Navigating Public Service Loan Forgiveness (PSLF) Presenter: Leslie

27 Slides1.88 MB

Navigating Public Service Loan Forgiveness (PSLF) Presenter: Leslie R. Kaelin, M.Ed. UofL SOM Financial Aid Director

Disclaimer The PSLF information presented is accurate as of today (to the best of my ability), based on current available information. The PSLF Program or the conditions of the PSLF Program can or may change. The borrower is responsible for keeping up to date on the news, any changes in the PSLF Program and for filing all required documentation and forms for the program. The borrower is also responsible for selecting their Repayment Plan, Consolidation decision and all aspects of loan repayment that best meets their needs and specific plans. If unsure, research first. Contact FedLoan Servicing or your loan Servicer, before you make a change or decision, as needed. Credit and a great deal of thanks go to: Sara Donnelly, Assistant Director Office of Financial Aid Case Western Reserve University, School of Medicine. Ms. Donnelly provided the starting point and actual screen shots of the various forms and clips from FedLoan Servicing and Studentloans.gov, for my presentation. She also provided some great tips. It would have been hard to explain the PSLF process without her experienced advice and screen prints! Thank you! Sincerely, Leslie R. Kaelin FYI PSLF was enacted, October 2007, as part of the College Cost Reduction and Access Act (CCRAA). First possible PSLF application, for forgiveness, was after 10 years (120 payments) or November 2017.

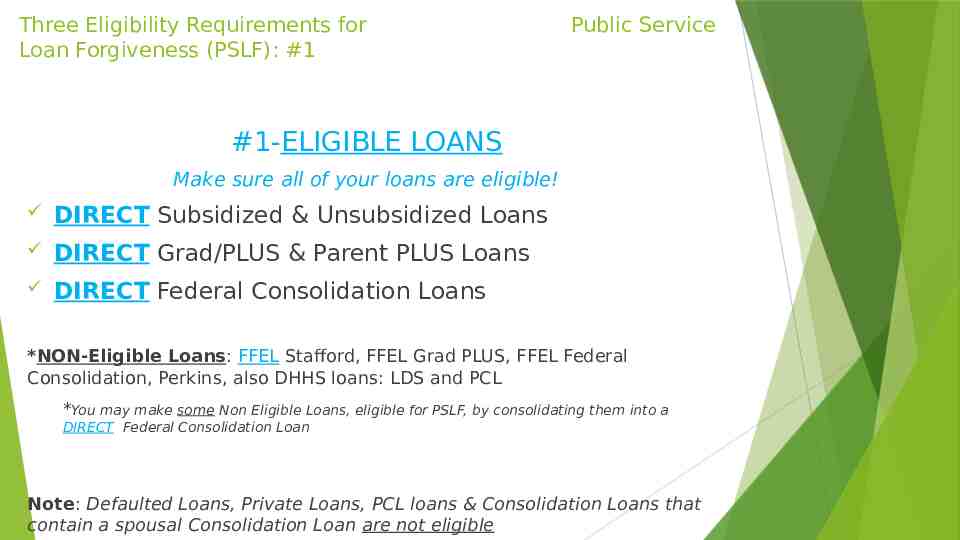

Three Eligibility Requirements for Loan Forgiveness (PSLF): #1 Public Service #1-ELIGIBLE LOANS Make sure all of your loans are eligible! DIRECT Subsidized & Unsubsidized Loans DIRECT Grad/PLUS & Parent PLUS Loans DIRECT Federal Consolidation Loans *NON-Eligible Loans: FFEL Stafford, FFEL Grad PLUS, FFEL Federal Consolidation, Perkins, also DHHS loans: LDS and PCL *You may make some Non Eligible Loans, eligible for PSLF, by consolidating them into a DIRECT Federal Consolidation Loan Note: Defaulted Loans, Private Loans, PCL loans & Consolidation Loans that contain a spousal Consolidation Loan are not eligible

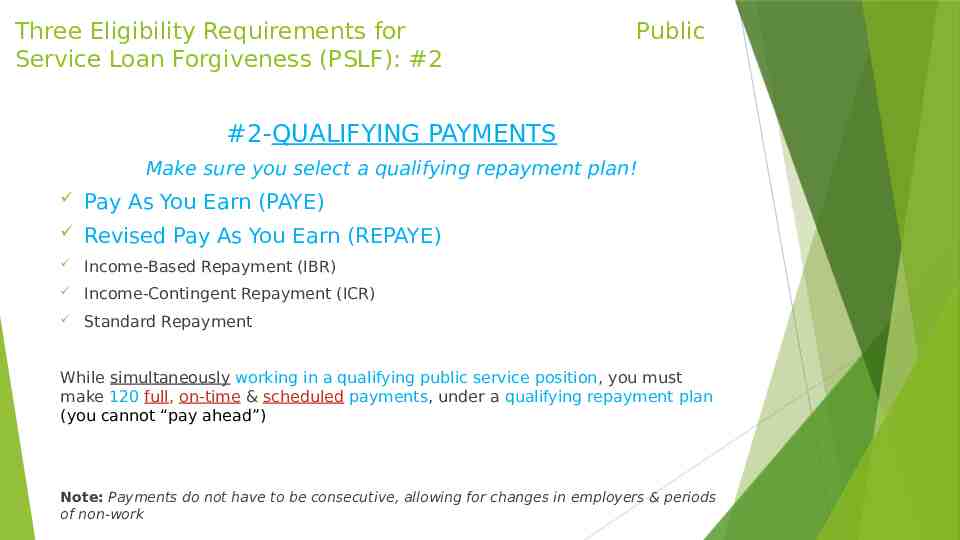

Three Eligibility Requirements for Service Loan Forgiveness (PSLF): #2 Public #2-QUALIFYING PAYMENTS Make sure you select a qualifying repayment plan! Pay As You Earn (PAYE) Revised Pay As You Earn (REPAYE) Income-Based Repayment (IBR) Income-Contingent Repayment (ICR) Standard Repayment While simultaneously working in a qualifying public service position, you must make 120 full, on-time & scheduled payments, under a qualifying repayment plan (you cannot “pay ahead”) Note: Payments do not have to be consecutive, allowing for changes in employers & periods of non-work

