moving money for better moving money for Brendan McGrath, CFA

43 Slides2.88 MB

moving money for better moving money for Brendan McGrath, CFA - Director of Corporate Risk better RISK MANAGEMENT HEDGING Management

Agenda Basics of hedging Understanding FX risk 5 simple rules for FX risk management This presentation is provided for informational purposes only and does not provide any financial, legal, accounting or tax advice. moving money for better RISK MANAGEMENT HEDGING

WHAT IS HEDGING? moving money for better moving money for better RISK MANAGEMENT HEDGING

Hedging – an Introduction Hedging is a method of protecting your business against changes in currency exchange rates Similar to an insurance policy, hedging can limit the impact of foreign exchange movements on profitability Hedging can also eliminate risk resulting from transactions in foreign currencies moving money for better RISK MANAGEMENT HEDGING

Why Hedge? Create certainty around gross margins Generate predictability of future cash flows Allow for concentration and focus on core business activities, not market fluctuations Hedging protects profits, reduces cash flow volatility, helps long-term financial planning, and can aid competitiveness. moving money for better RISK MANAGEMENT HEDGING

UNDERSTANDING FX RISK moving money for better moving money for better RISK MANAGEMENT HEDGING

Drivers of FX Risk Foreign payables – sourcing materials in a different country/currency Foreign receivables – selling in a different country/currency Foreign assets or liabilities – balance sheet risk moving money for better RISK MANAGEMENT HEDGING

Types of FX risk Changes in currency markets can impact a company’s earnings and cash flows in different ways. It’s important to understand what these risks are, how to measure them, and how to manage them Generally speaking there are two kinds of currency risk that a company must be aware of: transactional risk and translational, or balance sheet risk. Transactional risk involves sales or purchases that are denominated in a foreign currency Translational risk involves the foreign assets or liabilities that sit on a company’s balance sheet Both of these risks have different impacts on cash flows and earnings, so it’s important to understand the difference between the two and how to manage each moving money for better RISK MANAGEMENT HEDGING

Transactional Risk The risk related to sales or purchases in a foreign currency Typically these are the easiest to measure and identify, and as a result are easier to manage Transactional risks are typically shorter term in nature ( 1year) but can be longer term if a company has long term commitments Transactional risk is important to understand because it directly affects cash flows An appreciating foreign currency may mean the costs for an importer go up, directly affecting gross profit margins A depreciating foreign currency may mean that the domestic revenue of an exporter will be lower if they are receiving the foreign currency Any timing mismatch between when a company makes a commitment to buy or sell a foreign currency and when they actually pay or receive that currency could give rise to foreign exchange risk. moving money for better RISK MANAGEMENT HEDGING

Transactional risk Example: A U.S. based manufacturing company sources components for their products in Europe that are priced in Euros. The U.S. company sells their products in USD. Once the company makes a commitment to purchase these components, they are exposed to currency risk, even though they don’t have to pay for 90 days. Their risk is that the value of the Euro goes up in 90 days, and as such, they will have to pay more US dollars to purchase the same component. There are a couple things the company can do to manage this risk 2 1 They can do nothing and simply buy their Euros in the spot market in 90 days when the payment is due. This completely exposes the company to swings in the EUR, be they positive or negative, and will have a direct impact on their cost of good sold. The client can hedge this currency risk by locking in their future costs using a forward contract. A forward contract simply allows the client to set the rate they will deliver upon in 90 days. Regardless of where the spot market is trading in 90 days time, the client will trade at the rate of their forward contract, thereby eliminating FX risk. The trade-off is that the client won’t be able to participate in favorable market moves if the spot rate is advantageous in 90 days time. Regardless, by using a forward the company will be able to lock in their profit margins ahead of time and not worry about where currency rates go in the future. moving money for better RISK MANAGEMENT HEDGING

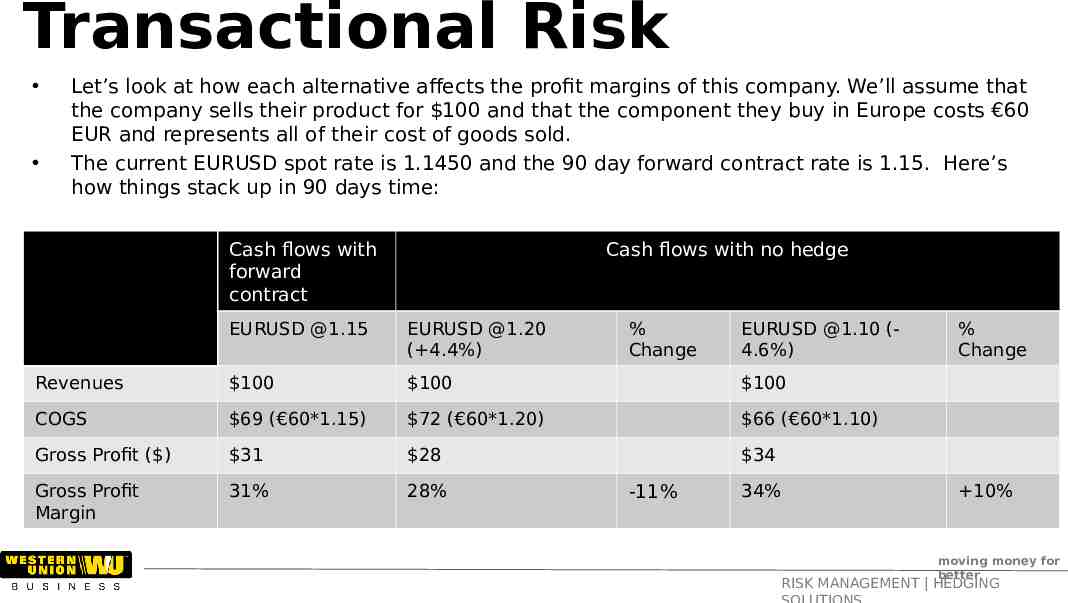

Transactional Risk Let’s look at how each alternative affects the profit margins of this company. We’ll assume that the company sells their product for 100 and that the component they buy in Europe costs 60 EUR and represents all of their cost of goods sold. The current EURUSD spot rate is 1.1450 and the 90 day forward contract rate is 1.15. Here’s how things stack up in 90 days time: Cash flows with forward contract Cash flows with no hedge EURUSD @1.15 EURUSD @1.20 ( 4.4%) % Change Revenues 100 100 100 COGS 69 ( 60*1.15) 72 ( 60*1.20) 66 ( 60*1.10) Gross Profit ( ) 31 28 34 Gross Profit Margin 31% 28% -11% EURUSD @1.10 (4.6%) 34% % Change 10% moving money for better RISK MANAGEMENT HEDGING

