prepay report) From BPP & FAMIS Connection, pp. 7 & 8 07/28/2023 18

Sample Reconciliation Process 1. Download the BPP FileDepot Prepay file 2. Verify the prepay spreadsheet amounts balance to the BPP Billing reports: BP7504 (Billed Amounts Due to Carriers ) with “Rcvd Total” column BP7500 (Bank Draft Report) with “Bnkdrft” column 3. Compare differences listed on BPP prepay recon worksheet to the general ledger (GL) monthly reports. 4. Adjust prepay worksheet file that shows actual prepay participants. 5. Verify the BP8563N report (Funds Due from System Members) matches BP7504 Employee Retiree column. This amount represents the payment to insurance carriers via equity transfer processed the following month. 6. List outstanding items (over or short). 7. Discuss reconciliation with billing/insurance processor and note comments. 8. Forward for approval. 9. File with GL Reconciliations by month. Original from Becky Evans, Financial Manager, TEES; “GL3063 Retiree Clearing” 07/28/2023 19