Estate and LongTerm Planning for Incapacity and Special Needs

29 Slides123.24 KB

Estate and LongTerm Planning for Incapacity and Special Needs Madison Estate Council May 17, 2021

Mark T. Johnson, JD Meghan M. Teigen, JD Presenters Johnson Teigen, LLC 2924 Marketplace Dr., Ste. 102 Fitchburg, WI 53719 (608)-273-8609 www.jtlawwi.com

Disclaimer The information provided here is not legal advice. Do not act on this information without the advice of professional legal counsel, who must evaluate an individual’s specific circumstances and wishes before providing legal advice.

Proactive and Prudent Estate Planning Revocable Living Trust or Will Marital Property Agreement Planning for Incapacity Trusts for minors and nomination of guardians for children Addressing unique assets and titling issues Family asset / business succession planning Surrogate decision making with robust powers (powers of attorney for finance and property/healthcare), etc.

Emergency Long-Term Care and Estate Planning Threshold question – Does the individual have capacity to make any changes if necessary? “Capacity” is specific to the task or document in question. Review powers of attorney; Planning for Incapacity Married couples – consider updating documents to reflect current circumstances, perhaps protect against the risk of the “healthier” spouse dying first; Review options for care and feasibility of privately affording such care In-home care options; Family caregivers (NOTE – family caregivers should use a care contract and be mindful of employer/employee relationship/payroll issues Long-term care facilities What level of care is needed? What facility is preferred? What is the cost and availability?

What is the feasibility for affording the care and facility that is preferred or required based on their needs? Paying for Long-Term Care Expenses Assess current resources—income and savings, any long-term care insurance; Assess spousal need for living expenses; Devise budget or spending plan to estimate feasibility of affording their needed level of care in the long-term; If it is evident that the person’s personal estate may not cover their care needs, will Medicaid be necessary?

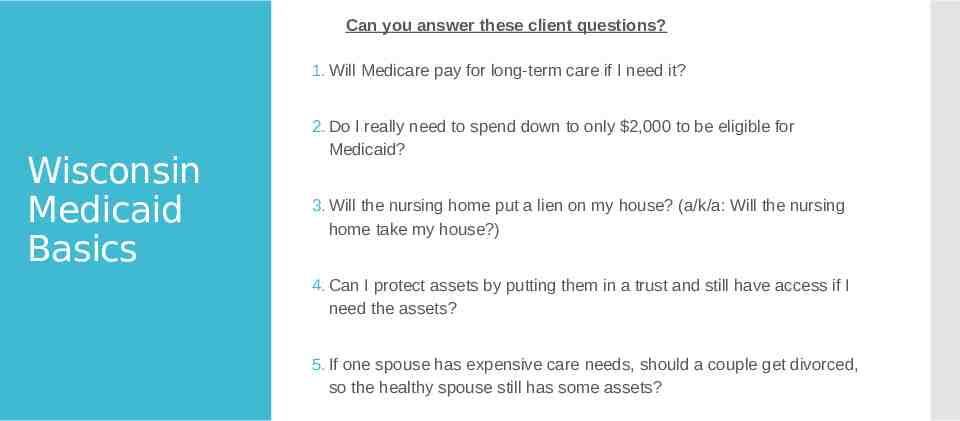

Can you answer these client questions? 1. Will Medicare pay for long-term care if I need it? Wisconsin Medicaid Basics 2. Do I really need to spend down to only 2,000 to be eligible for Medicaid? 3. Will the nursing home put a lien on my house? (a/k/a: Will the nursing home take my house?) 4. Can I protect assets by putting them in a trust and still have access if I need the assets? 5. If one spouse has expensive care needs, should a couple get divorced, so the healthy spouse still has some assets?

