Not FDIC Insured May Lose Value No Bank Guarantee EO102 297545

18 Slides1.16 MB

Not FDIC Insured May Lose Value No Bank Guarantee EO102 297545 10/15 1

Asset protection: Preserving your net worth We protect our homes, cars, valuable possessions — even household appliances What about our wealth? EO102 297545 10/15 2

Lawsuits target “deep pockets” “How a jury decided that a coffee spill was worth 2.9 million” Wall Street Journal, September 1994 “Mall sued over squirrel attack” Chicago Sun Times, August 2006 “N.J. woman hit with ball sues Little League player” USA Today, June 2012 EO102 297545 10/15 3

Are your assets at risk? Do you own a home? Are you in a high-risk profession? Do you own a business? Does your business have employees? Do you own rental property or real estate investments? Do you have significant personal savings or other valuable assets? Do you drive a car often? Do teenage drivers live with you? Do you have pets? EO102 297545 10/15 4

A critical part of a financial plan Investments Saving for retirement Minimizing taxes Funding education Comprehensive financial plan Planning for income in retirement Insurance Asset protection Estate planning EO102 297545 10/15 5

A two-part plan to protect your assets 1 2 Minimize your risks now Put a protection plan in place — before something happens EO102 297545 10/15 6

What asset protection is NOT An excuse or vehicle for evading taxes A method for hiding assets A way to defraud creditors Source: Asset Protection Planning Guide: A State-of-the-Art Approach to Integrated Estate Planning, Barry S. Engel, David L. Lockwood, and Marc Merric. EO102 297545 10/15 7

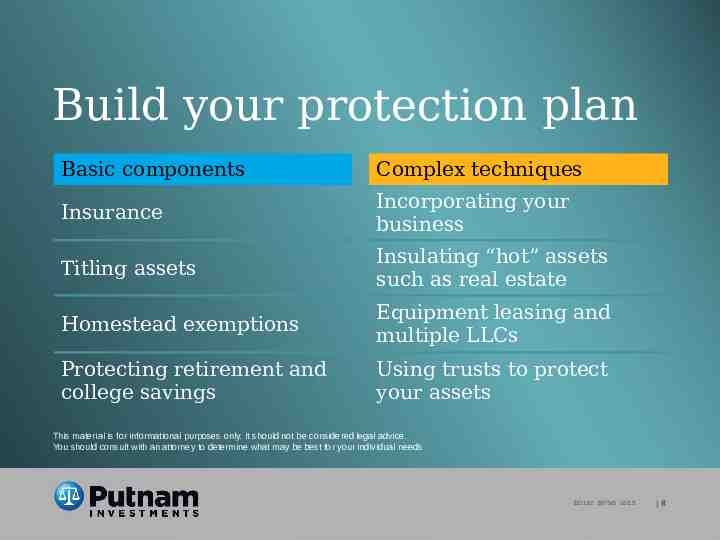

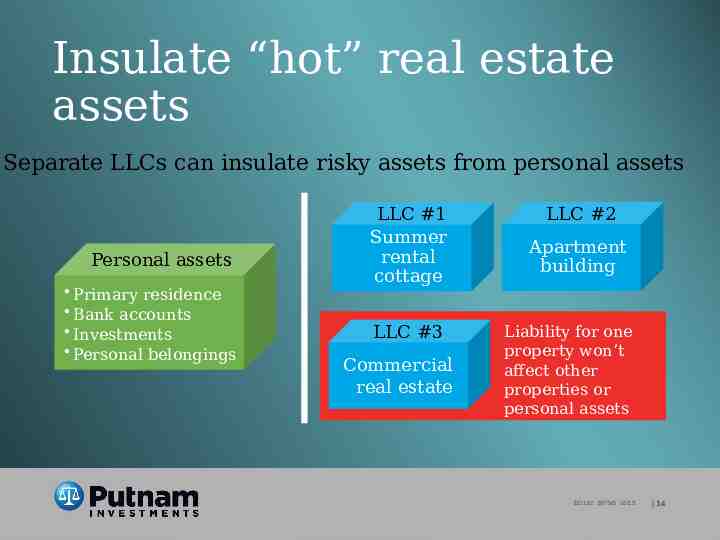

Build your protection plan Basic components Complex techniques Insurance Incorporating your business Titling assets Insulating “hot” assets such as real estate Homestead exemptions Equipment leasing and multiple LLCs Protecting retirement and college savings Using trusts to protect your assets This material is for informational purposes only. It should not be considered legal advice. You should consult with an attorney to determine what may be best for your individual needs EO102 297545 10/15 8

Start with the basics Identify and correct property risks Review your insurance coverage Purchase umbrella liability coverage Apply for a homestead exemption Be careful when titling assets Identify and correct any potential risks associated with property and real estate Maintain positive personal and professional relationships EO102 297545 10/15 9

Are your retirement savings protected? Type of retirement account ERISA plans: 401(k), pension, profit sharing, ESOP Rollover IRA, SEP IRA, SIMPLE IRA, most 403(b) plans, Individual 401(k) Traditional and Roth IRA File for bankruptcy? No bankruptcy Full protection Full protection Full protection Not protected at federal level, may receive protections at state level Protected up to 1 million Not protected at federal level, may receive protections at state level EO102 297545 10/15 10

How college savings are protected Federal protection in the event of Chapter 7 bankruptcy filing Point of contribution Made less than a year before filing: NOT protected from creditors 1 year 720 days After 1 year, 5,000 is protected Made more than 720 days before filing: 100% protected EO102 297545 10/15 11

Is your business putting personal assets at risk? Business owners may be at risk of legal claims by patients, customers, or employees Without a formal business structure, your personal assets may be at risk Select a method of ownership for your business to make it difficult — or expensive — for someone to access your assets EO102 297545 10/15 12

Structuring your business Business ownership Benefits Considerations Business owner does not May be more complex to Corporation (C corp or S corp) bear personal liability for establish and maintain Adverse legal judgment debts of the corporation could result in plaintiff receiving ownership shares Easy to establish and Some states may allow LLC or LLP maintain creditors to attach Potentially better liability ownership interest of LLC protection than or LLP corporations; creditor attachment may be limited to distributions, not shares of ownership EO102 297545 10/15 13

Insulate “hot” real estate assets Separate LLCs can insulate risky assets from personal assets Personal assets Primary residence Bank accounts Investments Personal belongings LLC #1 Summer rental cottage LLC #3 Commercial real estate LLC #2 Apartment building Liability for one property won’t affect other properties or personal assets EO102 297545 10/15 14

Example: Using leasing and multiple LLCs to protect assets LLC#1 Equipment Medical practice The medical practice leases office space and equipment from the LLCs Equity in these assets is NOT contained in the medical practice, where it could be at risk LLC#2 Real estate EO102 297545 10/15 15

Using trusts to protect your assets Type 0f trust Asset protection considerations Irrevocable trusts Typically prevent trustee from making distributions to satisfy creditors of the trust beneficiary Offshore or foreign trusts Domestic asset protection trusts Trustee is not subject to jurisdiction of U.S. laws and courts Creditors may find these assets more difficult/expensive to target Certain court cases have exposed limitations Trustee and beneficiary are same person Designed specifically to protect assets from creditors Relatively new, available in a few states; lack of existing case law to provide precedent of their effectiveness EO102 297545 10/15 16

Your action plan Meet with your financial advisor Review current assets and determine your net worth Take care of basics, such as insurance coverage Identify and minimize any prevalent risks Consult with an attorney EO102 297545 10/15 17

EO102 297545 10/15 19