Translational Risk The risk related to holding assets or liabilities in a foreign currency These risks can be difficult to measure, as the level of assets or liabilities can differ from day to day and can be difficult to quantify quickly. Translational risks are typically longer term in nature, such as factories in foreign countries, long term debt, etc Translational risk directly affects the accounting earnings of a company, although it doesn’t directly affect cash flow The impact to earnings is driven by the changes in the foreign currency rate from the first day in the reporting period to the last day, although many companies will re-measure their balance sheet on a quarterly or monthly basis. moving money for better RISK MANAGEMENT HEDGING

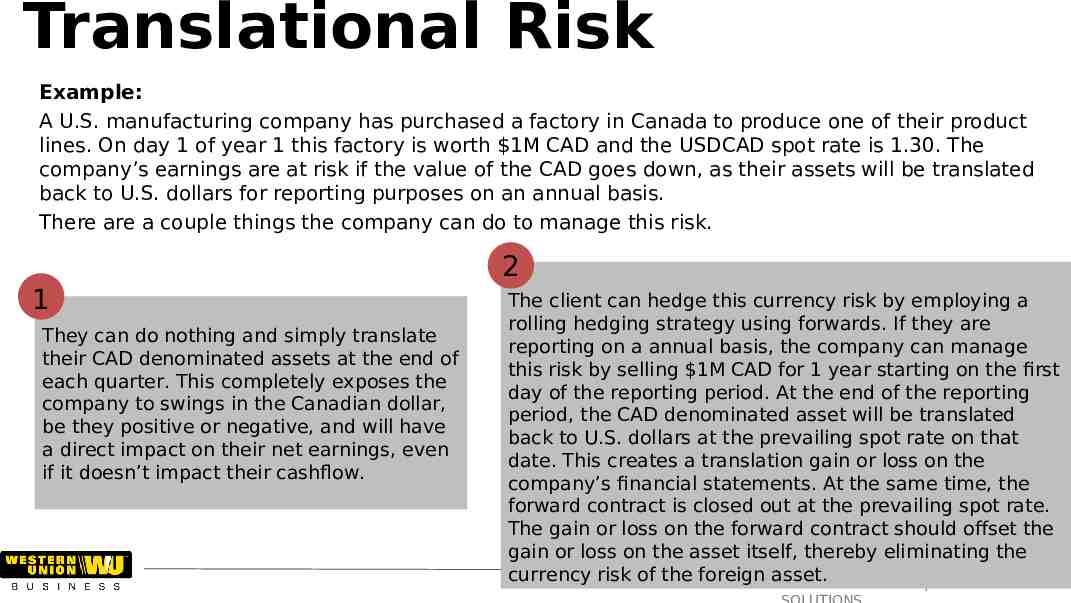

Translational Risk Example: A U.S. manufacturing company has purchased a factory in Canada to produce one of their product lines. On day 1 of year 1 this factory is worth 1M CAD and the USDCAD spot rate is 1.30. The company’s earnings are at risk if the value of the CAD goes down, as their assets will be translated back to U.S. dollars for reporting purposes on an annual basis. There are a couple things the company can do to manage this risk. 2 1 They can do nothing and simply translate their CAD denominated assets at the end of each quarter. This completely exposes the company to swings in the Canadian dollar, be they positive or negative, and will have a direct impact on their net earnings, even if it doesn’t impact their cashflow. The client can hedge this currency risk by employing a rolling hedging strategy using forwards. If they are reporting on a annual basis, the company can manage this risk by selling 1M CAD for 1 year starting on the first day of the reporting period. At the end of the reporting period, the CAD denominated asset will be translated back to U.S. dollars at the prevailing spot rate on that date. This creates a translation gain or loss on the company’s financial statements. At the same time, the forward contract is closed out at the prevailing spot rate. The gain or loss on the forward contract should offset the gain or loss on the asset itself, thereby eliminating the moving money for better currency risk of the foreign asset. RISK MANAGEMENT HEDGING

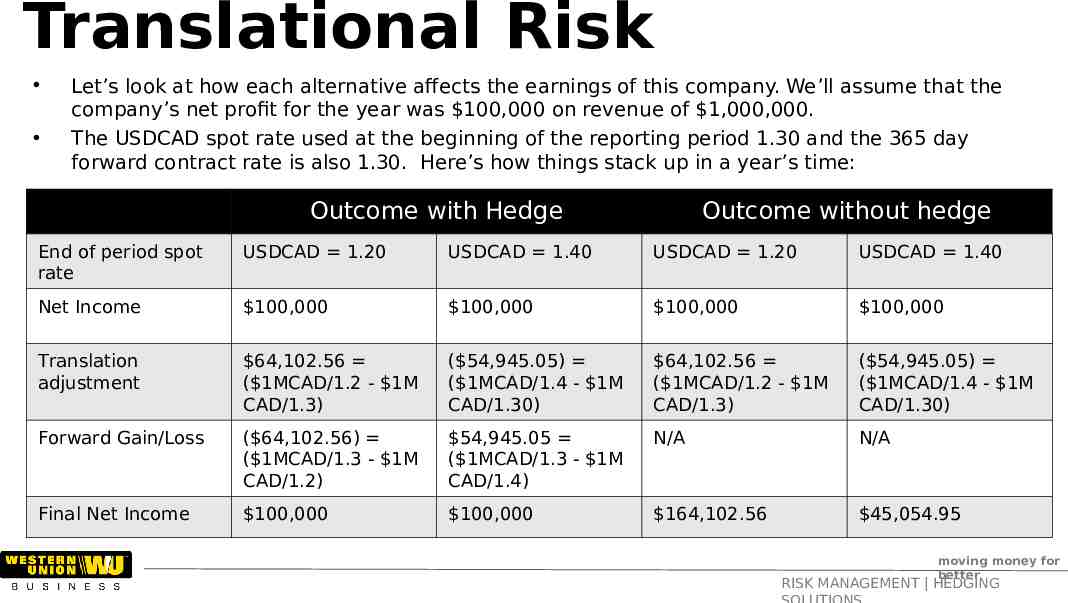

Translational Risk Let’s look at how each alternative affects the earnings of this company. We’ll assume that the company’s net profit for the year was 100,000 on revenue of 1,000,000. The USDCAD spot rate used at the beginning of the reporting period 1.30 and the 365 day forward contract rate is also 1.30. Here’s how things stack up in a year’s time: Outcome with Hedge Outcome without hedge End of period spot rate USDCAD 1.20 USDCAD 1.40 USDCAD 1.20 USDCAD 1.40 Net Income 100,000 100,000 100,000 100,000 Translation adjustment 64,102.56 ( 1MCAD/1.2 - 1M CAD/1.3) ( 54,945.05) ( 1MCAD/1.4 - 1M CAD/1.30) 64,102.56 ( 1MCAD/1.2 - 1M CAD/1.3) ( 54,945.05) ( 1MCAD/1.4 - 1M CAD/1.30) Forward Gain/Loss ( 64,102.56) ( 1MCAD/1.3 - 1M CAD/1.2) 54,945.05 ( 1MCAD/1.3 - 1M CAD/1.4) N/A N/A Final Net Income 100,000 100,000 164,102.56 45,054.95 moving money for better RISK MANAGEMENT HEDGING