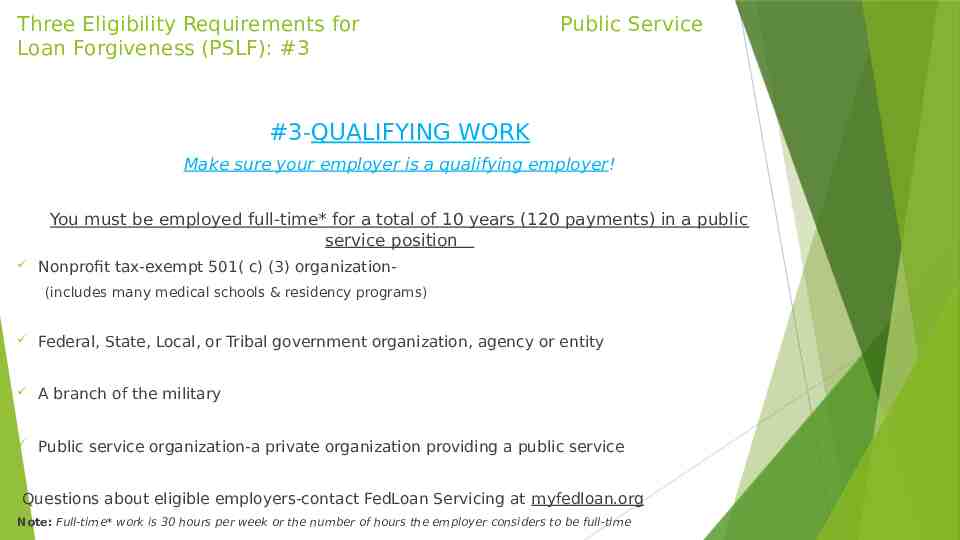

Three Eligibility Requirements for Loan Forgiveness (PSLF): #3 Public Service #3-QUALIFYING WORK Make sure your employer is a qualifying employer! You must be employed full-time* for a total of 10 years (120 payments) in a public service position Nonprofit tax-exempt 501( c) (3) organization(includes many medical schools & residency programs) Federal, State, Local, or Tribal government organization, agency or entity A branch of the military Public service organization-a private organization providing a public service Questions about eligible employers-contact FedLoan Servicing at myfedloan.org Note: Full-time* work is 30 hours per week or the number of hours the employer considers to be full-time

Public Service Loan Forgiveness (PSLF) Eligible Loans DIRECT Federal Loans Qualifyi ng Paymen ts PAYE, REPAYE, IBR or Standard Qualifyi ng Work Public Service

