MODERATELY PRICED DWELLING UNIT (MPDU) PURCHASE PROGRAM

64 Slides5.46 MB

MODERATELY PRICED DWELLING UNIT (MPDU) PURCHASE PROGRAM ORIENTATION SEMINAR – MPDU CLASS #2 Welcome Please mute your microphone on Zoom. Please put your questions in Chat. Please stay until the end of the seminar to obtain your code to get credit for the class. 1

WE WILL DISCUSS 1 What is the MPDU Program? MPDU Program Description 21 MPDU Program What is the MPDUEligibility Program? 3 How to Buy an MPDU 4 Selling or Refinancing Your MPDU 5 How to Apply to the MPDU Program 6 What to Do Next 2

1 WHAT IS AN MPDU? MPDU Program Description A Moderately Priced Dwelling Unit is a home you can buy at a lower price a market than MPDUs have a lower sales priced price in orderhome. to provide affordable housing in Montgomery County. For example, a property that would sell on the market at 300,000 would typically sell at about 175,000 in the MPDU program. Later, when you sell your MPDU, it will be at a lower price as well to keep the home affordable for other firsttime homebuyers. The Montgomery County MPDU Program is run by the Department of Housing and Community Affairs (DHCA). 3

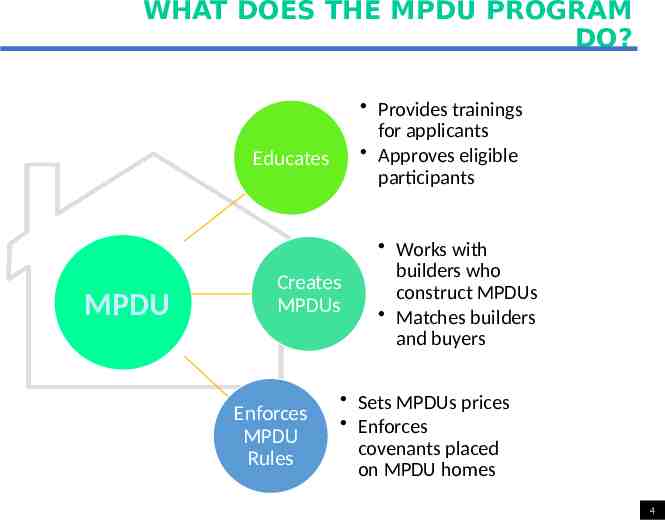

WHAT DOES THE MPDU PROGRAM DO? Provides trainings for applicants Approves eligible participants Educates MPDU Creates MPDUs Enforces MPDU Rules Works with builders who construct MPDUs Matches builders and buyers Sets MPDUs prices Enforces covenants placed on MPDU homes 4

HOW ARE MPDUs CREATED? MPDU The Moderately Priced Housing law, called Chapter 25A, requires all developers and builders to provide MPDUs in every new subdivision that has 20 or more housing units. At least 12.5% of the homes in each subdivision must be MPDUs. 5

TYPES OF MPDU DWELLINGS Duplexes Townhouses 6

TYPES OF MPDU DWELLINGS Condominiums High Rise Garden 7

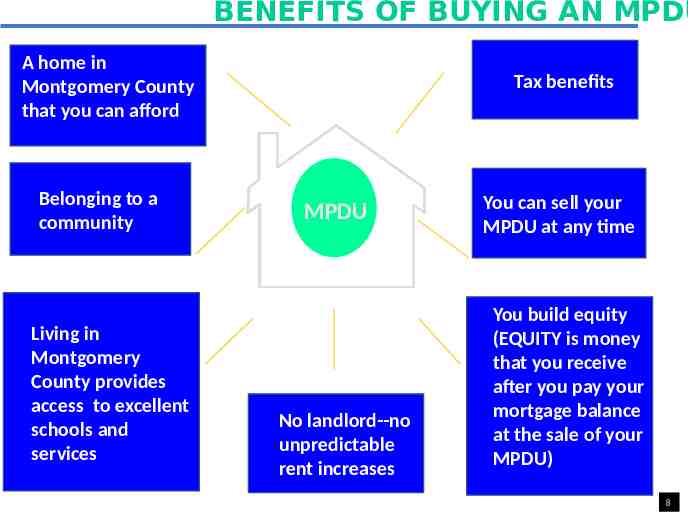

BENEFITS OF BUYING AN MPDU A home in Montgomery County that you can afford Belonging to a community Living in Montgomery County provides access to excellent schools and services Tax benefits MPDU No landlord--no unpredictable rent increases You can sell your MPDU at any time You build equity (EQUITY is money that you receive after you pay your mortgage balance at the sale of your MPDU) 8

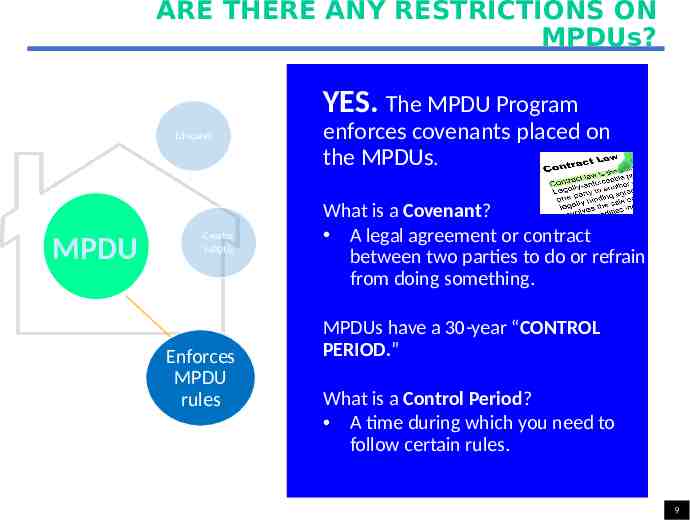

ARE THERE ANY RESTRICTIONS ON MPDUs? YES. The MPDU Program Educates MPDU Creates MPDUs Enforces MPDU rules enforces covenants placed on the MPDUs. What is a Covenant? A legal agreement or contract between two parties to do or refrain from doing something. MPDUs have a 30-year “CONTROL PERIOD.” What is a Control Period? A time during which you need to follow certain rules. 9

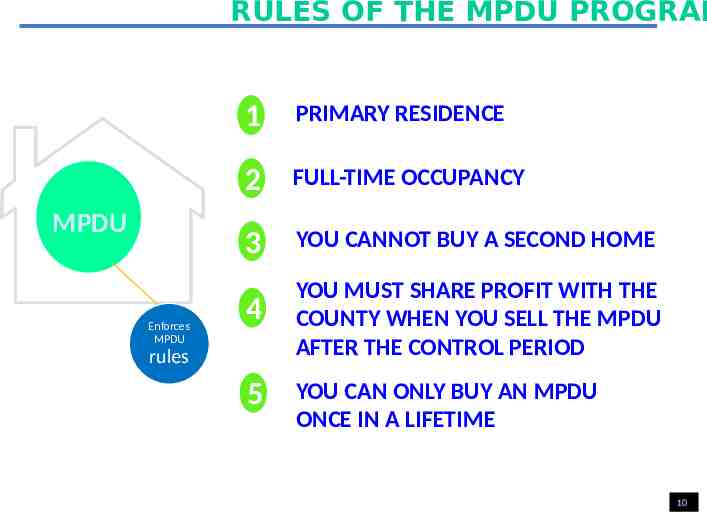

RULES OF THE MPDU PROGRAM MPDU Enforces MPDU 1 PRIMARY RESIDENCE 2 FULL-TIME OCCUPANCY 3 YOU CANNOT BUY A SECOND HOME 4 YOU MUST SHARE PROFIT WITH THE COUNTY WHEN YOU SELL THE MPDU AFTER THE CONTROL PERIOD 5 YOU CAN ONLY BUY AN MPDU ONCE IN A LIFETIME rules 10

