New Faculty Benefits Orientation William & Mary University Human

78 Slides4.05 MB

New Faculty Benefits Orientation William & Mary University Human Resources Rev. 01/2023 1

Orientation Agenda Welcome Remarks Part One – Getting Started Part Two – Retirement and Related Plans Part Three – Healthcare Plans Part Four – Voluntary Benefits Rev. 01/2023 2

Getting Started – Online Tools Rev. 01/2023 3

Getting Started – Checklist Checklist Item Location Online Cornerstone Online Code of Ethics & Mandatory Reporting Cornerstone Online Virginia Drug Policy Acknowledgement Cornerstone Direct Deposit Online Banner Clearance Deduction Policy Online Acknowledgement Cornerstone Welcome letter from UHR Rev. 01/2023 Deadline 7 Days 7 Days 7 Days Today Today 4

Getting Started – Online Tools NEW HIRE CURRICULUM Will be assigned to you via an email. Please log in once you receive the email. Rev. 01/2023 5

Getting Started – Online Tools Enter Direct Deposit information Tax information Emergency contact information Opt into electronic W-2s View Pay history Check stubs Rev. 01/2023 6

Getting Started – Online Tools Change of address – Use Banner Self-Service Change of name – Copy of new social security card required to be seen by UHR along with a Change of Name form which is available on the UHR website Rev. 01/2023 7

Getting Started - Payroll Information Pay periods: * 10th – 24th paid on the 1st of the month * 25th – 9th paid on the 16th of the month Pay checks must be direct deposited. Verify your Banner address. William & Mary workweek (Sun. through Sat.) VIMS/Athletics workweek (Sat. through Fri.) Rev. 01/2023 8

Getting Started – Direct Deposit Set up direct deposit before first payroll date Ensure your mailing address in Banner is updated Visit Payroll web page: “What You Should Know” Rev. 01/2023 9

Getting Started - Holidays Observed holidays: – New Year’s Day, Martin Luther King, Jr. Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Election Day, Thanksgiving & Day After Thanksgiving, Christmas Eve & Christmas Day Holidays such as George Washington Day, Columbus Day and Veteran’s Day are used for the winter break. Rev. 01/2023 10

Getting Started - Inclement Weather Watch/Listen – W&M Emergency Notification System – Local TV/radio broadcasts Call – W&M (757) 221-1766 – VIMS (804) 684-7000 Tribe Alerts – Set up in Banner Self-Service Rev. 01/2023 11

In Inclement Weather. . . “Essential” employees must report to work Supervisors Be aware if your employees are essential Review essential employee policy Rev. 01/2023 12

Decisions to be made Voluntary Benefits Leave Supplemental Retirement Savings Rev. 01/2023 Health Insurance Retirement Short & Long Term Disability Optional Life Insurance 13

Decision- Checklist Checklist Item Form Deadline Health Insurance Retirement Plan Selection Health Enrollment form VRS 65 Election to Participate Form 30 days 60 days Rev. 01/2023 14

If Your Previous Employer Was A VRS Participating Employer You Must Restart All Voluntary Retirement Deductions: Voluntary Hybrid DCP Contributions 457(b) 403(b) *Deferred Compensation contributions must be re-elected when transferring from another employer by calling MissionSquare/TIAA or by logging into your account online. You are subject to the IRS Calendar limitations when making your 457(b) elections combined. Rev. 01/2023 15

If Your Previous Employer Was A VRS Participating Employer Download Your Account Summary Statement from your myVRS Account and Upload it to Box. Rev. 01/2023 16

Rev. 01/2023 17

State Agency Transfers Your service dates and accrued annual leave balance will not be accurately reflected in Banner until after receipt of your 2nd paycheck. Rev. 01/2023 18

Retirement VRS Hybrid Plan or ORP 4% Voluntary Hybrid Contributions 5% Required 457(b) 401(a) Cash Match and/or Highly Recommended 403(b) Rev. 01/2023 Optional 19

Retirement: Definitions – Defined Benefit – benefit you receive for the rest of your life following retirement as a “pension” or monthly benefit. Benefit is based on a formula. – Defined Contribution – benefit you receive in retirement is based on investment results of your contributions into a fund(s) and how your investment(s) performed. Rev. 01/2023 20

Retirement: Hybrid Benefit Plan Each pay, 5% of your gross pay (pre-tax) goes toward retirement: 4% to the “defined benefit” (DB) component 1% to the “defined contribution” (DC) component Hybrid DB defined benefit at retirement is based on formula: (Average of final compensation x 1% x years of service) /12 Hybrid DC defined contribution at retirement is based on investment results. Rev. 01/2023 21

