Medicare Supplement Insurance (Medigap) Policies SHIBA and WA

50 Slides2.50 MB

Medicare Supplement Insurance (Medigap) Policies SHIBA and WA Version Updated August 2018

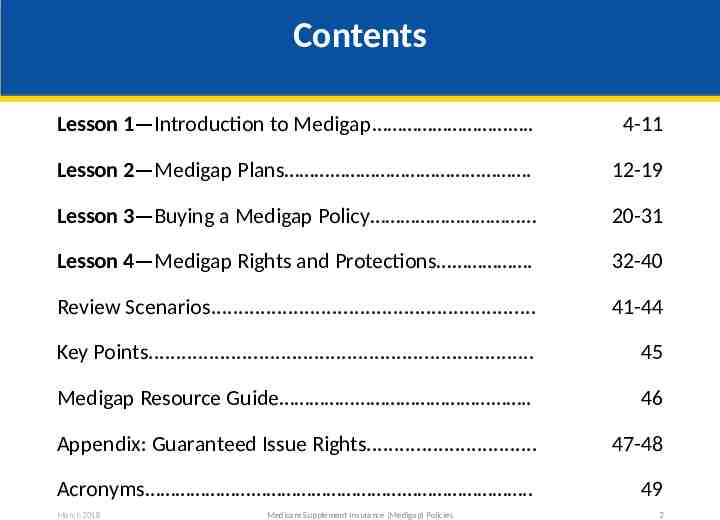

Contents Lesson 1—Introduction to Medigap . 4-11 Lesson 2—Medigap Plans . 12-19 Lesson 3—Buying a Medigap Policy 20-31 Lesson 4—Medigap Rights and Protections . 32-40 Review Scenarios. 41-44 Key Points. 45 Medigap Resource Guide . 46 Appendix: Guaranteed Issue Rights. 47-48 Acronyms . 49 March 2018 Medicare Supplement Insurance (Medigap) Policies 2

Session Objectives This session should help you Explain what Medigap policies are Recognize key Medigap terms Provide steps to buying a Medigap policy Define the best time to buy a Medigap policy Explain guaranteed issue rights Learn where to get information on Medigap rights and protections March 2018 Medicare Supplement Insurance (Medigap) Policies 3

Lesson 1—Introduction to Medigap Medicare Program overview Medigap overview March 2018 Medicare Supplement Insurance (Medigap) Policies 4

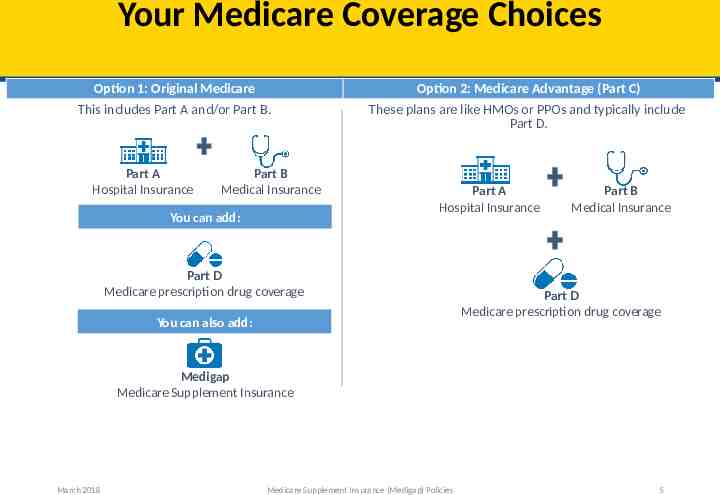

Your Medicare Coverage Choices Option 1: Original Medicare Option 2: Medicare Advantage (Part C) This includes Part A and/or Part B. These plans are like HMOs or PPOs and typically include Part D. Part A Hospital Insurance Part B Medical Insurance You can add: Part A Hospital Insurance Part D Medicare prescription drug coverage You can also add: Part B Medical Insurance Part D Medicare prescription drug coverage Medigap Medicare Supplement Insurance March 2018 Medicare Supplement Insurance (Medigap) Policies 5

Medicare Supplement Insurance (Medigap) Policies Medigap is private health insurance that Part A Part B Hospital Insurance Medical Insurance You can add: Part D Medicare prescription drug coverage You can also add: supplements Original Medicare You must have Part A and Part B Helps pay some health care costs that Original Medicare doesn’t cover Medicare will pay its share of the Medicare-approved amounts for covered health care costs Medigap Medicare Supplement Insurance Then your Medigap policy pays its share A Medigap policy covers one person You pay a monthly premium for the Medigap policy You pay your Medicare Part B premium March 2018 Medicare Supplement Insurance (Medigap) Policies 6