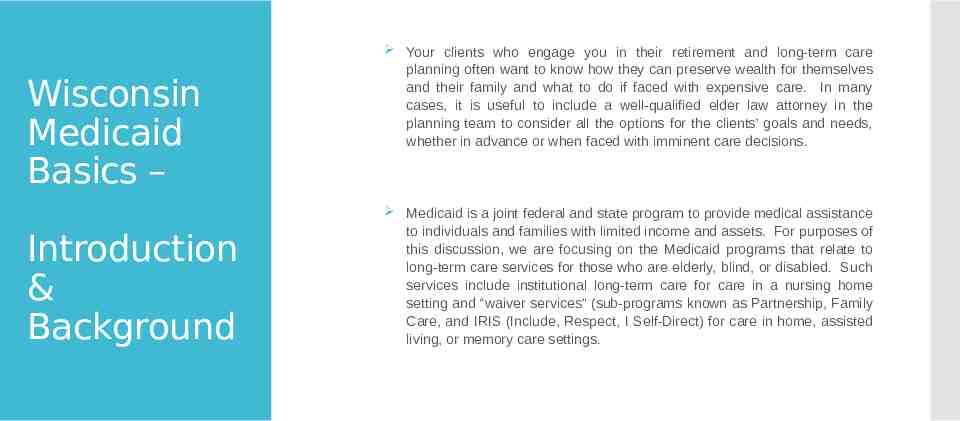

Wisconsin Medicaid Basics – Introduction & Background Your clients who engage you in their retirement and long-term care planning often want to know how they can preserve wealth for themselves and their family and what to do if faced with expensive care. In many cases, it is useful to include a well-qualified elder law attorney in the planning team to consider all the options for the clients’ goals and needs, whether in advance or when faced with imminent care decisions. Medicaid is a joint federal and state program to provide medical assistance to individuals and families with limited income and assets. For purposes of this discussion, we are focusing on the Medicaid programs that relate to long-term care services for those who are elderly, blind, or disabled. Such services include institutional long-term care for care in a nursing home setting and “waiver services” (sub-programs known as Partnership, Family Care, and IRIS (Include, Respect, I Self-Direct) for care in home, assisted living, or memory care settings.

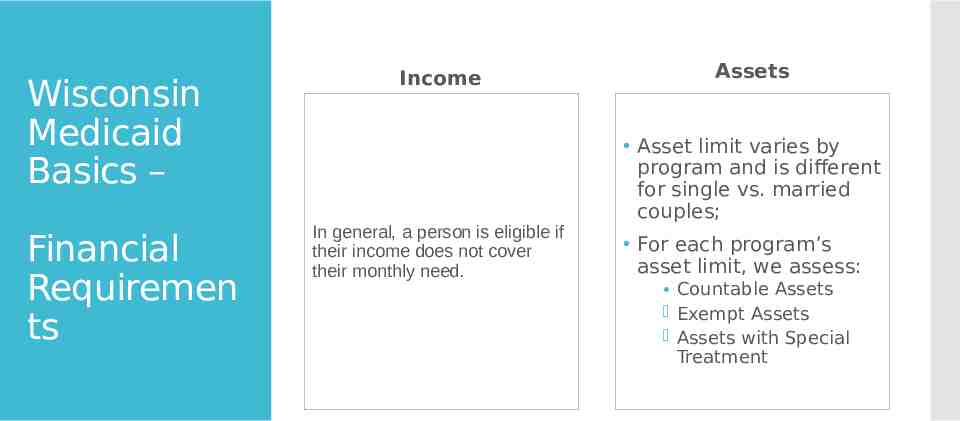

Wisconsin Medicaid Basics – Financial Requiremen ts Income In general, a person is eligible if their income does not cover their monthly need. Assets Asset limit varies by program and is different for single vs. married couples; For each program’s asset limit, we assess: Countable Assets Exempt Assets Assets with Special Treatment