RULES OF THE MPDU PROGRAM 1 MPDU Enforces MPDU rules 2 PRIMARY RESIDENCE You and all adults who signed the contract must live in the MPDU as your primary residence. If you need to move, you must sell your MPDU. When you decide to sell your MPDU, you must sell it through the MPDU program. You can only sell your MPDU at the MPDU resale price, not the market price. FULL-TIME OCCUPANCY Your MPDU cannot be rented, except in special circumstances. Permission from the MPDU Office is required. Your MPDU cannot be left vacant. 11

RULES OF THE MPDU PROGRA 3 YOU CANNOT BUY A SECOND HOME If you must move, or if you wish to purchase another home anywhere while your MPDU is still within the 30-year control period, you must sell your MPDU. If you inherit a second home, you must still occupy your MPDU as your primary residence. If you want to move to your inherited property, you must sell your MPDU. MPDU 4 Enforces MPDU rules YOU MUST SHARE PROFIT WITH THE COUNTY At the end of the 30-year control period, you may sell your MPDU at market price. When you sell, you must share the profit with the County. 5 YOU CAN ONLY BUY AN MPDU ONCE IN A LIFETIME After you sell your MPDU, you cannot buy another MPDU. 12

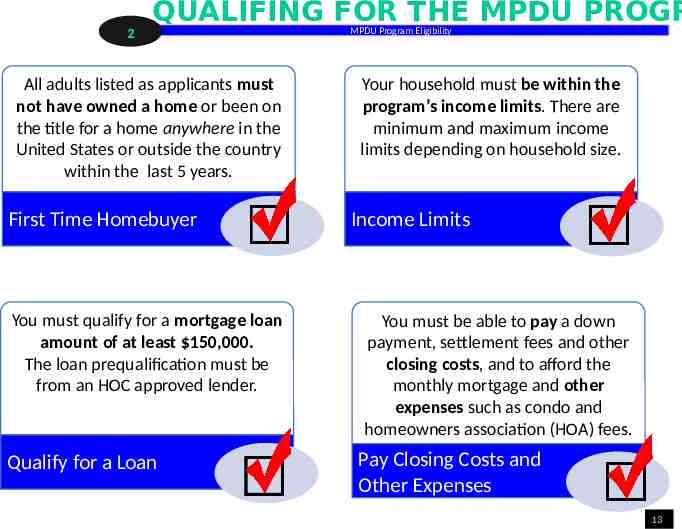

2 QUALIFING FOR THE MPDU PROGR All adults listed as applicants must not have owned a home or been on the title for a home anywhere in the United States or outside the country within the last 5 years. First Time Homebuyer You must qualify for a mortgage loan amount of at least 150,000. The loan prequalification must be from an HOC approved lender. Qualify for a Loan MPDU Program Eligibility Your household must be within the program’s income limits. There are minimum and maximum income limits depending on household size. Income Limits You must be able to pay a down payment, settlement fees and other closing costs, and to afford the monthly mortgage and other expenses such as condo and homeowners association (HOA) fees. Pay Closing Costs and Other Expenses 13

HOUSEHOLD INCOME LIMITS MINIMUM INCOME : 40,000* *If you have less than 40,000 gross income, but you have a lot of savings, you may be still able to qualify. The lender will determine if you can get a loan of at least 150,000 with your income and savings. 14

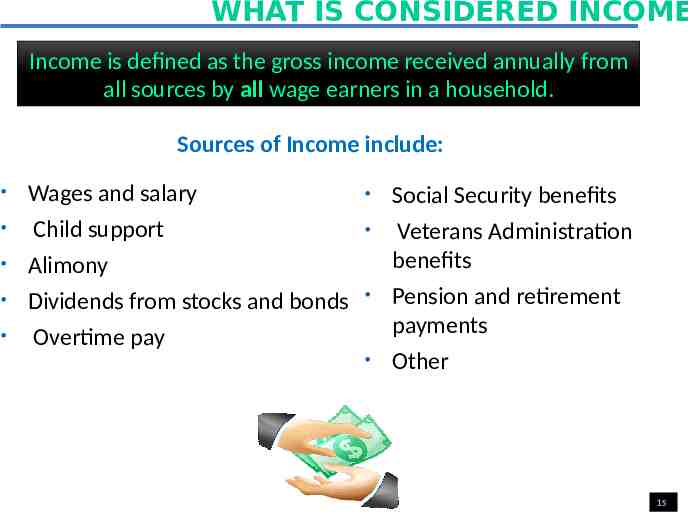

WHAT IS CONSIDERED INCOME Income is defined as the gross income received annually from all sources by all wage earners in a household. Sources of Income include: Wages and salary Child support Alimony Dividends from stocks and bonds Overtime pay Social Security benefits Veterans Administration benefits Pension and retirement payments Other 15

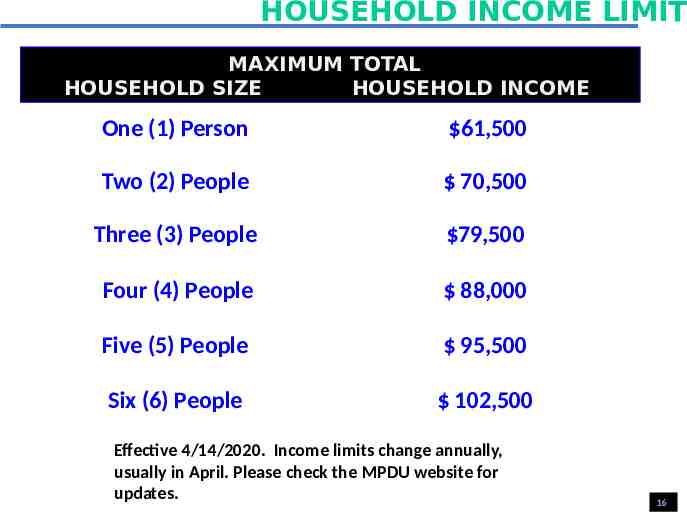

HOUSEHOLD INCOME LIMITS MAXIMUM TOTAL HOUSEHOLD SIZE HOUSEHOLD INCOME One (1) Person 61,500 Two (2) People 70,500 Three (3) People 79,500 Four (4) People 88,000 Five (5) People 95,500 Six (6) People 102,500 Effective 4/14/2020. Income limits change annually, usually in April. Please check the MPDU website for updates. 16

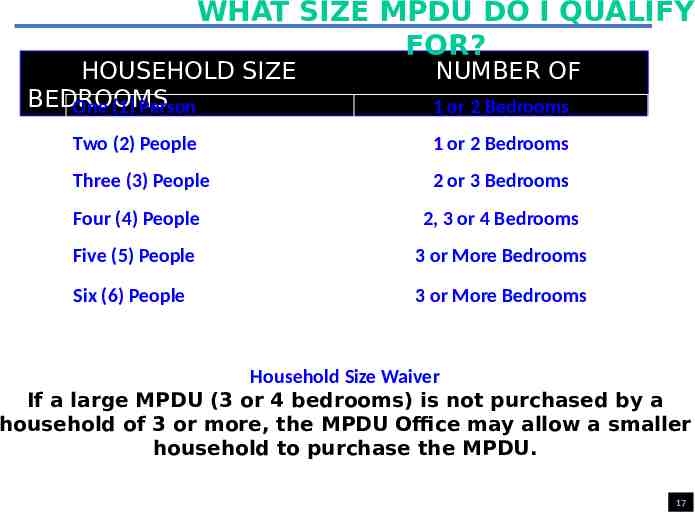

WHAT SIZE MPDU DO I QUALIFY FOR? HOUSEHOLD SIZE BEDROOMS One (1) Person NUMBER OF 1 or 2 Bedrooms Two (2) People 1 or 2 Bedrooms Three (3) People 2 or 3 Bedrooms Four (4) People 2, 3 or 4 Bedrooms Five (5) People 3 or More Bedrooms Six (6) People 3 or More Bedrooms Household Size Waiver If a large MPDU (3 or 4 bedrooms) is not purchased by a household of 3 or more, the MPDU Office may allow a smaller household to purchase the MPDU. 17