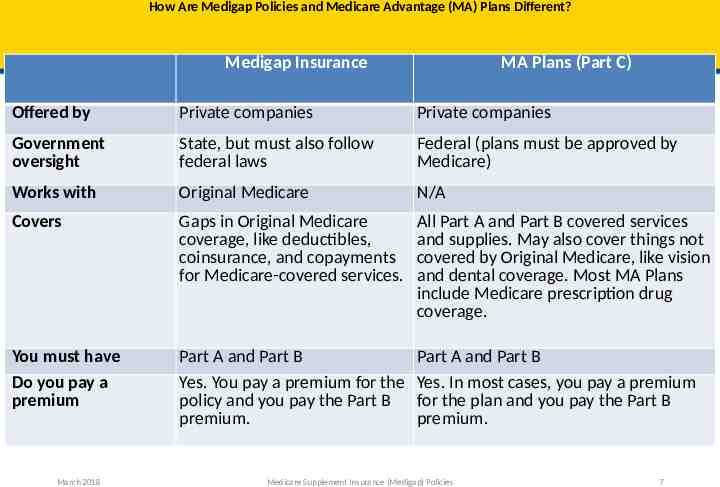

How Are Medigap Policies and Medicare Advantage (MA) Plans Different? Medigap Insurance MA Plans (Part C) Offered by Private companies Private companies Government oversight State, but must also follow federal laws Federal (plans must be approved by Medicare) Works with Original Medicare N/A Covers Gaps in Original Medicare coverage, like deductibles, coinsurance, and copayments for Medicare-covered services. All Part A and Part B covered services and supplies. May also cover things not covered by Original Medicare, like vision and dental coverage. Most MA Plans include Medicare prescription drug coverage. You must have Do you pay a premium Part A and Part B Yes. You pay a premium for the policy and you pay the Part B premium. Part A and Part B Yes. In most cases, you pay a premium for the plan and you pay the Part B premium. March 2018 Medicare Supplement Insurance (Medigap) Policies 7

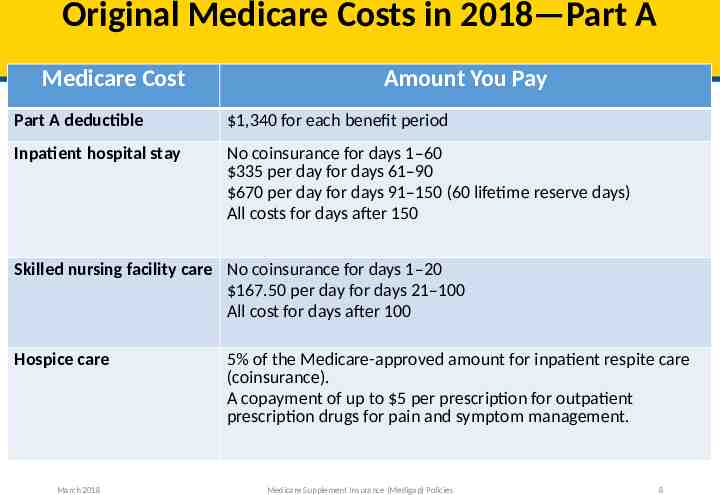

Original Medicare Costs in 2018—Part A Medicare Cost Amount You Pay Part A deductible 1,340 for each benefit period Inpatient hospital stay No coinsurance for days 1–60 335 per day for days 61–90 670 per day for days 91–150 (60 lifetime reserve days) All costs for days after 150 Skilled nursing facility care No coinsurance for days 1–20 167.50 per day for days 21–100 All cost for days after 100 Hospice care March 2018 5% of the Medicare-approved amount for inpatient respite care (coinsurance). A copayment of up to 5 per prescription for outpatient prescription drugs for pain and symptom management. Medicare Supplement Insurance (Medigap) Policies 8

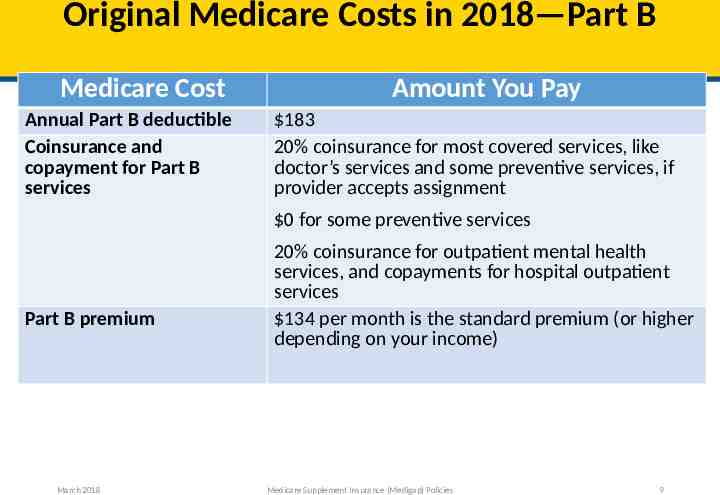

Original Medicare Costs in 2018—Part B Medicare Cost Annual Part B deductible Coinsurance and copayment for Part B services Amount You Pay 183 20% coinsurance for most covered services, like doctor’s services and some preventive services, if provider accepts assignment 0 for some preventive services Part B premium March 2018 20% coinsurance for outpatient mental health services, and copayments for hospital outpatient services 134 per month is the standard premium (or higher depending on your income) Medicare Supplement Insurance (Medigap) Policies 9

Check-Your-Knowledge—Question 1 If you join an MA Plan, you can buy a Medigap policy to pay for out-of-pocket costs. a. True b. False March 2018 Medicare Supplement Insurance (Medigap) Policies 10

Check-Your-Knowledge—Question 2 A Medigap policy will cover you and your spouse. a. True b. False March 2018 Medicare Supplement Insurance (Medigap) Policies 11

Lesson 2—Medigap Plans Medigap plan types Standardized policies Special types of Medigap policies How Medigap plans are structured Basic benefits covered by each type of Medigap plan March 2018 Medicare Supplement Insurance (Medigap) Policies 12