4% Voluntary Hybrid Contribution s Rev. 01/2023 22

Rev. 01/2023 23

Rev. 01/2023 24

Rev. 01/2023 25

Retirement: Hybrid Benefit Plan Vesting Years of Service 2 3 4 5 Rev. 01/2023 Defined Contribution 50% 75% 100% Defined Benefit 100% 26

VRS Retirement: Hybrid Benefit Plan Retire with Full Benefits – Social Security retirement age with 5 years’ service – Your age Years of Service 90 Earliest Reduced Retirement Eligibility – Age 60 5 or more years of service Defined Contributions Distributions – Upon leaving employment Rev. 01/2023 27

Tax Advantaged Savings Plans 457(b) 457(b) Roth 403(b) 403(b) Roth Contributions Taken Pre-tax Contributions Taken Post-tax Deductions for your contributions to the retirement plan are deducted from your paycheck before taxes are calculated. Deductions for your contributions to the retirement plan are deducted from your paycheck after taxes are calculated. No tax savings right now. You pay taxes on the money in your retirement account when you withdraw the funds from the account. You will not owe taxes on the money in your retirement when you withdraw the money from your account *if you meet the withdraw requirements*. Rev. 01/2023 28

Cash Match If you contribute to the 457(b) or the 403(b), you will receive a cash match of 50%. The minimum employee contribution required to receive a cash match is 10 per pay period. The maximum employer cash match contribution is 20. Contribute 40 each pay period & receive a 20 cash match! You can enroll in both the 457(b) and 403(b) plans, you will receive ONLY ONE cash match for your contributions. Hybrid plan participants must contribute 9% to be eligible for the cash match programs with the 403(b) or 457 (b) supplemental savings plans. 4% Mandatory DBP 1% Mandatory DCP 4% Voluntary Contributions To The Hybrid DCP Plan Rev. 01/2023 29

Campus Police Officers/ Professional Employees Enrolled In The ORP Plan: Automatically enrolled in the 457(b) plan after 90 days of employment. 20 Will Be Deducted Per Pay Period w/ a 10 match To opt-out, contact MissionSquare 1 (877) 327-5261 within 90 days of hire. Rev. 01/2023 30

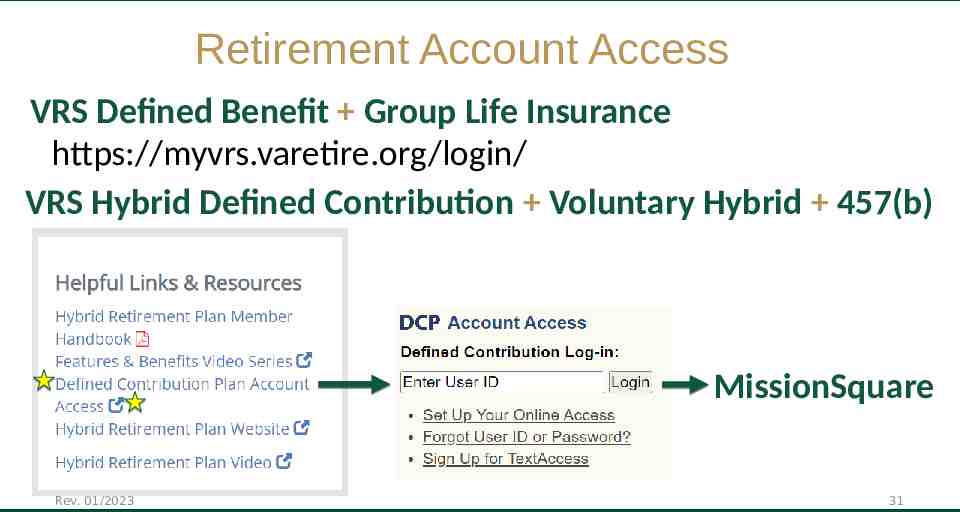

Retirement Account Access VRS Defined Benefit Group Life Insurance https://myvrs.varetire.org/login/ VRS Hybrid Defined Contribution Voluntary Hybrid 457(b) MissionSquare Rev. 01/2023 31