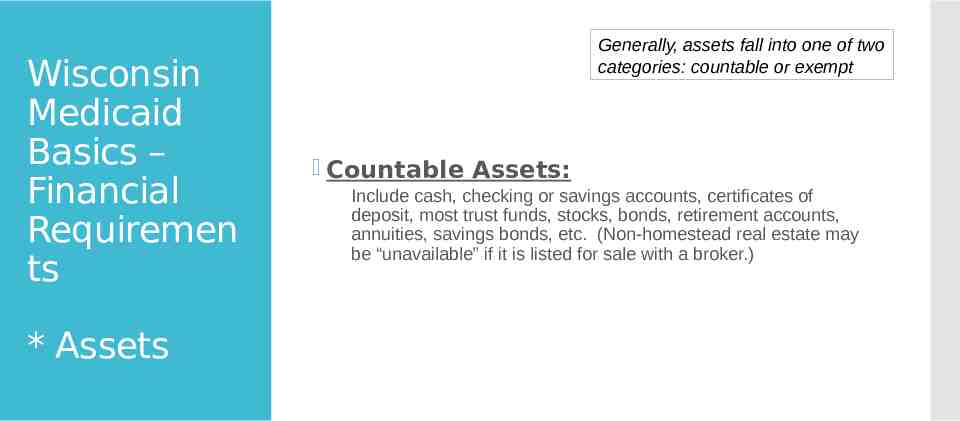

Wisconsin Medicaid Basics – Financial Requiremen ts * Assets Generally, assets fall into one of two categories: countable or exempt Countable Assets: Include cash, checking or savings accounts, certificates of deposit, most trust funds, stocks, bonds, retirement accounts, annuities, savings bonds, etc. (Non-homestead real estate may be “unavailable” if it is listed for sale with a broker.)

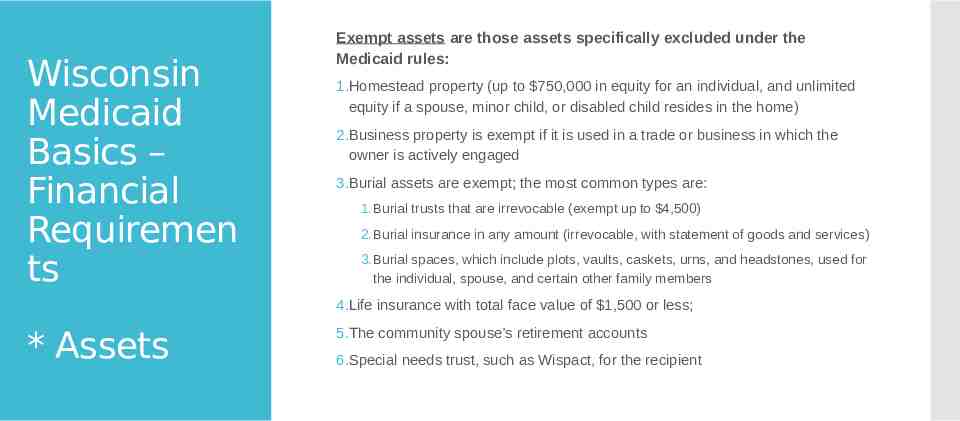

Wisconsin Medicaid Basics – Financial Requiremen ts Exempt assets are those assets specifically excluded under the Medicaid rules: 1.Homestead property (up to 750,000 in equity for an individual, and unlimited equity if a spouse, minor child, or disabled child resides in the home) 2.Business property is exempt if it is used in a trade or business in which the owner is actively engaged 3.Burial assets are exempt; the most common types are: 1.Burial trusts that are irrevocable (exempt up to 4,500) 2.Burial insurance in any amount (irrevocable, with statement of goods and services) 3.Burial spaces, which include plots, vaults, caskets, urns, and headstones, used for the individual, spouse, and certain other family members 4.Life insurance with total face value of 1,500 or less; * Assets 5.The community spouse’s retirement accounts 6.Special needs trust, such as Wispact, for the recipient

Wisconsin Medicaid Basics – Financial Requiremen ts * Assets Assets with special treatment: 1. Annuities 2. Promissory notes 3. Life estates Because the rules related to these types of assets have changed considerably over the past several years, review and advice of an elder law attorney is required to determine the treatment of existing assets or whether to acquire such assets as part of planning.