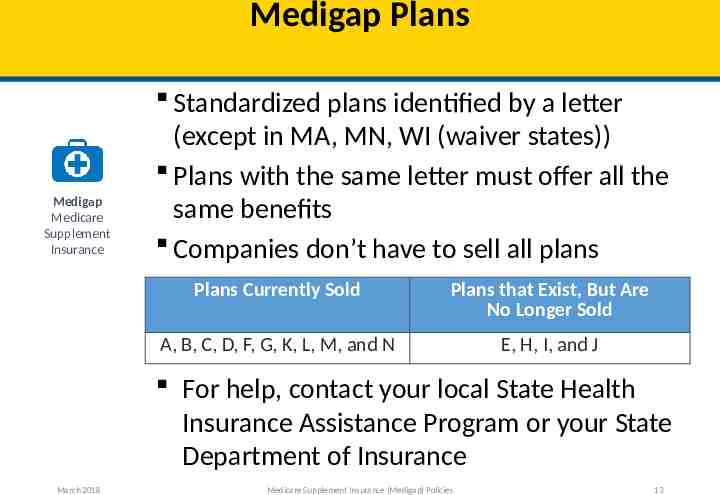

Medigap Plans Medigap Medicare Supplement Insurance Standardized plans identified by a letter (except in MA, MN, WI (waiver states)) Plans with the same letter must offer all the same benefits Companies don’t have to sell all plans Plans Currently Sold Plans that Exist, But Are No Longer Sold A, B, C, D, F, G, K, L, M, and N E, H, I, and J For help, contact your local State Health Insurance Assistance Program or your State Department of Insurance March 2018 Medicare Supplement Insurance (Medigap) Policies 13

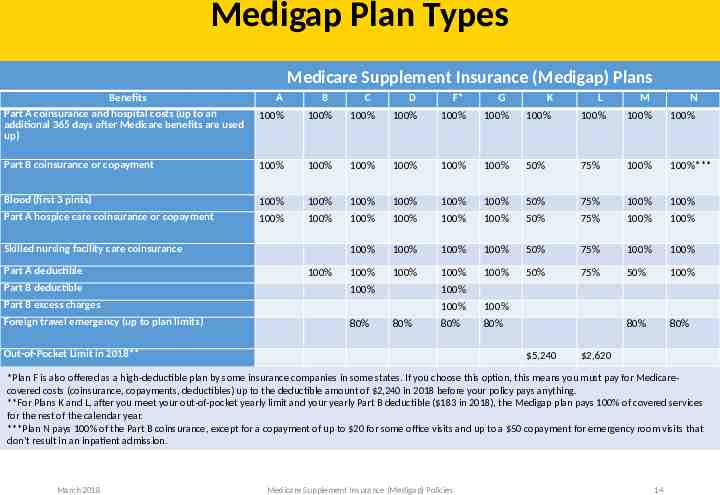

Medigap Plan Types Medicare Supplement Insurance (Medigap) Plans Benefits Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used up) A B 100% 100% Part B coinsurance or copayment 100% Blood (first 3 pints) Part A hospice care coinsurance or copayment D F* 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Skilled nursing facility care coinsurance Part A deductible Part B deductible 100% C K L M N 100% 100% 100% 100% 100% 100% 100% 50% 75% 100% 100%*** 100% 100% 100% 50% 75% 100% 100% 100% 100% 100% 100% 50% 75% 100% 100% 100% 100% 100% 100% 50% 75% 100% 100% 100% 100% 100% 100% 50% 75% 50% 100% 80% 80% 100% 100% Part B excess charges Foreign travel emergency (up to plan limits) 80% G 80% 100% 100% 80% 80% Out-of-Pocket Limit in 2018** 5,240 2,620 *Plan F is also offered as a high-deductible plan by some insurance companies in some states. If you choose this option, this means you must pay for Medicarecovered costs (coinsurance, copayments, deductibles) up to the deductible amount of 2,240 in 2018 before your policy pays anything. **For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ( 183 in 2018), the Medigap plan pays 100% of covered services for the rest of the calendar year. ***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to 20 for some office visits and up to a 50 copayment for emergency room visits that don’t result in an inpatient admission. March 2018 Medicare Supplement Insurance (Medigap) Policies 14

Special Types of Medigap Policies Massachusetts, Minnesota, and Wisconsin (waiver states) Medicare SELECT March 2018 Medicare Supplement Insurance (Medigap) Policies 15

Waiver States Massachusetts, Minnesota, Wisconsin Different kinds of Medigap policies NOT labeled with letters Benefits comparable to standardized policies Basic and optional benefits For information Call your State Health Insurance Assistance Program or State Insurance Department March 2018 Medicare Supplement Insurance (Medigap) Policies 16

Medicare SELECT Policies A type of Medigap policy with a network To get full benefits (except in emergency) Must use specific hospitals, and May have to see specific doctors Can be any of the standardized policies Generally cost less than non-network policies Can switch to plan with equal or lesser value at any time Not available in all states March 2018 Medicare Supplement Insurance (Medigap) Policies 17

Check-Your-Knowledge—Question 3 Each standardized Medigap plan (A-M) must offer the same basic benefits, no matter which insurance company sells it. a. True b. False March 2018 Medicare Supplement Insurance (Medigap) Policies 18

Check-Your-Knowledge—Question 4 What are the 3 waiver states? a. Massachusetts, Minnesota, and Wisconsin b. Maryland, Maine, and Wyoming c. Michigan, Montana, and Washington March 2018 Medicare Supplement Insurance (Medigap) Policies 19

Lesson 3—Buying a Medigap Policy Medigap costs The best time to buy a Medigap policy Switching Medigap policies Steps to buy a Medigap policy March 2018 Medicare Supplement Insurance (Medigap) Policies 20