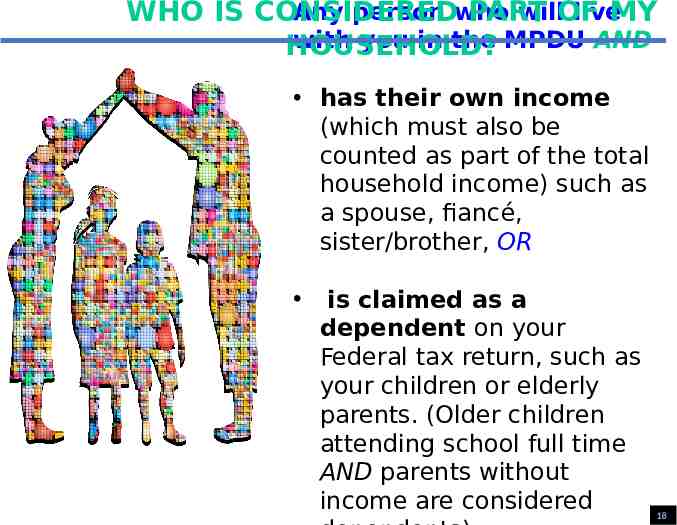

Any person who willOF live WHO IS CONSIDERED PART MY with you in the MPDU AND HOUSEHOLD? has their own income (which must also be counted as part of the total household income) such as a spouse, fiancé, sister/brother, OR is claimed as a dependent on your Federal tax return, such as your children or elderly parents. (Older children attending school full time AND parents without income are considered 18

REQUIREMENTS FOR CERTIFICATE OF ELIGIBILITY MUST COMPLETE ALL 3 REQUIRED CLASSES 1 Attend a First Time Homebuyer Class 2 3 Attend an Orientation Seminar Attend an Application Tutorial Certificate of Eligibility 19

WHAT HAPPENS AFTER I APPLY TO THE MPDU PROGRAM? If you are found eligible, you will be issued a CERTIFICATE OF ELIGIBITY Your certificate is valid for one year YOUR NAME This certificate is proof of your household’s eligibility to participate in the MPDU Program. It will be mailed to your home. It may take up to 30 days. After you receive your certificate, you may enter the Random Selection Drawings for MPDUs for sale. 20

MPDUs FOR SALE 3 How to Buy an MPDU MPDU Montgomery County’s MPDU Program offers affordably priced townhomes and condominiums - both new and resale - to eligible and certified participants. Your MPDU Certificate of Eligibility must be current. Participants who want to buy an MPDU enter an online drawing and are randomly selected and listed in the order of selection. This is what is known as a Random Selection Drawing. The first person on the list will be offered the MPDU first, and so on down the 21

FACTORS CONSIDERED IN THE RANDOM SELECTION DRAWINGS MPDU Current MPDU Certificate Your MPDU certificate is valid for one year. You must renew it each year. Lender Letter You must be pre-qualified for a mortgage loan for an amount that is equal to or greater than the MPDU sales price. Household size Your household size must be appropriate for the number of bedrooms of the MPDU for sale. Priority Points Households with the most priority points will be 22

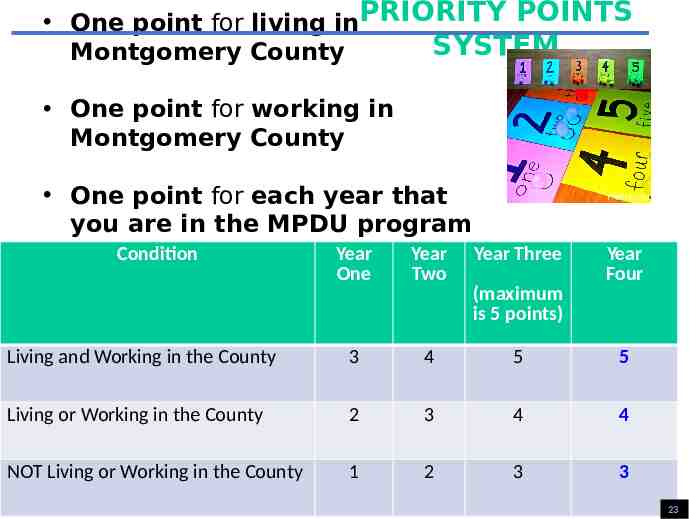

One point for living inPRIORITY POINTS SYSTEM Montgomery County One point for working in Montgomery County One point for each year that you are in the MPDU program Year Year Three (up Condition to three years). Year One Two Year Four (maximum is 5 points) Living and Working in the County 3 4 5 5 Living or Working in the County 2 3 4 4 NOT Living or Working in the County 1 2 3 3 23

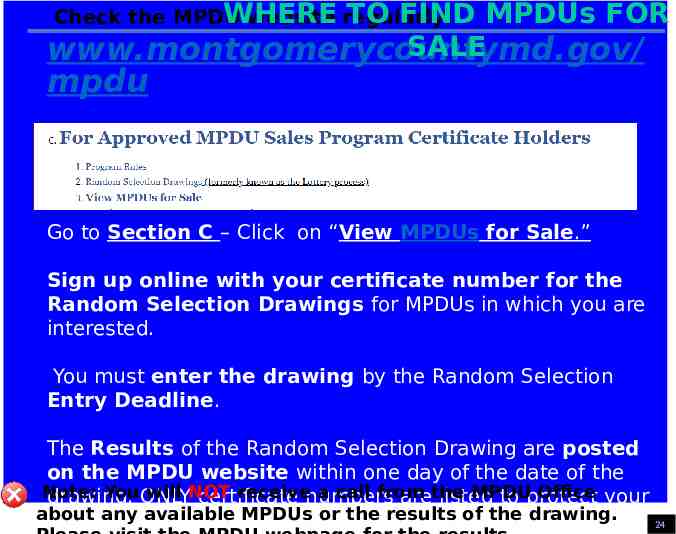

WHERE TO FIND Check the MPDU website regularly: MPDUs FOR SALE www.montgomerycountymd.gov/ mpdu Go to Section C – Click on “View MPDUs for Sale.” Sign up online with your certificate number for the Random Selection Drawings for MPDUs in which you are interested. You must enter the drawing by the Random Selection Entry Deadline. The Results of the Random Selection Drawing are posted on the MPDU website within one day of the date of the Note: YouONLY will NOT receivenumbers a call from MPDU Office your drawing. certificate arethe listed to protect about any available MPDUs or the results of the drawing. privacy. 24