SIMPLE RULES FOR FX RISK MANAGEMENT moving money for better moving money for better RISK MANAGEMENT HEDGING

FOCUS ON WHAT YOU CAN CONTROL moving money for better moving money for better RISK MANAGEMENT HEDGING

Focus on what you can control Process, not markets Business decisions, not trading decisions Drown out the noise Don’t try to time the market Psychology of decision making moving money for better RISK MANAGEMENT HEDGING

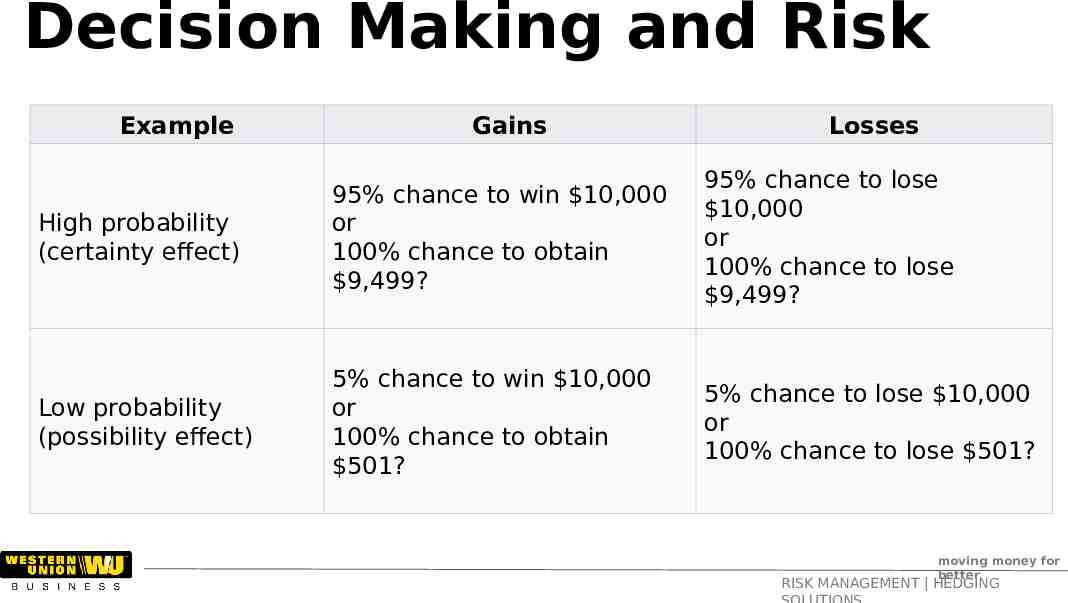

Decision Making and Risk Example Gains Losses High probability (certainty effect) 95% chance to win 10,000 or 100% chance to obtain 9,499? 95% chance to lose 10,000 or 100% chance to lose 9,499? Low probability (possibility effect) 5% chance to win 10,000 or 100% chance to obtain 501? 5% chance to lose 10,000 or 100% chance to lose 501? moving money for better RISK MANAGEMENT HEDGING

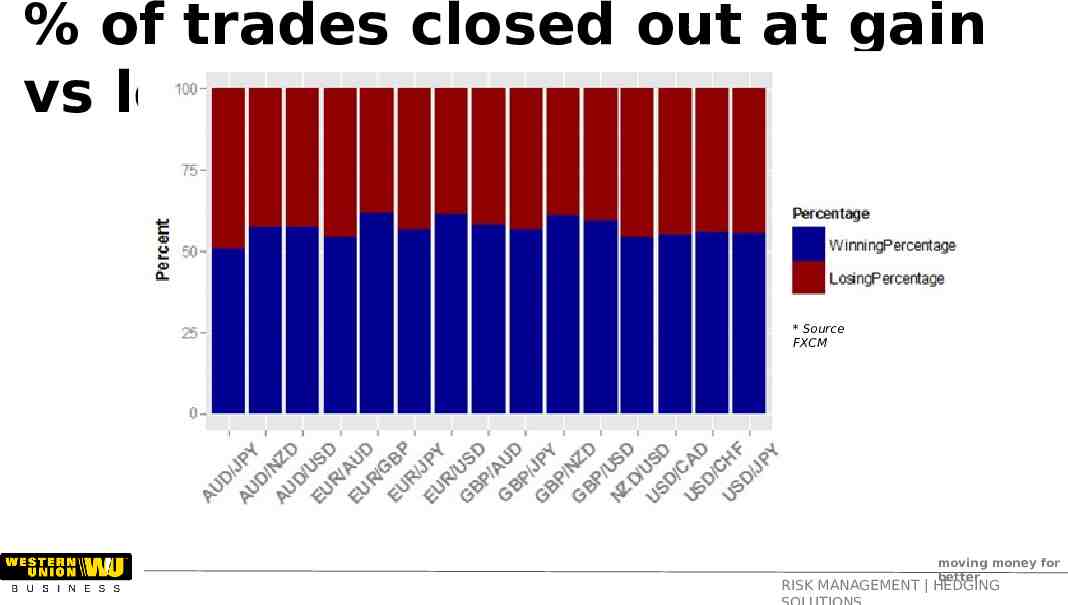

% of trades closed out at gain vs loss * Source FXCM moving money for better RISK MANAGEMENT HEDGING

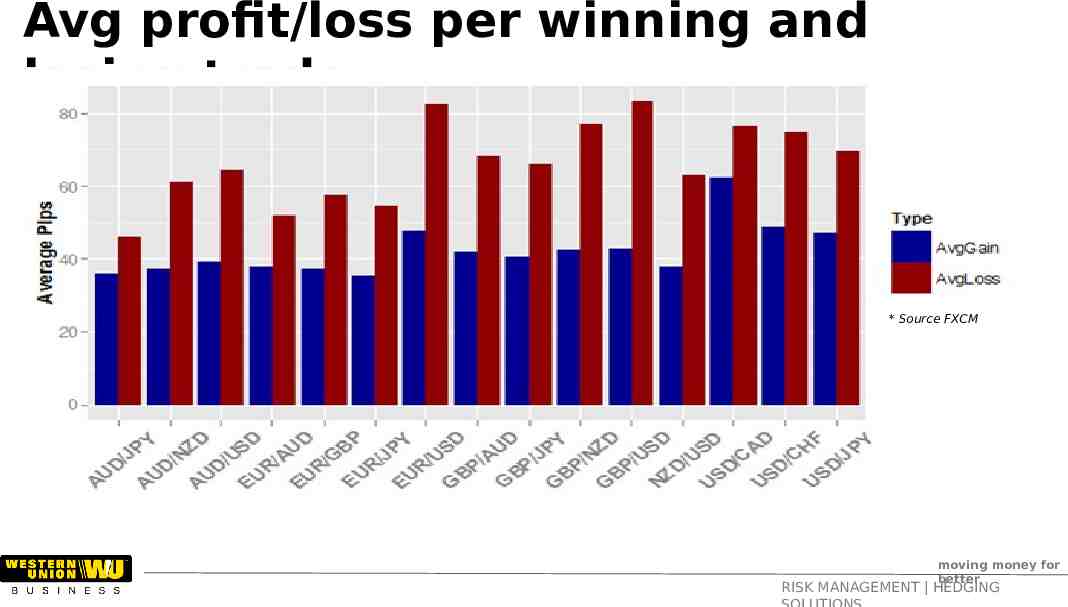

Avg profit/loss per winning and losing trade * Source FXCM moving money for better RISK MANAGEMENT HEDGING

