Mining Nonfinancial Information from Financial Statements William

26 Slides3.87 MB

Mining Nonfinancial Information from Financial Statements William B. Ford, CPA Director, Nonprofit Advisory & Assurance Services February 24, 2016

G.T. Reilly & Company is a full-service certified public accounting firm that has served the needs of nonprofit organizations for 60 years. Our clients in the nonprofit community include: Human service agencies Private schools Professional associations Community action and housing organizations Education and advocacy organizations Healthcare providers and advocacy groups Cultural/charitable foundations Religious organizations and houses of worship Among the services we provide to nonprofit organizations are : Financial statement audits, including audits under Government Auditing Standards & Uniform Guidance (formerly OMB Circular A-133) Assistance with preparation of the Massachusetts UFR 1 Management advisory services Financial and strategic planning Tax compliance and planning Human resource consulting Employee benefit plan consulting, design and implementation IT services

William B. Ford, CPA Director, Nonprofit Advisory & Assurance Services Accounting & Auditing Director With more than 30 years of experience providing auditing, accounting and consulting services for nonprofits, Bill Ford has helped scores of organizations find ways to fulfill their missions with evertighter resources. He draws satisfaction from helping them maximize efficiencies so they can continue to deliver services to their communities and members. Nonprofit organizations are a significant portion of Bill’s client group, and he is uniquely qualified with regard to Government Auditing Standards, including Uniform Guidance (formerly OMB Circular A133), and the Massachusetts Uniform Financial Report, as well as federal and state tax filings. Bill earned his Bachelor’s Degree in Accounting from Bentley College in 1980, and joined G.T. Reilly in 1988. He is a member of the Massachusetts Society of Certified Public Accountants Nonprofit Accounting & Auditing Committee. Bill understands the needs of nonprofit organizations first-hand, as he is the board treasurer for the Watertown Community Foundation. Additionally, Bill has volunteered his time as a financial analyst for United Way of Massachusetts Bay & Merrimack Valley. A devoted football fan, Bill holds season tickets for the New England Patriots and Boston College football. He also enjoys yoga and is an amateur gardener. He lives in Watertown. 2

Poll Question #1 Is your role in your organization: 3 Finance Executive/Management Board member/officer Funder Regulatory authority

Statement of Financial Position Objective: To report the assets, liabilities and net assets of organization at a particular point in time. Statement of Financial Position items: o Assets o Liabilities o Net Assets Classified vs. Nonclassified Statement of Financial Position o Distinction between ‘current’ and ‘non-current’ 4

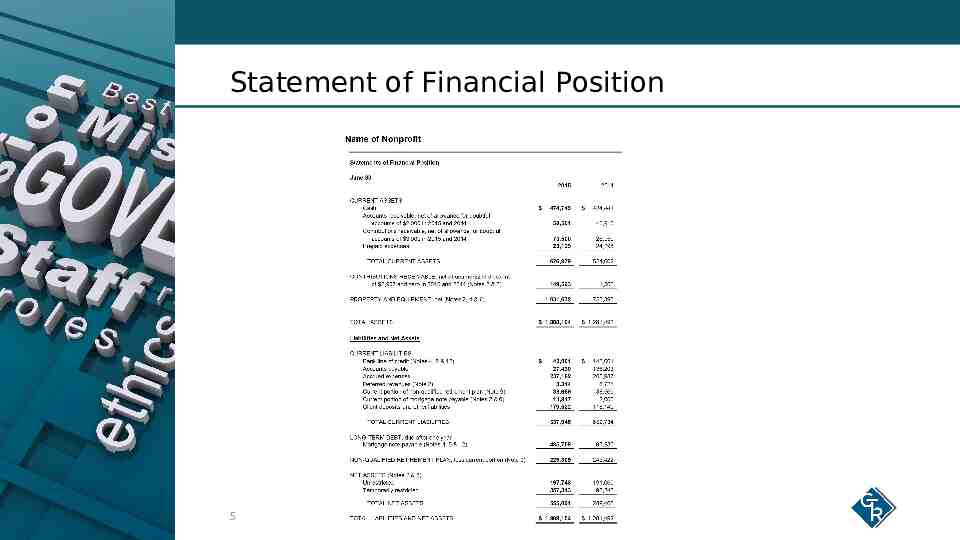

Statement of Financial Position 5

Board Perspective The ‘Picture’ Summary of organization’s financial information at a particular point in time Comparative o A two-presentation for comparison and trend analysis Performance indicators o Liquidity and financial strength Cash on hand Current ratio Cash reserves 6