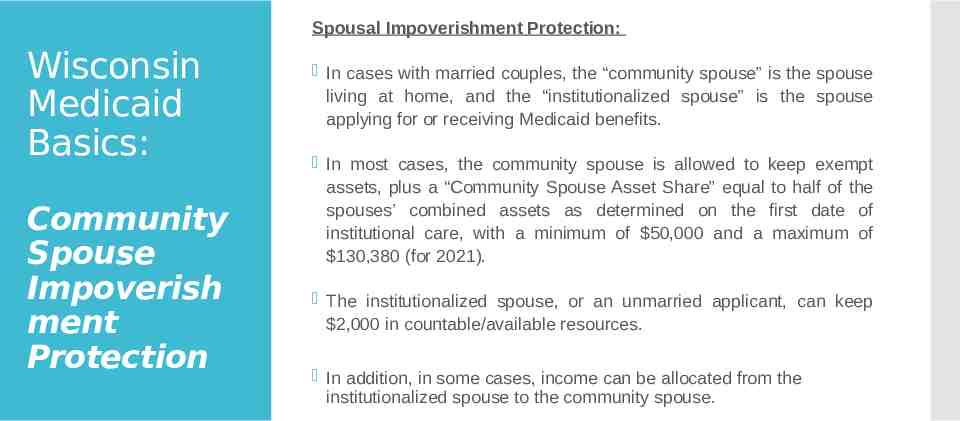

Spousal Impoverishment Protection: Wisconsin Medicaid Basics: Community Spouse Impoverish ment Protection In cases with married couples, the “community spouse” is the spouse living at home, and the “institutionalized spouse” is the spouse applying for or receiving Medicaid benefits. In most cases, the community spouse is allowed to keep exempt assets, plus a “Community Spouse Asset Share” equal to half of the spouses’ combined assets as determined on the first date of institutional care, with a minimum of 50,000 and a maximum of 130,380 (for 2021). The institutionalized spouse, or an unmarried applicant, can keep 2,000 in countable/available resources. In addition, in some cases, income can be allocated from the institutionalized spouse to the community spouse.

Divestment: Wisconsin Medicaid Basics: A “divestment” is the transfer of assets or income for less than fair market value. Medicaid looks back 5 years for divestments, and if any were made, then a period of ineligibility is calculated based on the total value of divested assets. Divestment Issues In addition, in spousal cases, the community spouse may not transfer assets for the 5 years after the institutionalized spouse begins receiving Medicaid benefits, which includes “disinheriting” the institutionalized spouse.

Estate recovery is the state government’s right to be reimbursed for Medicaid benefits, from the individual’s estate (or, in spousal cases, from the estate of the spouse who dies last). Wisconsin Medicaid Basics: Estate Recovery A lien may be attached to homestead real estate during the Medicaid recipient’s lifetime. A lien applies to homestead real estate, including a home held in a revocable trust or as a life estate (for life estates created after Aug. 1, 2014). A lien will not be filed if the spouse resides in the home or if certain other family exceptions apply. Recovery from non-probate assets—recovery is available when any of the following non-probate arrangements were made after August 1, 2014: revocable trusts, life insurance policies, and joint tenancy property.

Wisconsin Medicaid Basics: Estate Recovery Estate Recovery Summary: If a client can obtain Medicaid benefits and retain an estate of any size, the Estate Recovery claim will accrue at the Medicaid rate, rather than the private pay rate for care. Therefore, awareness of and planning for Estate Recovery can have significant results. Although it may be difficult or impossible to avoid Estate Recovery altogether, strategic planning for Estate Recovery can result in “discounted” nursing home care and the possibility of some estate remaining after Estate Recovery is paid.

Planning Strategies: Planning for eventual long-term care and possible Medicaid benefits Financial planning for privately paying for care Purchasing long-term care insurance Planning in advance of 5-year lookback for possible gifting or irrevocable trust Estate planning for maximum flexibility and spousal protection Durable financial powers of attorney Marital property agreement Will with testamentary special needs trust for one or both spouses Reconvening when a significant change occurs in finances, health, or family, so that if expensive care is on the near horizon, effective planning for spousal protection and maximizing exempt assets can be done.