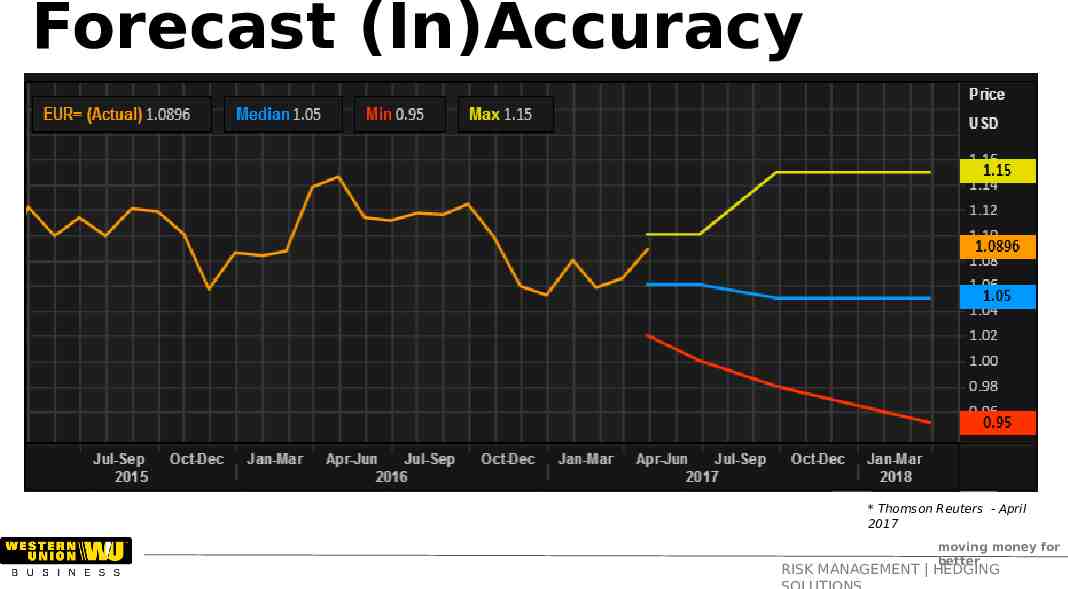

Forecast (In)Accuracy GBPUSD * Thomson Reuters - April 2017 moving money for better RISK MANAGEMENT HEDGING

KNOW THYSELF moving money for better moving money for better RISK MANAGEMENT HEDGING

Know thyself Understand your risk profile Know your objectives Know your business Seek advice moving money for better RISK MANAGEMENT HEDGING

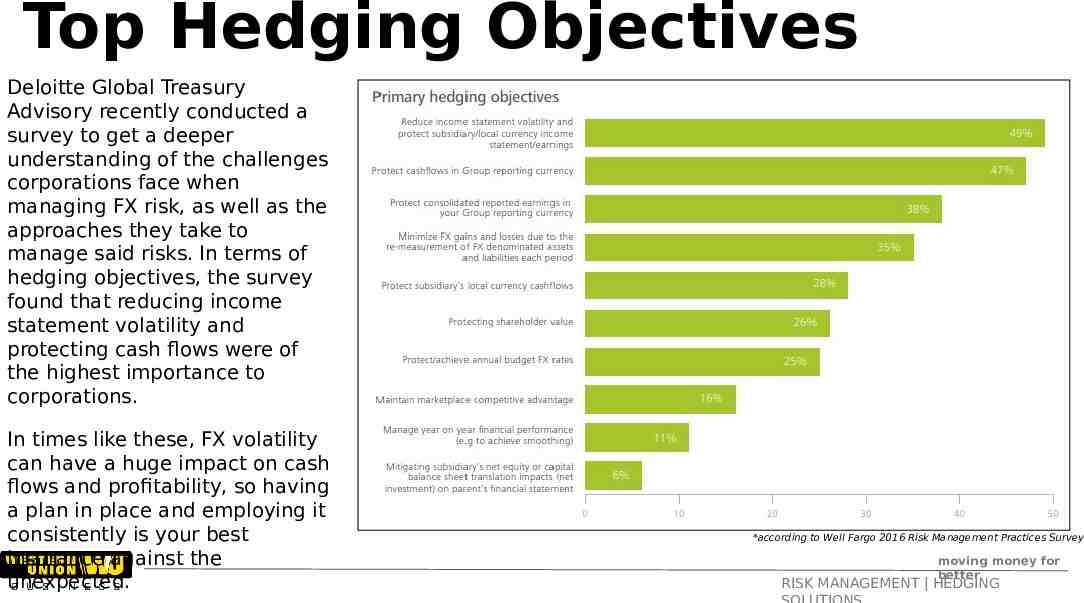

Top Hedging Objectives Deloitte Global Treasury Advisory recently conducted a survey to get a deeper understanding of the challenges corporations face when managing FX risk, as well as the approaches they take to manage said risks. In terms of hedging objectives, the survey found that reducing income statement volatility and protecting cash flows were of the highest importance to corporations. In times like these, FX volatility can have a huge impact on cash flows and profitability, so having a plan in place and employing it consistently is your best insurance against the unexpected. *according to Well Fargo 2016 Risk Management Practices Survey moving money for better RISK MANAGEMENT HEDGING