THE RESULTS OF THE RANDOM SELECTION DRAWINGS ARE PUBLISHED ON THE MPDU WEBSITE Within a week or two: The builder will contact selected households depending on the MPDUs available. Households will be contacted by phone and/or e-mail to set up an appointment. The first person on the list will be offered the MPDU first, and so on down the list. If you are contacted, you will meet with the builder to see floor plans and choose options or upgrades that the builder may offer. (Examples: carpet upgrade; finishing a basement.) The maximum price for options is 10% of the MPDU sales price. If you wish to buy the MPDU, you must sign a contract (you have 48 hours after the meeting to decide). Any adult listed as a participant on your MPDU certificate must sign the required sales documents. 25

IF YOU ARE CONTACTED, BE PREPARED! BRING with you: 1. 2. Your original MPDU Certificate of Eligibility signed by all adults in the household. A check or money order for a deposit of 1% of the purchase price. YOU WILL SIGN: Sales contract. Purchaser’s Agreement Form, by which you promise to follow the MPDU rules. Receipt of MPDU Covenants* – a form that says you have received the MPDU rules that apply to your property and a copy of the current MPDU law. (*The MPDU Covenants define the MPDU rules for a development.) 26

WHAT HAPPENS AFTER I SIGN THE CONTRACT? Meet with a lender to get a final loan approval (it does not have to be builder’s lender). Note: No ARMS (Adjustable Rate Mortgage) or Interest Only loans are accepted. Keep your documents up-to-date to take to the lender. (All adults who will be on the loan must provide all their financial documents). Maintain good credit: Do not buy a car or make other expensive purchases before you buy your MPDU. MPDU Avoid new credit cards. 27

WHEN CAN I MOVE TO MY MPDU? When you sign your contract, your MPDU will probably not be built yet. It may take several months to build. The builder will contact you to let you know when the MPDU is ready. You can move in after: The MPDU has been built Your final loan has been approved Settlement has occurred* (*Settlement is an appointment at which you sign the legal sales documents and get the keys) Do NOT breach your rental lease if you are uncertain of your move-in date for your MPDU. Tenants are responsible for any remaining monthly rent expenses if the lease term has not expired. If you have questions about rental lease requirements contact the Office of Landlord-Tenant Affairs at 240-777-0311. 28

HOW DO I PAY FOR MPDU? The MPDU Program does not offerMY financing or financial assistance to help you purchase an MPDU. However, loans with favorable terms are available from the Housing Opportunities Commission (HOC). You must get a Mortgage Loan from a lender. You will need savings for a deposit, down payment and closing costs. MPDU owners are responsible for all home maintenance, home improvements, condo and homeowner association (HOA) fees (if applicable). 29

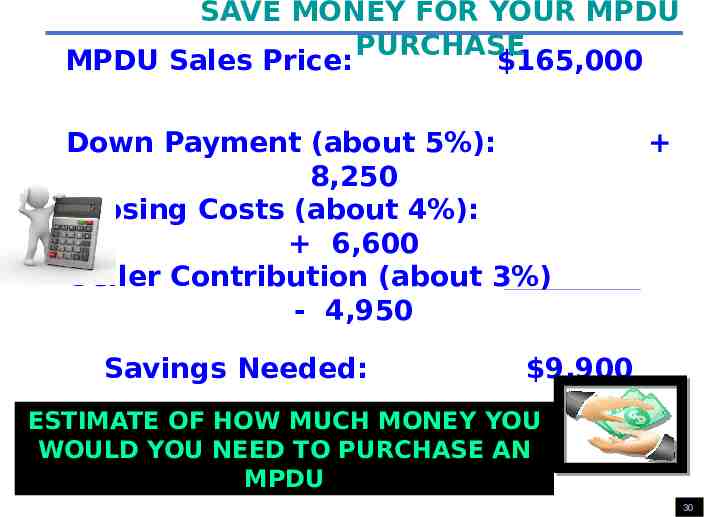

SAVE MONEY FOR YOUR MPDU PURCHASE MPDU Sales Price: 165,000 Down Payment (about 5%): 8,250 Closing Costs (about 4%): 6,600 Seller Contribution (about 3%) - 4,950 Savings Needed: 9,900 ESTIMATE OF HOW MUCH MONEY YOU WOULD YOU NEED TO PURCHASE AN MPDU 30

SELLING YOUR 4 MPDU Some Years Have Gone By Since You Purchased Your MPDU. Selling or Refinancing Your MPDU You are thinking about moving because: Your household size has increased or decreased. You have changed jobs and/or want a shorter commute. You want to live in another community, city, or state. You want your children to attend another school. Any other reason. 31

The MPDU Program allows you to SELL YOUR MPDU at ANY TIME Remember, the longer you live in your MPDU, the more benefits you will receive. A larger increase in your MPDU price Tax advantages for a longer period The money you get at the resale of your MPDU (equity) represents savings that you can use to purchase your next home. 32

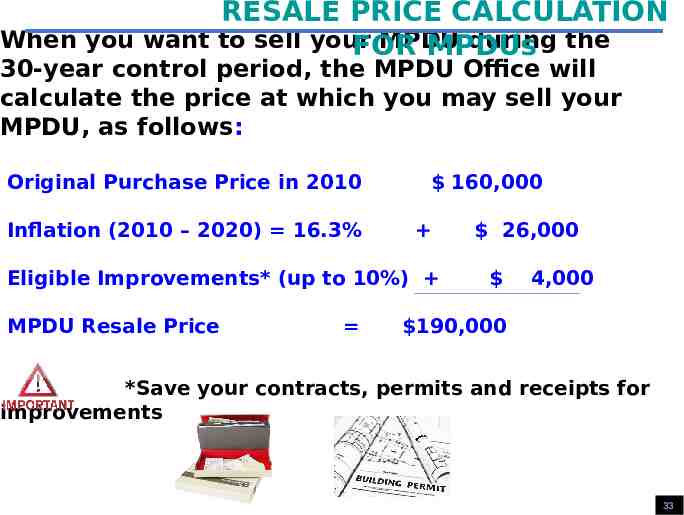

RESALE PRICE CALCULATION When you want to sell your MPDU during the FOR MPDUs 30-year control period, the MPDU Office will calculate the price at which you may sell your MPDU, as follows: Original Purchase Price in 2010 Inflation (2010 – 2020) 16.3% 160,000 Eligible Improvements* (up to 10%) MPDU Resale Price 26,000 4,000 190,000 *Save your contracts, permits and receipts for improvements 33

MONEY YOU GET AT RESALE MPDU Resale Price: 190,000 Pay your Loan Balance: ( 120,000) You Get (Equity): 70,000 You can use this equity to buy your next home. 34

SELLING AFTER THE CONTROL PERIOD 30 Years Have Gone By Since You Purchased Your MPDU. As part of the agreement with the MPDU Program, the MPDU owner is required to share one-half of the “Excess Windfall Profit” with Montgomery County. The payment made to Montgomery County is called the Shared Profit. This money is used to finance and produce new affordable housing in Montgomery County for other low- and moderate-income households. 35

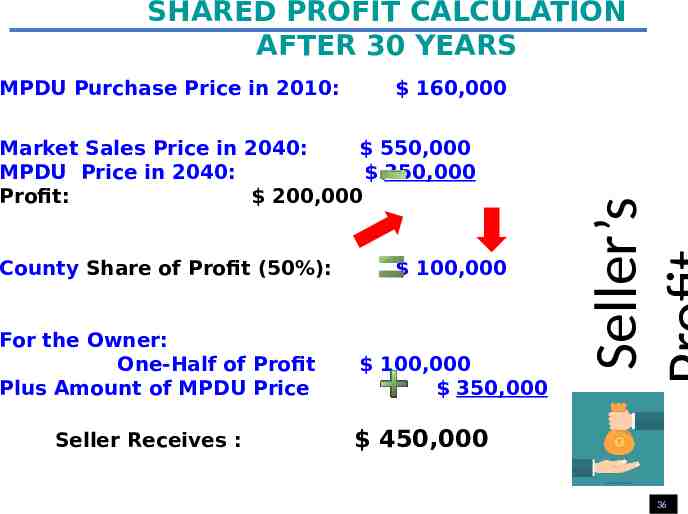

SHARED PROFIT CALCULATION AFTER 30 YEARS 160,000 Market Sales Price in 2040: 550,000 MPDU Price in 2040: 350,000 Profit: 200,000 County Share of Profit (50%): For the Owner: One-Half of Profit Plus Amount of MPDU Price Seller Receives : 100,000 100,000 350,000 Seller’s MPDU Purchase Price in 2010: 450,000 36