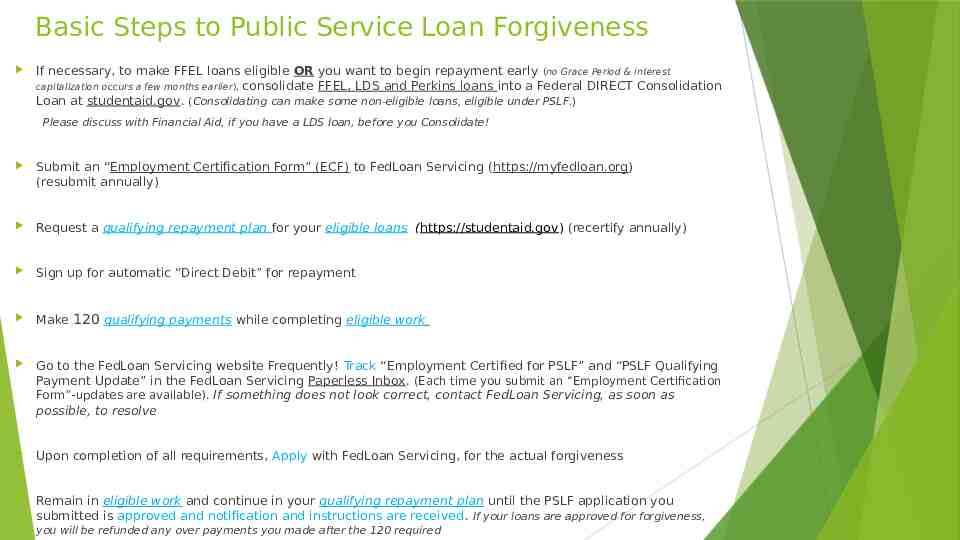

Basic Steps to Public Service Loan Forgiveness If necessary, to make FFEL loans eligible OR you want to begin repayment early (no Grace Period & interest capitalization occurs a few months earlier), consolidate FFEL, LDS and Perkins loans into a Federal DIRECT Consolidation Loan at studentaid.gov. (Consolidating can make some non-eligible loans, eligible under PSLF.) Please discuss with Financial Aid, if you have a LDS loan, before you Consolidate! Submit an “Employment Certification Form” (ECF) to FedLoan Servicing (https://myfedloan.org) (resubmit annually) Request a qualifying repayment plan for your eligible loans (https://studentaid.gov) (recertify annually) Sign up for automatic “Direct Debit” for repayment Make 120 qualifying payments while completing eligible work Go to the FedLoan Servicing website Frequently! Track “Employment Certified for PSLF” and “PSLF Qualifying Payment Update” in the FedLoan Servicing Paperless Inbox. (Each time you submit an “Employment Certification Form”-updates are available). If something does not look correct, contact FedLoan Servicing, as soon as possible, to resolve Upon completion of all requirements, Apply with FedLoan Servicing, for the actual forgiveness Remain in eligible work and continue in your qualifying repayment plan until the PSLF application you submitted is approved and notification and instructions are received. If your loans are approved for forgiveness, you will be refunded any over payments you made after the 120 required

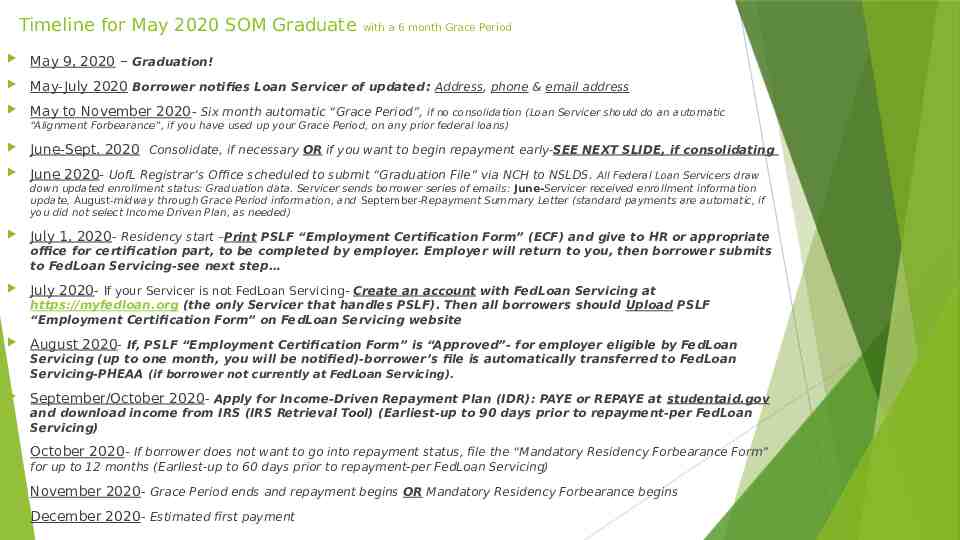

Timeline for May 2020 SOM Graduate with a 6 month Grace Period May 9, 2020 – Graduation! May-July 2020 Borrower notifies Loan Servicer of updated : Address, phone & email address May to November 2020- Six month automatic “Grace Period”, June-Sept. 2020 Consolidate, if necessary OR if you want to begin repayment early-SEE NEXT SLIDE, if consolidating June 2020- UofL Registrar’s Office scheduled to submit “Graduation File” via NCH to NSLDS. July 1, 2020- Residency start –Print PSLF “Employment Certification Form” (ECF) and give to HR or appropriate if no consolidation (Loan Servicer should do an automatic “Alignment Forbearance”, if you have used up your Grace Period, on any prior federal loans) All Federal Loan Servicers draw down updated enrollment status: Graduation data. Servicer sends borrower series of emails: June-Servicer received enrollment information update, August-midway through Grace Period information, and September-Repayment Summary Letter (standard payments are automatic, if you did not select Income Driven Plan, as needed) office for certification part, to be completed by employer. Employer will return to you, then borrower submits to FedLoan Servicing-see next step July 2020- If your Servicer is not FedLoan Servicing- Create an account with FedLoan Servicing at https://myfedloan.org (the only Servicer that handles PSLF). Then all borrowers should Upload PSLF “Employment Certification Form” on FedLoan Servicing website August 2020- If, PSLF “Employment Certification Form” is “Approved”- for employer eligible by FedLoan Servicing (up to one month, you will be notified)-borrower’s file is automatically transferred to FedLoan Servicing-PHEAA (if borrower not currently at FedLoan Servicing). September/October 2020- Apply for Income-Driven Repayment Plan (IDR): PAYE or REPAYE at studentaid.gov and download income from IRS (IRS Retrieval Tool) (Earliest-up to 90 days prior to repayment-per FedLoan Servicing) October 2020- If borrower does not want to go into repayment status, file the “Mandatory Residency Forbearance Form” for up to 12 months (Earliest-up to 60 days prior to repayment-per FedLoan Servicing) November 2020- Grace Period ends and repayment begins OR Mandatory Residency Forbearance begins December 2020- Estimated first payment