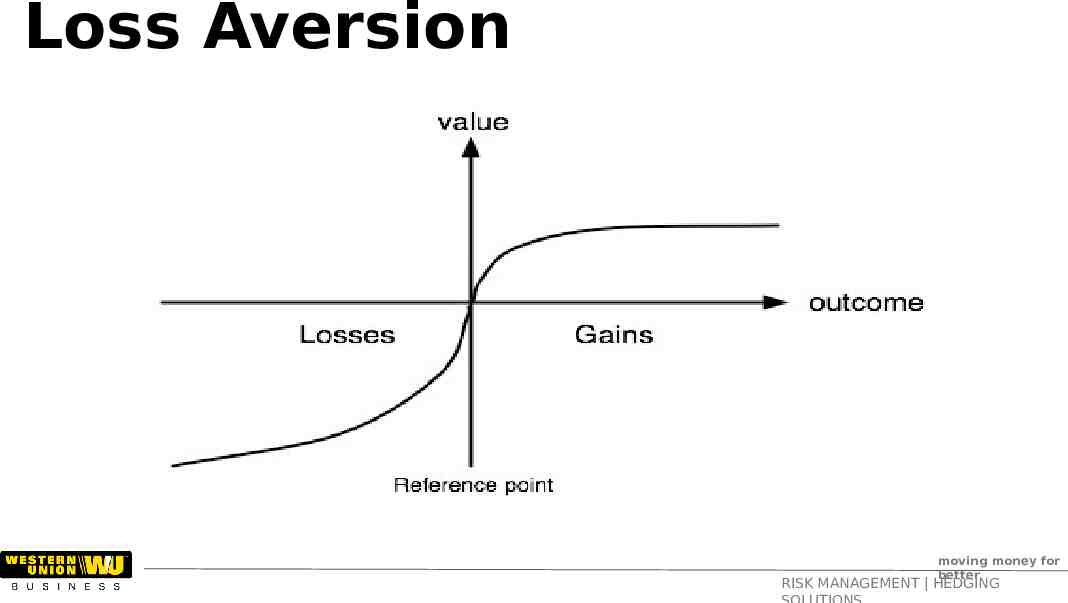

Loss Aversion moving money for better RISK MANAGEMENT HEDGING

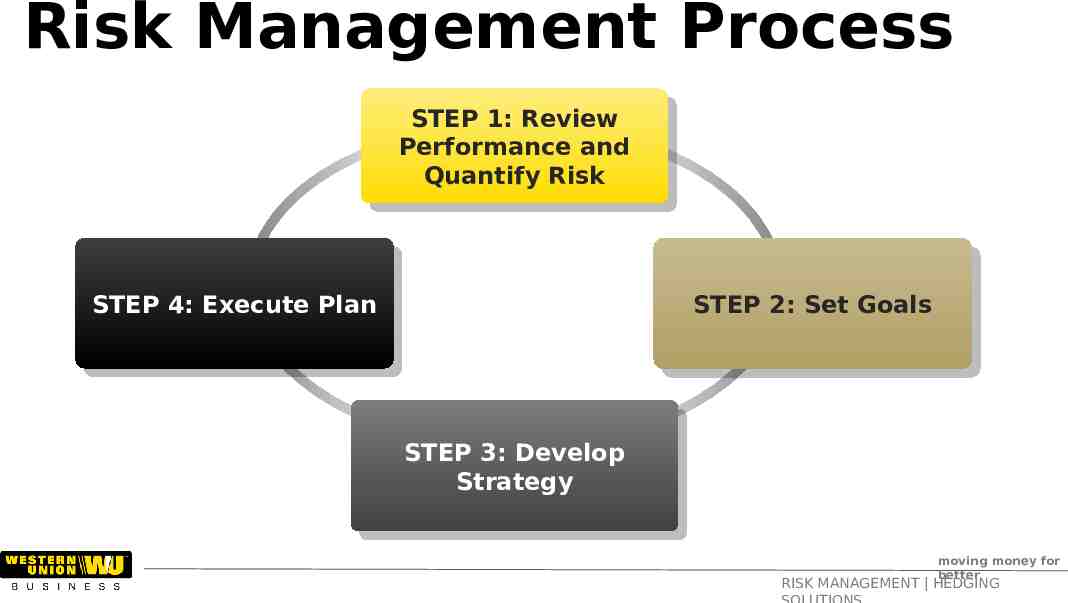

Risk Management Process STEP STEP1: 1:Review Review Performance Performanceand and Quantify QuantifyRisk Risk STEP STEP4: 4:Execute ExecutePlan Plan STEP STEP2: 2:Set SetGoals Goals STEP STEP3: 3:Develop Develop Strategy Strategy moving money for better RISK MANAGEMENT HEDGING

THINK LONG TERM moving money for better moving money for better RISK MANAGEMENT HEDGING

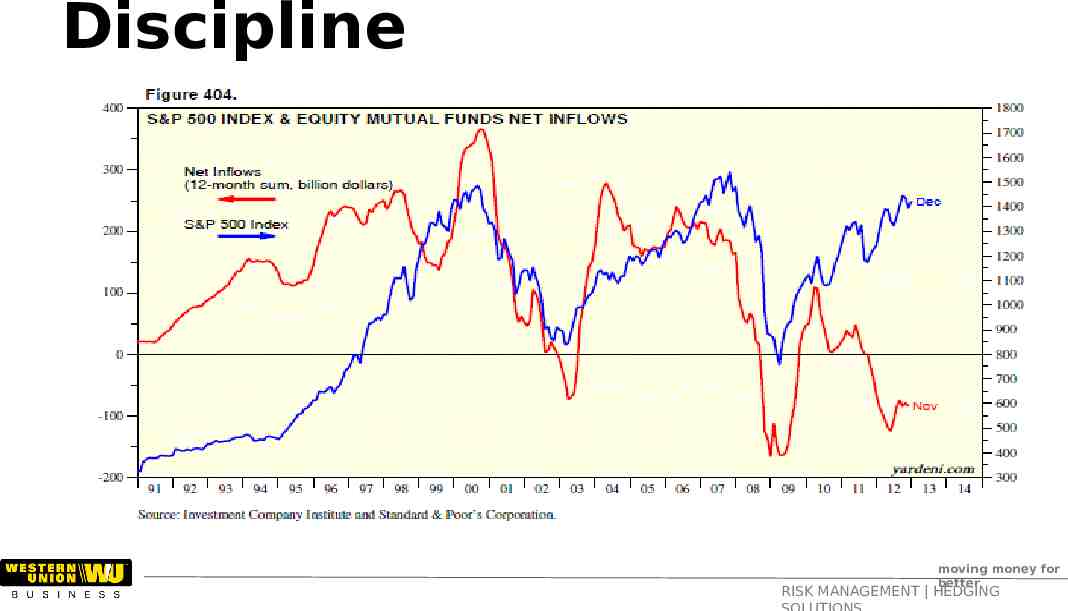

Think Long Term Short term moves shouldn’t dictate long term decisions Strategy to protect for the long term Success measured over time, not per trade moving money for better RISK MANAGEMENT HEDGING