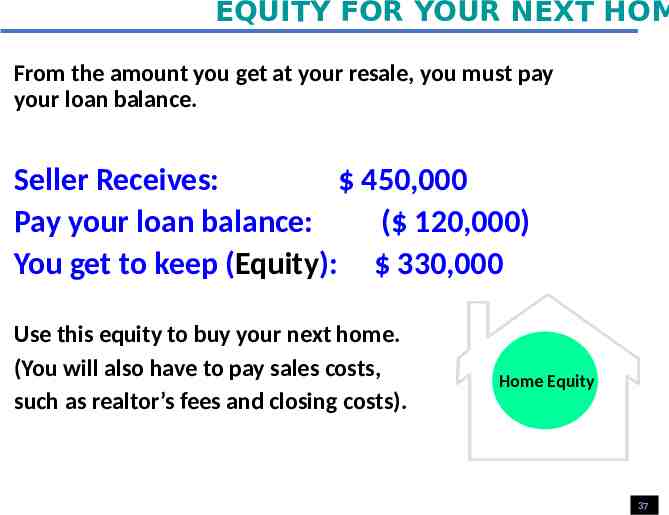

EQUITY FOR YOUR NEXT HOM From the amount you get at your resale, you must pay your loan balance. Seller Receives: 450,000 Pay your loan balance: ( 120,000) You get to keep (Equity): 330,000 Use this equity to buy your next home. (You will also have to pay sales costs, such as realtor’s fees and closing costs). Home Equity 37

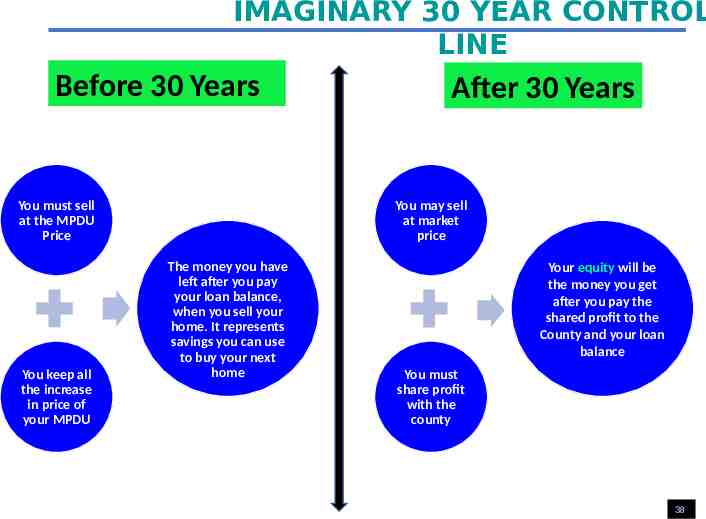

IMAGINARY 30 YEAR CONTROL LINE Before 30 Years You must sell at the MPDU Price You keep all the increase in price of your MPDU After 30 Years You may sell at market price The money you have left after you pay your loan balance, when you sell your home. It represents savings you can use to buy your next home Your equity will be the money you get after you pay the shared profit to the County and your loan balance You must share profit with the county 38

CAN I REFINANCE MY MPDU What is refinancing? Changing your first loan for a new loan. Why would I want to refinance my loan? You might get a better interest rate. Your monthly payments might be lower. It will cost you some money to refinance. Refinancing can cost between 2% and 5% of a loan's principal. You will start a new mortgage, which in many cases requires an appraisal, title search, and application fees. 39

BEFORE YOU REFINANCE YOUR MPDU Facts you need to know MPDU Refinancing You cannot refinance your MPDU for more than the MPDU price at the time of the refinance. The 30-year control period does not start again. You must request an MPDU Price from the MPDU Office before you go to the bank. The lender will ask you for a refinance letter from the MPDU Office. You cannot owe more money on your MPDU than the MPDU price at any time. MPDU Owners Are Not Permitted to Refinance an MPDU with a Reverse Mortgage. The reverse mortgage program assumes that a housing unit has a "fair market" value (FMV). MPDUs Do Not Have a Fair Market Value (FMV) During the Resale Price Control Period. 40

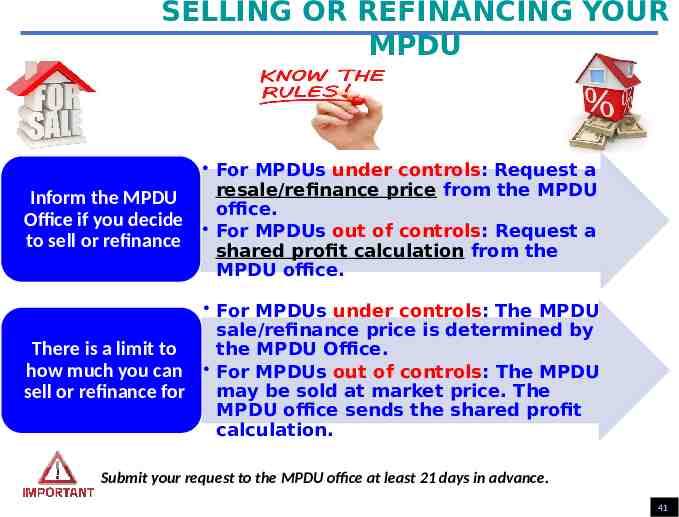

SELLING OR REFINANCING YOUR MPDU Inform the MPDU Office if you decide to sell or refinance For MPDUs under controls: Request a resale/refinance price from the MPDU office. For MPDUs out of controls: Request a shared profit calculation from the MPDU office. There is a limit to how much you can sell or refinance for For MPDUs under controls: The MPDU sale/refinance price is determined by the MPDU Office. For MPDUs out of controls: The MPDU may be sold at market price. The MPDU office sends the shared profit calculation. Submit your request to the MPDU office at least 21 days in advance. 41

WHAT HAPPENS WHEN SOMEONE DOES NOT FOLLOW THE MPDU RULES? Legal action by County: Fines Required repayment of illegally collected rent Forced sale of your MPDU 42

MOST IMPORTANT THINGS TO REMEMBER MPDU 1 2 3 4 5 When you buy an MPDU, the MPDU must be your permanent residence and the unit cannot be left vacant. You may sell your MPDU whenever you want. When you sell your MPDU during the 30-year control period, you must request the resale price from the MPDU office. When you sell your MPDU during the 30-year control period, you keep all the equity, but you must sell at the MPDU Price. When you sell your MPDU after the 30-year control period, you must share profit with the County. You can sell the MPDU at market price. 43

5 HOW TO APPLY TO THE MPDU PROGRAM How to Apply to the MPDU Program To apply : 2 key factors 1. Get all your financial documents ready for all adults in your household. Each adult must have the required documents to submit. 2. Become familiar with the MPDU application. Read it carefully before you apply. Incomplete applications will not be accepted. 44