Retirement Account Access re VRS Defined Benefit Group Life Insurance a u q S n e o k i a s t s l i https://myvrs.varetire.org/login/ il M w , t S I r R . VRS o V e f e m d i h t e t v s i i o t e h t c s n e t s r o a e i s c s s i Hybrid Defined Contribution Voluntary Hybrid c s e i k a it c M s e e , b v h S e a h R w yc t V a k o r p e n o t h t s W r ill i n f i w @ t r p u u u en o t Yo y e m . s r e s r e e i t m t f b e e a t o s s t y k s or R s e s e e rk w c o c o a W w 1-2 t mployee rement@ e ti r e u R o d y n a e r Squa Rev. 01/2023 457(b) 32

Rev. 01/2023

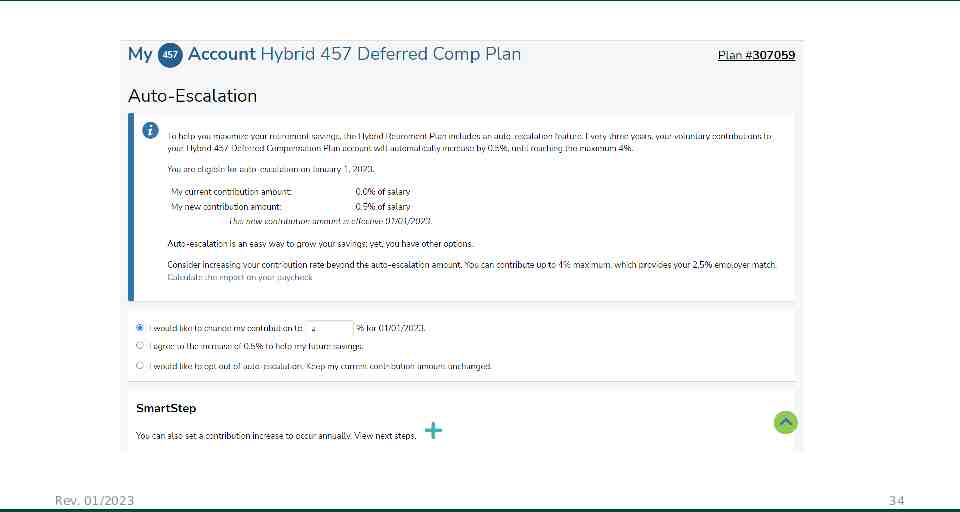

Rev. 01/2023 34

Retirement Account Access 403(b) Enroll & Select Investments Here After Your First Check Rev. 01/2023 35

Retirement: Optional Retirement Plan (ORP) Is a retirement benefit based on contributions & fund performance administered by TIAA 5% employee contributions 8.5% employer contributions Is a pre-tax deduction Has no vesting schedule – If you leave you may take the total plan value. As vesting is immediate, the employee employer contributions are yours. Rev. 01/2023 36

Retirement: Plan Comparison Topic Vesting HYBRID Defined Benefit 5 years Defined Contribution 4 years ORP Immediate Contribution Employee 5% Employer Dependent on voluntary contributions. Employee 5% Employer 8.5% Retirement Benefit Based on investment account balance Rev. 01/2023 Pension benefit income contribution income 37

Retirement Account Access 403(b) Optional Retirement Plan (ORP) Choose investments by accessing the Retirement@Work Platform after ORP contributions are deducted from your paycheck. Rev. 01/2023 38

Retirement: Deferred Compensation (DC) 457b ORP Plan Participants – Enrollment automatic after 90 days of employment. – Deducted amount 20 with 10 match* – DCP is administered by MissionSquare. To opt-out, you must contact MissionSquare 877-327-5261 within 90 days of hire Rev. 01/2023 39

Retirement: Plan Elections Selection of a Retirement Plan is IRREVOCABLE. Read Comparison Guide for detailed information **If you fail to select a retirement plan within 60 days of employment, VRS Hybrid Plan with VSDP disability will be selected for you. Rev. 01/2023 40

Retirement: Election Form You have 60 days from hire date to complete the VRS-65 Form. HR fax: 757 221 7724 Reminder: Selection of a Retirement Plan is IRREVOCABLE. Rev. 01/2023 41

How PPF Retirement Choice Affects Sick and Disability Election: Enroll in ORP Automatically placed in the University Sick and Disability Plan Enroll in VRS Hybrid, Plan 1 or Plan 2 Choice between University Sick and Disability Plan and the Commonwealth of Virginia Sickness and Disability Program (VSDP) *New employees are only eligible for VRS Plan 1 or Plan 2 if previously enrolled with prior agency Rev. 01/2023 42