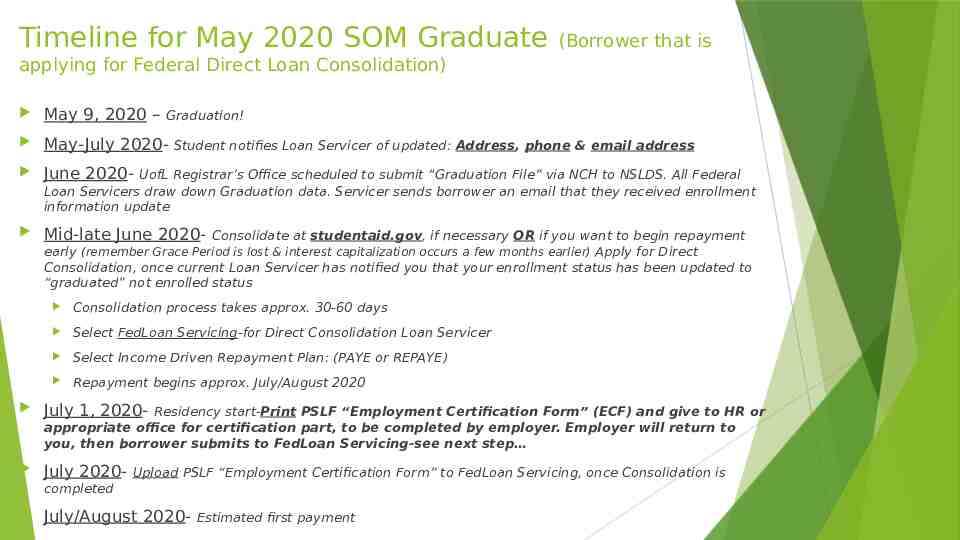

Timeline for May 2020 SOM Graduate (Borrower that is applying for Federal Direct Loan Consolidation) May 9, 2020 – May-July 2020- June 2020- Mid-late June 2020- Graduation! Student notifies Loan Servicer of updated: Address, phone & email address UofL Registrar’s Office scheduled to submit “Graduation File” via NCH to NSLDS. All Federal Loan Servicers draw down Graduation data. Servicer sends borrower an email that they received enrollment information update Consolidate at studentaid.gov, if necessary OR if you want to begin repayment early (remember Grace Period is lost & interest capitalization occurs a few months earlier) Apply for Direct Consolidation, once current Loan Servicer has notified you that your enrollment status has been updated to “graduated” not enrolled status Consolidation process takes approx. 30-60 days Select FedLoan Servicing-for Direct Consolidation Loan Servicer Select Income Driven Repayment Plan: (PAYE or REPAYE) Repayment begins approx. July/August 2020 July 1, 2020- July 2020- Residency start-Print PSLF “Employment Certification Form” (ECF) and give to HR or appropriate office for certification part, to be completed by employer. Employer will return to you, then borrower submits to FedLoan Servicing-see next step Upload PSLF “Employment Certification Form” to FedLoan Servicing, once Consolidation is completed July/August 2020- Estimated first payment

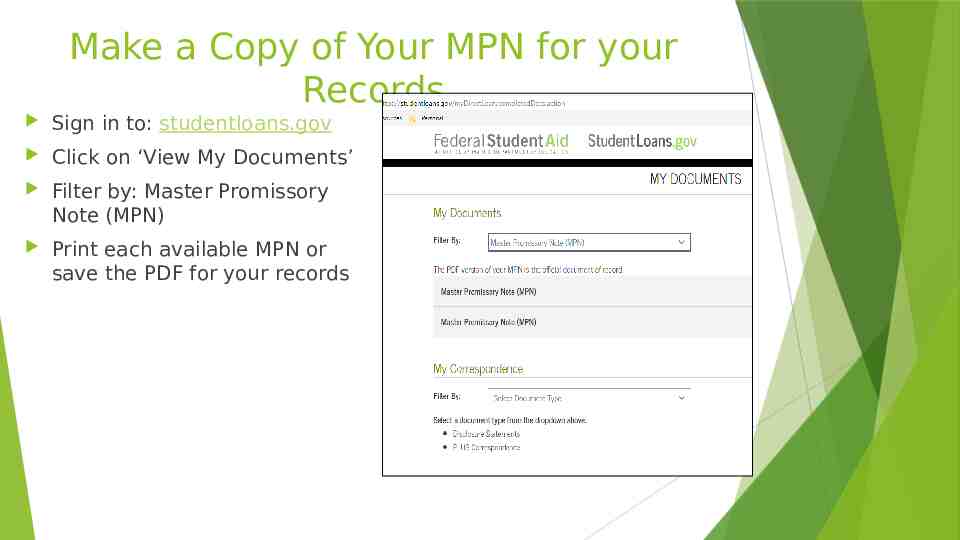

Make a Copy of Your MPN for your Records Sign in to: studentloans.gov Click on ‘View My Documents’ Filter by: Master Promissory Note (MPN) Print each available MPN or save the PDF for your records