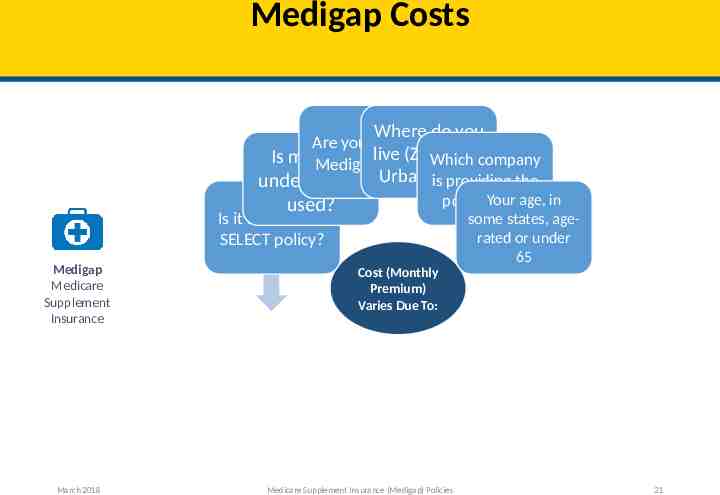

Medigap Costs Where do you Are you in your live (ZIP, Rural, Is medical Medigap OEP? Which company providing the underwriting Urban,isetc.)? Your age, in policy/plan? used? Is it a Medicare some states, agerated or under SELECT policy? Medigap Medicare Supplement Insurance March 2018 65 Cost (Monthly Premium) Varies Due To: Medicare Supplement Insurance (Medigap) Policies 21

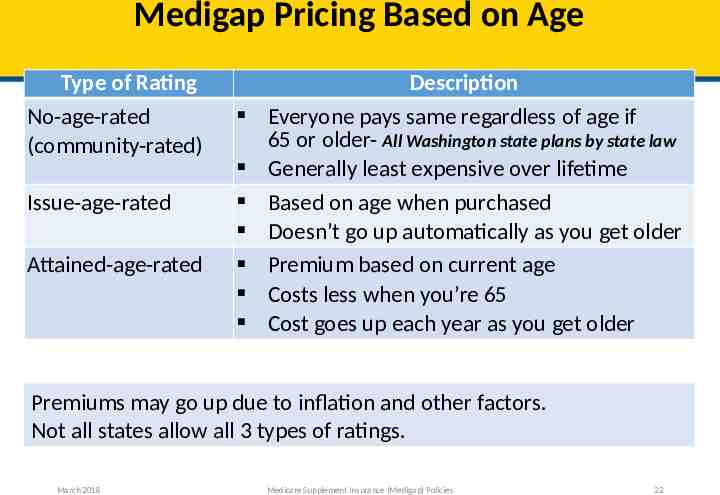

Medigap Pricing Based on Age Type of Rating No-age-rated (community-rated) Issue-age-rated Attained-age-rated Description Everyone pays same regardless of age if 65 or older- All Washington state plans by state law Generally least expensive over lifetime Based on age when purchased Doesn’t go up automatically as you get older Premium based on current age Costs less when you’re 65 Cost goes up each year as you get older Premiums may go up due to inflation and other factors. Not all states allow all 3 types of ratings. March 2018 Medicare Supplement Insurance (Medigap) Policies 22

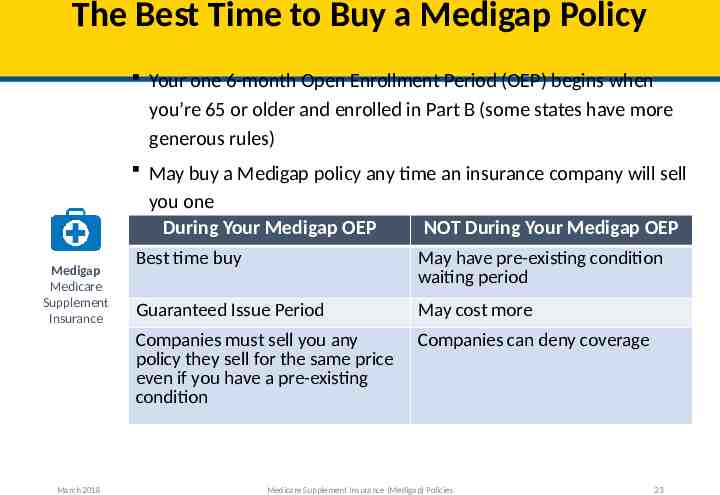

The Best Time to Buy a Medigap Policy Your one 6-month Open Enrollment Period (OEP) begins when you’re 65 or older and enrolled in Part B (some states have more generous rules) May buy a Medigap policy any time an insurance company will sell you one During Your Medigap OEP NOT During Your Medigap OEP Medigap Medicare Supplement Insurance March 2018 Best time buy May have pre-existing condition waiting period Guaranteed Issue Period May cost more Companies must sell you any policy they sell for the same price even if you have a pre-existing condition Companies can deny coverage Medicare Supplement Insurance (Medigap) Policies 23

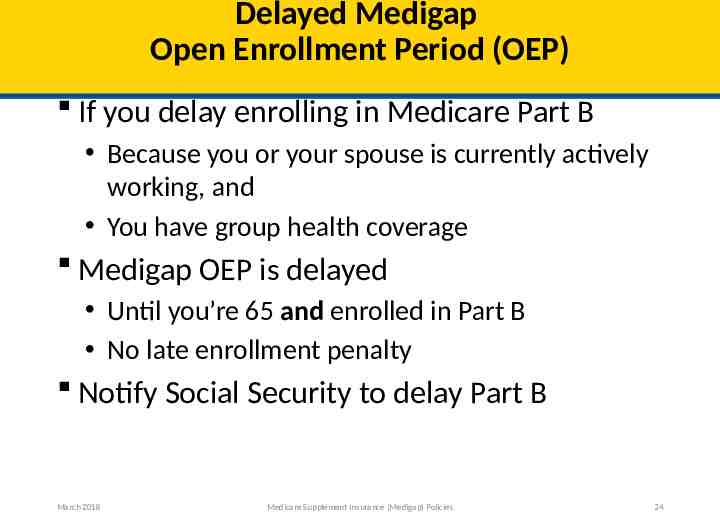

Delayed Medigap Open Enrollment Period (OEP) If you delay enrolling in Medicare Part B Because you or your spouse is currently actively working, and You have group health coverage Medigap OEP is delayed Until you’re 65 and enrolled in Part B No late enrollment penalty Notify Social Security to delay Part B March 2018 Medicare Supplement Insurance (Medigap) Policies 24