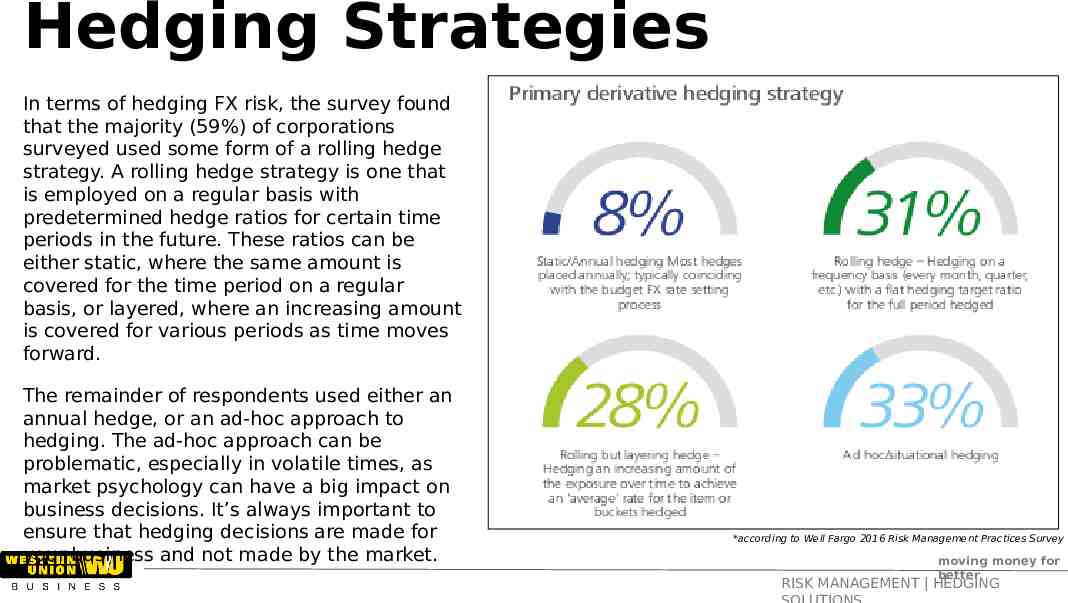

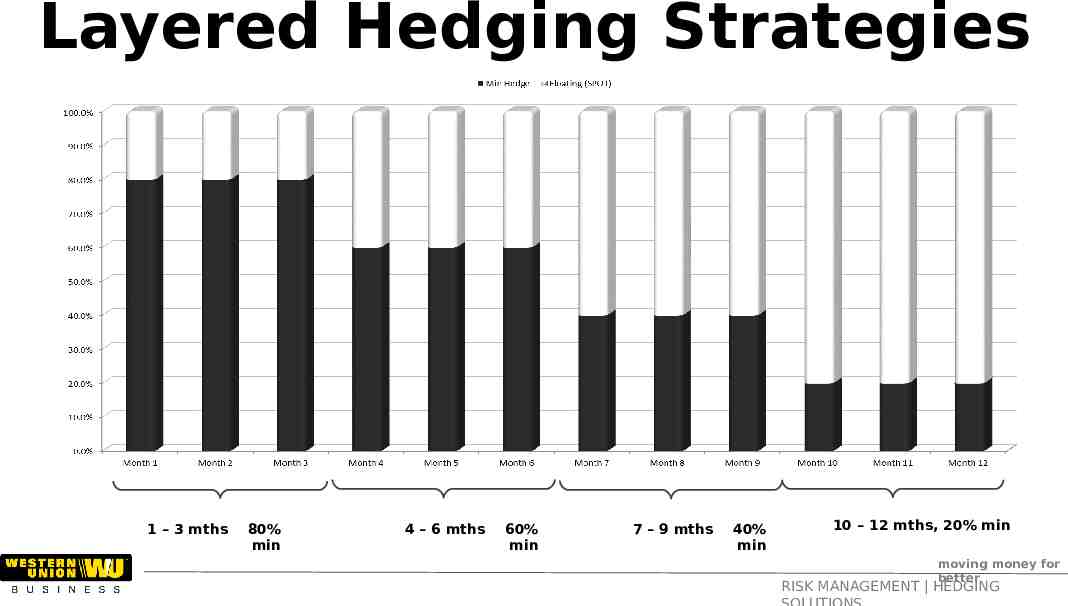

Hedging Strategies In terms of hedging FX risk, the survey found that the majority (59%) of corporations surveyed used some form of a rolling hedge strategy. A rolling hedge strategy is one that is employed on a regular basis with predetermined hedge ratios for certain time periods in the future. These ratios can be either static, where the same amount is covered for the time period on a regular basis, or layered, where an increasing amount is covered for various periods as time moves forward. The remainder of respondents used either an annual hedge, or an ad-hoc approach to hedging. The ad-hoc approach can be problematic, especially in volatile times, as market psychology can have a big impact on business decisions. It’s always important to ensure that hedging decisions are made for your business and not made by the market. *according to Well Fargo 2016 Risk Management Practices Survey moving money for better RISK MANAGEMENT HEDGING

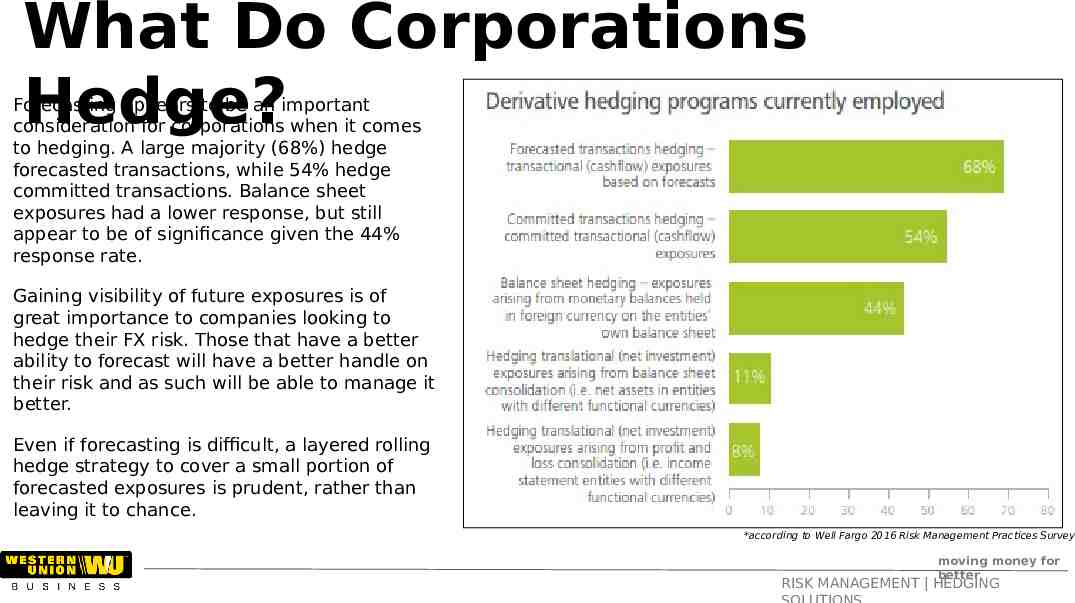

What Do Corporations Hedge? Forecasting appears to be an important consideration for corporations when it comes to hedging. A large majority (68%) hedge forecasted transactions, while 54% hedge committed transactions. Balance sheet exposures had a lower response, but still appear to be of significance given the 44% response rate. Gaining visibility of future exposures is of great importance to companies looking to hedge their FX risk. Those that have a better ability to forecast will have a better handle on their risk and as such will be able to manage it better. Even if forecasting is difficult, a layered rolling hedge strategy to cover a small portion of forecasted exposures is prudent, rather than leaving it to chance. *according to Well Fargo 2016 Risk Management Practices Survey moving money for better RISK MANAGEMENT HEDGING