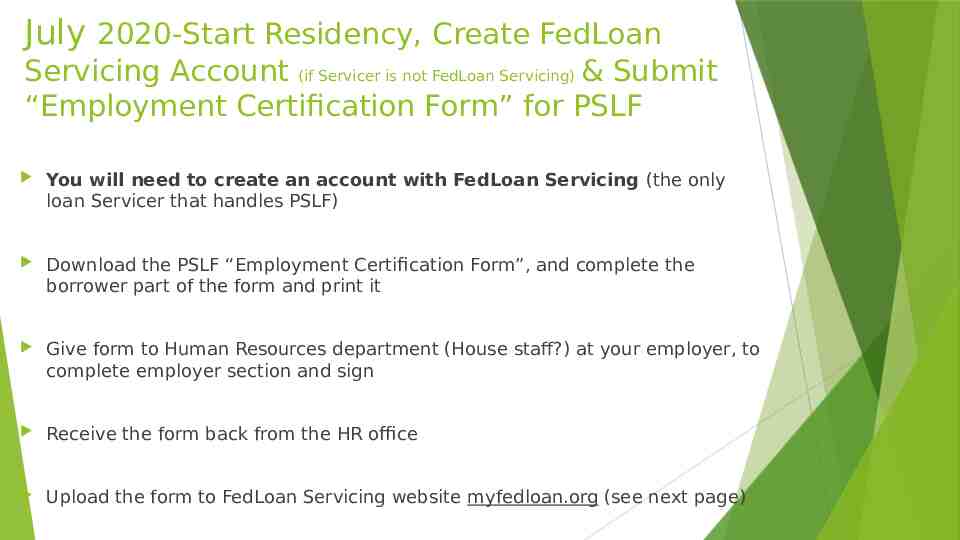

July 2020-Start Residency, Create FedLoan Servicing Account (if Servicer is not FedLoan Servicing) & Submit “Employment Certification Form” for PSLF You will need to create an account with FedLoan Servicing (the only loan Servicer that handles PSLF) Download the PSLF “Employment Certification Form”, and complete the borrower part of the form and print it Give form to Human Resources department (House staff?) at your employer, to complete employer section and sign Receive the form back from the HR office Upload the form to FedLoan Servicing website myfedloan.org (see next page)

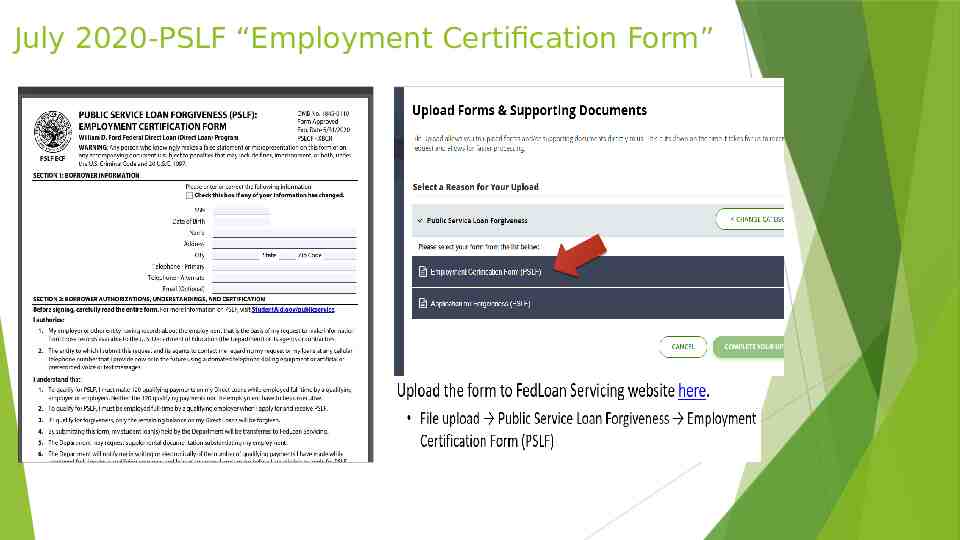

July 2020-PSLF “Employment Certification Form”

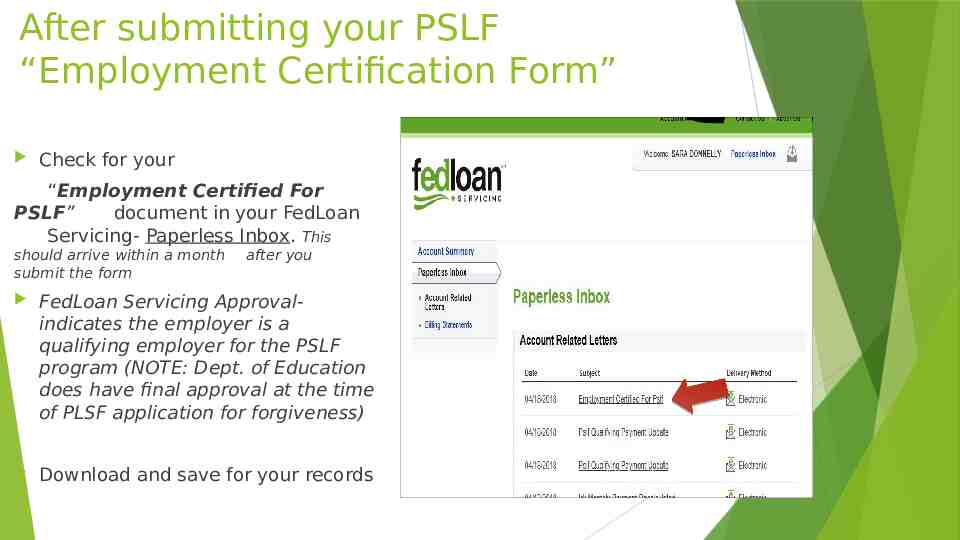

After submitting your PSLF “Employment Certification Form” Check for your “Employment Certified For PSLF” document in your FedLoan Servicing- Paperless Inbox. This should arrive within a month submit the form after you FedLoan Servicing Approvalindicates the employer is a qualifying employer for the PSLF program (NOTE: Dept. of Education does have final approval at the time of PLSF application for forgiveness) Download and save for your records