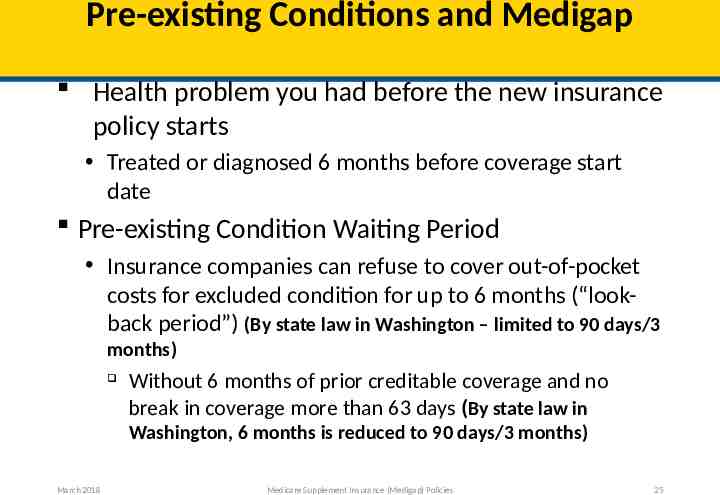

Pre-existing Conditions and Medigap Health problem you had before the new insurance policy starts Treated or diagnosed 6 months before coverage start date Pre-existing Condition Waiting Period Insurance companies can refuse to cover out-of-pocket costs for excluded condition for up to 6 months (“lookback period”) (By state law in Washington – limited to 90 days/3 months) Without 6 months of prior creditable coverage and no break in coverage more than 63 days (By state law in Washington, 6 months is reduced to 90 days/3 months) March 2018 Medicare Supplement Insurance (Medigap) Policies 25

Medigap for People With a Disability or End-Stage Renal Disease (ESRD) People with a disability or ESRD may not be able to buy a policy until they turn 65 Companies may voluntarily sell Medigap policies May cost more than policies sold to people over 65 Can use medical underwriting Get a Medigap OEP at 65 March 2018 Medicare Supplement Insurance (Medigap) Policies 26

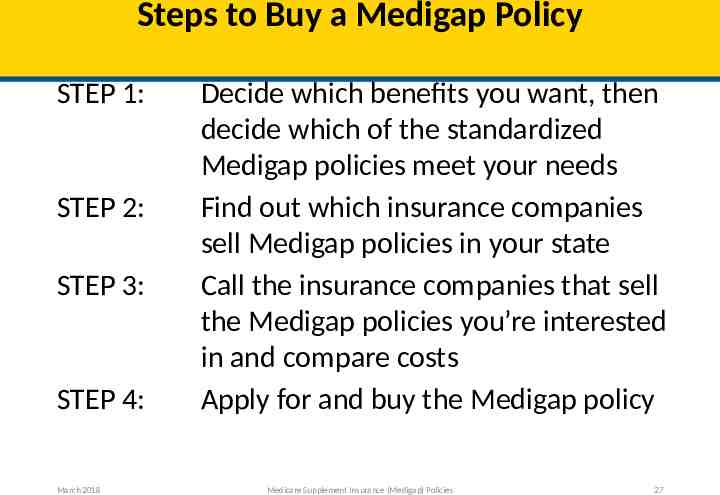

Steps to Buy a Medigap Policy STEP 1: STEP 2: STEP 3: STEP 4: March 2018 Decide which benefits you want, then decide which of the standardized Medigap policies meet your needs Find out which insurance companies sell Medigap policies in your state Call the insurance companies that sell the Medigap policies you’re interested in and compare costs Apply for and buy the Medigap policy Medicare Supplement Insurance (Medigap) Policies 27

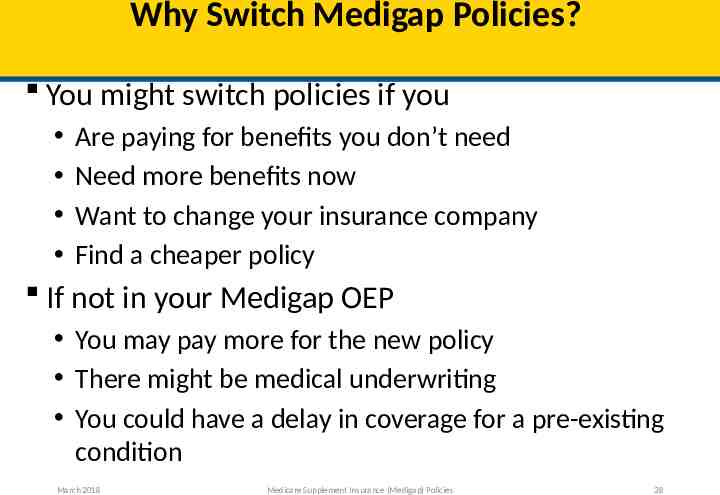

Why Switch Medigap Policies? You might switch policies if you Are paying for benefits you don’t need Need more benefits now Want to change your insurance company Find a cheaper policy If not in your Medigap OEP You may pay more for the new policy There might be medical underwriting You could have a delay in coverage for a pre-existing condition March 2018 Medicare Supplement Insurance (Medigap) Policies 28