Incorporating special needs planning into a client’s overall estate plan: Special Needs Planning In addition to planning for their own long-term care needs, clients who have a child or other family member with a disability need to incorporate the child’s care into their own long-term savings, retirement, and estate planning. In many cases, a special needs trust (SNT)—sometimes called a supplemental needs trust—can provide the proper legal arrangement to manage assets for the beneficiary’s lifetime and to preserve the beneficiary’s means-tested public benefits like SSI and Medicaid.

Preserving a beneficiary’s eligibility for means-tested public benefits. An individual who is disabled and who has a minimal work record may receive Supplemental Security Income (SSI) from the Social Security Administration. Special Needs Planning: Public Benefits 1. The federal SSI amount for 2021 is 794. Wisconsin also has a state supplement of between 83.78 and 179.77. 2. The asset limit for SSI is 2,000 for countable assets, such as any cash account. In addition to countable assets, an SSI recipient may have certain exempt assets, such as home real estate and a car. 3. With these strict asset limits, any additional resources are best managed through a special needs trust, which is also an exempt asset if it complies with certain rules. 4. In addition, distributions from a trust for food and shelter expenses, whether cash or in-kind, will reduce SSI benefits dollar for dollar, with a maximum reduction for in-kind support or maintenance. 5. When an individual receives SSI, they are also eligible to receive Medicaid as their health insurance. In Wisconsin, the Medicaid asset limits and exemptions parallel SSI. In many cases, Medicaid coverage is as valuable or even more valuable to a person with disabilities than cash assistance because out-of-pocket medical expenses or private insurance would be impossible to afford otherwise. 6. Other programs at the federal, state, and local level, such as HUD Section 8 housing assistance, food assistance and supportive services, often have income and asset limits. In Wisconsin, each county has an Aging and Disability Resource Center (ADRC) to provide information and application assistance for programs available to individuals with disabilities.

Special Needs Planning: Special Needs Trusts (SNT) The distribution standard for a special needs trust must be completely discretionary. In many cases, the distribution standard of a SNT is stated as the trustee having “sole and absolute discretion” to make any or no distributions from the trust for the benefit of the disabled individual. In addition, it is common to state that the SNT is intended to supplement, but not replace, income or support that the beneficiary may receive from other sources like public benefits. Therefore, a “health, education, maintenance and support” (HEMS) distribution standard or mandatory distribution of all income will cause a special needs trust to fail, because the assets of the trust will be counted as available to the beneficiary.

Two types of special needs trusts Special Needs Planning: Special Needs Trusts (SNT) 1. A third-party SNT may be created and funded by anyone other than the beneficiary. A third-party SNT may be a stand-alone trust, a sub-trust in a revocable living trust, or a testamentary trust created under a will. 2. A first-party SNT is created by the beneficiary, or the beneficiary’s grandparent, parent, guardian, or a court, and is funded with the beneficiary’s assets. For a first-party SNT to be an exempt resource for SSI and Medicaid, upon the death of the beneficiary, the SNT must payback all state Medicaid programs for any services the beneficiary received before any remaining balance may be paid to remainder beneficiaries. A first-party SNT may also be referred to as a self-settled trust, a payback trust, a (d)(4)(A) trust, or an OBRA ’93 trust.

Pooled and Community Trusts Special Needs Planning: Special Needs Trusts (SNT) Pooled and community special needs trusts can administer first-party or third-party trusts for individuals with disabilities. First-party pooled trusts are authorized under federal law to comply with SSI and Medicaid eligibility. In Wisconsin, Wispact, Inc. and Life Navigators offer statewide pooled and community trust options. Many states offer pooled trust programs, and there are several national pooled trusts too. Under Wisconsin’s Medicaid laws, an individual over age 65 can create a pooled trust sub-account for himself or herself. However, in many other states, creation of a first-party SNT is not an option for someone over age 65.

Third-party SNT for a Spouse Special Needs Planning: Special Needs Trusts (SNT) One tool for married couples contemplating Medicaid planning for nursing home care is a testamentary SNT in the non-nursing home spouse’s will for the benefit of the (anticipated) nursing home spouse. Although not allowed in all states, Wisconsin treats such a trust as an exempt asset for Medicaid eligibility purposes. Because of Wisconsin’s marital property law, it is advisable for the spouses to enter into a marital property agreement to classify the property of the non-nursing home spouse’s estate as that spouse’s individual property. This type of trust is a hedge against the possibility of the non-nursing home spouse predeceasing the nursing home spouse and the combined marital estate being exposed to Medicaid spenddown or estate recovery.