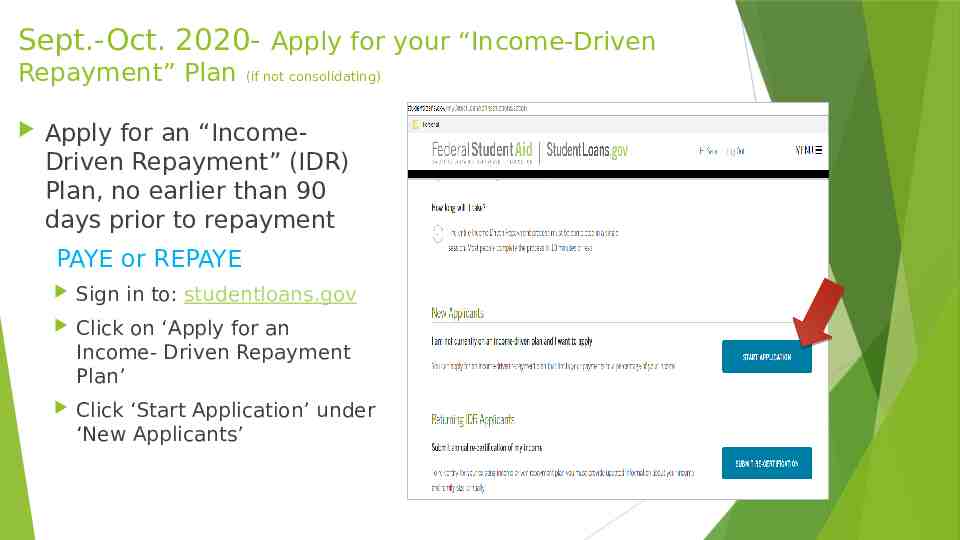

Sept.-Oct. 2020- Apply for your “Income-Driven Repayment” Plan (if not consolidating) Apply for an “IncomeDriven Repayment” (IDR) Plan, no earlier than 90 days prior to repayment PAYE or REPAYE Sign in to: studentloans.gov Click on ‘Apply for an Income- Driven Repayment Plan’ Click ‘Start Application’ under ‘New Applicants’

December 2020-Start Repayment (if not consolidating) OR July/August 2020-Start Repayment Review your loan servicer’s website to see how to make a payment (online, via the mail, etc.) FedLoan Servicing users can sign up for Direct Debit. This is a free service that will automatically withdraw your payment each month from your chosen bank account, so your payment is never late & tracking for PSLF is done automatically (Consolidated Loan)

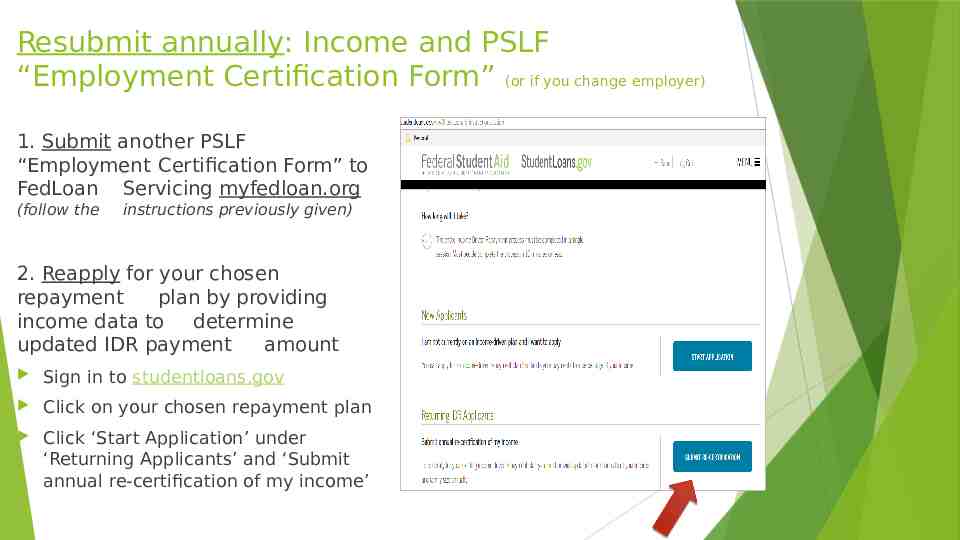

Resubmit annually: Income and PSLF “Employment Certification Form” (or if you change employer) 1. Submit another PSLF “Employment Certification Form” to FedLoan Servicing myfedloan.org (follow the instructions previously given) 2. Reapply for your chosen repayment plan by providing income data to determine updated IDR payment amount Sign in to studentloans.gov Click on your chosen repayment plan Click ‘Start Application’ under ‘Returning Applicants’ and ‘Submit annual re-certification of my income’