Sick/Disability Plan Comparison Type of Leave VSDP Sick Leave 8 Days At Hire 10 Days Increases With Years Of Service 4 Days None Family/Personal Rev. 01/2023 University Sick & Disability 43

Sick/Disability Plan Comparisons Type of Leave VSDP University Sick & Disability Short-term Disability Months 1-12 None Months 13-59 125 at 60% of pay % increases with service 120 days 100% of pay with Provost Approval Long-term Disability Available after one year-180 day Available after one waiting period. Income 60%. year-180 day waiting State provided period. Income 60%. Employee pays 40%. Long-term Care Up to 96/day. Maximum 7080 None lifetime. State provided Parental Leave 8 weeks subject to policy rules & May use short-term Provost approval disability leave. Rev. 01/2023 44

Retirement & Related Plans - Checklist Checklist Item Location Deadline VRS 65 Election to Participate Form VRS Beneficiary Designation Form Emailed 60 days Online VRS Sick & Disability Election Form Emailed After 1st paycheck deposited 60 days VRS Sick & University Disability Plan Emailed VSDP Opt Out Form (VSDP-2) Optional Retirement Plan (ORP) Fund Online Selection TIAA.com or R@W Rev. 01/2023 60 days After 1st paycheck deposited 45

Group Life Insurance: Securian Financial No cost to benefit eligible employees No medical examination required Effective first day of eligible employment Term life insurance Natural death coverage 2 times salary rounded to next 1,000 Accidental death coverage 4 times salary rounded to next 1,000 Rev. 01/2023 46

Health Care Plans - Checklist Checklist Item Location Deadline Health Insurance Deadline Notice Online Cornerstone Today Health Benefits Enrollment/ Waiver Form In Folder 30 Days Rev. 01/2023 47

Medical Plans: Affordable Care Act & Health Insurance Marketplace A Health Insurance Marketplace Notice is in Cornerstone Since you are offered coverage under the Commonwealth’s health insurance plans, you are not eligible for a tax credit through the Marketplace Rev. 01/2023 48

Medical Plans: Choosing a Plan Plan Provider Health Plan Choices Available Anthem COVA Care Statewide and elsewhere Anthem COVA HDHP Statewide and elsewhere Aetna COVA HealthAware Statewide and elsewhere OptimaHealth Optima Health HMO (NEW!) Regional, mostly in Hampton Roads Kaiser Kaiser Permanente HMO* Regional, mostly N. Virginia TRICARE TRICARE Supplement* Eligible Military Retirees *Not covered in the rest of this presentation; Ask about these options if they pertain to you. Rev. 01/2023 49

Spotlight contains a plan summaries, monthly rates, information on earning premium rewards as well as Flexible Spending Account information and carrier contact information Rev. 01/2023 50

Health Insurance Eligibility Rev. 01/2023 51

Medical Plans: Factors in Choosing a Plan Frequently travel outside of coverage area Travel Internationally Tight Budget Have experienced increase in out-ofpocket expenses Confused on the plan that is right for you? Seek help at: www.myalex.com/cova/2022. Rev. 01/2023 52

Medical Plans: All Basic Plans Basic plans include: – Medical – Dental coverage - optional expanded plan – Prescription drug coverage – Behavioral Health – Employee Assistance Program (EAP) Plan year is July 1 – June 30 Rev. 01/2023 53

Employee Assistance Program Contact your health insurance provider Rev. 01/2023 54

Medical Plans: Online Access Anthem COVA Care LiveHealth Online Anthem COVA HDHP LiveHealth Online Aetna COVA HealthAware Teladoc Optima Health HMO MDLive Rev. 01/2023 55

Medical Plans: Wellness Free Office Visits – Children up to age 6 Free Annual Check-ups – Children age 7 & older Free Routine Screenings & Exams – Adults Rev. 01/2023 56

CommonHealth Quarterly programs – Variety of formats Check Digest for on-site health & wellness programs Program (Weight Watchers, Smoking cessation) available Rev. 01/2023 57

COVA Care Primary Care Specialty Care In Patient Hospital Emergency Room 25 40 300 per stay 150 facility PCP- 25 Specialist- 40 Rev. 01/2023 58

Medical Plans: COVA Care Highlights Vision Basic – Blue View Vision – Routine exam once per year – 15 co-pay Vision & Hearing Options – Expanded vision – Routine hearing exams - 40 co-pay – Hearing aids and other services Rev. 01/2023 59