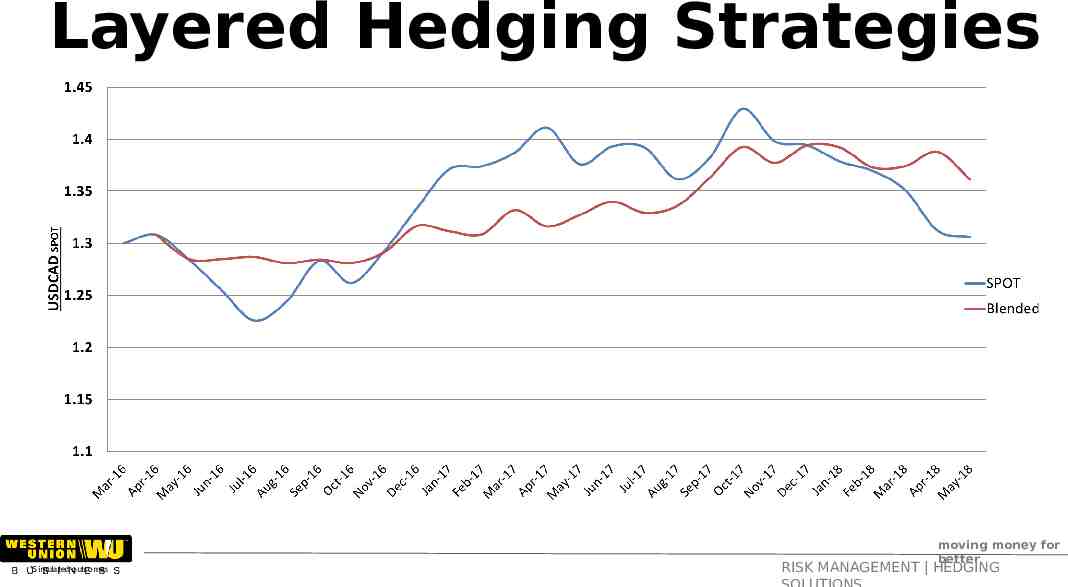

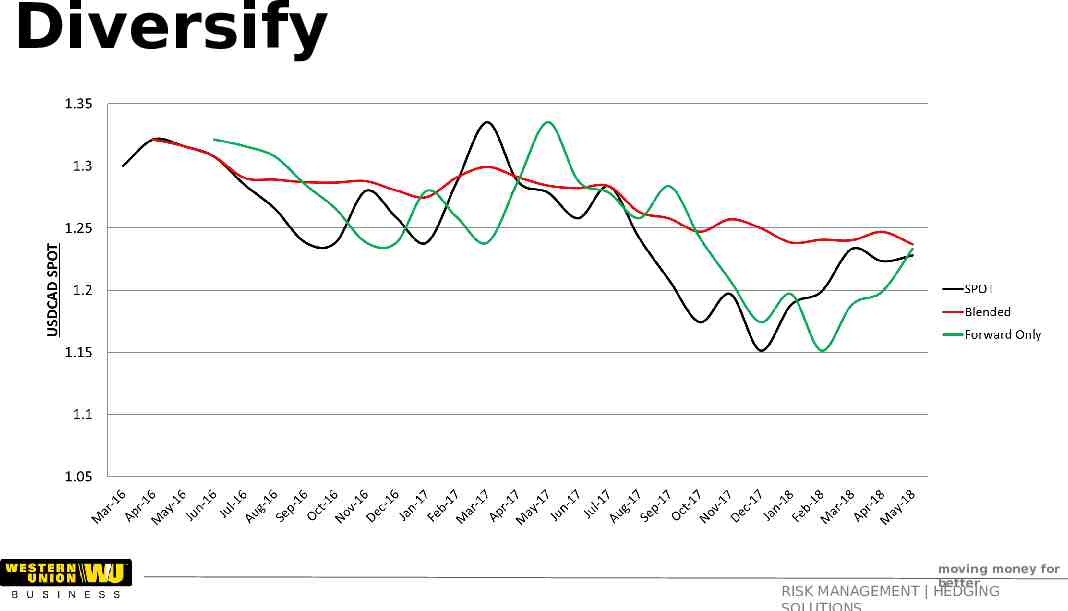

Layered Hedging Strategies *Simulated outcomes moving money for better RISK MANAGEMENT HEDGING

DISCIPLINE moving money for better moving money for better RISK MANAGEMENT HEDGING

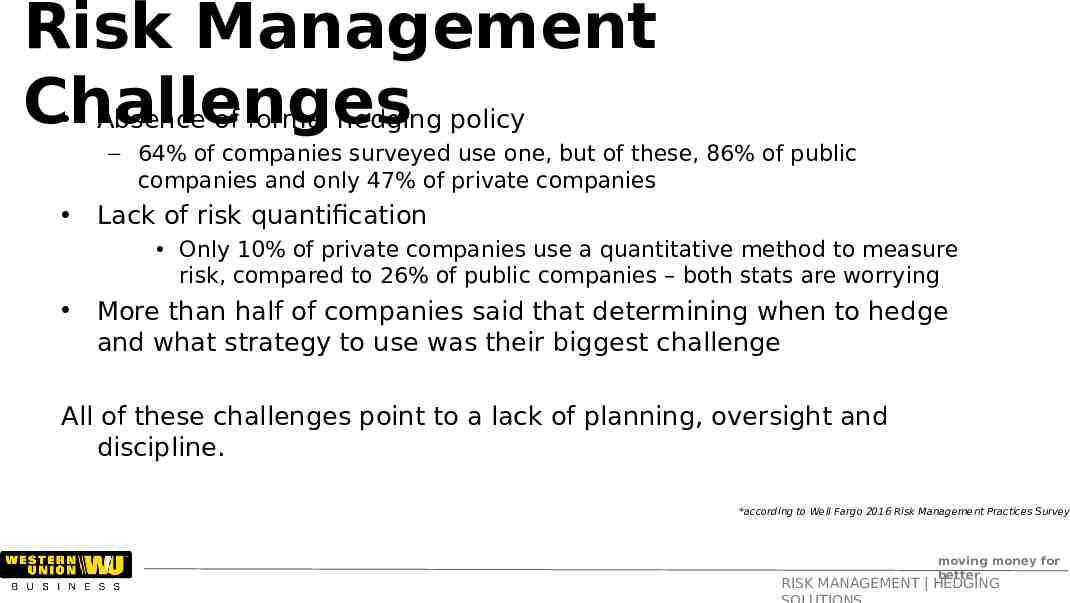

Risk Management Challenges Absence of formal hedging policy – 64% of companies surveyed use one, but of these, 86% of public companies and only 47% of private companies Lack of risk quantification Only 10% of private companies use a quantitative method to measure risk, compared to 26% of public companies – both stats are worrying More than half of companies said that determining when to hedge and what strategy to use was their biggest challenge All of these challenges point to a lack of planning, oversight and discipline. *according to Well Fargo 2016 Risk Management Practices Survey moving money for better RISK MANAGEMENT HEDGING