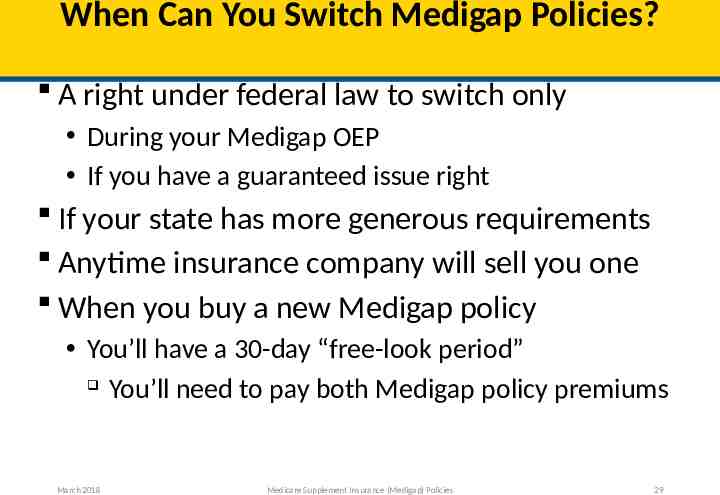

When Can You Switch Medigap Policies? A right under federal law to switch only During your Medigap OEP If you have a guaranteed issue right If your state has more generous requirements Anytime insurance company will sell you one When you buy a new Medigap policy You’ll have a 30-day “free-look period” You’ll need to pay both Medigap policy premiums March 2018 Medicare Supplement Insurance (Medigap) Policies 29

Check-Your-Knowledge—Question 5 Coverage for a pre-existing condition can only be excluded in a Medigap policy if the condition was treated or diagnosed within 6 months before the date the coverage starts under the Medigap policy. a. True b. False March 2018 Medicare Supplement Insurance (Medigap) Policies 30

Check-Your-Knowledge—Question 6 If you’re 65 or older, your Medigap begins when you enroll in Part B and it can’t be changed or repeated. a.Initial Enrollment Period (IEP) b.General Enrollment Period (GEP) c. Open Enrollment Period (OEP) March 2018 Medicare Supplement Insurance (Medigap) Policies 31

Lesson 4—Medigap Rights and Protections Medigap guaranteed issue rights Guaranteed renewable plans Right to suspend a Medigap policy March 2018 Medicare Supplement Insurance (Medigap) Policies 32

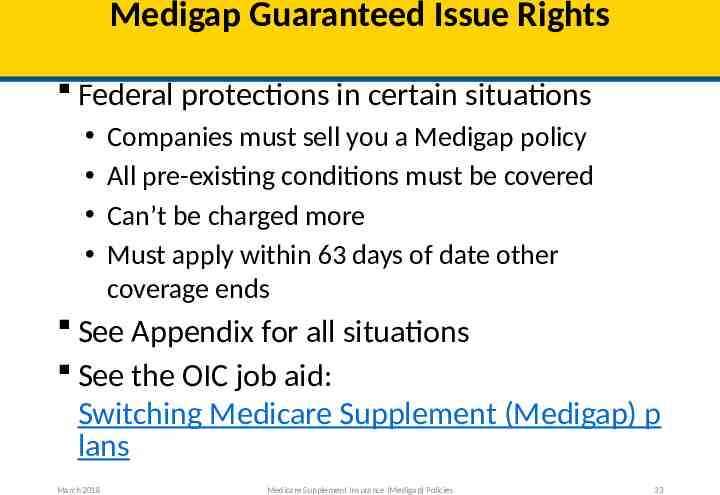

Medigap Guaranteed Issue Rights Federal protections in certain situations Companies must sell you a Medigap policy All pre-existing conditions must be covered Can’t be charged more Must apply within 63 days of date other coverage ends See Appendix for all situations See the OIC job aid: Switching Medicare Supplement (Medigap) p lans March 2018 Medicare Supplement Insurance (Medigap) Policies 33

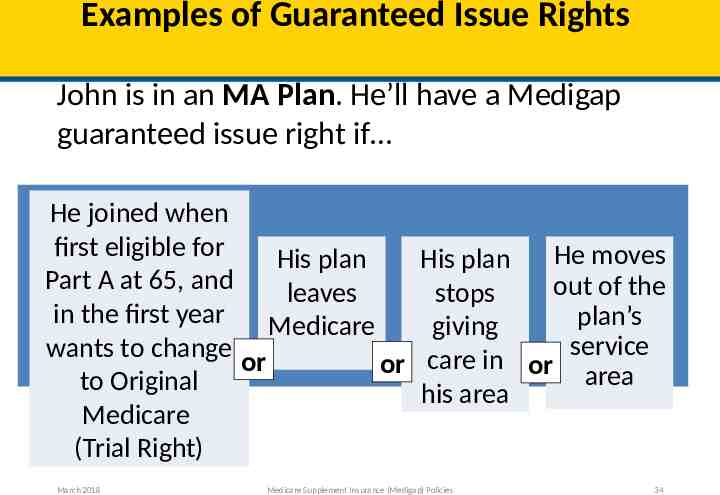

Examples of Guaranteed Issue Rights John is in an MA Plan. He’ll have a Medigap guaranteed issue right if He joined when first eligible for His plan Part A at 65, and leaves in the first year Medicare wants to change or or to Original Medicare (Trial Right) March 2018 He moves His plan out of the stops plan’s giving care in or service area his area Medicare Supplement Insurance (Medigap) Policies 34