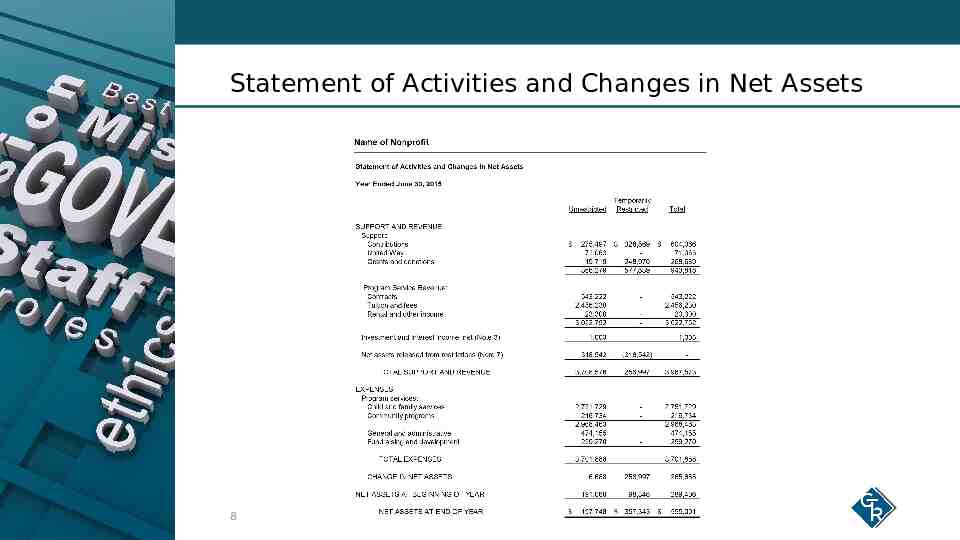

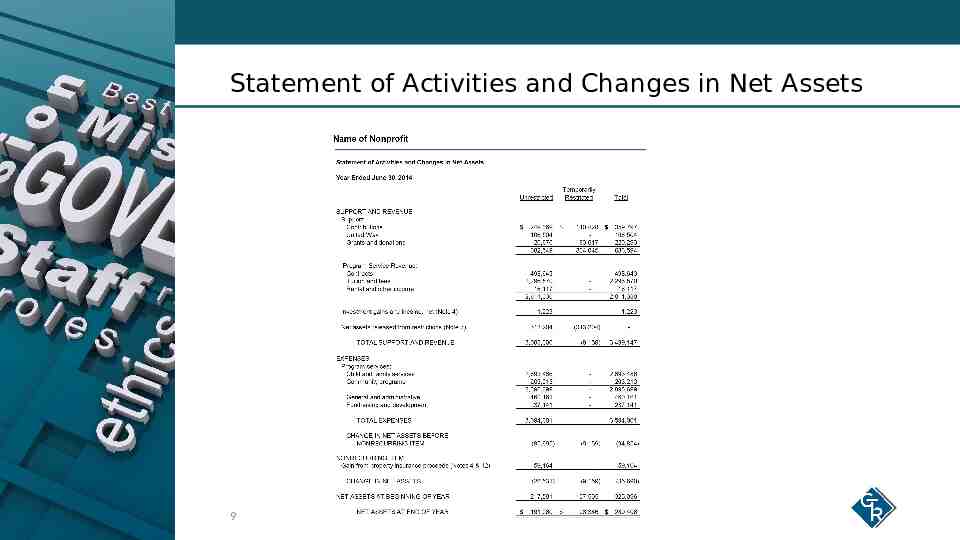

Statement of Activities and Changes in Net Assets Objective: Reports the surplus or deficiency for an organization typically for a 12-month period. Revenue and Support o Revenues Government contracts (federal, state, local) Fees for service Interest, dividends, realized and unrealized investment gains and losses o Support Grants Donations Fundraising Special events o Restricted vs. Unrestricted Support o Expenses o Change in Net Assets 7

Statement of Activities and Changes in Net Assets 8

Statement of Activities and Changes in Net Assets 9

Board Perspective The ‘Movie’ Summary of organization’s financial data throughout the year Comparative Performance indicators o Change in net assets o Diversity of funding o Indication of growth or contraction o Group analysis 10