WHO MUST BE LISTED IN MY APPLICATION? Anyone who will be living in the MPDU: spouse, fiancé, children, parents, brother, sister or adoptive child. Children older than 18 years old are considered dependents if they are full time students. Adults who are not working and do not receive income are considered dependents. Each adult (including elderly parents) must be listed on the household’s Federal income taxes, UNLESS they have their own income and tax returns. 45

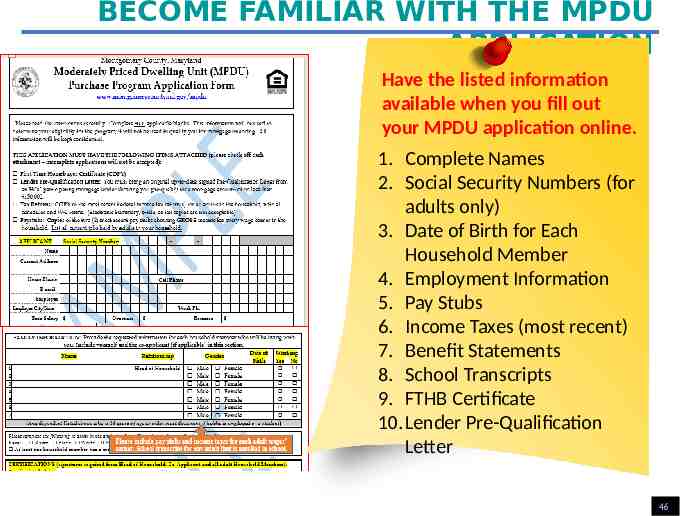

BECOME FAMILIAR WITH THE MPDU APPLICATION Have the listed information available when you fill out your MPDU application online. 1. Complete Names 2. Social Security Numbers (for adults only) 3. Date of Birth for Each Household Member 4. Employment Information 5. Pay Stubs 6. Income Taxes (most recent) 7. Benefit Statements 8. School Transcripts 9. FTHB Certificate 10.Lender Pre-Qualification Letter 46

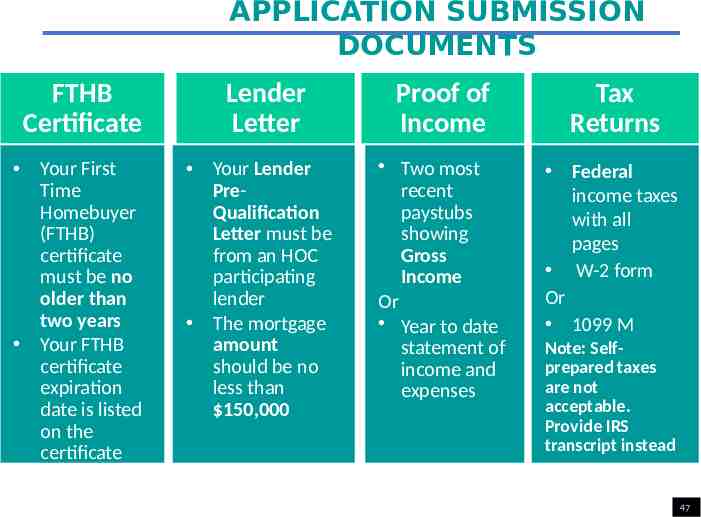

APPLICATION SUBMISSION DOCUMENTS FTHB Certificate Your First Time Homebuyer (FTHB) certificate must be no older than two years Your FTHB certificate expiration date is listed on the certificate Lender Letter Your Lender PreQualification Letter must be from an HOC participating lender The mortgage amount should be no less than 150,000 Proof of Income Tax Returns Two most recent paystubs showing Gross Income Or Year to date statement of income and expenses Federal income taxes with all pages W-2 form Or 1099 M Note: Selfprepared taxes are not acceptable. Provide IRS transcript instead 47

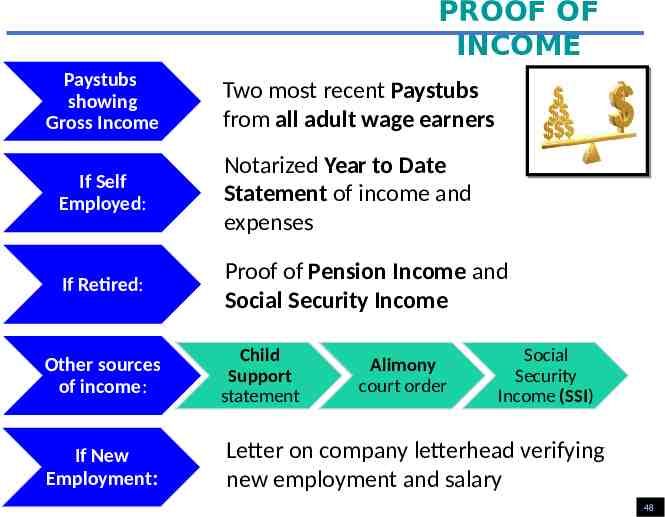

PROOF OF INCOME Paystubs showing Gross Income Two most recent Paystubs from all adult wage earners If Self Employed: Notarized Year to Date Statement of income and expenses If Retired: Proof of Pension Income and Social Security Income Other sources of income: Child Support statement If New Employment: Letter on company letterhead verifying new employment and salary Alimony court order Social Security Income (SSI) 48

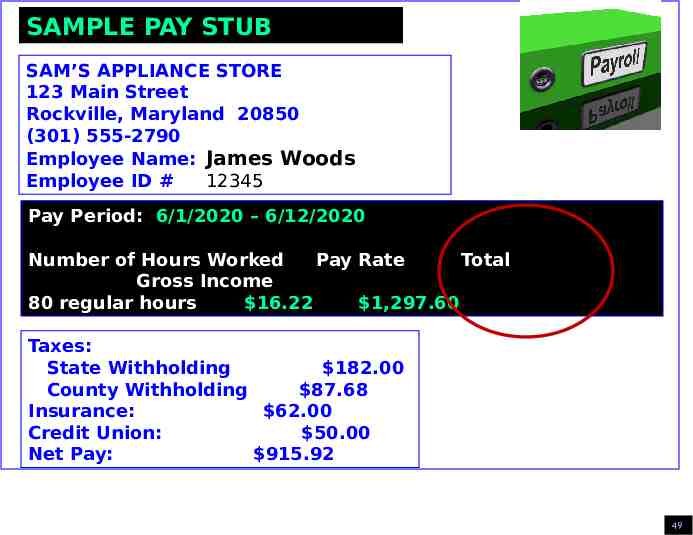

SAMPLE PAY STUB SAM’S APPLIANCE STORE 123 Main Street Rockville, Maryland 20850 (301) 555-2790 Employee Name: James Woods Employee ID # 12345 Pay Period: 6/1/2020 – 6/12/2020 Number of Hours Worked Pay Rate Total Gross Income 80 regular hours 16.22 1,297.60 Taxes: State Withholding 182.00 County Withholding 87.68 Insurance: 62.00 Credit Union: 50.00 Net Pay: 915.92 49