Discipline moving money for better RISK MANAGEMENT HEDGING

Layered hedging strategies Hedges in various amounts and time periods – diminishing profile Hedges built up over time Decisions based on rules and time constraints Consistent approach smooths future cash flows moving money for better RISK MANAGEMENT HEDGING

Layered Hedging Strategies 1 – 3 mths 80% min 4 – 6 mths 60% min 7 – 9 mths 40% min 10 – 12 mths, 20% min moving money for better RISK MANAGEMENT HEDGING

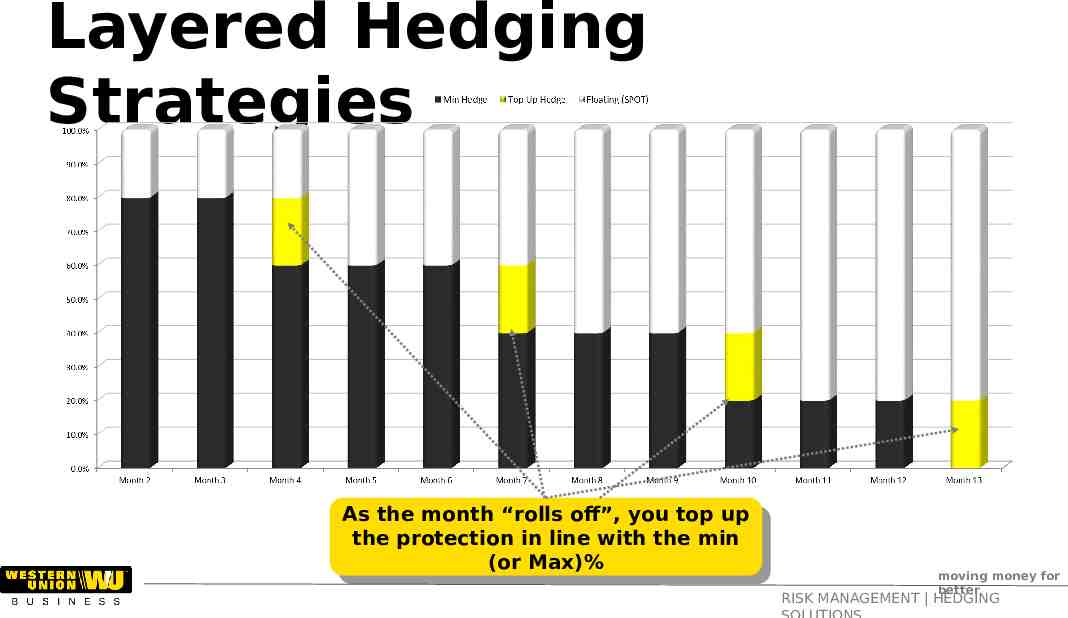

Layered Hedging Strategies As Asthe themonth month“rolls “rollsoff”, off”,you youtop topup up the theprotection protectionin inline linewith withthe themin min (or (orMax)% Max)% moving money for better RISK MANAGEMENT HEDGING

DIVERSIFY moving money for better moving money for better RISK MANAGEMENT HEDGING

Diversify moving money for better RISK MANAGEMENT HEDGING

Recap – Simple rules of fx risk management Focus on what you can control Know thyself Think long term Discipline Diversify moving money for better RISK MANAGEMENT HEDGING

Q&A moving money for better moving money for better RISK MANAGEMENT HEDGING

2017 Western Union Holdings Inc. All rights reserved. Western Union Business Solutions is a division of The Western Union Company. Services in the US are provided by Custom House USA, LLC (NMLS ID: 906985; MA MT license #: FT906985) and Western Union Business Solutions (USA), LLC (NMLS ID: 907333; MA MT license #: FT0041) (collectively referred to as “WUBS” or “Western Union Business Solutions”). For a complete listing of US state licensing, visit http://business.westernunion.com/about/notices/. For additional information about Custom House USA, LLC and Western Union Business Solutions USA, LLC visit http://business.westernunion.com/About/Compliance-Legal. This presentation does not create any binding obligation on any party, nor does it constitute an offer or a solicitation of an order. Any such offer or solicitation will only be made and the relationship between you and WUBS shall be governed by the applicable terms and conditions and any transaction-specific documentation entered into between you and WUBS. No representations, warranties or conditions of any kind, express or implied, are made herein. WUBS is the issuer of the products discussed herein and would be a counterparty to any transaction you undertake with us. This presentation is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject WUBS or its affiliates to any registration or licensing requirement within such jurisdiction. WUBS is not registered with the Commodity Futures Trading Commission as a Commodity Trading Advisor, as a Swap Dealer, or in any other capacity. WUBS is not a member of the National Futures Association. Protections that would otherwise be available under the Commodity Exchange Act, the rules of the Commodity Futures Trading Commission, or the rules of the National Futures Association will not be available to you in connection with your relationship with or transactions with WUBS. Customers may be required to meet certain eligibility requirements in order to enter into foreign exchange transactions with WUBS. Claims regarding the products discussed and other information set out herein are general in nature and do not take into account your specific objectives, financial situation, or needs. This presentation does not constitute financial advice or a financial recommendation. You should use your independent judgment and consult with your own independent advisors in evaluating whether to enter into a transaction with WUBS. WUBS bases recommendations only on general industry knowledge and the client profile you have provided, and WUBS is not undertaking to assess the suitability of any recommendation for your particular hedging needs. WUBS has based the opinions expressed herein on information generally available to the public. WUBS makes no warranty concerning the accuracy of this information and specifically disclaims any liability whatsoever for any loss arising from hedging decisions based on the opinions expressed and information contained herein. Such information and opinions are for general information only and are not intended to present advice with respect to matters reviewed and commented upon. moving money for better moving money for better RISK MANAGEMENT HEDGING

THANK YOU Brendan McGrath, CFA Director of Corporate Risk Management [email protected] Mobile: 250-661-8894 moving money for better moving money for better RISK MANAGEMENT HEDGING