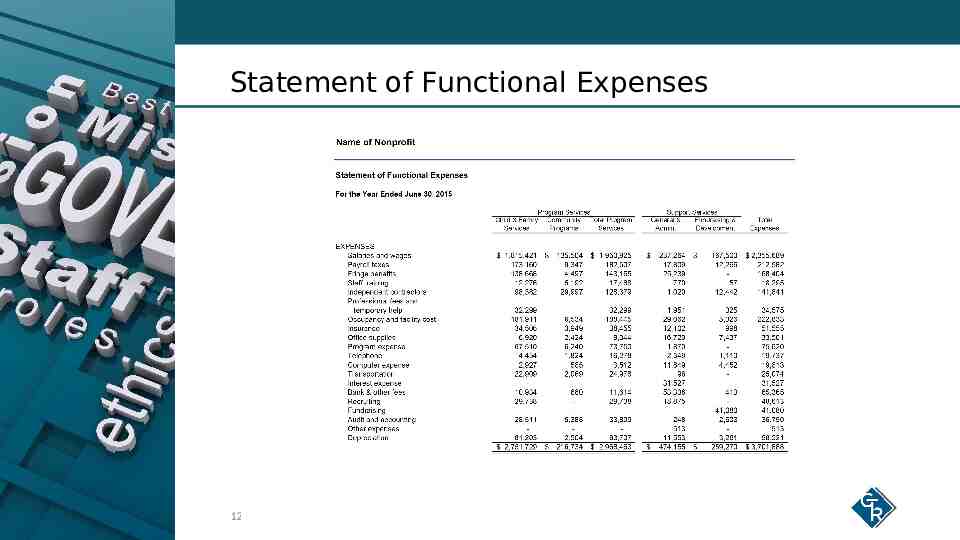

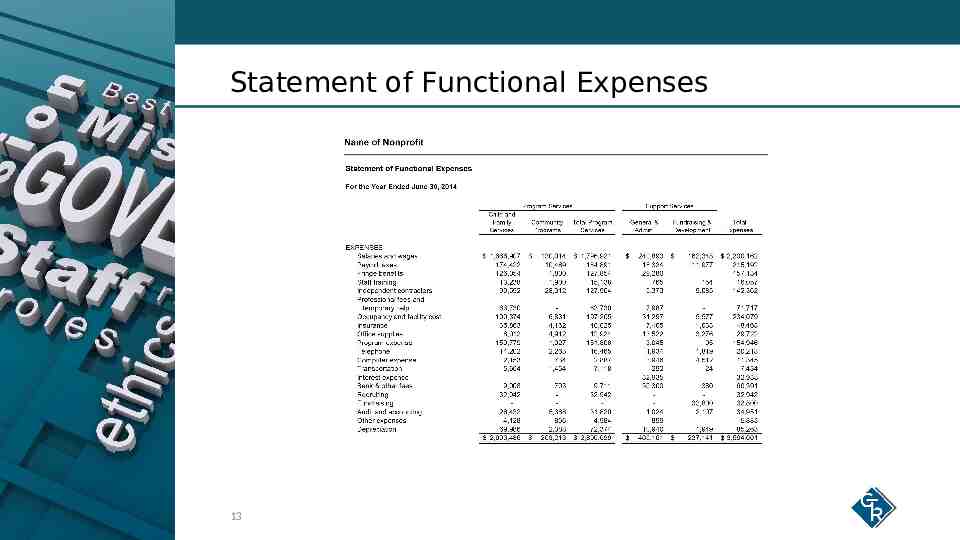

Statement of Functional Expenses Objective: Reports expenses by group by natural classification. Provides the detail of an organization’s spending. Currently only required by voluntary, health and welfare organizations. 11

Statement of Functional Expenses 12

Statement of Functional Expenses 13

Board Perspective Salaries and wages Review on a comparative basis o By group or individual program o As a percent of total expenses Significant line items Justifiable/reasonable o No surprises! 14