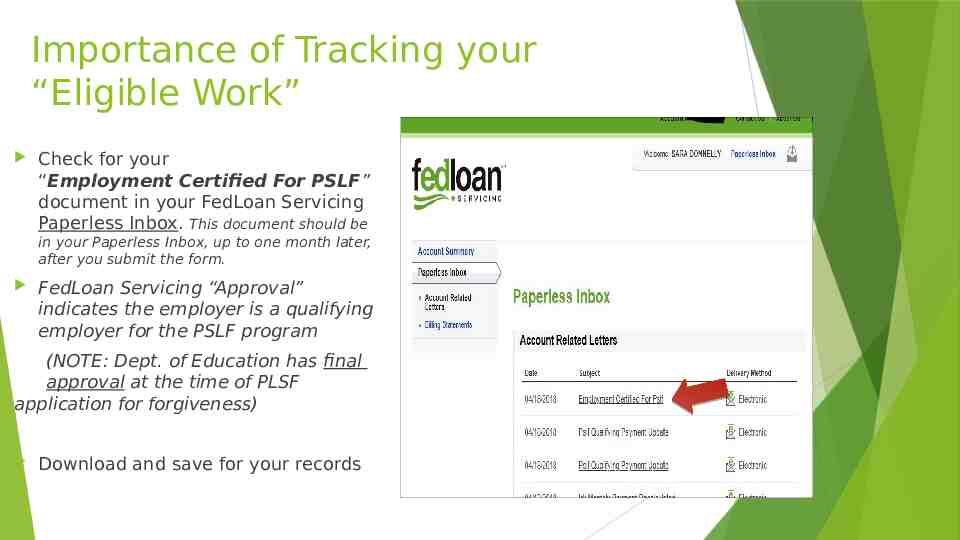

Importance of Tracking your “Eligible Work” Check for your “Employment Certified For PSLF” document in your FedLoan Servicing Paperless Inbox. This document should be in your Paperless Inbox, up to one month later, after you submit the form. FedLoan Servicing “Approval” indicates the employer is a qualifying employer for the PSLF program (NOTE: Dept. of Education has final approval at the time of PLSF application for forgiveness) Download and save for your records

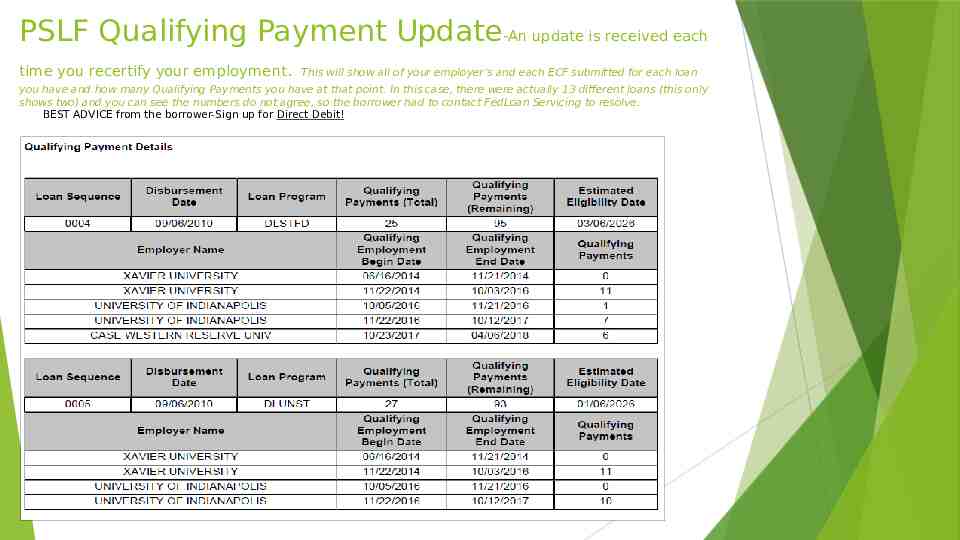

Importance of Tracking your “Eligible Payments” Check for your “PSLF Qualifying Payment Update” document in your FedLoan Servicing Paperless Inbox This notification will be sent to you via the Paperless Inbox, each time you submit an “Employment Certification Form”. After the employment dates are completed, it will indicate how many “Qualifying Payments” you have.(you should submit one every year) (NOTE: Dept. of Education has final approval at the time of PLSF application for forgiveness) Download and save for your records

PSLF Qualifying Payment Update-An update is received each time you recertify your employment. This will show all of your employer’s and each ECF submitted for each loan you have and how many Qualifying Payments you have at that point. In this case, there were actually 13 different loans (this only shows two) and you can see the numbers do not agree, so the borrower had to contact FedLoan Servicing to resolve. BEST ADVICE from the borrower-Sign up for Direct Debit!

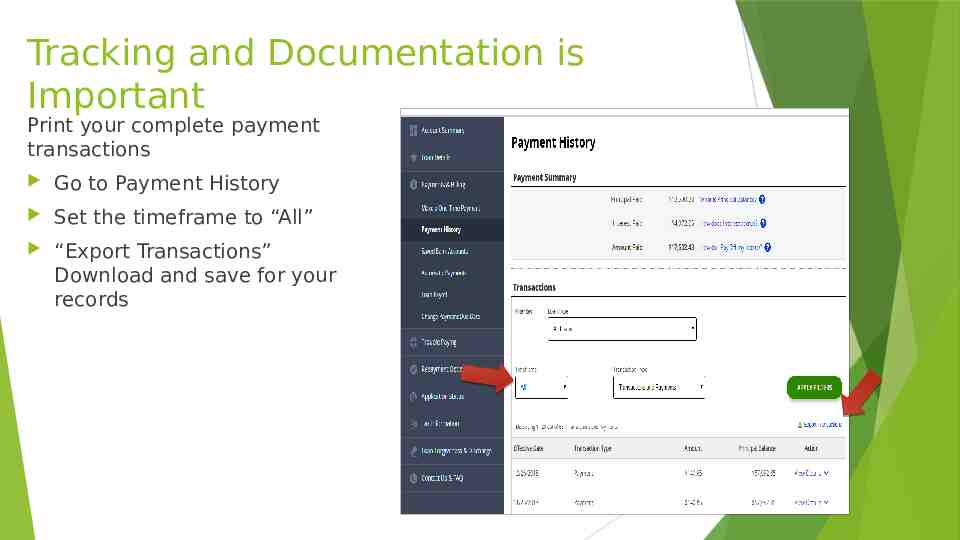

Tracking and Documentation is Important Print your complete payment transactions Go to Payment History Set the timeframe to “All” “Export Transactions” Download and save for your records