Other considerations when planning for SNTs A variety of circumstances may arise in advising clients and planning for a SNT. Special Needs Planning: Special Needs Trusts (SNT) 1. Beneficiary designations need to be coordinated with a third-party SNT. If the client has executed estate planning documents with appropriate language to create a third-party SNT, then beneficiary designations, such as for life insurance and retirement accounts, must be coordinated accordingly. Also, the advising professional should counsel clients regarding any POD or TOD arrangements to avoid provisions that pay an asset directly to a beneficiary, where such provisions will undermine the effectiveness of estate planning with an SNT. 2. If tax-deferred retirement accounts or annuities are paid to an SNT, then the trust document needs to be drafted to provide for appropriate provisions for the trust to be an “accumulation” trust and to accomplish the payout “stretch” for the beneficiary. (An accumulation trust is one type of “see-through” trust for purposes of IRS taxation of retirement benefits payable to a trust.) The SECURE Act, effective Jan. 1, 2020, affects some SNTs, mostly regarding remainder beneficiaries.

ABLE account Special Needs Planning: ABLE Account Under the Achieving a Better Life Experience Act (enacted in December 2014), an individual who was disabled before age 26 may establish and fund an ABLE account 1. The ABLE account balance exempt for public benefits purposes, with a maximum of 100,000 for SSI continued eligibility. 2. The maximum contribution to an ABLE account is 15,000 per year from all sources. (The annual limit for deposits into an ABLE account corresponds to the annual gift tax exclusion amount, which is indexed in 1,000 increments and is 15,000 for 2021.) 3. Any funds remaining in an ABLE account after the beneficiary’s death are subject to payback to the states’ Medicaid programs before the balance can be distributed to any heirs or beneficiaries. 4. Any ABLE account may be a useful companion instrument to an SNT for making distributions that avoid in-kind support and maintenance treatment for SSI purposes, among other benefits.

1. UTMA account—Under Wisconsin’s Uniform Transfer to Minors Account act, a custodial account may be held for a minor until age 21. This is an occasional planning device for parents or grandparents of minors but is not useful for an individual with a disability who will eventually receive SSI. Between age 18-21 for the child, the custodian still controls the account, so it is unavailable for public benefits purposes. However, before the child turns 21, some additional planning is needed—such as spending the funds, depositing into an ABLE account, or funding a first-party SNT—or otherwise the funds are countable for SSI purposes and may delay the individual’s eligibility. Furthermore, funds in an ABLE account or a firstparty SNT are subject to Medicaid payback, making an UTMA account a less desirable vehicle for third-party gifts. 2. Disinheriting the individual with a disability. Before special needs trusts were available as a planning tool for a recipient of public benefits, it was common for parents to disinherit their child with special needs and leave everything to other children, with the assumption that the other children would informally take care of the child with a disability. Such an informal arrangement can be derailed by a recipient child refusing to share with the sibling who is disabled, or through involuntary diversion of the inheritance through financial problems or death of the recipient child. Special Needs Planning: Planning strategies to avoid

Conclusion As you can see from this presentation, comprehensive estate planning that takes into consideration both proactive planning for incapacity, as well as immediate planning for the needs of someone requiring longterm care assistance, is a complex practice area. Even if you are not confident in the nuances of this field, spotting situations where clients would benefit from this type of planning is critical to help clients protect themselves and their loved ones. Establishing a relationship with other professionals who focus on this specialty is important, especially as this area of planning is very ripe for changes in law and strategy.

Questions?

Referral sources: References; Referral Sources National Academy of Elder Law Attorneys (NAELA): www.naela.org The Special Needs Alliance: https://www.specialneedsalliance.org/ Wisconsin Medicaid Eligibility Handbook: http://www.emhandbooks.wisconsin.gov/meh-ebd/meh.htm