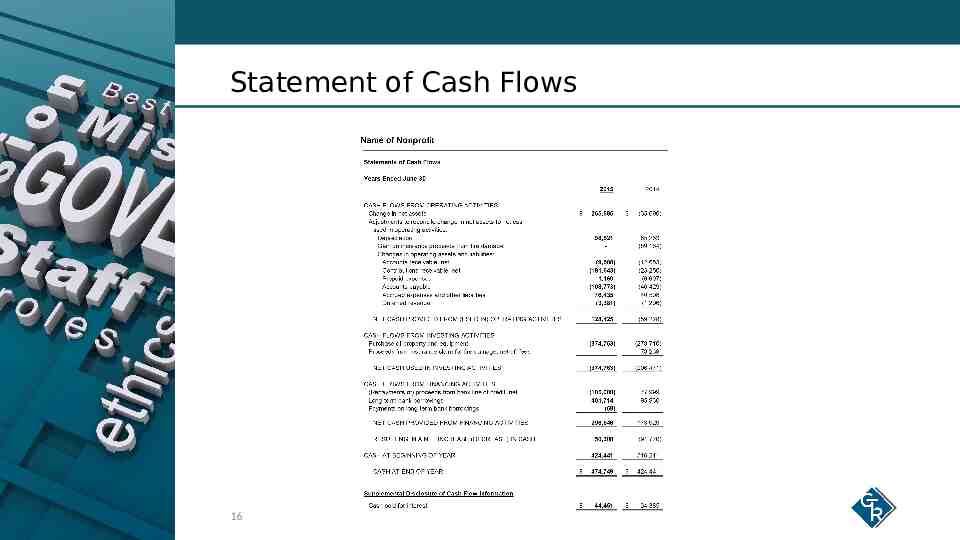

Statement of Cash Flows Objective: To convert accrual basis financial statements to the cash basis and present financial data in three separate categories. Cash flows provided by (used in) operating activities Cash flows provided from (used in) investing activities Cash flows provided from (used in) financing activities Other items 15

Statement of Cash Flows 16

Board Perspective Cash flows from operations o Positive o Negative Negative o Source of funding Investment activities Financing activities 17

Notes to Financial Statements Objective: To provide supporting narratives and numeric detail disclosures to the basic financial statements Nature of operations Significant accounting policies Expanded detail for statement of financial position Other significant items 18

Board Perspective Read the Notes! Non-statement financial information 19 o Leases o Lawsuits o Uses and balances of restricted funds

Poll Question #2 Do you feel your organization’s board has a good understanding of the organization’s financials? Yes No Sometimes 20

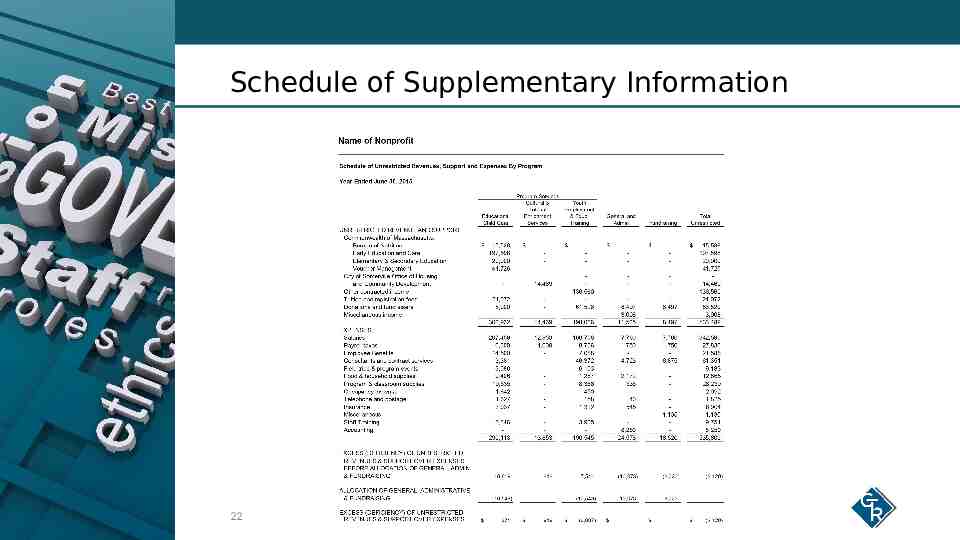

Schedule of Supplementary Information Objective: To provide financial information in a non-prescribed format that is ‘user-friendly’ to the reader. Schedule of Revenues, Support and Expenses by Program and Supporting Services Comparative Schedule of Functional Expenses 21

Schedule of Supplementary Information 22

Board Perspective If not in financial statement, request from management o Depicts surplus or deficiency by program What program is making money? What program is losing money? Is fundraising and development sufficient to subsidize program losses? 23

Poll Question #3 Is your board currently using the organization’s financial reports effectively to address weaknesses and deficiencies? Yes No 24

Thank you! G.T. Reilly & Company serves a wide variety of nonprofit organizations with accounting, auditing, tax and consulting services. Please visit us on the web at www.GTReilly.com. Contact information: William B. Ford, CPA Accounting & Auditing Director Director, Nonprofit Advisory & Assurance Services [email protected] 617-696-8900 25 G.T. Reilly & Company 424 Adams Street Milton MA 02186 617-696-8900