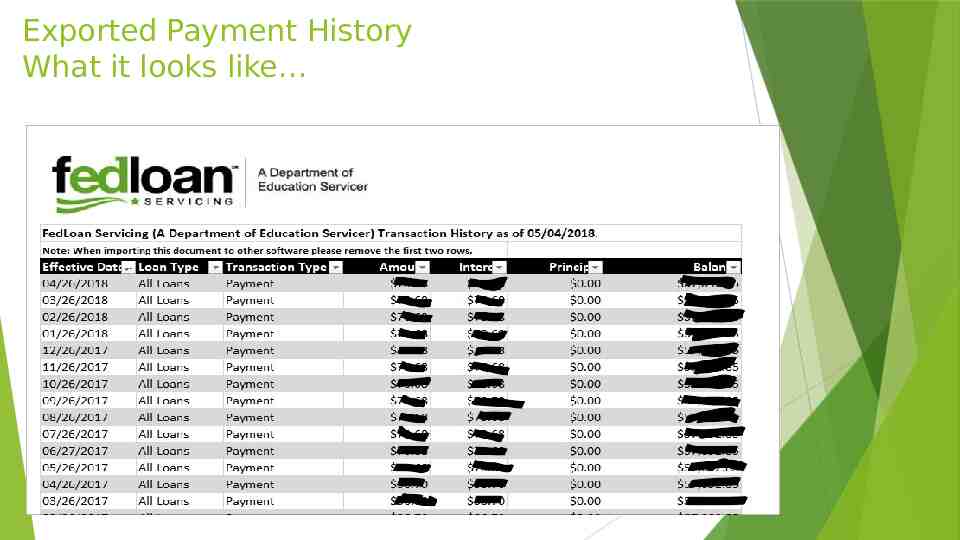

Exported Payment History What it looks like

120 Payments later Apply for PSLF! You will apply for loan forgiveness after making the required 120 qualifying payments Log in to myfedloan.org Click on “Manage Repayment” Click on “Loan Forgiveness” Click “Request Loan Forgiveness” Continue to make payments and work in the qualifying work until your loans are forgiven-any over paid funds will be refunded

Helpful Hints Tracking your documentation throughout this process is the most important thing you can do Keep copies of your paperworkmake a PSLF file Stay organized Keep annual records of where you are in the process at that point Download and save documents to a separate USB drive

Job Changes Make sure that your new employer is a 501(c)(3) or qualifying employer (ask the HR office) Recertify your employment at least once a year When you change jobs, make sure to do one form for the employer you are exiting from and do one for the new employer you are starting with

Postponing Payments Remember you can postpone your payments during residency by requesting a forbearance. You would request a “Mandatory Medical Residency Forbearance” during this time. 30-60 days before the end of the forbearance term, you will need to request another forbearance from each servicer. Forbearance periods do not count towards PSLF

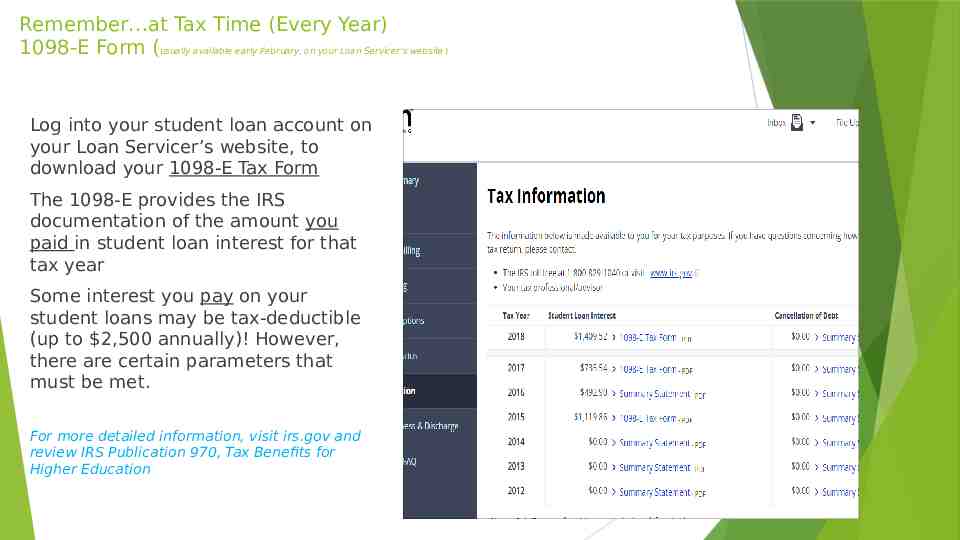

Remember at Tax Time (Every Year) 1098-E Form (usually available early February, on your Loan Servicer’s website) Log into your student loan account on your Loan Servicer’s website, to download your 1098-E Tax Form The 1098-E provides the IRS documentation of the amount you paid in student loan interest for that tax year Some interest you pay on your student loans may be tax-deductible (up to 2,500 annually)! However, there are certain parameters that must be met. For more detailed information, visit irs.gov and review IRS Publication 970, Tax Benefits for Higher Education

Questions? Where to go for help aamc.org/FIRST Medloans Calculator FedLoan Servicing (PHEAA) 800-699-2908 https://myfedloan.org Studentaid.gov