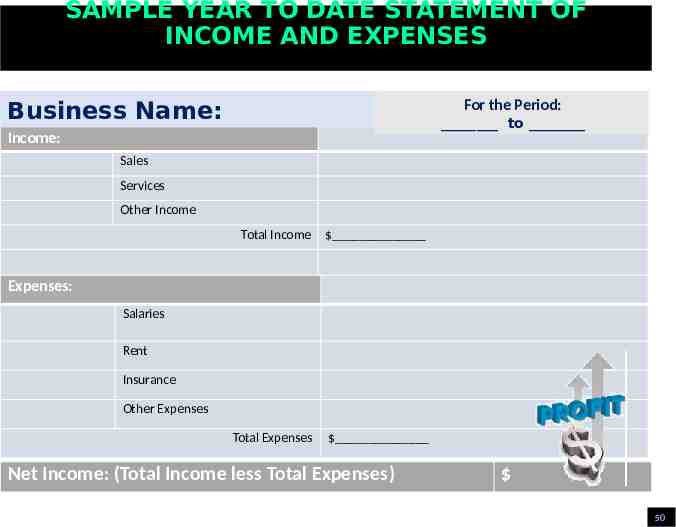

SAMPLE YEAR TO DATE STATEMENT OF INCOME AND EXPENSES Business Name: For the Period: to Income: Sales Services Other Income Total Income Total Expenses Expenses: Salaries Rent Insurance Other Expenses Net Income: (Total Income less Total Expenses) 50

SAMPLE YEAR TO DATE STATEMENT OF INCOME AND EXPENSES (continued) The Year to Date statement needs to be notarized and must include the following: I hereby attest by my signature below that the information above is true and accurate and represents the current status of my income and expenses. Business owner signature Date Notary signature Date 51

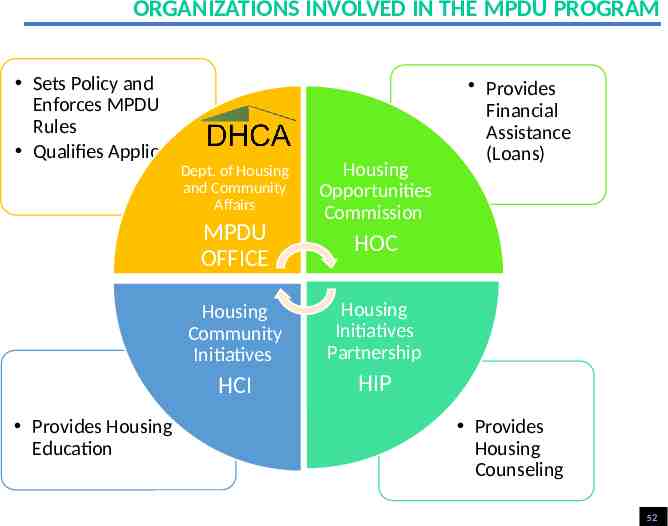

ORGANIZATIONS INVOLVED IN THE MPDU PROGRAM Sets Policy and Enforces MPDU Rules Qualifies Applicants Dept. of Housing and Community Affairs MPDU OFFICE Provides Housing Education Housing Opportunities Commission Provides Financial Assistance (Loans) HOC Housing Community Initiatives Housing Initiatives Partnership HCI HIP Provides Housing Counseling 52

THE MPDU PROGRAM AND HOC ARE NOT THE SAME THING MPDU PROGRAM: Teaches classes, receives applications and gives MPDU Certificates to households that are eligible to purchase an MPDU MPDU Runs Random Selection Drawings to select certificate holders to purchase MPDUs Works with the builders who construct new homes. The builders determine where they are building new homes, what type of homes and how many homes. Ensures that at least 12.5% of the homes that are built 53

HOUSING OPPORTUNITIES COMMISSION (HOC) The Role of HOC in the MPDU Program An HOC approved lender pre-qualifies applicants to the MPDU Program, giving them a pre-qualification letter. HOC provides mortgage loans with favorable terms to purchase MPDUs. HOC is not the only lender that can give you a loan to purchase an MPDU. Housing Opportunities Commission: 10400 Detrick Avenue, Kensington, MD 20895 (240) 627-9400 https://www.hocmc.org/homeownership.html 54

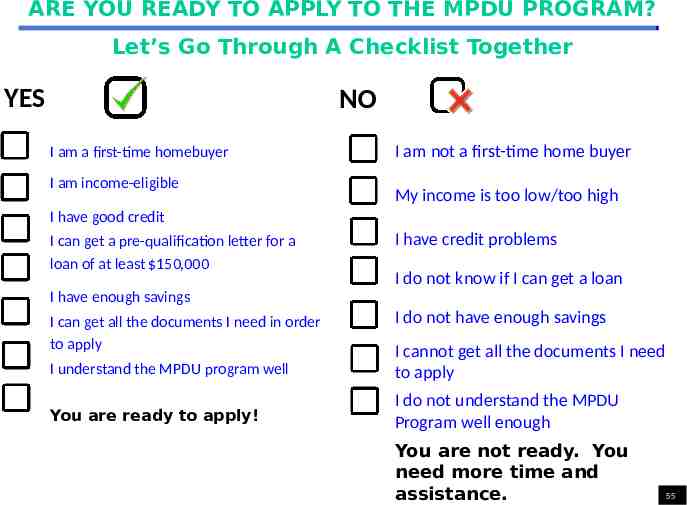

ARE YOU READY TO APPLY TO THE MPDU PROGRAM? Let’s Go Through A Checklist Together YES NO I am a first-time homebuyer I am income-eligible I am not a first-time home buyer My income is too low/too high I have good credit I can get a pre-qualification letter for a loan of at least 150,000 I have credit problems I do not know if I can get a loan I have enough savings I can get all the documents I need in order to apply I do not have enough savings I understand the MPDU program well I cannot get all the documents I need to apply You are ready to apply! I do not understand the MPDU Program well enough You are not ready. You need more time and assistance. 55

HELP IS AVAILABLE If you are not ready to apply yet because you have credit problems or need financial coaching, you can get individual assistance from a Housing Counselor free of charge. Call for an appointment: Housing Initiatives Partnership, Inc. (HIP) Main Office: 6525 Belcrest Road, Suite 555 Hyattsville, MD 20782 301-699-3835 Montgomery County – Housing Counseling Offices 12900 Middlebrook Road, Suite 1500 Germantown, MD 20874 301-916-5946 640 East Diamond Avenue, Suite C Gaithersburg, MD 20877 301-916-5946 https://hiphomes.org/ 56

OTHER AFFORDABLE HOUSING PROGRAMS City of Rockville MPDU Program: (240) 314-8200 https://www.rockvillemd.gov/194/Affordable-Housing City of Gaithersburg MPDU Program: (240) 805-1119 https://www.gaithersburgmd.gov/services/housing-services Montgomery County's Moderately Priced Dwelling Unit (MPDU) Program offers affordable rents at several MPDU apartment complexes located throughout the County. https://www.montgomerycountymd.gov/DHCA/housing/singlefami ly/mpdu/programrental.html 57

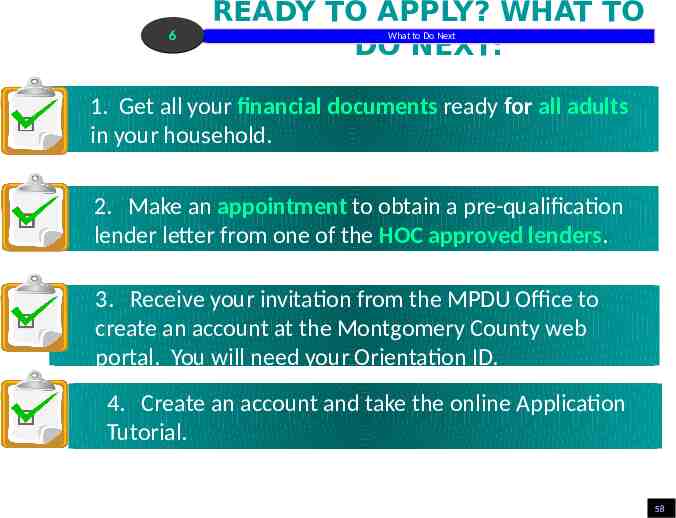

6 READY TO APPLY? WHAT TO DO NEXT: What to Do Next 1. Get all your financial documents ready for all adults in your household. 2. Make an appointment to obtain a pre-qualification lender letter from one of the HOC approved lenders. 3. Receive your invitation from the MPDU Office to create an account at the Montgomery County web portal. You will need your Orientation ID. 4. Create an account and take the online Application Tutorial. 58