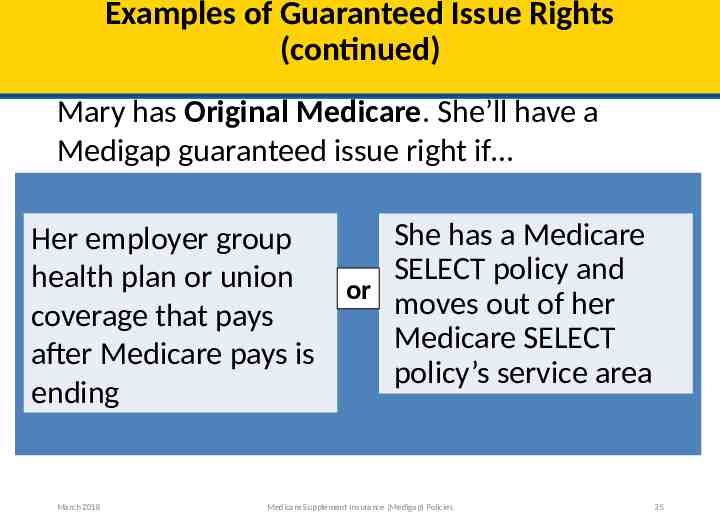

Examples of Guaranteed Issue Rights (continued) Mary has Original Medicare. She’ll have a Medigap guaranteed issue right if She has a Medicare Her employer group SELECT policy and health plan or union or moves out of her coverage that pays Medicare SELECT after Medicare pays is policy’s service area ending March 2018 Medicare Supplement Insurance (Medigap) Policies 35

Guaranteed Renewable Policies Medigap policies purchased after 1992 are guaranteed renewable Your insurance company can’t drop you unless one of the following happens: You stop paying your premium You weren’t truthful on the Medigap policy application The insurance company goes bankrupt or insolvent March 2018 Medicare Supplement Insurance (Medigap) Policies 36

Right to Suspend Medigap for People With Medicaid If you have both Medicare and Medicaid You generally can’t buy a Medigap policy You can suspend your Medigap policy Within 90 days of getting Medicaid For up to 2 years You can start it up again No new medical underwriting or waiting periods March 2018 Medicare Supplement Insurance (Medigap) Policies 37

Right to Suspend Medigap If you suspend your Medigap policy You don't pay Medigap premiums The Medigap policy won’t pay benefits You may not want to suspend your policy To see doctors who don’t accept Medicaid Call your state Medicaid office or State Health Insurance Assistance Program (SHIP) for help March 2018 Medicare Supplement Insurance (Medigap) Policies 38

Right to Suspend Medigap for People Under 65 Can suspend Medigap policy if under 65 While enrolled in your or your spouse’s employer group health plan Get your Medigap policy back at any time Must notify insurer within 90 days of losing employer plan No waiting period March 2018 Medicare Supplement Insurance (Medigap) Policies 39

Check-Your-Knowledge—Question 7 Medigap policies issued after are guaranteed renewable. a. 2002 b. 1982 c. 1992 March 2018 Medicare Supplement Insurance (Medigap) Policies 40

Review Scenario 1 Ted is 64 and has had Medicare for 4 years due to a disability. He lives in a state that requires insurance companies to offer a Medigap policy to people with Medicare who are under 65. He currently has a Medigap policy. What might change when Ted turns 65 next year? March 2018 Medicare Supplement Insurance (Medigap) Policies 41

Review Scenario 1 Considerations Ted will get a Medigap OEP when he turns 65 He’ll probably have a wider choice of Medigap policies and get a lower Medigap premium If he signs up during his Medigap OEP, insurance companies can’t Refuse to sell him any Medigap policy due to his disability, or Charge him a higher premium than they charge other people of the same age He may avoid the pre-existing condition waiting period since he had coverage for more than 6 months before he turned 65 March 2018 Medicare Supplement Insurance (Medigap) Policies 42

Review Scenario 2 Sophie is 67 and healthy. She retired last month and ended her employer-sponsored health coverage. She enrolled in Original Medicare (Part A and Part B). She’s interested in buying a Medigap policy to help her with her out-of-pocket costs. What does Sophie need to consider? March 2018 Medicare Supplement Insurance (Medigap) Policies 43

Review Scenario 2 Considerations Sophie should consider when she’ll buy a Medigap policy The best time is during her Open Enrollment Period (OEP), which lasts 6 months Begins with her Medicare Part B effective date She’ll have guaranteed issue rights if she enrolls during her Medigap OEP. If she has guaranteed issue rights: Insurance companies must sell her a Medigap policy All pre-existing conditions must be covered Insurance companies can’t charge her more If she doesn’t enroll during her Medigap OEP, companies may use medical underwriting or refuse to sell her a policy March 2018 Medicare Supplement Insurance (Medigap) Policies 44

Key Points You must have both Medicare Part A and Part B to get a Medigap policy You still pay the Medicare Part B premium You pay a monthly premium for Medigap Medigap policies cover one person Benefits are standardized in most states Costs vary by plan and by company In general, Medigap policies can only cover costs associated with services covered by Original Medicare Medigap policies don’t work with MA Plans March 2018 Medicare Supplement Insurance (Medigap) Policies 45