Medical Plans: COVA Care Highlights Out-of-Network Option Domestic Travel – BlueCard PPO Program International Travel – Blue Cross Blue Shield Global Core Rev. 01/2023 60

Medical Plans: COVA Care Premium Rewards th n o m a 7 1 e Sav miums! ent e m r l l P o r in n e l a u n n A d e r i requ Rev. 01/2023 61

COVA High Deductible Health Plan Primary Care Specialty Care 20% after deductible 20% after deductible 20% after deductible 20% after deductible Rev. 01/2023 In Patient Hospital Emergency Room 62

Medical Plans: COVA HDHP Highlight You pay low premiums Expanded Delta Dental Option Blue View Vision routine eye exams 15 No Hearing or Out-of-Network available Rev. 01/2023 63

COVA HealthAware Consumer-driven health plan Includes a Health Reimbursement Arrangement (HRA) – Up to 600 for employee – Up to 1,200 for employee and spouse Rev. 01/2023 64

Medical Plans: COVA HealthAware Enrollment Date Rev. 01/2023 Proration Percentage HRA Adjustment July 1 100% 600.00 August 1 92% 552.00 September 1 83% 498.00 October 1 75% 450.00 November 1 67% 402.00 December 1 58% 348.00 January 1 50% 300.00 February 1 42% 252.00 March 1 33% 198.00 April 1 25% 150.00 May 1 17% 102.00 June 1 8% 48.00 65

COVA HealthAware Primary Care Specialty Care 20% after deductible 20% after deductible 20% after deductible 20% after deductible Rev. 01/2023 In Patient Hospital Emergency Room 66

Medical Plans: COVA HealthAware Highlights Pharmacy – HRA covers pharmacy expenses – Retail and Mail Order – Some free generic and preferred brands Vision & Hearing – Basic & Expanded Out-of-Network Coverage Rev. 01/2023 67

Medical Plans: COVA HealthAware Earn HRA funds – Healthy Activities “Do Rights” 150 maximum Do Rights include: – Routine exams – Use MyActiveHealth Tracker – Flu Shot – Completing Coaching Module Rev. 01/2023 68

Medical Plans: Optima Health HMO Regional – Hampton Roads coverage area 26,000 providers Sentara Quality Care, Riverside Health & TMPG Networks Referral-less HMO/No Out-of-Network except Children Rev. 01/2023 69

Medical Plans: Optima Health HMO Rev. 01/2023 70

Medical Plans: OPTIMA Health HMO No out-of-network provided – Except emergencies over 100 miles from residence Coverage only provided in 17 cities and counties Out of Area Dependent Program provides coverage to dependent children who live outside of service area Rev. 01/2023 71

Medical Plans: OPTIMA HEALTH HMO Includes Expanded Dental – Dominion National Includes Vision – EyeMed Rev. 01/2023 72

Medical Plans: OPTIMA HEALTH HMO Primary Care Specialty Care In Patient Hospital Emergency Room 5 – Tier 1 25 – Tier 2 10 – Tier 1 40 – Tier 2 300 per stay 150 facility Rev. 01/2023 73

Medical Plans: Health Benefits Forms must be completed and returned to HR within 30 days of hire – the coverage is effective on the first of the month following the date of hire – failure to submit a form within 30 days of hire will result in an automatic waiver of coverage Rev. 01/2023 74

Medical Plans: Making Changes During Open Enrollment Usually occurs May 1 to May 15; effective July 1st With a Qualifying Mid-Year Event Within 60 days of the event with appropriate documentation Rev. 01/2023 75

Workers’ Compensation Report ALL on-the-job injuries or illnesses Send HR within 24 hours: – First Report of Accident form – Physician Selection form – Doctor Notes – Photo of location – Incident Investigation form Employee must respond to MCI investigations Rev. 01/2023 76

Voluntary Benefits Options Checklist Item Location Deadline Flexible Reimbursement Accounts Health Enrollment form 30 Days Legal Resources Online Enrollment Optional Life Insurance Paper Form Legal Resources Genworth Long-term care Rev. 01/2023 Online Enrollment Online Enrollment 31 Days 31 Days 30 Days 60 Days 77

UHR IS HERE TO HELP. HOW CAN WE HELP YOU TODAY? William & Mary University Human Resources Bell Hall, 109 Cary Street Main UHR Phone Number: (757) 221-3169 Main UHR Fax Number: (757) 221-7724 HR Email: [email protected] WEB: https://www.wm.edu/offices/hr/index.php Rev. 01/2023 78