TO APPLY YOU MUST TAKE THE APPLICATION TUTORIAL MPDU The MPDU Office no longer accepts paper applications. To apply you will need to create an online account through Montgomery County’s web portal called AccessMCG Extranet, which will be available in October. If you have completed both the First Time Homebuyer class and the Orientation Seminar within the past two years, you will receive an email invitation from the MPDU office to create your online account in late September. After you create your account, you will be able to take the Application Tutorial (formerly known as the Application Session), complete the online application form, and upload your application documents. The Application Tutorial is an online training that includes tests that you must pass with a score of 80% or better. You will be able to review the tutorial and re-take the tests as many times as you wish. 59

APPLICATION DOCUMENTS You will receive the following PDF documents after this session: MPDU 1. Facts You Need to Understand Before You Participate in Montgomery County’s MPDU Purchase Program. (Please read and make sure you understand it.) 2. Summary of next steps to apply to the MPDU program. 3. Instructions for getting a prequalification lender letter from an HOC approved lender. 4. The HOC approved lenders list. 5. Sample of the MPDU application. 60

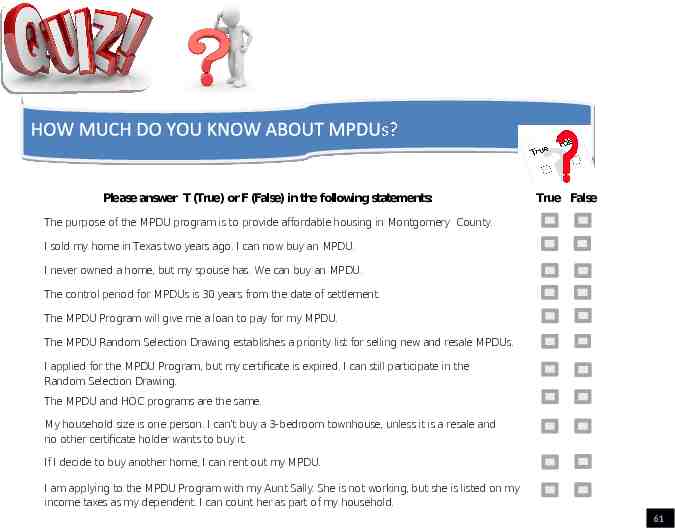

Please answer T (True) or F (False) in the following statements: True False The purpose of the MPDU program is to provide affordable housing in Montgomery County. I sold my home in Texas two years ago. I can now buy an MPDU. I never owned a home, but my spouse has. We can buy an MPDU. The control period for MPDUs is 30 years from the date of settlement. The MPDU Program will give me a loan to pay for my MPDU. The MPDU Random Selection Drawing establishes a priority list for selling new and resale MPDUs. I applied for the MPDU Program, but my certificate is expired. I can still participate in the Random Selection Drawing. The MPDU and HOC programs are the same. My household size is one person. I can’t buy a 3-bedroom townhouse, unless it is a resale and no other certificate holder wants to buy it. If I decide to buy another home, I can rent out my MPDU. I am applying to the MPDU Program with my Aunt Sally. She is not working, but she is listed on my income taxes as my dependent. I can count her as part of my household. 61

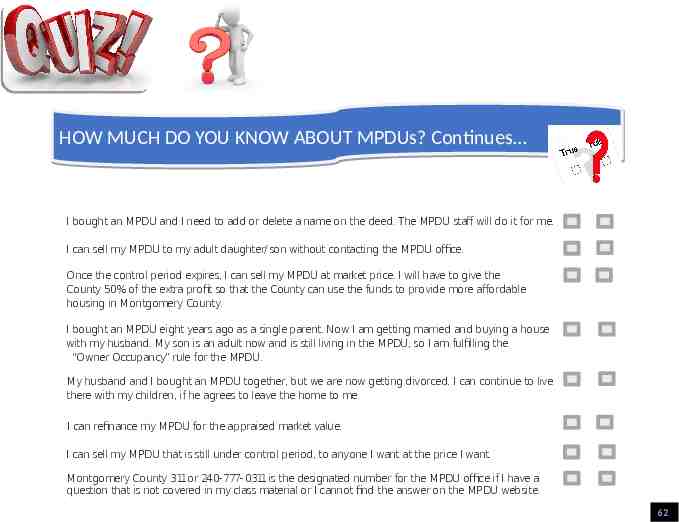

HOW MUCH DO YOU KNOW ABOUT MPDUs? Continues I bought an MPDU and I need to add or delete a name on the deed. The MPDU staff will do it for me. I can sell my MPDU to my adult daughter/son without contacting the MPDU office. Once the control period expires, I can sell my MPDU at market price. I will have to give the County 50% of the extra profit so that the County can use the funds to provide more affordable housing in Montgomery County. I bought an MPDU eight years ago as a single parent. Now I am getting married and buying a house with my husband. My son is an adult now and is still living in the MPDU, so I am fulfilling the “Owner Occupancy” rule for the MPDU. My husband and I bought an MPDU together, but we are now getting divorced. I can continue to live there with my children, if he agrees to leave the home to me. I can refinance my MPDU for the appraised market value. I can sell my MPDU that is still under control period, to anyone I want at the price I want. Montgomery County 311or 240-777-0311 is the designated number for the MPDU office if I have a question that is not covered in my class material or I cannot find the answer on the MPDU website. 62

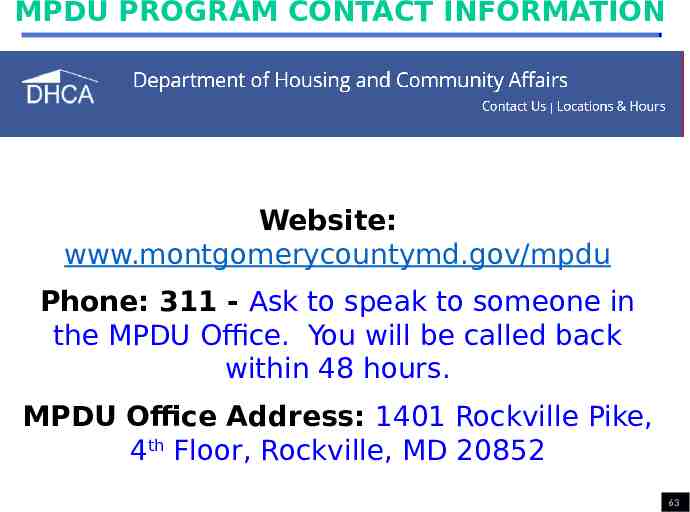

MPDU PROGRAM CONTACT INFORMATION Website: www.montgomerycountymd.gov/mpdu Phone: 311 - Ask to speak to someone in the MPDU Office. You will be called back within 48 hours. MPDU Office Address: 1401 Rockville Pike, 4th Floor, Rockville, MD 20852 63

THE MPDU PROGRAM THANK YOU! If you are seeing this slide you have completed the entire training. MPDU CONGRATULATIONS! However, this is not the end You will need to take down the CODE that will appear on the Zoom screen and send an e-mail with the code to HCI in order to validate your attendance. Partners with HCI (a nonprofit agency) to provide MPDU training sessions. 64