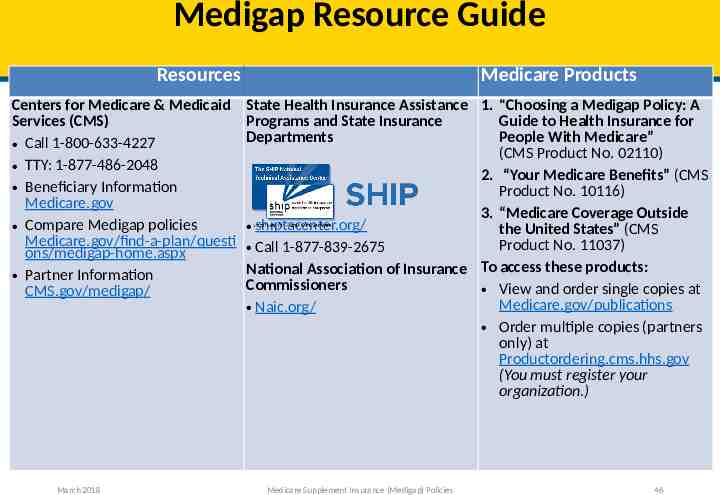

Medigap Resource Guide Resources Centers for Medicare & Medicaid Services (CMS) Call 1-800-633-4227 TTY: 1-877-486-2048 Beneficiary Information Medicare.gov Compare Medigap policies Medicare.gov/find-a-plan/questi ons/medigap-home.aspx Partner Information CMS.gov/medigap/ March 2018 Medicare Products State Health Insurance Assistance 1. “Choosing a Medigap Policy: A Programs and State Insurance Guide to Health Insurance for Departments People With Medicare” (CMS Product No. 02110) 2. “Your Medicare Benefits” (CMS Product No. 10116) 3. “Medicare Coverage Outside shiptacenter.org/ the United States” (CMS Product No. 11037) Call 1-877-839-2675 National Association of Insurance To access these products: Commissioners View and order single copies at Medicare.gov/publications Naic.org/ Order multiple copies (partners only) at Productordering.cms.hhs.gov (You must register your organization.) Medicare Supplement Insurance (Medigap) Policies 46

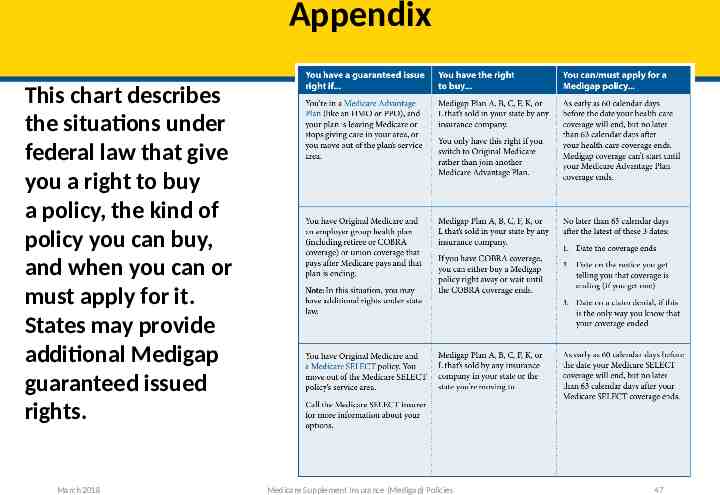

Appendix This chart describes the situations under federal law that give you a right to buy a policy, the kind of policy you can buy, and when you can or must apply for it. States may provide additional Medigap guaranteed issued rights. March 2018 Medicare Supplement Insurance (Medigap) Policies 47

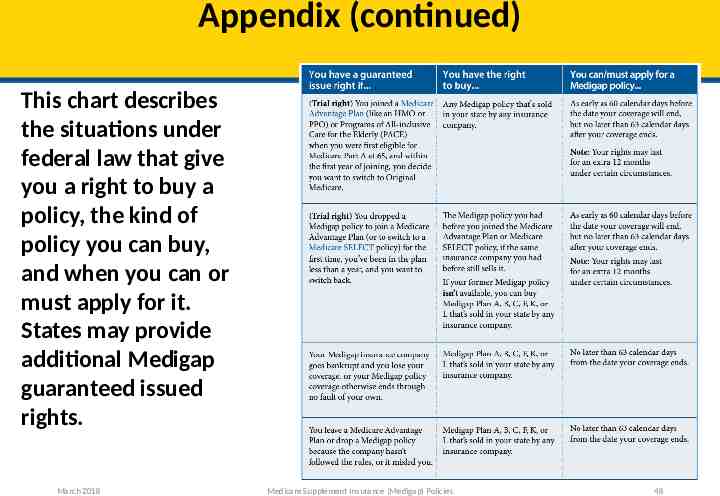

Appendix (continued) This chart describes the situations under federal law that give you a right to buy a policy, the kind of policy you can buy, and when you can or must apply for it. States may provide additional Medigap guaranteed issued rights. March 2018 Medicare Supplement Insurance (Medigap) Policies 48

Acronyms CHIP Children’s Health Insurance Program COBRA Consolidated Omnibus Budget Reconciliation Act CMS Centers for Medicare & Medicaid Services EGHP Employer Group Health Plan ESRD End-Stage Renal Disease HMO Health Maintenance Organization MA Medicare Advantage MA-PD Medicare Advantage Prescription Drug March 2018 NTP National Training Program OEP Open Enrollment Period PDP Prescription Drug Plan PPO Preferred Provider Organization SSA Social Security Administration SHIP State Health Insurance Assistance Programs TTY Teletypewriter/Text Telephone Medicare Supplement Insurance (Medigap) Policies 49

This Training is Provided by the CMS National Training Program (NTP) To view all available NTP training materials, or to subscribe to our email list, visit CMS.gov/outreach-and-education/training/CMSNational TrainingProgram . Stay connected. Contact us at [email protected], or follow us @CMSGov #CMSNTP March 2018 Medicare Supplement Insurance (Medigap) Policies 50